One of the key difficulties in measuring effects and attributing causality is the fact that there are typically many confounding factors. That is why social scientists (and financial economists) often resort to event analyses — looking at what happens around a certain event (like an announcement) when little else is happening. Because there is so much going on with the Trump administration, this is not always possible. However, yesterday evening, the White House released a directive to USTR to identify an additional $200 billion worth of taxable Chinese imports. Here is what happened.

Continue reading

Category Archives: Trade Policy

Round Two for US-China Trade?

One irrelevant graph and one (possibly) relevant graph, in light of Mr. Trump’s statement on additional trade sanctions.

First, the irrelevant: the US-China trade deficit, which has been deteriorating over the first five quarters of the Trump administration.

Continue reading

What Does This Mean? Trump asks USTR to…”identify $200 billion in Chinese goods for additional tariffs at 10% rate”

That’s part headline from CNBC.

President Donald Trump has requested the United States Trade Representative to identify $200 billion worth of Chinese goods for additional tariffs at a rate of 10 percent.

Continue reading

Explaining the Soybean Selloff: Ag Conditions, the Dollar, or Tariff Fears?

Guest Contribution: “Protectionism Is Nothing New for Republicans”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

On the Eve of Disruption

(Apologies to P.F.S./B.McG) Soybean, hog prices and corn prices dove even before the Section 301 import tax hit list was announced. (Orange dashed line denotes Trump announcing imminent Section 232 tariffs). Why?

Meanwhile, Back in Iowa

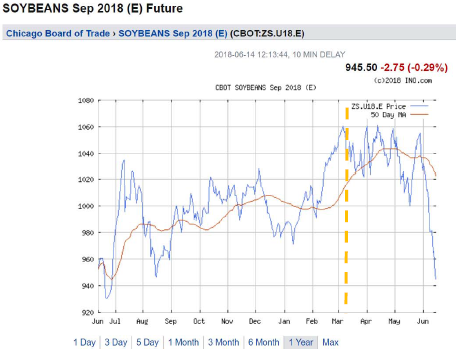

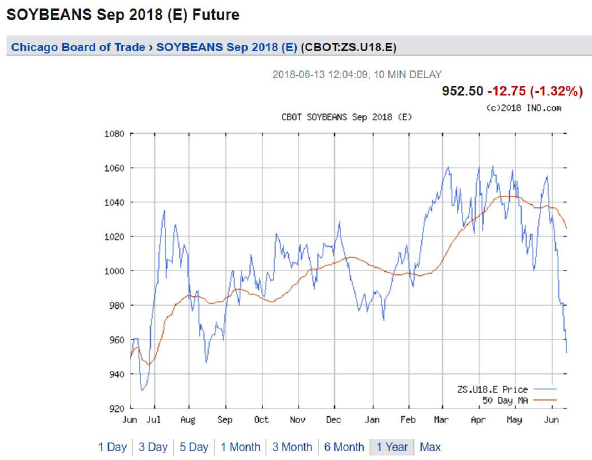

Soybean prices continue to collapse…

Source: ino.com, accessed 6/13.

Note that the peak was in early March, just as Mr. Trump hinted at Section 232 tariffs on aluminum and steel. This additional pain is unwelcome, given that even as of March, soybean prices were some 40% below their mid-2012 peaks.

From Progressive Farmer – Washington Insider today:

Anxiety Rising In US Farm Circles On China Trade

The U.S. has signaled it will make its intentions known by Friday on duties on some $50 billion in Chinese goods over intellectual property issues.U.S. ag interests like the American Soybean Association (ASA) are planning a full-court press to try and convince the administration to not take actions that would negatively impact U.S. soybean and other ag trade as China has threatened to respond with retaliatory trade actions against U.S. products like soybeans and other ag goods.

It’s not clear whether the U.S.-North Korea summit was enough to have the U.S. willing to hold off on imposing sanctions against China. But there are also still likely other steps in the process before U.S. sanctions go into place.

