Or, between identities vs. functions. Reader Corev comments:

… I’m amazed at the willful deceit and cognitive dissonance exhibited by liberals, especially economists. With production components, commodities’ prices, rising by YUGE fractional amounts, these same folks can not admit their inflationary impacts. Worse, they won’t and can not admit their future inflationary impacts. POLICY, POLICIES impact economics! Energy and other commodity production policies especially so.

At this juncture, it’s useful to distinguish between identities and functions. Suppose the overall price index is given by the geometric mean of energy and nonenergy prices:

This implies, by definition:

So, it would seem that if energy price inflation is positive, then ceteris paribus, overall inflation must rise. However, buried in there is an assumption of nonenergy price inflation not changing in a correlated fashion. If nonenergy prices fall, then it’s possible for the overall inflation rate to be higher, lower or even unchanged.

This seems obvious, but this sort of reasoning-by-identity logic shows up elsewhere, such as the argument that by merely eliminating the trade deficit, output would be commensurately higher. That too is reasoning by identity.

Now, it might very well be the case that rising energy (and other input price) inflation will push up overall inflation. That logic usually comes from an augmented Phillips curve. But one of the interesting aspects of such energy shocks over the past few decades is how little an impact there’s been on inflation, as discussed in this post. Jim provides a somewhat different view.

How to reconcile the alternative views. First, it’s to realize that inflation can generally be described by a Phillips curve specification, which nests different views about nonstructural parameters.

Notice the “=” sign implies this is a function, not an identity, about inflation π. The z variable summarizes the impact of input price inflation on overall inflation (so maybe z is given by:

Unless one is taking a strict New Keynesian interpretation of the Phillips curve (in which case the output gap should be some measure of marginal cost), then one doesn’t “know” the parameter values — one has to estimate them.

What you believe will happen with higher energy (or other input) price inflation then depends on your belief about parameter values. For a “recent-ish” survey on Phillips curves, see Blanchard, Cerutti and Summers (2015).

More on short and long term inflation expectations here.

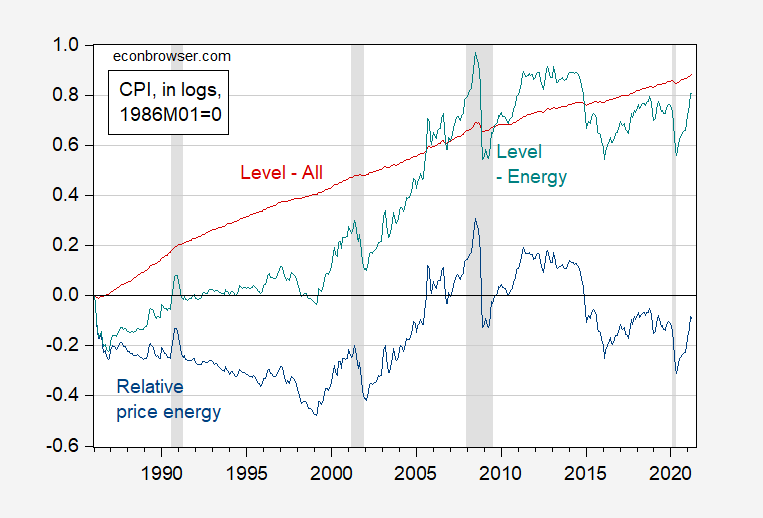

Below is a figure of CPI overall, energy, and relative price of energy to nonenergy.

Figure 1: Log of relative price of energy to nonenergy components of CPI (blue), of overall CPI-urban (red), and of energy CPI (teal), all 1986M01=0, s.a. NBER defined recession dates shaded gray; assumes last recession ends 2020M04. Source: BLS via FRED, NBER, and author’s calculations.

I realize that this excellent and straightforward discussion has escaped CoRev’s constant confusion but permit me to ask one question. What is the weight (alpha) for energy in the overall price index. I suspect it is rather modest.

pgl: According to BLS, latest is 6.9% for year through April. See Table 7, here.

Damn, I was gonna honestly answer that one. My numbers were dated (old) from 2017, but then it was about 7–8%. But then, isn’t the immediate next question the percentage of that on input prices?? I assume there’s no number for that, certainly it would surprise me if there was.

Thanks.

Energy commodities is 3.8%

Energy services is the other 3.1%

And since the latter is usually regulated, energy services prices would likely not be rising as fast.

Trying to answer my own question about how important energy is to the overall cost of living, I tried Google and found this:

https://www.eia.gov/todayinenergy/detail.php?id=26072

OK five years ago energy prices were falling but we did not see deflation. Why? It seems EIA put the energy share at a mere 8%. Yes the HYPERinflation freaks such as Princeton Steve, CoRev, Sammy, and Bruce Hall have their panties all wound up over something that is less than 10% of the budget. Then again I think Bruce Hall gave up on bleach and not taking daily doses of gasoline to treat COVID19.

Did you forget John “Grumpy Economist” Cuckrant??? He’s the true star of The 5 Stooges.

