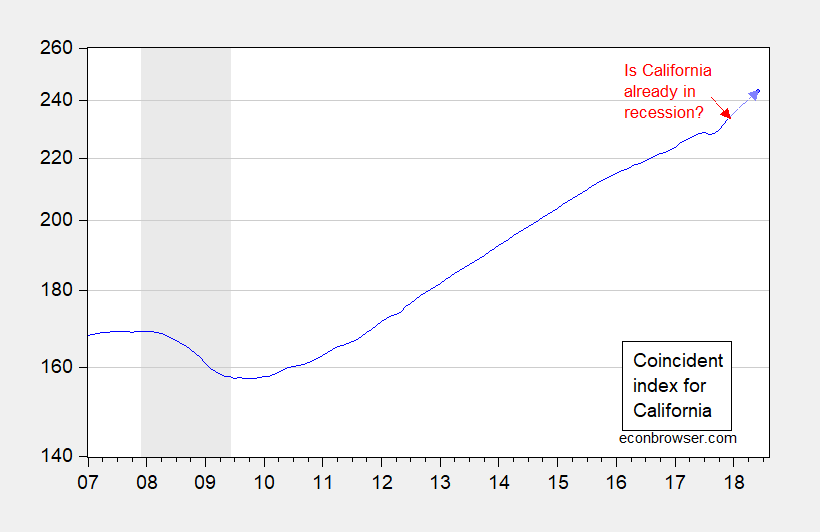

Back in mid-December, Political Calculations asked if California was in recession. Data released by the Philadelphia Fed suggests the answer is no.

Figure 1: Coincident index for California (blue), and implied index value for June 2018 using leading index (light blue arrow, blue dot) against log scale. NBER defined national recession dates shaded gray. Red arrow at date of Political Calculations post. Source: Philadelphia Fed [1], [2], and author’s calculations.