Reader Move On admonishes me to … move on. So here is job creation in this Administration, in comparative perspective.

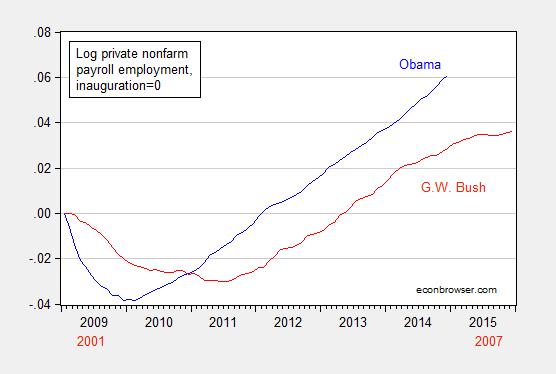

Figure 1: Log private nonfarm private employment normalized to 2009M01 (blue), and to 2001M01 (red). Source: BLS, and author’s calculations.

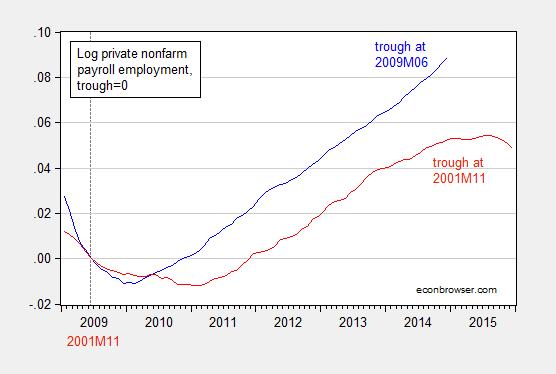

Figure 2 presents private employment normalized on the relevant troughs (as defined by the NBER).

Figure 2: Log private nonfarm private employment normalized to 2009M06 (blue), and to 2001M11 (red). Source: BLS, NBER, and author’s calculations.

The astute observer will note the deceleration in employment growth as one moves toward the end of the G.W. Bush Administration. In fact, private employment was 462,000 less at the end of the G.W. Bush administration than at the beginning, i.e., -0.4% lower (in log terms).

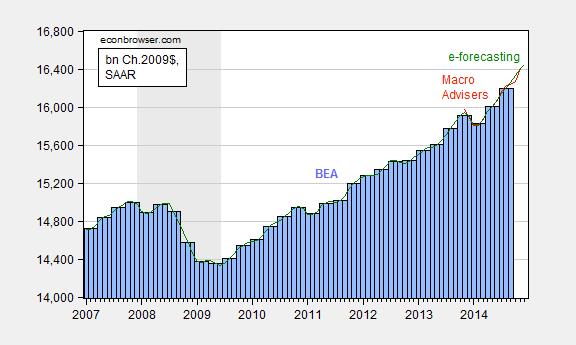

On a related matter, Macroeconomic Advisers and e-forecasting have reported monthly GDP for November and December, respectively. For now, output seems to continue to rise at a fairly rapid clip.

Figure 3: GDP, in billions Ch.2009$, SAAR (blue bars), monthly GDP from Macroeconomic Advisers (red), and e-forecasting (green). NBER defined recession dates shaded gray. Source: BEA 2014Q3 final release, Macroeconomic Advisers (15 Jan.), and e-forecasting (21 Jan.).

‘Statistics are like lampposts. They can be used as intended, for light, or they can be used as the drunk uses the lamppost, for support.’

Patrick R. Sullivan: Pretty funny comment from a guy who doesn’t even consult statistics before making assertions.

And on that point, I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Here’s a statistic for you to ponder; Employment to Population ratio;

http://data.bls.gov/timeseries/LNS12300000 (There’s even a picture!)

Jan. 08; 62.9%

Dec. 14; 59.2%

How does that square with the fabulous job creation under Obama?

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Patrick R. Sullivan: Thank you for continuing your reign of disinformation. Peak EPR is 64.7% in April 2000. Perhaps you should ponder that data point.

I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

One doesn’t have to ponder too long to remember that Y2K was the end of the dot.com boom/bubble. There were newspaper stories almost every day, of retirees being lured out of retirement, of ex-convicts finding themselves recruited by businesses that once would have shunned them, people being allowed to bring their infant children into the office ….

Using the year 2000 as a base year, is typically Menzieconomics.

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

I don’t think using the participation rate is useful for comparing administrations. The rate doesn’t account for the huge effect of boomer retirements which started to hit in earnest around 2008. See this article which attributes nearly half of the drop in participation to an aging population.

http://www.federalreserve.gov/pubs/feds/2014/201464/201464pap.pdf

comments like that usually come from somebody whose ideology conflicts with the data presented, in an effort to denigrate the data and results.

I’m genuinely mystified at the number of comment sections that are dominated by ring-wingers, cranks or otherwise. I know Ron Paul was found to have used some sort of automated software to drum up support some years back, but what I’ve seen–what we see here, with the number of people that hate the content of the blog, yet keep returning–indicates it’s natural. And yet…WHY? I get there is time to kill–that’s why I am here on Friday at 4:45, before I leave the office–but at all times, it seems, these people are out and about. Why aren’t they out, you know, creating jobs or something?

Let’s try another comparison: http://portalseven.com/employment/unemployment_rate_u6.jsp

The U6 rate held fairly steady during Bush’s administration despite the first recession. 2008 marked a highly unusual break from other recessions of the past three decades so the percentage of recovery was bound to be much greater for President Obama and, in fact, still not historically “normal.”

Secondly, the employment “recovery” still has “abnormal” characteristics: http://www.advisorperspectives.com/dshort/commentaries/Full-Time-vs-Part-Time-Employment.php

Apples to oranges: Bush to Obama.

But, But These Numbers Can’t Be Correct!

Everyone knows that Republican presidents are better for private sector job growth because free market, conservative principles, deregulation, argle bargle. Democrats only create socialist government jobs. In fact, Mitt told us that just last week and he was a very successful businessman who created millions of jobs — of course they were in China, but still, millions of jobs!

menzie, I can’t help but feel you are taking advantage of (some of) your readers with (constant) partisan posts such as this. Wether it is intentional or not, the ‘ceteris paribus’ implication in such graphs are misleading at worst and disingenuous at best. Someone with your credentials should know better than to compare job growth between theses two (or possibly any) administrations, unless there is an agenda. With one beginning near the trough of one of the worst economic downturns in modern history, it was virtually guaranteed an upward trend with the other administration experiencing the exact opposite – implying causation or relevance (to anything other than dogma) is absurd. On the other hand, maybe your implication is that central banks don’t matter at all.

