Today we are pleased to present a guest contribution written by Maurizio Michael Habib, Elitza Mileva and Livio Stracca. The views expressed belong to the authors and are not necessarily shared by the institutions to which the authors are affiliated.

Is the Trump Dollar Rally Over?

Mix together the dashing of great (plutocratically oriented tax cut) expectations, the complete absence of any plan for infrastructure spending, and mix in some risk, and one gets this:

Figure 1: Dollar index (DXY). Source: Tradingeconomics.

Pondering Economic Policy Implementation over the Next Four Years

From Reuters today:

“It’s becoming increasingly difficult to attract good people to work in this administration,” said one senior official. “In other cases, veteran people with expertise are leaving or seeking posts overseas and away from this White House.”

“Exchange Rate Models for a New Era: Major and Emerging Market Currencies”

That’s the title of an upcoming conference organized by Global Research Unit at Department of Economics and Finance, City University of Hong Kong, Bank for International Settlements, Asian Office, Centre for Economic Policy Research, and Journal of International Money and Finance, May 18-19 at City University Hong Kong. The conference program is here, official conference website here.

FinCEN to Share Information with Senate Intelligence Committee

As noted in Wednesday’s post, FinCEN — the Treasury’s Financial Crimes Enforcement Network — was asked by the Senate Intelligence Committee about information regarding connections between Russia and Trump and his associates. News reports indicate that FinCEN will provide the requested information.

EconoFact: “Import Limits on Steel and Aluminum: Protecting National Security or Protectionism?”

That’s the title of my article at EconoFact today.

The Issue:

The Trump Administration has proposed a number of trade related measures purportedly on the basis of national security. The first involves invoking a seldom-used provision of the trade law to investigate whether imposing import restrictions for steel and aluminum is justified by national security reasons. The second is the creation of a new White House office, the Office of Trade and Manufacturing Policy, superseding and replacing the National Trade Council established at the outset of the Trump Administration.

The question is whether the threats posed to national security are genuine, or merely a means of protecting domestic industries under the guise of national security.

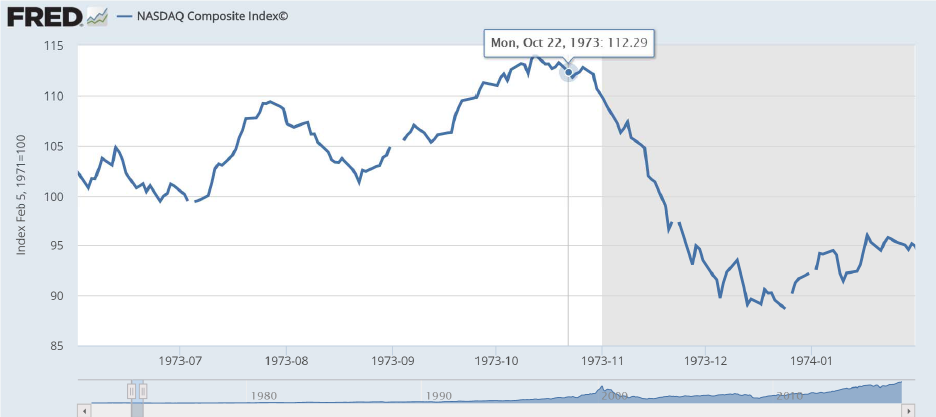

Stock Prices around October 20, 1973 (The Saturday Night Massacre)

Reader Julian Silk asks what happened to indicators around the Saturday Night Massacre, when President Nixon fired the Independent Special Prosecutor Archibald Cox. The Baker, Bloom and Davis daily version of the Economic Policy Index only extends back to 1985. Here is the Nasdaq around that date. Since October 20th was a Saturday, the relevant dates are 10/19 and 10/22.

Figure 1: Nasdaq index, June 1973-January 1974.

The Nasdaq rose slightly today. The true issue is what happens as events unfold.

What Is FinCEN?

Several accounts [1] [2] [3] have noted that the Senate Intelligence Committee has requested information regarding related to President Donald Trump, his senior officials and his campaign staffers from the Treasury’s FinCEN. What is FinCEN?

It’s shortened form for “Financial Crimes Enforcement Network”.

From the official website:

The mission of the Financial Crimes Enforcement Network is to safeguard the financial system from illicit use and combat money laundering and promote national security through the collection, analysis, and dissemination of financial intelligence and strategic use of financial authorities.

For the record, the current acting director is Jamal El-Hindi (as of 2:22PM Pacific).

Other Surprising Ends: BuCensus

From WaPo, U.S. Census director resigns amid turmoil over funding of 2020 count:

The director of the U.S. Census Bureau is resigning, leaving the agency leaderless at a time when it faces a crisis over funding for the 2020 decennial count of the U.S. population and beyond.

Economic Policy Uncertainty Likely to Rise

In the wake of the decapitation of the FBI, financial indicators suggest a negative shock. I suspect an increase in uncertainty, given that political turmoil could cloud the path of economic policy implementation (tax reform/cuts, infrastructure, etc.). Here is the S&P 500 futures for June 2017.

Source: Yahoo Finance accessed as of 5:05PM Pacific.