With updates on the econometric debates on effects, and efficacy in targeting low income groups (3/30)

Minimal employment number impacts and minimal inflation impacts. But I am sure the resistance to having a greater share of income going to labor will continue.

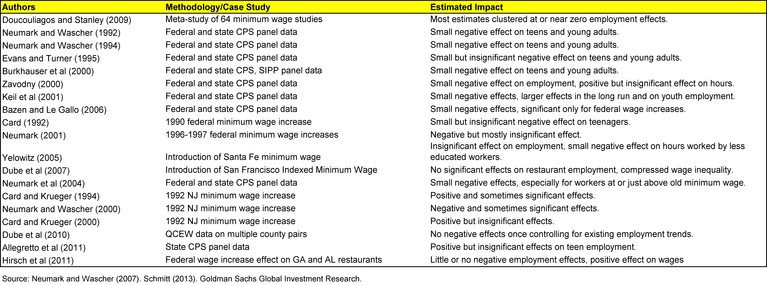

From Goldman Sachs, “What to Expect from a Minimum Wage Hike” (3/25, not online), a survey of studies relevant to the debate over employment effects:

Source: Michael Cahill and David Mericle, “What to expect from a minimum wage hike,” GS Daily (3/25/2014).

Confirming the summaries of the literature contained in CBO and CEA (discussed in this post), most estimates are for quantitatively small impacts on employment, even when the estimates are statistically significant. It’s important to further recall that in the CBO assessment, the distribution of estimates spans positive impacts on employment (for some simple analytics of why this can occur in the short run, see this post; people averse to analytics should steer clear). Regarding the CBO midpoint estimate, the authors remark:

In our view, the CBO estimate is likely a bit toward the upper end of reasonable estimates, for two reasons. First, as Exhibit 3 shows, a large number of economic studies have found no statistically significant effect. Second, demand effects are likely to be particularly pronounced under current conditions in which considerable slack remains in the economy with the funds rate already near zero. As a result, raising the incomes of low-wage workers, who are likely to spend a larger share of their income, should provide a larger-than-usual offsetting boost.

That is, for the same reason fiscal policy has a greater impact at the ZLB and when slack exists, [1] boosts to labor income from an increase in the minimum wage can have a meaningful impact.

I’m teaching econometrics this semester, and it’s interesting to see how some of the prominent studies in the minimum wage literature dovetail with the more recent (not new any more) approaches to controlling for endogeneity — in particular the use of quasi-natural experiments, as in the Card and Krueger (AER, 1994) study of the New Jersey minimum wage increase. In that case, they used a differences-in-differences approach, examining how the gap between NJ-PA employment growth changed after the advent of the minimum wage. Card and Krueger found that there was a small employment increase in employment growth when NJ raised its minimum wage (borderline significant in many cases, and significant in others).

As the Note remarks upon, a number of states have recently implemented increases in their minimum wage rates; these changes constitute a series of quasi-experiments. Here is their assessment of the early outcomes:

… January’s state-level payrolls data failed to show a negative impact of state-level hikes. Relative to recent averages, the group of states that had hikes at the start of 2014 in fact performed better than states without hikes. While this is only one month’s data, it suggests that the negative impact of a higher federal minimum wage–if any–would likely be small relative to normal volatility.

The authors also conduct an event analysis of minimum wage increases on inflation on post-1990 data. They find no evidence of a discernable impact on PCE inflation. Their best estimate is 0.3 percent elevation in the price level by the end of the three year implementation of the minimum wage increase to $10.10.

The impact on employment is minimal, while wages will rise for many, thereby inducing an increase in the low-wage labor share. If we are concerned about affecting inequality, rather than mouthing platitudes, then the minimum wage seems a reasonable place to start.

Digression: Since I’m teaching the Card Krueger paper in my econometrics course, I have been reading the rebuttals and replies. In the Card-Krueger reply to the Neumark and Wascher paper, they discuss the latter’s use of an “interesting” dataset — with markedly different attributes from other data sets in use — originally compiled by the “Employment Policies Institute”. I find it remarkable how influential this think tank has been — see discussion here; link to IRS form 990 for interesting reading) (it gives “cozy” industry ties a new meaning). One of the most recent takes on the employment impact, accounting for spillover effects, is in Dube, Lester and Reich (REStat, 2010).

