As oil prices start heading up, the usual questions arise regarding the macro implications. One view is that with the revolution in tight oil production, the US will experience less of a negative impact than before. This conclusion relies on a set of assumptions, possibly including the US being substantially less dependent on oil imports. Is this true?

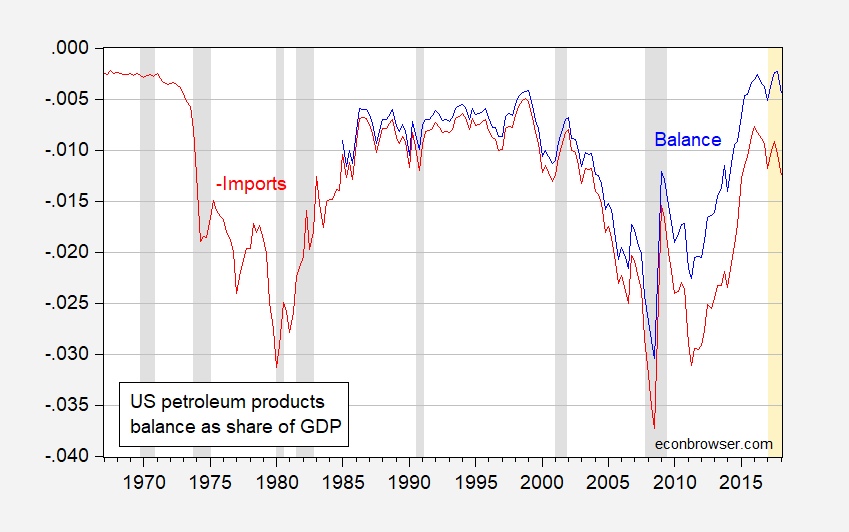

Figure 1: US petroleum trade balance (blue), and negative of US petroleum imports (red). NBER defined recession dates shaded gray. Source: BEA, 2018Q1 advance release, NBER, author’s calculations.

Notice that the petroleum trade balance (as a share of GDP) is roughly the same as it was in 1999, and in 2017Q1. If the price of oil should increase, then in the short term this would result in a larger nominal oil deficit. Over the longer term, higher oil prices would spur domestic production while reducing domestic consumption, tending to accelerate the US move to a net oil exporter (in real terms at least); see EIA’s Annual Energy Outlook, 2018 (Feb. 2018).

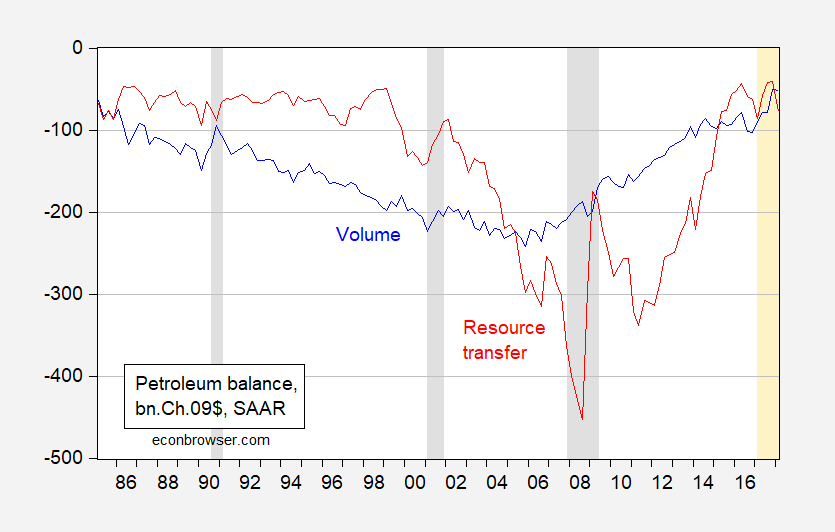

The nominal petroleum products balance conflates quantity and price changes. In some ways, we want to know what is happening to the volume of the balance. In chained quantities of petroleum products, the real petroleum deficit is shrinking.

Figure 2: Volume measure of petroleum trade balance (blue), real value of petroleum trade balance in Ch.2009$ of GDP. NBER defined recession dates shaded gray. Source: BEA 2018Q1 advance release, NBER, and author’s calculations.

