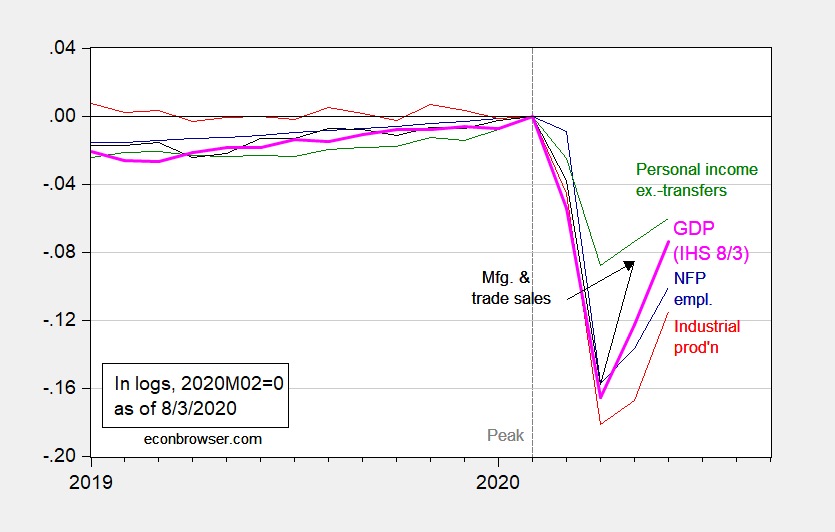

Here are five key indicators referenced by the NBER’s Business Cycle Dating Committee in Figure 1: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2019M02=0.

Figure 1: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2019M02=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (8/3 release), NBER, and author’s calculations.

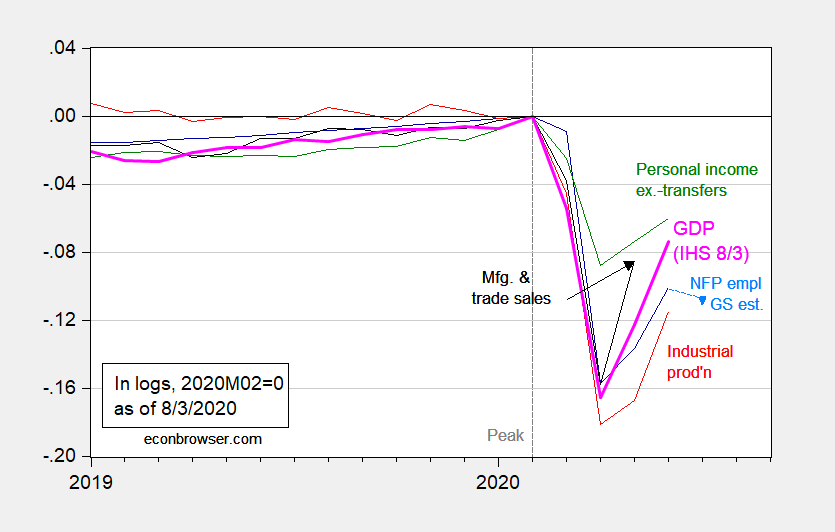

We will soon get July employment numbers. Goldman Sachs employment tracker indicates a loss of 1 million jobs, using data through 7/15. The picture looks a little less V-ish then.

Figure 2: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), Goldman Sachs Employment Tracker using data through 7/15 implied level of employment for July (light blue). all log normalized to 2019M02=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (8/3 release), NBER, and author’s calculations.