Update, 6:40PM Pacific: Neumark provides a critique of the DLR and other papers, in an Employment Policies Institute document (January 2013).

The Employment Policies Institute has an interesting blogpost observing that some of the 600 or so economists who signed the petition in favor of raising the minimum wage are “Specifically, at least 40 of the signers are specialists in or have done considerable work in the economics of Marxism or Socialism, or are affiliated with the “radical” study of economics.” (Full disclosure: I signed the petition, and I once took a course on Socialism from the famous leftist(!!!) Adam Ulam, so I must be on their list as well).

Update, 10:20PM Pacific: Professor Reich directs me to this paper which addresses critiques leveled by Neumark et al. (see Appendix B).

Update, 3/30 2:15PM Pacific: Recent work documenting the increasing target efficiency of the minimum wage, in this paper:

In this study I show that the target efficiency of the minimum wage improved between 1999 and 2013. In 1999-2001, 15.3% of the minimum wage benefits went to workers in poor families. By 2011-2013 this figure had risen to 18.8%. Nearly two-thirds of the improvement in target efficiency occurred during pre-recession years (1999-2001 to 2005-2007), and the balance of the improvement occurred since the onset of the Great Recession. The improvement in target efficiency during pre-recession years was entirely due to an increase in the share of minimum wage workers in poor families. Decreased income among near-poor minimum wage workers drove the majority of the increase in the share of minimum wage workers in poverty. Reduced teen employment, increased teen wages (relative to the minimum wage), and increased employment among poor low-skilled 20-29 year-olds also contributed.

Clearly the biggest employment issue is our youth, particularly inner city. Here, on average, is a group apparently not worth the current minimum wage: no high school degree, no previous job experience, etc. Without apprenticeship programs or similar to get their skills up, the situation is hopeless. These sorts of skill-building programs are abhorred by unions and tradesmen. Folks are shocked that we have 30% effective unemployment within a group, and yet others are risking their lives and paying the coyotes exorbitant amounts to get here to work. Obviously, raising the minimum wage, which is already above the typical teen’s marginal value product, will not increase the likelihood of them finding jobs. When empirical models begin to substitute for common sense, there are big problems to follow. Think of copula functions and the housing crisis.

Well stated, Pete, as your 30% unemployment number bears full weight

against the intelligentsia economic arguments.

Have you noticed that those whom support labor cartels, scream and howl

when it is done by businesses.

It is any wonder why this nation economy is now essentially run by

governmental units? God help us!

When lack of argument begins to substitute for perspective or knowledge, expect rhetorical appeals in the name of common sense.

You are both throwing crap at the wall hoping something will stick, I’m a little embarrassed that you thought this was bearing on the subject.

The teen unemployment rate has been about 2.8 times the adult unemployment rate — over 24 years old — as far back as the data goes –1947.

Interestingly, that is almost exactly where the teen unemployment rate is now.

I live in a rural area – unless a teen has a car there’s no way to get to/from work, fast food or otherwise. And I grew up in the city of Detroit – transportation is an even bigger barrier there, since there are so few jobs left within the city. Even if a young person does have wheels, they don’t always get a favorable reception in lily-white suburbia. And is it possible to have a reliable car and pay for gas and so on if all you earn is the minimum? – try the math (rather arithmetic, no need for partial derivatives). You’ll find that it works if your parents are well enough off to subsidize the car directly (or indirectly, by providing room and board).

I remember first reading Card Kruger and thinking, “You mean this is one of the only studies to do real field work?” It’s neat work.

Menzie,

Well, if you are not denying that the minimum wage has a negative impact on employment, that’s progress I suppose. But, still, you just assert the effects are small but don’t give any evidence or do any calculations.

