Surprisingly, that’s not a quote from Larry Kudlow on today’s news shows. Rather that is then Council of Economic Advisers Chairman Ed Lazear on May 8, 2008. Just to remind people, that is 5 months after the recession start determined by NBER.

Compare and contrast (Bloomberg):

“I don’t see a recession at all,” Kudlow said on “Fox News Sunday.” He added that there were no plans for additional fresh measures to boost the economy, and that the Trump administration would stay the course on its current agenda.

“Consumers are working. At higher wages. They are spending at a rapid pace. They’re actually saving also while they’re spending — that’s an ideal situation,” he said on NBC’s “Meet the Press.”

What did Ed Lazear see as of May 8, 2008?

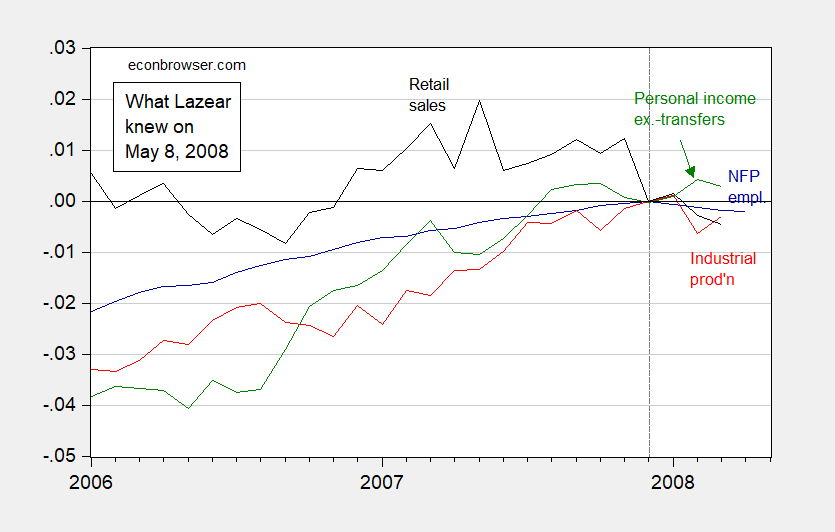

Figure 1: Nonfarm payroll employment (blue), industrial production (red), personal income excluding current transfers (green), retail sales (black), all in logs, normalized to 2007M12=0. Source: BLS, Federal Reserve Board, BEA via FRED, and author’s calculations.

These are, with the exception of retail sales, several key indicators followed by the NBER’s Business Cycle Dating Committee. (I could not obtain the relevant vintage of real manufacturing and trade sales, so plot real retail sales instead).

And what does Larry Kudlow (who is, by the way, National Economic Council chairman; CEA Chairman Tomas Philipson has not opined on television, but he has emailed an assessment) know (or should know)?

Figure 2: Nonfarm payroll employment (blue), industrial production (red), personal income excluding current transfers (green), manufacturing and trade sales (black), and monthly GDP (pink), all in logs, normalized to 2019M01=0. Source: BLS, Federal Reserve Board, BEA via FRED, Macroeconomic Advisers (25 July 2019), and author’s calculations.

Just as in May 2008, it’s not clear one way or the other, but outright dismissal was (as I discussed with other macroeconomists at the time) probably not a good idea.

Note that Mr. Kudlow was similarly dismissive back in December 2007, as noted by Chuck Todd on Meet the Press (Washington Examiner):

“This is what you wrote,” Todd said on Meet the Press. “‘There’s no recession coming.’ This is in December of [2007]. ‘The pessimistas were wrong. It’s not going to happen. The Bush boom is alive and well. It’s finishing up its sixth consecutive year with more to come.’ The more to come was a massive downturn. I admire your optimism, but the data is pointing in another direction.”

Looking Forward

In addition, Mr. Kudlow today stated:

There’s no recession on the horizon.

While Peter Navarro argued:

“Technically we didn’t have a yield curve inversion,” he said on “State of the Union.” “All we’ve had is a flat yield curve.”

