Today, we are pleased to present a guest contribution written by Laurent Ferrara (Banque de France, Head of the International Macro Division) and Clément Marsilli (Banque de France, Economist in the International Macro Division). The views expressed here are those of the authors and do not necessarily represent those of the Banque de France.

The latest update of the IMF WEO report has been released on April 12, 2016, and can be downloaded from the IMF web site (for a summary see also this Econbrowser post here). The salient fact of this report is that global GDP growth in 2016 has been revised downwards by -0.2pp years, from 3.4%, as assessed in the WEO update of January 2016, to 3.2%. Those revisions are quite homogeneous across countries (-0.2pp for both advanced and emerging/developing countries), although some commodity-exporters countries are more impacted.

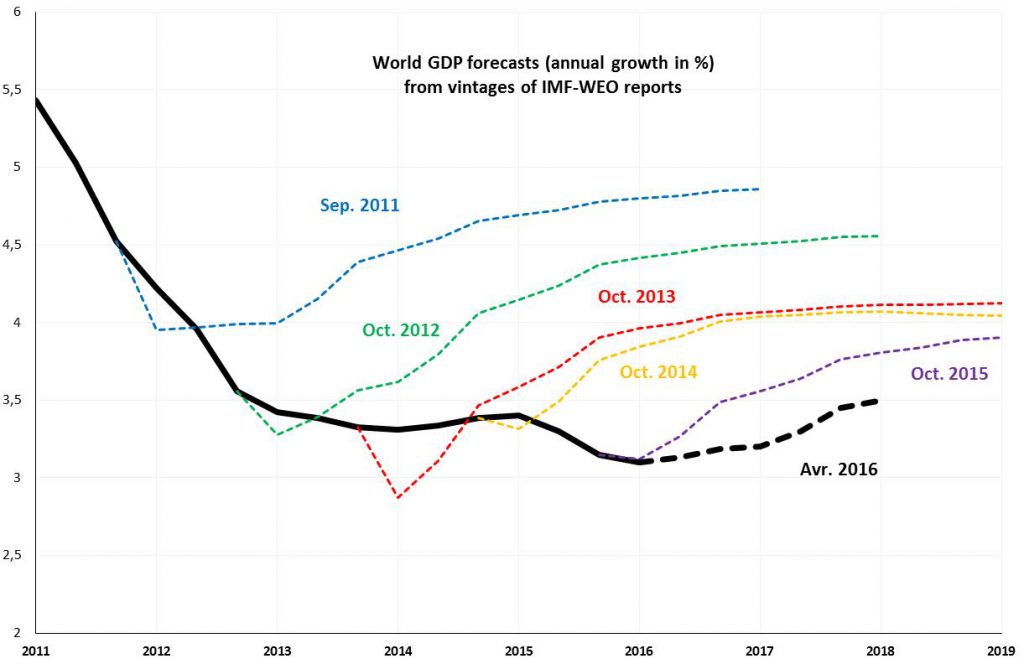

Unfortunately, this is not the first time that IMF forecasts are revised downwards; it seems to be a stylized fact since 2011 (see Figure 1 below).

Figure 1: Evolution of IMF-WEO forecasts for world GDP (annual growth in %). Source: IMF-WEO

