In search of a “supply side success” after the end of the Kansas experiment, conservative observers turn to Wisconsin. The Manhattan Institute’s Mr. Riedl declares victory:

Wisconsin’s job growth over the past six years has been extraordinarily strong.

When last we met Mr. Riedl, he was explaining why fiscal policy could have no impact on GDP because, well, because. That does not augur well for his abilities an economic analysis, and indeed we can easily poke holes into the argument that Wisconsin’s doing just great!

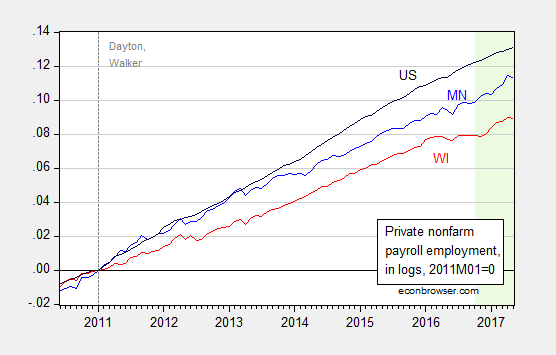

First, let’s compare Wisconsin to its neighbor Minnesota (and the Nation). To paraphrase the President, “Sad!”

Figure 1: Log private nonfarm payroll employment in US (black), Minnesota (blue), and Wisconsin (red), all normalized to 2011M01=0. Light green shading denotes data not yet benchmarked to QCEW data. Source: BLS and author’s calculations.

Note that the apparent surge in Wisconsin private nonfarm payroll employment in recent months is based on establishment survey data, not yet benchmarked (see this post). This is relevant because, while the BLS establishment survey provides the most accurate indicator of employment on a monthly basis, the nonfarm series can still be substantially revised, and previous surges have been “revised away”, as discussed in this post.

Second, let’s compare what Wisconsin private nonfarm employment looks like against a counterfactual based upon the historical correlation between US and Wisconsin log employment (nUS and n respectively). To do this, let’s estimate an error correction model over the 1994M01-2010M12 period (so up until just before the Walker administrations):

(1) Δnt = -0.0036 – 0.036×nt-1 + 0.027×nUSt-1 – 0.178×ΔnUSt + one lag of first differences + ut

Adj-R2 = 0.65, SER = 0.0015, DW = 2.02, Obs.=204, sample 1994M01-2010M12. Bold face denotes significance at the 10% MSL, using HAC robust standard errors.

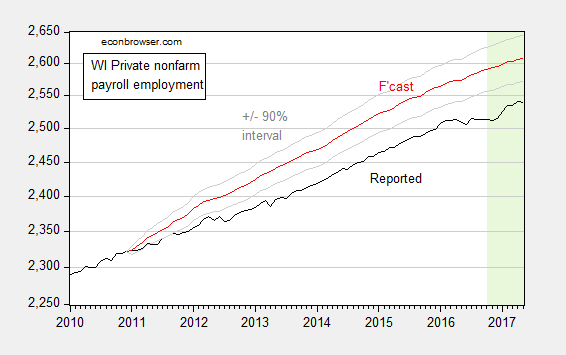

I then use this equation to dynamically forecast using ex post observations on national employment (this is sometimes termed an ex post historical simulation). I plot this forecast plus the 90% forecast interval against reported employment in Figure 2.

Figure 2: Wisconsin private nonfarm payroll employment, May release (black), and out-of-sample forecast (red), in 000’s, s.a. 90% forecast interval (gray). On log scale. Light green shading denotes data not yet benchmarked to QCEW data. Source: BLS and author’s calculations. See text.

Regression output is here. The methodology roughly follows that in Chinn (JPAM, 1991).

The results indicate that Wisconsin private employment has been lagging what one would have expected given historical correlations with US employment.

To paraphrase the President, again: “Sad”.

Third, Mr. Reidl argues employment growth has lagged in Wisconsin because everybody’s employed that can be employed.

In fact, job growth has slowed recently only because Wisconsin essentially has run out people who are unemployed due to broad economic factors.

In other words, one cannot reduce a jobs deficit that no longer exists.

