Implications for the dollar’s trajectory

A few days ago, reader Tom chastised me for announcing “somebody’s estimations of a theoretical, unobservable phenomenon” as known. Today, I will repeat that alleged offense in regard to the counterfactual known as the purchasing power parity exchange rate, a pervasive concept in international finance.

Recall, if one extends the law of one price to the international context, and assume bundles of goods are identical, then it must be true that:

S = P/P*

Where S is the exchange rate expressed in $ per foreign currency units, P is the US price level and P* is the foreign price level. In logs:

s = p – p*

If purchasing power parity (PPP) holds instantaneously, then the real exchange rate, q ≡ s-p+p* is a constant.

Few people believe that PPP holds instantaneously; however, many believe that s, p and p* are cointegrated with unit elasticities, so that q is stationary. One interpretation, then, is that PPP defines a “fair value” for the exchange rate, i.e., a “counterfactual”.

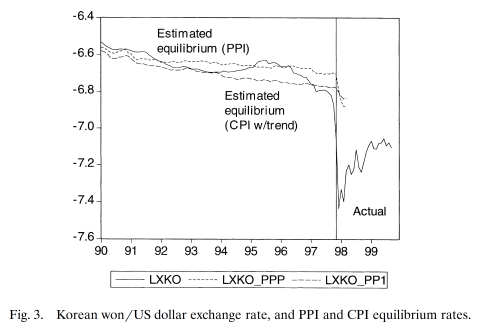

How many people believe it? Hard to say. Punching in the words “cointegration” and “purchasing power parity” into Google Scholar yields 100 pages of references (100 pages appears to be the maximum that Google Scholar provides). One example of calculating counterfactual “equilibrium exchange rates”, based upon PPP, for the currencies involved in the 1997 East Asian crises is “Before the Fall: Were East Asian Currencies Overvalued?”. Below are PPP estimates for the Korean won.

The use of PPP as a measure of “fair value” is commonplace; see for a recent instance Ruskin and Saravelos, “Long-term overshoot,” FX Forecasts and Valuations (October 9, 2014). [not online]:

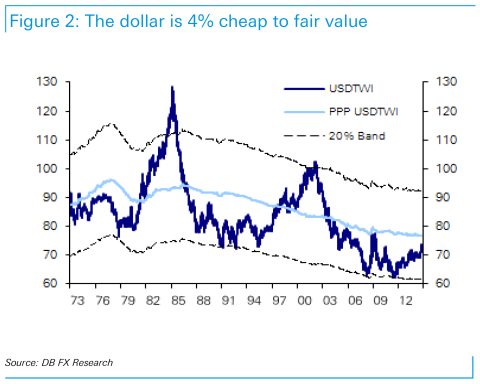

The thrust of our USD positive forecasts are centered around the theme of multi-year policy divergence in favor of the dollar. This has not changed materially in the past year. Readers will find more surprises in the out years, notably in our new 2016 and 2017 forecasts when we expect the USD to overshoot ‘fair value’. This follows a familiar post-Bretton Woods pattern of USD overshooting (up and down) in every cycle when USD policy rates strongly transition from a very low ranking against G10 peers, to a ranking at or near the top end. Only in the 2018 – 2019 period do we project some reversion back to long-term ‘fair value’ in line with expected monetary policy trends. …

(Note: using Tom’s criterion, every appearance of the term “fair value” should be preceded by the adjective “estimated”, which I think would be tiresome, but that’s just me.)

Here is Deutsche Bank’s fair value series for the trade weighted US dollar.

Source: Ruskin and Saravelos, “Long-term overshoot,” FX Forecasts and Valuations (October 9, 2014). [not online]

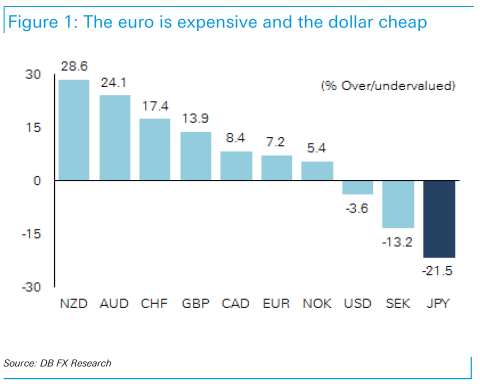

Some people would say that it is silly to estimate counterfactuals in this case — that is one couldn’t know what the exchange rate would be — but apparently the appeal to counterfactuals is widespread in the international finance/applied econometrics literature. Here are the DB estimates as of October for the degree of misalignments (of course, contingent on the possibility of calculating counterfactuals):