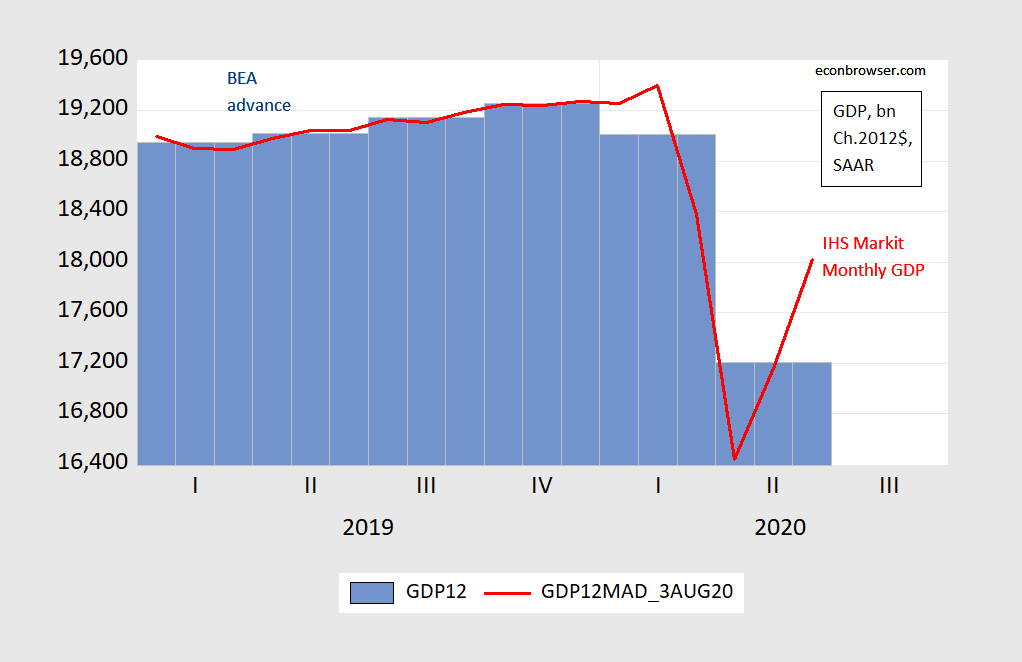

Finally, I place the IHS Markit estimate of GDP in the context of the official data.

Figure 3: GDP (blue bar), Monthly GDP (red line), all bn. Ch.2012$ SAAR. Source: BEA 2020Q2 advance, IHS Markit (8/3/2020).

The IHS Markit estimate implies a quarterly GDP 0.02% less than the BEA advance estimate. Today’s letter observes:

…zero growth of monthly GDP in each month of the third quarter would imply 20.4% annualized growth of GDP for the third quarter. This is about what we expect (we currently look for 20.1% annualized growth in the third quarter).

A zero m/m GDP growth in July is consistent with Goldman Sachs employment tracker estimate for a 1 million decline in nonfarm payroll employment, shown in Figure 2. So…we might either get a 2 month recession (for monthly data), or — depending on what happens to GDP and employment in August — a longer recession with zig-zags.

Addendum, 3 August:

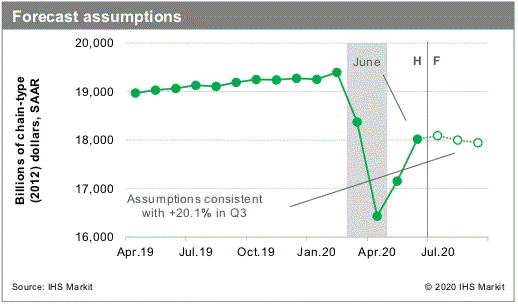

Here is a graphic depicting the IHS Markit forecast for monthly GDP, to make more concrete my view it’s likely to look “W”-ish or may “reverse radical”.

Source: IHS Markit, 8/3/2020.

For me, it’s an incomplete V so far, and we have a chance of W or reverse radical going forward if IHS Markit is prescient.

Did anyone here want to tell me how much this “stimulus” is if we calculate in the money multiplier effect?? Looking for a straight dollar figure here. : )

https://www.nytimes.com/2020/08/03/us/politics/yrc-coronavirus-relief-funds.html?action=click&module=Top%20Stories&pgtype=Homepage

Or maybe the mathematical economist of the James Madison Dukes can tell me how much that adds to future monthly consumer spending. Might be a record??

I’m being nice Uncle Moses tonight to one of the blog hosts and telling you that the Ari Melber interview with Steve Cortes was pretty entertaining tonight. Just do a keyword search in Youtube for those two names together. Get yourself a couple Reese’s cups and some dark truckdriver style coffee (and if you really need the double-whammy sugar jolt add ice to your coffee and some Torani salt caramel syrup) and let the good times roll. It’s 9 minutes and 2 seconds long. Cortes does the verbal version of Three-card Monte.

Actually, Moses, in terms of my original discussion that looked at what GDP would like at the end of the second quarter compared to what it was at the end of the first quarter when I posed that it might be higher at the end of Q2 than at the end of Q1, well, it looks that speculation turned out to be right, at least if the IHS Markit estimate shown by Menzie above is correct. It looks like at the end of March, which was the end of Q1, GDP was about 17.6 trillion while at the end of June, that is the end of Q2, it was about 18 trillion. That looks like an increase of about 2.2% (not annualized) from the end of the first quarter to the end of the second quarter, even as the average of the second quarter was 9.5% lower than the average of the first quarter for GDP.