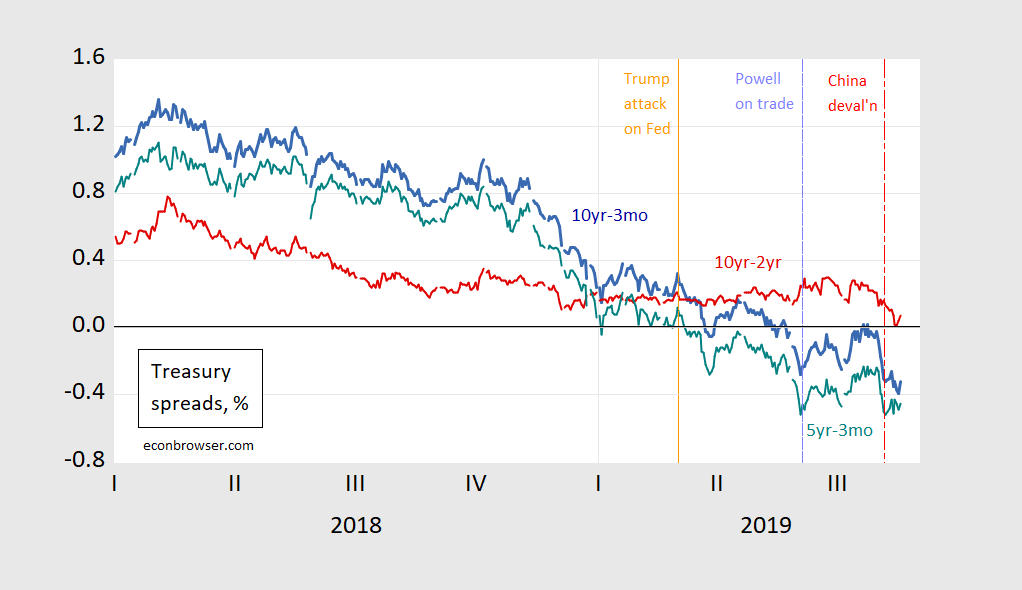

I beg to differ. That characterization may be true for the 10yr-2yr, but definitely not true for the 10yr-3mo, and 5yr-3mo identified by Cam Harvey as critical.

Figure 3: 10yr-3mo Treasury spread (blue), 10yr-2yr (red), 5yr-3mo (green), all in %. Source: FRED, Treasury, and author’s calculations.

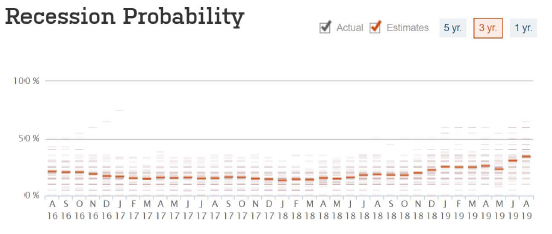

Prediction markets put 40% probability of recession by end of Trump’s term (as of 10:40am Pacific time), and Wall Street Journal August survey sets mean probability of recession in 2020 at 33.6%.

Source: Wall Street Journal.

Permit me to combine two previous comments –

Kudlow the Klown was on the TV this morning:

https://www.realclearpolitics.com/video/2019/08/18/larry_kudlow_no_recession_on_the_horizon_whats_wrong_with_a_little_optimism.html

“I don’t see a recession at all. Second of all, the Trump pro-growth program, which I believe has been succeeding lower tax rates, bid rollback of regulations, energy opening, trade reform, we’re going to stay with that. We believe that’s the heart of the free enterprise. We want an incentive-oriented supply-side economy, providing opportunities for everybody across the board.”

This was followed by a few lies and this nonsense:

“What’s wrong with a little optimism, Dana?”

First of all real fixed investment – both business and residential – have started declining. We never got that enormous increase in investment demand they promised to get that tax cut for the rich. Secondly, real net exports of goods and services have hit almost negative $980 billion per year. We were told that Trump’s trade policy would eliminate the trade deficit but it has risen substantially. But how good is Kudlow at economic forecasting?

http://money.com/money/5197470/trump-pick-kudlow-predictions/

“5 Times Trump’s Favorite Economic Advisor Has Been Spectacularly Wrong About the Economy”

Check out these classics which includes:

“There’s no recession coming. The pessimistas were wrong. It’s not going to happen. At a bare minimum, we are looking at Goldilocks 2.0. (And that’s a minimum). Goldilocks is alive and well. The Bush boom is alive and well. It’s finishing up its sixth consecutive year with more to come. Yes, it’s still the greatest story never told.”

When he said it: December 2007

What happened next: The global financial crisis, followed by the worst recession since the Great Depression.

You left out the statement Kudlow said which the GOP used as a sound bite: The Clinton surplus was the result of the Reagan tax cuts.

So Navarro lied about the yield curve. OK! But this from Kudlow is either a lie or just another one of his incredibly stupid statements:

They are spending at a rapid pace. They’re actually saving also while they’re spending — that’s an ideal situation,” he said on NBC’s “Meet the Press.”

Of course anyone who knows anything realizes that for any given level of disposable income, the more one consumes the less someone saves. And this contradiction was on full display when liars (or maybe idiots) pushed the Bush43 tax cuts. People like Mankiw kept saying we needed this tax cut to increase consumption while Glenn Hubbard said we needed to increase national savings. These two economists were contradicting each other even though both worked for the White House. And Kudlow the Klown agreed with both of them.

Is Kudlow a liar or just the Stupidest Man Alive?

BTW – I do get that when rich people get a massive tax cut, they have higher disposable income. Checking with FRED, it seems that nominal disposable income rose by about $1.25 trillion since the Dec. 2017 tax cut. Consumption has risen by only $0.4 trillion since the Dec. 2017 tax cut. So what Kudlow should have said if he had a brain and the least bit of integrity is that the rich are saving most of that tax cut. Alas Kudlow’s brain is less sharp than that of the scare crow in the Wizard of Oz and his integrity matches that of Kelly Anne Conway.

