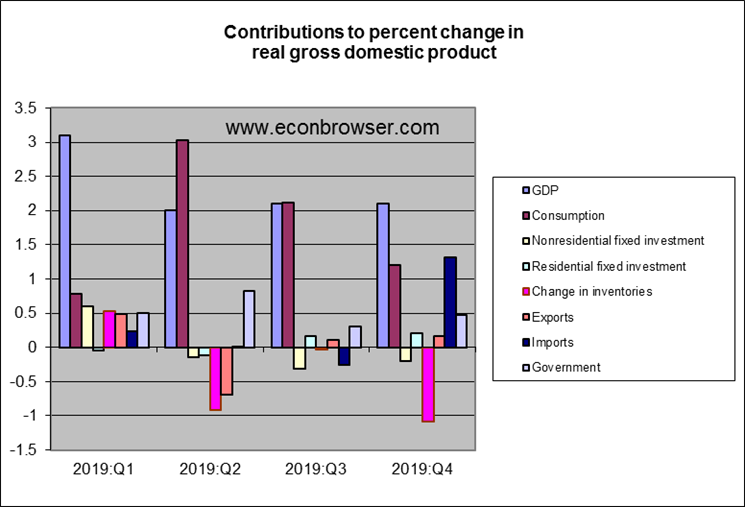

The Bureau of Economic Analysis announced yesterday that U.S. real GDP grew at a 2.1% annual rate in the fourth quarter of 2019. That’s slightly below the 2.3% average rate since the recovery from the Great Recession began in 2009:Q3.

Real GDP growth at an annual rate, 1947:Q2-2019:Q4, with the 1947-2019 historical average (3.1%) in blue and post-Great-Recession average (2.3%) in red.

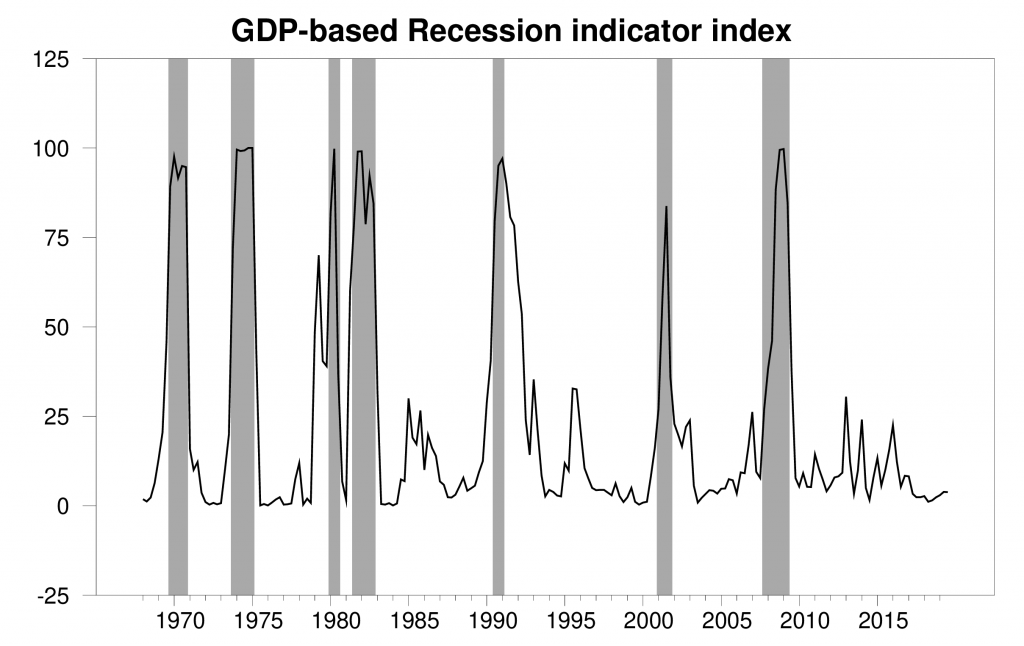

The new release kept the Econbrowser Recession Indicator Index nearly steady at 3.8%, consistent with the very low range it’s stayed in over the last two years. With the expansion now over ten years old, each quarter that economic growth continues sets a new record for the length of the longest expansion ever observed in the U.S.

