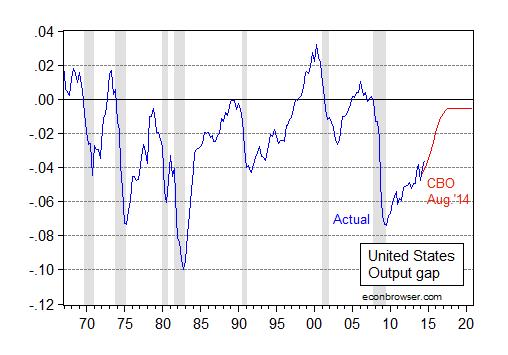

Yesterday’s advance GDP release for 2014Q3, covered by Jim, was welcome news, and was something Jeff Frieden and I predicted at the beginning of the year [1]. However, while growth seems to be firming, it is far too soon to take away stimulus. Figure 1 shows that the degree of economic slack remains large. [edits 11/6 to accommodate reader Tom’s critique]

The [Estimated] Output Gap Remains

Figure 1: [Estimated] Output gap (blue) and projected (red) using August 2014 CBO projection. Source: BEA, 2014Q3 advance, CBO An Update to the Budget and Economic Outlook: 2014-2024 (August 2014).

The [estimated] current output gap is 3.6% (log terms); this is [estimated to be] larger in absolute value than the [estimated] gap when the G.W. Bush proposed a second round of tax cuts to stimulate the economy (even if they were ill-designed to do so). Even by end-2015, the [estimated] gap is projected by CBO to be 2.3%.

Downside Risks Remain

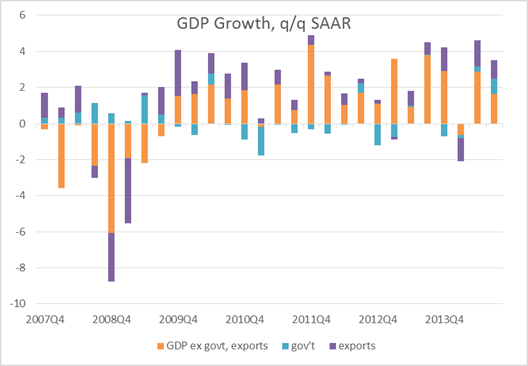

While [estimated] output is currently exceeding the August 2014 CBO forecast, there remain definite downside risks. Two [estimated] spending components accounted for a large portion of [estimated] growth over the last two quarters: exports and government.

Figure 2: [Estimated] Contributions to growth from all except exports and government (orange), government (blue) and exports (purple), q/q SAAR, %. Source: BEA 2014Q3 advance and author’s calculations.

It is unclear why [estimated] government (defense) expenditures rose so much in 2014Q3, but in any case it would not make sense to bet on continued defense spending at elevated levels.[2] [Estimated] Exports are growing strongly for now, but the slowdown in Europe and China puts in doubt that sustaining force (although Goldman Sachs [10/21/2014, not online] observes that a 0.3 ppt markdown in RoW growth implies a 0.1 ppt reduction in US growth, using the Fed’s FRB/US model.) See also Furman/CEA regarding export growth.

Misplaced Concerns about Inflationary Pressures

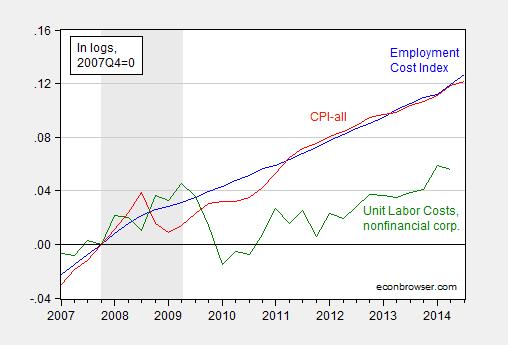

Despite the fact that the [estimated] output gap is still large, and substantial downside risks to the outlook persist, I hear people worrying about wage inflation, particularly given the 3% (annualized) upward movement in the 2014Q3 Employment Cost Index (ECI) reported today. As always, it’s important to keep these numbers in context. The [estimated] ECI has risen roughly the same amount as the CPI since the last peak in 2007Q4. This is fact is illustrated in Figure 3.

Figure 3: Log [estimated] Employment Cost Index (blue), [estimated] CPI-all (red), and [estimated] unit labor cost index for nonfinancial corporations (green), all normalized to 2007Q4=0. NBER defined recession dates shaded gray. Source: BLS, and BEA via FRED, NBER, and author’s calculations.