They’re actually saving also while they’re spending

I’m still trying to figure out how that’s possible.

It’s not but Republicans do this all the time. Spend that tax cut. Save that tax cut. New Shimmer is floor wax! No it is a dessert topping!

https://www.nbc.com/saturday-night-live/video/shimmer-floor-wax/n8625

Not as contradictory as it seems, although those advocating it are not usually seeing it all the way through. Just the flip side of the Paradox of Thrift. If by spending more people make the economy grow sufficiently with incomes rising sufficiently, savings in the aggregate might rise, even as the savings rate might be lower.

Yes – if more consumption could get us out of a deep recession we would end up with the Paradox of Thrift. But this is not 1930 or even 2009. Besides last I check Kudlow declared himself to be a supply-sider not a Keynesian.

So his comment today is still wrong within the context of whatever excuse this Klown has for a model and especially in the context of an economy near full employment.

If you’re talking in levels, then that could be true. But normally when we talk about changes in consumption and saving we usually mean it in terms of relative percentages of disposable income. In any event, BEA Table 5.1 shows that household and institutional saving (in levels) actually fell by $49B in 2019Q2, so Kudlow’s claim was simply untrue no matter how you figure things.

Yes but Kudlow has the marvelous habit of just making things up as he goes. He learned that from Stephen Moore and it is why Trump keeps him on.

There is so much dishonesty in the Kudlow interview. Where to begin? The FED bashing maybe. Or this:

“Consumers are working. At higher wages.”

The Employment Cost Index rose by 6.95% from 2016QIV to 2019QII but that is a nominal increase. The consumer price deflator over this same period rose by 4.48%. So real compensation has grown at a mere 1% per year. Kudlow wants us to think real wages are soaring but then again Kudlow’s job is to lie for Donald Trump.

What is a supply-side economy? Making stuff nobody wants?

In Kudlow’s case, making more cocaine. As I watched that interview, it struck me he was back on it.

Now there is a technical version which goes like this – reduce national savings with tax cuts that people consume (they are not exactly slashing government purchases – yet) and some how magically raise investment demand. It is junk science at best and sheer dishonesty more likely.

More Navarro lies:

https://www.axios.com/peter-navarro-trump-china-tariffs-consumers-842fa6f2-b903-4b96-b6db-281c3b432810.html

‘White House trade adviser Peter Navarro said on CNN’s “State of the Union” Sunday that tariffs on Chinese goods are not hurting consumers in the United States, despite reports to the contrary from researchers at Harvard, the University of Chicago, the International Monetary Fund, the Federal Reserve of Boston and more.’

Here is the key part of the interview:

JAKE TAPPER: “You and the administration keep saying the entire burden of these tariffs and this trade war is being bore by China. A study from researchers at Harvard, the University of Chicago, the IMF and the Federal Reserve of Boston in May found that U.S. importers are shouldering about 95% of the price change from tariffs, and China is shouldering only 5%. Are you saying their research is wrong?”

NAVARRO: “You put on 10% tariffs on $200 billion. And China devalues its currency by 12%. Are consumers bearing anything on that? No. We have seen absolutely no evidence in the price data. It’s not showing up in the consumer price index.”

I guess Navarro is unaware of that 25% tariff which did raise prices to consumers. And if he is so confident that the additional 10% would not be passed onto consumers, why did they suspend until for the Christmas shopping season.

There’s lot of interesting chains of thoughts, or branches of thought on this you could go down—that even an overly-prolific blog commenter like me does not have the energy to go down the laundry list. But that was a “big tell”. They really ratted themselves out on the timing phases (or whatever you wanna label it, "tiers") of the tariffs. Especially of the electronics tariffs. People get really cranky and b*tchy when they don't get their electronics and tech toys. So who gunned for the "p*ssying out" on the full tariffs?? We can guess who in the WH staff gunned for the slower phasing of tariffs—but we all know donald trump had the final sign off. Which shows, as dumb as donald trump is, he is smarter than he lets on. donald trump knows this will effect consumers, which Menzie knows trump knows, and I know trump knows—which is why we both knew (and confidently predicted weeks before) trump was NEVER going to put on the FULL tariffs on September 1. Orange Excrement is easier to read than a book if anyone can actually read a respected newspaper.

I’m not as confident predicting his move on tariffs in December yet, but I will say this much—it will not surprise me if he backs off again in December. That’s NOT a prediction on December, only saying I won’t be surprised if that indeed happens—that the “VSG” backs off AGAIN.

I don’t want to start referring to him in terms of godly deference. No Gundlach is not the local chapter leader of my Nxivm weekend meet-up group. The man has gotten some calls wrong before, but Jeffrey Gundlach is one of the sharper guys out there. He’s one of the few white dudes I would put up against Menzie in a mathematics contest. Not to mention the fact he specializes in bonds and bonds guys are usually much better at calling markets than equities guys are.

https://finance.yahoo.com/news/doubleline-ceo-jeffrey-gundlach-warns-234924365.html

Jeffrey Gundlach, chief executive of DoubleLine Capital, warned on Wednesday that rate cuts by the U.S. Federal Reserve were not going to stop a recession from happening and that “once the Fed is in easing mode, it is already too late.”