GDP-based recession indicator index. The plotted value for each date is based solely on information as it would have been publicly available and reported as of one quarter after the indicated date, with 2019:Q3 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index, and which were sometimes not reported until two years after the date.

Consumption growth slowed in the fourth quarter. But most of that was due to a reduction in purchases of imported consumer goods, presumably partly in response to new tariffs on Chinese imports that went into effect in September. Because imports are subtracted from GDP (Y = C + I + G + X – M), a drop in consumer purchases of imports (if consumers do not replace those lower purchases with increased purchases of domestically produced goods, as they seemed not to in the fourth quarter) simultaneously lowers both C and M with no effect on GDP. With total consumption spending making a smaller contribution to GDP growth, but lower imports making a new positive contribution to GDP growth, GDP ended up growing in the fourth quarter at exactly the same rate as it had in the third.

Investment spending and exports remained weak. So despite the slower growth in total consumer spending, it remains the case that consumers are still the main driver of recent U.S. economic growth.

So consumer spending is driving GDP while fixed investment is weak and we’ve seen three consecutive quarters of declining inventories. I would describe this as living off your seed corn.

Business fixed investment fell rather dramatically but so did imports. And there was a rather large increase in defense spending. So that tax cut for rich people is not doing what it was advertising to do but sending more troops to the Middle East and trade protection makes up for all of that – I guess.

Trade protection nope. Future consumer spending decelerating yes. I smell a downward revision with this one.

what is the SAAR please.

Why do you yanks have such woeful stats.

Nice post by Professor Hamilton. This seems pretty neutral in tone. It’s hard to argue with a factually presented case, but I think the underlying view using other barometers is much darker. That’s not a critique in any way of the neutrality of the post, just a point I think bears being made.

This is so boring. Moderate, steady growth; low unemployment; low interest rates, good corporate profits; moderate, steady growth in average hourly wages, good housing market, and on and on. We need the good old days of the late 70s and early 80s. Now that was a ride! That 10-1/2% mortgage interest rate was soooo exciting. Gas prices tripling was a gas. Now? Blah.

Bruce Hall Trump did not promise moderate, steady growth; he promised real GDP growth of 4%. You were very critical of economic growth under Obama, but growth under Trump has been no better. The main difference is that under Obama the deficit was shrinking as the economy moved toward full employment, while under Trump the deficit has been increasing while the economy is at full employment.

One thing that’s definitely worse today is inequality. Back in 1979 the World Bank Gini coefficient was only 34.6. Today it’s in the low 40s and getting worse each year.

BTW, gas prices did not triple in the late 1970s. From Jan 1976 to Dec 1979 they increased by 76%.

I see Bruce “no relationship to Robert” Hall making claims without evidence. Dr. Hamilton has studied the relationship between oil prices and gasoline prices in the U.S. so maybe he can augment this but here is a chart of oil prices from our good friends at Macrotrends:

https://www.macrotrends.net/1369/crude-oil-price-history-chart

I think Bruce needs a good calendar. He talked about the late 1970’s and the early 1980’s. Let’s see – we had a big price spike in the earlier part of the 1970’s followed by a mere doubling of oil prices in the late 1970’s. And I thought everyone knew oil prices headed back down in the 1980’s. But not Bruce Hall!

I found this chart showing nominal gasoline prices from 1918 to 2016:

https://inflationdata.com/articles/wp-content/uploads/2015/01/Inflation-Adjusted-Gasoline-Jan-2016.jpg

Even in nominal terms, gasoline prices fell in the early 1980’s. Of course, this should be done in real terms even if Bruce “no relationship to Robert” Hall continues to miss this basic points. But this was a period when inflation was sort of high. So real prices fell rather dramatically when our research challenged MAGA hat wearing fool thinks they were soaring.

What is really interesting that from 1972 to 1981 – a period when nominal prices did soar – real prices less than doubled.