When you look at the research, the elasticities of employment of young people with respect to the minimum wage are typically between -0.1 to -0.3. That means that a 1% increase in the minimum wage reduces the level of employment by between 0.1% and 0.3%. Just to get a back of the envelope, let’s see what this implies. Let’s take -0.2 as the central estimate and note that the proposal to raise the minimum wage from $7.25 to $10.10 represents a 39% increase, quite large by historical standards. The level of employment in Feb for 16-19 year olds was 4.3 million and for 20-25 year olds it was 13.7 million for a total of 18 million. A simple calculation is then -0.2 X 39% X 18 million = -1.4 million. And when you throw in workers over 25, that number could be easily 50% higher, meaning job losses in the 2 million range.

If we compare to the CBO study, we see they get an estimate of 500K with an upper bound estimate of 1 million, which is a lot smaller than my back of the envelope. The reason for that is that CBO makes many downward adjustments to the published estimates. For example, they use an elasticity of -0.1 as their central estimate, based on their judgmental reading of which papers they believe are more accurate. They also claim there is publication bias and so adjust downward. And they also make a number of downward adjustments by trying to estimate the number of people affected, etc.

I don’t believe these non-transparent adjustments are very credible. No doubt some adjustments do need to be made, but I would think the true number is between my back of the envelope and CBO’s estimate, probably a bit north of 1 million.

Is that small?

We should also keep in mind that the case against the minimum wage is based on a lot more than the disemployment effects, which I’ve noted in previous comments.

stryker,

the article lists 19 studies cited by golman sachs, the vast majority of which disagree with your assessment of minimum wage and employment effects. not only do you have a problem with the CBO, but a bunch of other professional economists as well. while you may believe their adjustments are not credible, i suppose the same thing could be said for your adjustments.

Rick Stryker: I think I said I agreed the effects are typically small; I don’t think I said in this post that they are negative.

I have added a new post for your benefit, putting into context your preferred estimate of -0.2.

Pete and Hans:

I would respect your opinion more if you cited some studies. As I volunteer helping some undocumented immigrants and also with youth who have dropped out of school, I do not see evidence that the undocumented workers are taking jobs from unemployed youth. Please cite evidence rather than basing your statements on ideological bias.

Here is a paper by Meer and West that looks at the impact of a higher minimum wage on job growth rather than the level of employment. It overcomes many of the problems inherent in other studies. (Of course, nothing will overcome Menzie’s support of policies that restrict economic freedom of young workers, especially inner-city minorities).

http://econweb.tamu.edu/jmeer/Meer_West_Minimum_Wage.pdf

Robert Hurley

Do a Google on George Rojas. He’s an economist at Harvard and has done a ton of work on the impact of illegal immigration on US workers who do not have a high school degree. The impact is negative and quite substantial, and is something you can use rather than basing your statements on ideological bias.

On the bottom end of the wage scale we may find a “DISCOUNT wage effect”: wherein weak bargaining power leaves wages below — in the American labor market probably far below — what consumers would have been willing to pay: meaning that today’s consumers are getting a – probably hugely serious — bargain.

On the other end of the wage scale we may find examples of a “PREMIUM wage effect”: where consumers are pressured by market conditions to pay much more than the seller would have been willing to accept had there been sufficient competition or whatever: meaning consumers are getting a — possibly hugely serious — skinning.

If a deeply discounted minimum wage is raised to a still deeply discounted level — in Obama’s case …

… nearly a dollar below LBJ’s 1968 minimum wage …

… almost double the per capita income later (!) …

… (dragged out over three years; agh!!!) …

… I think consumers are much more likely to drop some spending on premium wage products (where they are still being skinned) to continue purchasing DISCOUNTED wage products – which are still very much comparative bargains.

All these fancy words mean that we do not buy more ice cream cones and jeans just because the minimum wage is too low – neither are we likely to buy less of same should the wage go up within reason: we are likely to spend less at Nordstrom’s so we can maintain our level at Target.

Even if today’s $7.25 federal minimum were doubled to $15, consumers still end up paying only as much as they would probably have been willing to pay all along – leaving minimum wage products still a COMPARATIVE bargain against PREMIUM wage made products.