In terms of what resources are being transferred via a petroleum trade deficit, the series is increasing as oil prices rise. That is because the petroleum products balance remains in deficit. Further notice that because the US exports a good deal of refined petroleum products, while importing primarily crude, then petroleum terms of trade (price of petroleum exports to petroleum imports) is not constant; rather it tends to rise as crude prices rise.

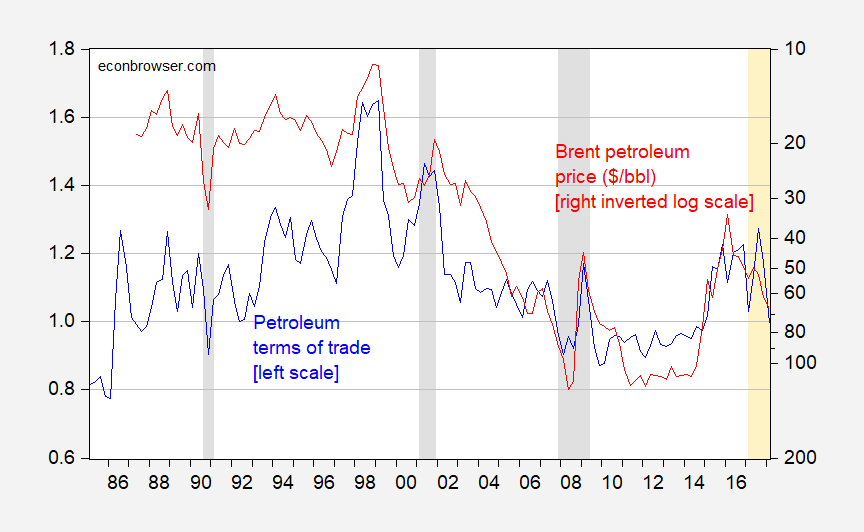

Figure 3: Price deflator for petroleum exports divided by price deflator of petroleum imports (blue, left scale), price of Brent crude oil (red, right inverted log scale). Source: BEA 2018Q1 advance release, US EIA via FRED, NBER, and author’s calculations.

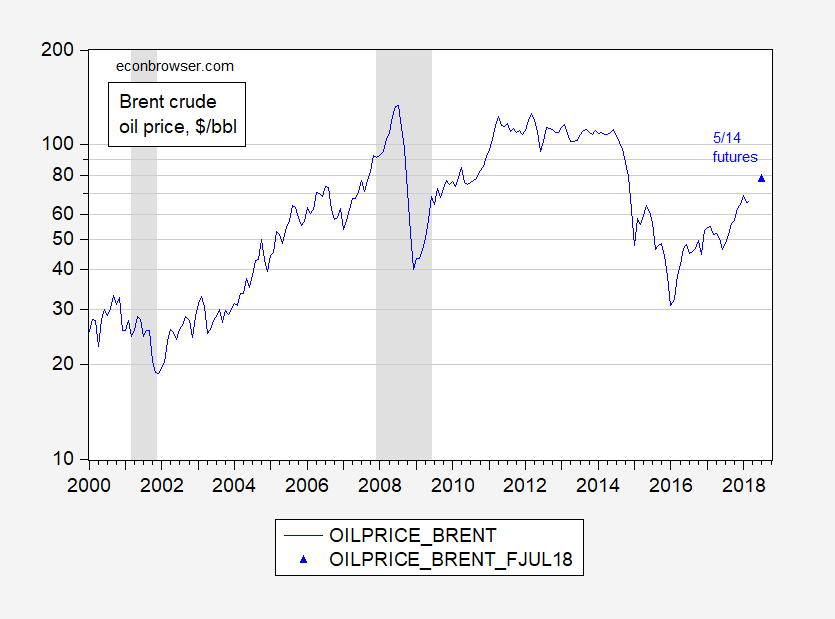

Hence, should oil prices rise substantially, the initial impact will to be to effectuate a transfer to the rest-of-the-world. Crude oil futures for Brent are already rising in the wake of MidEast political tensions, so one should expect some short term deterioration in the balance.

