Today’s Bloomberg article notes that my one-time coauthor Peter Navarro has pushed to have countervailing duty (CVD) investigations augmented with assessments of currency unvervaluation. A prominent target of CVD investigations has been China.

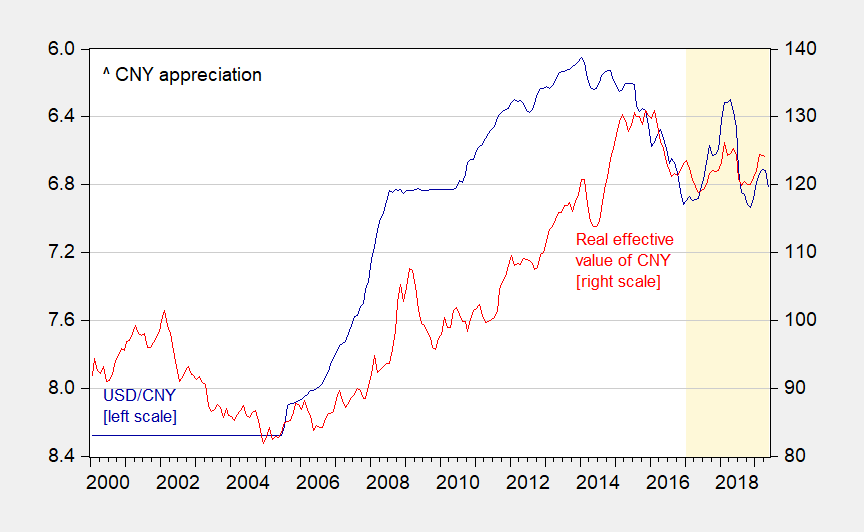

Figure 1: USD/CNY bilateral nominal exchange rate (blue, left inverted scale), and real trade weighted (broad) value of the CNY (red, right scale). May 2019 observation is for first 20 days. Light orange denotes Trump administration. Source: Federal Reserve via FRED, BIS.

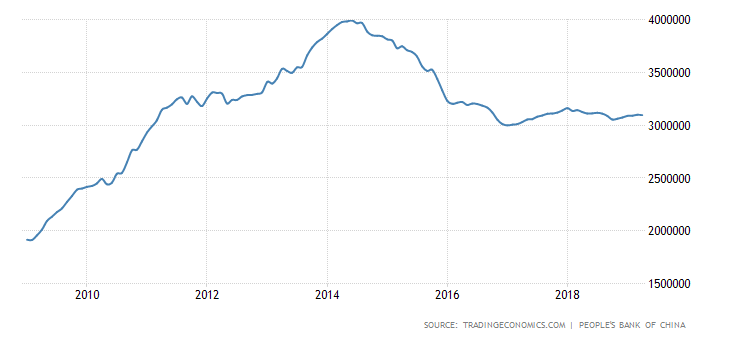

Figure 2: China foreign exchange reserves, in millions of USD, through April 2019 (blue). Source: TradingEconomics.com accessed 5/23.

While the value of the inflation-adjusted CNY in April was the same that it was the month Mr. Trump took office, this is not conclusive evidence either way on the undervaluation question. Foreign exchange reserves (official) are slightly above levels in January 2017 — but far below levels in early 2014 near $4 trn. (See Brad Setser for more.)

Hence, it might be useful to recount the various ways in which different observers define currency “misalignment”. Here I update a primer first posted in 2010 (note that the Treasury’s approach — as discussed most recently in its October 2018 report — incorporates aspects of several approaches).

Currency misalignment can be determined on the basis of the following criteria or models:

- Relative purchasing power parity (PPP)

- Absolute purchasing power parity

- The “Penn Effect”

- The behavioral equilibrium exchange rate (BEER) approach

- The macroeconomic balance effect

- The basic flows approach

- An equilibrium approach

I have discussed several of these approaches in the past [0] [1], but a review of the approaches bear repeating, if only because there so much confusion regarding what constitutes currency misalignment.

Relative PPP

Relative PPP can be expressed as:

s = μ + p – p*

where lowercase letters denote log values, s is the price of foreign currency, p is the price index, and * denotes a foreign variable, and μ is a constant arising from the fact that p and p* are indices.

