Reuters has an interesting article, entitled “Inside China’s strategy in the soybean trade war”.

Mu Yan Kui … ticked off a six-part strategy to slash Chinese consumption and tap alternate supplies with little financial pain.

Reuters has an interesting article, entitled “Inside China’s strategy in the soybean trade war”.

Mu Yan Kui … ticked off a six-part strategy to slash Chinese consumption and tap alternate supplies with little financial pain.

November soybean futures keep on going down. And the US-Brazil spread has proven durable.

Continue reading

As part of the United States’ continuing response to China’s theft of American intellectual property and forced transfer of American technology, the Office of the United States Trade Representative (USTR) today released a list of approximately $200 billion worth of Chinese imports that will be subject to additional tariffs. In accordance with the direction of President Trump, the additional tariffs will be effective starting September 24, 2018, and initially will be in the amount of 10 percent. Starting January 1, 2019, the level of the additional tariffs will increase to 25 percent.

The list contains 5,745 full or partial lines of the original 6,031 tariff lines that were on a proposed list of Chinese imports announced on July 10, 2018. …

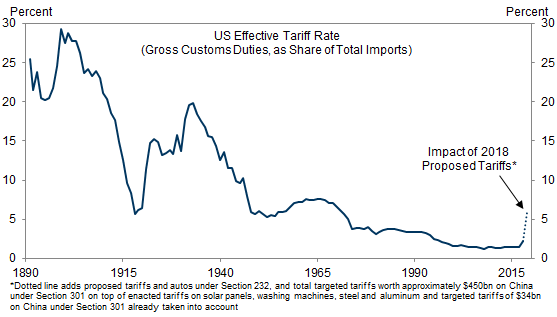

Implied US tariff overall tariff rates, from GS:

Source: Hatzius et al., “The Trade War: An Update,” Goldman Sachs June 25 2018.

Haven’t seen the Chinese back down so far, as some sanctions enthusiasts have predicted. If the demand is for China to give up on Made in China 2025, I’m guessing the Chinese are not going to back down in effect.

That’s a quote from Paul Burke, regional director for North Asia at the U.S. Soybean Export Council, in Time. He continues “This is the realization that we’re coming to within the trade within the last couple of weeks.”

Soybean harvesting begins soon, with the new market year (9/1-), and it was thought by some observers that as China would have to eventually access American soybeans, so prices would recover. That event has not occurred.

Continue reading

With the election, and anticipation of a large fiscal impulse (tax cut, infrastructure spending), the dollar rose and the term spread increased. As expectations of the latter disippated, both the dollar and spread shrank. But recently, the comovement has broken down.

Statement yesterday, as reported by Washington Examiner:

“[That country] really needs to make up its mind” … “Do they want to be in the community of nations, do they want to be part of the WTO and just behave like everybody else, or don’t they?”

…“And if they don’t, then we, the community of nations, are going to have to think about what are we going to do about that?”… “Are we going to let them stay in the WTO?”

Not quite the Flying Dutchman, Peak Pegasus and its load of US soybeans finally docks at Dalian in China.

(Translation: “Waiting for Godot”) Many observers have noted that the Chinese must eventually come to the US for some of their soybean needs, as the supply of Argentine and Brazilian soybeans are depleted and American soybeans are harvested. Current futures for November 2018 do not indicate a price recovery to pre-Trump tariff war levels, even if they do come. As of today:

When prices are low for a storable commodity, agents (farmers or intermediaries) can wait for higher prices to sell. Of course, there is a carrying cost to storage for many commodities, like soybeans (deterioration of stock, direct storage costs, opportunity cost of capital tied up in commodity). Hence, while storage can mitigate losses, it does not necessarily eliminate economic losses that arise from persistent tariffs.