A reader writes:

I think, however, there is a need to more closely examine the overheating of the economy and paths and timing of unwind, for example. As you’ll recall, I argued that the economy was under suppression, not recession, and that’s proving right. So we’re seeing a kind of overheating I can’t recall since maybe the late 1960s or 1970s.

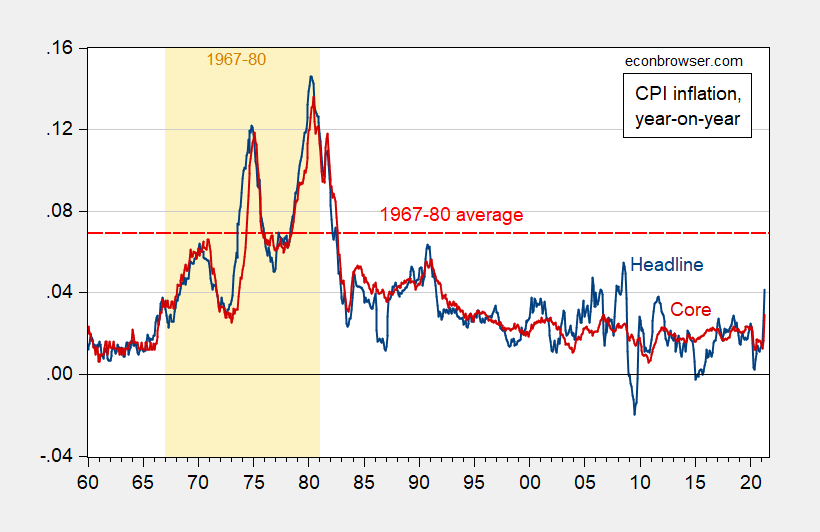

The economy might overheat, and overheat substantially. However, so far as measured by the CPI inflation, it hasn’t, as shown by Figure 1.

Figure 1: CPI-all inflation (blue), and CPI core inflation (red), year-on-year. 1967-80 average inflation red-dashed line. Source: BLS via FRED and author’s calculations.

As the figure clearly indicates, the latest (high) read of 4.2% inflation is still well below the 1967-80 average of 6.9%. Further note that one year ahead expected inflation is at most 3.4% (consumer survey based), and 2.4% for professional forecasters.

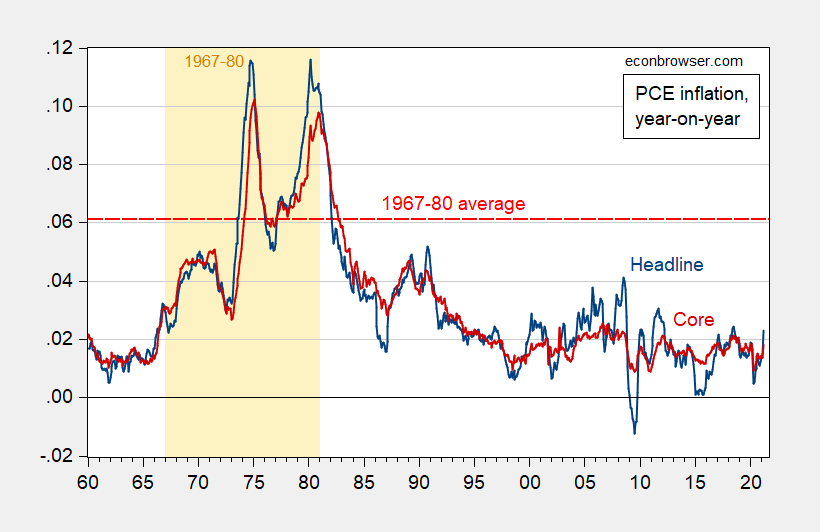

The CPI is an upwardly biased measure of inflation, and the Fed focuses more on the personal consumption expenditure (PCE) deflator inflation. Inflation so measured looks like this (through March, rather than April):

Figure 2: PCE-all inflation (blue), and PCE core inflation (red), year-on-year. 1967-80 average inflation red-dashed line. Source: BLS via FRED and author’s calculations.

On average over the past two decades (2000 onward), the PCE y/y inflation has averaged 0.3 percentage points slower than CPI y/y inflation. If that holds true for 2021M04, then the April observation for PCE inflation will be 3.9%. Bloomberg consensus for Core PCE inflation is 1.8%, the same as March’s figure.

So, the economy is definitely heating up. Whether it’s now comparable to the 1960’s and 1970’s seems doubtful to me.

I kinda wish Hamilton would do a post on inflation, not because I value his analysis more than Menzie’s (I like them both, but probably lean more to Menzie, just…… I don’t know, because you gravitate to who you gravitate to (???) )~~~but because I think Hamilton’s gauge on inflation concurs with Menzie’s more than Mr. Kopits imagines.

More than one boxer asked for a rematch with Joe Louis. I guess some people like taking beatings.

The two key words here for me are “transitory” and “reflation”. It’s all going to come out in the wash in the end. If you throw out extreme comparisons like “1970s inflation” then you better be ready to “take your lumps”. Even Bank of America has used the term “transitory, and is using relatively low numbers on their target for 2022 inflation. OK, Bank of America is not GS, but what do B of A have to gain from predicting pretty low inflation?? Does Kopits think the board of directors at B of A are a bunch of “dirty liberals”??

Does Kopits think the board of directors at B of A are a bunch of “dirty liberals”??

Well Bank of America started in San Francisco where everyone has to be some sort of commie per our Usual Suspects.

“As you’ll recall, I argued that the economy was under suppression, not recession, and that’s proving right.”

I recall Princeton Steve making all sorts of bogus claims which he doubled down on. Proving right? This is akin to Trump declaring he won the 2020 election.

We are definitely not in a period comparable to 1967-80. The country then was dependent on foreign oil for its needs and when the Arab oil embargo hit our economy twice, we experienced major economic dislocations. Today, we are still mostly energy independent so we can’t be coerced on the energy front, but we have become technology dependent which has recently shown another type of vulnerability in our economy. Our technology dependence in more insidious because it seems more benign, but as we move toward Biden’s vision of the future, we may increasingly become dependent for energy on materials and products that are produced overseas. Hopefully, our government and corporations will recognize this present weakness as a lesson learned from the current computer chip debacle and take measures to see that it isn’t repeated in lithium production and battery manufacturing which will be needed for our wind/solar and EV future.

https://abcnews.go.com/Business/wireStory/chip-shortage-cars-scarce-prices-77645971

Can you write more fact free nonsense? First of all we did import over $220 billion in terms of oil and other petroleum products in 2020. So pretend we do not need these imports. And I’m surprised you brought up the semiconductor chip issue given the vast wealth of information we have provided that undermines your total lack of knowledge.

