From Zeng and Wei in the Wall Street Journal today:

Central banks around the world are selling U.S. government bonds at the fastest pace on record, the most dramatic shift in the $12.8 trillion Treasury market since the financial crisis.

The article continues:

many investors say the reversal in central-bank Treasury purchases stands to increase price swings in the long run. It could also pave the way for higher yields when the global economy is on firmer footing, they say.

…

Foreign official net sales of U.S. Treasury debt maturing in at least a year hit $123 billion in the 12 months ended in July, said Torsten Slok, chief international economist at Deutsche Bank Securities, citing Treasury Department data. It was the biggest decline since data started to be collected in 1978. A year earlier, foreign central banks purchased $27 billion of U.S. notes and bonds.

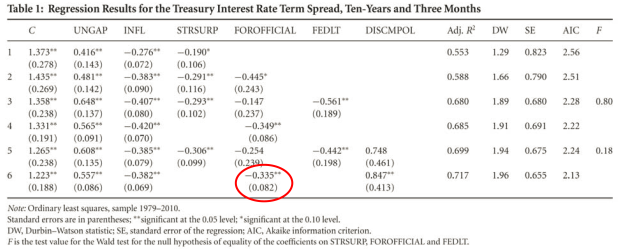

Using estimates in Kitchen and Chinn (2012), we can calculate the increase in yields that have already occurred. Table 1 presents estimates from a regression of ten year yields on the cyclically adjusted budget surplus, Fed purchases and foreign purchases (plus activity variables).

Source: Kitchen and Chinn (2012)

Constraining the slope coefficient on these three variables to be equal (after sign switches), we obtained a point estimate of 0.335 (circled in red).

Potential GDP according to CBO in 2015Q2 was $18425 billion (SAAR). The ratio of net sales to potential GDP is thus is 0.0067 (0.67%) Using our estimate of 0.335, I get an elevated ten year yield of 0.22 percentage points relative to what otherwise would have occurred.

None of this should be too surprising; back in April, I pointed out that foreign exchange reserves (of which 60% of emerging market/LDC holdings are in US dollars) were declining.

For those who are attracted to apocalyptic views (e.g., here), a $1 trillion net sale of Treasurys would result in a 1.82 percentage points increase in yields (0.0543 ratio to potential GDP times 0.335, indicating a 1.82 ppt increase). That being said, there are other downward forces on yields, including deficient aggregate demand (aka secular stagnation).

Nonetheless, the prospects for upward pressure on long term yields (on top of the appreciated dollar) suggests caution in tightening monetary policy.

Isn’t this what you get if you’re trying to defend an overvalued yuan?

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=25zY

“Money” is currently “tight”. 🙂

There is a zero probability that the Fed will raise rates or restrict reserves under these conditions.

BTW, CBs are “dumping Treasuries” because US and Japanese supranational firms are in the process of repatriating Yuan deposits from China-Asia en masse, requiring CBs and primary dealers to engage in CB custodial and derivatives account swaps.

I always laughed at my “fiscally conservative” brothers who insisted that because China holds a huge supply of US debt they could create massive inflation. In truth China selling US Treasury bonds removes currency supply and until the dollars received are spent in the US they do not increase the money supply but decrease it.

The deflation being allowed by the FED is causing deflation in the rest of the world and a selling of US debt. The FED deflation is actually causing more deflation. So there is outsourcing money tightening at just the time when money tightening is the wrong policy. Deflation feeding deflation.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=25Xp

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=25Xi

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=25XX

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=25Y1

At the so-called Austrian TMS velocity and its acceleration to private GDP, the US economy entered another recession in late 2014 or earlier this year as in 2008, 2001, and the early 1980s.

Moreover, by implication, the Fed will have to print, and the US gov’t borrow and incrementally spend, an additional $2.5-$3 trillion over the course of the next recessionary cycle to prevent nominal GDP from contracting over the next 2-3 years.

We are where Japan was in the early 2000s and the US in the late 1930s, which is consistent with the debt-deflationary regime of the Long Wave.

Thus, long yields and velocity will fall further; CPI, wages, and nominal GDP will further decelerate; periodic price deflation will occur and persist; asset prices face another big bear market; and the Fed and ECB will follow the BOJ from the early to mid-2000s.

Menzie,

Can you point to a time since 1992 that monetary policy should have been tightened more than what it was?

My take on this, of a sort, on CNBC: http://www.cnbc.com/2015/10/09/is-the-oil-rally-real-commentary.html

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=26d1

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=26d8

I was very interested in the fact that the flow vs the stock was chosen in your regression.

reading your paper, It seems that the market reaction is not what you would expect in a tobin’s general equilibrium view of the world.

This doesn’t make sense. To sensibly be called a tightening, foreign CB sales of Treasurys would have to absorb money supply or increase the private cost of borrowing. The latter rose as US growth strengthened and expectations of rate hikes were priced in, not because foreign CBs are selling Treasurys.