Want to disagree with that, Moses? How about apologizing for all the ridicule you heaped on me when I noted the possibility of this based on indeed those monthly consumer spending numbers you were once again ridiculing here? Did you forget that Menzie had to correct you when you dismissed the idea that the growth of consumer spending in May was at a record level? Since we know you do not like to apologize, even when found to be blatantly wrong, I suggest you get some Reese’s cups to assuage your embarrassment.

Oh, and it sure looks an awful lot like a V shape as well. Want to admit that also, Moses, or are you blind?

What I’d like you to do, instead of hedging like the senile coward you have always been, is either tell us you’re still predicting a V-recovery or not. Either you are or you’re not. If you’re not, you need to shut the F up before you embarrass the students who are dumb enough to sign up for your class or take it when it’s the last open one on the schedule.

I know how discussion happens in your class Junior, and any idiot reading this blog knows as well, and I gotta tell you, it pains me for them. Laughing at your loud blathering and your leather pants doesn’t mean they like you. You’re like a teenage girl, you think any form of attention is good. If it could get you attention would you wear diapers and carry a baby rattle in your left hand instead of the leather pants??

BTW, I’m about to eat my dinner, so I don’t want indigestion too early, but I am gonna look up all your links and quotes, and put them right in this thread once again because the sad Shenandoah Valley prof wants to play revisionist history for the millionth time, and so we’re going to run through your ACTUAL quotes once again. But if you can show me the non-existent link where you said you thought consumption would be high in May before the BEA number came out, I bet all the readers here would love to see that nonexistent link. Or maybe pgl would like to put that quote up (pre-BEA May consumption announcement) for you?? It depends on if pgl wants to spend a millennium looking for predictions you never made I guess. Normally, I wouldn’t ask pgl , but you’re embarrassed of your own Quora links, so I thought I’d try to recruit help for your losing argument.

To anybody: I have no idea who first predicted V, W, Swoosh, L, etc. Barkley Rosser writes on 4/15/2020:

Moses Herzog writes on 4/5:

Maybe there are earlier claims to V or L or whatever. But it seems foolhardy to me to claim bragging rights for the guessing correctly the recovery’s shape given that so much depends on the political decisions.

Well, I did not expect the apology that really should have been delivered, but this doubling down on massive misrepresentations is quite over the top. Two points for starters for Moses: a) I am not now predicting a V, I did so awhile ago for the near term with Menzie’s post here proving me correct (see third figure above), while also saying that will flatten out, as it is doing so now; so current prediction is flattening out of the V that has happened, and b) I never forecast the high growth of consumption in May; I noted that it happened after the BEA reported it, which led you, Moses, to somehow attempt to deny that it happened, a point on which Menzie had to correct you.

So, this is really a waste of time for me and probably for most readers, but since Moses is going to go bonkers digging through posts here, I shall lay out the evolution of my views by citing my posts on Econospeak, with my comments here generally following my posts there. So following my comments that Menzie commented that I made here on 4/15 where I discussed L versus V versus the pattern I then thought was going on that had a slower rebound from a more rapid decline. Following that discussion of the “J” posed by Papell et al, I would propose this asymmetric pattern to be called a “lazy J,” a label you repeatedly ridiculed and that nobody picked up. Later it would seem that some were calling such a pattern a “swoosh,” which I switched to while still thinking it was the most likely pattern to happen, a view held by many here, including as near as I could tell, Menzie. This was rougnly late April well into June or so.

Thus on Econospeak on May 8 I posted “What is the Cycle as a Letter: V, L, J, U, or a Lazy J or Wiggly W?” In that post I suggested one of the latter two as the most likely. The data that was on my mind was the report that had come out on April 20 in Nature, after the comment I made here that Menzie quotes at length here. That article suggested that global carbon emissions bottomed out around April 7 and were increasing afterwards more slowly than they had declined, with the total decline amounting to 17%. This was important in influencing my view at that time that we would have the lazy J or swoosh, although I noted this was global data not US data.