Source: Ruskin and Saravelos, “Long-term overshoot,” FX Forecasts and Valuations (October 9, 2014). [not online]

See here for Known Unknowns in Macro. A simple exposition on PPP is here, and a post on the subject of PPP and the dollar over eight years ago.

Counterfactuals are like love: they mean you never have to say you’re sorry.

Ecomedian, LOL!!!!!!!

That is really deep if you think about it – and also very funny.

As I read Menzie’s post I wondered what the counterfactual would be for kimchi. Is it even remotely possible that price levels for a basket of goods could be different based on cultural preferences? Naw, people all over the world demand exactly the same things, Differences are simply an illusion.

I also wondered, what if there were a monetary commodity that was demanded over the whole world and would be a good proxy for all goods and services? Could we then compare currencies from different countries so that cultural tastes would be minimized? Is there such a commodity? Is there such a precious metal? But then comparing the prices of a calculated price of goods is much more robust even if culture makes it less accurate.

Ricado, how about a McDonald’s hamburger that the Economists calculates..

My view: Dollar is likely to get much stronger.

You ought to write more on labor markets. There are just some gems here at CR. http://www.calculatedriskblog.com/2014/11/more-employment-graphs-duration-of.html

Note the sustained improvement in manufacturing employment; long term unemployment will be at normal levels by year end 2016; return to employment has significant equality implications–the less educated gain the bulk of the jobs; we’re still a million jobs low on construction, a good chuck of those are going to go to illegal immigrants. Lots of stuff going on in labor markets just now.

Also, McBride’s JOLTS table is really worth a look. Job openings are soaring and looking to surpass hires, which is very unusual in the historical record. It speaks to a really hot labor market (in trend, not level). Are we going to see big wage increases from the middle of next year? I would guess so.

Me, on Saudi oil policy: http://www.prienga.com/blog/2014/11/11/understanding-saudi-oil-policy-the-lessons-of-79

Regarding Saudi Arabia, I suspect that they have been waiting for a downturn in global demand that would allow them to maintain their production and net exports (especially during their low domestic demand winter season), as a way to drive down oil prices, which would hurt the high cost tight/shale producers.

But an important point to remember is that the Saudis have so far been unable, or unwilling (take your pick), to exceed their 2005 annual net export rate of 9.1 mbpd (total petroleum liquids + other liquids, EIA). This post-2005 decline in net exports is in marked contrast to the large increase that they showed from 2002 to 2005, as their net exports increased from 7.1 mbpd in 2002 to 9.1 mbpd in 2005. Based on EIA data, their 2013 net exports were 8.7 mbpd (total petroleum liquids + other liquids).

A second, and almost totally ignored, point is that CNE (Cumulative Net Exports) depletion marches on. By definition, it’s not whether Saudi Arabia has depleted their remaining volume of post-2005 CNE, it’s a question of by how much. The following chart shows normalized values for Saudi production, net exports, ECI Ratio (ratio of production to consumption) and remaining estimated post-2005 CNE by year (with 2005 values = 100%). The estimate for post-2005 CNE is based on the rate of decline in the Saudi ECI Ratio (at an ECI Ratio of 1.0, net exports = zero). I estimate that in only seven years, through 2012, Saudi Arabia shipped roughly one-third of their post-2005 CNE.

http://i1095.photobucket.com/albums/i475/westexas/Slide21_zps74c9ebac.jpg

Professor Chinn,

Would you consider discussing the WSJ comment by A. Mattich online today, “Even in a Low _ Growth World, Yield Can Rise”. The author mentions research by the San Francisco Fed.

Thanks for considering.

AS: The article makes sense, although I have two reservations (at least). First, inequality has been increasing for a long time, so a cyclical upturn seems hardly enough to undo the increase in savings. Second, demand for credit is other half of the equation; maybe investment will pick up, but that depends in part on aggregate demand.