As background, economists consider an unemployment rate of around 4% to be “full employment.” Even when jobs are plentiful, roughly 4% of the workforce is temporarily transitioning between jobs at any given moment. Economists typically set aside this base level of unemployment, and look for additional joblessness that would reflect economic weakness or labor market deficiencies.

And yet Wisconsin’s current unemployment rate — 3.2% — is even better than full employment.

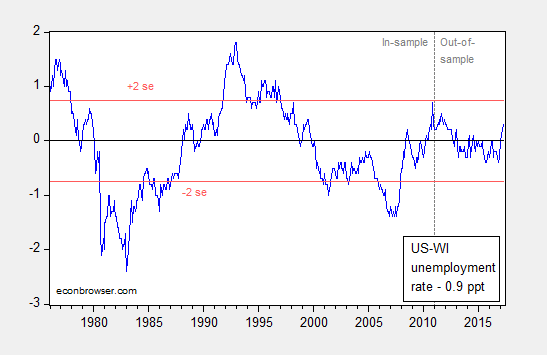

Well, it’s of interest to note that Wisconsin on average experiences a lower unemployment rate than the Nation, by nearly a percentage point, over the 1986-2010 period. This idea of a “fixed effect” is critical if one wants to assess performance across individual states. Figure 3 presents the deviation of US unemployment relative to Wisconsin; despite the recent improvement in Wisconsin unemployment, the gap is not statistically significant.

Figure 3: US-Wisconsin unemployment rate differential, adjusted by 0.90 ppts, in % (blue), and +/- 2 standard error band (red). Differential estimated using OLS, HAC robust standard errors lag length selected by AIC. Source: BLS, and author’s calculations.

In any case, I would be reluctant to put too much weight on the unemployment rate at the state level, since that is the ratio of two very imprecisely measured variables (unemployed, labor force, both from the household survey). (See discussion of revisions to the Kansas employment series here).

By the way, some 2 years and 4 months after the target date (January 2015) for adding 250,000 new jobs, Wisconsin private nonfarm payroll employment remains nearly 33,000 below target. This Governor recommitted to this goal in August 2013.

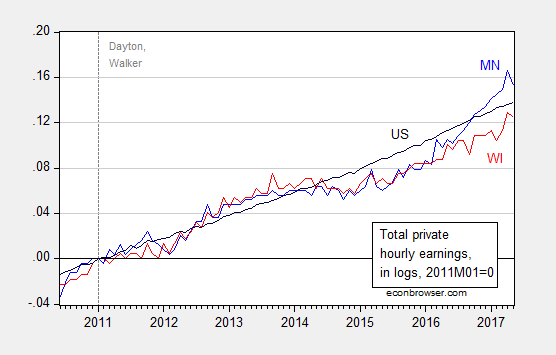

Update, 5:30PM Pacific: Reader Mike v observes if labor slack was disappearing in Wisconsin, we should see wages rising fast, perhaps faster than in the US (or say Minnesota). Figure 4 depicts average hourly earnings relative to 2011M01.

Figure 4: Log total private hourly earnings for US (black), Minnesota (blue), and Wisconsin (red), all normalized to 2011M01=0. Source: BLS and author’s calculations.

So, I’d say the tight labor market argument seems empirically lacking — at least for Wisconsin. Better for Minnesota. Sad!

Perhaps Illinois merits a thought.

Agree. https://www.illinoispolicy.org/reports/203-billion-and-counting-total-debt-for-state-and-local-retirement-benefits-in-illinois/

Wouldn’t we expect a rapid increase in WI wages if they have “run out of people who are unemployed”?

Mike v: Good point. I’m adding Figure 4 which highlights the intellectual vacuity of the “running out of unemployed” argument as applied to Wisconsin.

Thank you for adding this.

In Japan, we see effectively full employment with little wage pressure and tepid GDP growth.

Welcome to Japan.

Under normal condition, low unemployment would cause the wages to rise for companies to compete to hire someone, the trend is more nuance. I have a feeling that the investors can drive it more by demanding more money from their investment instead of companies increasing employees’ wages.

I can use two actual cases: United Airline CEO gave increase in pay to workers two years before their contract negotiation and the Citi analyst complained that investors are being played second to the employees. Second is the Amazon purchase of Whole Food led investors to hammer grocery companies’ stocks.