Figure 4: Brent crude oil price, $/bbl (blue, on log scale). Observation for July is futures as of 5/14. NBER defined recession dates shaded gray. Source: FRED, INO.

In general, it’s still likely true that with the US being a larger producer than in the past, the boost to domestic producers and ancillary suppliers will likely mitigate the negative effect from the transfer, and hit to consumer budgets, as noted by Jim in his analysis of the modest boost from the 2014 collapse in oil prices. (A sharp boost in oil prices is, as Jim notes, a different matter).

U.S. and Canadian oil producers face a singular problem: pipeline capacity. As long as political opposition to building pipelines continues, North American producers will be limited and OPEC will have leverage over world prices while U.S. and Canadian producers will get the shaft. Anti-pipeline protests have throttled the market for North American producers. While such protests are based on supposedly noble intentions, the economic harm to the U.S. is real.

https://www.forbes.com/sites/judeclemente/2018/04/19/the-permian-basin-needs-more-oil-and-natural-gas-pipelines/#47b5c1f4aa5a

Since April 2016, Permian oil production has increased around 55%, especially impressive in the low price environment. But the boom has been creating bottlenecks because the pipelines are being filled more quickly than expected. And refinery maintenance and the delay of Energy Transfer Partners’ Permian Express pipeline expansion have restricted flows out of the region. At some point over the next few months, the Permian’s production of 3.1 million b/d will collide with its takeaway capacity of 3.2 million b/d, which could depress local prices even more and make the region the “worst oil and gas market in the country.”

I think this is mostly a transient problem, Bruce. Producing is rising incredibly fast in the Permian. Indeed, the Permian is serving almost the entirety of global demand growth by itself. They will build more pipelines there.

Quite right. Yes – it would require some new investment which is good for aggregate demand growth. I think this was Dr. Hamilton’s point.

Bruce Hall I’m not seeing the problem here. The Permian oil field is in west Texas and expanded pipeline capacity is already in the works:

https://www.chron.com/business/energy/article/Apache-Noble-sign-on-for-EPIC-Permian-oil-12907134.php

I also don’t understand your implication that Canadian oil producers are facing pipeline capacity issues. According to the Canadian government statistics, the only oil pipeline facing any capacity constraint is the TransCanada Keystone line, but capacity utilization of that pipeline has been volatile (see the utilization graph):

https://www.neb-one.gc.ca/nrg/ntgrtd/pplnprtl/pplnprfls/index-eng.html

You also mentioned pipeline constraints regarding natural gas. Again, FRED data doesn’t show any special reason for concern. The numbers for May 2018 look to be running at only 86.5%.

https://fred.stlouisfed.org/series/CAPUTLG2212S

Like a lot of Forbes articles, you have to stay alert for special pleading.

Gas pipelines are an issue regionally, Slugs. There’s a pretty decent amount of resistance towards building new capacity in the Northeast; indeed, locally here in central Jersey. As a consequence, our power prices are higher than they would be if Marcellus gas could easily flow east to load centers.

@ 2slugbaits

Maybe this is what Bruce Hall meant by “pipeline capacity issues”??

https://www.smithsonianmag.com/smart-news/keystone-pipeline-leak-was-twice-big-previously-thought-180968722/

Oh well, it’s only good quality Midwestern farmland. Nothing to worry about in the new “MAGA” era. We’ll find a way to blame this on Democrats if any Republicans ever decide they want turn off FOX to read anything more complex than Beetle Bailey.

After all, in the new “MAGA” era, good quality Midwestern farmland is nearly as useless as an independent Justice Department is to Republican committee heads. “USELESS”

I should add, it was “only” upwards of 210,000 gallons of oil spilled on the South Dakota farmland. So if you filled your tank with 10 gallons each time at the gas station, it would only take 21,000 trips to the station to match that. I think TransCanada said the clean up is easy, you just put a couple Bounty paper towels on top and wait 2 weeks and then you can grow any crop there you like. We may have to double-check with “Princeton” Kopits to see if that’s right, because I know “Princeton” Kopits is a straight shooter. Next to Paul Manafort and Michael Cohen, there’s no one I trust more than “Princeton” Kopits.

https://www.nytimes.com/2017/11/16/us/keystone-pipeline-leaks-south-dakota.html

M,

Yes, 5,000 barrels of oil did leak. That’s from approximately 25,000,000 barrels of oil transported each month. The alternative is rail transport (rail car restricted) or truck (more dangerous and expensive). What is your brilliant alternative? Double-hulled tanker ships down the Mississippi?

