Donald Luskin writes in the Wall Street Journal:

The global economy is slipping into recession. The evidence is showing up in all the usual ways: slowing output growth, slumping purchasing-manager indexes, widening credit spreads, declining corporate earnings, falling inflation expectations, receding capital investment and rising inventories. But this is a most unusual recession– the first one ever caused by falling oil prices.

A drop in oil prices means less money in the hands of oil producers but more money in the hands of oil consumers. Currently the U.S. is importing about 5.1 million barrels a day more than we’re exporting of crude oil and petroleum products. At $100 a barrel, that had been a net drain on the U.S. economy of $190 billion each year. That drain that will now be cut by more than half by falling oil prices.

We usually see consumers spend their extra income right away, whereas it takes more time for producers to alter their spending plans. As a result, even if the U.S. was not a net importer of oil, we might still expect to see a short-run positive stimulus from dropping oil prices. The actual change in overall consumption spending in response to the oil price decline through March of last year was about 0.4% smaller than would have been predicted on the basis of the historical correlations. But we see something different when we look at the behavior of individual consumers. A study by the JP Morgan Chase Institute compared the response to lower gasoline prices of people who had previously been buying a lot of gasoline with the responses of people who had been buying relatively little. They found that the first group increased spending relative to the second, with the magnitude of the difference in spending between the two groups consistent with the claim that consumers spent almost all of their windfall. The conclusion I draw from the seemingly conflicting evidence in the macro and micro data is that each consumer spent more than they would have if oil prices had not fallen, but that there were other macro headwinds at the same time that were offsetting some of the positive stimulus of falling oil prices.

In any case, we’ve now had plenty of time for cuts in spending by U.S. oil producers to start to have an economic effect of their own. If there’s an increase in spending by consumers of $1 and a decrease in spending by producers of $1, it’s not really a net wash for the economy. The reason is that the consumers are spending their money in different places and on different items than the producers are cutting. There is a lot of specialized labor and capital that’s involved in oil extraction that can’t move costlessly to some other sector when the oil patch goes sour. I presented a model in 1988 in which an oil price decline could actually result in an increase in unemployment either because it takes time for people in the oil sector to move to the sectors where the jobs are now available, or because unemployed oil workers are still waiting where they were hoping for conditions to improve.

And of course we’re talking here not just about the people who work in the oil industry itself but all the other industries and services that sell to the oil sector and more in turn who sell to these suppliers. A recent analysis by Feyrer, Mansur, and Sacerdote concluded that without new U.S. oil and natural gas extraction, there would have been 725,000 fewer Americans working and a 0.5% higher unemployment rate during the Great Recession.

There are thus some reasons why a decrease in oil prices would be a boost to the U.S. economy and other reasons why it could even be a drag. A number of studies have looked at the effects of oil price decreases and concluded that these have little or no net positive effect on U.S. real GDP growth; see for example this survey. The price of oil fell from $30/barrel in November 1985 to $12 by July of 1986. U.S. real GDP continued growing throughout, logging a 2.9% increase overall for 1986, neither significantly faster nor slower than normal.

But 1986 was a bad time for Texas and the other oil-producing states. Here’s a graph from some analysis I did with Michael Owyang of the Federal Reserve Bank of St. Louis. We estimated for each state’s employment growth a recession-dating algorithm like the one that Econbrowser updates each quarter for the overall U.S. economy (by the way, a new update will be posted this Friday). In the gif below you can watch the energy-producing states and their neighbors develop their own regional recession during the mid-1980’s even while national U.S. employment and GDP continued to grow.

One of the reasons that more people outside of Texas share Luskin’s worries is the recent striking comovement between oil prices and the U.S. stock market. On days when oil prices go down, U.S. stocks go down, suggesting the market is seeing bad news, not good, in oil price declines.

Cumulative percent change since Dec 22 in U.S. stock market (as measured by S&P500, in blue) and U.S. oil prices (as measured by the USO ETF, in red). Source: Google Finance.