But let’s tell it like it is, the band was never the same after PeakTrader, CoRev, and Ed Hanson left for their solo music careers.. When John Cuckrant took over playing one string bass guitar on the less-than-successful single “Inflation!!!!! Inflation!!!! Inflation!!!!! Inflation!!!!! I said INFLATION!!!!!”, it was like David Gilmour taking over for Syd Barrett. Sure, the guitar got better, but all the zany laughs were gone.

Did you see this “gem” from Bruce Hall?

‘I would guess that the winners in a >5% inflation scenarios would be those in the higher income brackets while the losers would be in the lower income brackets who tend to have fewer assets and relatively fixed incomes. If so, the current monetary expansionism leading to higher inflation would seem to hurt the “little people” whom the progressives so vocally profess to want to save’

Not that we are about to see 6% inflation but even if we do – could someone remind Bruce “no relationship to Robert” Hall that Social Security benefits are indexed? And why would nominal wages be fixed in a period of higher inflation? They wouldn’t be. Like these concepts are usually taught early on during a freshman course in economics. But I guess Bruce Hall is still taking off his shoes to count past 10.

The other lapse in knowledge evident in CoRev’s yelling-at-the-TV style rant is that “liberals” (whoever they are) and economists (you know who you are) won’t “admit” to the possibility of inflation resulting from current policy when inflation is the state goal of policy.

So, for those of you who pretend to know about monetary policy, economics and stuff, but actually don’t, here’s the scoop: the Fed’s goal is to increase the rate of inflation from its recent (15-year or so) average. In public. In writing. Stated goal. OK?

The Fed’s three big concerns in the past few years, concerns which led to the adoption of a brand new operational paradigm, have been:

1) Inflation is too low

2) The Fed may not be able to boost the rate of inflation

3) The Fed may not be able to convince the public that the Fed can boost the rate of inflation.

Nobody, nobody, who knows anything about the state of current economic debate could have honestly written what CoRev wrote. Which leaves two non-mutually-exclusive possibilities regarding CoRev’s thinking at the time that he wrote…

Which leads to a question that is far more interesting that CoRev wrote at the behest of his master’s. Or that CoRev could ever write.

If there is a secular rise in inflation, will it be because of the Fed’s efforts? Ahead of the fact, we can’t tell, of course, but how would we tell? Demographic change, changes in the rate of productivity growth, global warming (yes, in the current cycle), policies other than monetary policy, monetary policies other than the Fed’s – it’s all so messy. What would a true Fed policy success, in the Fed’s own terms, look like?

If the Fed succeeds, is the current policy regime the right one? Setting aside reluctance to change regimes, should the Fed abandon whatever form of price-level or inflation targeting* it has now once the job is done? I think a 2% target is too low to abandon an explicit policy of making up for lost inflation, but maybe there are risks or distortions that I have undervalued.

*Whatever it’s declared program, we won’t know what the Fed is doing in practical terms until a cycle of two have passed.

Republicans and Rand Paul types want to blame “the Fed” for everything. Because they know it’s a topic rednecks do not understand at all. “The Fed” is a big brother-ish sounding term, the same as “big government”. To people who can’t read it’s either very abstract, muddied up in federal government bureaucracy, or BOTH. While they try to tie it into paper money growth, it often has no connection, and even the money that is created mostly benefits bankers and broker/dealers because they charge interest on it. How does that get out to the guy working at McDonalds?? This is why monetary policy is largely a joke, or it certainly is in the current context. Most of it is a ruse to act like they are doing the working man a favor when all they are doing is recapitalizing banks who then turn around and either sit on the money or lend it out to folks like hedge funds.

Of course the easy way to stop A LOT of the conspiracy theory crap related to the Fed would be for the Fed (i.e. whoever it’s current Chairman is) to take the Fed’s regulatory function seriously, which they have ever and only done ONE time, when Janet Yellen hit the exit door and announced possibly the only truly good thing the Fed has ever done—the punishment on Wells Fargo. But they aren’t interested in that, they are only interested in handing out more “throw away” capital (what idiots in Virginia call “liquidity”) to their friends labeled “the broker/dealers” while they have guys like Gundlach, Santelli, and Sam Zell waving the naughty finger at middle America for taking out loans.

be careful, you almost sound like rand and ron paul there at the end…

I’m sharpening up my presidential announcement speech. Too much??

Obviously this not not realistic. Just play along with me here for chuckles:

Do you ever wonder if you could do a “blindfold test” on folks like sammy, CoRev, and Bruce Hall, and they just had no idea which party the current President belonged to, or even better, you told them that there was a Republican President from 2008–2016, and a Democrat president from 2016–2020, that they’d know the difference in the blindfold test??~~or say that they were even more happy in 2008—2016 than they were in 2016–2020 if you told them the current party in power was the reverse from the reality in which it was?? How much would you like to wager they’d be telling you how much their life was really a pleasant experience until “that Democrat” took office in 2016 and made it a living hell?? They have no idea what makes them happy or sad until they check with FOX news or Alex Jones. No idea at all. It’s like FOX/Alex Jones/Glenn Beck are tied into their brain’s release of dopamine.

“It’s like FOX/Alex Jones/Glenn Beck are tied into their brain’s release of dopamine.”

I think it’s exactly that, inextricably interwoven with their tribalism, of course. Their arguments flip 180 degrees when the party in power changes.