One criticism of the use of the term spread model to forecast recession in current times is that this time is different. [1] [2] [3] In particular, due to quantitative easing, the term premium is lower than in past episodes. Hence, in this interpretation, an inverted yield curve no longer signals as much future depressed interest rates as in the past.

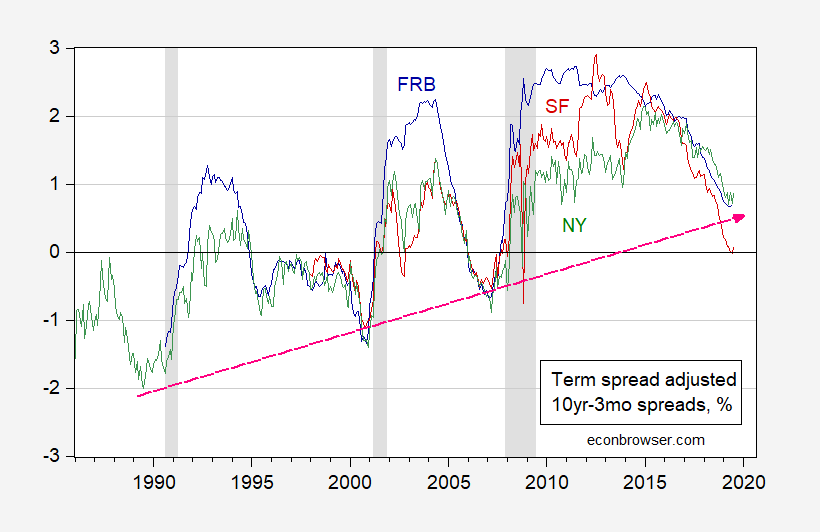

To see this, consider this decomposition. The long yield is the sum of two components: (i) EHTS, expectations hypothesis of the term structure, and (ii) tp, the term premium (Benzoni et al. (2018) further decompose the term premium.) The first component is the relevant one for predicting the business cycle. A long rate is the average of the expected short rates, so a EHTS component lower than the current short rate means expected rates are lower than the current rate. However, the EHTS component is not directly observable, so this is not a directly testable proposition.

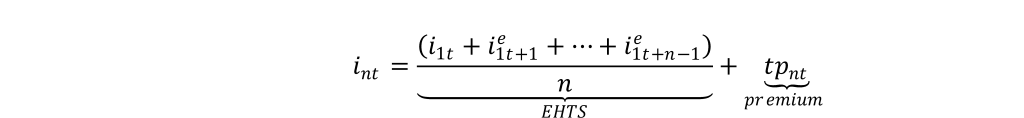

We can adjust the term spread by the term premium. There are several estimates of the term premium (we assume the 3 month is zero). The resulting 10yr-3mo adjusted spreads are depicted below.

Figure 1: Term premium 10yr-3mo spread adjusted by Kim-Wright estimated term premium, series THREEFYTP10 (dark blue), using SF Fed Christensen-Rudebusch estimated term premium (red), using NY Fed Adrian-Crump-Moench estimated term premium (green). NBER defined recession dates shaded gray. Source: NBER, Federal Reserve Board via FRED, SF Fed, NY Fed, and author’s calculations.

Take the spread estimated by subtracting off the NY Fed’s estimate of the term premium (this is the longest spanning series). Estimating a probit regression on the adjusted spread over the 1986-2019M08 period leads to a miniscule estimate of recession probability for July 2020 (2%).

Notice that the inversion of the adjusted spread that is associated with the subsequent recession becomes less and less pronounced over time (as shown by the pink dashed arrow). One can account for this effect by including a linear time trend. This leads to the following estimated regression:

Pr(recessiont+12) = -35.8 – 2.04(i10yrt – i3mot)+ 2.00(tpt) + 0.016time + ut+12

McFadden R2 = 0.43, NObs = 392. Bold denotes significant at 5% significance level. Figure 2 shows the relevant predicted probabilities.