On May 20 there I first posed the possibility that the second quarter might have positive growth, although I was at that time operating under the erroneous view that what we look at is end of quarter to end of quarter changes, which Menzie would later correct me on. Title of that post was “Maybe this is not (technically) a Recession?” I was still focusing on the precvously noted carbon emissions data and figured out that US had probably started growing by the end of April, which is confirmed by Menzie’s IHT figure above that actually has the bottom point about mid-April. I still held to a lazy J/swoosh forecast and even wrote “this will definitely not be a V,” but thought that the length of the slow growth period might outweigh the relatively short period in early April of much more rapid decline, thus leading me to say we might only have one quarter of decline, the first one, and thus not a “journalistic technical recession of two successive quarters of negative growth.” Again, at that time I was operating under a mistaken notion of how we measure these things, with the official BEA numbers (now out) comparing average GDP in each quarter, a very different measure.

Then things began to move more and my views would change. On June 1 I noted reports that global oil demand was growing.On June 5 I posted on “Jobs Report Not all that Surprising,” this being after it was reported that jobs had grown in May even though pretty much all forecasts had jobs declining. I cited both that carbon emissions had started rising well back in April and that oil demand was also rising, although I was still resisting the V idea, writing “I remain doubtful of a V shaped recovery.”

My change of view came with the release of the dramatic 17.7% retail sales growth numbers for April to May, which led me on June 17 to post “Might there be a V shaped recovery after all?” I noted that the April to May retail sales growth more than offset the -14.4% decline for March to April. I clearly stated at this point that “I may be wrong on my past forecasts.”

But, even as I began to see that the short term pattern was looking like a V I quite quickly moved to the position I have held since that it would probably flatten out, although we have not clearly seen that yet. On June 22 I posted “Is the Possible V-shaped recovery flattening as the second quarter comes to an end?”

I think my comments on Econbrowser largely track these posts. It was sometime around the end of June that you reappeared here, Moses, and then began denouncing me for changing my forecasts and demanding that I make more specific ones for the second quarter. I think my first response to you was to quote Keynes on noting that “When the facts change, I change my views. What do you do, sir?” That remains my position. I call things as I see them, but if new information suggests I am wrong, I admit it and change my position. That is what happened with my views as I moved from my prediction of a “lazy J/awoosh” to a short term V that would flatten.

Got it?

Oh, and where is that apology? Do you really wish to continue to deny that what happened from about mid-April to the end of June looks more like a V than anything else, even as we expect that V to flatten out after end of June? I challenge anybody here to claim that what Menzie has posted in that third figure above looks like anything more than it looks like a V. It has been the V shaped recovery I called in mid-June. Deal with it.

I do not think anyone could be faulted for miss classifying the shape of this recession.

First, no general recession-classification system exists. We all know how a V, U and W recessions look like; however, there are no rules as to their duration (? as far as I am aware). Judging from past examples it seems that a V-shaped recession lasts about a year (mid-point from peak to through to mid-point from through to peak). A U-shaped recession lasts for several years, say more than 2 years. Based on their duration, one can speculate that a V-shaped is likely to be caused by temporary shocks and induces little to no structural change in the economy. A longer-lasting U-shaped recession is likely to be caused by (more) permanent shocks and is accommodated by structural changes.

Second, any early speculation on the nature of the Covid shock was just that… a guess. We had and still have a very limited understanding of the Covid shock. We were speculating on the possibility of secondary outbreaks, duration of immunity, effectiveness of preventive measures such as masks, limiting gatherings, lockdowns, time to vaccine, availability of symptom reducing medicine, etc… Without this info the recession could range anywhere from V to W and one cannot fault economists for not knowing the answers to these questions (in fact, one cannot even fault the epidemiologists…).

The bottom line is that in the absence of a clear recession-classification system and lack of information on the severity of the Covid shock in May, no one could be faulted for miss characterizing the recession. Further, on, we still do not know how things will play out. In my view it is absolutely too early to judge the shape of this recession.

GBP-USD seems to be performing well yes?? Even when you compare the pound to the Euro it hasn’t done poorly the last 3 months. I was reading that Aussie policy makers might want to make the Australian dollar stronger. It’s around 0.71 now. Curious if “Not Trampis” thinks it can keep rising up from 0.71, because it seems to have had a very strong ride the last roughly 4 months.

My crystal ball just keeps getting prove cloudier and more made out of plastic all the time. I sure didn’t expect a V, but then we don’t know what’s going to happen with the relief bill staggering through Congress right now. Or what crazy things Trump might do. This is one of those rare times when chaos in Washington DC will have an immediate and direct impact on the economy. If the relief payments aren’t extended, then I would expect the V to get broken off a bit. If they are extended, then maybe it will continue to look like a V. The economy will not reach previous levels for a long time, though. So the second leg of the V is going to bend off to the right over time. I don’t see any way to avoid that.