Is this Gundlach explaining the 1988 recession? Oh wait – that one never happened.

A lot of people thought Black Monday (October 19, 1987) would usher in a recession but note the section on the Federal Reserve response:

https://www.federalreservehistory.org/essays/stock_market_crash_of_1987

If Jeffrey Gundlach does not know this – time to sell DoubleLine Capital short.

The 1987 crash caused the Fed to abort a tightening move that was already underway.

Portland’s Andy Ngo Is the Most Dangerous Grifter in America

https://www.jacobinmag.com/2019/08/andy-ngo-right-wing-antifa-protest-portland-bigotry?fbclid=IwAR1eVzcuKlzp9qltbFO6kUHDrRXGkk9GwMYoLBbFYYt4sZ2Dv0XgET0pmCk

The back story on Proud Boys excuse for trying to start a race war in Portland. Donald Trump and his right wing minions want us to believe there is some liberal domestic terrorism plot. The truth is that the domestic terrorists are Trump’s Brown Shirts.

Huh – I recall some spin from Bruce Hall about liberal domestic terrorism. I wonder how he looks in his little Brown Shirt.

Here are some suggestions on what to do when the Stupid White Boys march that I sent to my daughter in Portland:

Nude bike ride

https://sf.funcheap.com/brides-march-wedding-dress-pub-crawl-union-square/

In San Francisco it’s a Valentines Day pillow fight.

Fancy Clown Parade

No Pants Day on public transit

I am sure Portland Weird can think of many other wonderful ideas

The wedding dress pub crawl is interesting as I suspect the “Proud Boys” are scared of girls.

And yes Ngo was beaten so here is a very balanced account of who he really is and how Antifa were fools for letting be beaten:

https://www.vox.com/policy-and-politics/2019/7/3/20677645/antifa-portland-andy-ngo-proud-boys

We’ve looked at these same numbers about 50,000 different ways, but it never hurts to have a different angle or different presentation:

https://www.bloomberg.com/graphics/2019-yield-curve-inversions/

BTW, I just found out I can check out very recent versions of BloombergBusinessweek magazine at my public library. I’m not certain but I think I can keep them for 3 weeks. I tell you, the public library is such a great thing, I almost feel like it’s some anomaly that jumped through a quantum physics wormhole into our dark MAGA world.

Professor Chinn,

Is the description at the base of Figure 1 correct? It looks like Figure 1 is normalized to 2007M11.

It looks like the optimistic view would emphasize current GDP actual and Q3 estimates, personal income ex-transfers and NFP employment for the current recession watch. However, as I recall from previous posts, both income and employment can decline rather quickly.

Regarding 2019Q3 GDP forecast, so far for August 2019

Atlanta Fed 2.2%

NY Fed 1.8%

Blue Chip 2.0%

Ave. 2.0%

Am I wrong in thinking that this recession watch seems to be the more intense than past recession watches? Or are Econbrowser readers perhaps more aware currently than we may have been of the previous recession watch, if we were not reading Econbrowser in 2007-08?

AS: Yes, my mistake. Normalized to 2008M12. Thanks for catching that.

@ AS

I’m guessing that Menzie didn’t answer your tail-end question there, because it is kind of subjective as to what the answer would be. I read this blog very intermittently probably starting either in 2008 or 2009, I honestly can’t swear to how I became aware of this blog, as that was near exact or slightly over 10yrs ago—but there is a decent chance I found out about this blog through the BaselineScenario blog by James Kwak and Simon Johnson, which I read near religiously at that time. My theory is people were aware something was about to happen because the mortgage situation had become apparent back in 2007, but the real. uuuuuhh. “brick to the face” moment came when the credit derivatives crisis started to take hold, and I wanna say that was about October 2008 because the consequences of that hit the stock market simultaneously. Of course those risky trades and unethical sales of credit derivatives had happened over years—but it was that final dungheap of credit derivatives (TBTF banks and Insurance companies induced) that had accumulated only came to hit society in late 2008. That’s my recollection anyway. I think inside of the last year when I got a little smart-aleck-ie about this blog’s recession measures that Professor Hamilton showed that this blog had gotten the timing pretty well with their “emoticons” indicators (and I had to give one of my sheepish/mousy apologies to Jim and Menzie, which I so loath giving)

What “the CoRevs” and “the Rick Strykers” were saying I don’t dare to guess. Probably something to do with the impending world apocalypse if the Harvard educated Oreo known as Barack Obama became our leader.

Moses,

Given your comments about Professor Hamilton’s GDP/GNP forecasting model for recession, I found three links that may be of interest to you and others.