Just for the sake of argument, let’s assume that this “running out of unemployed” story makes sense. If that’s the case, then wouldn’t that same point have been true back when Walker pledge to create all of those jobs? So if you really believe that line about running out of unemployed workers, then you have to ask why Walker didn’t factor that into his earlier promise. Sounds like Walker and his apologists are trying to have their cake and eat it too.

Can we realistically expect Wisconsin’s unemployment rate to fall much lower? It seems, it hasn’t fallen below 3%, at least since the ’70s:

https://fred.stlouisfed.org/series/WIUR

PeakTrader: Remember, the unemployment rate is a ratio of two random variables; the labor force could increase, so that employment could rise faster.

Menzie Chinn, it looks like Wisconsin out-migration has been a problem for a while:

http://familyprosperity.org/application/files/8914/7708/4401/Wisconsin_Family_Prosperity_Index_Migration_Update_102016.pdf

PeakTrader: But, but, Governor Walker said “Wisconsin was open for business” in order to make the state more attractive to workers to stay in the state. Guess it didn’t work.

Slowing the increasingly bigger snowball rolling down the hill is a start.

https://www.illinoispolicy.org/illinois-2015-2016-out-migration-problem-is-much-more-dire-than-in-other-midwestern-states/

After a century of democratic party control.

Plus their little gerrymandering experiment is headed for the Supreme Court. That seat McConnell stole will come in handy.

The part that is more “sad” is their complete lack of understanding how critical the parameter of consumer class incomes is to the growth of the economy. It is the horse that pulls the cart. Anything that increase consumption (70% of our GDP) is good for the economy and anything that reduce consumption will be bad. The Walker attacks on public employees and their good middle class income, have had the predictable result of slowing economic growth.

So, you want a bigger government, like in Western Europe, where per capita GDP is over $10,000 a year lower than the U.S. and consumption is only 60% of GDP.

The horse that pulls the cart is producing real value and efficiency through the marketplace and competition.

No. That would be horrible. I wouldn’t be able to write any checks out of my GDP per capita bank account since income is spread evenly so a high gdp per capita mean I have more money too. It’ like when Bill Gates walked into the bar I was drinking at last night and I became a billionaire per capita bar income. It was so sweet. I bought a mega yacht, a huge mansion, and a Ferrari with my per capita windfall.

You wouldn’t have to worry about being one of the 10,000 millionaire employees Microsoft created, or one of the many others who made money from the multiplier effect.

You can dig holes and fill them up as your contribution to society, or wait for a check from your heavily indebted government.

Sarcasm is a great tool, and you used it well.

Unfortunately Republicans are immune to it. They will read it as if you agreed with them.

PeakTrader There is no country called “Western Europe.” I don’t know where you’re getting your information, but it doesn’t square with the facts. There are plenty of Western European countries with per capita GDP comparable or greater than the US. Here’s what the World Bank says:

US: $56,116

Switzerland: $80,999

Luxembourg: $99,718

Ireland: $61,094

Norway: $74,482

Sweden: $50,585

Denmark: $53,015

Keep in mind that these countries also enjoy far lower Gini coefficients, so that high per capita income is spread much more equally:

US: 41.1

Switzerland: 31.6

Luxembourg: 34.8

Ireland: 32.5

Norway: 25.9

Sweden: 31.6

Denmark: 29.1

Even the notoriously class based UK has a lower Gini at 32.6.

In terms of income inequality the US is in company with a “who’s who” of kleptocracies:

Argentina: 42.7

El Salvador: 41.8

Georgian (Republic): 40.1

Putin’s Russia: 41.0

And don’t forget that many Western European countries with lower measured per capita GDP also work fewer hours and have more leisure time. In other words, they take their “wages” in the form of unmeasured leisure rather than measured GDP. The French have a lower per capita GDP but French hourly labor productivity is virtually identical to the US. We also need more GDP to pay for our much higher and less efficient healthcare system.

Unless you’re in the top 1% you would almost certainly be economically better off in a Western European country. Forty years ago the image of Eurosclerosis was appropriate. Today, not so much. This isn’t you father’s Europe. And for that matter, this isn’t your father’s USA.