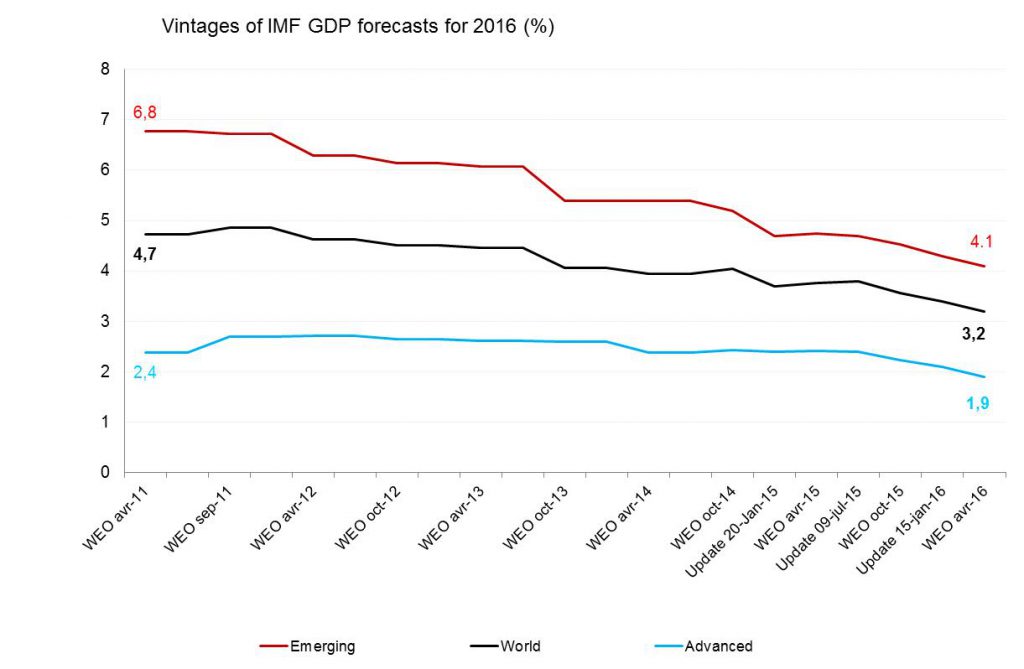

Remember that the first time the GDP growth rate for the year 2016 was predicted was in the WEO report published in April 2011: the estimated value was about 4.7% (see Figure 2). This large revision of 1.5 pp between April 2011 and April 2016 is mainly due to emerging countries (from 6.8% in to 4.1%), while forecasts for advanced economies were only moderately revised (from 2.4% to 1.9%). In fact, it seems that one of the major issues for forecasters was to integrate the structural shift in emerging economies, mainly in China, and to realize that the slowdown was more structural than conjunctural and was thus likely to persist.

Figure 2: Vintages of IMF-WEO forecasts for world GDP in 2016 (annual growth in %). Source: IMF-WEO.

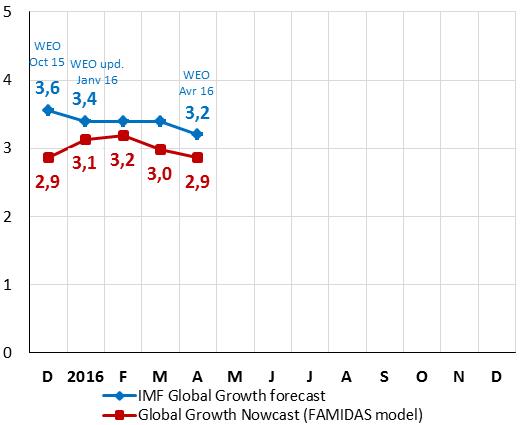

Against this background, one may wonder where the global economy is heading. Are we going to continue to follow this pattern of systematically downgrading economic growth? We recently developed a tool to monitor in real-time the global GDP growth on a high-frequency basis using a large database and recent econometric models (see a summary on Econbrowser). The latest results have been published in a Banque de France economic letter and show that with data used until April 4, the world GDP growth rate is estimated to be at 2.9%. This nowcast for 2016 is below IMF estimates, but close to OECD value estimated at 3.0%. Thus, the IMF estimation of world GDP could be revised downwards in the coming months, taking it to its lowest level since 2009.

Figure 3: Nowcasts for world GDP in 2016 (annual growth in %). Source: Ferrara and Marsilli (2016), Rue de la Banque No. 23, Banque de France, April 2016.

This assessment has been reinforced by the recent GDP release for the US economy in Q1 2016 (see comments on Econbrowser here). The first GDP figure estimated by the BEA is about 0.5% (annual rate) for Q1, below expectations and well below growth rates observed in previous quarters. Today, the carry-over for 2016 is about 0.9%, meaning that it will likely be difficult to reach the IMF forecast of 2.4%. Two nowcasting tools for the US economy have been developed by the Atlanta Fed (GDPNow) and the NY Fed (FRBNY Nowcast). Both indicators point to a moderate GDP growth for Q2: The NY Fed estimates a GDP growth of about 0.8% (with data up to April 29) while Atlanta Fed is a bit more optimistic and nowcasts a GDP growth of 1.8% (with data up to May 2).