This is Taylor, Cochrane, Krugman, Wolfers, DeLong-level myopic partisanship. IMO, you constantly taint the objective, rational, and meaningful conversations & analysis econbrowser is known for thanks to your upstanding co-blogger, Dr Hamilton.

rtd: To the best of my recollection, other folks (e.g., Lazear) first made the comparisons. I am responding, and have tried to discuss issues of conditioning on financial crisis, housing busts, etc., so I’ve tried to do what you asked (see e.g., here); a pity you didn’t comment at those times. Hence, I suggest you take it up with those individuals who have harped on “the worst recovery ever”.

“To the best of my recollection, other folks (e.g., Lazear) first made the comparisons.”

To the best of my recollection, you’re an adult and this isn’t about other folks (e.g. Lazear). This reply is a GREAT example of your childishness and inability to be rational and objective. If other folks (e.g., Lazear) first jumped off of of a bridge, would you follow suit?

“I am responding, and have tried to discuss issues of conditioning on financial crisis, housing busts, etc., so I’ve tried to do what you asked; a pity you didn’t comment at those times.”

This is your excuse? Why doesn’t Jim Hamilton act in this way? If you dropped a sandwich face-down where only a single side touched the dirty floor, would you consider the sandwich clean or dirty? What’s a pity is that you are defending your actions.

“Hence, I suggest you take it up with those individuals who have harped on “the worst recovery ever”.”

First of all, your myopic approach is showing once again as this post has nothing to do with comparing recoveries. You are explicitly comparing administrations.

You’re supposed to be an academic. Just because this blog isn’t technically affiliated with University of Wisconsin, Madison or your peer-reviewed publications, that doesn’t mean that you shouldn’t hold yourself (as an academic and scholar) to the same level of objective and rational analysis of issues. Especially on the issues that you should be considered to be an expert who is to be trusted. Moreover, in a setting where the marginal likelihood (relative to a journal) that your readers are innumerate, economically illiterate, and easily swayed by emotion is high, you should hold yourself to a HIGHER standard. You’ve failed here and this is in no way the first occurrence. Don’t make excuses, as I certainly don’t see your co-blogger stooping to such sophomoric levels.

Rtd – this is a legitimate economic question. The evidence from Wisconsin supports Menzie’s position. If you have evidence to the contrary, present it. It is both amusing and instructive to see how many of the responses present no evidence and resort to ad hominem attacks.

Unless I am missing something, this particular post has absolutely nothing to do with Wisconsin. If you have evidence to the contrary, present it. It is both amusing and instructive to see you reference a completely separate post that isn’t relevant to the claims made here by Menzie or myself.

Oh dear, who is being disingenuous now?

Menzie has the temerity to point out the facts and therefore he is ignoring the “virtually guaranteed an upward trend” in private employment. Since when is anything “virtually guaranteed” in economics? Were oil prices “virtually guaranteed” to increase as the economy expanded? Some Texans would like to speak with you rtd.

Yes, it is virtually guaranteed that after a nation’s business cycle trough, that same nation’s employment growth will display an upward trend. That isn’t disingenuous at all: (e.g.: http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=YaE )

Why would one assume that prices of a globally traded commodity would increase relative to a certain geographical location’s economic expansion?. Seems odd to assume such.

Ah, the Real Business Cycle Once Again:

After a nation’s business cycle trough, employment will naturally increase. How’s that working out in the EU? Not so well I hear, maybe because they followed the wrong policy?

You anti-Keynesians have learned nothing in more than 80 years. Just ignore all the facts and “assume the can opener.”

Paul, you’re taking Menzie’s approach assuming all else is equal. The Eurozone is a conglomerate of nations with varying fiscal policies, ideologies, cultures, and the list goes on and on. Please don’t compare apples with hand grenades.

Really rtd?

Professor Paul Krugman, I assume you have heard of him, has many times compared the austerity policies of the EZ to the American policies of the past 6 years and has said repeatedly that those austerity policies have caused the utter failure of the EZ’s recovery in contrast to America’s success. Is Dr. Krugman badly mistaken too?

Of course such comparisons as his are merely based on evidence and facts as opposed to the grandiose assumptions of RBC so no doubt you will dismiss them.

rtd, the germans enforced a pretty regular fiscal and monetary ideology on the eurozone over the past few years.

Okay, so we’re going to ignore the differences in $policy now?

You’re purposefully getting off the point that comparing employment gains between two administrations that were facing vastly different periods intra-business cycle (and monetary policies) is silly and disingenuous at best for anyone who should be an objective expert within the field. There’s really no getting around this fact.

rtd,

so you dislike comparing obama and bush recoveries. then you should be equally harsh on anybody who wants to compare reagan’s recovery to obama, correct?

baffling,

You said: I “should be equally harsh on anybody who wants to compare reagan’s recovery to obama, correct?”

First off, I don’t know what a Reagan recovery is, nor do I know what an Obama recovery is. That point aside, I do understand what you’re trying to ask. And, the answer to your question would be: absolutely!

‘Menzie has the temerity to point out the facts…’

Correction; Menzie has pointed out ONE FACT, in isolation from other facts that would make him a laughingstock if he tried it in a room crowded with his peers.

This room isn’t quite as tough.

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

rtd: First, thank you for your advice on how to conduct myself on my own blog. I always welcome advice; however, by most metrics, we seem to be doing okay, so I am uncertain of the usefulness of your comments.

Second, you seem to have a very low opinion of the Econbrowser readers. You write: “…in a setting where the marginal likelihood (relative to a journal) that your readers are innumerate, economically illiterate, and easily swayed by emotion is high…” I have a somewhat higher regard for our readers; else I wouldn’t be writing about error correction models, unit roots, DSGEs.

Third, you seem to have a low opinion of standard graphical analysis (note I had two graphs of employment, to present a fuller picture); you write:

“Wether [sic] it is intentional or not, the ‘ceteris paribus’ implication in such graphs are misleading at worst and disingenuous at best.” I figure if the St. Louis Fed can show a variety indices moving up after a trough, it’s good enough for me (in fact, here is their employment graph). So, if you have such a problem, go take it up with them as well.

