Here I review key trends in the oil market over the last decade.

Continue reading

Category Archives: Uncategorized

Guest Contribution: “Fiscal Education for the G-7”

Today, we are pleased to present a guest column written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. This is an extended version of a column appearing at Project Syndicate.

Guest Contribution: “Where is global economic growth heading?”

Today, we are pleased to present a guest contribution written by Laurent Ferrara (Banque de France, Head of the International Macro Division) and Clément Marsilli (Banque de France, Economist in the International Macro Division). The views expressed here are those of the authors and do not necessarily represent those of the Banque de France.

The latest update of the IMF WEO report has been released on April 12, 2016, and can be downloaded from the IMF web site (for a summary see also this Econbrowser post here). The salient fact of this report is that global GDP growth in 2016 has been revised downwards by -0.2pp years, from 3.4%, as assessed in the WEO update of January 2016, to 3.2%. Those revisions are quite homogeneous across countries (-0.2pp for both advanced and emerging/developing countries), although some commodity-exporters countries are more impacted.

Rich States, Poor States, 2016 Is Out

Arthur Laffer, Stephen Moore and Jonathan Williams strike again in this year’s installment of RSPS. According to their report, Utah’s prospects are the best, and Wisconsin’s outlook has risen to #9. Should the residents of these states rejoice?

2016 Econbrowser NCAA tournament challenge winner

Congratulations to Jackiegee, winner of the 2016 Econbrowser NCAA tournament challenge. None of our entrants correctly picked the tournament winner to be Villanova, but Jackie (like a number of others of you) thought it would be UNC, and came within half a second of being right! For fans of Michigan State, West Virginia, and others, better luck next year!

Text of Executive Order 9066

From The Hill:

Republican presidential front-runner Donald Trump echoed rival Ted Cruz on Tuesday in calling for patrols of Muslim neighborhoods in the U.S., and said the country must begin torturing terror suspects to get information out of them.

Guest Contribution: “Liquidity Trap and Excessive Leverage: How Excessive Debt Hurts the Economy and Why to Curb It”

Today we are pleased to present a guest contribution written by Anton Korinek (Johns Hopkins Univ.) and Alp Simsek (MIT).

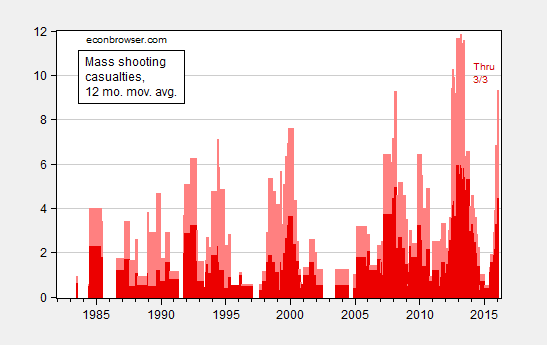

Mass Shooting Statistics, 3/3/16

Figure 1: 12 month moving average of mass shooting casualties; deaths (dark red), wounded (pink). Source: Mother Jones, GunViolenceArchive.org. for 2/26/2016 data, and author’s calculations.

For a per capita depiction, see this post. The upward trend is obvious there as well.

Negative interest rates

For an economy with underutilized resources or too low a rate of inflation the traditional prescription for monetary policy is to lower the interest rate. Central banks around the world tried to do that in response to stubbornly weak economies, bringing the overnight interest rate in many countries all the way to zero. But when that didn’t seem to be getting the job done, the Bank of Japan last week decided to go negative, charging banks 0.1% interest for excess reserves. With this step Japan now joins the Euro system, Switzerland, Denmark, and Sweden, all of whom have had negative interest rate policies in place for over a year. Here I describe how negative interest rates work, what they are intended to accomplish, and some of the limitations of using this policy to try to stimulate the economy.

Continue reading

This Wisconsin Resident Feels Much Safer Now

From FoxNews6:

“Gov. Scott Walker is set to sign a bill that would allow people to carry concealed switchblades and knives.”