Using this criteria, a currency is misaligned if s deviates from the μ + p – p*. One difficulty is that μ has to be estimated. Typically, estimates of μ can vary drastically with sample period. Oftentimes, there is a time trend in q ( which equals s – μ – p + p*), which means that relative PPP cannot literally hold. Then, one might have to allow for a (ad hoc) time trend, which itself has to be estimated. In Chinn (Emerging Markets Review, 2000), I apply this approach to the East Asian currencies, pre-crisis.

In the case of China, presented below is the (log) trade weighted real effective exchange rate of China, (q), using the latest data spliced to an older series incorporating the swap rates pre-1994 per discussion in Chinn, Dooley, Shrestha (JIMF, 1999). Upwards denotes depreciation.

Using a simple linear trend, one obtains the counter-intuitive result that the RMB is overvalued. This suggests caution.

For more on effective exchange rates, see this survey paper (Open Econs. Review, 2015).

Absolute PPP

Given the drawback of relative PPP, it seems like one could get around the problem of estimating μ by using actual prices of identical bundles of goods across countries, rather than price indices.

s = p – p* or equivalently p = s + p*

where lowercase letters denote log values, s is the price of foreign currency, p is the price level, and * denotes a foreign variable.

The problem is that prices of identical bundles of goods are not collected. One thing that comes close is the Big Mac — hence the MacParity measure. But the problem is that prices of Big Macs (when expressed in a common currency) are systematically lower in lower income countries, and systematically higher in higher income countries. This is true when using Big Mac prices [2] [latest estimate] Parsley and Wei (2005) and when using the “price levels” in the Penn World Tables. This is so much a stylized fact that it is sometimes called “The Penn Effect”.

The Penn Effect

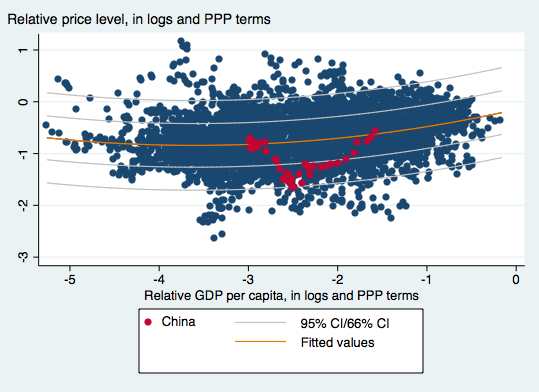

Instead of viewing the “Penn Effect” as a problem, one can exploit this stylized fact. Define r ≡ p – s – p*. Then one can exploit the relationship:

r = α 0 + α 1 (y-n)

Where y-n is log per capita income. In Cheung et al. (2008), we exploited this relationship (following Frankel (2005), in a panel regression setting. In that study, we found an approximate 40% RMB misalignment (in log terms).

In more recent work, we have adapted the analysis to incorporate nonlinearities (following Hassan, JIE 2016). In Cheung, Chinn and Nong (IF, 2017), we exploit the significant nonlinearity (a quadratic in per capita income) to find that as of the most recent data, China’s currency is not significantly undervalued, and plausibly is overvalued.

As of 2014, the Chinese currency was not undervalued; indeed it might have been overvalued.

Use of the GDP adjusted Big MacParity is a version of the Penn Effect, where the bundles are “Big Macs”. Using the Economist’s interactive tool, the CNY was 4% undervalued in January 2019, hardly a substantial misalignment (and well within the 50% confidence interval). It’s doubtful the situation has changed drastically given the US bilateral rate in May was close to that in January.

The Behavioral Equilibrium Exchange Rate (and related) Approach

Yet another approach is to use some theoretically and empirically motivated equations to estimate an exchange rate relationship. The variables can include productivity variables, or relative price of nontradables, or fiscal variables like the deficit, or interest differentials. Typically the variables can be motivated by some model of the exchange rate; which ones are included are motivated by goodness of fit. Goldman Sachs and JP Morgan had models of this sort. Zhang (China Economic Review, 2001) and Wang (2004) in Prasad (IMF, 2004) are some models in the public domain (see this 2007 Treasury occasional paper). Chinn (RIE, 2000) implements a specific type of BEER (or productivity based) model for East Asian exchange rates, while Ricci, Milesi-Ferretti and Lee (JMCB, 2013) examine a broader set of currencies. Chong, Jorda and Taylor (IER, 2012) look at long run income/exchange rate relationships (see this post).