Fourth, if you lump me in with Krugman, DeLong, and Wolfers, I would be honored.

Fifth, I am not “supposed to be an academic”. I am an academic, not an anonymous commenter who thinks him/herself better than the average person. In fact, if you are so strongly offended, I suggest you set up your own blog. I look forward to reading your “fair and balanced” analysis, under your own name. At that juncture, we can determine whether (note: correct spelling!) you are supposed to be an academic as well.

You proved my point well, Menzie.

First, you’re welcome. I agree that ‘your blog’ is doing fine. It’s disappointing however (as previously mentioned) that some of your posts containing partisan and subjective “analyses” tarnish the good posts you occasionally post and your co-blogger always posts. Dr. Hamilton is always objective and rational – you aren’t.

Second, I said “marginal likelihood (relative to a journal) that your readers are innumerate, economically illiterate, and easily swayed by emotion is high”. I stand by that comment and am disappointed (though not surprised) that you cherry-picked the comment. You can’t be oblivious to the fact that your blog will attract readers who aren’t at the level of those reviewing journal submissions. Again, I said “relative to a journal”. RELATIVE TO A JOURNAL. RELATIVE TO A JOURNAL. RELATIVE TO A JOURNAL. RELATIVE TO A JOURNAL. RELATIVE TO A JOURNAL. RELATIVE TO A JOURNAL. Maybe you caught it that time.

Third, I don’t have a “low opinion of standard graphical analysis” if it is objective and not driven by dogma. Your FRED links don’t compare employment gains between administrations. That was what you are doing. So, there’s nothing to take up with the FRED team. Please don’t change the issue.

Fourth, your partisan & dogmatic approach is showing again by purposefully leaving out the other (right-leaning) economists that I mentioned.

Fifth, act like an academic. If even an “an anonymous commenter who thinks him/herself better than the average person” can see the pervasive partisanship and sloppy analysis that you present in the blog post, there is an issue with your approach.

Sixth, I’m sure, after I called you out in the past for elementary math errors (e.g.: https://econbrowser.com/archives/2014/09/reading-macro-data-growth-rates-annual-rates-data-breaks) that you have quite the thrill in correcting my spelling error. However, I think it just shows your immaturity, ego, and lack of professionalism.

I’ll continue to stick to reading Dr. Hamilton’s blog posts around these parts. I regret deviating from doing so & subsequently calling you out on your b.s. Good day.

rtd: I see you have graduated to the use of even more ALL CAPS. Not an improvement, in my book.

One observation — in the post you reference, it wasn’t a math error, it was a deflation error, if you look back. I used the deflator to deflate the nominal into real. That turns into a rounding error. I guess you can call it a math error, but I don’t think most people would.

I am sorry to correct your spelling. I will not do so in the future.

Let me also observe that other writers normalize on all sorts of things. I thought highly enough of my readers’ intellectual capabilities that I presented graphs normalized on both inaugurations and troughs, so they could make their own inferences. I am sure I have seen both in the past; maybe you have not, in which case you must have a highly restricted set of reading materials. But if you declare prima facie don’t normalize on inaugurations, because conditions differ, it seems you also have to say don’t normalize on troughs, because troughs differ. If that is your view, I agree, don’t do either!! But you say you’re okay with the latter (and hence with the FRED team, and pretty much every other macroeconomist in the world), then you should be okay with the former.

So instead of getting high and mighty, I presented two graphs. You say you have the revealed truth, and know which ones people should see. I think I know who has the more nuanced, nay, academic, view. In the end, I can only conclude that you were irritated that both graphs revealed the relatively poor performance of the economy under G.W. Bush, which conflicted with your deeply held convictions.

Once again, thank you for your comments. Since you have indicated you will no longer read my posts, I look forward to your future silence.

Unless I’m misunderstanding the title of this blog post, you’re whole point is to compare “Private Employment under Obama and Bush”. IMO, and especially given the circumstances surrounding each administration, that’s extremely poor form for a professional economist.

To think you’re able to save face by adding a graph comparing one of the worst economic downturns in recent history with a much milder recession and a less-activist $policy among others is a plain silly.

Also, you have absolutely no reason other than your own hurt feelings to conclude that I’m “irritated that both graphs revealed the relatively poor performance of the economy under G.W. Bush, which conflicted with your deeply held convictions”. If you honestly can’t see the issue with such baseless assumptions, my calling into question your ability to be objective and balanced is justified. Just to put it out there, I don’t care about the Bush2 administration any more or less than Obama’s. You are correct in one regard, however. I was in fact irritated that both graphs conflicted with my deeply held convictions of providing an objective and unbiased analysis of the economy, thus my comments.

Also, I’m going to comment to every reply you provide here. Sorry to disappoint.

rtd: By the way, in the post on the “math” error, I believe I did thank you (and Rick Stryker) for catching the error, and then added to the post the correction. I didn’t remember that you’d been one of the persons who had commented on that post; there are tens of thousands of comments on this weblog, after all.

Yes, my bringing that up was just a below-the-belt response to your initial below-the-belt response picking at a spelling error. If you wanna go low, I’ll oblige.

rtd: I don’t take your comment about my deflation/rounding error as below the belt. I made a mistake, I owned up to it.

Well, since you have revised your intentions, then I look forward to your comments. Let me assure you, I have no hurt feelings, as you put it. Welcome aboard!

The performance of the economy, especially job growth, generally correlates with Republican control of Congress, especially the House.

The party of the President has less to do with it.

Republican House control : 1994-2000, 2002-06, 2010-present.

Democrat House control : pre-1994, 2000-02, 2006-10.

That is pretty much what it comes down to. The correlation of House control is much tighter than that of the President. Unfortunately, this means that a Democrat President gets credit for a GOP House that obstructs him from doing the socialist damage he would like to do.

Ha Ha, Good One Darren

Yeah, Bill Clinton created 21,000,000 private sector jobs because Republicans controlled the House! Unbelievable delusions.

Facts are facts. Too bad facts contradict your blind beliefs and need for dumbed-down memes.

If Clinton was so great, why did jobs only begin after the GOP came into the House in early 1995?

And what policy did Clinton enact that caused the job growth you are desperately trying to attribute to him? You can’t name one, nor do you even have the curiosity.

To be fair, Clinton was, in fact, much better than Obama. That is not in doubt.