Never forget – seems de rigueur for all to forget – that labor costs represent only a small fraction of ultimate price tag – as low as 7% with Wal-Mart – even if sales drop a bit, poverty incomes can soar – everybody seems to serially forget this.

* * * * * * * * * * * * * * * * * * * * * * *

When I was a gypsy cab driver in the Bronx, back in the late 1970s, the city’s yellow cabs raised their meters and we raised ours in step. Most drivers agreed this did not hurt business. I also heard from veteran drivers that the previous meter raise did cost business (I was new – having finally gotten my driver’s license at age 32).

In any market, selling anything, you never know for sure what the customer will pay until you test. Does this chart below look like the federal minimum wage has been much tested OVER MULTIPLE GENERATIONS!!!?

“Dbl-index” is for inflation and per capita income.

yr..per capita…real…nominal…dbl-index…%-of

68…15,473….10.74..(1.60)……10.74……100%

69-70-71-72-73

74…18,284…..9.43…(2.00)……12.61

75…18,313…..9.08…(2.10)……12.61

76…18,945…..9.40…(2.30)……13.04……..72%

77

78…20,422…..9.45…(2.65)……14.11

79…20,696…..9.29…(2.90)……14.32

80…20,236…..8.75…(3.10)……14.00

81…20,112…..8.57…(3.35)……13.89……..62%

82-83-84-85-86-87-88-89

90…24,000…..6.76…(3.80)……16.56

91…23,540…..7.26…(4.25)……16.24……..44%

92-93-94-95

96…25,887…..7.04…(4.75)……17.85

97…26,884…..7.46…(5.15)……19.02……..39%

98-99-00-01-02-03-04-05-06

07…29,075…..6.56…(5.85)……20.09

08…28,166…..7.07…(6.55)……19.45

09…27,819…..7.86…(7.25)……19.42……..40%

10-11-12

13…29,209…..7.25…(7.25)……20.20?……36%?

* * * * * * * * * * * * * * * * * * * *

I almost forgot: … 🙂 …

There is a growing consensus is that the economy may be permanently slowing down (economists dub this “secular stagnation” as opposed to “cyclical”). Progressives see DEMAND — and therefore EMPLOYMENT — stalled because of too much income squeezed out of the pockets of Americans who spend a lot more than save …

… meaning that raising the minimum wage – doubling it if we want any noticeable effect on the economy or poverty; not, not quite catching up with 1968 — should be a sure fire way to bring down unemployment.

Progressive economists should readily admit — shout — that a “moderate” federal minimum wage increase, typically 10% cited in conservative studies, should indeed have little or no effect on poverty rates. Why would an extra 1/4 of one percent of GDP added to low wage pay checks be expected to clear a broad swath through poverty? That is what a $1 an hour increase in the federal minimum wage equates to — about $40 billion out of a $16 trillion economy. (E.I.T.C. shifts $55 billion.)

A $15 an hour minimum wage OTH would send about 3.5% of GDP the way of 45% of American workers — about $560 billion (much of it to bottom 20 percentile incomes who today take only 2% of overall income).

* * * * * *

Could raising the wages of 45% of the workforce actually raise demand for the goods and services they produce? Sounds sensible at some level; raising wages so much ought to add demand somewhere – but, is it all smoke and mirrors? Before the 45% — who would get a wage hike to $15 an hour — can raise demand anywhere, they would need to get the extra cash from somewhere else – meaning the 55%. (Bottom 45 percentile incomes – not wages – currently take 10% of overall income – so, at no time are we talking giant chunks of the economy here.)

The 45% can get higher pay even as “numerical” (to coin a phrase?) demand for their output declines due to higher prices — as long as labor gets an bigger enough slice of the new price tags. This can be compared to a leveraged buyout or buying stocks on margin.