OK Ford does not have enough chips because when car demand temporarily fell, some idiot at Ford canceled all orders with the chip manufacturers. Hey wait – were you still working for them in charge of procurement? That would explain a lot!

The msg’s dependent on chips could have just stock piled them.

Exactly. One would think they would have figured that out. Then again Bruce Hall still hasn’t and he used to work for Ford.

That’s just stupid. Totally against the whole just-in-time supply chain concept. That’s like saying pgl should stockpile gasoline in his garage in case there is a pipeline shutdown. But sure, stockpile billions of dollars of computer chips from your two sources in Asia. Obviously, computer manufacturers would just sit by idly while chip capacity was crushed.

The real issue is how much control a country has over its critical supplies. In the case of oil, pgl says “oh, look, the U.S. imported oil!” Sure, but the U.S. also exported oil. Why? Because U.S. refineries use different types of oil and it’s a balancing act… but on balance the U.S. is energy independent or has been, but unlikely to be in the future. There is no complete independence in the way the world of trade is presently constructed, but there are actions that can be taken to increase protection of critical supplies. https://www.forbes.com/sites/steveculp/2012/10/08/supply-chain-risk-a-hidden-liability-for-many-companies/?sh=4803163594da

Or do you like the idea of China, for example, being the primary supplier of medicines and PPEs? That worked out so well last year even though some were warning about that before the COVID crisis. https://www.nbcnews.com/health/health-care/u-s-officials-worried-about-chinese-control-american-drug-supply-n1052376

It seems you logistical “experts” are more interested in being snarky than intelligent. You’re all about low-cost trade and profits, but when strategic issues come back to bite the nation in the butt, you’re all about “well, they should have stockpiled computer chips.” From where?

“That’s just stupid. Totally against the whole just-in-time supply chain concept.”

OMG. Ever heard of being able to predict. Gee Bruce – when you ran Ford’s procurement you never ordered parts in anticipation of future sales? No wonder Ford had such financial difficulties.

The failure I noted has been discussed by a lot of smart people including the CEO of Taiwanese Semiconductor Manufacturing. But Bruce “no relationship to Robert” Hall thinks he is stupid? Wow – you are one funny dude!

Optimal inventory models have existed for generations. In case you have never thought about this issue – here is a recent paper:

https://www.researchgate.net/publication/275539802_Determination_of_Optimum_Inventory_Model_for_Minimizing_Total_Inventory_Cost

Now if demand were certain, transaction costs were zero, and interest rates were very high, then your just in time view of the world might make sense. But guess what old clueless wonder. Interest rates are low so the cost of carrying inventories is low. And with uncertain demand – the benefits are clearly high.

But of course simple economics is beyond your mental capacities so I feel sorry for any firm foolish enough to hire your as their procurement manager,

“Totally against the whole just-in-time supply chain concept. ”

maybe we should reconsider the seriousness of this concept to begin with? what just in time assumes is that there will be no disruptions of significance, and therefore has few contingencies planned. this is a cheap and lazy way to operate a business, in my opinion. of course, there is a limit to how much and what to stockpile, but it appears that many businesses have become much too lean at the urging of the bean counters.

The US was a net exporter of crude oil and refined products in 2020 to the tune of 650,000 bpd. Using an average value of $39 / barrel WTI for the year, this represents net export revenues of around $9 billion.

Of course, the US both imports and exports crude and refined products. This has to do with geographic considerations, as well as the nature of US refining capacity, which is geared more towards heavy, sour crudes. In aggregate, however, the US is energy independent with respect to crude and products. An oil price shock would in theory be neutral to the US economy. Regional differences, however, could be striking. In the mid-continent, Texas to North Dakota, they would be printing money and buying Ferraris and Bentleys. On the coasts, they would be sucking pond water, possibly even more so than earlier oil shocks. An oil shock could easily see the currencies of the advanced countries and manufacturing exporters depreciate compared to the dollar, which would be buttressed by higher oil revenues. Auto manufacturers, for example, could at once see collapsing consumer demand through much of the country even as the dollar appreciates against the won, Euro and yen and makes foreign rivals more competitive.

You can find US net crude and product imports (exports) on the STEO spreadsheet labeled 4atab. Net imports can be found on line 46 of the spreadsheet.

https://www.eia.gov/outlooks/steo/

just a point of clarification, the current chip shortage occurred under the watchful eye of donny trump.

True but the real blame lies with the short sightedness of the car companies. Brucie used to be one of their employees so draw your own conclusion.

One thing is obvious – Bruce has no clue how this very integrated international sector is structured. Neither did Trump. Biden’s team, however, and is making some smart steps to address the various issues.

I would ask Bruce to explain these issues but of course the boy is utterly clueless and incompetent so why bother.

Idiot.

Your world of day trading is a fantasy world that has nothing to do with supply chain logistics. It’s the stupid advice of “get the lowest cost bid and damn the consequences” that has created strategic fragility.

This is from the same clown that just argued Ford should not order chips in anticipation of future sales. Make up your mind clown.

“It’s the stupid advice of “get the lowest cost bid and damn the consequences” that has created strategic fragility.”

agreed. but i would posit that approach is more championed by conservatives than liberals. its what happens when you push for a free market capitalist environment, where profits rule. just saying…bruce, you may have joined the wrong political party.

President Eisenhower’s 1959 9% cap on oil imports (to consumption) lasted 14 years. When Nixon finally ended the cap, imports were 30% of demand, rising to 45% by 1977. President Carter moved America back toward greater domestic reliance, as well as lower overall levels of consumption via conservation. Imports decline to 28% of demand by 1982.

https://www.cfr.org/timeline/oil-dependence-and-us-foreign-policy

This is true, but misleading.

Eisenhower’s cap was an upper limit designed to protect US producers from being undercut by foreign competition. It was a protectionist measure, not one designed to reduce US oil consumption.

In the broader sense, President Carter did not move the US back toward domestic reliance. Rather, two brutal oil shocks crushed US oil consumption, leading to structurally lower levels of demand, eg, to the end of giant US sedans and the rise of the thrifty Japanese imports. It is fair to say that the US oil industry also responded, notably by developing Alaska’s north slope, which saw Prudhoe Bay brought on line in 1977, and the development of US offshore Gulf of Mexico production essentially from the early 1980s. Neither of these developments brought US energy independence, and as late as 2007, the US was a net importer of 12 mbpd, representing 60% of total US consumption.

The policy and industry approach which John McCain’s described as ‘drill, baby, drill’, did — despite widespread skepticism in the mainstream media — bring US oil independence. By 2011, oil imports had fallen below 50% of consumption. By 2014, this had fallen to 25%. In 2018, it was 12%. In 2020, the US became a net exporter, with exports representing 3.5% of US consumption. This is an incredible transformation, a testament to US entrepreneurship, innovation, ingenuity — and the critical role of appropriate property rights.