But I gave hard numbers. Since you obviously are terrified of numbers, you doubled down on your ignorance.

Heh heh heh heh

The Obama “recovery” was uniquely expensive. The Bush recovery, somewhat unremarkable in price and effect.

For the price paid, the risk taken, the “all-in” mentality at the Fed, from that perspective, those charts are deeply embarrassing.

What Exactly is the “Price Paid?”

Hyper-inflation? Soaring interest rates? Stock market collapse? “Debasement” of the dollar? Laughable.

Jackson: What is the “cost” — Fed balance sheet expansion? And what was the fiscal cost of G.W. Bush? See this post for some numbers.

So what’s your point? Do you think this is causation or correlation? Was it pure chance or was it policy? Obviously they did not have parallel earths to experiment on. The world was different for each. The starting points were different; people flying planes into buildings was different. And they are not completely able to control the economy, the business cycle timing, etc. anyways. There is also the role of Congress to consider.

If causation, what are the factors that Obama did that caused the better job growth (or things Bush did that made his worse) so that we can repeat more of the good and less of the bad. [After all, probably Obama did some good and some bad things, and same for Bush. So let’s speculate on the relevant factors–like was going into Iraq a waste of money?]

What are the factors that Obama did that caused the better job growth

Bailouts of GM and Chrysler together with Cash for Clunkers resulted in millions of jobs in the auto industry. Republicans completely opposed.

$800 billion stimulus. Republicans opposed.

Bank bailouts and restructuring with Dodd-Frank. Republicans opposed.

Re-appointing Bernanke Fed Chairman in August, 2009. Republicans opposed.

It’s interesting to note that one of the robust areas of employment growth has been in health care. Here is a chart to show that growth: https://fbcdn-sphotos-g-a.akamaihd.net/hphotos-ak-xfa1/t31.0-8/p600x600/10750122_10153007057512095_5313074575484473111_o.png

Another similar area of growth has been in education which I recognize is not “private”. Here is a chart to show that growth: http://www.heritage.org/~/media/images/reports/2012/10/bg2739/chart1600.ashx?w=600&h=715&as=1

The question is whether this growth has been beneficial or burdensome to our economy. Both are driven by government policies and regulation.

More Americans getting health care at cheaper cost would not be a benefit to our economy? Really?

BLS employment data differentiates between private-sector and public-sector education and healthcare jobs. Granted much of private healthcare is publicly funded.

Menzie is posting economic history not economic theory or even labor theory.

Many here are nearly ignorant of supply side economic theory. Below is a great primer that is an excerpt from an email sent to me by a good friend concerning President Obama’s SOTU speech. It is important to understand that most of the Bush administration policies suffer from the same delusions. Please think deeply about this explanation of why most economists today base their theories on wrong assumptions. One concept to consider in this context is: “wealth is a possessory right, cognizable at law, to a future income stream.”

“[D]omestic investment has been in decline for decades even while consumption and government spending has increased.”

What exactly drives domestic investment if not consumption and government spending? Do businesses simply build factories on the premise of “build it and they will come?”

Much of the decline in American investment is due to our massive trade gap with China, Germany, etc. Perhaps you have not been shopping lately and don’t realize that most products Americans buy come from overseas. You might want to go to the local mall or Walmart occasionally to familiarize yourself with the facts.

Menzie, your comparison is not reasonable, and you know it.

But the only one important, if the recovery will continue and speed up, and it will : 2016 Hillary.

Johnny: Why isn’t it reasonable? Please explain.

I think the reasons for both recessions were not the same,.

Your comparison implies that Obama “made” more jobs in a 6 year time span, while such a comparison can only be fair if the circumstances and causes of each recovery are comparable, which is not the case. That is to say in consequence, for instance, during Obamas recovery the FED took and had to take other steps than during GWBs term. You can not give credit for a speedy recovery only to Obama, which you try to imply with your comparison, when the FED acted correct, as we know now.

Sometimes, a picture, especially when it has logs in it, is not worth a thousand words. There is a much more straightforward way to compare job growth during the two administrations.

During the recession that Bush inherited when he took office, employment dropped from its peak of 132.8 million at 2/1/2001 to 130.2 million by 8/1/2003, for a total loss of 2.6 million. Subsequently, during the 4.5 years before the next recession started, employment climbed to 138.4 million, for a gain of 8.2 million. So the net Bush gain is 8.2 – 2.6 = 5.6 million.

During the recession that Obama inherited, employment dropped from its peak of 138.4 million to 129.8 million by 3/1/2010, a total loss of 8.5 million. During the 4.8 years of the Obama recovery to the present, employment climbed to 140.3 million, for a gain of 10.5 million. So the net Obama gain over the same time frame as the Bush recovery is 10.5 – 8.5 = 2 million.

That’s a startling difference, leading observers like Lazear to call the current recovery the worst in history. What explains the difference? During the 2 years in which the Administration had a free hand, it rolled over the opposition party and with perhaps some of the most partisan zeal since the 1930s proceeded to foist on a protesting public a number of damaging policies, to wit: Obamacare, Stimulus, and Dodd-Frank, while looking the other way as minimum wage hikes percolated through the economy. This juggernaut of bad policy was stopped in 2010 with the Republican victories, but the economy needed time to heal. Fortunately, the Republicans succeeded in getting some much needed austerity through in 2013. Of course, progressive economists howled about disaster and those of a Keynesian persuasion predicted damage to the labor market as a result of the sequester. But in yet another black eye for Keynesians, employment continued to grow and the unemployment rate continued to fall.

Meanwhile, after his repudiation by the voters, the President retreated from policy, becoming GOLFTUS, the golfer (in chief) of the United States. As the President’s golf score dropped, so did the unemployment rate, leading many to believe that the President’s golf score and the unemployment rate are cointegrated.

Rick Stryker: Since I was at CEA at the time Bush took office, let me just observe that the 2001 recession is dated to March 2001 by NBER, two months after Bush took office. Hence, I am unsure the word “inherited” is correct.

I seem to remember James Hamilton once writing that he thought the NBER was in error in dating the recession as starting in March 2001, when the 4th quarter of 2000 made more sense. However, maybe Menzie can inform us of what policies George W. Bush instigated upon his inauguration in the third week of January, that provoked a recession in March.

Patrick R. Sullivan: Yes, one can disagree on the date. But officially (since NBER is the arbiter), it began in March 2001.

