Mark Thoma comments on the impact of the likely dollar appreciation:

A stronger dollar will make imports cheaper for American consumers…The U.S. economy is now strengthening and approaching full employment, but it’s not quite there yet. So I expect the stronger dollar to have some employment effects, but I don’t expect them to be substantial…

so that it’s a wash for the average household — but he adds the caveat:

But that’s an average across the entire population. If you’re one of the workers who loses a job due to the strengthening dollar and are forced to seek employment elsewhere, the costs could be considerable.

I thought it of interest to highlight what happened around the previous two periods of sustained dollar strengthening.

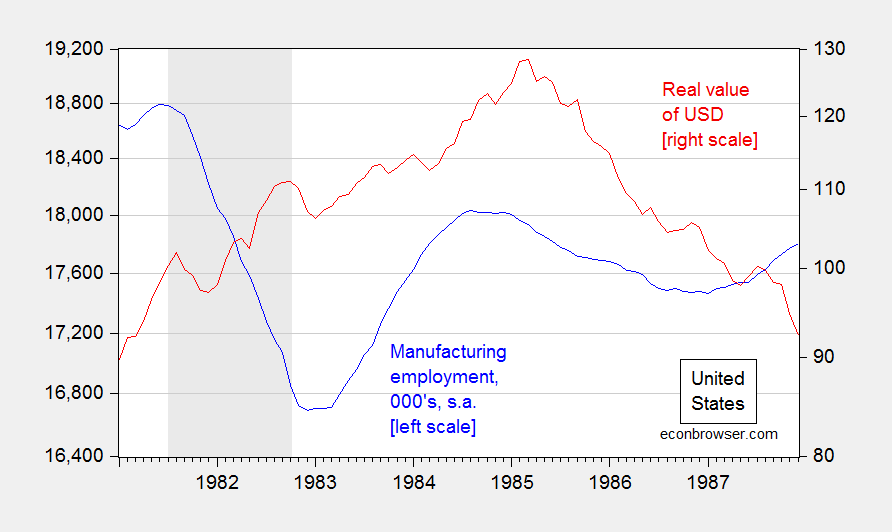

Figure 1: Manufacturing employment (blue, left log scale), and real trade weighted value of US dollar against broad basket of currencies (red, right log scale). NBER defined recession dates shaded gray. Source: BLS and Federal Reserve Board via FRED, and NBER.

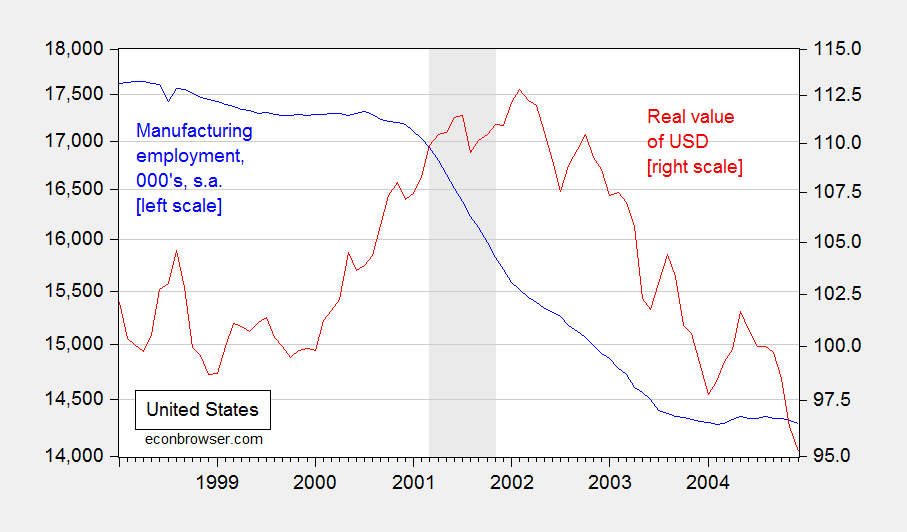

Figure 2: Manufacturing employment (blue, left log scale), and real trade weighted value of US dollar against broad basket of currencies (red, right log scale). NBER defined recession dates shaded gray. Source: BLS and Federal Reserve Board via FRED, and NBER.

It looks like manufacturing employment responds negatively to dollar appreciation. Work by Campa and Goldberg (2001) examining two decades of data (1972-95) encompassing the 1980-85 dollar appreciation found little effect on net employment, although there were substantial reallocation effects (and did find effects on wages). Klein et al. (2003) examined a similar period, but distinguished between trend and cyclical components of dollar movements (where cyclical components are estimated using deviations from deterministic time trends). They found a significant negative impact on employment by way of job destruction due to cyclical appreciation. (See also this guest post that argues the dollar appreciation is mismeasured, biasing downward estimates of job effects.)