Transitioning from fossil fuels such as oil to renewables would solve the problem. and it is doable. except for those wacky protestors.

baffling,

Sure, and unicorns fart cherries. Transitioning from fossil fuels such as oil to renewables would solve the problem. and it is doable. except for those wacky protestors.

The fact is that wind and solar have an upper limit of replacement for fossil fuels, simply because they are unreliable and require expensive backup power generation systems (read: fossil fuels). https://www.neon-energie.de/Hirth-2013-Market-Value-Renewables-Solar-Wind-Power-Variability-Price.pdf (may load slowly) .

In Europe, the share of electricity coming from wind and solar was 53 percent in Denmark, 26 percent in Germany, and 23 percent in California. Denmark and Germany have the first and second most expensive electricity in Europe.

• https://1-stromvergleich.com/electricity-prices-europe/

This despite the dramatic drop in the price of solar panels and wind turbines. Why? Read the previous paragraph.

The fact is that despite increased efficiency of vehicles, oil demand is growing. That might have something to do with the number of people and their need for transportation. The U.S. is not the largest consumer of petroleum on a per capita basis: https://www.indexmundi.com/map/?v=91000 . Of course, because of the size of the U.S. economy, it is still the largest consumer of petroleum, but that has leveled off: https://www.weforum.org/agenda/2015/07/the-surprising-decline-in-us-petroleum-consumption/ . But demand is growing throughout Asia and that means without U.S. sources of petroleum, the price of oil could cripple economies… think 1980.

bruce, you really have presented no argument against the transition from oil to renewables. first, oil in the form of gasoline will become an extinct species as we transition to electric vehicles. electric vehicles come equipped with their own power storage system, overcoming your “unreliable” and “expensive” argument. even the major auto firms have acknowledged this and are moving away from oil based systems.

in addition, your argument on “unreliable” and “expensive” is certainly not supported by reality. those issues are being solved almost daily. you really do need to read up on the latest in energy storage and smart grid technology. even in the fossil fuel capital of the us, texas, the renewables are game changing the electricity system. as governor, rick perry even subsidized the construction of high power transmission lines to bring renewables online faster and more efficiently.

but most importantly, my original comment was directed towards oil specifically. it will be the first to be replaced. coal and gas are coming, but further down the line.

“But demand is growing throughout Asia and that …” with respect to oil.

and that is why the major asian economies, such as china, are researching and producing electric vehicles. major cities like beijing understand that oil (and coal and other fossil fuels) are very damaging to the public health of their city. you are confusing current demand for oil with long term demand for oil. the demand is for energy rather than oil specifically. the asian countries will switch to cleaner energy versions much faster than you realize. china is investing in electric vehicles, not gas powered vehicles. you think that research and investment is going to go to waste? foolish.

baffling,

If the demand is for energy rather than oil specifically, then the cheapest alternative is natural gas which is abundant and for which there is a significant infrastructure for distribution. It is relatively easily tapped locally around the world (locally meaning within a nation), and automobiles, HVAC systems, cooking systems, and power generation all use it for a fuel. So, why isn’t NG being pursued rather than funky solar or wind energy?

“So, why isn’t NG being pursued rather than funky solar or wind energy?”

bruce, you are smart enough to at least ask the question. in the long run, industry and consumer both appreciate that fossil fuels are not a good long term answer. they are building up infrastructure in what they want the future to be-electric and renewables. you ask the proper question, you just do not want to accept the future is electric and renewables. but you are at least making progress with a proper question. kudos.

The New York Fed also did an insightful analysis on the issue coming to a similar conclusion: “Going forward, the changes in domestic production and consumption have significantly moderated the impact of oil prices on the petroleum trade deficit. That is, changes in oil prices are increasingly redirecting income between domestic consumers and producers rather than between U.S. consumers and foreign oil producers. ”

http://libertystreeteconomics.newyorkfed.org/2018/05/recycling-oil-revenue.html

That is, New Jersey and Connecticut get crushed.