A comprehensive set of estimates, updated regularly, is undertaken by Couharde et al. (EQCHANGE, described in this post).

The Macroeconomic Balance approach

The Macroeconomic Balance approach takes the perspective from saving and investment rates (see Peter Isard’s survey). Recall:

CA ≡ (T-G) + (S-I)

In other words, the current account is, by an accounting identity, equal to the budget balance and the private saving-investment gap. This is a tautology, unless one imposes some structure and causality. One can do this by taking the budget balance as exogenous (or use the cyclically adjusted budget balance), and then include the determinants of investment and saving. Then one obtains “norms” for the current account. Chinn and Prasad (JIE, 2003) is one example of this approach.

Then, using trade elasticities, one can back out the real exchange rate that would yield that current account. If that exchange rate is stronger than the actually observed exchange, then that currency would be considered “undervalued”.

Variations in this approach are numerous. One important question is whether to take official sector intervention as an exogenous (or somewhat exogenous) variable; doing so can yield a substantially different estimate of the normal current account balance, and hence equilibrium rate, as noted by Bayoumi, Gagnon and Saborowski (JIMF, 2015).

Starting in 2011, in a project I was somewhat involved in, the IMF began a process of revamping the approach. The External Balances Approach (EBA) emphasized desired policy factors such as social spending, and used annual data (see post here). The current formulation is embodied in the IMF’s External Sector Report.

The closely-related Fundamental Equilibrium Exchange Rate (FEER) determines the current account norm on a more judgmental basis (in other words, the current account norm is not estimated econometrically, just imposed per the analysts priors).

The Basic Balance approach

One could take a more ad hoc approach, asking what is the “normal” level of stable inflows — for instance looking at the sum of the current account and foreign direct investment, and see whether that value “made sense”. Or one could look at the sum of the current account and private capital inflows. If either of the flows are “too large”, then the currency would be considered undervalued (since a stronger currency would imply a smaller current account balance).

Note that a target value of zero for the current account or the basic balance is arbitrary, and does not in itself make sense. It behooves the serious analyst to remember this when considering, for instance, the Coalition for Prosperous America’s study.

It is interesting to make two observations. First, note the need for many non-model based judgments. To see this point, recall the balance of payments accounting definition:

CA + KA + ORT ≡ 0

Where CA is current account, KA is private capital inflows, and ORT is official reserves transactions (+ is a reduction in forex reserves).

Saying CA + KA is too big is the same, then, as saying ORT is too small, i.e., reserves are rising “too fast”. Morris Goldstein and Nick Lardy are among the most prominent exponents of this approach (see e.g., this this small volume).

Alternatively, running surpluses that are “too large” for “too long” will lead to foreign exchange reserves that are “too large”. Obviously, a lot of judgment is necessary here.

Second, one aspect of this judgment is that it is conditional on the constellation of all other macro policies, including monetary, fiscal and regulatory, in place. If the CA+KA is adjudged to be “too large”, one could say the exchange rate is “too weak”, but one could say with equal validity that the fiscal policy is “insufficiently expansionary”.

A (newer) Equilibrium View

The final approach would be to step back and think in terms of “equilibrium” exchange rates. One might argue that the exchange rate is undervalued if, in the absence of central bank intervention, the exchange rate would be stronger. Of course, this means that whenever any central bank pegs an exchange rate, then the exchange rate is definitionally misaligned. I suspect when people use this particular definition, it is usually conjoined with some sort of threshold. One problem in my mind with operationalizing this definition is figuring out what that the right “threshold” is.

A more fundamental conception of what an “equilibrium” exchange rate is is laid out by my colleague Charles Engel. As noted in this post, the equilibrium exchange rate is the one that minimizes the distortion from sticky prices and other rigidities. That is not necessarily the exchange rate delivered by a free float, even in the absence of capital controls. Indeed, it might be best delivered by some type of monetary policy (see the paper).