But of course do not expect Brucie Hall to get any of this. He still struggles with the concept of inflation adjusted.

Oh gee Brucie – so sad we cannot excite you. Try going to a MAGA rally as I hear the people there are ready to go after Mitt Romney and his entire family. I’m sure that would excite you.

The mid 80’s.The Reagan years.Economic nirvana. The conservative glory years when a principled conservative promised to reduce deficits, reduce the national debt, negate big spending liberals by slashing federal spending and…..Yeah, it was all nonsense.

But those were the kind of good old that bring tears to Republican eyes Genuflect frequently to the memories.

That 85 prime rate (10. .5%) deficit (about $515 Billion in today’s dollars) , average 7% increase in federal spending, skyrocketing debt…..Those were the days indeed

GDP growth moderate. What, no comment about deficits?

I can remember when JDH was apoplectic about the thought of trillion dollar deficits. This was at the depths of the Great Recession when millions were out of work.

But here we are at the peak of an expansion and the CBO projects trillion dollar deficits, even in the best scenario, for the next decade. The Republicans just added $1.5 trillion with their tax cuts for the rich.

Radio silence from JDH. I just seems, shall we say, peculiar.

Federal budget deficits are fueling the economy. Everyone knows this but nobody talks about it. If we balanced the budget, we would collapse into recession immediately.

joseph Did you mean JBH (of 99,000 unsealed indictments fame) rather than JDH? Big difference. My recollection is that JDH was moderately supportive of greater fiscal stimulus as a necessary evil. I disagreed with him on the R&R 90% debt threshold thing, but that’s not quite the same thing as saying he opposed fiscal stimulus during the Great Recession.

I’m pretty certain that’s what Jospeh meant when you look at his last sentence, still you did well to clarify. Honest mistake by Joseph.. I pulled a stunt at least twice where I thought a Hamilton post was a Menzie post.

I stand corrected, my apologies to Joseph for reading something into it that wasn’t there and misinterpreting his observation.

Say what? The news of the day was this BEA release. You know if you want a blog post on the deficit then write one yourself. Maybe that will get Brucie boy Hall all excited!

Actually I just decided to check all those customs duties Trump is collecting from this trade war (paid for by US consumers mind you and not Chinese producers but shhh – don’t tell Trump’s sycophants):

https://fred.stlouisfed.org/series/B235RC1Q027SBEA

The graph shows these duties are soared!!!! $85.54 billion per year in 2019QIV. What, what? Take that as a percentage of GDP you ask?

OK – 0.39% of GDP. Yes – so YUUGE it will pay for those tax cuts!

Oh wait. I’m doing Bruce Hall arithmetic. Never mind!

Among the most robust sectors was federal government spending, up a real 4.3% (YoY) from 3.7% growth in Q-3. As measured by the national accounts, the federal deficit in the last two years, an average of 5.2%, is ever so slightly higher than in 2010-17, when Mr Obama ran the show. That is due to the Republican tendency to keep spending high while slashing revenues in the most economically unhelpful way possible.

Socialism!

Corporate welfare!

2slugbaits: “Did you mean JBH (of 99,000 unsealed indictments fame) rather than JDH? Big difference.”

Well, to start off, here’s the one where JDH chides the Democrats for their ARRA. JDH says that the ARRA should be one-forth that amount, no more than $200 billion. And then he finishes off with his demand that this clause be included:

“In authorizing this Act, Congress is hereby signaling its intention to raise federal taxes by May 30, 2019 to a sufficient degree to repay all principal and interest due on the debt that is incurred by the Treasury as a result of implementing provision.”