If Princeton Steve wants to claim overheating, could he try give us a measure of it such as real GDP relative to potential GDP. Uncle Moses recently suggested that the CBO measure of potential GDP understates potential and I tend to agree. But I tried an experiment looking at this measure for some classic periods. During Clinton’s 2nd term for example this measure said actual output exceeded potential GDP but we did not experience high inflation.

Of course we did see a bit of overheating back in the late 1960’s. By CBO measures, actual output was 105% of potential GDP in 1966. Now if Stevie pooh thinks we are close to that he needs to check the data. Actual GDP is only 97.9% of potential GDP by this CBO metric which likely understates potential.

Look if his crack staff at Fox and Friends can produce a series that shows we are currently above full employment, Stevie pooh should provide it. That way we can all have a good laugh at his latest nonsense.

Real to potential GDP will not give you appropriate insight regarding recession v suppression. In both cases, real GDP will be below potential. For policy purposes, the reason for the gap is germane. If the gap is caused by cyclical factors like a normal recession, then low interest rates should not cause bubbles or inflation, at least materially. If the gap is the result of the government or public opinion forcing people to stay at home, then easy money and fiscal stimulus will really pop the economy as the source of the suppression — in this case, the pandemic — passes. That’s what we’re seeing.

The gap is “germane” but it isn’t? Does your worthless consulting also comes with such contradictorary gibberish? Now I like how you pull “suppression” out of your rear end as you have no coherent definition for your little made up BS.

“If the gap is caused by cyclical factors like a normal recession, then low interest rates should not cause bubbles or inflation, at least materially.”

Repeat after me – your bubble nonsense ignores basic finance. Real rents are up and the cost of capital is lower so of course housing prices have risen. Based on the fundamentals of basic finance which of course you never learned.

BTW agents are forward looking so if the expectation is that real GDP will rise significantly, expected inflation does not wait to raise. But of course things like Rational Expectations is way over your incompetent little brain.

Rational expectations as principal, or as agent?

My comment was anecdotal, not statistical, and it was made as a big box food shopper, not as an economic analyst. The last time I saw one time jumps like that, as I recall, was around the first and second oil shocks.

Forbes confirms this feeling: “Overall, prices in April climbed 4.2% year over year, the biggest such gain in the headline CPI data since September 2008. Even when you strip out volatile food and energy prices—so-called core CPI inflation—prices rose by 3% year over year in April. Month over month, core CPI inflation rose by 0.9% in April, the biggest one-month jump since 1982.”

https://www.forbes.com/advisor/investing/why-is-inflation-rising-right-now/

Babble from Taylor Tepper? Do you have a clue what he does for a living? Oh yea – charging commissions to fools who rely on his utterly incompetent personal finance advice. Why would anyone care what this “financial advisor” has to say? I criticize Bruce Hall for citing clueless wonders but Taylor Tepper? My apologies to Bruce as his crack pots are more reliable than Taylor Tepper.

Yup, the great oil consultant “Princeton”Kopits has his finger on the pulse:

https://cms.zerohedge.com/s3/files/inline-images/bfm3CEE.jpg?itok=saEvES6K

I assume these are the type numbers Kopits feels melancholy about Prof Hamilton not sharing with us??

“My comment was anecdotal, not statistical”

A wee bit of honesty for a change? As a general rule – your comments do tend to hype anecdotes and not reliable statistics.

steven, you are comparing prices to a year ago. exactly when we were in a NATIONWIDE SHUTDOWN due to the initial spread of the coronavirus. how much did gpd crash in the first and second quarters of last year? now that we have put this rise back into context, care to revisit your anecdotal observations?

I was comparing prices to the previous shop a few weeks earlier. For example, a six pack of bagels went from $2.49 to $2.99, as I recall.

I guess who eat bagels for three meals a day 7 days a week. Now a good bagel is worth 50 cents but I bet your Princeton shop does not carry NYC quality bagels. Could you even TRY to understand what Menzie is trying to convey. Oh wait – you never do so why start now?

inflation is not a measure of a single and couple items. this conversation is pointless if you are going to offer up such an argument.

10 year bonds are yielding 1.65%. square that with inflation.

Steve’s entire food budget is spent on bagels ever since his wife left him. You see – he never learned to cook.

A point Kevin Drum has made. We have asked Stevie to read what Kevin has written but of course this is below our pompous clown. BTW Kevin is not economist but what he writes is FAR more enlightening than the nonsense from Princeton pompous.

Exactly so. March and April 2020 suffered big declines in CPI. In May. there was a big rebound. When dealing with y/y comparisons, base effects can matter a lot. A big part of the 4.2% y/y gain in April happened last May.

I would also note that my house has risen by 27% in value in ten months, ten months during which the US was ostensibly in a downturn, which little over a month ago was deemed so bad that it required $2 trillion of stimulus. How do we square that circle, of a dreadful downturn paired with house prices shooting to the moon?

I believe the current downturn is better described as demand suppression rather than a traditional recession. Therefore, simulative policies — notably very loose monetary policy and gargantuan fiscal program — are likely to lead to undesirable results, including a bout of inflation, massive asset bubbles, a blown out trade deficit, and the discouragement of work. We see clear signs of all of these.

It is nice that your home equity is up. But this is Finance 101 when the cost of capital falls. Oh wait – you have proven over and over again that you flunked freshman finance. What I guess is why you cite Taylor Tepper as your macroeconomist.

Now if you really believe that housing prices are in a bubble why are you not selling that house? Oh yea – your financial advisor is Taylor Tepper!

“I would also note that my house has risen by 27% in value in ten months”

when you sell your house and lock in the profit, then this statement will be true. until then it is not true. home “values” are up simply because the number of houses on the market are at historically low levels. it is a supply problem.

we are NOT in a dreadful downturn precisely because we have used stimulus wisely. would you rather we not have a stimulus and let your housing price crash 25%? is that your preferred outcome? and since you would be unemployed and need to sell your house, you would have locked in that loss.

all you people complaining about the stimulus are living in a revisionist world in which the pandemic never seems to have existed and mass unemployment never occurred.

During the prior recession, policy mailers learned that letting households fend for themselves while propping up financial institutions was a serious mistake. Income support and protection against eviction and foreclosure have prevented the asset collapse suffered a decade ago. That is a profound difference.

Back then, easy money did little good because of clogs in the financial system. Now, easy money can flow to asset markets. There’s yer difference, right there.

Any effort to draw a distinction between recession and suppression which relies on housing market performance but ignores the fundamental difference between assistance to mortgage debtors and assistance to lenders is kind of a mess.