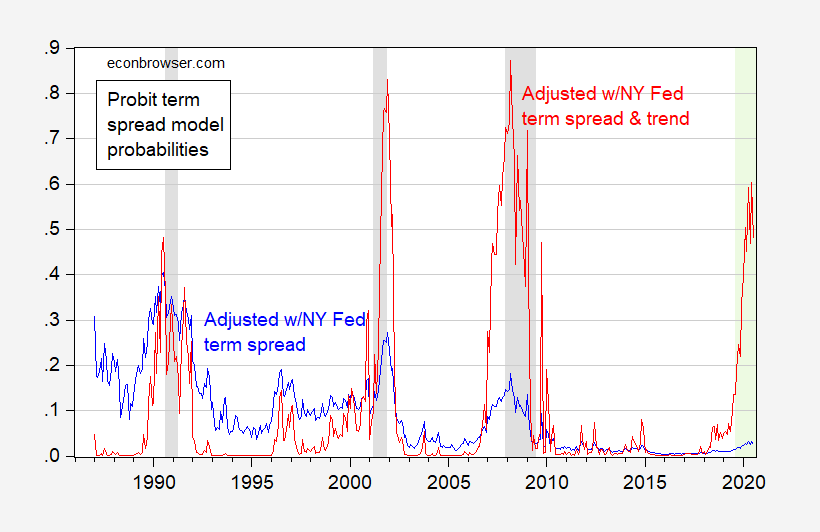

The estimated probability of recession from the NY Fed term premium adjusted spread is shown below in blue, while the estimated probability using the above specification (including trend) is in red.

Figure 2: Probability of recession using term premium adjusted 10yr-3mo spread (blue), and using term premium adjusted 10yr-3mo spread and time trend (red). NBER defined recession dates shaded gray. Light green shading denotes forecast period. Source: NBER, and author’s calculations.

The probability of recession in June/July 2020 would average 54% under this specification.

Note that if one uses the SF Fed estimate of the term premium, as noted in this post, the probability of recession in July 2020 is 20% (no time trend).

For more on unadjusted term spread based-estimates, see this post. The procedure is based on Chinn Kucko (2015).

https://www.politico.eu/article/how-bernie-sanders-and-cardi-b-became-2020s-oddest-alliance/

Off-topic yet again, Mose.

So, this Cardi B supported Bernie in 2016, but nobody gave a hoo. But now that he is desperate, suddenly the Bernie people are puffing up this old endorsement by a pop star he has managed not to lose. or has she become so much more popular in the last three years that her endorsement is now a really big deal worth putting here as an off topic comment?

What do think explains the positive time trend in the TP-adjusted curve?

MC, when I made the ‘this time is different’ comment a week or so ago, I had 2 issues: 1. the previous cycles had no positive Fed floor and I’m not sure how that works and 2. the current Fed floor is a virtual dam holding back commercial-bank lending of massive excess reserves.Nancy Marion and I have been fighting about this. She thinks the excess reserves are there for the long run as bank recapitalization. I think they are much less stable. As I also mentioned both Eric Sims and Monica Piazzesi have models set up that may handle the required simulation.

Bob,

Are you saying that that the Fed paying interest on excess reserves is “holding back commercial bank lending” of them to a significant degree? Do you support Jufy Shelton’s demand that the Fed stop paying interest on those excess reserves? Has it been a mistake to do so?

Thanks for the regression numbers Menzie. Bronx New York (I didn’t take the photo, just copy/paste from a reddit post)

https://i.redd.it/x9y8b0x9vsi31.jpg

When Bruce Krasting was still an active blogger, he used to put up a lot of this street graffiti images on his site. I disagreed with Bruce Krasting’s politics and his thoughts on inflation (he thought it would rise uncontrollably after QE under President Obama). But overall he was a great blogger. His best posts tended to be on either currency exchange movements, or, weirdly, weather forecasts and the consequences thereof. I halfway wonder if Bruce Krasting passed away, because he left blogging without so much as a sayonara to readers.