Now consider the current situation:

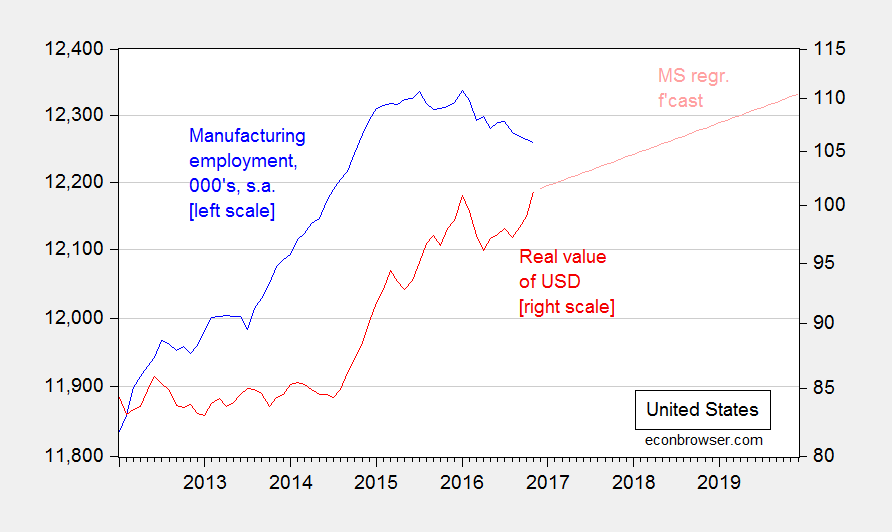

Figure 3: Manufacturing employment (blue, left log scale), and real trade weighted value of US dollar against broad basket of currencies (red, right log scale), and forecast assuming 0.23% appreciation/month. Source: BLS and Federal Reserve Board via FRED, and author’s calculations.

Obviously, we don’t know how much further the dollar is going to appreciate. In this post, I calculated an incremental 10% appreciation in about 3 years (that’s using the implied reversion coefficients from the error correction model), above and beyond what was going to happen (i.e., the counterfactual). Another approach is to extrapolate the continuation of the dollar cycle; I do this formally by estimating a Markov switching model on the first log difference of the real dollar, allowing the constant to change between two regimes, using quarterly data (see discussion of this methodology in this post). I then simply assume the appreciation-regime rate of appreciation continues indefinitely. This yields the pink line in Figure 3; in about 3 years, this implies an additional 10% or so appreciation.

The bottom line: Since the long run cointegrating relationship between log manufacturing employment and the log real value of the dollar is about 0.156 (holding constant non-manufacturing employment, and allowing a trend in the cointegrating vector), then one should expect a roughly 1.6% reduction in manufacturing payroll employment relative to what would have otherwise would have occurred. Using November 2016 figures (12,260,000), that implies an additional loss of about 200,000 in employment. If the impending fiscal stimulus is sufficiently large, the domestic impulse could offset the dollar-induced employment loss.

Further note that the trend decline in manufacturing employment share will continue as long as productivity growth in manufacturing exceeds that in the rest of the economy (see also Krugman).

Real Manufacturing Output is at a Record High

Manufacturing correlates closely with recessions and booms. The Great Republican Recession of 2008-09 caused a massive collapse of the manufacturing sector — thanks Dubya!

https://fred.stlouisfed.org/series/OUTMS

The main driver of manufacturing employment over the long term is technology advancement which even the Luddites understood 200 years ago. Apparently, this is a very hard concept for policy makers today to understand.

Of course if we followed Keynes’ advice, we could have much more employment in manufacturing and most other industries. But Keynes is simply ignored now despite being right about most everything.

What about the integration of the national economy with the global economy? If a greater percentage of manufacturing jobs are related to exports (or face import substitution) now than in the past, should one expect the dollar’s rise to have a greater impact this time than in the past?

Nick de Peyster

Although this article is a year old, I find it interesting that Ford Motor Company was the target of Donald Trump’s ire when it has more of its manufacturing jobs in the U.S. than General Motors, which was the recipient of Obama’s largesse.

http://www.autonews.com/article/20150215/OEM/302169970/ford-tops-gm-in-u.s.-factory-jobs

It would seem that Ford is more community-minded than GM by keeping production jobs in the U.S.

Also, Ford has been making cars in Mexico since 1925 so not exactly a new issue. The UAW had no problem with Ford moving small car production to Mexico because a new truck will be built in the American plant and trucks are much more viable. As usual, Trump is being an idiot.

Great post. What is interesting to plot here would be “structurally adjusted” manufacturing employment, to correct for the fact that manufacturing employment is generally very pro-cyclical. In my paper (thanks for the link to my guest post), I do that in an appendix graph on page 50, Figure 13: http://dougcampbell.weebly.com/uploads/1/0/2/2/10227422/campbell_rers_hysteresis_aug_2016.pdf.

In both cases, the timing of the structural decline in manufacturing matches the dollar appreciation, with about a 9 month delay. This is the big thing that is obscured by the focus just on the role of China in the decline in American manufacturing.

Part of the picture that many economists miss here is the hysteresis aspect. If you are overvalued, even temporarily, your tradables sector could shrink in a persistent way. In that case, you’d need a weaker equilibrium RER in the future. Of course, these jobs aren’t coming back after a huge tax cut for the rich and the dollar appreciates. More will be gone, and gone for good. Trump may be able to reduce the “elasticity” of manufacturing w.r.t. the exchange rate though. That elasticity appears to be smaller for most other countries than thus US, such as in Germany, where companies need the explicit consent of labor unions in order to offshore jobs.