Eviction protection and a moratorium on mortgages are not the same as artificially low interest rates blasting home values through the roof. If no one borrows against increased — and to my expectations, unsustainable — home values, then we’re only talking paper gains. And I thought this was the case in 2005-2007, as it was clear we were in a bubble then. Turned out I was wrong, and a whole lot of homeowners ended up being under water for a decade. If you read my comments, you know that I define the difference between a recession and a depression as a sustained, material decline in housing prices. Such a sustained drop forces now over-leveraged home owners to rebuild their equity, leading the negative equity withdrawals, that is, sustained declines in consumer borrowing and a generally tepid economy for some time. Let’s call it secular stagnation.

Real home values are now above the bubble peak of 2005-2006, and this at a time when the commenters here are pushing the narrative that the economy is in such bad shape. During the Great Depression and Great Recession, as I recall, home values fell by 17% peak to trough. By contrast, in the Great Suppression, home values are up about 15%. Are these events then equivalent, or rather something entirely different? Home price trends tell us they are different.

So, I am all for protecting those who need it. Professionals who have been employed all along and have expensive homes do not need a few hundred thousand extra dollars of equity value to keep them alive and the lights on. Instead, we have had too easy monetary policy which has blown a big bubble into asset values, and almost all of this benefits the well-to-do.

At some point, there will be a reckoning.

But probably not yet. Home inventories are historically tight, and until building catches up with demand, housing prices will likely remain high. The punch bowl is still full at the party. The hangover will come later.

and your evidence for artificially low interest rates is ????????

my guess is that you are involved in a financial trade or transaction that is materially better if rates are higher than lower, and simply pining for better conditions. steven, we heard this story after the financial crisis as well. too much free money, and the pain is coming soon. never really happened after the financial crisis. so you were wrong then. what makes you think you are right this time?

See the graph.

https://fred.stlouisfed.org/series/DGS10/

Fed officials have pledged to keep their ultra-loose, crisis-fighting policies in place, betting that the unexpected surge in consumer prices last month stems from temporary forces that will ease on their own, and that the U.S. jobs market needs far more time to get people back to work.

But the minutes of the April 27-28 meeting showed the Fed beginning to wrestle with the emerging difficulties of getting the $20 trillion U.S. economy fully reopened after the disruptions caused by the coronavirus pandemic.

The emerging logistical challenges set up a potential clash between the two sides of the Fed’s twin goals of encouraging maximum employment while also keeping inflation tame.

A “couple” of officials were already concerned inflation could hit “unwelcome levels” before they had time to recognize it was happening and plan the proper policy response, the minutes showed.

https://www.reuters.com/business/finance/readout-fed-meeting-may-highlight-potential-policy-dilemma-2021-05-19/

Sorry, nothing there says artificially low.

this is great prof chinn. this is exactly what i have been asking the inflationistas. look, i get that inflation is rising. but until it gets to levels that have caused problems in the past (and we are still FAR away from those levels) it is foolish to embark on solutions to hypothetical problems that are far into the future. we are not even half way to a level that MAY be problematic, and even then only on a sustained level. inflation may impact how investments need to change to be successful, but so what? may be time to work for those profits. but it simply is not at the level of problematic.

But Princeton Steve has his anecdotal babble so relying on reliable data from the BLS is “fake news”.

https://www.nytimes.com/2021/05/16/world/asia/india-covid19-black-market.html

May 16, 2021

A Desperate India Falls Prey to Covid Scammers

As the health care system fails, clandestine markets have emerged for drugs, oxygen, hospital beds and funeral services. Fake goods may be putting lives at risk.

By Hari Kumar and Jeffrey Gettleman

NEW DELHI — Within the world’s worst coronavirus outbreak, few treasures are more coveted than an empty oxygen canister. India’s hospitals desperately need the metal cylinders to store and transport the lifesaving gas as patients across the country gasp for breath.

So a local charity reacted with outrage when one supplier more than doubled the price, to nearly $200 each. The charity called the police, who discovered what could be one of the most brazen, dangerous scams in a country awash with coronavirus-related fraud and black-market profiteering.

The police say the supplier — a business called Varsha Engineering, essentially a scrapyard — had been repainting fire extinguishers and selling them as oxygen canisters. The consequences could be deadly: The less-sturdy fire extinguishers might explode if filled with high-pressure oxygen.

“This guy should be charged with homicide,” said Mukesh Khanna, a volunteer at the charity. “He was playing with lives.” (The owner, now in jail, couldn’t be reached for comment.)

A coronavirus second wave has devastated India’s medical system and undermined confidence in the ability of Prime Minister Narendra Modi’s government to treat its people and quell the disease. There are widely believed to be far more deaths than the thousands reported each day. Hospitals are full. Drugs, vaccines, oxygen and other supplies are running out.

Pandemic profiteers are filling the gap. Medicine, oxygen and other supplies are brokered online or in hushed phone calls. In many cases, the sellers prey on the desperation and grief of families….

Having the logistics and engineering capabilities of structuring particular prices when necessary can be especially important for a developing country. What has been sadly happening in India, has not been an isolated occurrence.

Biden is talking about this virus and his desire to ramp up production of the Moderna, Pfizer, J&J, and AstraZeneca vaccines even though we currently have enough vaccines for every American age 12 and up. Why? To export a lot of vaccines to the rest of the world. Good for American workers, good for our trade balance, and great for citizens in other nations.

OK I can hear the chirping from Biden’s’ critiques. Those with MAGA hats will say he is not putting America First. Or was it that the virus is fake news and vaccines are a form of communism. And I’m sure our favorite cheerleader for the Chinese government will just ignore what Biden just said.

Got my 2nd Covid-19 shot. Was 20 minutes late like a JackA$$ and the folks at the pharmacy were extremely kind. I apologized twice and they were like “it’s all good” Then on top of it I called the person putting my gunk into the computer “Sir”, the person was wearing a mask but had their hair in a pony tail with jewelry around their neck, but a pretty masculine voice. So what do I do then after calling them “Sir”?? I still have no idea if the person is a girl, if I bring it up no matter what then I multiply the offense and possibly hurt them more, I can’t win. I’m not being facetious here, I really wanted to get it right, because they were extremely nice to me after being late. Anywayz. whatever…… the person was super kind and so was the pharmacist giving the shot.

No one on this blog will believe it, but I feel pretty guilty when I think of places like India and Brazil. What makes me better than those people who are having their dead bodies burned in the streets right now after getting the Covid-19?? What makes me better than them?? I can tell you the answer to that~~NOTHING I can’t think about it too much or I’ll want to get an extra bottle of alcohol next time I head to the supermarket. Maybe that Washington State gunk. Bottle is kinda small though.

i was one of the few with side effects after the second shot. hopefully you don’t experience them. i described it as symptoms without actually being sick. at any rate, lasted from hours 12-36 and then disappeared. plan on taking the day off tomorrow, just in case. and welcome to the club! we are gonna beat this sob when we all work together.