1. Professor Hamilton’s 1989 paper, for which I would need a live-in tutor to be able to follow the much of the math. https://www.ssc.wisc.edu/~bhansen/718/Hamilton1989.pdf

2. EViews written example of how to replicate Professor Hamilton’s model using Markov switching. http://www.eviews.com/help/helpintro.html#page/content%2Fswitching-Examples.html%23

3. YouTube demonstration of the EViews Markov model. https://www.youtube.com/watch?v=hkxAewAaEYQ

@ AS

I’m focusing on “R” mainly to crunch the heavy lift numbers, but I assume there’s some similarities in code instruction names etc, that I can draw parallels with enough to also practice it in “R”, so I greatly appreciate this. I think your math skills are higher than mine, but I can get some tough ones by perseverance. Thanks

Moses,

September 2008 was when the scheiss hit the fan, weekend of Sept. 17 to be precise, which was when nobody at the Fed went to bed. Took cutting the deal to take on Eurotrash debt from the ECB to prevent possible total global collapse. That got quietly rolled over into US mortgage-backed securities over the next six months. Irwin’s The Alchemists provides a good account, Chap. 11 in particular.

Didn’t Donald Luskin pen an oped on 9/14/2008 dismissing we were in a recession. Of course the very next day Lehman Brothers went bankrupt!

A post on Argentina might be nice.

Do we agree with Prof. Ghosh?

https://www.project-syndicate.org/commentary/imf-lending-austerity-argentina-ecuador-by-jayati-ghosh-2019-08

While I am at it, Bloomberg has an article that China will start the next global recession.

Can China do that? How? That might also be worth a post.

@ “Princeton”Kopits

We’re all waiting for that post on your blog. What’s the matter, did the “consulting” part of your brain turn to crap?? Or was that section of your brain just crap the entire time…..

I’m also waiting for your blog column stating you encourage and endorse the arrest and imprisonment of American CEOs and executives who hire illegal immigrants without verifying their status. When are you writing THAT post “Princeton”Kopits?? Too busy popping Raisinets and Milk Duds in your mouth while watching Latin American children crying in ICE/CBP cages?? Keep your hands above your waist while watching those hispanic children crying on your TV “Princeton”Kopits or your wife might think you are a sadist in more ways than one.

My views are well-known. I have written about them here at least a dozen times. We are in the legalize-and-tax category, and not either the supply suppression (crack down on migrants) or demand suppression (crack down on employers) camp.

Let me quote myself, which you could have read for yourself here: https://www.princetonpolicy.com/ppa-blog?offset=1556723683691

Black markets can be addressed with three different approaches.

• Suppress Supply

As we note above, governments without fail try to suppress black markets by focusing on supply, arresting drug dealers or detaining hotel maids and berry pickers attempting to sneak across the US border. Supply suppression is politically attractive because it externalizes the problem. The problem is the fault of Colombian or Mexican drug dealers or tricky Hondurans enlisting children in fake asylum claims to gain entrance to the US labor market.

Supply suppression has never worked, because enforcement provides the incentive for its own undoing. When supply is suppressed, prices go up, sales opportunities are plentiful and competition is reduced. The effect is much like pressing on a spring. The harder one presses, the greater effort required, the greater the resistance and the more violent the rebound when pressure is released.

Enhanced enforcement increases black market suppliers’ incentive to bring contraband to market. This results in the most extraordinary creativity, certainly in drug smuggling, which has employed ‘mules’ with marijuana-filled backpacks, disposable aircraft, high speed boats, catapults, tunnels, swallowed packets, or drugs canned or hidden in fruits vegetables or manufactured goods – the list is endless.

In the case of migrant labor, options can include walking across the unsecured border; fake papers; tunnels under or ladders over the border; disabling border barriers; fake asylum claims; visa overstays; conveyance hidden in trucks, boats, aircraft; transit over the Canadian border and other means. The very worst, and perhaps the most common, means to circumvent enforcement is bribery, or as the case may be, intimidation and violence. It is the corruption of law enforcement, the bribery of politicians and judiciary, and the intimidation of the press which wreak the greatest damage on society.

Because supply suppression creates the economic incentive for its own undoing, it has virtually no track record of success. True, supply suppression has historically reduced the flow of illicit goods by 10-15%, but this is merely a dent in the business and very far from a meaningful prohibition. Much blood and treasure is spilled for a near meaningless reduction in supply.

• Suppress Demand

Demand suppression is as effective as it is unpopular.

Cold turkey detention of drug addicts vastly reduced addiction rates for hard drugs in Japan and Singapore.

Arizona’s hard line on migrants has also shown notable success. The state brought in tough anti-illegal labor laws in 2007 and reduced their undocumented population by half. Not only that, they have kept the numbers down by closing businesses that use undocumented labor.

Of course, this internalizes the problem. Rather than blaming migrants, enforcement focuses on their US employers. The question is whether such an approach is politically viable.

Nor is it clear that Arizona’s approach achieved its intended goals. On the one hand, Arizona did manage to materially reduce education and health expenditures associated with its undocumented population.