But we New York City residents take the subway!!!

Reminds of that old Texas bumper sticker: “Let Them Freeze In The Dark”. I think that was when folks in the NE were protesting a new oil refinery or something.

dilbert,

Seems we got plenty of refining now! US (net) exports distilled product……….. we could see idle refining if prices/crude supply dictate.

https://www.eia.gov/petroleum/supply/weekly/pdf/highlights.pdf

See net imports is negative indicating US exports refined product. What would a supply price increase do to US product exports? Would US slow crude production as product prices lower export demand?

The EIA “balance sheet”, for more research:

https://www.eia.gov/petroleum/supply/weekly/pdf/table1.pdf

If the price of crude goes high enough the trucks can carry crude rather than build a pipeline or railroad (although military’s did that quite a lot in WW II)

http://www.prienga.com/blog/2018/5/14/oil-consumption-as-a-percent-of-world-gdp

And John is writing what we are all thinking.

https://www.reuters.com/article/oil-prices-kemp/column-rising-oil-prices-boost-us-economy-kemp-idUSL5N1SM6YS

“When oil is cheap and oil spend is less than 2.5% of world GDP, the global economy tends to grow at a solid pace. When oil consumption exceeds 4.5% of global GDP, the world economy typically faces either recession or stagnation (in the 1970s, ‘stagflation’, after 2011, ‘secular stagnation’). ”

A 2% difference does all of that? Why not have offsetting changes in fiscal policy for the oil importers? 2% of GDP isn’t exactly busting the long-term budget if these swings are short lived.

At 2%, the consumer is spending 1/50th of their budget on oil.

At 5%, they are spending 1/20th of their budget on oil, and they will try to re-equilibrate that back to the 2% number to re-align marginal utilities across their consumption bundle. For oil importers, the stress with show up on the current account. This in turn requires either 1) taking on debt to support incumbent oil consumption levels, 2) reducing imports and consumption of oil, 3) exporting more to offset more pricey oil imports, or 4) increasing domestic oil production.

Note that in ‘fight’ mode, the initial impulse will be to take on debt, which could lead, for example, to a debt crisis. When the debt option is exhausted or discredited, the consumer shifts to ‘flight’ mode, with the next stop to reduce oil imports. However, because oil is an enabling commodity and a monopoly fuel for transportation, reducing oil imports is painful indeed and may result in lower levels of aggregate output. In some cases, an oil importer could export more of, say, services like tourism, principally through devaluation (which would also lower oil imports). Now, if you’ve exhausted your debt possibilities and can’t devalue, then you pretty much have to make the adjustment one for one on oil consumption. And that makes you Greece, where oil consumption collapsed by a third from 2007 to 2013.

Finally, if at all feasible, the best solution would be higher domestic production of oil — exactly the US solution, but not much available elsewhere, in large part due to the dead hand of the state on the oil sector.

So, yes, 2-3% (pp) incremental spend on oil imports is a material burden for most economies and will prompt them to reduce oil consumption and associated economic activities.

“At 2%, the consumer is spending 1/50th of their budget on oil.”

Wow – you passed preK arithmetic! Spare me. BTW if I pay more for oil, someone else has received an increase in economic rents. Try reading what Dr. Hamilton wrote as Menzie linked to it. Maybe I consume less but someone else consumes more. Net effect on world consumption – not so much. But higher oil prices in North Dakota will mean more investment demand there.

I used 1/50th, because that’s psychologically a small amount. 1/20th, that’s appreciable part of your budget. It will be in your top five expenses or so.

If you consume less oil, that means you’re driving less, you’re taking fewer vacations, fewer soccer lessons, unable to take a job with a longer commute. That’s a measure of stress in society.

