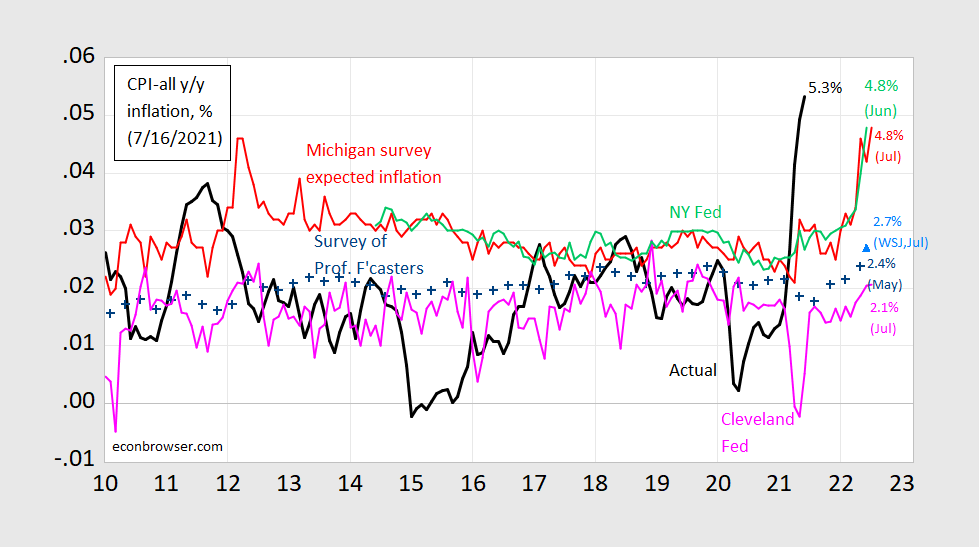

Household forecasts are about 2 percentage points above those of economists.

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), WSJ July survey for June 2022 y/y inflation (light blue triangle). Source: BLS, University of Michigan via FRED, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed, WSJ July survey.

A reminder that — as all expectations of y/y inflation move up — consumer/household based expectations are higher than those from economists and other forecasters, and (as discussed here), upwardly biased.

Michigan forecast discussed here.

Seems households are the same as the NY Fed, who apparently are not ‘economists’.

Steven Kopits: Yes, I’ve been writing repeatedly for the past year that Michigan survey and NY Fed “survey of consumers” share the same attributes, contra SPF, WSJ, Blue Chip. You might want to click on a link to the data notes sometime before making comments that illuminate your ignorance so profoundly.

Forget the link – you wrote in your note:

“median from NY Fed Survey of Consumer Expectations”

And yet Princeton Steve missed this notation!!!!

The NY FED conducts a survey of households and you think this was the forecast of their economists? Excuse me – but what utter fools hire you as a consultant?

I think Barkley Junior has Kopits advising him on his energy futures and WTI options trading strategy. Kopits has Barkley in deep on some $105 WTI December ’21 option calls right now. Barkley’s not too worried even if he loses the whole stack because he’s been watching those Tom Selleck reverse mortgage ads and Tom told Barkley he would never lead anyone astray.

Moses Herzog: It’s not like I’ve been following their exchanges closely, but from what I have gleaned, Rosser is *not* on Team Kopits for $100-plus oil…

Maybe lukewarm support. OK, maybe I had half a foot out of bounds on that one.

I guess I think that 100-plus for oil before end-of-June 2022 is SO ludicrous that it’s ludicrous that anyone wouldn’t think that it’s ludicrous.

Menzie,

Thank you for keeping Moses in line. I am mostly inclined to play it straight with him, but he has recently somehow decided to go back to his long-running vendetta against me.

Indeed, unlike Steven Kopits, my line on oil prices for the rest of the year has been completely steady and consistent, arguably in its sloshy lack of certainty. So I have been open to the possibility of both $40 and $100 per barrel before the end of the year, while repeatedly arguing both of these are highly unlikely. So indeed Moses is simply outright lying when he claims that somehow I am in on some bet for $105 per barrel. Just total bs. And I have on another thread laid out the conditions that could lead to either of those outcomes, which, while unlikely, are not impossible.

Just how sick are you, Moses? Really.