This approach departs from the “equilibrium” approach embodied in the real models of the late Alan Stockman, as summarized here, in that those models assumed away nominal rigidities. With complete markets, the free floating exchange rate is almost irrelevant since the real rate will always adjust to the “right” levels.

Review and Summing Up

Two last observations. First, each of these approaches has advantages and disadvantages. PPP and variants are easy to implement, but are more akin to parity conditions, so it’s not clear over what horizon they apply to. The macroeconomic balance and FEER approaches are most appropriate to the medium term, and hence perhaps more relevant to policy questions. But they require more judgment on the parameters of the models. Moving to the basic balance approach, the time horizon is the shortest, and of perhaps most interest to policy analysts, and yet requires the greatest subjective judgment, since one needs to take a strong stand on what constitutes the appropriate values for critical variables. (There are also data considerations as well — the PPP criteria is most popular in part because of the limited data requirements.)

Second, in some ways, it’s not necessarily correct to think of these approaches as all inconsistent (in some instances they might be). Better to think that some approaches are more appropriate at one horizon versus another horizon. (This echoes Richard Cooper’s description of how elasticities, absorption and monetarist interpretations were all consistent over time, in thinking about the effects of devaluations.)

I summarize the typology of studies in this table (which is adapted from Cheung et al. (2006).

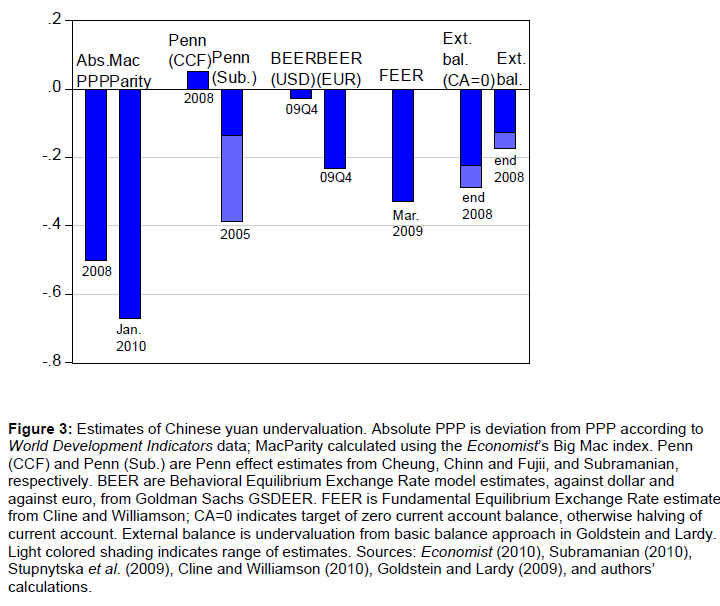

Given the variety of concepts, multiplied by the number of statistical methodologies, and data sources, it’s no wonder estimates of misalignment differ. Figure 3 from Cheung, Chinn and Fujii (in Evenett (ed.), US-Sino Currency Debate, 2010) highlights the wide variation in estimates in the latter part of the 2000’s.

For everything one wants to know about purchasing power parity and real exchange rates determination, see this recent survey.

“I summarize the typology of studies in this table (which is adapted from Cheung et al. (2006).”

This would be a good thing to do if one were trying to present this to the President. Word is that even on national security issues, his generals are limited to 3 Powerpoint slides. Anything beyond that he gets mad and storms out of the room.

“While the value of the inflation-adjusted CNY in April was the same that it was the month Mr. Trump took office, this is not conclusive evidence either way on the undervaluation question.”

Your graph also shows how much this exchange rate has appreciated since 2006.

Any of Professor Chinn’s students that are having a hard time understanding this?? I’m here to help you. Let me explain……..

It all gets down to the muh-puh-guhz. And if you don’t know muh-puh-guhz, well then….. I’m sorry….. but I can’t help you

https://youtu.be/ocIdLvlLFTs?t=61

Amateurs…..

Dear Menzie and Folks,

Let me suggest a simpler approach. Look at bank balances held by private individuals in both countries. Suppose there are no capital controls so that people can shift accounts from one currency to another only paying a standard transaction cost. Wouldn’t we have equilibrium if the series of shifts over some given period, like a quarter, is totally random and relatively small, so that daily shifts could be expressed as a martingale?