Thanks. Sure seems like a lot of forecasters were fooled thinking interest rates on 10 year treasuries would be above 3% by now. I assume that when we all think that rates will never go up again, rates will begin rising.

Steve Kopits,

With the huge win by the Republicans the FED knows it is only a matter of time until their secrecy will be pierced. There are a lot of Republicans who want to audit the FED and there could be a lot of skeletons exposed. I think that gold is declining because the FED is trying to fix a lot that would be exposed in an audit. Yes the dollar will remain strong because the FED is, rightfully, running scared.

There is also a growing movement to audit the reported gold held by the FED. This has become even more broadly supported since the FED refused Germany to see their gold that is supposed to be held by the FED. Word from some ex-fed employees is that the FED has leased the gold from other countries to Goldman Sachs and JP Morgan among others.

Spencer,

A McDonald’s hamburger is probably more accurate than most techniques used to calculate monetary value. I would at least say it would be more consistent than kimshi. But then again do you mean a Big Mac or perhaps a bean burger? I guess even though it is better than the aggregate attempts to value a currency, the precious metals are still the most consistent monetary commodity from culture to culture.

Ricardo: The McDonald’s hamburger index the Spencer refers to is the Big Mac index. The data set is available there, should you decide to avail yourself of it. PPP does not hold in it; rather there is a fairly predictable correlation between higher price level and income per capita. Some people might even call “MacParity” a counterfactual(!).

Menzie,

In your previous post on this topic, it seemed to me that the problem was that some macro concepts are hard to measure and therefore may not be very useable. I mentioned potential output, NAIRU, and the multiplier as examples of well-defined macro concepts that are hard to measure. In this case, it seems to me the problem is different. The real exchange rate is very easy to measure. However, the problem is how to interpret the evidence on the real exchange rate and how to use it. Here are the problems as I see it with the interpretation:

1) Yes, I think there may be a consensus that PPP holds in the long run, but you gotta have faith, since the evidence is not especially strong. As you know, early tests failed to reject unit roots, but that’s because these tests have low power. People have put together 100 year data sets and panel data sets and now tend to reject the unit root. However, as your colleague Charles Engel has pointed out, these tests have significant probability to reject the null when it’s true. Tests of stationarity have low power, even in these very long data sets. Also, over very long time horizons, other factors can interfere with these statistical tests, such as regime shifts. Belief in long-run PPP is very plausible but you do have to have some faith.

2) If the real exchange rate is stationary, it’s close enough to a unit root so that deviations from the long run can last for very long times, with half-lives that are perhaps 3 years or more long.

3) The real exchange rate is very volatile in the short run, since nominal exchange rates are much more volatile than price levels.

So, I think the bottom line is that if the real exchange rate is stationary, it bounces around quite a lot in the short run, and when it is disturbed, it takes a long time to get back.

If you agree with all this, then I’d be curious as to your answers to these questions:

1) How do we actually use the information that an exchange rate is under- or over-valued relative to PPP? Should economic policy respond to deviations from PPP?

2) More specifically, if we were targeting the exchange rate, should monetary policy take into account deviations from PPP?

Rick Stryker: The real exchange rate is easy to measure, but since we typically have price indices — rather than prices of bundles of goods — then the constant representing the PPP level of the real exchange rate has to be estimated. Equivalently the constant in the cointegrating relationship has to be estimated.

The consensus on real exchange reversion has changed (surprisingly) much since the early 1990’s literature. Part of it is due to longer data — even post-Bretton Woods — and part to more powerful techniques. Now I think it is not uncommon to find trend stationarity for real exchange rates, and even less uncommon to find cointegration with non-unit elasticities, when the exchange rates involve developed country pairs (that’s addressing your added on question).

Personally, I think mean stationary real exchange rates is to be expected in cases where the Balassa-Samuelson effect is likely to be minor, and goods baskets similar; as in the EMR paper, if one uses the more powerful Horvath-Watson test, which does not impose the common factor restriction on dynamics, then it’s not so rare to find cointegration with unit elasticities.