I agree, Europeans work less and there’s more unemployment. That’s helps explain why they’re poorer. They live in much smaller houses and drive much smaller cars (how much is gas in Europe now?). There are much fewer shopping malls per capita in Europe. The U.S. health care industry creates enormous value. Los Angeles’s economy is bigger than most of the economies you cited (what’s per capita income and the Gini coefficient in LA?).

US healthcare creates very little value. It does a better job at preserving ex ante value.

So, the innovations, advancements in technology, and high quality goods & services in the U.S. health care industry create “very little value” to you. Maybe, you should’ve bought some health care stocks.

I stand by my statement. Increasing levels of activity are not the same as increasing levels of welfare.

Consider my mother, who suffered a mild heart attack when I was yelling at her in the car outside New Haven. (Lesson: Don’t yell at Mom.)

She spent three days in the Yale New Haven Hospital, got a pill and a couple of tests: $41,000. Now this was a quite profitable engagement for the New Haven hospital and its staff. But how did it add to GDP? We were better off after the incident than before the incident? The answer is categorically ‘no’.

When we have a Malthusian system with large and rising costs of this sort, that’s a real issue. And it’s why I keep calling for a national balance sheet.

GDP growth is the equivalent to the profit of a company. If depreciation is low, company profits and cash from operations may be pretty similar. If however, depreciation is high, then cash from operations will be much higher than profits, if you’re using an accrual accounting system.

We need the US, for both the government and nation as a whole (ie, the civilian sector) to adopt accrual as well as cash accounting. If we did, we’d see that perhaps 90% of healthcare spending is an offset to the depreciation of human physical and mental capital, and not a net gain to society.

So if you’re healthcare spending is increasing by 1% of GDP per year and GDP is growing by 2% per year, then net welfare is only increasing by 1% per year, not 2%.

Net versus gross matters in a country with a rapidly aging society and a slow-growing or declining population otherwise.

Fortunately, your mom didn’t have to use much of the tremendous value in U.S. health care, since she only needed “a couple of tests” and “a pill.”

I don’t know why the hospital kept her for three days. I doubt you actually paid $41,000. It should be noted, some people pay nothing or very little. Yet, receive the same high quality care.

Of course, medical costs would be much cheaper without excessive regulations and frivolous lawsuits. And, GDP is not profit, etc..

Peak –

I am not making an argument about the merits of US healthcare.

I am simply pointing out that cash accounting, which is what the US government uses, will give you a distorted picture of net economic performance if depreciation is high. Our health spending is not making society better off, but is preventing society from being worse off.

When people proudly point out the contribution of healthcare to GDP, I personally do not think it raises the standard of living at all. If I go to the orthodontist and get my teeth straightened, that’s an investment. I am better than before.

However, if I broke my hip and have it replaced, I am no better than before. Welfare has not been improved, only prevented from declining.

Most of our vast healthcare spending is not increasing our standard of living. It is only preventing the quality of life of retired persons from deteriorating as fast as it otherwise would, by and large.

And I think increase in GDP less the increase in national debt is pretty close to the national analogy to corporate profit.

“However, if I broke my hip and have it replaced, I am no better than before. Welfare has not been improved, only prevented from declining.”

steven, your view on this is incorrect. you are trying to compare your position prior to the broken hip to after the replacement. wrong. you must compare after the replacement to the current state of the broken hip-those are the adjacent events on the timeline. your welfare was improved.

same situation with your mother. your position after leaving the hospital must be compared to the condition entering the hospital, not the 5 minutes prior to berating your mother! you paid a price for the unknown condition, which could have been devastating. your argument would have been completely different had your mother suffered a massive heart attack but recovered a month later due to the treatment at the hospital. you cannot decrease the value of potential hospital services using hindsight. it is this uncertainty which leads to the need for health insurance, rather than simply pay for service.

You are incorrect, Baffs.

My mother’s hip fracture occurred in Q3.

Let’s take GDP at the end of Q2, when my mother was healthy.

In Q3, she breaks her hip, and GDP declines by whatever the hip cost, let’s say $25,000.

The hip is fixed, and at the end of Q3 my mother is as healthy as the end of Q2, ergo, national welfare in unchanged.