And here we are in 2020 and where is JDH’s demand that the Republicans repeal their tax cut for the rich.

https://econbrowser.com/archives/2009/01/stimulus_bill

And then there is this one declaring the horrors of trillion dollar deficits, even as 10 million people are still without jobs.

https://econbrowser.com/archives/2009/03/how_much_is_a_t

And then this about the possibility in the next five years (from 2009) Treasury auctions will fail.

https://econbrowser.com/archives/2009/11/yes_the_future

Or when he goes on the attack against Krugman saying:

“If the government tries to double taxes on people like me, it’s in real political trouble. If it doesn’t try to double taxes on people like me, it’s in real solvency trouble. It looks like we may have a problem here.”

https://econbrowser.com/archives/2009/08/9_trillion_what

How about this embarrassing claim, channeling Fama and Cochrane, that the accounting identity proves that stimulus doesn’t work.

“private saving + government budget surplus = investment + net exports

“So, if the deficit increases as a fraction of GDP by 6% within two years, we’re going to see adjustments in some combination of the other three terms of the same magnitude, that is, some combination of a plunge in private consumption, private investment, and net exports.”

https://econbrowser.com/archives/2009/02/projected_size

Attacks on Keynesian spending:

“My own view is that there are more fundamental problems beyond the low level of total spending, namely, the financial system is broken and needs to be fixed, and until it is both our basements and parks may go wanting, despite the willingness of Congress to increase the deficit.”

https://econbrowser.com/archives/2008/10/brief_questions

Here JDH uses the tired old excuse that stimulus won’t work because the recession will be over before the stimulus can take effect. And here we are 10 years into a discouragingly slow recovery.

Plus this classic: “In my opinion, the reckless U.S. budget deficits of recent years have been one of the most important threats to that special and very valuable status.”

https://econbrowser.com/archives/2008/01/the_case_agains

So my question is, what happened to all the fear and doom about the debt crisis? What about the pledge to pay for the stimulus by tax increases by 2019? After all the talk about the evils of trillion dollar deficits, why no similar crisis talk to repeal the Republican tax cuts that added another trillion and a half to the debt?

From honest economists we at least expect political consistency. Or honest economists can admit when they made an honest mistake. Or honest economists, if they change their minds, can explain their change in a cogent manner. But at the least be consistent.

Americans have a right to be bitter about economic arguments that supported the Republican austerity and unnecessarily prolonged their misery.

joseph I have a somewhat different interpretation of JDH’s comments. To begin with, many of your links are from 2008 or very early 2009; i.e., long before the severity and depth of the Great Recession was fully appreciated. Remember that the initial GDP numbers for 2008Q4 significantly understated the rate at which GDP was actually falling. My reading of JDH’s comments is that he was primarily concerned with the political will to take away the punch bowl after fiscal stimulus worked its magic. I didn’t see anything that denied the potency of fiscal policy. Indeed, one of his concerns was that fiscal policy risked providing economic stimulus at the wrong time. That’s not an argument for the impotence of fiscal policy; it’s an argument about how tricky it can be to get the timing right. As to the ARRA, JDH did not say he was against fiscal stimulus, he said that he wanted to see a $200B injection fully disbursed in 120 days and then repaid over a 10 year period. Now personally I have lots of concerns with the specifics of his proposal, but I don’t see it as him arguing against the macroeconomics of fiscal stimulus, just the political risks due to the fact that voters are oftentimes myopic nitwits, which ends up giving us myopic, nitwit politicians. It’s hard to argue against that argument. But it was clear to me that his primary concern was that the ARRA might deepen the structural deficit, which would have adverse effects on the currency. In other words, I don’t read JDH as opposing cyclical deficits per se, but rather the political risk that cyclical deficits become structural deficits. I think you’ll find that same concern in Menzie’s book Lost Decades. Look at the dates of your links. It’s clear that JDH had the experience of the Bush fiscal policy disasters in the back of his mind.

Here’s where I would criticize JDH:

1. I believe that in the early days of the Great Recession he put too much faith in the Fed’s ability to staunch the recession and to generate inflationary expectations.

2. Instead of emphasizing R&R’s paper on the 90% debt threshold, he should have paid more attention to R&R’s work on the persistence of financial recessions.

3. His recommendation for a $200B pulse in early 2009 did not acknowledge that not having another $200B pulse in 2010 would be contractionary. I believe JDH failed to see that the Great Recession was not like ordinary recessions and would take several years to work itself out. Again, the R&R work on financial recessions would have been a helpful guide.