On a lark, I checked the most recent IMF IFS series for the US CPI deflated real rate. It rejects the unit root null at the 10% level, using the Elliott-Rothenberg-Stock DF-GLS test (intercept, no trend), and fails to reject the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) mean stationarity test at conventional levels.

I think the threshold AR literature and the threshold cointegration literature have changed the perspective on pace of adjustment considerably. A good review of the more recent literature is by Taylor and Taylor (published in JEP).

Menzie,

Thanks for your reply. Yes, the KPSS and the DF-GLS test evidence helps with the issues I raised on real exchange rates being near unit root and the power of the tests. I just took a look at the review you suggested and I saw what you were talking about on the pace of adjustment issue. Wasn’t aware of that– I appreciate the pointer.

Menzie,

One more question. As I understand this, people typically assume that the cointegrating vector is (1,-1,1) when they do the stationarity test. However, I’d assume that if you tried to estimate the vector you wouldn’t get that, for all the reasons that PPP might fail in the first place. I think you might still be able to claim that s, p, and p* are cointegrated, but that the cointegrating vector would imply that PPP does not hold in the long run as conventionally defined. Is that right? And does it matter for the questions I’ve asked above?

Alan Greenspan at the Council on Foreign Relations October 29, 2014 on gold

“Gold and Economic Freedom,” a 1966 essay by Alan Greenspan:

http://www.constitution.org/mon/greenspan_gold.htm

Menzie,

I know about The Big Mac index. As the article you linked reports, this index was originally for amusement but many economists adopted it and even included it is text books. Since you are aware of this index, is it one you follow? My post was an attempt to set it in perspective. Spencer called it a “hamburger” index. I was pointing out that most commodities are not consistent enough to be a proxy for all goods so such an index is virtually useless for the same reason a basket of goods is inaccurate. Cultural differences make a difference in a basket of goods.

But this does give me a chance to offer another thought experiment. Consider that you prepare a basket of goods with all the goods in a country in the proper ratios. What we know is that their are certain goods, such as seasonal goods, that must constantly be change. But consider that removing the more volatile commodities from the basket actually make it more stable when determining the value of the currency. Now let’s assume that we continue to remove goods until we finally only have one good that is the most stable good concerning the value of a currency. Would you be surprised at what commodity that would be?

It amuses me that economists choose second and third best data that builds in errors rather than simply choosing the best data. I assume they get bored with the simply but accurate data, preferring to have to adjust for errors to make their analysis more “robust.”

I guess it is the old “complexity allows one to charge a higher price for services” syndrome.

Ricardo: Sometime, you should actually look at the data. In fact using seasonally adjusted or seasonally unadjusted data is completely inconsequential to whether one finds purchasing power parity holding in the long run or not. For instance, consider the euro/dollar exchange rate over the 1996M01-2013M10 period. Both the unit root and trend stationarity tests (DF-GLS, and KPSS, respectively) yield the same results, whether using seasonally adjusted or not seasonally adjusted CPI’s. Anyone with a passing knowledge of exchange rate variability post-Bretton woods for floating rates would know that the variability associated seasonal factors are swamped by the variability in nominal exchange rates.

There might be reasons to be fixated on gold. The one you give is not one of those reasons.

It’s unlikely purchasing power adjustments, for price and quality, are accurate.

For example, China’s per capita GDP based on purchasing power may be overstated, e.g. because of air, water, and land pollution.

Here’s another example:

The Problems and Potential of China’s Pharmaceutical Industry

April 2009

“China is dogged by a history of poor-quality pharmaceuticals that have killed hundreds and sickened thousands of its own citizens and people across the globe. The government has begun to tighten its laws, but enforcement remains weak, and official obfuscation is rampant.”

Menzie,

Your response reminds me of my daughters when I would not allow them to go to a party that was questionable. “But everyone is going.”

Just because two calculations of PPP support one another does not prove the accuracy of PPP. All it does is prove that the two Sudoku puzzles can be solved by using two different methodologies.

As you state prior to 1971 there was no need for PPP because there was a more accurate indicator of purchasing power.

Menzie wrote:

There might be reasons to be fixated on gold.

Menzie, I have been thinking about your statement above and I want to say thank you for at least recognizing there are reasons gold could be the proper indicator for currency value. When you get one right I definitely want to encourage you to continue.