Households are consumers so…

But how would you know that, EConned? As a pure troll you are neither a household nor a consumer.

Hey Barkley Rosser,

Please inform us all what it is that this comment makes you.

And as alway, thanks again for the free rent. You faux.

I’m noticing quite a bit of delay in accepting posts to the point that it’s rather interesting/worrisome – especially considering some comments are posted that were created after others that haven’t been posted. I do recall questions from commenters wondering about censoring of comments on this site…

EConned: Seriously, you’re asking about censoring on this site after complaining about lack of moderating of comments.

If you want to keep track, I’ve just approved 20 odd comments if not more, including your no-substance ones.

Menzie,

1) Neither precludes the other – how do you not understand that? You can’t possibly be that naive to confuse the two.

2) I only mention the lack of consistency in your process. You can’t possibly be that naive to confuse this.

3) Please note that it’s your behavior responsible for “no-substance ones” – your behavior is what dictates the tenor of this blog. You can’t possibly be that naive to miss this reality.

EConned: I have a day job. Sometime, I get pressed for time. I want to see what is in a comment before approving it. Hence, there may be delays in approving comments because I do not willy nilly approve comments. I hope this linkage between time-to-approve and demands by people to review comments for adherence to blog policy is clear to you now that I have laid out the logical chain.

Menzie,

You’re NOW clear that you delay publishing comments and do not publish comments chronologically. That wasn’t too hard to admit, now was it? Most would admitted that fact from the beginning. Moreover, inquiring about post not appearing chronologically doesn’t seem to be an odd question to ask – my apologies that it ruffled your feathers so.

EConned: No, you are just plain wrong. I just approved a swath of 40 comments in one fell swoop, including yours simultaneously with about 30 others (my you have been loquacious of late). I … have … a … day … job…

I will admit that *any* post that includes a youtube link that I have to check may be delayed more than the others. But the relevant individuals have been warned of that.

Menzie – I don’t believe the history supports your assertion, but if you insist you *never* delay non-YouTube posts, I’ll take you at your word. I have noticed comments of mine that have been delayed while others have not.

in any case, I couldn’t care less about your conveniently selected sample of a “swath of 40 comments in one fell swoop” that you keep referencing – Trump didn’t lie about wanting to increase tariffs on imports but does that mean he never lies about anything? Get out with such a sophomoric reply. And, again, your. having. a. day. job. is absolutely irrelevant to the point that I’m making regarding *selective* approval of posts. You really aren’t trying hard enough with your defense. But I’m not surprised.

EConned: I haven’t selectively delayed you. You have been delayed along with batches of others. If you want to assert that’s they case, that’s your perogative (please provide documentation). But you’ve got your wish – you’ll be permanently delayed from hereon out.

It seems feeding this troll has only generated more dumba$$ comments from him. You do know this BS is his only reason for existence.

pgl, aka PaGLiacci, the clown of dumba$$ comments, still can’t keep me out of his empty skull. It’s *something* to hear from you again, bozo.

And we thought you were one of those “corporations are people too” types.

And again you prove you’re one of those “they who never thinks” types.

Are you really that pathetic? Nothing but childish cheap shots. Nothing. I guess since the kiddies kicked you out of the sand box, you got nothing else. I would tell you to get a life – but something tells me you are as incapable of doing that as writing a coherent comment on actual economics. So troll on!

pgl – you cannot be serious. You literally started the cheap shot. It was you, not me, who started with the absolutely pointless and baseless claim. Please put away your clown nose and start acknowledging reality.

Footnotes??? Data notes?? We don’t need no stinkin’ footnotes!!!!!

Princeton Steve probably prefers Econned’s footnote and data source free style of writing!

pgl (PaGLiacci) definitely prefers spending spare time daydreaming about the preferences of others and footnote and data source free style of writing (whatever the literal f*ck that means) of others. Honk! Honk! Clown show arrived when pgl pulled up.

I see that the thread where I gave my summary on my completely consistent oil price forecasts has scrolled off. So, here are three points for the record, completely consistent with everything I have posted on this here.

The chance of crude oil prices exceeding $100 per barrel is extremely low, but not zero. What could bring that about, even if only briefly, would be a sudden cutoff of production in a major supplier. I proposed, although there are other possibilities in the next half year, an attack by the north Yemeni Houthis successfully taking our a substantial portion of the Saudi production facilities, not out of the question, although unlikely. But that is not the only such possibility.