On the other hand, Arizona is the poster boy for unintended consequences with respect to its labor market. When Arizona implemented its tough anti-migrant policies in 2007, Arizona had the 16th best unemployment rate among the states. Today, it is in 45th place. In fact, Arizona has the second worse relative record (change in rank) of all the states since 2007. Moreover, six of the seven states which enacted restrictive laws regarding use of undocumented labor have seen their relative rank, in terms of unemployment rate, deteriorate compared to the other states.

Coercive interventions in markets have a habit of backfiring, and this includes actively preventing businesses from operating by depriving them of employees. Still, demand suppression is a viable option for the conservative purist to the extent the politics are palatable.

• Legalize and Tax

The classic remedy for a black market is to legalize and tax it. The US chose this route with alcohol, gambling and more recently, marijuana. Rather than trying to prohibit a good or service entirely, demand is regulated by a tax regime, with the goods legalized otherwise.

Historically, this approach will eliminate 95% of the criminal pathology associated with prohibition, For migrants, this includes illegal border crossing, murder, rape, kidnapping, human trafficking, theft, corruption, intimidation, smuggling and tax evasion. Domestically, it will materially reduce wage theft, workplace sexual harassment and worker exploitation.

Importantly, legalization does not end all the problems associated with prohibited goods. Alcohol consumption remains the third leading cause of preventable death in the US and is associated with a loss of $250 bn in GDP annually. Nevertheless, the public has accepted these as ‘costs of doing business’. Similarly, the legalization of gambling created much anxiety at the time, but since then, the capital of gambling, Las Vegas, has been transformed into an adult amusement park. Gambling addiction remains a problem for some people, but “what happens in Vegas stays in Vegas” has risen to a selling point, rather than a cry to shutter the city.

Marijuana legalization has – and continues – to cause consternation among politicians, with New Jersey’s attempt to legalize now stalled. And yet, society has not collapsed in those states where marijuana is now legal. Colorado government has prepared a report on its experience at the five year mark for recreational marijuana legalization. (The summary is well worth a read.) There are issues, but far from being a disaster, marijuana legalization has actually improved some statistics (and underscores again that legal alcohol is an order of magnitude more dangerous substance than cannabis).

Migrant workers – primarily interested in mowing lawns or making up the hotel beds in decadent Las Vegas – represent a far lower risk to society than any prohibited drug or traditional vice. Legalization will not make all associated problems go away. Migrants, as the rest of society, will still occasionally commit crimes of various sorts. Notwithstanding, the history of legalization shows that this sort of anti-social behavior will fall to a fraction of its current level.

Moreover, legalization closes the topic as a political issue. Despite the adverse effects of alcohol and gambling, no one is calling for a new prohibition. So it will be with migrant labor. If a well-ordered, fair, transparent and accountable channel for migrant labor is established, and if the government is appropriately compensated for providing labor market access, history shows that illegal immigration will disappear as a political issue of major importance.

Comparing Supply Suppression and Legalize-and-Tax Approaches

As luck would have it, the US is currently running a natural experiment on the unsecured southwest border with Mexico. Three types of contraband are coming over the border: economic migrants, hard drugs and marijuana.

Despite the most aggressive efforts of the Trump administration, both hard drug seizures and border apprehensions have more than doubled compared to the last years of the Obama administration. Not only is a crackdown not slowing traffic, it is actually associated with a doubling of flows!

By contrast, even though recreational marijuana has been legalized in only ten states, marijuana seizures over the unsecured border will have dropped in 2019 by 80% – 80%! – Since President Trump took office. Smuggling is down 95% since its peak in 2009. This is the singular success of the Trump administration at the southwest border, and yet it was not achieved with hardcore enforcement, but through legalization and taxation.

This same effect could be achieved with illegal immigration, with the difference that the border could be closed much more quickly and completely.

Yea we have read your intellectual garbage enough in the past. Quite frankly I do not want to read any more of it.

Fleeing dangerous lands is not the same thing as simply seeking a higher paying job. So it would be appreciated if you did pollute these discussions with more of your self serving irrelevant garbage. And while you are at it – email Stephen Miller and tell him to shut up too.

@ “Princeton”Kopits

Steven, sometimes you even surpass my own measurement of your stupidity. Is it not yet dawning on you why your “policy prescriptions” get put in the paper shredder 25 seconds after they got past that White House gates?? Has it not dawned on you yet why you’re only on pre-6:00am Fox news?? You’ve forgotten your main line of business is telling rich white guys who employ illegals and uneducated white trash what they want to hear. This is your “talent” you offer the world Steven, try to remember that, ok???

I’ll try and highlight your own words and see if that helps your cognition. If I was teaching this to you in a classroom I’d speak it out very s-l-o-w-l-y for you Steven:

“We are in the legalize-and-tax category,”

Are any metaphorical lightbulbs magically appearing over your head right now??? Did you see the part of your words I put in bold?? Not to mention the fact, even if you could get this amazingly dumb-a$$ policy enacted into law, you can’t get blood out of a turnip. The laugh-riots that would ensue in Congress when they estimated gross revenues on your plan would be too laughter inducing even for Republicans to choke back their snickers.

