Today, we are pleased to present a guest contribution written by David Papell and Ruxandra Prodan, both of the Department of Economics at the University of Houston.

Even as the US economy plunges into recession, there has been a great deal of interest regarding the shape of the recovery from the coronavirus pandemic if and when potential GDP returns to its trend path following the trough of the recession. Will it be V-shaped with a quick recovery, L-shaped with no recovery, or U-shaped with a prolonged bottom after the trough followed by a fast recovery. These choices have been discussed by Menzie Chinn, John Cochrane, and Janet Yellen.

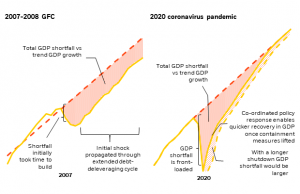

The BlackRock Investment Institute has proposed a different scenario (presented below) where, while GDP eventually returns to potential, the recovery is much slower than with a V-shaped recovery. We propose that this type of recovery should be called J-shaped. The terminology comes from the J-Curve, where a devaluation first causes a trade deficit before reversing itself. As with the J-curve, the recovery part of the J is tilted to depict the long return.

Severe recessions following financial crises provide historical evidence for J-shaped recoveries. We presented a paper, “The Statistical Behavior of GDP after Financial Crises and Severe Recessions,” at the 2011 Boston Fed Annual Research Conference, the proceedings of which were published in the October 2012 BE Journal of Macroeconomics and summarized in an Econbrowser post on October 24, 2011. We use structural change tests to estimate how long, if ever, it takes to return to the trend path of potential GDP following severe recessions associated with financial crises. In contrast to the V-shaped recoveries that characterize US recessions between World War II and 2008, the recovery from these recessions takes much longer. We consider recoveries from five severe European recessions characterized by a sharp drop in GDP analyzed by Carmen Reinhart and Ken Rogoff in their 2009 book, “This Time is Different, as well as the Great Depression in the US. While potential GDP is eventually restored, the return to the trend path takes an average of nine years. We later used the same methodology to analyze the recovery from the Great Recession in a February 17, 2015 Econbrowser post. In contrast with previous experience, the recovery is L-shaped with potential GDP never restored.

At this point, of course, we do not know what path the recovery will follow. The historical experience of recoveries from severe recessions following financial crises, however, may provide some guidance. Based on the projected magnitude of the recession and the slow re-opening of the economy, we believe that a J-shaped recovery is more likely than a V-shaped recovery. It is also more likely than a L-shaped recovery because, as discussed by BlackRock, we do not expect the initial shock to be propagated through an extended debt deleveraging cycle. Finally, it is also more likely than a U-shaped recovery, since the latter implies a long bottom followed by a fast recovery, which we do not see in the historical experience.

This post written by David Papell and Ruxandra Prodan.

Long term possibility. People become more frugal as they did post Depression. Greater savings less consumption.

Short term concerns are supply chain problems have not gone away. will yanks trust trump when he says everything is ‘beautiful’. or will they stay in homes and not spend much.

both consumers and businesses will have to build up savings,

Remember it is much harder to reduce unemployment. It takes time.

People will stay home and spend less. Those with work will not have restaurants and night clubs and boutiques to spend money in. All those people who worked in those small businesses will be looking for work. As life returns to semi-normal, some of the delivery and other emergency hiring will reverse. Plenty of people will not have work, and will not spend money. The combination of the Great Recession and now this will leave mental scars on plenty of people. They will save and save.

It will not just be us Yanks.

Will try to get around to reading the entire paper. Already DL’d it

I suspect that they are pushing the idea of a J-shaped recovery because of Papell’s background in international finance, where these apply to balance of payments responses to devaluations. But I doubt this is really applicable here. Recessiona have a downrurn that hits a bottom and then goes up. The question at hand is how that upturn compares with the downnturn, not deciding to compare based on some point prior to the downturn hitting bottom, which is what a J-curve implies.

As it is, I would say there are three cases, although we have very rarely seen one of them. The one rarely seen is the L-curve, that lots of peeople are talking about but which there is almost no evidence of being likely to happen, and indeed, I cannot name a depression or recession that has clearly exhibited that, which would involve a long flat bottom period of zero growth (uh oh, there I go again, indulging in oxymorons!). Can anybody name any suvh event in US economic history? I know of none.

So the main choice is between a V-shaped one where the uptrun is as fast as the downturn, and we have seen such events, and something else that does not have a cleear name, but which is what I think the authors here are proposing, not unreasonably. I think this is usually described by the terminology of “asymmetry.” So we quite often see situations where the downturn is faster than the upturn, not a flat bottom like the almost-never observed L-curve, nor the symmetry of the V-curve. Indeed, I think this is the most common pattern: downturns tend to be sharper than the subsequent upturns, but there is not a letter that corresponds witt shis.

