That’s a quote from an Econbrowser reader who is almost uniformly wrong on all matters related to economics, but it seems useful to me to provide the empirical evidence on futures as predictors, especially as noted in a recent post rising commodity prices have put upward pressure on inflation rates. Further, with the efficiency of futures markets might have changed over time, with greater financialization.

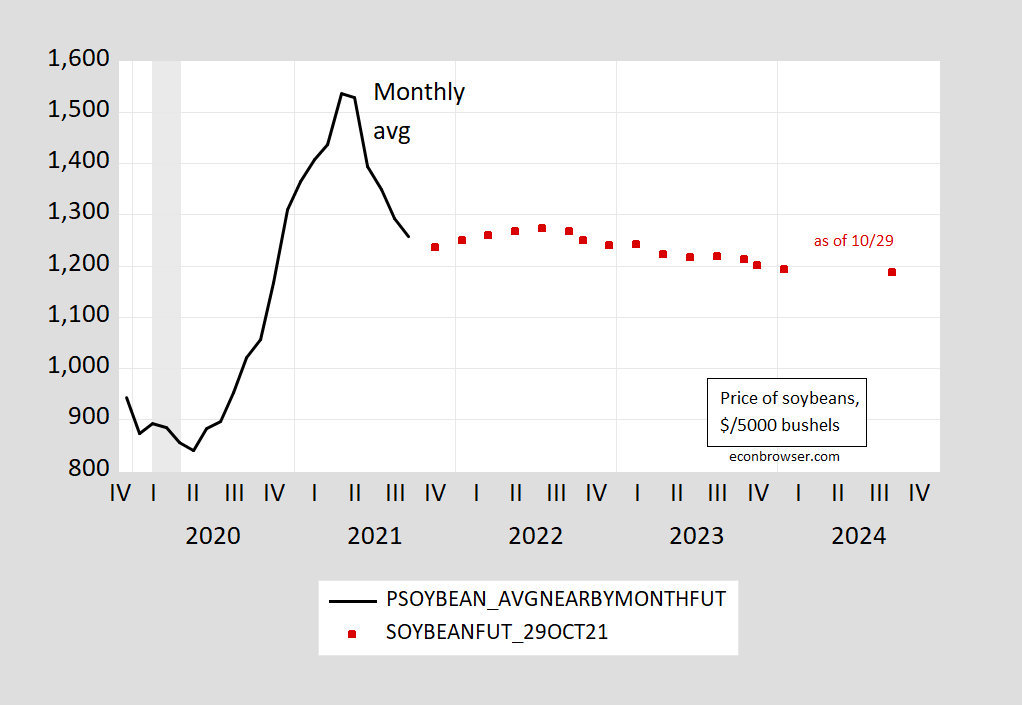

Figure 1: Price of soybeans, nearby month futures, monthly average of daily data (black), and soybean futures as of 10/29 (red squares), both in $/5000 bushels. Source: investing.com, ino.com (accessed 10/30/2021).

Previously, I’ve noted my work with Olivier Coibion (Journal of Futures Markets, 2014), in which we evaluate — among other commodities — soybean prices. V. Fernandez (Resources Policy, 2017) conducted an update of our work. Kwas and Rubszek (Forecasting, 2021) has examined the predictive power of futures up to March 2021 (starting the sample in 2000) (neither examines soybeans, though).

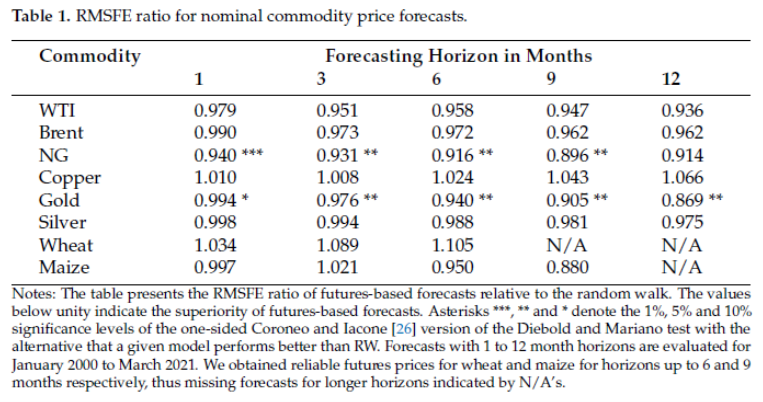

In Table 1, the ratio of the root mean squared forecast errors (RMSFEs) for futures relative to random walk is shown. Values less than one indicate futures outperform the random walk, with the asterisks denoting significance (one-sided tests).

Source: Kwas and Rubszek (2021).