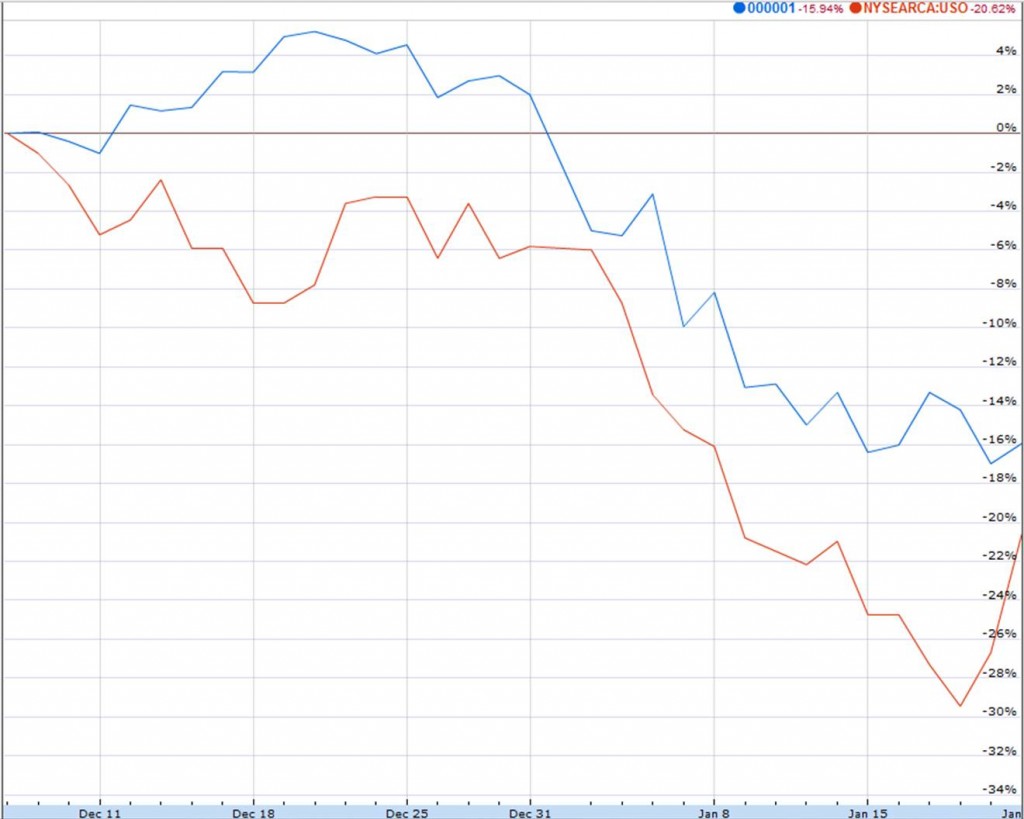

The correlation is even more striking if you look at the Chinese stock market instead of the U.S.

Cumulative percent change since Dec 8 in Chinese stock market (as measured by Shanghai SSE composite, in blue) and U.S. oil prices (as measured by the USO ETF, in red). Source: Google Finance.

And that’s not because of all the carnage that’s in store for Chinese frackers. It’s concerns about China that are driving oil prices, not the other way around. If there is a global slowdown or recession, it certainly would be a factor contributing to lower oil prices.

But regardless of whether it’s oil prices that are moving stock prices or the other way around, folks in Texas and North Dakota have plenty of reason to be concerned.

“If there’s an increase in spending by consumers of $1 and a decrease in spending by producers of $1, it’s not really a net wash for the economy. The reason is that the consumers are spending their money in different places and on different items than the producers are cutting.”

Americans don’t have to work so hard for the same barrel of oil. We can import cheap oil and produce other goods & services that actually raise our living standards.

He told about your opinion and said “There is a lot of specialized labor and capital that’s involved in oil extraction that can’t move costlessly to some other sector when the oil patch goes sour.”

which says that it takes time to move the human resources from one sector to another

So? It’s not a zero-sum game.

There’s abundant unemployed and underemployed labor and capital for the non-oil economy to grow from stronger demand, because of cheaper oil, while oil production continues.

Both producers and consumers don’t have to work so hard for the same barrel of oil. Cheaper oil can be imported and fewer resources can be employed in domestic oil production. Consumers gain more than producers lose.

What new Made in America goods are you buying with the increased consumer spending that lower oil spending allows you? Specifically, what good American middle class jobs are you paying for now that you are no longer paying for a fraction of the labor costs spent over the past five years to build oil production capital assets?