Products produced by low-wage labor tend to be staples whose demand tends to be inelastic. Demand for food is inelastic – maybe even fast food. If the price of your Saturday family jaunt to McDonald’s rises from $24 to $30, are you really going to eat at home (the kiddies haven’t forgotten the fundamental theorem of economics: money grows on trees :-])? And fast food should be the most worrisome example: lowest wages to start with; even so, highest labor costs, 25%.

Wal-Mart is the lowest price raising example (surprise) with 7% labor costs. Jump Wal-Mart pay 50% and its prices go up all of 3.5%.

If low wage labor costs average 15% across the board and go up 50%, overall prices increase only 7.5% — and that is for low wage made products only; nobody’s car note, mortgage payment or health premium is affected. If demand drops just enough for price increases to maintain the same gross receipts (conservative, even without inelasticity), low wage income should improve appreciably.

Allow me to cite: from a 1/ll/14, NYT article “The Vicious Circle of Income Inequality” by Professor Robert H. Frank of Cornell:

“… higher incomes of top earners have been shifting consumer demand in favor of goods whose value stems from the talents of other top earners. … as the rich get richer, the talented people they patronize get richer, too. Their spending, in turn, increases the incomes of other elite practitioners, and so on.”

The same species of wheels-within-wheels multiplier ought to work the at both ends of the income spectrum — and likely in the middle. A minimum wage raise to $15 an hour is not going to send most low-wage earners in pursuit of upper end autos, extra bedrooms or gold seal medical plans. Wal-Mart and Mickey D’s should do just fine, OTH – which in turn should keep Wal-Mart and Mickey D’s doing even better.

Professor Chinn,

“But I am sure the resistance to having a greater share of income going to labor will continue.”

Who or what will be the cause of resistance? Are you thinking that resistance will come from employers, the switch from labor to mechanization, international competition or some additional combination of factors?

I notice on BEA Table 1.12 that Wages and Salaries were about 59% of National Income in 1929 reached a high of about 67% in 1980 & 1982 and as of 2013 are about 62%. http://www.bea.gov/iTable/iTable.cfm?ReqID=9&step=1#reqid=9&step=3&isuri=1&910=x&911=0&903=53&904=1929&905=2013&906=a

so I googled George Rohas and found nothing. I googled the economics department and the Harvard Business School and found nothing. If you get me an actual citation, I could read and react. But again, I talk to many undocumented and find they most often take jobs few if any American teens would ever take. Working in the fields or for outfits that know they can pay them less with no benefits. Again, I would be interested in any studies on the subject

Robert Hurley: I am just guessing, but I think anon and lazy is trying to cite George Borjas, not Rojas. If so, it makes one wonder exactly how well acquainted with the actual research anon and lazy is.

The distribution of income is of course determined politically, with grotesque and fast-increasing income inequality an example that endangers our society. Here is Nicholas Kristof’s mention of several of the expensive taxpayer subsidies that go to the super-rich, and which those of your readers who protest all help for the impoverished somehow neglect to protest.

===============================

A NATION OF TAKERS?

Nicholas Kristof, N Y Times March 27 2014

In the debate about poverty, critics argue that government assistance saps initiative and is unaffordable. After exploring the issue, I must concede that the critics have a point. Here are five public welfare programs that are wasteful and turning us into a nation of “takers.”

First, welfare subsidies for private planes. The United States offers three kinds of subsidies to tycoons with private jets: accelerated tax write-offs, avoidance of personal taxes on the benefit by claiming that private aircraft are for security, and use of air traffic control paid for by chumps flying commercial. As the leftists in the George W. Bush administration put it when they tried unsuccessfully to end this last boondoggle: “The family of four taking a budget vacation is subsidizing the C.E.O.’s flying on a corporate jet.” I worry about those tycoons sponging off government. Won’t our pampering damage their character? Won’t they become addicted to the entitlement culture, demanding subsidies even for their yachts? Oh, wait …

Second, welfare subsidies for yachts. The mortgage-interest deduction was meant to encourage a home-owning middle class. But it has been extended to provide subsidies for beach homes and even yachts. In the meantime, money was slashed last year from the public housing program for America’s neediest. Hmm. How about if we house the homeless in these publicly supported yachts?