4. I think JDH overlearned the lessons of New Keynesian economics and forgot old school Dornbusch & Fischer 1970s IS-LM macro. I realize that IS-LM is hardly respectable in academia, but in the case of the Great Recession I think it would have provided better instincts and heuristics than a New Keynesian model that had nothing to say about the financial sector.

Finally, I think we have to ask ourselves if we’re in a state of secular stagnation or not. If we are, then concerns over chronic structural deficits to prop up weak private sector demand should not have been a concern in 2009. But by the same token, if you still believe we’re in that same secular stagnation rut, then you should be more relaxed about Trump’s deficits. So do you think secular stagnation is still a problem?

@ 2slugbaits

I was thinking IS-LM was more of a John Hicks thing. I guess that shows how clueless I am. BTW, it looks like we will finally have our “real life” event study here on Brexit. I have a sense you might claim the results are already in, I beg to differ, and I think, allowing for a global downturn, 5-10 years after the official announcement is a better measure—and I think they are not going to be as severe as you imagine—or even as bad as those British government numbers Menzie posted in the comments section once were implying. I assume those are still in that thread, and I will hunt them down for future reference.

Moses Herzog The IS-LM formulation is John Hicks. The Dornbusch-Fischer reference is to the old standard macro textbook presentation of IS-LM that Krugman learned. As to Brexit, I don’t expect some sudden collapse of the British economy. Instead I expect it to be more like the frog in the gradually warming water. A generation from now Britain will be noticeably poorer than its peers. That said, a very badly managed Brexit transition could send the British economy into recession along with the rest of us. And given the economic incompetence of Team Trump and Team Boris, that’s something you can’t entirely discount. It also increases the likelihood of a UK break-up.

Team Boris is as incompetent as Team Trump. Except with far less wiggle room. They will be very lucky not to botch it. And if they manage a smooth Brexit, it will be entirely luck, not skill based upon Boris’ history. Just like Trump, he has managed to profit somehow from hucksterism covering up one abject failure after another. Britain is in for a dark age.

Well as far as a UK break-up is concerned I don’t doubt we’ll have an “As the World Turns” 3-5 year soap opera over that. But I don’t see it coming to fruition. Going to be interesting spectating as far as the post-Brexit UK though. Not much arguing that. I foresee much less dark clouds than predicted though. More like slightly overcast with sunlight beams speckled through off in the horizon. I’ll be watching Malcolm Brabant on PBS NewsHour on the UK break-up talk for cracks in the ground.

The first edition of Dornbusch-Fischer was published in 1978, I used it when I taught my first macroeconomic course just after it come out. A good book but William Branson’s 1972 book was the one I learned intermediate macroeconomics from when I was an undergrad. A great book but the original edition was sort of graduate level in its presentation. Macroeconomics took that New Classical turn back in the late 1970’s but was powerless to explain the Great Recession. To which the always sharp Wilem Buiter declared that the 30 year old New Classical revolution was a complete waste of time.

“To begin with, many of your links are from 2008 or very early 2009; i.e., long before the severity and depth of the Great Recession was fully appreciated.”

2slugs, even if the severity of the situation was more fully appreciated (lets not make 20/20 hindsight, but lets assume in real time we did have a better appreciation for the severity of the situation), how different do you think the “response” would have been? do you really think any conservatives would have advocated for a robust social and financial intervention prior to the economy blowing up? at what point would conditions make it clear that austerity was not a solution? in my view, lines were drawn and sides already chosen. look, in sept 2008 lehman was blowing up and it was very clear we were in dire straits, and yet 1/3 of democrats and 2/3 of republicans voted against the bailout. even with proper information, it appears rather difficult for politicians (and economists) to overcome preconceived notions. most people already have solutions, they are just looking for a problem to solve.

baffling In the case of Republican politicians, I doubt that it would have made much difference at all. Politicians are just stupid. And Republican politicians are especially stupid. OTOH, I suspect that a lot of mainstream economists would have been more receptive to the idea of fiscal stimulus if in early 2008 they had a better appreciation of where the economy was heading.