Note that the co-trending of the ECI and CPI implies a constant real wage, while (as we know) [estimated] productivity has been rising. In fact [estimated] unit labor costs in the nonfinancial corporate sector in 2014Q2 was only 1.1% higher than the previous peak in 2009Q2. In other words, [estimated] rapid productivity growth has not shown up in wages thus far, and when a little bit does, there is panic in the (Wall) Street. If indeed we are serious about reversing the declining [estimated] share of labor in national income, then we should not fear a little wage growth. Another way of viewing the increase in wages is that it represents a small shift in balance of monopsony power between capital and labor (not literally monopsony but monopsonistic competition). From Larry Meyer in “Wage-Setting Power and the Labor Share of Income,” Macro Focus 9(6) (Macroeconomic Advisers, October 14):

…when firms have wage-setting power in labor markets (as represented here),

1. employment is lower than when firms do not have wage-setting power,

2. nominal and real wages are lower than when firms do not have wage-setting

power,

3. the real wage is below the marginal product of labor, and

4. the labor share of income is lower than when firms do not have wage-setting

power.To this point, we have explained why the labor share of income is lower in the case of monopsony than in the case of perfect competition, but we have not explained the declining labor share of income exhibited over the last 15 years or so. We view the conditions that have given rise to wage-setting power on the part of firms as having evolved over time, leading to wage-setting power that has increased over time and a labor share of income that has decreased over time.

[Note that the labor share of income cited by Meyer is [estimated] — mdc 11/6]

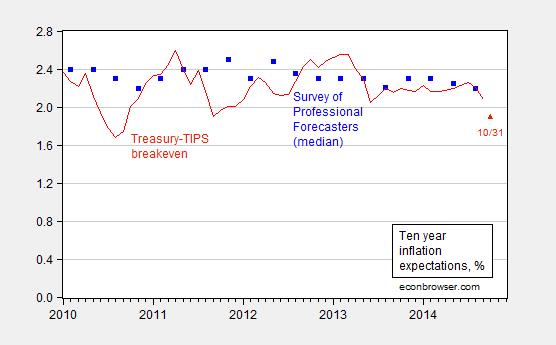

Moreover, if inflation expectations are well anchored, we should not be worrying about higher wage costs feeding into inflation. (Note that if anything, [estimated] expected inflation is dropping.)

Figure 4: Median ten year expected CPI inflation from Survey of Professional Forecasters (blue square), Ten year constant maturity Treasury-TIPS spread (red). Source: Federal Reserve Board via FRED, Philadelphia Fed.

Update, 11/1, 10:10AM Pacific: Reader Tom castigates me for writing as if the output gap as a known. Since I do not wish to be accused of overstating my confidence, let me state for the record there is some variation in these measures; the October IMF WEO indicates -2.6% gap for 2014, a vast (!!!!) difference from the CBO’s August estimate of -2.9%. To document the fact that I am aware of uncertainty attendant estimating output gaps, see [1] [2], [3], [4], and [5].

I think, if President Obama was pragmatic, like President Clinton, and worked with everyone in Congress, in 2009, on a comprehensive package to cut taxes $5,000 per worker (or $700 billion for the 140 million workers at the time), reduce and remove $1 trillion of the $2 trillion a year in federal regulations (rather than adding more regulations), and gradually raising the minimum wage to $15 an hour, e.g. by 2015, we would’ve had much stronger growth.

And, when the economy actually recovered, tax rates could be raised and regulations could be reintroduced.

Tax rates could be raised?

Never. No way.

If unicorns could fart rainbows…oh never mind…

You have a bizarre way of writing about output gaps as if they were knowable.

Tom: For 2015, CBO (August) forecasts -2.9% gap; IMF (October) forecasts -2.6%. I did cover these issues extensively in several posts a few years ago, but for your edification, here they are: [1], [2], [3], [4], and [5].

I hope this addresses your concerns.

I don’t have any concerns, I’m just mocking your silly behavior. You announce somebody’s estimations of a theoretical, unobservable phenomenon as “the output gap” or “the actual output gap” as if you and they actually know them to be the output gap. You can’t know what we could have produced. It’s a counterfactual.

Tom: Yeesh. I apologize, I misunderstood your criticism. I thought you were referring to model and parameter uncertainty in the calculation of the potential output. Now I see you have a much more nihilistic interpretation.

I better stop referring to the “expected rate of inflation”, the “natural rate of unemployment” or NAIRU, the “real interest rate”, the “equity risk premium”, the “liquidity term premium”, the “intertemporal rate of substitution”, the “marginal rate of substitution”, the “marginal rate of technical substitution”, the “coefficient of risk aversion” both relative and absolute, etc.

Indeed, using your criterion, we should close up shop here at Econbrowser. Sounds like we can’t talk about anything, since GDP — especially advance — includes a big chunk of extrapolated data.

Again, sheer silliness.

