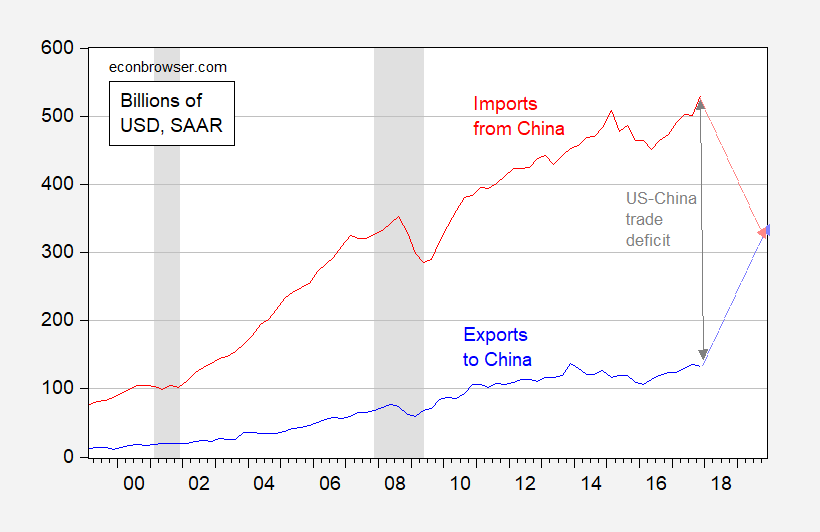

Jim Tankersley/NYT discusses how hard it will be to reduce the $337 billion US-China gross trade deficit by $200 billion by increasing exports (as I point out in this post, our trade deficit in value added is probably about half the $337 billion).

The enormity of the task of cajoling the Chinese into buying $200 billion more is shown in Figure 1 (see the light blue arrow).

Figure 1: US exports to China (blue) and US imports from China (red), in billions of USD, SAAR. NBER defined recession dates shaded gray. Increasing exports to China by $200 billion over two years (light blue arrow); decrease imports from China by $200 billion over two years (pink arrow). Source: BEA/Census, NBER, author’s calculations.

A much simpler way to reduce the deficit; instead of browbeating the Chinese into buying $200 billion dollars more, just throw the US economy into a deep, deep recession, and reduce US imports from China (the pink arrow).

In Cheung, Chinn and Qian (Review of World Economics, 2015), we estimate the income elasticity of US imports from China is in the range of 2.6 to 3.4 (Table 3). $200 billion is about 0.40 of $506 billion (US imports from China). Assuming a high income elasticity of 3.4, all we need to do is reduce US GDP by 11.6% (about $2.32 trillion in for US nominal GDP of nearly $20 trillion in 2018Q1). Of course, this is ballpark, particularly because many things would not stay constant — the USD/CNY exchange rate would doubtless change, as would US exports to China. But you get the idea.

Now one could say this is a crazy idea; I say it’s no more crazy than building a wall with Mexico and forcing them to pay, banning all immigrants from s***hole countries, doubling Amazon’s shipping costs with the US postal service, collaborating with the Russians on cybersecurity, implementing a border adjustment tax, arming teachers to protect students, and a myriad of other Trump musings.