I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Rick Stryker More nonsense. The Democrats hardly “rolled over” the Republicans in Congress. Obama went out of his way to try and bring the GOP on board. Remember what Sen. McConnell and his fellow traitors were doing on the night of Obama’s first inauguration? They were conspiring to wreck the economy for partisan political purposes. Remember how Sen. Grassley got caught bragging to his fellow wingnuts how he had played the President for a sucker by pretending to want to be cooperative? Remember how the Democrats only had 59 votes in the Senate during the critical months when the stimulus was being debated? Remember when Sen. McConnell came down like a hammer on any GOP senator that attempted to offer an amendment to the ACA in good faith? And we’re supposed to believe that the GOP opposition to Dodd-Frank was because they were all worried about how it would hurt the working man??? Puh-leaze. And which party wanted to lynch Ben Bernanke? And why don’t you assign any blame to Bush 43 for the severity of the Great Recession? Or don’t you think some of his policies and political appointees at key regulatory agencies have any culpability? How stupid do you think Econbrowser readers are? Here’s a useful tip. Sometimes it’s helpful to step back and evaluate your beliefs by looking around at the kinds of people who share those beliefs. Who is the typical Econbrowser reader that typically agrees with your side? Well, that person is likely to be a climate change denier, befuddled by logarithms, gold bugs, followers of zerohedge.com, and inclined to believe that Adam & Eve road around on the backs of dinosaurs, and that a televangelist in Texas can bring children back from the dead (ask Gov . Bobby Jindal about that one!). Look at your friends and it will tell you a lot about your own views.

The most important fact about the Bush and Obama recoveries is that they were both weak relative to our fathers’ economic recoveries. That seems to be a problem across the developed world. Still, relative to the rest of the world, the Obama recovery looks pretty good. That’s especially revealing since the policies advanced by Merkel and Cameron are strikingly similar to the policies advocated by the GOP. Look how well that turned out. Recall that in real time back in early 2009 many of us on this side of the aisle were yelling at the top of our lungs that the ARRA was too small for the job. We needed a bigger boat. The Administration was very naïve in thinking that the GOP had the best interest of the country in mind. I think Obama has since been disabused of that notion. He knows them by the fruits of their labors. It’s clear now that the big problem is deflation. That’s a problem for a political problem that is still trapped in 1979. I trust the Democrats to fight deflation far more than I trust the part of Wall St. and rentiers.

2slugs,

You are just blind if you still believe the nonsense that the President kept reaching out to be slapped down by the Republicans. I’m amazed at how successfully the Administration has marketed this myth in order to disguise its own extreme partisanship. Bipartisanship does not mean that you tell the other side that they must accept all the key points of your policy but allow them to negotiate on a few minor details. Bipartisanship means that your policy contains key features of what the other side wants. If the Administration had been truly bipartisan, its key policies would probably still have happened but would have been very different. Here’s how I think the key policies might have changed:

Obamacare:

– insurance exchanges

– guaranteed issue of policies, with some time period in which pre-existing conditions are not covered

– no individual mandate

– no employer mandate

– tax credits for people to help purchase insurance on exchanges with greater subsidies for low income people

– much less regulation of individual policies, with insurance companies having more leeway to offer plans at various price points

– Medicare and medicaid reform

– tort reform

– Insurance available for purchase across state lines

Stimulus:

– tax cuts much more oriented to cuts in marginal tax rates

– more military spending

Dodd-Frank

– much less regulatory empowerment

– reform of bankruptcy code

– more focus on affecting incentives rather than top down control

That’s what true bipartisanship would look like. But had the Administration done that, Congress may not have been Republican at this point.

Clinton started sharply left during his first 2 years in office. But when he lost Congress, he listened to the public and began to cooperate with a Republican congress in a bipartisan manner. During the remaining 6 years of the Clinton Administration, their policies were moderate to right in nature. This Administration has consistently refused to do that. The president said the 2014 election was a referendum on his policies. When he lost badly in November, did he go into the State of the Union promising to listen to the verdict of the public? Or did he turn sharply Left after losing the election, walking into a fully Republican congress with tax increase proposals and more spending, proposals that he knew would be dead on arrival, thereby sticking a finger into the eye of the Republicans and the voters?

“During the recession that Obama inherited, employment dropped from its peak of 138.4 million to 129.8 million by 3/1/2010, a total loss of 8.5 million. ”

you mean conservative bush policies produced a recession with a LOSS OF ONLY 8.5 MILLION WORKERS! wow, conservative policies produced a LOSS OF ONLY 8.5 MILLION WORKERS! thanks for the update on the effectiveness of conservative economic policies rick! i did not realize just how disastrous they were compared to bill clinton.

Baffling,

You’ll need to provide an argument that Bush’s policies were responsible for the recession of 2008-09. I know you don’t understand this requirement, but you can’t just assert it ex cathedra.

In my comment, I was staying on Menzie’s topic, which is focused on the recoveries after both recessions. We can argue whether Clinton’s policies caused the 2001 recession or Bush’s the most recent recession. But that’s not the issue. The voters hired both Bush and Obama to fix the problem. And Bush fixed it much better.

By the way, I wanted to include in my comment the results of a cointegration test between the President’s monthly average golf score and the unemployment rate to appeal to that segment of the econbrowser readership that is not “innumerate, economically illiterate, and easily swayed by emotion.” (See Menzie’s exchange with rtd above.) However, in spite of a FOIA request, I have not been able to get a good time series on the President’s golf score.

Just to be clear

During the presidency of G.W. Bush, the U.S. economy lost 462 thousand private sector jobs.

During the presidency of Barack Obama, the U.S. economy has gained 7,005 thousand private sector jobs so far.

http://research.stlouisfed.org/fred2/series/USPRIV

Anti-Keynesian conservatives are very unhappy when anyone points out these inconvenient facts.

Menzie,

Really? While the new Administration was still choosing its furniture and Clinton appointees were still at CEA, the Bush Administration found time to cause the next recession, and in only 2 months? That’s some fast work.

Well, I guess you have a plausible point. You can confirm, but I’ve heard that there is a button at CEA headquarters with a sign that says: “Warning: Do not Push-Causes Immediate Recession.” Likely Dick Chaney skulked in there and pushed that button when you guys weren’t looking. He probably needed to get the recession out of the way so that the Administration could proceed to the next phase of its plan: the massive conspiracy to manufacture intelligence evidence of weapons of mass destruction so that it could convince the gullible Democrats as well as foreign powers and their intelligence services to go along with its warmongering plans.