Julian

Julian Silk: I think what we know is that banking is hardly frictionless, even w/o capital controls, due to asymmetric information and (more recently) macropru regs. China definitely has capital controls, and political risk, hence…

As I suspect you at least partly agree with me, all of this is quite silly. We already know the Chinese Politburo operates from largely selfish and pragmatic methods. I think my last sentence is something both pro-trump and anti-trump could agree on. When we are in a period where capital flight is a legitimate risk to China, devaluation can only go so far where the capital flight becomes a huge problem for China. Therefor I don’t think China chooses that road. All this CVD talk is yet another ruse for Navarro (the great central planner that he is) to justify his job.

Menzie, is my memory serving me correctly that you like the IMF’s External Balances Approach as one of the better ways to do this, or do you even favor any of the approaches at this point (as your personal choice of best “go to” method on sniffing out “undervaluation”?? And if your answer is “depends on context”, can you just assume this very moment as you answer my question.

Moses Herzog: As someone who participated in the older CGER and the newer EBA, yes, I think it largely is an appropriate way to assess misalignments.

You know another question that randomly enters my mind reading Setser’s column. If you could short sell a basket of foreign currencies (or maybe more specifically an Asian basket of currencies) would now be the time to do it?? I guess that bet would depend on if a person believes China will go ahead and devalue the currency as a policy move or reaction against donald trump tariffs. The market moves so fast and I don’t keep track like I did when I was younger, hard to believe this isn’t already “baked in” to prices if the market believes China will devalue the RMB. But, again, as someone who doesn’t follow markets that closely, I would think there is STILL enough gray area there, that a significant amount of money could still be made on the short selling of those Asian currencies if China goes ahead and makes that move.

On the following:

‘Democratic lawmakers have also pushed for such changes to trade law to address currency concerns for years but never garnered enough support to pass legislation. In 2010 testimony to a congressional commission on dealing with China, Robert Lighthizer, now the U.S. trade representative, pushed for the same. “We should respond to China’s currency manipulation,’’ he said. ‘’The U.S. government should treat currency manipulation as a subsidy.”’

Note that since Lighthizer’s 2010 testimony, the China’s real exchange rate has appreciated by 20%. Maybe it was undervalued back then but is properly valued now. Of course the point I’m trying to make here will neither be understood by Team Trump nor matter to these protectionist clowns.

The last paragraph of the Bloomberg article:

“The yuan has weakened about 8% against the dollar over the past year as the U.S.-China trade was has taken off, offering Chinese exporters a cushion against Trump’s tariffs.”

Gee – Mundell’s writings some 60 years ago would have predicted this offsetting exchange rate movement. Quick – someone ask Lawrence Kudlow even if he knows who Robert Mundell was.

“that my one-time coauthor Peter Navarro”

Interesting.

He really should keep this “on the down-low” yeah?? This is the type professional background you pay David Pecker to do a “catch and kill” on.

Hope it goes without saying that’s friendly razzing Menzie. You know I’m the wannabe class clown.

2014 arguably has nothing to do with 2019.

Plot US CPI vs USDCNY in 2019.

zi zi: that’s why I include macparity jan 2019.

OK I did. What did I find? U.S. consumer prices rose by almost 8% over the past 5 years while a US$ buys 10% more in yuan. So as long as China’s inflation has been even slightly positive, the real yuan devalued. Which is what Menzie’s graph shows.

So Zi Zi’s point was ?????????????????????

I should have linked to a measure of Chinese consumer price inflation earlier. Better late than never:

https://www.ceicdata.com/en/indicator/china/consumer-price-index-cpi-growth

Note its inflation rate over the past 5 years has been similar to our inflation rate. Which is why Menzie’s chart shows the real exchange rate closely tracking the nominal exchange rate over this period.

Again – what was Zi Zi’s little point? Oh yea – he never said.

Two great articles. There’s no “real” paywall for Alphaville, All you have to do is register and it’s free. I would say it’s certainly in my top 5 blogs if you’re purely looking at more financial emphasis than economics, but it obviously has both:

https://ftalphaville.ft.com/2019/05/23/1558596623000/Why-China-doesn-t-want-to-breach-its-renminbi-red-line/

https://ftalphaville.ft.com/2019/05/24/1558684850000/Who-s-paying-for-the-US-China-trade-war-/

Hope everyone is having a great start to their weekend.