Third, welfare subsidies for hedge funds and private equity. The single most outrageous tax loophole in America is for “carried interest,” allowing people with the highest earnings to pay paltry taxes. They can magically reclassify their earned income as capital gains, because that carries a lower tax rate (a maximum of 23.8 percent this year, compared with a maximum of 39.6 percent for earned income). Let’s just tax capital gains at earned income rates, as we did under President Ronald Reagan, that notorious scourge of capitalism.

Fourth, welfare subsidies for America’s biggest banks. The too-big-to-fail banks in the United States borrow money unusually cheaply because of an implicit government promise to rescue them. Bloomberg View calculated last year that this amounts to a taxpayer subsidy of $83 billion to our 10 biggest banks annually. President Obama has proposed a bank tax to curb this subsidy, and this year a top Republican lawmaker, Dave Camp, endorsed the idea as well. Big banks are lobbying like crazy to keep their subsidy.

Fifth, large welfare subsidies for American corporations from cities, counties and states. A bit more than a year ago, Louise Story of The New York Times tallied more than $80 billion a year in subsidies to companies, mostly as incentives to operate locally.

You see where I’m going. We talk about the unsustainability of government benefit programs and the deleterious effects these can have on human behavior, and these are real issues. Well-meaning programs for supporting single moms can create perverse incentives not to marry, or aid meant for a needy child may be misused to buy drugs. Let’s acknowledge that helping people is a complex, uncertain and imperfect struggle.

But, perhaps because we now have the wealthiest Congress in history, the first in which a majority of members are millionaires, we have a one-sided discussion demanding cuts only in public assistance to the poor, while ignoring public assistance to the rich. And a one-sided discussion leads to a one-sided and myopic policy.

Do these studies measure short-run or long-run changes? In the short run there might not be a whole lot business can do to escape the higher wage bill. However, in the long run businesses can substitute capital for labor. Think automated check outs, less help at retail stores, etc.

Thank you for the reference. I looked at some of the articles Brojas has written. I am not convinced that the evidence is compelling. My question about raising the minimum wage is – even if there is a slight impact on unemployment, doesn’t the benefit outweigh the decrease in employment over the long run. Those benefitting will spend a very high percent of the increase. So, there will be a multiplier effect that should further increase employment.

Robert Hurley

Menzie is correct. It is George Borjas, not Rojas (I was thinking baseball). Here is a link to one paper on the effects of illegal immigration on wages/employment of unskilled blacks.

http://www.hks.harvard.edu/fs/gborjas/publications/journal/Economica2010.pdf

You can find more here:

http://www.hks.harvard.edu/fs/gborjas/journal.html

I do not think that correlation means causality. 1. Without a high school diploma, it is difficult for anyone to get a job. The number of black urban youth who fail to graduate from high school is high crippling their ability to get a job. From my own experience, they are often reluctant to go far to get a job. I do not see how immigrants impact on this fact. I thin that Borjas cherry picked data to prove his case. His one case that he cited does not prove his thesis. If you look at farm workers in NJ, my observation is that a number of them are undocumented immigrants. Do you really think that they are taking jobs away from unemployed youth who live in the cities? It could be that undocumented workers are more willing to take more risks as evident from the risks they take to get here and this shows up in their willingness to take jobs that no one else will take at the prevailing wages. I agree there is some impact, but I don’t think that Brojas proves how much

Mr Hurley, it is the war on poverty and it’s high benefits which allow non-producers

to sit in their LazyBoy and watch cable, while we have to keep the borders open

for the illegals (aka undoc) to cross and enter our farm fields and our home

construction industry.

If you want a great society just count on the government – LBJ

Rick Stryker The level of employment in Feb for 16-19 year olds was 4.3 million and for 20-25 year olds it was 13.7 million for a total of 18 million. A simple calculation is then -0.2 X 39% X 18 million = -1.4 million. And when you throw in workers over 25, that number could be easily 50% higher, meaning job losses in the 2 million range.