Glad you are vaccinated. Now Spike Lee has an idea. For the old ladies in our neighborhoods who have not gotten their shots out of a lack of transportation we can call Uber and donate a ride.

Spike Lee is practically a neighbor. He lives around the corner from the Barkley Center but he cheers for the Knicks and not our Nets. OK Brooklyn does have its share of characters!

Brooklyn is my adopted team. I am a GARGANTUAN Kevin Durant fan, so basically any team he gets traded to becomes my de facto favorite team. Hopefully most of their playoff games will be on regular antenna TV, I don’t have cable.

I am making this comment not because I have delusions my individual situation is that interesting or important, but in the hopes that it may be beneficial to those who have already smartly decided to get your shot and are getting near to your 2nd Moderna shot (the only one I can speak to on a personal experience basis) and/or those who are still riding the fence on getting a shot or can’t decide Pfizer or Moderna.

First I should say, may overall experience was positive, and I would do it again in a heartbeat. My first shot, I felt nearly nothing, only the immediate needle going in, which was so small and short, it wouldn’t even qualify to the pain you would get from a very small bug-bite. Miniscule miniscule weakness in the upper arm immediately after, lasting maybe half a day (6–8 hours??), and I could sleep on the upper arm that same night, with really zero pain.

My 2nd Moderna shot, roughly 28 days later, much different. I have to confess (semi-sheepishly) that after ALL the discussion of the 2nd Moderna shot being worse than the first, I was cynical it would be worse. I was wrong, it was worse. The upper arm (my left upper arm where I got the shot) felt significantly weaker, a mild muscle ache type pain. My entire body was weaker (what I would describe as a “mild flu-type weakness”) for about 1 woke hours day (about 18 hours). It hit me the following morning (Tuesday morn). I took the vaccine shot roughly 11:40am Monday, and only truly felt the effects starting roughly 6:00am Tuesday. I also had some weird aches [ insert brain problems jokes here ] in my head, inside the cranium, on that Tuesday, for about 12 hours. Sporadic, not continual. These I would not describe as a “traditional headache”~~front part of the head, like when you grab your forehead when you got a headache. NO—-most of these I felt more to the back of my head. Like guessing here, but more towards the parietal lobe, and/or the occipital lobe. I take these to be some of the effects of the virus ittself—in other words, nothing wrong with my vaccine shot, but the way in which the vaccine (correctly) replicates the effects of the virus itself. Today, Wednesday, my flu weakness is gone, and I have no headaches or head pains, which confirms to me the headpains are directly related to naturally expected effects of the vaccine shot. And I had no aspirin today. I took 800 IUs of vitamin D Tuesday (I normally only take 400 recently). I took 400 IUs of vitamin D Today, and I didn’t take any aspirin today (I normally take one pill of aspirin a day) because I wanted to see how my head felt without any aspirin.

Bottom line. 2nd Moderna shot is rougher than the first shot, but not that bad, and not even close enough bad to make you regret you got the protection from the virus. Maybe if you’re over age 35, arrange to take a day off from work the day after you get your shot, or try to make your shot appointment for a Friday afternoon, thereby giving your body the weekend to get back to 100%. I advise to KEEP WEARING YOUR MASK until at least TWO WEEKS AFTER you get the 2nd shot!!!!!! (I am still wearing a mask in public settings and will continue wearing a mask at least to the end of May) Then after those 2 weeks you can make your personal decision on continuing to wear the mask.

sounds similar. i described it as flu like symptoms without the sickness. it was impactful, but not nauseous and sick. just plan on taking the day off. glad you got your second jab moses. welcome to the club! i encourage others to do the same and get that jab. much better than spreading the virus to others.

https://twitter.com/DeanBaker13/status/1393889263570149378

Dean Baker @DeanBaker13

If we were serious about vaccinated the world, we would be immediately sitting down with Russia and China and every other country capable of developing or manufacturing a vaccine and figuring out how to ramp up production and delivery (1/2)

7:21 AM · May 16, 2021

The New York Times treats the issue as a joke. An article with four reporters never once mentioned Russia or China (2/2)

https://cepr.net/hot-tip-for-the-nyt-on-vaccines-there-are-these-two-countries-called-russia-and-china/

Hot Tip for the New York Times on Vaccines: There Are These Two Countries Called Russia and China

I realize that it’s hard for reporters at the country’s leading newspaper to stay on top of the news, but this major piece (four reporters) on vaccinating the world should get a Pulitzer for ignorance.

For those who do take the issue seriously, China has already exported more than 650 million doses to the rest of the world

https://www.scmp.com/news/china/diplomacy/article/3133563/coronavirus-china-seeks-boost-influence-filling-vaccine-vacuum

China seeks to boost influence by filling ‘vaccine vacuum’ in poor nations

As countries in Africa and elsewhere struggle to secure Covid-19 shots, China has stepped in.

http://www.xinhuanet.com/english/2021-05/17/c_139951354.htm

May 17, 2021

Over 400 mln doses of COVID-19 vaccines administered as China steps up vaccination drive

BEIJING — More than 400 mln doses of COVID-19 vaccines have been administered in China by Sunday as the country steps up the inoculation drive.

A total of 406.938 million doses of COVID-19 vaccines have been administered across the Chinese mainland, according to the National Health Commission on Monday.

Sinovac’s Covid-19 vaccine has an efficacy rate of just a tiny fraction above WHO’s 50% acceptable lower limit in lab trials – just 50.7%. In the field, the results are below the WHO threshold at 49.6%. Tied with Novavax South Africa as the worst performing Covid vaccine on the global market. I’m not sure why ltr’s masters want her to draw attention to this poor result. It’s embarrassing.

https://www.economist.com/graphic-detail/2021/04/15/in-clinical-and-real-world-trials-chinas-sinovac-underperforms

I guess Dean Baker wrote this before Biden’s speech today, which I commented on. And I predicted you would certainly ignore what Biden said.

Your credibility on this issue has gone to zero.

https://fred.stlouisfed.org/graph/?g=x2gN

January 30, 2018

Case-Shiller Composite 20-City Real Home Price Index, 2017-2021

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=x1E2

January 30, 2018

Case-Shiller Composite 20-City Home Price Index / Owners’ Equivalent Rent of residences, 2017-2021

(Indexed to 2017)

Case-Shiller Composite 20-City Home Price Index / Owners’ Equivalent Rent of residences, 2017-2021

Up 9% not the 70% of whatever garbage that has Princeton Steve do chicken little. Yes real rents are up.

And the cost of capital is very low. If someone does not realize that an increase in cash flows with a decrease in the cost of capital should not raise the value an asset, that person should stop commenting on an economist blog.