Did you guys read the NYT video story on Nancy Pelosi?? I think regular readers know I have a strong dislike for Pelosi, but altered video of that nature is below the belt and I hope they find out who started or originally created that video. I’m not sure if it’s a prison worthy crime, but I do think we have the right to know who planted that seed. When I criticize Pelosi I like to think it has some grounding on basis in fact.

In other good news, I got my public library to obtain a Modern Monetary Theory book on their shelves, it may be awhile before it’s physically on the shelves but I know they have ordered it. I tell you my local public library have been true angels in allowing me access to things I couldn’t otherwise afford and I would say 8 times out of 10 when I request an item they don’t have, they get it in a short period of weeks. Ashoka Mody’s book, others, and the list is endless. I have pretty much decided the 3 greatest inventions of mankind are (not necessarily in this order but probably) 1. Strong alcohol/liquor 2. Air-conditioning 3. Your local public library. Those are the greatest inventions of mankind, and I don’t care what any physicist says.

Check this video of Trump out talking about billions and trillions:

https://www.youtube.com/watch?

v=0pex6o6f3YE&fbclid=IwAR3RevQg4UjX2H6bkd2HnUPEHAl5svb90SdCdho552gPgnVA4t1ztzIPwRI

OK it was doctored. But the original was even worse. At least with this version, he sounds like Dr. Evil!

https://www.youtube.com/watch?v=-vohNUTTx3A

Trump is in Japan whining about our deficit with that country. OK, we have trade deficits ranging from $60 billion to $70 billion per year for a number of years. So let’s check the Real Broad Effective Exchange Rate for Japan

https://fred.stlouisfed.org/series/RBJPBIS

There was a considerable real devaluation of the yen after 2010. Of course Japan’s macroeconomic policy has relied more on easy money with fiscal austerity so one would expect this pattern.

The CIA’s World Factbook Is nice way to do cross national comparisons. Here is Germany whose net exports in 2017 represented 7.6% of GDP:

https://www.cia.gov/library/publications/the-world-factbook/geos/gm.html

Go to China – its net exports were only 2% of GDP in 2017. And yet Trump bashes China leaving Germany alone. How come? Oh yea – Merkel is a strong woman leader. Which means Trump is scared of her.

I’m not defending donald trump, but they’ve spent a decent amount of time bashing Germany too if you’ve been paying attention.

https://www.theguardian.com/us-news/video/2017/mar/17/donald-trump-angela-merkel-no-handshake-video

https://www.washingtonpost.com/world/2018/09/25/trump-accused-germany-becoming-totally-dependent-russian-energy-un-germans-just-smirked/?noredirect=on&utm_term=.3eda6cbcdf75

https://www.ft.com/content/31145e8a-717f-11e9-bbfb-5c68069fbd15

Germany acquiring a high percentage of its energy supply from Russia is a legitimate complaint, but there’s much better ways of handling the problem. On both sides. And if Russia ever invades another European country (and that’s not out of the question) Germany is going to regret more and more a very dumb policy, They get between 50% to 75% of gas imports from Russia. It might be wise to cut that down to around 25%.

https://www.bbc.com/news/business-44794688

This data is slightly dated, from around 2016, but according to this Germany gets about 35% of its crude oil from Russia. Again, if they could taper that down to say 19%, it would send Russia a clear message about Ukraine, and also set up less reliance if Europe was invaded.

https://www.bmwi.de/Redaktion/EN/Artikel/Energy/petroleum-oil-imports-and-crude-oil-productions-in-germany.html

Trump is mad that Germany buys oil from Russia? Guess what – we do too:

https://www.census.gov/foreign-trade/statistics/product/enduse/imports/c4621.html

(10000) Crude oil $2 billion in 2018

(10010) Fuel oil $6.7 billion in 2018

Trump as usual is an idiot.

“This data is slightly dated, from around 2016, but according to this Germany gets about 35% of its crude oil from Russia. Again, if they could taper that down to say 19%, it would send Russia a clear message about Ukraine”.