The chance of crude oil prices falling to $40 per barrel is also extremely low, but not zero. What could bring that about would be a collapse of aggregate demand. What could seriously bring that about would be the appearance of a new Covid variant that current vaccines do not help resisting, which could lead to another pandemic set of widespread lockdowns and massive economic collapse.

Finally, for those interested in following the oil industry in a reasonable way the site https://oilprice.com is quite good. It provides price changes on various crude types as well as at any time usually five links to various reports about developments in the industry. Not all of these are fully reliable, and one should check other sources to really be on top of things, but this is generally a useful source that provides more than the usual general news sources.

While we are at it – could we present oil prices in real terms? It does seem they past $100 a barrel back in 1980 as well.

https://inflationdata.com/articles/inflation-adjusted-prices/historical-crude-oil-prices-table/#:~:text=Monthly%20Average%20Domestic%20Crude%20Oil%20Prices%20%20,%20%20%24111.48%20%2082%20more%20rows%20

BTW, today for reasons nobody seems to be attempting to explain, crude oil prices took a sharp decline, with both Brent and WTI now below $70 per barrel.

“for reasons nobody seems to be attempting to explain”. You need to star in your own half-hour TV comedy called “Satirizing Myself”.

https://www.reuters.com/business/energy/opec-meets-agree-oil-supply-boost-prices-rise-2021-07-18/

Originally I thought you had to be entering early senility because no one with a PhD could be that dumb. I was wrong, you’re just a very dumb man.

It’s below $67 post USA market close BTW.

The output deal between the Saudis and the UAE was made six days ago. The price should have happened then but did not. This OPEC meeting just ratified something the markets already knew was going to happen. What is mysterious is why the reaction was delayed.

The price DROP should have happened then.

I give up.

Young people, I want to tell you something important. You will run into some people in your life who can NEVER admit when they are wrong. There are actually a decent amount of these type people. Probably a higher ratio of them live in America than in other nations. Some, obviously, we have Exhibit A here in comments, work in academia. Do not ever try to figure out why it is these people are the way they are, just know, as a young person, that you will encounter people in your life, who will NEVER EVER admit they are wrong. And they don’t have to have orange skin and be President of a nation. It’s a personality type. Probably related to their childhood to a degree. But just know, you will meet some in life, and there’s no figuring it out, these people just exist. Don’t waste time trying to figure them out.

Moses,

I have admitted I was wrong very recently here, e.g. regarding the matter of whether Iran would negotiate getting back into the JCPOA before the new admin comes in, which I noted that many experts, such as Juan Cole, were forecasting. But very recently it has been announced that they have halted negotiations until after the new admin comes in. I made a comment here that you were right and I was weong.

So, Moses, why are you lying that I never admit I am wrong when I just did so, even granting you being right? Did you not read that comment? Or are you consciously covering up and lying so you can rant senselessly here.

I know you have gotten all excited about this recent oil price drop, but note i have made absolutely zero forecasts about near term price movements. I have never said the price could not go down, especially in the short run.

As it is, I am for the record sticking with what my position has been for some time and has recently been atated and restated several times. So I shall do it again, especially given that you lied about that earlier in this thread with Menzie having to correct you. Is that why you are ranting and raving while lying yet more here?

So, my position is that by the end of the year, not next week, there is a chance both that we can see crude oil hit $40 per barrel and also a chance that we can see $100 per barrel. The former would involve an unexpected sharp decline in global aggregate demand, with me noting at least one possible scenario how that could happen, although there are other possibilities, although they are low probability.

As for a large price surge, that would depend on an unexpected supply shock. Again, I have provided a possible way that could happen, but there are other possible ways it could happen. However, all of these are low probability, even though you inaccurately claimed earlier in this thread that I was supporting buying futures on $105 per barrel. That was just an outright lie by you, Moses.

Why are you so keen on repeatedly lying about what I say here? Just how sick are you?

BTW, Moses, WTI is above $67 and rose by $1 today, although both it and Brent are still under $70. This decline does not look like it is going any further, with the price basically hanging around $70, although currently a few dollars lower than it was last week.