You’re incoherent, Moses.

We’re taxing migrants, which will have the effect of bidding up their wages to the US unskilled level.

If you don’t tax the migrants, then — because this system allows background-checked migrants to enter the country at will — they will come until either 1) unskilled realized wages fall to about $6.50 / hour or 2) we run out of migrants. Even in just Mexico and Central America, we’re talking a potential market in excess of 10 million migrants, maybe as many as 30 million. There are 20 million Americans working at the unskilled wage of about $10 / hour. So if you double that pool, you’ll probably tank wages, either at the $ / hour or hours / week level. The tax prevents that from happening.

This policy would net something like $30 bn annually to the Treasury, I believe the biggest incremental revenue generator during the Trump administration, at least from new policy.

Still surfing for anyone to read your worthless blog? No thank you.

Surely it should be the data IS pretty clear and I won’t call you shirley again. You mean you have never watched Flying high

@ Not Trampis

https://youtu.be/StmlVqzmWAc?t=1

Menzie is right, politicians come and go, economic advisers come and go, but I swear, the speech writers must be permanent.

More of who said what when:

“I am pleased to report that the American economy today is strong. We are

enjoying the longest economic expansion ever recorded, with more than

22 million new jobs… the lowest unemployment rate in 30 years,

the lowest female unemployment rate in 40 years, the lowest Hispanic and

African-American unemployment rates ever recorded…

“We think the fundamentals are strong and we are not going into a recession,”

Yes that is right, both these quotes are from Jan. 2001, not maybe a year away from recession but just 3 months.

Oh, the first quote is from the President William Clinton, and the second is from the Chairman of the Council of Economic Advisers Martin Bailey.

CBS news commented on Bailey, “Martin Baily, chairman of the president’s three-member Council of Economic Advisers, said there was no reason to believe the economy was slipping into a recession, even with the sharp slowdown in economic activity in the past few months. He noted that the unemployment rate in December remained at 4 percent, near a three-decade low.”

Thanks Menzie, this was fun. Funny though, after being able to find so many comments of one Menzie Chinn on recession, google seems to have let me down. I did not find one public comment during that 2000 political season nor in the days leading up to the 2001 recession by Professor Chinn, or more properly membrer, Senior Staff, Menzie D. Chinn, International Finance, Council of Economic Advisers. I am sure that they were out there, after all look at how out there they are now.

Ed Hanson: If you knew anything about serving in the government, it was the case that nonpolitical appointees (like me) were not permitted to “speak for the administation”. Somewhere, dated in 2001 I think, there is a document that is a set of discussant remarks, where I comment on an academic paper at a conference, but I preface my remarks by saying “My comments are solely mine, and do not represent the position of the US government”.

I am amazed by your ignorance of how the US government *used to* work.

Menzie,

Now, now, now. Don’t be upset. I do not care if you made public statements referring to recession probabilities in 2000 and 2001. I looked there because it was my only source for information, at least, until I got your attention. But I do see the deflection in your response, not anything on the recession comments of your esteem administration, but an obtuse reference to protocol, true as it may be. So I will ask you directly.

Did the Council of Economic Advisers hold discussions on the probability of recession? I assume they did, most certainly. What were the estimates? Were they so low as not to be mentioned, but in that case, how could such estimation be so wrong? Or were estimates indeed high enough to bring into question such statements of the President and Chairman of the Council of Economic Advisers. Your latest chart in your new post seems to indicate that probabilities were high enough.

Ed

PS. Perhaps you would like to bring this discussion into your latest post. Your new charts are certainly pertinent.

Ed Hanson: Not upset, just repeatedly surprised at how determinedly your forge ahead in comments given your ignorance. In any case, I was not privy to the recession discussion in the waning days of the Clinton administration (I was senior economist for international finance, not macroeconomics, nor forecasting). I did have informal conversations regarding the possibility of a recession with the incoming CEA Chair and other staff.

I do have several posts on the recession of 2001; see https://econbrowser.com/archives/2006/08/the_2001_recess

Menzie

Just open up. We all read your opinion and most such as I appreciate (does not matter if there is any agreement) when you make it clear it is opinion. “I was not privy to the recession discussion”. I can believe that, but find it difficult that in small and intimate group like the CEA, you did not know of rumblings of such a vital matter as recession.

Lets ask the question a different way about Jan 2001;:

Was President Clinton wrong to write about the economy as he did in the Report and not mention the probability of a looming recession?

Was Martin Baily wrong to say what he said about a recession?