Professor Hamilton estimates U.S. consumers spend over $200 billion a year less for gasoline, because of lower prices.

So, consumers can purchase more other goods & services. Personally, since the price of gasoline is half as much, I spend more at Home Depot and Costco, upgraded my Apple iPhone, bought more clothes (e.g. at Sears), go to the theater more often, go to restaurants more often (e.g. Black Angus), etc.. More spending creates more employment.

Stick your neck out more. Will the drop in oil prices weaken us growth or won’t it?

Hot, hot US VMT. Up 4.3% Nov on Nov.

We might want to keep an eye on US natural gas production.

The EIA is apparently forecasting that US natural gas production will be approximately stable in 2016 and then rising in 2017. Here is a chart showing the EIA’s current outlook for US gas production in 2016 and 2017:

http://peakoilbarrel.com/wp-content/uploads/2016/01/556826-1.png

I find the EIA outlook for US natural gas production to be interesting, given the collapse in the US total rig count, down to below 650 currently, from about 1,700 to 2,000 in recent years.

Assuming about a 24%/year gross rate of decline in existing US gas production, which is an estimate that Citi Research prepared, the US has to put on line about 17 BCF/day of new production per year to maintain current production*. Based on 2013 EIA data (2014 data not available), 17 BCF/day exceeds the dry gas production of every country in the world, except for the US and Russia. In other words, to maintain stable output, the US has to put on line, in one year, more dry gas production per year than the 2013 production levels of every country in the world, except for the US & Russia–with a collapsing US rig count.

Here is the EIA data table for 2013 and 2014 international dry gas production, in thousands of BCF/year (as noted incomplete for 2014):

http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=3&pid=26&aid=1&cid=regions&syid=2013&eyid=2014&unit=BCF

17 BCF/day is 6.2 TCF/year (6,200 BCF/year).

Following is what the EIA showed for all countries in 2013 that produced 5 TCF/year or more of dry gas, and for context, I have shown the estimated annual volumetric gross decline in existing US gas production:

US: 24.3 TCF

Russia: 22.1

Est. US Gross Decline: 6.2 TCF

Iran: 5.7

Qatar: 5.6

Canada: 5.1

*Also supported by the observed 20%/year net rate of decline in Louisiana’s marketed gas production from 2012 to 2014 (net decline being the decline rate after new wells were put on line)

Where are the other jobs ? I would like to read some more research about why the Americans arent taking advantage of the lower pump prices , could it possible be that there isn’t any jobs . Gas can go to 10 cents a gallon and if there is no jobs, no money to buy gas. Maybe those that receive a government check (welfare) can spend less on gas to get to the stores to spend their food stamps.

PA Marcellus and Utica shale situation= Enormous infrastructure capacity was created during the boom and, at present, development is at an utter, complete standstill, awaiting any encouragement, which ain’t happening. But if it does, they can flood the market so fast it would make heads spin, in a way to kill old people, as the expression goes.

Thanks for citing my Journal article. I have always followed and respected your writings on energy economics.

Don,

I haven’t talked to you in a long time. Do you really believe it is oil that is causing the decline or the underlying deflation? Isn’t the price of oil just another indicator or the deflation we are now facing? Couldn’t we be posting Jude’s memos from 1995 all over again?

what “underlying deflation” are you considering? core inflation has not dropped.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=38sJ

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=3emV

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=3emY

https://app.box.com/s/q3bptspeemivodqvs5a4nq5x8a3rsc27

https://app.box.com/s/vvt8ywyh6w3xxtgvv39myfny2jhgnu0e

https://app.box.com/s/xywlbqm8wswzhfmxh0paiil9cysh8cmk

The global economy decelerated to stall speed in late 2014 to early 2015, along with the US and world entering recession in Q3 or Q4 2015.

This is old news by now. The Fed will be required to reverse course as soon as Q1-Q2 and resume QEternity, printing AT LEAST $2 trillion in fiat digital debt-money credits to the Fed’s balance sheet to fund primary dealers’ purchase of US gov’t debt issuances in order to prevent nominal GDP per capita from contracting in 2016-17 (and more than $3 trillion to sustain the post-2007 sub-2% nominal GDP per capita).

We are in the debt-deflationary regime of the Long Wave Trough, not unlike in the 1930s-40s, 1890s, and 1830s-40s, and in Japan since the late 1990s and early 2000s.