Gee – could this be because of geography. It is easy to pipe oil from Russia to Germany. Just as it is easy for us to buy oil from Canada. Now if Germany turned to another source it will cost them extra. And Russia would have no problem selling oil to Canada.

Oil is a commodity sold on global markets. The economics is rather easy even if Donald John Trump cannot understand this either.

pgl just plot US CPI vs USDCNY only in 2019, or only in 2018-2019. Don’t cover earlier period. The data’s behaviour changed around 2016, possibly due to the (expectation of) supply-side economics.

Could you write again what you found?

What Trump is doing is more of a currency war than a trade war. CNY is gaining credibility on the back of USD. Once the USD rate inversion deepens, CNY will be on the offensive. Their current work is to make sure Europe, Russia, Middle East would get to a point where they’re indifferent about holding USD or holding CNY. It was well strategised.

Zi Zi – I have no idea what you are babbling about and neither do you. Try this from what Menzie explained:

“Relative PPP can be expressed as:

s = μ + p – p*

where lowercase letters denote log values, s is the price of foreign currency, p is the price index, and * denotes a foreign variable, and μ is a constant arising from the fact that p and p* are indices.

Using this criteria, a currency is misaligned if s deviates from the μ + p – p*.”

Now read this several times and do something you never do – THINK!

Eyeball the curves and calculate. Note how they turn together.

Gee the real rate movement approximates the movement in nominal rates when inflation in both nations is both low and similar. What I’ve been saying. What are you saying? Oh right – you have no clue. Babble on!

Europe is not holding large CNY as of yet however there was large inflow of funds after currencies weakened post Brexit referendum in 2016.

European situation deteriorated after 2018, which may have reversed the inflow.

Thanks to Menzie for a good review of the various ways of measuring this controversial matter.

To Moses, the Politburo is not the top ruling body in the PRC. That would be the Standing Committee of the Politburo, a subset of the Politburo.

On the matter of Trump and Germany, while he has probably been louder and more unpleasant about China than Germany, he has complained about Germanny’s trade surpluses also. But part of the problem is that Germany’s exchange rate is based on the that of a group of countries in the eurozone, which complicates things greatly. As it is, Trump has been threatening the EU with auto tariffs, but has held off for now.

@ Barkley Junior

You’re an idiot if you think members of the Politburo don’t have some say on these issues. They are largely the ones who have a say in who ends up on the Standing Committee. There are different “factions” in the Politburo, and very few people pretend (like you do) to know how the leadership structure of China works. All most people know is that the longer a person is General Secretary the longer they have to put their own cronies in, and their own stamp on the Politburo and leaders of the provinces.

If you really wanna be a supreme d*ckhead about it Junior, which comes very natural to you, it’s Xi Jinping who makes all these decisions. That was clear when Xi’s writings/theory were held up alongside Mao’s and Xi’s leadership term was set to “indefinite”.

I’m here to give you a “news flash” Barkley Junior: Unless you go on summer vacation with China’s leaders to Beidaihe, you probably don’t know WTF China’s leadership structure is, because it can’t always (if ever) be drawn up on an official flowchart for leadership. But you couldn’t find that on your first Google search could you Junior??

But no one on this blog is impressed with you Junior. And the more someone like you feels the need to hover over the comments section on one person who has multiple times embarrassed you on your lack of verification of facts, including quoting research papers you apparently hadn’t/haven’t even read, the more you show yourself to be a rather pathetic individual. Not to mention how you supremely embarrassed yourself on your half-thread long lecture to me on all the ways you mistakenly thought I had gotten something wrong on a very simple reference to one of Professor Chinn’s co-authored papers. Should I be linking that comment up in every thread when you wet your adult pampers for the thousandth time?? Because you sure are making it tempting.

https://econbrowser.com/archives/2019/05/white-house-considers-economist-judy-shelton-for-fed-board#comment-224960

Junior, do us all a favor, and just try to make your own comments correct. Don’t you have some apologetics to do for James Madison’s racism or something??