Adam Clyde claimed that the 1/6 rioters were not rioting – they were only tourists. But this out. On 1/6 he was involved in barricading the chamber doors:

https://vozwire.com/image-surfaces-of-rep-andrew-clyde-barricading-chamber-doors-during-us-capitol-attack-after-he-compared-rioters-to-tourists/

Every resident of Manhattan gets this as the tourists at Times Square should be barricading when we are just trying to go to work.

https://fred.stlouisfed.org/series/MORTGAGE30US

Mortgage rates are half what they were in 2005. Real rents are up about 20%. Now it would be an interesting question for a Finance class to calculate the implication for the value of a house. Of course one could follow this up with a quote from Princeton Steve as to how we are now in a housing and ask the students to explain in an essay why such claims are beyond stupid.

https://fred.stlouisfed.org/graph/?g=AAc2

January 30, 2018

Household Debt Service Payments as a percent of Disposable Personal Income, 2017-2020

https://fred.stlouisfed.org/graph/?g=rnxQ

January 30, 2018

Household Debt Service Payments as a percent of Disposable Personal Income, 2000-2020

https://fred.stlouisfed.org/graph/?g=BJDw

January 30, 2018

Homeownership Rate for White, Black and Hispanic, 2007-2021

(Indexed to 2007)

Harvard’s https://tracktherecovery.org/ records a – 28.9% employment decline for low income workers as of April 2, 2021 compared to January 2020. Consumer spending in high income neighborhoods as of May 2, 2021 is up + 5.8%. Small business revenue in high income neighborhoods as of May 4, 2021 is down – 35.4%.

I just saw a commercial for Cliff Bars which I have not consumed in mass quantities since my Manhattan when I ran and biked a lot more than I do now. That was over 8 years ago and I could buy bars for $1 a piece at the local BB&B.

I checked on Amazon and now the best price is $1.35. 35% increase – OMG hyperinflation. Oh wait a 35% increase over 8 years for a single product that I do not even buy any more (for some reason this is the only product that costs more in Brooklyn than Manhattan). OK the hyperinflation BS of Bruce Hall and Princeton Steve has got me getting silly.

But yea Bagels here are a bit costly but they are so incredibly good. Princeton Steve pays $0.50 for his crappy bagels. Rip off!

Having watched Pretty Woman last weekend I bet I have an example of hyperinflation. Consider the thrift shops in Hollywood where Julia Robert’s character was shopping. I bet she could get a hot dress for a mere $10. But then she got to shop on Rodeo Drive on a rich dude’s credit card. I bet the cheapest outfit she bought cost $10 thousand. Hyper inflation? No but a fun movie!

http://www.xinhuanet.com/english/2021-05/18/c_139952286.htm

May 17, 2021

Nearly one-fourth of U.S. adults worse off financially amid pandemic: Fed survey

“This increase occurred broadly across segments of the population, and likely reflects financial distress resulting from the pandemic,” the Fed said.

WASHINGTON — Almost one-fourth of U.S. adults said that they were worse off financially in 2020 compared to a year earlier, reflecting the economic fallout and distress resulting from the COVID-19 pandemic, a Federal Reserve survey showed Monday.

That was up from 14 percent in 2019 and the highest share since the survey began collecting this information in 2014, according to the Fed’s most recent Survey of Household Economics and Decisionmaking, conducted in November 2020.

“This increase occurred broadly across segments of the population, and likely reflects financial distress resulting from the pandemic,” the Fed said….

Almost one-fourth of U.S. adults said that they were worse off financially in 2020 compared to a year earlier:

https://fred.stlouisfed.org/graph/?g=E6cy

January 30, 2018

Share of Total Net Worth Held by Top 1%, Top 90 to 99% and Top 50 to 90%, 2020

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=DDj3

January 30, 2018

Share of Total Net Worth Held by Top 1%, Top 90 to 99% and Top 50 to 90%, 2007-2020

(Indexed to 2007)

https://www.federalreserve.gov/publications/files/2020-report-economic-well-being-us-households-202105.pdf

May, 2021

Economic Well-Being of U.S. Households in 2020

Executive Summary

This report describes the responses to the 2020 Survey of Household Economics and Decisionmaking (SHED). The Federal Reserve Board has fielded this survey each fall since 2013 to understand the wide range of financial challenges and opportunities facing families in the United States. The findings in this report primarily reflect financial circumstances in the fourth quarter of 2020….

http://www.xinhuanet.com/english/2021-05/18/c_139952286.htm

May 17, 2021

Nearly one-fourth of U.S. adults worse off financially amid pandemic: Fed survey

“This increase occurred broadly across segments of the population, and likely reflects financial distress resulting from the pandemic,” the Fed said.

https://www.federalreserve.gov/publications/files/2020-report-economic-well-being-us-households-202105.pdf

May, 2021

Economic Well-Being of U.S. Households in 2020

[ This is what has been bothering me when I read about booming times to come. ]

Steven Kopits: “I was comparing prices to the previous shop a few weeks earlier. For example, a six pack of bagels went from $2.49 to $2.99, as I recall.”

Give Kopits some credit. He’s is good company with the feckless Federal Reserve.

From the Atlantic:

https://www.theatlantic.com/business/archive/2014/02/how-the-fed-let-the-world-blow-up-in-2008/284054/

Back in late 2008, as the economy was entering the worst recession since the Great Depression, all the Fed board could manage to talk about was inflation. “Dual mandate” you say?

From the Fed meeting minutes —

June 25, 2008: 468 mentions of inflation, only 44 of unemployment.

August 5, 2008: 322 mentions of inflation, only 28 of unemployment.

September 16, 2008: 129 mentions of inflation, only 26 of unemployment

From the Atlantic article:

“And then there was Dallas Fed chief Richard Fisher, who had a singular talent for seeing inflation that nobody else could—a sixth sense, if you will. He was allergic to data. But, in Fisher’s case, the plural of anecdote wasn’t data. It was nonsense. He was worried about Frito-Lays increasing prices 9 percent, Budweiser increasing them 3.5 percent, and a small dry-cleaning chain in Dallas increasing them, well, an undisclosed amount.”

September 2008, even after the collapse of Lehman —

“Even though commodity prices and inflation expectations were both falling fast, Hoenig wanted the Fed to “look beyond the immediate crisis,” and recognize that “we also have an inflation issue.” Bullard thought that “an inflation problem is brewing.” Plosser was heartened by falling commodity prices, but said, “I remain concerned about the inflation outlook going forward,” because “I do not see the ongoing slowdown in economic activity is entirely demand driven.” And Fisher complained that the bakery he’d been going to for 30 years—”the best maker of not only bagels, but anything with Crisco in it”—had just increased prices.”