And right now, that matters. Today, the average American is driving 19 days less than they did in 2005. To my mind, that is a lesser society. And worse, per capita VMT seems to be peaking out again right now. These are all signs of social pathology. Of course, there are some other explanations, but the plain vanilla read is pessimistic.

http://www.prienga.com/blog/2018/5/15/per-capita-vmt-is-peaking-outagain

steven, part of the reason we drive lesser miles is more and more people are living in more urban environments. more choices closer to home reduce the miles driven, not necessarily the amount of activity. there was a time, when i grew up in a small town, i put on over 20,000 miles a year. we had to drive 45 minutes to go to the mall-and we did it regularly. now i would never even consider driving such a distance. partly because i am in cities where 45 minutes might get me 20 miles instead of 60 miles. i now drive under 10,000 miles a year, (probably under 8k), but spend more and have more activities. the miles driven parameter is probably rather misleading over longer periods of time.

Baffs –

Urbanization is not a compelling argument, because vmt per capita was recovering nicely into November. It could be related to the ‘Amazon effect’, that people are not shopping as much in person. That’s plainly visible at retail shopping locations.

I think, though, demographics are most likely. People drive much less if they don’t have a job. And if they don’t have children.

steven, miles travelled per capita peaked in the early 2000’s. we have reached a steady state of urbanization of around 80%. it may be hard to move that much higher. but look at most urban environments. over the past 20 years, many of those (larger) urban centers have continued to grow. the resulting infrastructure has really not kept up with that demand. it is much harder to drive 20 miles in la or chicago today than it was 20 years ago. it certainly has an impact on miles driven per capita. and it probably won’t get any better soon. but you are also correct, demographics are an issue as well. millennial and similar cohorts do not drive as much. and boomers are aging and probably driving less as a result. you saw a recent uptick, but probably due to us moving out of the depths of the financial crisis. not sure if that trend would have continued. we are well below the historical predicted growth from the 60’s-90’s, and probably never will recover. we probably fly rather than drive on long vacations as well-that could represent a couple thousand miles a year.

Baffs, driving per capita peaked in 2005 with the oil supply. See the graph: http://www.prienga.com/blog/

The number of departing aircraft in the US also peaked in 2005 and has never recovered. I’ll dig up the latest numbers at some point.

steven, perhaps its anecdotal. but prior to the financial crisis, i used to fly half filled airplanes. it was grand. i could sprawl across empty seats in comfort. since then? never really had an empty seat next to me. so number of departures is probably a bad metric. airlines simply reduced flights and upped the number of fliers. total domestic miles flown originally peaked abound 2007. last year, we had over 100 million more miles flown than that peak (https://www.transtats.bts.gov/Data_Elements.aspx?Data=3)

as for driving peaking with oil in 2005, true. but we have since reloaded with a lot of oil, and cheap, until very recently. and yet we are not really even close to that peak miles driven (even with more output i believe). there is definitely a change in user behavior occurring.

“Today, the average American is driving 19 days less than they did in 2005. To my mind, that is a lesser society.”

I gave up my car entirely 10 years ago and do not miss. Biking to work or taking the subway is not making my life lesser.

“rising prices are transferring income from net consuming states such as California, Florida, New York and Illinois to net producing states including Texas, Oklahoma, New Mexico and North Dakota.

Rising prices are also transferring income from households, motorists, the transportation sector, manufacturers and retailers to the oil industry and its supply chain.”

Tax Texas etc. and use the funds in invest in the transportation infrastructure of NY and Cali!

Pgl, another meaningless and ignorant comment from someone claiming to be an economist: “Tax Texas etc. and use the funds in invest in the transportation infrastructure of NY and Cali!” Great idea, because those taxes won’t be passed back in higher prices to those “consuming” states. BTW, your solution should go for all the products provided by the net producing states. Moreover it would be best for consuming states to put excise taxes on those products, to localize the effects. Oh wait, that’s what happened with the Tax Reform Bill.

It’s that old takers vs producers argument only based upon consumption. Another example of what goes on in the liberal mind.

“It’s that old takers vs producers argument only based upon consumption.”

the takers of federal government welfare are mostly the red conservative states. they take in much more in federal support than they pay in federal taxes.

So, Steven, elsewhere you argued that the US would be a petroleum net exporter when the next oil pirce shock hits. It is not yet, although getting close. What then is the basis of your claim that the net exporter condition will be achieved prior to the next oil price shock?