Note that with the exception of natural gas and wheat, futures outperform a random walk.

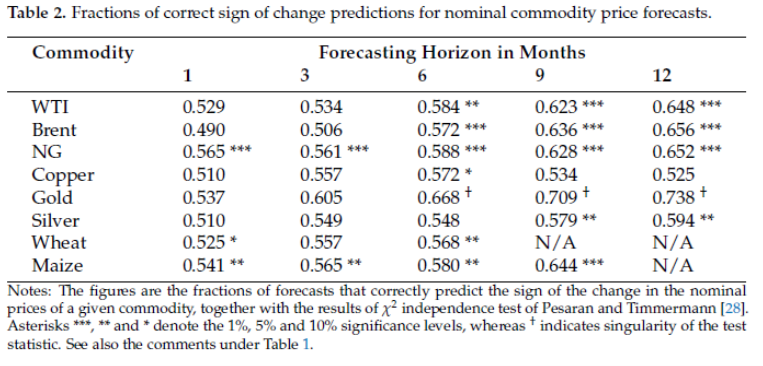

Another conventional way to assess forecasts performance is to see whether the indicator signals the correct direction of change. When the statistic is greater than 0.50 in Table 2, then futures outperform a coin toss; once again, asterisks denote statistical significance.

Source: Kwas and Rubszek (2021).

Note that with one single exception, futures correctly predict direction vs. a no change prediction. Admittedly, not all instances are statistically significant – but there are quite a few that are.

As I noted before, neither of the studies examined soybean futures specifically. However, in a 2019 paper (Huang, Serra, Garcia, Eur. Rev. Agric. Econ.) [ungated working paper version], the authors write:

Using quantile regression, we evaluate the forecasting performance of futures prices in the soybean complex. The procedure provides a more complete picture of the distribution of forecasts than mainstream methods that only focus on central tendency measures. Forecast performance differs by location in the futures price distribution. Futures forecast perform well in the centre of the distribution. However, futures prices tend to over-forecast when futures prices are high and under-forecast when futures prices are low, suggesting that futures prices tend to under-estimate price reversion towards the centre of the distribution. Forecast errors are larger when futures prices are high.

At the time that reader CoRev was debating the informativeness of soybean futures, the price was 814, which places the price at the upper end of the lower price range, i.e., roughly in the center of the distribution, exactly where the authors find soybean futures to be relatively good predictors of future soybean prices.

Futures markets are not predictors in the sense of being high accuracy. There’s actually huge variability. However, they are best mean expectation. The anti-EMH types on Internet forums routinely confuse these two issues.

However, you can actually use FIXED PRICE futures to estimate the market’s view of uncertainty. For example, see the famous funnel graph by EIA for oil price futures:

https://www.eia.gov/outlooks/steo/images/fig1.png

Internet econ chitchat is plagued by sunk cost fallacies, ignorance of NPV, ignorance of supply and demand, ignorance of arbitrage, etc.. I guess this is how biologists and physicists feel with debate versus those who don’t know basics. Chemists and material scientists don’t have to deal with that. Then again, there stuff is more boring and doesn’t attract the hoi polloi.

Here is a guy (CoRev) who also thinks that vaccines kill people, and the vaccines that don’t kill “99%” of the people who take them, the remaining 1% of the vaccine takers that don’t get killed by the vaccine “produce mutations” that “cause more severe disease in unvaccinated hosts”.

I used to think nobody on planet Earth could have “managed” the USA’s national policy on Covid-19 any worse that donald trump. Now, upon further reflection, I believe CoRev might have handled it worse than donald trump did.

Is he just trying to sweet-talk Jenny McCarthy into the sack or what’s going on here with CoRev??

From Ana Swanson of NYT:

https://www.nytimes.com/2021/10/30/business/economy/biden-steel-tariffs-europe.html

This begs the question: “Is normal the new normal??”

Reading month-old NYTs on Hallows Eve. I think this is a topic Mr. Baffling has rightly discussed with some perturbance:

https://www.nytimes.com/2021/09/27/us/politics/texas-congress-map-republicans.html

texas has gotten worse since i last commented on the topic. while the state is steadily shifting blue, i did not realizes the full extent of chicanary the republicans would partake in to keep the state as red as possible. the elimination of the voting rights act has set back democracy in texas by at least a generation. not only is the gerrymandering going to impact representation. but the new voting restrictions, aimed directly at minorities and the poor, will ensure that only the good ol’ boys hold office over the next decade. texas is creating a roadmap to show how a minority party (republicans) can abuse the law to maintain rule. republicans are using new gun laws to permit voter intimidation in the urban democratic strongholds. last year’s trump truck assault on the biden tour bus, and subsequent refusal of the county sheriff to assist, is a prime example of the voter intimidation occurring in this state. we are back to the 1920’s in behavior, unfortunately.