There are observable phenomena, such as GDP and backward-looking real interest rates. There are forecasts of observable phenomena, such as expected inflation and forward-looking real interest rates. And there are unobservable phenomena that exist only in theory, such as potential GDP and NAIRU.

Obviously, neither estimating GDP nor forecasting GDP are at all like estimating potential GDP or NAIRU. GDP is observable, albeit too big and complicated to precisely measure. Potential GDP is a counterfactual. It exists only in theory.

I never said it’s silly to write about potential GDP or the output gap or any other theoretical, unknowable thing. I said it’s silly to write about them as if they are known. You can measure slack capacity, but you can’t measure how much value slack capacity would have added had it been employed.

Tom: Well, you’d better get in touch with the Fed, and tell ’em to get rid of Fed release G.17, und macht schnell! They are wasting their time! Also, let’s hunt down everybody who says “capacity utilization” without adding in “plus or minus Z%”.

In addition, let’s identify every reference in the academic and journalistic and blogging literature to NAIRU without standard errors — isn’t that the logical implication of your point?

Let me just say this sentence:

For some people, that is the definition of slack capacity.

‘not literally monopsony but monopsonistic competition’

I laugh.

And how did we get more monopsonistic competition today than in 2007, when the unemployment rate was 4.5%?

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Patrick R. Sullivan: From Meyer:

You seem to be disdainful of the notion of monopsonistic competition. I suggest you consult one of the key NK papers of the 1980’s: Blanchard-Kiyotaki (1987). It has a mere 1691 google citations.

Will the real potential output please stand up? Larry Summers has a nice graph on the evolution of potential GDP over at the CBO, here: http://www.voxeu.org/article/reflections-new-secular-stagnation-hypothesis

I think we’re still on track for the most jobs created since 1998; on current trend, we’ll have the lowest initial unemployment claims since 1973 by next summer. The budget deficit is below 3%; inflation is low; GDP last quarter was 3.5%.

What exactly is the problem we’re trying to solve? Existing programs need to be consolidated or wound down. And frankly, that’s what’s already happened. The budget deficit could still be tightened up to a small surplus, but it’s manageable as it is. And QE3 is done, even as the DOW has reached an all time high.

Right now, I think the economy just needs to be left alone.

“What exactly is the problem we’re trying to solve?”

Well, median wages suck. Household assets are minuscule for about half the country.

100+ million people in the US have no trouble answering your question.

The irony of this post is that the fall in labor share has lowered potential output to such an extent that there is no output gap now. The continued thinking that the output gap is still so large greatly distorts policy. … Yes, output calculated on former full-employment levels of utilizing labor and capital gives a large output gap. Yet the utilization of labor and capital will not return to those levels. Potential.output is in dire need of some recalibration.

What if the output gap was zero? How would you change policy?

Inflations, wage and price, can still stay below target even at full employment.

There has been some destruction of potential output, in part, because some people were willing to work longer, or harder, to pay-down debt, and build-up saving.

Unfortunately, they were unable to get a job, or a decent paying job.

Consequently, many people defaulted on their debts and/or retired on less income.

However, the continued massive idle and underemployed labor and capital are not frozen, to where there is no output gap.

Peak T

The only reason the output gap in the first graph above decreases is because potential output is curving down as we move into the future. Real GDP is not curving up. You will see going into 2015 that real GDP has hit its “effective” limit.

Edward Lambert, is Angry Bear still kicking people out who are to the right of Karl Marx?

You wrote the most moderate articles. I’m surprised they tolerated you.

I was at the Carpe Diem blog, then went to the Angry Bear blog, and now I’m here.

Both Carpe Diem, a libertarian blog, and Angry Bear, a liberal blog, are way too extreme.

PeakTrader: “I think, if President Obama was pragmatic, like President Clinton, and worked with everyone in Congress, in 2009, on a comprehensive package to cut taxes $5,000 per worker (or $700 billion for the 140 million workers at the time), reduce and remove $1 trillion of the $2 trillion a year in federal regulations (rather than adding more regulations), and gradually raising the minimum wage to $15 an hour, e.g. by 2015, we would’ve had much stronger growth.”

You seem to have a rather peculiar twist on history. Pragmatic like Clinton? Clinton raised taxes in 1993, which passed without one single Republicans vote. So much for pragmatic. Republicans declared this would plunge the country into depression. Of course they could not have been more wrong as the tax increase was followed by the greatest economic growth in decades and a budget surplus. But of course that was a different economic situation than today.

You must be hallucinating concerning the willingness of Republicans to cooperate. In 2010, Obama was barely able to push through a 2% payroll tax holiday , amounting to about $1000 for the median household, despite Republican opposition only by agreeing to also extend the Bush tax cuts for the top 1% giving them billions in tax cuts. Yes, the Republicans would agree to a miserly $1000 cut for the middle class only if they could get a $1 million tax cut for Mitt Romney. A $5000 cut for everyone else is delusional given the Republican agenda. Republicans eagerly axed even that miserly payroll tax holiday as soon as they got a chance in 2012.