Hold on, fella. Are you trying to say that ALL workers from age 16 through 25 are paid minimum wage? Really? First, a helluva lot of them make less than minimum wage. The tip minimum wage is $2.13/hr. You’re numbers are crazy. Then again, you were the one who refused to believe that Obamacare would get between 6.0-6.5 million before 31 March, as I predicted a few weeks ago.

anon and lazy One problem with the Borjas paper. They describe the “conventional” wage calculation as the “mean log wage” and criticize the other paper for using a “log mean wage.” This actually makes a big difference in the study results. So here’s a question. Which is the more conventional estimate of the mean between 1,000 and 100? Is it 550 or 317? If you said 317, then you agree with Borjas.

For the math challenged: Log((1000 + 100)/2) = 6.31 ==> exp(6.31) = 550.

Mean(Log(1000), Log(100) = Mean(6.91, 4.61) = 5.76 ==> exp(5.76) = 317.

Robert Hurley

March 27, 2014 at 8:45 pm

Pete and Hans:

I would respect your opinion more if you cited some studies. As I volunteer helping some undocumented immigrants and also with youth who have dropped out of school, I do not see evidence that the undocumented workers are taking jobs from unemployed youth. Please cite evidence rather than basing your statements on ideological bias.

You should be please to known, that the Connecticut Duma just passed their 10.10 bill, Mr Hurley!! I oppose any minimum wage statute on philosophic grounds.

http://cnsnews.com/news/article/susan-jones/conn-all-republicans-and-5-dems-voted-against-1010-minimum-wage

Is it unfortunate, that you require “studies” to field an opinion on a matter which requires little or no academic input. Of course, it is

a war on wages, starting in 1938, with Bathos based policies with no comprehension as to the effects upon economic welfare…As I

have stated before, it is a wage cartel sponsored by governmental units whom bear no economic consequences..Plainly put, it is

unnatural law and no amount of “studies” will alter that fact…In fact, it is part and parcel of a growing governmental control over the

free markets…Worst, did does not work.

You see, the Socshevik, such as Senator Professor Elizabeth Warren, argue this social engineering policy as nothing more than a political agenda, especially for 2014 in which they have few if any other issues…That’s the crying call for the left this year, economic

inequality…Remember, last year, it was LGBTQ inequality.

” No one should work full time and live in poverty. In 1968, the minimum wage was high enough to keep a family of three out of poverty. In 1980, the minimum wage was at least high enough to keep a family of two out of poverty. Today, the minimum wage leaves a working parent with one child in poverty. This is fundamentally wrong.” – Senator Professor Elizabeth Warren

Why does she not admit that the war on wages and poverty has failed? Nope, let’s just double down or for that matter triple down

on failed policies.

Hear is a link with many self contained links: http://cnsnews.com/commentary/hans-bader/increasing-minimum-wage-and-regulation-means-fewer-jobs

All of this voodoo economics for those who are only 1% of the total employment (not including tip based employment)…If anyone

can not see this as nothing short of political pandering to another minority group, then you are part of the problem.

90% of economics stated in this survey, that minimum wages would increase unemployment for part timers.

http://townhall.com/columnists/thomassowell/2013/09/17/minimum-wage-madness-part-ii-n1701833/page/full

And should a 12 or 14 or 16 year old be paid as much as a 25 year old employee? Which one would be worth more to

a business, the younger greenhorn or the more mature adult? Do you see where this all leads to?

http://www.openmarket.org/2013/12/12/minimum-wage-increases-harm-the-young-unskilled-and-less-educated/

Then examine the loss of welfare benefits for the “working poor.” You never thought about that angle either, did you?

I know, you will have a statute fix for that too.

http://www.thefiscaltimes.com/Articles/2014/03/28/Minimum-Wage-Hike-Comes-Costs

As Professor Perry stated how does one size fit work in every corner of America? You know the answer but won’t

admit because your ideology trumps all.

http://american.com/archive/2014/march/a-national-minimum-wage-is-a-bad-fit-for-low-cost-communities

Even the space agency, the NASA, has gotten into a redistribution “study.” And you wonder why people no longer

trust their governmental units???

http://www.realclearmarkets.com/articles/2014/03/24/were_all_redistributionists_now_so_well_fail_together_100965.html

There are no logical arguments for support of a wage cartel other than Bathos and Marxism…

BTW, the next time you visit a Burger Queen, why not tip the attendant a buck or two which I frequently do…

It is quick, easy and effective unlike your bureaucracy…

We don’t need no stinkin minimum wages!