In early 2008 the Bush Administration started pushing the idea of another tax rebate. There were politicians on both sides of the aisle who opposed it. I suspect that some Democrats were leery because it appeared that Ed Lazear was talking out of both sides of his mouth; vis., no recession on the horizon but we need another stimulus bill! Over at Angry Bear I was in the minority as someone who supported the 2008 tax rebate and thought it probably needed to be even larger. Those who opposed it felt that the Fed would be able to stimulate growth, but I was concerned that the Fed was fast running out of bullets and some fiscal stimulus would be welcome. Rebates probably don’t do much for consumption, but there was evidence that they helped people pay down debt and repair balance sheets. In hindsight I think I got it right, but maybe I just got lucky. In early 2008 it was far from obvious that monetary policy would not be up to the job. After all, there was a general consensus that monetary policy was the preferred policy tool. But if academic economists had known the severity of the crisis, then they might not have had less faith in monetary policy. My sense is that by 2010 a lot of mainstream academic economists had come to agree on the necessity of fiscal stimulus, even if they disagreed as to how much.

Also, I don’t think there’s any inconsistency in accepting both the need to run fiscal deficits when you’re at the ZLB and having a concern over debt. Just because I don’t think there’s anything magic about a 90% threshold doesn’t mean we can forever run deficits that exceed GDP growth rates.

Christina Romer got how deep the problem was as early as November 2008. Too bad the rest of Team Obama was not on the same page.

Since this seems to be bash-Jim-Hamilton time, I shall throw in where I think he was most off, which was actually before the Great Recession hit. I am not going to go dredge around for the specific links, but Jim was one of the last to hang on to arguing that the housing bubble was not a bubble, a position that I gave him heck for back then here and elsewhere on more than one occasion. I grant that he eventually admitted that he had been wrong on that one.

There is an older intellectual debate involved with this, one that Bob Flood has participated in. It is the problem of the so-called “misspecified fundamental” regarding econometrically detrmining wheher or not a particular price series really reflects a speculative bubble or not. The gist of it is that while ex post one might see a price moving up and then sharply down while apparent fundamentals did not move, one may not be accurately identifying what agents were expecting the fundamental to be in the future, or just plain that what looked to be the fundamental was not, that it is very hard, maybe even impossible, to econometrically identify the fundamental with solid confidence. Jim was one of the first and most important to make this argument in general, as was Bob Flood in some papers with Peter Garber and others.

In the case of housing I think this argument is weaker than for some other markets. The problem is that in reasonably competitive real estate markets rents generally reflect market fundamentals pretty well. As the bubble proceeded in the mid-oughties, and economist after economist joined the bandwagon that people like me and Dean Baker and Bob Shiller and me and some others had gotten going much earlier, Jim continued to argue that the bubble might not be a bubble because of low real interest rates. I accept that this was not a completely ridiculous argument, but he stuck with it beyond when it could really be justified, and as already noted, he later agreed that he did so.

Of the various links and arguments here, I am probably most in agreement with Jim’s critics regarding his jumping too eagerly on the R&R bandwagon regarding the supposed 90% debt/GDP threshold, since shown not to be there, quite aside from the infamous and embarassing errors in the R&R paper.

Let me add a crucial part I left out in this. Rents usually reflect fundamentals in real estate markets well. So when one sees price to rent ratios climb high as they did starting after 1998 and reaching unprecedented levels by 2005, this looked awful lot like a bubble. It is true that low real interest rate justify higher price/rent ratios, but we had low real interest rates in several earlielr periods, and we had never seen price/rent ratios like those occurring in 2005-06 at the national level, although occasionally in some local markets here and there, generally accepted to have been bubbles after they crashed. Ed Glaeser gave an excellent Ely lecture on the history of real estate bubbles in the US a few years ago, a good source on much of this, along with the second and third editions of Shiller’s Irrational Exuberance book.