Trae “The Flopmaster” Young having “a tough time of it” this year. And if someone tells you this makes me laugh nearly every day, or it’s something I “get my jollies” out of, don’t you dare believe them people. Don’t you dare believe them. This whole thing with Trae “The Flopmaster” suffering through having to earn his hoops by actually putting the ball in the basket has been, uh, uhm, uh, very…. “rough on my constitution”. I want to tell you that kids.

https://www.yahoo.com/news/trae-young-fined-15-000-232648475.html

[does my best to keep off-brand Mountain Dew with lime squeezed in from coming out of my nose as I’m dying laughing] I just hope commenter pgl and Stephen “Women Bring Violence On Themselves” Smith can also get through this trying time.

“I have been repeating the same story”. CoRev is certainly persistent. Persistly wrong.

I miss the days (seems like only a few months ago) when we could watch 3/4 of Atlanta Hawks games, watching Trae “The Flopmaster” Young shoot free throws after he had his skin lotion discombobulated.

https://news.yahoo.com/trae-young-frustrated-with-new-shooting-rules-theres-a-lot-of-missed-calls-185210672.html

Oh, if only to return to the exciting days of the NBA……..

https://twitter.com/BleacherReport/status/1409336114549170176

Trae “The Flopmaster” will just have to “endeavor to persevere”.

So, by definition CoRev is an economist.

CoRev is this site’s would-be Carnac the Magnificent, all knowing, all seeing and normally all irrelevant.

You hope you get inflation.

If commodities futures are predictors of inflation, what are predictors of great depressions?

T.Shaw: Since there is no uniformly common definition of a “great depression”, it’s hard to answer your question. Is it the great depression of the 1890’s, or of the 1930’s, or some other great depression that is resides in your own mind?

Menzie, on this Halloween 2021, it’s important to remember, from T. Shaw’s viewpoint the voices he hears in his head about events none of the rest of us are familiar with, are very legitimate:

http://kdrevision.com/researchers-are-figuring-out-why-some-people-can-hear-the-voices-of-the-dead/

Those who can hear the voices of the dead have been specially chosen by Satan to do so. Now we know who is feeding Shaw all this weird stuff!

Gee – soybean prices finally did top $10/bushel well after the pandemic got rolling:

https://www.macrotrends.net/2531/soybean-prices-historical-chart-data

So CoRev was EVENTUALLY right that some Trump policy restored high soybean prices – letting COVID-19 get out of control creates supply disruptions leading to higher prices. Now that was a brilliant plan! MAGA!

https://fred.stlouisfed.org/graph/?g=EGFT

January 30, 2018

Global Prices for Soybeans and Soybean Oil, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=EFPj

January 30, 2018

Global Prices for Soybeans and Soybean Oil, 2007-2021

(Percent change)

If futures were systematically wrong about spot prices at some future time, hedgers would learn not to use them. If futures were no better than a random walk, hedgers would learn not to use them.

Hedgers use futures because they are better than nothing. Hedgers use options because they are worth the premium.

So while Menzie has kindly offered empirical evidence that futures mostly have predictive value, the mere existence of hedging in futures markets should mean a strong presumpion that futures have predictive value. Arguing otherwise without evidence is, well, it’s a bad sign.

i don’t think you should expect futures to be exact. they are a prediction of the future, made today. people are allowed to then act on those predictions. this changes the outcome.

in gambling, the odds change with time. some of it is due to important new information. some of it is due to reaction to the odds themselves. long shots attract some money while others shy away from the favorites because little money is to be made. but nobody expects the original odds to exist come game time.

md,

When the distribution of a series is skewed, then futures may systematically misforecast future spot prices, even with rational expectations holding. This is the famous “peso problem” in international finance, first identified by Ken Rogoff in his PhD thesis at MIT in the late 70s. So the problem with the peso was that there was (probably still is) this downward skew, a downside risk of periodic sharp drops not offset by periodic sharp revaluations upwards. So, the mean is lower than the median, with the median tracking better those future spot prices, with them thus being above what the forward markets had forecast, with the mean coming about due to those occasional times when the future spot price ends up a whole lot lower than the forward market price forecast it to be.

This reminds me of a huge online argument I had with a Muslim financial journalist that swaps were in essence the same thing as insurance and it was a way for large financial companies to evade regulations related to insurance (a cheaper way to get the benefits of regular insurance).. I’m certain you’d take her side on it, but anyway, she seemed to disappear from financial journalism roughly a year after that, so I must have annoyed her just the right amount.

