Five Thirty Eight warns us to prepare for a (not likely imminent) recession; Wall Street Journal‘s Real Time Economics cautions “All Clear on Recession Risk? Not Yet”, even if the latest employment indicate continued growth. Time to review market indicators of the outlook.

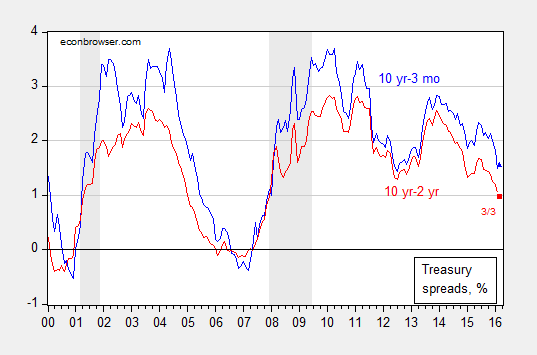

Here’s the 10 year – 3 month spread, and the 10 year – 2 year spread.

Figure 1: Ten year minus three month Treasury (secondary market) spread (blue), and ten year minus two year Treasury spread (red). NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, NBER, author’s calculations.

Notice that while both spreads have shrunk considerably, they remain positive. As of 3/3, the ten year – three month spread was 1.53%. Plugging this value into the equation for predicting recessions, estimated over the period of the Great Moderation (see this post) yields an implied probability of recession of 6.7% (down from 9.3% based on the 2/11 spread).

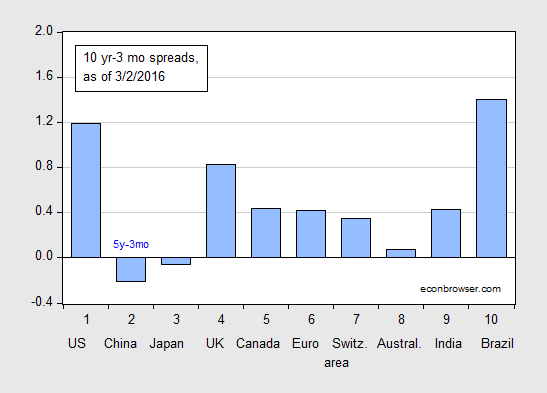

Across the globe, most spreads are positive.

Figure 2: Ten year-three month term spreads, as of 3/2/2016 (blue bar). China observation is Five year-three month term spread. Euro ten year rate is for Germany. Source: Economist March 4th edition, and author’s calculations.

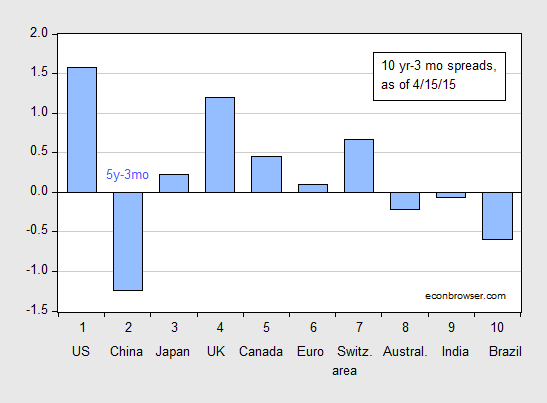

Contrast this with mid-April 2015, when many of the spreads were negative or near zero.

Figure 3: Ten year-three month term spreads, as of 4/15/2015 (blue bar). China observation is Five year-three month term spread. Euro ten year rate is for Germany. Source: Economist April 18th edition, and author’s calculations.

As noted in this post, there’s little evidence that inversions reliably predict recessions in these other countries. Note that one could argue that Brazil is in recession, while India did not experience one. Further, China’s inversion was steeper nearly a year ago than it is now.

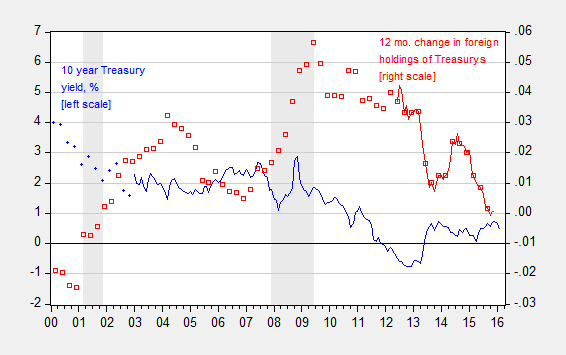

Just because the yield curve does not signal an imminent recession in the US, and current employment growth continues, doesn’t mean we should stay the course on raising the Fed funds rate [1]. In particular, monetary conditions are already tightening as foreign investors (private and official sector) are decumulating their stocks of US Treasurys. Figure 4 shows that by December 2015, foreign holdings were essentially unchanged relative to December 2014.

Figure 4: Real ten year yields, % (blue, left scale), change in foreign holdings of US Treasurys as a ratio to potential GDP (red, right scale). NBER defined recession dates shaded gray. Real yields are ten year constant maturity TIPS from 2002 onward, ten year minus ten year expected inflation from Survey of Professional Forecasters before; US Treasury holdings from Treasury, Fiscal Service via FRED, and TIC from 2011M06 onward, potential GDP from CBO Budget and Economic Outlook (Jan. 2016), interpolated to monthly via quadratic match.

In other words, the decumulation of emerging market foreign exchange holdings is showing up in a reduced pace of Treasurys acquisition. That’s not yet a decumulation of Treasury’s (that scenario’s impact is outlined in this post), at least as measured, but it might very well in the near future (and these TIC data are estimates; more reliable numbers on holdings will come out with the benchmark numbers).

Interesting as always. Just for the record: My FiveThirtyEight piece (linked in the first line) doesn’t argue that a recession is imminent. Quite the opposite: It argues that now, when the economy is reasonably strong, is when the Fed should be considering alternative policy regimes in order to be prepared for the next recession, whenever it comes.

Ben Casselman: Yes, apologies, my mistake!. I meant to include the caveat. Will edit accordingly.

Looking at these graphs, wouldn’t one have the impression that China is in recession?

Professor Chinn,

Do you have time or interest to comment on George Melloan’s opinion piece in the 3/8/2016 WSJ, page A13 titled, “Rising Global Debt and the Deflation Threat”? There are some interesting comparisons with the past discussed.

Also, if you have time or interest, on page C4, the chance of prices falling is modeled based on inflation options along with a Citi Economic Surprise Index. Any chance to show us how to model the inflation options model?

Thanks

Not clear of recession risk, “even if the latest employment indicate continued growth”, sounds like as if a recession risk for the near future and employment growth were in contradiction to each other. Aren’t the employment numbers a lagging indicator?