So cut Kopits some slack. He is in good company with the idiots of the Federal Reserve in his allergy to data and his obsession with the price of bagels.

we have low inflation, yields are low, and we have no wage pressures. this obsession with inflation controls is just weird.

steven, let me give you a scenario. you go to the doctor, and he says that as an older, overweight male with poor diet and poor exercise and moderately elevated blood pressure, i recommend that we perform a quadruple bypass surgery to eliminate the possible risk of a heart attack sometime in the future (ht corev here). would you think this doctor is a quack, steven? because that is what you sound like when advocating for an inflation problem that does not exist. on the other hand, we know that today you are overweight and sedentary. would it not be better to address those issues we know about today with diet and exercise, rather than take rash action like surgery to eliminate a hypothetical some unknown time in the future? let’s talk when PROBLEMATIC inflation is actually here, not a hypothetical.

“an older, overweight male with poor diet and poor exercise and moderately elevated blood pressure”

Aka Donald Trump!

“And then there was Dallas Fed chief Richard Fisher, who had a singular talent for seeing inflation that nobody else could—a sixth sense, if you will. He was allergic to data. But, in Fisher’s case, the plural of anecdote wasn’t data. It was nonsense. He was worried about Frito-Lays increasing prices 9 percent, Budweiser increasing them 3.5 percent, and a small dry-cleaning chain in Dallas increasing them, well, an undisclosed amount.”

Budweiser and Frito Lay’s? OK – one cannot get a decent bagel in Dallas I guess!

Joseph,

Every one of the Fed officials’ quote which you’ve cited was the president of a regional Fed bank. That’s no excuse, but it is telling. Fed governors were somewhat less dogmatic at the time. We have had some good Fed presidents, including Bullard and Plosser, but Fisher never had a clue.

In fact, the Fed funds rate was cut to as near zero as the Fed is willing to go in Q4 2008: https://fred.stlouisfed.org/series/BOGZ1FL072052006Q

It was not a proud time for the Fed, but quoting a discussion which took place immediately before the Fed folk caught on puts them at a disadvantage.

And let’s not forget that the inflation worriers were reacting to earlier rate cuts and some extraordinary liquidity provisions, including one just a day before the meeting. The nervous Nellies were nervous because the Fed was already easing and lending and swapping like mad. Texts of discussions from that time don’t give a realistic picture of the earnestness (freak out) with which Bernanke and his allies, including Dudley at the open market account, were addressing the problem.

Kind of unfair of the Atlantic to imply that the Nellies represent the Committee as a whole.

Frantz Fanon in the Wretched of the Earth explained the coloniser feelings towards the colonisers. As US practically coloniser half of the world, the next logical step is that US will experience what France experienced in Algeria, from where Fanon got his ideas

macroduck: “It was not a proud time for the Fed, but quoting a discussion which took place immediately before the Fed folk caught on puts them at a disadvantage.”

Was it a proud time, had the Fed folk caught on, when Janet Yellen decided to raise rates in 2015 for no good reason, stalling the recovery and helping usher Donald Trump into the White House?

Yellen had testified to Congress that she and the Fed were baffled as to why inflation was so stubbornly below their 2% target and also baffled as to why wages so stubbornly refused to rise even as unemployment dropped below their supposed NAIRU of 5.5%, no that’s not right, 4.5%, no that’s not right, 3.5%. Yet even though she confessed in her testimony that she didn’t understand the baffling behavior of these targets, she was certain that now was the time to raise interest rates — no reason, just because that’s what the Fed always does.

Nope, economists and bankers have inflation fears baked into their genes, despite all evidence to the contrary. And the Fed has been responsible for the suppression of worker wages for decades now.

It’s interesting that the first Fed chairman to actually “get it” is the first Fed chairman in over 40 years not to be an economist.

I have said before, if you want to have a credible Federal Reserve Board, it should be one third bankers, one third labor representatives and one third consumer representatives. Otherwise, as history has shown, you always have bankers and economists with a bias to inflation hawkery.

joseph,

Sorry, but Powell is not the one making the policies there, although he is the face of it. He is going along with the views of others on the FOMC, some of whom are serious economists like Jim Bullard. he is not telling them what should be done. It is going the other way. Sorry, this is not a case of “non-economist charges in and saves the day.” This is Powell being a good leasder of consensus decision-making at the Fed.

yellen raised rates because she caved to political and pundit pressure. at the time, i don’t think she realized that true fed independence comes with a cost, sometimes personal.

Political pressure to raise interest rates? From whom? I think she let interest rates increase because the economy was getting close to full employment.

as i recall, there was a time in 2015 when trump and the republicans were livid because rates were simply too low. in reality, they wanted rates to rise so that it would hurt the economy, and they could blame the democrats in office for a slowdown. right after trump got into office, the tune changed and they wanted rates to drop so that it would continue to spur the economy. yellen got bullied a bit during that time. unemployment continued to fall and core inflation held steady. looking back, neither really seemed problematic when they commenced a rate increase.

Barkley Rosser: “Sorry, but Powell is not the one making the policies there, although he is the face of it.”

Oh, and who are these people putting words in Powell’s mouth when he is the first Fed chairman to say out loud that employment is more important than inflation. And say out loud that suppression of wages disproportionately affects lower income workers, non-college grads and people of color. That after a decade of inflation below the 2% he is prepared to run above 2% “for quite some time.” By saying that it is the Fed’s priority is to run a tight labor market and push employment lower than ever before, he is reversing four decades of Fed obsession with inflation and labor suppression.

Oh, and I suppose Janet Yellen was also just “the face of it”. Who was giving her the marching orders when she raised rates? Why was she unable to say the things that Powell is saying about wage suppression for low income workers? Was she just a puppet of the inflation hawks?

Joseph,

I am sorry that you know nothing about how the Fed operates, but then not many people do. In the cases of both Yellen and Powell they were reflecting collective judgments coming out of the FOMC, which consists of a group of headstrong people, with it the very hard job of a Chair to herd to come sort of consensus decision.

While you are all horrified about the interest rate increase that happened during Yellen’s watch, which you somehow think led to the election of Trump, a conclusion I seriously doubt, although there will be no resolving that one, what it looks like the Fed was trying to do (and Powell was a governor then and part of that consensus that decided to raise those interest rates, for the record he voted for it, so your heroizing him personally is just plain ignorant), was to try to “get back to normal” as indeed as pgl notes the economy was reaching a full employment state and growing solidly. Such a state had higher interest rates than what had been there for a long time, and there were other reasons for doing so, such as supporting the insurance industry and the ability to pay annuities. in the end, it was an effort that failed, and they backed off pretty quickly.The real problem was that other nations kept their interest rates low, so that thosein the US were too high compared to other nations, which led to problems. This was not something that was ridiculous upfront as you have yourself convinced it was, and I definitely note that Powell supported it and went along with it, so your narrative of wise Powell versus foolish Yellen is just a crock of stinking ignorant doo doo.