Well, Willie, I pointed out here quite some time ago that it looked like a V in the short tun, noting the surprisingly high numbers for retail sales growth, employment growth, and consumption growth in May, with much of that appearing to carry on in June. I even speculated we might see GDP higher at end of Q2 than at end of Q1, which indeed has come to pass along with the short term V that has as well. Why are you surprised? Did you pay too much attention to Moses Herzon’s silly remarks?

I also noted well over a month ago that this V looked to be coming to an end, with growth clearly beginning to slow before June ended. The V was going to flatten. We do not have much in the way of numbers for July, but retail sales were up only 3.2% (not annualized, which is a noticeably smaller increase than in May or June. That V is flattening almost for sure.

I wonder if I made some of the SAME god-awful statements as made in Junior’s above comment to Willie as regards objective economic facts, if Menzie would feel the need to “interject” since I am not part of the professor’s club?? There’s zero animosity in that question, I’m just honestly curious what would have happened in that case.. I’m enjoying this one so much, I’m just going to let people read it and come to their own conclusions.

Looks like you got a convert then. I didn’t expect the economy to bounce back as far as it has, even though it makes perfect sense now. I can always learn something.

And for what it is worth, I glance over what MH says but do not study it.

@ Willie

Hey I get it Willie, the blind like following the blind. I don’t take it personal. I have seen those with the red hats following donald trump. And I know everyone has to follow their own North Star.

All of these quotes are from Barkley Junior, except for the final one by commenter “AS”, who I would rank as probably one of the top 2 commenters (NO I do not include myself in the Top 2) of this blog. They include the links, so anyone can verify, or check the context.

“But now it is clear this projection is too conservative. If instead we assume that the increase in June is twice what was forecast, the moves it up by 1,000 to 18,000;. That remains a net negative for the second quarter, but now of only 300. That comes to a measly quarterly decline of -1.6%.

I do not know what that becomes annualized, but it is certainly not as negattive [sic] as a -20% annualized rate.”

https://econbrowser.com/archives/2020/07/continued-recovery-in-june#comment-237996

“ ’Possibility’ it might be as high as -20% for second quarter? It now looks like consumption is highly likely to be positive for the second quarter kills any chance of overall GDP growth for the second quarter being -20% or lower. Heck, I would be very surprised if it is lower than-10%.”

https://econbrowser.com/archives/2020/06/gdp-nowcasts-june-26th#comment-237778

“As it is, yes, Frankel is indeed on the list of ‘authorities’ I am challenging regarding these projections of a massive GDP decline in second quarter.”

https://econbrowser.com/archives/2020/06/gdp-nowcasts-june-26th#comment-237929

“I do not know whether US GDP growth for second quarter will be positive or negative, but as of now it looks to be a close call,”

https://econbrowser.com/archives/2020/06/imf-world-economic-outlook-june-update-forecast#comment-237773

Barkley Rosser June 19th

“So it is highly likely that global GDP will exhibit positive GDP growth for the second quarter of 2020.”

https://econbrowser.com/archives/2020/06/guest-contribution-defining-recessions-when-negative-growth-is-too-common-or-too-rare#comment-237553

From commenter “AS” June 26th:

“Hi Moses,

As I recall, Barkley was the first and perhaps the only economist to say that we may have a positive 2020Q2 GDP, so I was trying to give credit to his comments which are far different from what the average of the forecasts by the various NowCasts.”

https://econbrowser.com/archives/2020/06/imf-world-economic-outlook-june-update-forecast#comment-237756

Folks….. two things. you might ask at this point. Question 1: Did Barkley Junior, after 3 decades working as a “mathematical economist” at a semi-respected but ill-named University “not know” that the number quoted by IHS, and the different Fed regions and quoted by Jeffrey Frankel, all of them un-camouflaged estimates of the BEA number itself, as apposed to, say, whatever number Larry Kudlow had made up, or some “Rt/R-naught” number the great epidemiologist Ron Vara had pulled out of his….. head…… did not know that BEA number was an SAAR tabulated number???

And Question 2: Why a PhD who can manage to use his keyboard for many things, can never provide links to anything??~~~(thereby giving him the excuse of not being able to link back to his own continually badly sourced data, while also misattributing quotes, and falsely quoting peoples’ argumentative stances, and having the excuse that “I can’t do links” when he repeatedly misstates the opposing person’s argument in a way that flatters his argument.

