In all the excitement between the Italian crisis and the US lashing out with tariffs to be levied against our allies, it was easy to overlook this event:

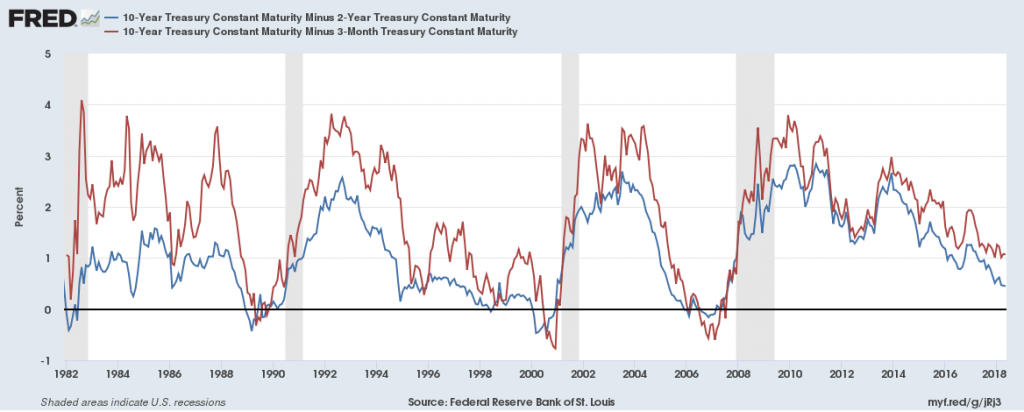

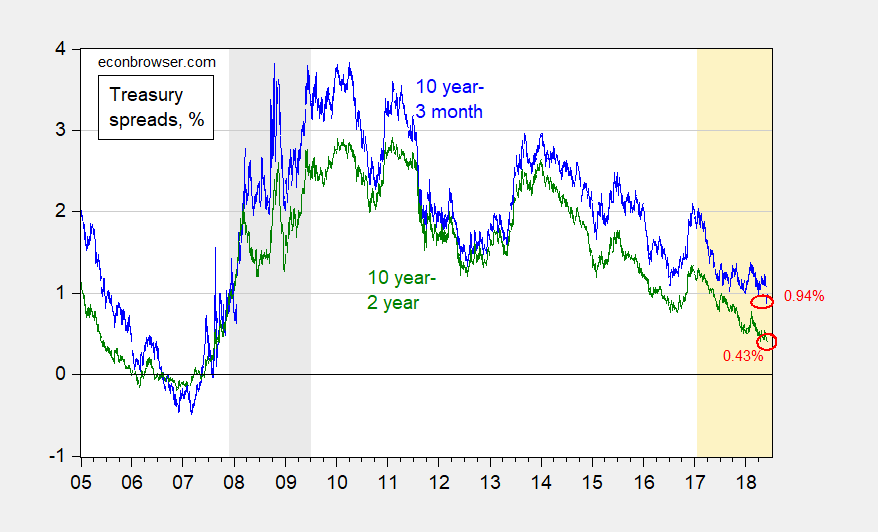

Figure 1: Ten year constant maturity Treasury minus three month Treasury bill yield spread on secondary market (blue), and ten year minus two year yield spread (green), both daily, %. Last observation is 6/1. Source: Federal Reserve via FRED, Bloomberg, and author’s calculations.

Continue reading