Rick Stryker: I just wanted to be precise. I didn’t say anything about causal factors. I think you are being a tad defensive.

Rick is correct that these charts stink, but the problem is not as he says. These charts hugely underplay how much bigger the 2009-2010 job losses were compared to 2001-2003.

I don’t think anyone serious blames the 2001-2003 recession on Bush (which tells you what I think of Menzie and his the-recession-started-two-months-after point).

On the other I think everybody who’s even half-serious does blame the 2008-2010 job losses on Bush (though I’m sure some of the rightwing nutjobs on here will find a way to at least pretend to believe Obama was to blame).

Tom,

I don’t blame the 2008-2009 recession on Bush’s policies. Just what did Bush do to cause this recession?

Hence you can not be considered even halfway serious. Bush enabled and promoted the subprime industry, duh. He threw huge resources at an attempt to replace the Baathist state with a US-allied democracy, duh.

Tom,

You have quite a few leaps in there. So it was Bush Administration policy to promote the subprime industry? And the subprime problems caused the recession? And the war in Iraq also caused the recession?

Only people who aren’t serious rehash Democratic party talking points as if they are established facts. Asserting those points without argument or evidence and then saying “duh” is hardly an argument.

Rick Stryker: Subprime alone, no. But regulatory disarmament sure helped push things along. See some arguments laid out, here. An alternative view of the crisis is “stuff happens”.

The causation for the 2008 collapse is clear: Wall Street fraud in the MBS market that the Bush administration enabled with its “hands-off” approach to regulation and efficient markets philosophy that both utterly failed. Bush caused the job losses and Obama turned the economy around. The facts are irrefutable.

Paul,

The recession started in December of 2007 according the NBER dating committee. The trouble in the banking system began after the recession started.

When you talk about lack of regulation and the efficient markets hypothesis, I know you’ve been reading Quigglin’s “Zombie Economics,” or perhaps you heard about his arguments second hand from Krugman or the NY Times. Quigglin and those who parrot him make a number of false assertions: that the efficient markets hypothesis implies that markets should be deregulated; that markets were in fact deregulated; and that efficient markets imply that crises, financial or emerging market for example, can’t happen. No, No, and No.

What you think you know about the financial crisis is all false.

Rick Stryker: Do you mean “Quiggin”?

Menzie,

Yes, sorry, you got me on my spelling again. I meant John Quiggin’s book Zombie Economics: How Dead Ideas Still Walk among Us. Don’t know if you are familiar with the book. If not, the discussion on efficient markets, regulation, and the 2008-09 recession is in Chapter 2. In my view, Quiggin is seriously confused about the efficient markets hypothesis, not seeming to understand that it is a joint hypothesis of rational expectations coupled with a particular equilibrium model.

Justin Fox touches on some of the same themes in The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall Street, although I don’t remember him claiming that a belief in efficient markets implies a belief in deregulation.

Rick Stryker: Read the latter (excellent), not the former.

Rick Stryker The recession started in December of 2007 according the NBER dating committee. The trouble in the banking system began after the recession started.

The first sentence is correct. The second one is not. Troubles with sub-prime mortgages began long before Dec 2007. Bear Stearns started accumulating huge losses in 2006. Lehman brothers closed its sub-prime mortgage BNC Mortgage in August 2007. The stock market plunged in Oct 2007 because of concerns over the housing and lending markets. The rating agencies didn’t just start issuing fraudulent ratings one morning in Dec 2007; it had been going on for a long time. AIG was up to its neck in fraud by late 2004/ & 2005, paying out billions in fines for various crimes. The financial shenanigans were already long in the tooth by the time Dec 2007 rolled around. Menzie’s book “Lost Decades” has a nice, readable summary of the events leading up to the Gotterdammerung of Sep 2008.

You asked what Bush did to cause the Great Recession. That’s the wrong question. Bush’s guilt is not so much a crime of commission as it is a crime of omission. It’s what Bush didn’t do that contributed to the Great Recession. Team Bush was guilty of looking the other way when they knew, or at least ought to have known, that their Wall St friends were just Mafia gangsters with better suits and better looking mistresses.

As to your sarcastic comment about the left’s claim that Cheney manufactured evidence against Saddam, I don’t think that’s quite right. While there probably are some on the left who believe that, the more common charge is that Cheney simply forced a particular interpretation onto whatever evidence was found, whether the evidence actually supported Cheney’s crazed mind or not. Cheney didn’t believe he had to manufacture evidence because he didn’t believe evidence was important one way or another. Cheney was certain that he was right, and the evidence be damned. You know, it wasn’t just Colin Powell who said that by 2002 they no longer recognized the Dick Cheney from 10 years earlier. There were plenty of people within the five sided puzzle palace who were saying the same thing.

2slugs,

Before accepting the NYTimes account of the recession of 2008-09 that you just regurgitated, you really ought to expand your view beyond the US and become less provincial. Was it Bush’s policies that caused the recession and financial market stress outside of the US? Did Bush’s policies cause the problems with Iceland’s, Ireland’s, and the UK’s banking system. Did Bush’s policies cause the sovereign debt crisis in Europe? Did Bush’s policies also create a housing bubble in Europe?

Obviously, there was some kind of common shock that triggered the recession, with similar problems across countries which were then exacerbated by the particular vulnerabilities in each country, just like typical global recessions. Thus, I think Stock and Watson have it pretty much right in their paper Disentangling the Channels of the 2007-09 Recession. That triggering shock was the oil shock, which then exposed the particular financial vulnerabilities in both the US and Europe, which then fed back into the downturn, making it worse. The blame for these financial vulnerabilities is shared quite widely. You can’t put it on one institution, party, etc.

stryker,

“The voters hired both Bush and Obama to fix the problem. And Bush fixed it much better.”

bush policies produced a recession with a LOSS OF ONLY 8.5 MILLION WORKERS! rick stryker, it is quite baffling how you could completely ignore this result of those bush conservative policies. this was a number you yourself produced. learn to live with it instead of rewriting history.

Baffles,

You just assumed what I asked you to provide an argument for.

Measured by the employment to population ratio, the US is dead last in the OECD in the post-recessionary (Obama) period compared to the pre-recessionary (Bush) period.