However, we spent $25,000 to deliver unchanged welfare. In terms of national accounts, that spending shows up as a contribution to GDP. In welfare terms, we just lost $25,000 to hold welfare steady. It would be the equivalent of a healthy 30 year old buying a new Honda Civic and setting it on fire.

If we used accrual accounting, we would clearly see that the $25,000 was an offset to depreciation and did not increase welfare from end Q2 to end Q3. As it is, all that healthcare spending looks like a plus for the economy. It’s not.

Steven Kopits: Instead of creating a new approach on your own, maybe refer to what real economists have developed, e.g. Nordhaus and Tobin, Measure of Economic Welfare.

Thank you, Menzie.

I would not institute my own measures of GDP without a suitable partner. I would note in passing that a number of satellite image analysis firms have sprung up which now promise to be able to monitor the globe more or less real time on a cost effective basis. I have consulted for one of them on oil related topics. In any event, I think we’ll see an expansion of real time global GDP proxies in the next five years or so. If you’re into the measurement of these sorts of things, we’re entering a golden age. (There’s an initiative for UW for you.)

In any event, to return to Norhaus et al. Their Measure of Economic Welfare (MEW, link below) is still nothing like we’d expect to see from a decent accounting firm, because it is still entirely flow-based.

I’ll leave my comments on their model for another occasion, save to agree that unpaid work and environmental quality should be included in GDP and that defense expenditure should not be excluded. The arguments over environmental quality would be really vivid, but worthwhile, I think.

Let me turn instead to stocks, because these are the ones which will affect productivity and GDP growth.

Where do we invest our big money as a society?

– infrastructure

– education

– health

Let’s take them one by one:

Infrastructure

Infrastructure is subject to known and widely accepted rates of depreciation. These should be applied to government assets as well. Thus, when we call for a major infrastructure initiative, it would be good to see it’s affect on infrastructure values net of depreciation. My guess is that the net stock of infrastructure assets may actually be declining over time as measured using accepted depreciation tables. Thus, much of infrastructure spending would be directed to preventing national wealth (and sort of GDP) from declining over time, rather than increasing GDP as such.

Education

Like infrastructure, education is a long-lived asset subject to amortization. This can be measured both at cost and at market value. I personally would be quite interested to see work on the value of human capital from formal education. Indeed, I think a young economist could make a career and a name for themselves in this area just as Amy Finkelstein has come to embody health economics. I have a feeling this would produce some really uncomfortable insights into the lack of education efficacy in the US, but who knows? In any event, this should be tracked as well.

Health

For most people, health is a natural endowment subject to material depreciation, particularly after age 65. Given that healthcare is the fastest growing component of government spending and that the over 65 age cohort is anticipated to grow by 50% to 2025 (if I saw that right), this is a real driver of both government spending and the nation’s human capital. One could put this in Amy Finkelstein’s wheelhouse, but I think the nature of this exercise is somewhat different than what she normally does. Again, I think it’s a good opportunity for a young economist.

So, if we tracked just those three asset classes, Menzie, and reported on them regularly, we’d have a much better sense of what’s going on with the economy, our own Malthusian transformation, the sustainability of government programs, and the appropriate related fiscal and monetary policies.

I’d add that regular reporting on these topics is essential to bring them into mainstream use. This may well be accomplished by a satellite company as part of their standard macro econ offerings. I could easily imagine, say, Steve Ballmer contributing $10-20 million to making all this happen.

http://www.economicsonline.co.uk/Global_economics/Measure_of_economic_welfare_MEW.html

“As it is, all that healthcare spending looks like a plus for the economy. It’s not.”

steven, rather than spend the money on the healthcare (treating your broken leg or moms heart attack), lets simply avoid spending on health care. no treatment. what happens to gdp? it drops because you lost productive capacity. this is your new baseline measure. the pre-injury condition no longer exists, so should not be used as a reference to measure impact of treatment.

Baffs –

I think the numbers suggest that, if we stopped spending health care funds on the retired elderly, GDP would rise. The retired, if they are involved in neither paid nor unpaid work, do not contribute to the productive capacity of the economy. They are part of consumption, to be sure. However, were they not there, those funds could be re-directed towards education, infrastructure or other consumption goods.