I take it from your comment that you have spent zero time working with the poor. If you had, you would see that what you say is not true for the vast majority of the poor and the undocumented. I spent my career in the private sector and was fortunate to have been a success. I retired at the age of 72. I now volunteer with urban youth who have dropped out of school and with community organizing groups where I meet many undocumented workers. You believe in a myth. I can testify to reality of good hard working family people who are and will contribute to building a prosperous country. Try getting out and tasting reality, before you make a judgement!

God will bless you for your endeavors, mous!

Hans. Exactly what are your philosophical grounds? By the way, it is the programs that were passed under the War on Poverty, that provide the safety net that prevented the 2008 recession from hurting even more than it did. I take you are happy that so many more families have slipped into poverty!

Mr Hurley, all solutions should be private and volunteer…Remember all of those

Catholic hospitals which were privately funded and served the downtrodden? Most

do not exist anymore, vics of the poverty pimps’ war on poverty…Direct funding by

you and me, with the ability of exercising local control rather than a EBT card from

WDC.

After decades of welfare, we have even more people on the dole…Trillions of dollars

later and no progress, yet the Progressos continue down this wrong path. Why?

” I take you are happy that so many more families have slipped into poverty!”

I am disappointed by your callous remark.

Hear is more of the NASA, study on income equality…

““This NASA-funded study makes case that future is socialism or extinction,” Derrick O’Keefe, a contributor to Ecosocialism Canada, summarized in a tweet. –

http://cnsnews.com/news/article/barbara-hollingsworth/ivy-league-statistician-debunks-nasa-funded-socialism-or

Those that seek solutions for problems from governmental units, will ultimately help to end this great

nation existence…The rot is everywhere, for all to see…

Hans: You really should read the article a bit before describing it. Suppose I took some BLS data on Wisconsin state employment. If I then used that data to analyze trends in Wisconsin employment, would the resulting study be a “US government funded study” or a “Wisconsin state/Walker administration funded study”? I think most reasonable people would say no. But that is exactly what you (and to a lesser degree the CNS article) do when you assert the study is NASA funded.

Hans. I have been told by the director of our local food pantry that 90% of the food provided is given by the Government and to replace that aid, every church in America would have to pony up $50,000 a year! So apart from the economic impact of the government safety net, if you support private charity that cannot provide enough money, why the objection to government programs that achieve the same ends? Would you rather see them suffer than go against your ideology or are you making a moral judgement that they deserve their fate? Sorry to be harsh, but on the ground level talking about the people I see, that would be the impact of withdrawing public aid. And what about the aid that big business receives from Government or the benefits that many in the middle class receive in the form of deducting mortgage payments, lower tax on dividends?

captcha iterate

Mark Perry has a post on how the “one size fits all” minimum wage makes little sense and can be harmful.

http://www.aei-ideas.org/2014/03/why-a-national-minimum-wage-of-10-10-per-hour-would-be-a-bad-fit-for-americas-low-cost-communities/

Direct disemployment effects are irrelevant. Unless the Phillips curve shifts, the newly unemployed workers will put downward pressure on wages and the unemployment rate will return to the NAIRU. The relevant measure is the effect on the NAIRU, which is large. See

http://www.federalreserve.gov/pubs/feds/2000/200038/200038abs.html

Peter Tulip: Thank you for the comment. While I believe that NAIRU could rise in response to an increase in the minimum wage (that is textbook), I am not so optimistic for fast adjustment (and I think you should be skeptical too, given the experience of the past five years).

Relatedly, it’s not clear to me that the long run Phillips Curve is vertical at near zero inflation, per Akerlof-Dickens-Perry.