Further central bank printing of reserves to fund fiscal deficits will only exacerbate the pernicious effects of wealth and income inequality as a result of unprecedented asset bubbles and the corresponding annual net flows to the financial sector, which, since 2008-09, have absorbed virtually all annual net increase in value-added output of the US economy.

In fact, the imputed compounding interest to total credit outstanding to average term is an equivalent of 100% of US output hereafter in perpetuity, meaning that there can be no growth of US real GDP per capita after gov’t’s share (taxes and debt service) and total net financial flows forever hereafter (or until there is a debt/asset jubiliee to restore to a sustainable level debt/overvalued assets to wages and GDP and permit an increase in labor share of GDP).

I’m with BC on this one – locally here in the Philadelphia area there’s a very good energy analyst named Stephen Schork who writes an eponymous newsletter.

His view for at least a year now has been that the global manufacturing economy is in a recession, and that’s what’s driving energy (and other commodity) prices down.

End of story.

Your both wrong. There is manufacturing and then there are utilities. Guess what is at a cycle high? Reversing course? For what?

I think the arrow of causation leads from money to oil prices, not the other way around.

The graph on http://www.philipji.com/item/2015-12-05/the-fed-is-set-to-squeeze-during-a-monetary-contraction shows that the YoY growth rate of money has been falling since January 2014. The initial effect was on commodity prices in general, not just oil. This was followed by equity prices, which is why stock market returns were poor in 2014 and 2015. Assuming the Fed does not loosen up, I see a massive crash in one or more asset markets towards the end of this year.

Another bad post. There is no monetary contraction. That is not the rate of money. That is the cost of the rate of money.

Your incorrect. The rate of money growth is not what that graph is indicating, but the reduced costs for borrowing. Real consumption normalized and came back into the long 50 year run of aggregate path which correlated with that decline in 2014. Employment ticked up and the recession ended. The mistake is, people can’t adjust for the demographic bean counters. This is where the government struggles with data.

There were a lot of bad investments made in oil and gas. A lot of wells that would not pay off at $100 oil. The junk bond market was dominated by energy investment the past few years. It should be no surprise that junk bond yields are now rising to recession levels, wait until many of these companies start going bankrupt, including the investment grade ones. I don’t understand why anyone would think this couldn’t affect the entire economy. House prices going down should be a good thing for consumers too… problem is they are also an asset for home owners. Same thing for oil as the resource in the ground is still an asset for producers.

Every recession has the same cause: a surprise change in the terms of trade of the factors of production. Think of the economy as a machine in society with three inputs (the factors of production) and two outputs. The inputs are land, labor and Kapital. the outputs are goods and services. Over time the inputs can change their prices, quantities and qualities. The “terms of trade” is another way of saying “the ratio of prices”. So a change in “the terms of trade of the factors of production” means that the ratio of prices between, for example, oil (part of the factor called “land”) and money (part of Kapital) changes. A surprise change means that business people cannot make a profit any more. If it was a change which we all see in advance then business people can adjust and still make profits.

A surprise change in interest rates – the price of credit (part of Kapital) – is very often a cause of recessions. After the Yom Kippur war there was a surprise change in the price of oil -it went up quickly, because the quantity went down fast. A recession followed. Today the price of oil is dramatically down by surprise but the quantity changed slowly. Today oil is a smaller factor of production. We are much more energy efficient than before. So there are three differences between now and then: the price went the opposite way, quantity has not changed dramatically this time, and we use oil more efficiently. The first difference is not relevant. Will the other two differences be enough to save us? I doubt it. The bond and stock markets are already spoiled. That means another factor of production (Kapital) has a surprise change in its terms of trade. I suspect it is too late. I hope the price of oil is steady from now on. That could save us, perhaps.

The 80’s also had the Ag crisis which went well beyond a simple oil bust.

The price of oil was speculated on for 2 years after the rate of growth of BRIC slowed down. Once the belief that trade was fictitious, the herd followed. Personally, I think the BRIC recession ends with some growth bounce back in 2016 to manys surprise.

As for US oil producing states……..we don’t have any oil producing states outside 2-3. Texas and oil represent a small faction of its economy. Much smaller than 30 years ago.