My most popular recent comment:

You want line 46 tab4a of the STEO, “Total Petroleum and Other Liquids Net Imports”

https://www.eia.gov/outlooks/steo/

For 2018 E, net imports come in at 2.6 mbpd

2019 F is 1.5 mbpd by EIA

If we allow the US production will rise around 1 mbpd / year thereafter, by 2020 or 2021, the US should be a net exporter on current trends. Our oil shock forecast is set for 2021 at this point, but the range is still +/- two years on that, depending on contingent events.

If we are a net exporter, then higher oil prices means a transfer of income from the ROW to us. Put 2 + 2 together man!

That’s correct. But within the country, it means transfers from the coasts to the mid-continent.

For NJ and CT (and other coastal states) this is somewhat different from, say, 2008 or 2011-2014. The dollar will strengthen, not ease. So even as costs are rising fast, export unit revenues are likely to decline.

For Texas, consider: In 2011, Texas produced about 1.3 mbpd of oil. By 2020 or so, it will produce 5 mbpd of oil. The increment, call it 3.7 mbpd, at $110 / barrel, represents an additional $150 bn to the state. That’s about 1/3 the GDP of New Jersey. They are going to be building palaces down there.

This is why I’m advocating that we in New York stop subsidizing those Texans. I want an economic rent tax on their oil to pay for my subway repairs!

Steven Kopits,

I sold a house in Texas in early 1985. Riding the oil country run up as the economy grew out of the Shah deposed oil shock….. with “Reagan economy.

”

My neighbor did not get a price near mine for 6 or 7 years, and the S&L’s were harmed.

Pgl, “This is why I’m advocating that we in New York stop subsidizing those Texans. I want an economic rent tax on their oil to pay for my subway repairs!” If you are serious and not just being sarcastic, you are so far off base that it amazes those poor hinterland residents.

There are several kinds of revolts, wars, political, social, and your proposed economic. Winners usually have the greater supplies, and takers/consumers are not in this category. Winners enact borders, what would happen in your economic revolt?

For all of your negative comments and claims of ignorance to the conservatives here and else where, yours just trumped your own worst. Wow!

Back at the beginning of the 1980s with oil prices high, there was a reported “black tag people” problem in Texas, unemployed people from Michigan where the car license plates were black hanging out in their cars under bridges and wherever while trying to fins jobs and places to live. By 1986 when the Saudis crashed the price of oil out of disgust with Iran and Iraq both exceeding their OPEC oil production and export quotas to buy arms to fight with each other, this triggered the Savings and Loan crisis that emanated from Texas, eventually costing US taxpayers several hundred billion dollars. Yes, these interregional income transfers can be pretty severe when the price of oil moves sharply one way or the other.

Off topic, but eerily appropriate: https://www.washingtonpost.com/opinions/democrats-are-about-to-have-to-pay-up/2018/05/15/b7638b54-5877-11e8-858f-12becb4d6067_story.html?utm_term=.cd1c2941771a

“Democrats are about to have to pay up”

Well until the next debt crash and oil crashes. This rise is a illusion based out of the Saudi/Israeli alliance Trump represents.

Read pgl’s and baffling’s above comment to see why this article is eerily appropriate.

CoRev The problem is that even with the partial rebate the blue states got through the deductibility of federal taxes, the fact is that they still heavily subsidized red states. What this change in the tax law does is make the red states even bigger “takers” than they were before. Besides, since when did conservatives start praising the principle of taxing taxes???

2slugs, wow! Why did you not cite “real” tax data. Don’t you know that any decent economist would allow for demographic differences/changes?

corev, why do you support a tax on taxes? conservatives argued that capital gains taxes should be lower because they were already taxed. and yet in a very direct manner, we have a direct tax on a tax, which you support? so you like to use taxes to attack those who differ in political opinion. interesting. hypocritical to the nth degree.

Baffled, yep! Just like pgl wants to tax the producer states to support his convenience. The only hypocrites are the TDS sufferers claiming all sorts of foolish claims in hopes of diminishing current US administration progress. Why do you folks want to harm the US?