For example, for selected countries, employment to population ratios pre recession, post recession, and percentage point change:

US: 72 (Bush era); 65 (Obama era); change -5 pp

Germany: 65, 73, +8 pp

Italy: 58. 56. -2 pp

France: 64, 64, unchanged

UK: 74, 74, unchanged

Switzerland: 78, 79, +1

The employment ratio has fallen much farther in the US since the recession (ie, under the Obama administration) than in any other OECD country, by a substantial margin. We have, in effect, switched places with Germany, which has raised the employment ratio even during the recession–and with significantly lower GDP growth than the US. Even France and Italy performed better compared to pre-recessionary times. The US, which used to be on par with the UK, is now on par with France.

US performance is awful, absolutely dreadful–and for reasons which we have debated here over the years. Updating labor market policies should be a priority for any administration, and a key campaign issue for Republicans.

http://www.prienga.com/blog/2014/10/31/employment-to-population-ratio-detail

-7 pp for the US, obviously.

Menzie,

I don’t think regulatory disarmament is the explanation for what happened with subprime. There were certainly regulatory failures. But it was a very complex situation with much blame to go around. As I mentioned to 2slugs above, it’s a much broader problem when you consider the similarities and differences with how the crisis unfolded in Europe. I don’t think the regulatory disarmament explanation works for the European case either.

rick stryker,

the 8.5 million lost jobs due to the bush policies was a policy success, don’t you think? or is it unfair to judge bush’s policy based on his results? or was bush not responsible for the loss of these 8.5 million jobs? maybe you could give me a story about stryker jr or his sister surviving the job loss while skipping out on their obamacare health insurance, like we had in previous discussions?

“the voters hired both Bush and Obama to fix the problem. And Bush fixed it much better.”

how in the world can bush cause the loss of 8.5 million jobs and you have the nerve to say bush fixed it much better? really rick, back that statement up.

Paul wrote:

“[D]omestic investment has been in decline for decades even while consumption and government spending has increased.”

What exactly drives domestic investment if not consumption and government spending? Do businesses simply build factories on the premise of “build it and they will come?”

Much of the decline in American investment is due to our massive trade gap with China, Germany, etc. Perhaps you have not been shopping lately and don’t realize that most products Americans buy come from overseas. You might want to go to the local mall or Walmart occasionally to familiarize yourself with the facts.

Paul,

Thanks for your question.

Do you earn a salary by spending at Walmart? You earn a salary by working to increase capital. Now your spending at Walmart may pay the salary of someone else creating capital made available at Walmart but without the creation of capital you do not have a salary to spend nor does Walmart have assets to sell.

But even more to the point, if the stream of income is taken from existing assets the collateral value, the wealth of the asset, is reduced even if that income is given to you to spend. Then if you spend that stream on consumption rather than productive assets overall wealth in society declines.

This is the heart of supply side economics versus your consumption based demand theory, and it is why income disparity is increasing and why the economy has declined over the past decades.

Ricardo,

A question. I understand one persons spending is another persons income. If I spend my salary on food am I decreasing the wealth of society? Such spending is not for an increase of assets, but I do have a demand for food I cannot ignore.

TdK,

Thanks for the thoughtful question.

No, one person’s spending is not another person’s income. That is a Keynesian fallacy. First, for the person to be able to spend he or she must produce (or borrow with the promise of paying back with production). You may say that production and consumption are two sides of the same coin but not spending and income. Spending is dependent on income and income is dependent on production. There can be no consumption (spending) without production.

If you spend your production (salary) on food that does indeed reduce the wealth of society. Consider a gatherer of bananas goes into the forest and gathers a bunch of bananas (work creating production). He then brings them to your home to sell them to you. If you have nothing to exchange he will move on to another. But let us say that you have gone fishing (work creating production) and have fish to exchange. If you and the gatherer exchange half of your fish for half of his bananas then happily consume them, what is the wealth of your society afterward? You and the gatherer have nothing. There is no wealth.

Both you and the gatherer must engage in additional production to create wealth in your society. To use my friend’s definition, “wealth is a possessory right, cognizable at law, to a future income stream,” The tree for the gatherer or the sea for you is wealth. The bananas and the fish are the income stream.

Now let us say, the chief comes and takes a banana and a fish by force and gives it to his friends to consume; there is a loss of wealth and a loss of income from the assets. You and the gatherer must work harder and longer to make up for what is taken and consumed by others. To you and the gatherer the assets have lost value.

This loss of value is easier to see if the chief takes all the fish and bananas. Your possessory rights essentially fall to zero because there is no stream of income from your work. The gatherer will not gather and you will not fish. You will search for other work (production) that can be hidden or protected from the chief’s confiscation. (A bonus: consider this in relation to the Laffer curve.)

The heart of supply side economics is the act of production. Wealth creates the income stream that will then be turned back to create more wealth.

A demand side economics like Keynesianism is a consumption economics, an “eat the seed corn” economics. The focus is on spending the income stream rather than creating wealth and this makes the society less wealthy. This concept easily explains why socialism leads to poverty as in Zimbabwe or Venezuela. A society cannot consume itself to wealth. Wealth must be created or a society will disappear.

Ricardo thank you for your answer. Now if I purchase the bananas and eat them I diminish the wealth of society. Is the reasoning you gave as an answer. What if instead I sell the banannas for a profit to others who will eat them. Has the wealth of society grown, diminished or stayed the same? Is there any growth in the wealth of the society in the sales transaction or is it only created in the act of gathering the bananas?

ricardo, who owns the bananas in the forest or the fish in the ocean? were they paid for when the gatherer or fisherman acquired them? are they free? if so, why are some resources free and others not free? do all people have equal access, or are their favorites? did somebody own the forest or the sea, and were they compensated for their loss? how did they acquire those properties to begin with?

TdK,

Great follow-up question!

Wealth is the asset that produces. Income is the product that flows from the wealth. If you create a better distribution system for the bananas then you have created wealth. The sale of the bananas does not create wealth but the improved distribution system does. The creation of wealth is using mental capital to create something new that increases the future income stream (that can include reducing the cost of producing).

Consumption is what Mises calls reducing uneasiness, so do not think of consumption as necessarily destructive. The capital process is creating wealth that will produce what will reduce uneasiness. You do not create wealth by consuming, but you can reduce uneasiness. Consumption is the goal, but only deferred consumption allows for increasing wealth and increasing future consumption.