Ha, ha. Barkley Rosser would have you believe that Volcker, Greenspan, Bernanke, Yellen and Powell are just clerks that call roll and see how the vote goes. This paints you as so incredibly naive that it’s a miracle you can breathe on your own. Maybe you have spent too long in academia.

Everyone knows that the Fed Chair steers the ship and Volcker, Greenspan, Bernanke, Yellen and Powell would be the first to tell you.

joseph,

Sorry, but what you claim that “everyone knows” is not necessarily correct. This varies from Fed Chair to Fed Chair with this depending on their ability to influence the FOMC, which voted on what actual Fed policy about once a month. That body includes all the governors along with five of the regional bank presidents, with the other regional bank presidents attending the FOMC meetings and expressing their views on what should be done.

As it is, Volcker has long been viewed as maybe the most influential/powerful of all Fed chairs ever. And he was a most impressive man, whom I met a couple of times, six feet seven and always smoking humongous cigars that I have no idea where he found them. And there were periods when he was able to dominate the FOMC, notably during the 1979-82 period when he pushed a strongly monetarist policy to crack inflation, with interest rates soaring. But later in his time there he lost control of the FOMC. The sign of this was that a big divergence opened up between the federal funds rate and the discount rate. The former was set by the FOMC votes while the latter was set by the governors alone. Volcker maintained majority support among the governors, but lost it with the FOMC, and this became very clear in the markets with this divergence. To some extent what happened is that a bunch of the regional bank president plus a couple of governors got ticked off at Volcker for his domineering ways and rebelled against him. The supposedly most powerful of all Fed Chairs lost control of Fed policy and was repudiated, this happening in the mid-1980s.

I only met Greenspan once. He was a wily character who managed the FOMC and governors more cautiously. He avoided such a repudiation, by the FOMC, but had to move carefully and gradually on getting policy directions changed. He was famous for being a super data wonk, reportedly spending hours in the bathtub each morning poring over data that he cherry picked to throw out when somebody argued with him, things like “WE can’t do that; pig loadings in Des Moines were X this morning!’ This often carried the day, but not always. He gained a lot of credibility by foreseeing the sharp stock market crash that happened in October, 1987, a few months after he arrived in office. When he came in, he reportedly was worried about a crash and ordered a study to prepare an action plan if one did, which was put in place when it did, with the market turning around the day after the single one day largest crash ever, 22% on the Dow. But when it came to his biggest policy shift, getting the FOMC to agree to not raising the ffr in 1996 a the unemployment rare sank below what many observers thought was the infamous “natural rate of unemployment” involved crucial input and support from then governor Janet Yellen, with the two of them going to staff in the basement to get support for the idea that productivity was growing more rapidly so that they could let unemployment decline further without setting off inflation, and they did this and inflation indeed did not increase, with the late 90s being a period of substantial boom for the US economy. As it was, when it got to the end of his time in office, he ignored the advice of Yellen that something needed to be done to offset the getting-out-of-control housing bubble, but Greenspan got out before it blew to much praise at the time, although to some embarrassment later.

I have not met Bernanke, but, of course, he had to deal with the crisis of 2008, which was a genuinely scary moment. Bernanke did provide strong leadership during the crisis itself due to his own background as one of the leading scholars of what happened to the US financial system during the Great Depression. However after that immediate time he retreated more to the sort of collective decisionmaking by the FOMC that has pretty much dominated what has gone on since, including both Yellen (whom I have met many times) and Powell. (whom I have not met). Yellen was known to manage the FOMC in a very careful and diplomatic way, but essentially never imposed her views on a recalcitrant FOMC. By all reports Powell has followed a similar approach, with the decisionmaking done by consensus. You are quite deluded, perhaps impressed like Trump by how he looks like a central casting central banker. But he is not driving what goes on there. You and “everybody” are simply not well informed. Sorry.

volcker created too much long lasting damage to earn my respect.

greenspan left the party and mess for somebody else to clean up.

bernanke earned my respect for keeping out out of a great depression 2.

yellen had a minor hiccup in the rate raise. otherwise her tenure ended too quickly. wish she was still there.

powell surprised me to the upside. he handled the pandemic well. not sure how i would feel if he had to handle a panic like bernanke. is he the guy you choose to take the last second shot? just not sure yet. but he should certainly be on the floor.

Again, a lot of your are mistaking the person who holds the press conferences for who is driving the decisiions on the policies. A major reason why this is going on is that there has been a long term change at the Fed, in partiuclar regarding the compositino of the decisionmaking FOMC, whose significance has not really been widely noted.

It is that the FOMC has come to be dominated by econ PhDs in contrast to the bankers and lawyers who used to dominate it. It is true that Powell is a throwback to those types, but the new situation means he is not running decisionmaking because, frankly, those econ PhDs on the FOMC do not take any economic analysis he makes remotely seriously, and he knows it. This does not mean he is a bad Fed Chair, it simply means he is not driving policy. The last Fed Chair we had who did not have an econ educational background was G. William Miller under Carter in 1978-79, a lawyer like Powell who came from being the CEO of Textron. He was a complete disaster, allowing the inflation upsurge that led to him being replaced by Volcker who was given the mandate to crack down on inflation hard (and did).

An important point here is that in the FOMC debates people are dealing with each other as individuals, with at best the Chair only having a fairly minor edge if any at all. When someone makes an argument, they are being evaluated personally on their perceived knowledge of the economy and intelligence, including their ability to forecast. As more highly published econ PhDs have been on the FOMC, as has been the trend, the more somebody’s track record on that matters. Both Bernanke and Yellen had excellent such track records so were highly respected for those alone, not just being Chairs. But even they had to convince the other FOMC members, not just browbeat them like Volcker used to do with his size and his cigar. Powell has no such background and certainly no such publications, so they know that he knows that if he tries to make some independent argument about the economy on his own, nobody will take him remotely seriously. He has to operate by supporting somebody else who does have such credibility.

This is where it is at, so crediting policy decisions of the Fed, good or bad, to the Chairs these days is simply naive. Sorry.

What is hard right now for anybody making forecasts is that we have almost never seen such weird sectoral disjunctures before, some sectors suffering supply bottlenecks and sharply rising prices while others are quite the opposite with substantial levels of unemployment occurring. Hopefully indeed these supply bottlenecks will straighten themselves out by the end of the year or so, thus halting most of the price rises, although the cost of shipping between US and China has now gotten to three times its normal level. But this is what the people at the Fed have been forecasting for some time, Bullard notably ahead of the others, and it still looks to be the most likely outcome. But in the meantime some of the price increases have been very sharp, especially aggravated in the headlines right now thanks to the hack of the Colonial Pipeline, leading to scenes not seen since 1979 at gas stations in some areas, such as where I am.

Price increases = some things get more expensive

Inflation = the accepted value of money changes.