Then again, why not just see it my way, do not believe politicians and those who jobs came from those politicians when it comes to the state of economy during uncertain times. It does not matter if it is Bailey and Clinton or Kudlow and Trump. Or any of the rest of them. They could be right or wrong, but bias looms too large. To me, your analysis is important, but incomplete. Unfortunately, you can not overcome your political partisanship to become the dreaded two handed economist You, at times, give lip service to the positive aspects of the economy, but give them very, very few words. But never mind, there are other sources.

One last thing. Such an intriguing comment, “I did have informal conversations regarding the possibility of a recession with the incoming CEA Chair and other staff.” If informal means something you would rather or should keep privileged, I can understand. But if not, what a nice contribution to history if you could relate the substance. After all the new President was somewhat vocal and pessimistic about economy at the time. Looking forward to what you can tell.

Ed

Ed Hanson: Clinton was not wrong – the economy was strong at the time he wrote those words (would’ve been November or December 2000, given the lead time in printing).

Baily was technically correct — as of the time of the writing of ERP, it was surely unclear (and as the NBER BCDC decided, the recession start *was* after January). I would have said it differently, but he was right – we were not entering recession as of the writing of the ERP.

Ed at least got the dates right – “Yes that is right, both these quotes are from Jan. 2001”.

Of course the Federal Reserve was already lowering interest rates in January 2001. Betcha Ed did not know that either.

Of course most people would note that the 2001 recession was very mild when compared to the recession that started in December 2007. I trust you get this but if you have some compelling evidence that the 2001 recession was anywhere on par with the Great Recession – please share. This should be fun!

“Ed Hanson

August 19, 2019 at 12:07 pm

Menzie

Just open up.”

This is from the Trump troll that cannot bother to address my 2 simple questions to him. Ever noticed this is a pattern with our Usual Suspects?!

I have a question for Ed Hanson which I’m sure this Trump troll will also duck.

The White House passed from Republican Ronald Reagan to Republican George H. W. Bush in early 1989. How many members of either White House including their economic teams predicted the 1990 recession.

After all – Ed thinks Bill Clinton and his economic team were somehow responsible for the 2001 recession and that they deliberately forgot to warn George W. Bush. So did St. Reagan deliberately forget to tell his successor of recessionary risks?

Off-topic

I hesitated making this comment because I know this is an economics blog. and I think Menzie and Jim (Honestly I think less so Jim, but Jim tolerates it in a friendly way and himself has even broken off the main blog objective with his love of basketball, and other things semi-personal that are at his core as a person) have been patient tolerating other topics. I’m very conscious of the fact that when Menzie tolerates my borderline vulgarities and non-PC views that this could cause him issues and yet he tries to extend that line out of friendliness to let readers vent. This is a core reason I like the blog. But I also think the blog does attract some very intelligent people and intelligent people like intelligent conversation—so in that spirit I wanted to put this link up. It also touches on some hard decisions blog hosts or social media hosts face. I have only watched HALF the video so far, and am about 85% (not 100%) sure none of this video has vulgarities in it. The former runner of the controversial site seems very sharp, and I found it fascinating listening to him and the conversation. He strikes me as way above average intelligence–and I always like to soak in these type people.

https://www.youtube.com/watch?time_continue=588&v=yMlrBL1Tgmw

Well and how many times economists have predicted a recession which never came into being? Or stock market crashes, or high inflation? What was mr. Market thinking when loading up with Arg. 100 years bonds? Cherry picking is always good.

Stories like this make me think the Democrat party is just an extension of the Republican party. What all this rubbish about “qualifying polls” is, is just the same “stuff” we saw when Debbie Wasserman Schultz was calling the shots in the DNC. It all amounts to “Payback” from the DNC towards Tulsi Gabbard because she “wouldn’t play ball” with the party bureaucracy. It’s stuff like this is why voters become demoralized about the voting process and choose not to show up for November. And if it turns out there’s low Democrat voter turnout in November 2020 because candidates that voters were enthusiastic and adrenalized about were filtered out of the process by Wasserman Schultz and Tom Perez types—then the DNC have no one to blame but the SOB they see in the mirror.

https://www.youtube.com/watch?v=xdunhAkRJtU

if things are going so well with the economy and trade policy, why does the trump administration suddenly retreat with a “hold” on tariffs until after the holiday season? let’s be honest, a strongly humming economy and even stronger trade position would not result in a retreat right after a threat. not played very well by the home team.

Remember Navarro’s claim that this tariff would be paid by the Chinese and not by American consumers. With that “logic”, we can see the “hold” as a Christmas present to the Chinese!

OK. Just don’t call it a “Holiday present.” Trump’s Christian base will have none of that. Besides, what better exemplifies the season than a plastic Christmas tree made in China? Or, one “Hecho en Chine”?

i find it very hypocritical of trump and his acolytes claiming to have the best economy ever and in the same sentence crying about not lowering interest rates enough. obviously anybody supporting trump and his economic policies has demonstrated a complete lack of economic literacy, or are simply apathetic to the field of economics and its impact on society. that is aimed at dick stryker, peak loser, corev , bruce, ed and all. its called talking out both sides of ones mouth. loss of integrity. or conman sales job.