Nevermind Junior moving the football goal posts of Barkley’s own arguments….

I am sure everyone here is tired of these. I can assure you, I am exhausted of typing them as well. And on the day that Junior stops making asinine statements like those enumerated above, that is the same day on which these back-and-forths will HAPPILY end.

Still not admitting that you were dead wrong in your denunciation of my V forecast made in mid-June? There it is in plain view in the third figure shown by Menzie above, although maybe the fact that Willie thinks it looks like a V is some sort of trick by him due to his being part of “the professor’s club,” shame on him.

All four of the quotes you have pulled from here that look off are due to my having been operating with the incorrect idea that BEA was measuring quarterly changes as being what happens from the end of one quarter to the end of the next, a big mistake I credit Menzie with having corrected me on this matter. How big it is can again be seen by noting that the annualized rate of change from end of Q1 to end of Q2 according to IHS as shown above looks to be about +9.0% while official annualized BEA rate of change from Q1 to Q2, the change of average GDP per quarter, is currently estimated to have been -32.9%, obviously an enormous difference.

As for your obsession with SAAR, Moses, that is your obsession. Again, you at one point foolishly declared that all official numbers are SAAR, when in fact many are not, as Menzie had to point out to you. It was quite reasonable to experience confusion when numbers were being presented in the media without it being clear whether the numbers were SAAR or not. Continuing to drag this point up just reminds anybody paying attention of your error in proclaiming all numbers to be SAAR, just as Menzie seems to have pinpointed a quote from you where it at least looks like you said the recovery pattern would be an L rather than a V, even as later you denied making such a claim, even as I remembered you having done so. But, indeed, the actual recovery could not have been farther from an L and looks to have been a V in the short run.

Still waiting for that apology. You have been wrong, wrong, wrong, Moses, and even Willie sees it, and I certainly fail to see anybody stepping forward to support you or defend you here now, nobody, and certainly not Menzie.

Update – I did read what you said a few days ago, and it makes sense when I read it enough to say so. It has been a long couple days. And apparently we agree on what is happening, although I am the obtuse kid who has to find out for himself that grabbing an electric fence is not the best idea. (That was actually true about 50 years ago. It is a bad idea.)

Two stories on the Biden VP pick. First up the bow tie racist Tucker Carlson:

https://talkingpointsmemo.com/news/carlson-hurls-attack-on-black-women-for-potential-biden-vp-pick-probably-illegal

Carlson Hurls Attack On Black Women For Potential Biden VP Pick: ‘Probably Illegal’

‘Fox News host Tucker Carlson, who continues to come under fire for his racist rhetoric, zeroed in on potential Black women vice presidential candidates on Monday night, accusing Joe Biden of selecting them “exclusively” based on their race and gender and calling those candidates unqualified. Carlson, whose former head writer resigned last month after a CNN investigation revealed that he had posted racist remarks in an online forum, began his Monday night show by hurling an attack against Rep. Karen Bass (D-CA), Senator Kamala Harris (D-CA) and former Democratic Georgia House member Stacy Abrams.’

Wait – this pathetic little boy could not find a way to attack Susan Rice?

https://talkingpointsmemo.com/news/susan-rice-highlights-past-virus-response-efforts-as-she-vies-for-vp-slot

Former Obama National Security Adviser Susan Rice challenged those who have suggested she isn’t a qualified pick for vice president, saying Tuesday that her career has been dedicated to public service over personal political ambition. “It’s not about one’s own profile,” Rice told CBS when asked about the role of a vice president, adding that while some have suggested she lacks the experience of running for political office, she is proud of a career dedicated to serving others. “I don’t have a personal political ambition,” Rice said. “I have a longstanding commitment to public service. That’s been what’s defined my career.” But Rice, who has recently faced attacks from conservative news hosts and is said to be a strong contender as running mate to Democratic presidential nominee Joe Biden, says she does have a broad list of credentials that would make her a suitable governing partner to Biden.During her tenure as Obama’s national security adviser, Rice dealt with the Ebola epidemic, the Zika virus and the H1N1 pandemic. Rice said that her background as national security adviser in particular would be “very important” in tackling the crises faced by a new administration, including the COVID-19 pandemic, economic recession, and repairing the United States’ position as a global leader, “which is suffering enormously.” The former Obama administration official told CBS that the previous administration had handled the threat of disease “much more effectively than, unfortunately, we’ve seen as of late.” She added that a new administration would have “an enormous amount of work to do” to come together, to tackle challenges more effectively “than what we have seen under Donald Trump’s leadership.”