Looking forward, a key issue for international economists is to assess whether this sluggish global growth is likely to persist in upcoming years. In a recent FT post, Olivier Blanchard acknowledges that this slow growth is “a fact of life in the post-crisis world”. Indeed, it seems that the catching-up process of some large emerging countries comes to an end while we cannot expect in the upcoming months a huge boost to global growth stemming from more mature economies. A least in the short-run, it seems that the global economy is expected to grow below the pace of the pre-Global Financial Crisis period (around 4.5% on average over 2000-07).

This post written by Laurent Ferrara and Clément Marsilli.

Looks like China is the big disappointment. If you look at China’s decelerating growth, it looks a lot like the China GDP actuals.

Right now, China’s political situation is becoming fraught. Here’s an excerpt from an upcoming article of mine entitled, “Is it time to pull out of China?”

“We can hope that US stands firm at Scarborough Shoal. If not, I believe events will deteriorate quickly in East Asia, as China and North Korea will perceive that South Korea and Japan are not, as a practical matter, protected by the US nuclear umbrella. But even if the US holds the line at the Scarborough Shoal, I believe President Xi will continue his program, both at home and in the South China Sea. US resolve with delay, but not defuse, the rising conflict with China.

“Thus, international investors in China will continue to face a rapidly deteriorating investment environment. Apple and Disney are not the end. They are just the beginning.

“Some companies already seem to be responding. For example, McDonald’s is selling 2800 outlets in China and South Korea. Of course, the company has stated its intention to reinvest funds in China, opening 1500 new restaurants in the next five years. Be that as it may, the exit is certain, while the reinvestment is contingent. Whatever else may be occurring, McDonald’s is taking money off the table today. Others will follow.

“China is rapidly closing its doors to foreigners, their businesses and societal activities. Meanwhile, the country is pursuing an external policy which will, in a matter of months, likely lead to sanctions and undermine its competitiveness as an foreign supplier. The China we admired and loved, that China is gone. It may be time to leave.”

World actuals reflect the deceleration of China’s growth.

Also, this was a good post.

This type of overestimation bias is not restricted to economics. It occurs in psychology, business, even climate (https://wattsupwiththat.files.wordpress.com/2013/10/cmip5-90-models-global-tsfc-vs-obs1.jpg) and molecular science.

One such bias has been termed the “availability heuristic” which are forecasts that stress the latest information in making forecasts. So, if the latest growth is 4%, there is a tendency to use that as a base and then, if one has a bias toward anticipating growth/acceleration, to project up from there. It certainly looks as if the IMF-WEO have that bias.

The U.S. has been the main engine of global growth and it has slowed substantially. It may be a while before the U.S. recovers, because of the Baby-Boom retirement, which will peak in 2029, along with the movement towards socialism. The good news is the U.S. won’t be as bad as Venezuela or Brazil.

The cheapest way to improve our economy is to remove and reduce regulations, to lower the cost of production and the cost of living, reduce progressive taxes on the middle class, to promote work and investment, raise the minimum wage, to promote work and reduce negative taxes or raise taxes, and eliminate or replace expensive failed government programs.

We’ve been accelerating towards a pro-entitlement and anti-business society (Sanders was very close to winning) when we can’t afford it and need the opposite, because of the high national debt and huge unfunded liabilities, including the Baby-Boom retirement (where taxes need to fund Social Security and Medicare, while younger workers provide the goods & services for the retired population).

I would suggest that the reason for the erosion of GDP forcasts, is the decline in credit expansion in China. China right now has a total debt to GDP ratio of more than 280%… The USA has run debt up to more than 330%, courtesy of Chimerica trade and America’s global reserve currency status.

A little research will reveal that most of the world suffers from high credit to production ratios. The OECD average total debt to GDP ratio is more than 300% and has remained there since 2008…. Despite a world-wide banking crisis and recession, the headline “deleveraging” never happened. debt/GDP ratios have remained high in virtually all advanced economies reflecting central banking manipulation of markets and quantitative easing on an epic scale…

This problem is so persistent, the World Bank, the CIA database, and the Federal Reserve have scrubbed their websites to make retrieval of this statistic difficult! The traction that Barry Sanders and Donald Trump are experiencing doesn’t take a rocket scientist!

“a key issue for international economists is to assess whether this sluggish global growth is likely to persist in upcoming years. ”

Yes. We live in a debt laden, highly regulated welfare state. Sluggish rates are the new norm.