That’s the point I am making. You need to be very careful about spending on the elderly, and indeed, in places like Japan, society will be facing an on-going showdown between the unemployed elderly and those employed. If we over-value the elderly, the result may well be too few children. The elderly seem to be winning the argument for the moment, and it on this basis that I allowed that disposable income for the average working Japanese may be lower in 2050 than it was in 2020.

Now, this is not to call for the abandonment of the elderly. And indeed, by moving to a human capital metric, a person has intrinsic value by being alive, with this value — for accounting and actuarial purposes — affected by age, education and physical condition, among others. By this measure, an elderly person — although not a net contributor to the productive capacity of the country — still has value as part of its social capital.

GDP only measures gross flows. I am arguing that we need to also measure key stocks and net flows.

PeakTrader This is rich. Here you are complaining about a culture that takes what you consider to be too much leisure time…and yet by all appearances you yourself don’t work at all. You frantically post 24/7. You’re either unemployed or you are massively cheating your boss out of a day’s pay.

Did you know that the employment-to-population ratio among prime working age adults is higher in France than in this country? If there’s an unemployment problem it’s here, not there. But you probably didn’t know that because it’s a fact that doesn’t fit with your preconceptions of lazy, cheese eating Frenchmen who’d prefer discussing Camus or Sartre over brie & wine rather than do a day’s work.

And in your world driving big cars and having big houses amongst suburban sprawl is a good thing??? Some of us hate big cars. And you really don’t need them if you have better transportation options available. Yes, we have big cars. We also have the worst airports and rail service in the developed world. Our transportation infrastructure is a national embarrassment. And BTW, those shopping malls you seem to love are an endangered species. This isn’t 1980 anymore with teenage mallrats running all over the place. Malls are where old people go to shuffle and walk.

Finally, the fact that Microsoft created 10,000 rich folks needs to be put in the context of that same economic system creating tens of millions of poor people living below the poverty line. A “winner take all” world is fine for the 1%, but not for the other 99%. Noah Smith has a nice column about how we’re becoming a country of 1% predators who extract rents from the 99% rather than business men and women who add real value. Big Pharma and the AMA are more concerned with extracting rents than curing patients. Same with banks. Anyone who works for Wells Fargo should be forced to wear big scarlet letters “CB” on their shirt to identify that person as a crooked banker.

2slugbaits, I’m sure, you want to destroy even more of the U.S. economy and turn it into France.

http://money.cnn.com/2017/04/19/news/economy/france-election-economy/index.html

I’ve been living on savings for a while, because I worked hard. Something you should try.

you’ve been living on savings because you were exposed as a fraudulent banker who nobody is willing to rehire after the financial crisis. and you sort through blogs all day trying to defend and justify your actions to yourself.

Those are just more lies.

I’ve been revealing reality.

And, I can get a job at a bank, because people who work at banks are very responsible and honest.

Extensive background checks are required.

peak, you lost your job at the bank because of the financial crisis. rather than acknowledge you were a contributor to the problem, you blame your job loss and subsequent inability to be rehired on government regulations. hence your obsession with blaming congress rather than bankers for the financial crisis. the banking industry realizes you provide no real value to the modern banking sector, probably due to computer illiteracy, so you have been living off your savings until you can officially retire and start collecting welfare (social security and medicare) from the government. that sums up your recent existence fairly well.

rather than continue to blame others for your position, own up and become a positive contributor to society. punishing others to make up up for your shortcomings is a poor way to live life.

Baffling, that’s quite a fairy tale. LOL

peak, it still describes an unemployed banker trying to promote his economic views on a blog. note the important term here, unemployed. you constantly insult others who you feel should be working, or improving their work position. and yet you sit unemployed, living off of savings, rather than working. hypocrisy.

PeakTrader You really stepped in it this time. Yes, the youth unemployment “rate” in France is indeed 24.6%, which sounds really bad. It’s also very misleading because of the way the youth unemployment is defined in France. Educational benefits in France are such that young people stay in school a lot longer than they do in this country. Almost half of 20 year olds are in tertiary education. The norm in France is 51% of 20-24 year olds are in school. In other words, going to school is considered a job in France. When you account for the fact that more young people go to college in France and tend to stay there longer, the youth unemployment “ratio” is only 9.1%. And when they do finally finish their higher education they are more likely to have a job (French employment-to-prime-working-age is higher in France than the US) and they are likely to be at least as productive (measured as hourly productivity) as a US worker.

http://www.independent.co.uk/infact/france-youth-unemployment-oecd-a7752816.html

2slugbaits, they likely stayed in school longer, because they can’t find a job or need a higher paying job to pay the high taxes.