I was lucky enough to watch this interview live. Dr. Rice has impressive credentials. But Tucker Carlson does not like because: (a) she is black; and (b) because she is a woman.

I feel very strongly about this. I am on the record. I have proudly beat this horse so vehemently and repeatedly that no one recognizes that it indeed visually represented a dead horse at one time. For whatever it’s worth, I appreciate these sentiments by pgl . Again. It’s not that they “wouldn’t” falsely attack Rice on Benghazi. She fell on the sword for Hillary, with no “thank you” from either Barack or Hillary (again, which speaks to her personal code and ethics of public service). The question is, would people who are caught up in the Benghazi side show be “potential voters” for Biden anyway?? My argument is that they wouldn’t.

But who knows maybe Susan Rice had a private “off the record” meeting with Elizabeth Warren, and Susan Rice said during that “off the record” meeting that white women claiming to be “Native American” could never be U.S. President?? One never knows….. but if Elizabeth Warren shook her hand very gladly and happily AFTER that meeting, and then decided not to shake Susan Rice’s hand after being called out as a liar~~~how could we not believe “Native American” Senator Warren?? I surely don’t know.

Maybe Barkley Junior has a “skewed” distribution he’d like to show us of a Native American admixture that’s been intermingling with European Americans over the last 500 years?? Seems like a “realistic assertion” to me…….. And really, why would anyone argue with that?!?!?!?

Wow, you are just totally losing it, Moses. Can’t see a V that is staring you plain in the face, and now you are dragging up skewed distributions yet again, one of your most embarrassing and completely idiotic memes ever?

I happen to be OK with Susan Rice, and the Benghazi charge is indeed a bunch of baloney, although the Trumpists will certainly drag it out and throw it all over the place if she is the pick. But she does have real baggage, some of it pretty serious as pointed out on Sunday by Dana Milbank in WaPo. One of the worst items is her support for a Rwandan dictator guilty of genocide who was a client of hers. This is substantially worse than doing one’s job by putting people in jail for marijuana when that is what the law demands.

But, again, I am OK with Rice as I am also with both Warren and Harris, well noting that all three of them have baggage that the Trumpists will throw at them, In some cases the baggage you have yourself spouted here at length, such as all that Pocahontas baloney about Warren that led to your embarrassingly incorrect claims about skewed distributions that you have astoundingly brought up again. It is like we are getting to see the greatest hits here of your stupidest remarks ever made on Econbrowser.

The buzz this morning is the short list is down to two candidates – Dr. Rice and Sen. Harris. The latter would be a decent choice but Dr. Rice is the right choice for so many reasons.

Nope. Rice is going to join the administration. She isn’t a candidate for VP. There is no gibberish. They want experience in running government. That is a direct Jill Biden quote. Harris is a nonevent.

Maybe stop listening to biased media which is clueless.

Biden doesn’t want a black women. He isn’t comfortable and it shows. White women are by far the biggest voting bloc in the Democratic party.

No it doesn’t, Rage. Sometimes you are as stupid as Moses Herzog.

Are you insane? You usually write gibberish and this I guess is par for the course.

You expected any different from a guy like Tucker Carlson?

We have found someone even dumber than Bruce Hall and his name is Donald Trump!

https://www.msn.com/en-us/money/other/trump-replied-you-cant-do-that-when-his-interviewer-pointed-out-the-uss-terrible-record-on-covid-19-deaths-per-capita/ar-BB17ybwE

Trump replied ‘you can’t do that’ when his interviewer pointed out the US’s terrible record on COVID-19 deaths per capita

When Swan pointed out that the US was averaging about 1,000 coronavirus deaths a day recently, Trump said “but you’re reporting it wrong.” Trump also repeated a favored talking point by claiming the US had a higher recorded case count than other countries only because of its high amount of testing. Experts say this is not true. President Donald Trump refused to acknowledge the seriousness of the US’s high per capita death rate from COVID-19 in a tumultuous interview in which he instead argued for more flattering statistics.

Look we all know Trump lies 24/7. But his also an utter moron. And Bruce Hall is his Minnie Me!

How Jonathan Swan kept his cool is beyond me. I would have been on the floor laughing.