By your silly argument then it is the CCP Central Committee that is the most important as it selects the 25 members of the Politburo, just as those select the 7 who are on the Standing Committee of the Politburo. I agree that Xi has amassed a massive amount of power unseen since Mao, but the Sitting Committee in Zhongnanhai of the past presidents who still have associates throughout the hierarchy remain not under Xi’s control, and there have been ongoing rumors of dissension in the upper ranks, with him actually worried about the opposition, despite his apparent total consolidation of power (no, I am not forecasting his removal from power any time soon). But, sorry, for the bottom line here, the Standing Committee is more powerful and important than the Politburo.

I know you have spent time there, Moses, and may have vacationed with big cheeses. But as it is, I have spent time there also and know a few people, and I have also published refereed journal articles on the Chinese economy, including with Chinese authors, as well as being coauthor of a highly respected comparative economics textbook whose China chapter has been highly praised and drew on a lot of serious sources not all recognized in the book.

And I have been studying China from many angles since before you were born, Moses, with high connections going way back. So, just to play my old name dropping game, my late mother knew Madame Chiang Kai-Shek, and many things deeply about China, although, of course, I recognize that is not all that useful for studying modern PRC politics. But, in any case, you are wrong on the main point. The Standing Committee is more important than the Politburo. Xi Jinping certainly understands that, even if you do not.

By your silly argument then it is the CCP Central Committee that is the most important as it selects the 25 members of the Politburo, just as those select the 7 who are on the Standing Committee of the Politburo. I agree that Xi has amassed a massive amount of power unseen since Mao, but the Sitting Committee in Zhongnanhai of the past presidents who still have associates throughout the hierarchy remain not under Xi’s control, and there have been ongoing rumors of dissension in the upper ranks, with him actually worried about the opposition, despite his apparent total consolidation of power (no, I am not forecasting his removal from power any time soon). But, sorry, for the bottom line here, the Standing Committee is more powerful and important than the Politburo.

I know you have spent time there, Moses, and may have vacationed with big cheeses. But as it is, I have spent time there also and know a few people, and I have also published refereed journal articles on the Chinese economy, including with Chinese authors, as well as being coauthor of a highly respected comparative economics textbook whose China chapter has been highly praised and drew on a lot of serious sources not all recognized in the book.

And I have been studying China from many angles since before you were born, Moses, with high connections going way back. So, just to play my old name dropping game, my late mother knew Madame Chiang Kai-Shek, and many things deeply about China, although, of course, I recognize that is not all that useful for studying modern PRC politics. But, in any case, you are wrong on the main point. The Standing Committee is more important than the Politburo. Xi Jinping certainly understands that, even if you do not.

BTW, Moses, once it was pointed out that I mistook whom you on the Shelton thread, I immediately agreed that I had. OTOH, you are still pretending that you are right about several matters you have been shown to be wildly wrong about. That is a major difference between us, Moses. I readily admit and agree when I have made a mistake. You sometimes do, but regularly do not, especially if I am the person pointing it out.

Off-topic Was reading some old NYT hardcopies strewn around the house. Thought this would make a great weekend read for some of Menzie’s regulars. I remember when I drove semi-truck (some years ago) many drivers put the confederate flag on the grill of their truck. This was one of the few things that would make me feel some small degree of shame when telling people I drove semi. I think Miss Clark has found a much more suitable use for that.

https://www.nytimes.com/2019/04/01/arts/design/confederate-flag-fabric-workshop-museum-sonya-clark.html

This article is about 8 weeks old. It’s still interesting in the totality of the data and the barometers that have been coming in recently. Also I believe that overall Japan has been a friend to the USA, a positive player in world events (obviously referencing recent history), and therefor we should care what is happening to them:

https://www.nytimes.com/2019/04/03/business/economy/japan-economy-china-abenomics.html

pgl I wasn’t trying to evaluate whether CNY was overvalued or undervalued because it’s largely set by PBOC. That’s why I talked about “US CPI vs USDCNY”.

Your formula is very well, now could you explain why CNY appreciated 10% in 2017 with your formula?

Zi Zi: Are you saying that because PBoC sets the nominal exchange rate, then the discussion of overvaluation/undervaluation is moot? That would be a transcendental and revolutionary insight for international economics.

I never thought evaluating whether CNY is overvalued or undervalued from real world point of value. I understand with your formula you can do general studies. But for CNY I’ll never even to pose a question like this.