So this I think iis what the authors are proposing, that the upturn will be slow, but it will not linger at some floor just flat on its back. Unfortunately, using this terminology of a J-curvee just confuses things by shifting the focus to some point before the downturn hits bottom, when the point is the lower nature of the uptrun compared to the downturn, which is indeeed just a standard asymmetric downturn. As it is, I would agree that this latter is quite likely, with the most obvious alternative, a V-curve, highly unlikely for a lot of teasons, although if we do see such a thing, it will be because of all the stimulus that has been applied to the economy simply gushes through and pushes up such a return. Obviously this is what Donald Trump would like to see.

I am retracting much of my comment above. On reconsidering it, all of these look at the total pattern of the decline and recovery, however we label the letter describing it. J-curve certainly fits the idea of an asymmetric pattern with a sharp decline and a slower recovery. Probablyi the most questionable part of the apbve piece is presuming that it will get back to the former potential path.

@ Barkley Junior

If only your mother was here to witness this moment:

https://cdn.someecards.com/someecards/usercards/-i-have-only-been-wrong-once-there-was-a-time-where-i-thought-i-might-be-wrong-but-that-turned-out-not-to-be-the-case-9fb07.png

Probably would have been overcome with tears of joy.

Oh Moses, I have admitted I was wrong here on quite a few occasions. You just forget that I did so because I tend to do it quickly, apologize to the extent appropriate, and move on. You prefer to deny you were wrong about things everybody says you are and keep bring them up and over and…

Heck, just a few threads ago I admitted to Macduck (and john) that I was wrong to say that “negative economiic growth” is not an oxymoron, although in that case after initially apologizing ti then proceeded to say that I thought they were silly to make a fuss about it, and that economists in general, way beyond me, will continue to use that terminology.

However, I wish to make a third comment no the matter of substance here. I am in more of an intermediate position between my precious two posts. While I think the post Menzie has put up is technically correct, it is I think somewhat misleading as presented, more than just my doubts expressed in my last comment here that I doubt we shall get back to the old growth path.

I think it is more misleading in the figures shown, which go out of their way to make the path look like a J, with a steep long term growth path that has GDP soon way above the high point before the decline. This I think is really off. I think the coming period of positive economic growth (see, I am being bad again) will be much slower than they make it look like. They make it a J that looks not too far from a V with a long right end going up. I think it will be much flatter, probably closer to an L, especially given how sharp and deep the decline is that is still going on. I do not think it will look at all like a J, way to flat.

Indeed, a point I made in my original post remains accurate, all they are really arguing is that we shall see something that has long been the most common form of shape to recessions: an asymmetric pattern of sharper decline than increase. We have not had a V-shaped recovery since at least the early 90s, if not since the early 80s, when we definitely had ont. But in fact, these flattened Js, if they are even worth calling that, have been the norm much more common than Vs, and certainly more common than the nearly nionesitent Ls. Indeed, can anybody name any recesion that looked like an L? I cannot.

Oh, and final note for Moses. My late mother, who played string quartets with Albert Einstein (really), saw me admit to being wrong many times, and as she lived to be 97, that was many times. She would have found this matter rather boring.

Oh, and, fun and games, Harrisonvburg with its a bit more than 50,000 people, has just turned into a super hot spot for covid-19, with cases rising from 119 yesterday to 214 today. Hope all of you are staying well, even you, Mose, :-).

To My Dearest and Most Comically Diverting Septuagenarian:

Can you do me a big favor?? Can you grab some good reading glasses and tell me what you see there?? Can you make that out??

https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?end=2007&locations=JP&start=1990

If you are asking me, Moses, I am not looking at any of your links, given your past record of linking to uttterly worthless garbage. If it is really so wonderful and important, how about you just tell us what is in this link, please.

Barkley Junior

You are obviously having problems figuring it out. I bet other readers are not having too much difficulty. If Menzie thinks there is no point in the graph or it’s not pertinent to the thread I’m more than happy to expound. Something tells me, as someone much more intelligent and edified than you on economics matters, that Professor Chinn “gets” my point. As much as it humors me, it certainly doesn’t surprise me you have no idea what the hell the World Bank graph is expounding.

As I have said repeatedly, Moses, I am not opening any link you provide. You now tell us that is some sort of graph from the World Bank. Maybe others have looked at it and find it interestiing, although I see zero people here commenting on it.

Again, if it is so important, how about you just tell us what it shows. Making stupid remarks about how I “obviously having problems figuring it out” shows that you are obviously haviing problems reading what I have writeen: I am not opening any link you provide because of your long history of providing links that are just worthless garbsge.

Yes, My World Bank links referring directly to the post topic of the shape of a recovery just cannot compare to your inability to post ANY link (I think I could instruct a 10 year old Down syndrome child to do a copy/paste of a link) cannot compare to your “Quora” non-linked references. You got me on that one Fred G. Sanford.

https://econbrowser.com/archives/2018/11/origins-and-challenges-of-a-strong-dollar#comment-218761

The above Barkley Junior comment containing a link to Quora, given by who?? Great reference there. Of course, Barkley Junior quotes it, then is so ashamed of his own sourcing, suddenly becomes unable to perform a simple copy/paste to his own crap.