So let me address what I believe is the theoretical foundation of your last question. Wealth is only created when assets that produce are created. When assets are consumed either through lack of maintenance or through consumption – “eating the seed corn” – the society loses wealth. Wages decline and the gulf between the income of those who hold wealth and those who only consume becomes greater. This is why you see the greatest disparity of income in totalitarian societies and why you see societies that become more centrally planned increasing the disparity of income.

I realize that this concept does take a change in thought process from a demand driven economy (mercantilism) to a supply driven economy. For centuries the mercantilist mentality has infected economic thought. In the 18th and 19th Centuries mercantilism was refuted, but in the 20th Century it returned in different forms with significant support from government because the new academics justified growing government. It is once again being refuted, but fallacious thinking dies hard.

I am still thinking about your answer. One point that stands out and bothers me is the assertion about inequality. In T. Picketty’s book his information points to inequality in a number of countries returning to very high levels the previously held prior to WW!. With your statement in mind how could they achieve such levels in both the earlier era and today. I can well understand the Belle Epoque in Europe with many more totalitarian states. What about the present day circumstances? They seem quite dissimilar.

TdK,

I think I understand your question but if not please correct me.

You cannot use history to prove economic theory. Let me use Austria as an example. It was essentially a monarchy prior to WWI but a benevolent dictatorship. The society was actually more free than a lot of the countries of the time considered democracies especially concerning economics when the Austrian economists were at their most influential.

Today most democracies have actually become social democracies or Fascist democracies. With the development of “administrative” governmental systems, even though legislatures and presidents are elected, the economies are run by a bureaucracy that is dictatorial in nature, commanding the citizens rather than representing them. The advent of central banks has also removed much of the freedom of the past as money is used not as a medium of exchange but as a magic elixir to manage economies.

Comparisons must be made on the level of governmental control of the citizens. As free markets are destroyed they are replaced by confiscation and cronyism, causing a widening of inequality.

It is fallacy that free markets create inequality, and an even worse fallacy that command economies will more evenly distribute wealth. Command economies redistribute income and so doing destroy wealth. Most economists do not consider Picketty’s book as authoritative but more pop politics.

Is a totally free and fair market possible in the real world? Doesn’t an imbalance of knowledge in the market give some actors advantages that others do not have, thus skewing the market to their gain? Is a level playing field of any importance to having a free market?

If history cannot be used to prove or disprove an economic theory then how does one know that it is a properly thought out theory? Concerning Picketty’s work I have read economists who have not agreed with his conclusions and those who do. Both do praise the work itself.

TdK,

The imbalance in the market is the most important element of the free market. Knowledge is always in an imbalance regardless of the economic system. The economic system is about dealing with this imbalance of knowledge. There are either free markets or managed markets. Most of the criticisms of free markets are actually criticisms of managed markets calling themselves free. The role of government should not be to manage markets but to maintain free markets. Its primary role is protecting property rights and allowing citizens the freedom to use their property as they desire. Government controlling commerce leads to theft and crony capitalism through the confiscation of other’s property.

Some market actors do have more advantages but that is life. There is no equality in life and those who claim to be able to create it are only justifying confiscation for themselves. Greed is at the heart of command economies. The same is true when you seek a level playing field. There is no such thing.

That is where free markets come in. Those who have knowledge that others do not have must be encouraged to use that knowledge to help others. That means policies that will make them producers. Free market capitalism does just that. It encourages those with resources to use them for helping others by making their income dependent on helping the most number of people possible. The major producers, the major corporations, are enriched by pleasing their customers.

Now back to the model that began this conversation. Command economies take income from producers and that prevents the creation of wealth. Hopefully you can see that in our model all redistribution activities only confiscate income but do nothing to create wealth.

Freedom is always the key. It worked in Chile by moving the country from poverty to the 6th most free country in the world and making it one of the most prosperous. While Chile was improving economic freedom, the US fell from number 2 to number 12. Chile passed the US on its way up. Consider how China was in poverty until the government began to give freedom to the people. Compare China to Venezuela and Argentina. They were two of the most prosperous countries in the world until they changed to command economies. Those who want to use the power of government to confiscate promote command economies to enrich themselves; the political class is never poor. But if he people prevent a full command economy the political elite promotes mixed economies with the intent of being part of the mix that benefits from the confiscation. Can you see how greed drives command economies? All of this can be easily seen if you understand the model presented.

But this require a paradigm shift from a demand, confiscation of income model to a supply, creation of wealth model.

Last night, I was thinking about our discussion and I realized I did not address your question, “If history cannot be used to prove or disprove an economic theory then how does one know that it is a properly thought out theory?”

Let me make two points about this. First, is the nature of history. When you look to the past it is impossible to know all the variables and how they influence each other. This prevents you from isolating one condition and stating that the events of history were caused by your condition. For example, the period before 1914 we were on a gold standard, there was not Federal Reserve system, there was a political battle going on between the bimetalists and the monometalists over the monetary system, most federal tax revenue came from tariffs, and there was no real welfare system from the Federal government. Just to mention a few. Today we have a floating currency, the Federal reserve attempts to manage the economy though monetary changes, there is not consideration of a foundation to the currency, most tax revenue comes from personal income taxes, and there is a massive welfare system that consumes more than half of the budget. With such great differences how can you compare one conditions? Even if you attempt to include factors to account for differences these would only be guesses and would not account for other historical events such as war preparation, transportation and communication improvements.

The second point is how you can know a properly thought out system. The best way is through forecasts. Under a theory and current conditions you make a forecast of the results of policy based on a theory. Robert Mundell did this when Nixon took us off of the gold standard as he forecast massive inflation and economic hardship. He was proven correct from the results of the 1970s. Then when the supply siders made their forecasts concerning the tax reductions during the Reagan years they were also proven correct. That included warning of the 1981-2 recession because of Volker following monetarist theory and holding the money supply too tight

When you forecast, while you do not have perfect knowledge of the period, you have a much better understanding of the conditions because you are living in them. What we have found is that Keynesian policies simply do not live up to their forecasts (consider the failure of the Phillip’s curve forecasts in the 1970s, monetary expansion during the Bush years along with Bernanke’s QE, the failure of the Christina Romer stimulus plan in 2009, and the failure of the Austiran’s in forecasting inflation based on the Quantity Theory of Money, for example).