And Republicans ever agreeing to a $15 minimum wage? What are you smoking? The Republican position is that there shouldn’t be any minimum wage, period.

All it required was pragmatism? Surely you jest. Obama even foolishly offered to put Social Security cuts on the table and the Republicans still wouldn’t budge. This idea that all Obama had to do was wish a little harder and have a few drinks with the Republicans is nonsense.

Joseph, the best time to raise taxes is when an expansion is well underway, e.g. when the Bush expansion began in 1991.

The U.S. economy did well with a Democrat President and a GOP Congress. There was give and take, or compromise.

Clinton working with the GOP did move to “reinvent government” (including welfare to workfare) and finally agreed to balance the budget.

Obama has been a rigid ideologue, unlike Clinton. Constantly demonizing and ridiculing the GOP is not leadership.

PeakTrader: “The U.S. economy did well with a Democrat President and a GOP Congress. There was give and take, or compromise.”

What is this compromise you speak of? That well timed tax increase in 1993 that you favored. It passed without a single Republican vote. In fact it required Vice-President Al Gore to cast the tie-breaking vote in the Senate. Remember the Newt Gingrich slash and burn policy?

Obama an ideologue? He offered everything the Republicans wanted on the budget, even Social Security cuts, and they still wouldn’t budge unless they included tax cuts for millionaires.

Clinton’s welfare reform? Oh, I get it now. By compromise you simply mean agreeing to implement the Republican agenda.

Yet, Republicans refused to support the Republican plan for healthcare reform because Obama wanted to implement it. Republicans refused to support the Republican plan for carbon cap-and-trade because Obama wanted to implement it. Where’s the compromise? Obama compromises by trying to implement Republican plans and Republicans refuse.

There is no compromising with Republicans because they are at root a one-issue party — tax cuts for the rich. For anything else they are the party of “No” (unless it’s cynical pandering on issues like guns and gays.)

Menzie,

What stimulus are you referring to when you say we should not yet reduce stimulus? Government expenditures have declined substantially over the past four years. Or are you referring to monetary policy?

Anonymous: I meant primarily monetary; i.e., we should not [corrected — mdc] reduce the Fed’s balance sheet yet, and forward guidance should continue to be extended low policy rates. You are right, the Republicans have already effectively ended a lot of fiscal stimulus (ending additional SNAP, extended UI), but if they had their way, they’d probably hack away at more spending, particularly at the state level, following Kansas’s lead.

Gotcha, thanks for the clarification. And I think you meant ‘shouldn’t’, not ‘should’ in your reply.

Anonymous: Thanks, you are right – corrected that error.

Sorry, but the “ouput” gap is a intellectual creation. There is no such thing. Output is declining because we are aging and the private sector has less to do for similiar results. This isn’t like in 1833 when Andy Jackson at the advice of Astor(who ran MVB, who was a British agent) and his British allies, abolished the National Bank killing industrial production and sent the North’s economy reeling for 25 years(while Chase Manhattan, which Astor the largest shareholder, and starts “Wall Street”). It was a large reason why the Union struggled to win the war and why it was the North that actually initiated the Civil War when they elected a ardent economic nationalist in Lincoln because of the stagnation.

The output gap is being steadily revised down because that is where 4.8% unemployment is at. The reality of this eludes people. We have “public sector” output gap in terms of investment, but that isn’t cyclical. Cyclically, the recession is over as much as it was over in November of 1994. The only way to drive unemployment down 4.8% is by another bubble. It is why the Fed has refused to cover the credit loss in full and only half. It is actually a break with their charter, but understandable. The primary dealers aren’t reliable right now and when they start competing over credit expansion, bad things happen(another lesson from Alexander Hamilton).

The Rage: GDP is an intellectual creation…should we jettison it?

Menzie asks It is unclear why government (defense) expenditures rose so much in 2014Q3

I believe the answer is that CY2014Q3 also happens to by FY2014Q4. The government shut down at the beginning of FY2014 (last October) and the ongoing concerns over sequestration made it rational to develop agency spending plans that spiked obligations towards the end of the fiscal year. In other words, because agencies weren’t sure if they would have to reduce FY2014 spending from previously authorized levels, those agencies developed spending plans that were very conservative during the first three quarters of the fiscal year. But since the law requires agencies to obligate 100% of authorized funds, agencies had to press the panic button in the fourth quarter and step up the pace of obligations. People don’t always understand that spending less than what is Congressionally authorized is not an option and can land you in jail. If Congress directs that $X billions must be spent, then $X billions must be spent and not $X – $N billions.