Anchored Consumer Expectations

For nearly a decade, consumers experienced high oil and gasoline prices – over $4/gal. peak in 2008 – that made them skeptical of the rapid reduction of prices we have seen over the past 18 months. But they are now expecting low prices to continue and are buying large gas guzzler vehicles while shunning Prius-like economy cars. Auto sales just hit an all time record in 2015 with even Toyota showing gains only in SUVs and trucks. http://pressroom.scion.com/releases/tms+november+2015+sales+chart.download

So going forward, assuming oil prices stay low, we should see consumer demand accelerate especially as unemployment continues to decline. Bottom line: no recession and maybe a pick up in growth.

There is an interesting longer article related to this topic in the latest Economist issue.

http://www.economist.com/news/briefing/21688919-plunging-prices-have-neither-halted-oil-production-nor-stimulated-surge-global-growth

It is in the print edition as well.

What do we know about Chinese oil inventory? When China was growing faster, there was a lot of press about an assortment of commodity stockpiling. Consider in period 1 China consumes 1 mill bbls/day and stockpiles .25. In period 2 China grows and consumes 1.05 mill bbls/day but ability to stockpile is more limited so this slows to .1. Total demand falls even though China is still growing. Is it possible Chinese demand slowdown is more related to stockpiling than to economic growth?

It might be interesting to simply list where the falling oil prices lead to GDP growth and where it leads to decline. Some impacts are obvious and painful while others are subtle and may not be readily apparent to the man on the street. And, of course, the effects are not uniform geographically as point out in the article, so perception is not necessarily reality.

If consumers use the windfall to reduce debt, that doesn’t necessarily translate into more consumer purchasing of goods and services. If airlines pocket the cash by keeping fare high while fuel costs go lower rather than buying new planes, that doesn’t necessarily translate into more production and jobs. The point is that the calculated effect on GDP may be meaningful mathematically, but the dynamic effect on the economy can be filled with time lags and variation. One would expect some pick up in consumer spending, but the money saved on gasoline purchases might just go toward paying down previous purchases which may or may not stimulate anything.

I think its useful to think about different reasons for recessions, and therefore, whether a fall in oil prices will cause them.

There are essentially four reasons for recessions, i) the anarchy of the market ii) overaccumulation of capital iii) under consumptionism iv) disproportionality.

A fall in oil prices might cause a recession due to disproportionality, wasted investments, cuts to the value of the fixed capital stock etc. but it will be offset by a lower accumulation of capital, i.e. more profits relative to total investment due to falling cost of inputs and iii) increased consumption. In the medium term it will be a positive to the economy as consumption and profits rise and costs fall.

So will it cause a recession? Only if iv) the disproportion causes i) the anarchy of the market to get out of hand.

At the peak in 1980-81 energy accounted for 9.5% of nominal personal consumption expenditures (PCE). It had bottomed at just over 6% in 1974.

It fell to under 6% of PCE just before the 1990 recession and 4% before the 2000 recession.

It was only 6% in 2011 and just fell to 4% now.

So lower oil prices will probably have a smaller positive impact this cycle than in earlier cycles.

I’m not sure that we’re heading into global recession or that the oil price collapse should be blamed for it. But it seems like a better argument could be made than the usual vague, unexplained references to deflation. The most logical argument I can think of would go like so: investment spending of emerging markets is bigger relative to global GDP than you might think, and the oil price collapse kicked it into a downward spiral. Low oil prices crushed spending by oil producers, which in turn crushed spending by construction commodity producers, which put a stop to China’s export growth, which tipped the late cycle of China’s residential construction sector, adding to the woes of construction commodity producers. Although low oil prices are very good for most of the developed world, especially Europe and Japan, they’re overall not in a position to leverage up and swing into the kind of real boom phase that could outweigh the vicious spiral underway in EMs. This isn’t something I’m convinced of, just a formulation of the most gloomy spin I can put on the oil price drop.

Does anyone have a thought or opinion of what will happen to housing prices? Are homes connected to the decline in economic output? If we fall into a recession, will home sales slow, will properties come available, will there be foreclosures, or will people start putting their capital into this sector? Will China redistribute their money to buy America real estate, rental properties? Bottom line, will housing ever come down across the nation ever again or is there going to be this trajectory regardless of stock prices and oil? Thanks