I think maybe because the virus people have the doldrums. And negative outlook. So we have to find the little patches of sunlight where we can?? Well I found something I thought is kind of a “bright spot”. Most of us here are anti-trump yes?? Or half certainly of those who comment?? Kris Kobach was such a trump ally, and I don’t know much about Roger Marshall, but I have to think he’s not as close to trump as Kris Kobach is. Kris Kobach is losing so far tonight. I haven’t seen the precincts reporting yet, but it’s so late at night and NYT has Marshall leading. Will Kobach go running back to trump for a job?? I have to think it’s a decent bet. But I have to think this is at least semi-good news. Kansas is a red state, so when they choose someone else over Kobach I have to think it’s “something”. Hope it brings a half grin from someone out there.

Some of the numbers are interesting on the IGM/538 survey. I keep checking back intermittently. Not ready to make predictions, but I would say there were some things about question 9 that did get my attention. These things are actually more fascinating when there is more “gray” area or mystery, which at this portion of 3rd quarter estimates is very high in the mystery dept. I was 4% off on my BEA 2nd quarter GDP guess. I’m presuming that number will widen on the revisions, but we’ll see.

Moses,

Congratulations on being that close. Now maybe you can help all of us figure out which letter or symbol that third figure Menzie posted most resembles, the one showing the time path of GDP. I have said it most resembles a V. But then, as you have so eloquently explicated, I am a “senile coward” no better than Nancy Pelosi or Joe Biden, and on my last Trump-approved dementia test I mistook an elephant for a baboon. so, maybe you can help out here and we can stop upsetting these poor folks with all out “shouting past each other.”

You said it Kris, we didn’t.

https://www.motherjones.com/politics/2020/08/kris-kobach-senate/

From the Jessica Huseman authored story:

“Kris Kobach spent the final days of his primary campaign denying that he’s racist. “If I’m a white nationalist, I’m not a very good one,” Kansas’ notorious Republican Senate candidate said at his closing events. In fact, this statement is entirely true. Kobach has the record of a white nationalist, just one who has repeatedly bungled his agenda.”

https://www.propublica.org/article/kris-kobach-voter-fraud-kansas-trial

Please moderator, tell Barkley and Moses to “Take It Outside”

I think they are shouting past each other.

They are. And one of them tried to get me to referee. As usual – I just skipped their fussing with each other.

For the record, I did not ask pgl to “referee” this shouting. Menzie made some substantive remarks as did Willie, and Vasja sort of flew above the fray. Then DD came in before acting like all are equally at fault and repeating his previous command to “Take it outsided.” There is only one problem, DD; there is no outside.

Again, I am going to put you on the spot. I admit I do not respect your high and might attitude. Does that third figure look like a V or not? You and everybody else here know that it does, and if you are too chicken to say so, well, too bad.

Yea it was Moses that tried to drag me into this. But does it really matter? Come folks – it is almost time for the next Tucker Carlson Show and I’m trying to perfect my ability to discern dog whistles.

I can’t criticize too harsh because I listen to Alex Jones for chuckles sometimes. But we may have to flag you for some violation here. Penalty no Brooklyn delis for 3 weeks or something.

That is curious, pgl, and I understand your reluctance to get into it, given that the last time you did Moses indulged in personally attacking you, pretty much as he does anybody who disagrees with him, with the slight exception of Menzie, who only gets dismissed with a wisecrack about his being in the “professor’s club.”

Anyway, I am going to revert to trying to follow Dilbert’s request, even thought doing so in the past has amounted to obeying to a request to me to “shut up” because Moses just seems to level an ongoing stream of abuse at me disconnected with whatever is the topic. I get it that he is beyiond, lost in “borderland hate”for me as he has stated here. But I shall go back to just taking it.

But it would be nice if somebody like Dilbert would recognized that his requeest is essentiallly a one-sided one, given how things go around here.

Turning on the Television when Tucker Carlson is spewing should be enough. Everything he says is a deafening dog whistle. Wear ear protection.

pgl,

You did well to step in and support Moses in correcting me when I was misspelling “McKinnon.” I am not an unbiased observer, but I think your credibility is reasonably in tact. And I do take correction when I am clearly wrong, as I think the record shows.

So, DD, do you think the third figure Menzie posted looks like a V, an L, a checkmark/swoosh, a U, a W, or none of the above? This is really quite simple: I say it looks like a V, and I have seen nobody openly disagree with that, although MH denounced the possibility of a V in the past and has not renounced his denunciation.