I don’t know what they’re studying. However, Marxism and socialism may not help.

peak, rather than speculate and promote your opinion as fact, read the article and learn from 2slugs.

So the question is: does Wisconsin have a unique problem or is it endemic to the Midwest?

http://www.chicagotribune.com/news/columnists/kass/ct-dissolving-illinois-kass-met-20170620-column.html

Nope. Wisconsin is 6th out of 7 Midwestern states for job growth in Walker’s 6 years, is way behind Michigan, Indiana and Minnesota, and even trails Illinois in that time period.

https://jakehasablog.blogspot.com/2017/06/wisconsin-proving-to-be-gold-standard.html?m=1

Oh, and we’ve had revenue shortfalls each of the last 3 years, population growth has stagnated, and our debt is at an all-time high. Other than that…

The latest Coincident Economic Activity Indicators released earlier this week show Wisconsin might be gaining some ground. Over the last year, Wisconsin is up 4.7% while Minnesota is up 3.2%. It looks like Wisconsin has been growing faster — at least by this measure — since late 2013. Is this a data series that you’ve used / seen?

All this employment data is most confusing. According to the Trumpers last fall, nearly the entire country was unemployed, and we were told the “real” unemployment figures were shocking.

Now, we’re supposed to accept the data blindly? Or have miracles transformed the economy since the third week in January? Have we gone from not believing to instant genuflection to the same data compiled by the same number crunchers?

The California unemployment rate (a state with 7X Wisconsin’s population) is now at 4.7%. Which California doomsdayer would dare believe that?

Just last fall the Trumpers warned us to be very wary of government data re: employment figures. Don’t trust them or they those who compile them. There were tens of millions more unemployed, numbers so shocking there would be riots if the “real” numbers surfaced.

Yet, those same skeptics are now snapping their suspenders as data from those very same detested bureaucrats and their suspect computers reveal encouraging employment news in various states.

Not so fast. What doomsdayer worth his ideology believes that California’s u.e. Rate is down to 4.7% (a state with a population and labor force about 6X that of Wisconsin)?

Those numbers? Orwellian, of course. Wisconsin goooood. California baaad.

“Slowing the increasingly bigger snowball rolling down the hill is a start.”

peak, if you want to give walker such a benefit, then you need to quit complaining about obama. the us economy certainly outperformed wisconsin over the past few years. obama not only stopped the snowball from rolling down the hill, he began to push it up the hill. but you call walker successful, and obama failure. that is the working of a political hack.

I wasn’t talking about Walker or Obama.

The U.S. didn’t have an out-migration problem like Wisconsin.

Of course, you blindly support the liberals, who took over Washington from the moderates.

That’s why you’re the political hack.

peak, you were talking about walker and his policies which were supposed to improve wisconsin. you use a double standard when talking about obama. you need to own up when you are confronted with your hypocrisy. unless you are a political hack, in which case you will simply pivot to a different argument.

Baffling, if you hate America so much, why don’t you move to France? I’m sure, you can get a bureaucratic job easily. I know, you wouldn’t mind living in a small house and drive a small car to “work.” Or, not even mind the time and inconvenience taking public transportation. Of course, riding a bicycle would be healthier and within your budget, after paying the high prices for your goods & services, high taxes, high energy prices, etc., which you wouldn’t mind, because it’s all for the public good, along with your two-hour lunch. Socialized medicine is waiting for you. And, with so much leisure time, you can write a manifesto.

peak, i love my country. which is why i am critical of selfish cranks like you. for instance, you rail against socialized medicine. but you are very willing to enjoy medicare, which is socialized medicine. in your view, socialized programs that benefit you are fine. but when they benefit those OTHER people, they are a waste. you are a hypocrite and a hack.

Hi Menzie

Can we get some blog posts on the conservative economic miracle occurring in Illinois?