So, having done some bashing on this housing bubble matter, let me throw some stars and points Jim’s way (and also Bob Flood’s although he has lain low in this thread and I do not think said anything publicly about the housing bubble specifically at the time).

So I am going to grant that while a stretch, it was still possible to defend the misspecified fundamental argument doubt regarding the housing bubble even at its peak in 2006. The reason is that one could argue that rational agents were expecting either substantially rising rents in the future or further declines in real interest rates. I would say that the former would have been hard to believe for the national averages, but such an argument could hold with greater likelihood for an individual city.

I also note that there are some assets for which this misspecified fundamental argument does not hold, which I also note is quite a sophisticated argument that Jim and Bob and others should be admired for developing. One such asset is closed-end funds in cases where agents can freelyi buy and sell the underlying assets, which is not always the case as it was not for some closed-end country funds such as for South Korea at the end of the 80ss when the main ROK closed-end fund saw sharp rise in its price/net-asset-value(NAV) ratio, suggesting a likely bubble. ROK had strong capital controls on then limiting foreigners from buying stocks of their companies directly.

As it is, normally closed-end funds sell for small discounts, single digit negative percents, due to fees and tax effects. But if one can freely buy and sell the underlying assets, when one sees such a fund’s price/NAV soar to 100 percent or so and then crash, one can be near certain this is a bubble, with the misspecified fundamental argument not holding. This happened for closed-end country funds in late 1989-early 1990, something that I with Ahmed, Koppl, and White published on in JEBO in 1998.

I been quite consistent all along. I didn’t believe that there was a debt crisis before and I don’t believe there is one now.

On the other hand JDH couldn’t stop talking about the debt crisis back then, when 10 million people were out of work. But now, with even bigger deficits, after another Republican tax cut for the rich, it seems to have slipped his mind. Seems rather curious.

And when at every turn jDH chose what to worry about most, the highest priority, the most important crisis facing the country was the debt crisis. The human crisis, eh, not so much.

i think i have to go with joseph over 2slugs in this case. i very much respect prof. hamilton. but when i look at the dates of those posts, this was the time when intervention may have been the most effective. in the heat of the battle, prof. hamilton was calling for the wrong orders. and he was not alone. now, many rational folks with similar views understand today that the approaches they advocated a decade ago were not correct. it would be quite helpful if they were just as vocal today in explaining why their approach was not correct from a decade ago, to better educate the next generation when another crisis hits. otherwise we will get another rinse and repeat cycle.

Krugman has been clear here. When we are near full employment, this kind of fiscal stimulus needs to be called out. If James Hamilton was assuming we would quickly get back to full employment then his posts make sense. The problem is that the drop in aggregate demand turned out to be larger than what most economists expected back in the earlier part of 2008. And the weakness of our monetary tools were not fully appreciated until later. But yea – Dr. Romer got this right more than anyone else at the time. And she could still call out that nonsense from Gerald Friedman in 2016. She was a great choice for CEA chair. Alas her boss paid more attention to others when she was giving him great advise.

I am not sure it prolonged much. Debt is debt. Shutdown consumer loans with subprime debt and stop corporate leverage, growth is done. Looks like the cycle is done. Budget deficits provided no more growth.

All debt is the same? Congrats on making the dumbest comment of the day!

Maybe I was too busy reading everyone else on ARRA to have noticed what Dr. Hamilton wrote on this topic way back when. My bad and thanks for these selections. I’m curious if some of the leading old fashion Keynesians like Brad DeLong and Paul Krugman was reading Econbrowser back then and if they had a rebuttal to any of these quotes you have raised. BTW – I’m also one of those old fashion Keynesians so my adjective toward Dr. DeLong and Dr. Krugman were meant to be a compliment. Of course, I was on record back then noting that Christina Romer was giving President Obama excellent advice. Too bad Lawrence Summers wanted to water it down.

pgl,

Romer’s advice was good, and probably Obama should have pushed for a larger fiscal stimulus, but at least part of Summers’s advice involved looking at the hard realities of what the GOP in Congress would be willing to pass. Even with a push for more from Obama, it is quite likely the case that what got through Congress was about as much as going to be allowed to get through no matter what was initially advocated by the administration, although maybe they could have gotten a bit more.