The U.S. has to publish a formal determination on the duties in the Federal Register, with up to 30 days after that point for the duties to come into effect. Plus, indications are the Trump administration is studying taking up to another 180 days before putting the duties in place.

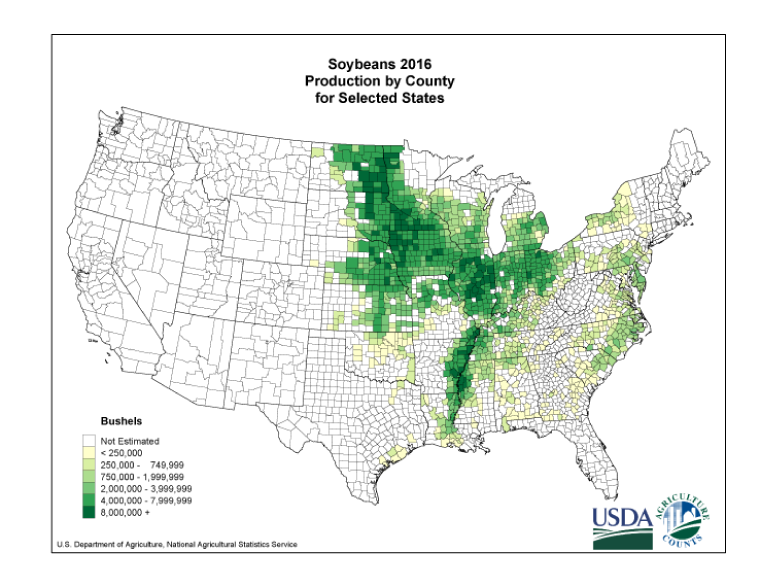

As a reminder, here is a map of soybean production.

Source: USDA.

Deep State Speaks…from Within the White House

From United States Trade Representative (USTR), within the Executive Office of the President, headed by Robert Lighthizer, hand-picked by Mr. Trump:

When, oh, when, will we be rid of these conniving back-stabbers?

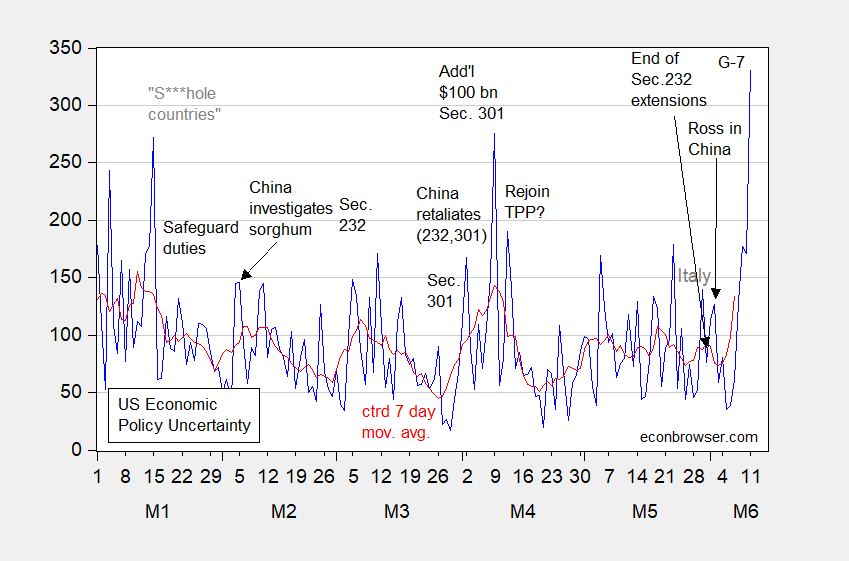

Yikes! Trade and Economic Policy Uncertainty

First, overall (news-based) economic policy uncertainty:

Figure 1: Economic Policy Uncertainty index (blue), and centered seven day moving average (red). Source: policyuncertainty.com accessed 6/11, and author’s calculations.

Trade Deficit Rising!

Since 2017Q1. By Mr. Trump’s own metric, we’re losing. But it’s a stoopid metric for evaluating “unfair”-ness.