This is the same stunt Junior pulled in the last week, literally linking to an editorial commentary, and, I kid you not, bastion of hard journalism “www.dailysignal.com” as his “proof” that “the best” theory on the COVID-19 virus now, is that it was created in a Chinese research lab.

Well, a PhD referencing editorial commentaries and “dailysignal.com” as “proof” of his “best theories right now”. Folks, that’s certainly hard for me to top. I just can’t.

So, Moses, your WB link says something about the shape of the recovery. What is it, V or J or L or something else? Can’t say? Pretty obviusly not a single person here thinks whatever it says is worth commenting on. And in fact this is pretty much always the case. You supply lots of links, and I cannot remember a single time anybody commented on any of them. None of them have been worth commenting on, none of them. Oh, Moses, there probably have been one or two. Maybe you can go back and dig one up for us with the commentary following it. I challenge you to do that, since you are so proud of your ability to provide links.

And, yes, since you seem to want to make a big deal of it, you are a lot better than I am at providing working links here. I have never claimed I was good at it, and avoid trying to do it because I regularly both it up.

OTOH, I regularly provide titles or phrases that will lead one instantly to what I am talking about if one googles them. That was certainly the case for this story that the virus may have come out of a lab in Wuhan, not some weapons lab, but ironically one studying how to protect humans against coronaviruses coming from bats. I have provided titles and authors easily found, including a column by the super well-nformed David Ignatius, and noe more recently the story by Josh Rogin in WaPo that ended up being reported on in national radio and TV about how in 2018 Us physicians on a WHO team that visited that lab in Wuhan wrote cables to the US State Dept. expressing concern about what they considered to be lax safety practices there. Unlike you, I tell people what is in the stories I am referring to as I provide a way to find them, even if it is not an immediate direct link out of here.

BTW, in today’s WaPo the latest account of the initial transmission, from fact checker Glenn Kessler, is that it was almost certainlyi originally from bats and most likely from an animal possibly at the “wet market” in Wuhan long suspected, although bats are not sold there so it would have had to have been from another animal that got it from a bat or that it originated from “an accidental spill” at the nearby Wuhan virology lab mentioned in the 2018 cables. It was almost certainlhy not due to something created consciously in a lab either as a bioweapoin or something else. As of now, we do not know which of these explanations is more likely, and given that the wet market was closed and cleaned up on Jan.1, it is highly likely we may never know, or at least any time soon, as I previously wrote.

Bottom line: I provided a story that looks to be true and provided information on how ti find it by googling, even if I did not provide a direct functioning link. You provide links you never explain and that nobody bothers to comment on, and the few times I have linked to them they proved to be utterly silly worthless nonsense, although maybe occasionally some of them are not, maybe even this one you claim is from the World Bank supposedly telling us something useful about the possible shape of the recovery, even as you refuse to tell us what that might be. And, as always, nobody has stepped forward to thank you or comment on whatever iit shows.

I would argue both 1990 and 2000 were U recessions. I might even put 1980 in that as well.

1980 to 1983 was awful. Especially for those of us who were fresh out of college and who had always held blue collar jobs because the paid better. There was precious little blue collar work and no work for new grads with no connections. But, that experience did instill a lifelong fascination with economics and the consequences of economic events.

Ok, back to the real discussion.

Bottom line on recovery shape, not using a model, I say a”lazy-J” so tilted over it is closer to an L than a V. Maybe Moses’s supposed World Bankgraph provides an answer.

Oh, and on the origin story, I did just google “Wuhan virology lab as origin of coronavirus..” There are plenty of links there. The latest story that has been on LiveScience and the Hill and came out a day ago is that the director of the labe in question is denying that it came from her lab to the point of “swearing on my life” that it did not, despite those 2018 cables from US visitors there warning about it, and the fact that they have since at least 2015 been studying SARS coronaviruses originally from horseshoe bats in Yunnan province hundreds of miles south of Wuhan. Indeed, they have items closer to SARS-Cov-2 than anything else out there, although still some distance. But even in the LiveScience story reporting the director’s arguments, it is noted that mutations could have occurred in the lab with it then getting out by accident, with an infected person at the lab spreading it at the nearby wet market that was shut down on Jan.1.

The alternaitves have no data supporting them. Given that they did not sell bats at the wet maeket, the leading alternative to the Wuhan lab as the origin is that somehow it got from bats hundreds of miles away to some intermediate probably mammalian animal, from which it then spread to humans at the wet market. This is possible, but a further problem is that there is no clear evidence or indication of what that intermediate animal is or was. This then amounts to a not unreasonable speculation that is possible, but that for now is lacking in a shred of actual evidence supporting it. It remains highly likely that we shall not be able to determine the answer to this ultimate origin story, possibly ever (and the lack of a definite answer on the origin story of the Spanish flu may be a sign of how this ends up).