The Effects of Tariffs and Trade Barriers in CBO’s Projections

https://www.cbo.gov/publication/55576 by Daniel Fried, August 22, 2019

In the Congressional Budget Office’s newly published economic projections, higher trade barriers—in particular, increases in tariff rates—implemented by the United States and its trading partners since January 2018 reduce the level of real (that is, inflation-adjusted) U.S. gross domestic product (GDP) by roughly 0.3 percent by 2020. The tariffs raise domestic prices, thereby reducing the purchasing power of domestic consumers and increasing the cost of business investment. The tariffs also affect business investment by increasing businesses’ uncertainty about future barriers to trade and thus their perceptions of risks associated with investment in the United States and abroad. In CBO’s projections, the economic effects of the tariffs wane after 2020, as businesses make adjustments to their supply chains to mitigate the costs associated with the tariffs.

Don’t forget that Greenlaw, Hamilton, Hooper and Mishkin came up with their own embarrassing version of the R&R debacle with their paper in 2013, in which they argued for a fiscal cliff at 80% of GDP. Their empirical analysis was based on Greece, Ireland, Italy, Spain and Portugal — all countries which cannot borrow in their own currencies — which is missing the entire point when they try to apply it to the U.S.

Their abstract includes this gem: ” In simulations of the Federal Reserve’s balance sheet, we find that under our baseline assumptions, in 2017-18 the Fed will be running sizable income losses on its portfolio net of operating and other expenses and therefore for a time will be unable to make remittances to the U.S. Treasury.”

Oh, well. Better luck next time.

Still curious about why no panic when Republicans run up the debt.

Let’s give professor Hamilton this much, he is allowing an open forum with open criticism of himself. That speaks highly of the man’s ethics and his belief in dialogue and sharing ideas. I can think of no higher compliment or characteristic of any man serving in higher education. [ Golf gallery applause inserted here ]

This is why prior to this blog “baselinescenario” headed by sirs Simon and Kwak was my favorite blog, they allowed both legitimate and non-legitimate criticism of themselves. Again, this action/behavior speaks very highly of them as individuals and their ethics. I’d think it’s the type of thing a Navy man would be exceedingly proud of his son for. Not that I’d know.

Yes, that is admirable, and he has also gotten lots of praise as the top time-series macroeconomist that he is. I would note that Menzie has also gotten quite a bit of criticism from some parties. Both of them are to be applauded for allowing themelves to be critiicized.

This is something that varies across blogs. Some do delete/block critical remarks about themselves, with Brad Delong having a rep for especially doing so, one reason I no longer read him, although he is smart and well-informed.

OTOH, there are others who put up with a lot of criticism, some of it much nastier and more personal than what goes on here. One is Tyler Cowen at Marginal Revolution, a place infested with some really nasty trolls, with quite a few of them harshly going after Tyler quite personally. Maybe he has blocked some of it, but there is plenty there that others would not tolerate.

On Econospeak, one of our bloggers does block some comments on his posts, but I let it all go, with at least one person periodically dumping on me in ways that would make what Moses has to say about me here look like hagiography. But I let it all stay.

i will second this comment. i had some harsh words for Prof Hamilton, and disagree with him (or what I ASSUME he meant with his columns-and i could be very wrong on that), but at the end of the day i would certainly want his input if/when we once again encounter dire straits. i may disagree with him once again, but i would certainly listen to what the man has to say. both he and Prof Chinn have my respect in that regard. their tolerance for those of us in the peanut gallery is commendable.

“Let’s give professor Hamilton this much, he is allowing an open forum with open criticism of himself.”

Agree. Greg Mankiw’s blog cut off comments a long time ago. Not because of trolls but because he did not like reasonable criticism of some of his more Republican-esque defenses of tax cuts for rich people. Which is too bad because he is one of the better of the Republican economists (make that former Republican in the age of Trump).