Moses,

Oh my, this is odd. So I do not even know which of you took which position, and there are a lot more details needed to know about this, so I have not comment on this, and am not likely to provide any even if you bore us with some long discussion of this debate you had somewhere or other.

What I find most amusing about this is you deciding that somehow I would agree with this person you debated with. So, does this mean that since you think that your debate with her led to her disappearance from the internet your claiming that I would have agreed with her in this poorly described debate will lead to me disappearing also?

Sorry to disappoint you, Moses, but not particularly likely.

https://www.bbc.com/news/business-59070020

October 28, 2021

Impact of Brexit on economy ‘worse than Covid’

The impact of Brexit on the UK economy will be worse in the long run compared to the coronavirus pandemic, the chairman of the Office for Budget Responsibility has said.

Richard Hughes said leaving the EU would reduce the UK’s potential GDP by about 4% in the long term.

He said forecasts showed the pandemic would reduce GDP “by a further 2%”.

“In the long term it is the case that Brexit has a bigger impact than the pandemic”, he told the BBC.

His comments come after the OBR said the cost of living could rise at its fastest rate for 30 years, with suggestions inflation could hit almost 5%.

Speaking after Wednesday’s Budget, Mr Hughes said recent data showed the impact of Brexit was “broadly consistent” with the OBR’s assumption that leaving the EU would “reduce our long run GDP by around 4%”….

https://www.nytimes.com/2019/01/16/opinion/what-to-expect-when-youre-expecting-brexit.html

January 16, 2019

What to Expect When You’re Expecting Brexit

The short run could be bad for the rest of Europe, too.

By Paul Krugman

What’s going to happen with Brexit? A second referendum? A disorderly hard exit? A new offer from the European Union that isn’t as offensive as the deal that just got rejected? God knows, and even He may be uncertain.

Part of the problem is that there don’t seem to be many rational actors out there. Much has been written about the fantasies of many Brexiteers; I don’t have anything to add to all that. But we should also note the fantasies of the Eurocrats, who have behaved at every step of this process as if Britain were Greece, and could be bullied into capitulation. Minor gestures could have saved Remain in 2016; a bit of flexibility, a bit less determination to impose humiliating terms, might have led to a soft Brexit now. But it was arrogance all the way.

Now we hear that E.U. officials are horrified * by the scale of May’s defeat, and my sense is that European leaders are starting to realize that a disorderly break would do a lot of damage to a fragile eurozone too. No kidding.

Anyway, let’s talk about where the economics of Brexit seem to stand now….

“If futures were systematically wrong about spot prices at some future time, hedgers would learn not to use them. If futures were no better than a random walk, hedgers would learn not to use them.”

Not necessarily. Insurance has a negative expected value. You could imagine a farmer willing to pay a premium to hedge the possibility of going bankrupt and losing their farm. I might be willing to sell insurance on a coin flip if the premium is sufficient.

I see you point. Hedging is buying a reduction in risk. I’m not sure hedging and insurance in a general sense should be thought of in the same way, though.

Insurance against total loss must have a negative expected value if private insurers are to remain in business. It is one-way market – no upside for either party in the case of a claim. Liquidity providers in the futures market can make money on the spread, so to tha extent, there is q negative expected value between tye buyer andd seller of futures, but futures are not a case of pooling risk. Each side assumes a different risk, presumably becausje each party can better afford one risk over the other.

Futures contracts are also not (usually) insurance against total loss. The risk of paying more is different from the risk of total loss. If one’s business will collapse in the face of a modest rise(fall) in input prices, then futures may serve as insurance against total loss. More often, though, futures are used to lock in a price at which business can be done at a profit (one hopes). The cost of hedging cannot be so high that the risk of having to accept the spot price on delivery is acceptable. I kinda think a random-walk futuress market would be too expensive. If there were no information in future prices, firms could simply negotiate a price with suppliers.

But you may be right. After all, there is a market for copper futures. Even so, I think the presumption ought to be that hedgers hedge with futures because the futures market offers efficient pricing. Otherwise, just use options.

md,

Actually insurance looks a lot like the peso problem in that it deals with skewed distribution situations, with the events that one is insuring against being like those occasional sharp drops of the Mexican peso not offset by occasional sharp increases in its value. So one goes along without one’s house catching fire, but then once in a very long while it does so with devastating consequences, with no equivalent sudden irmprovement on the upside to offset the dowward skew.

https://legacy.rma.usda.gov/aboutrma/what/history.html

History of the Crop Insurance Program

Strategic Plan | Our Mission, Vision, and Core Values

________________________________

Congress first authorized Federal crop insurance in the 1930s along with other initiatives to help agriculture recover from the combined effects of the Great Depression and the Dust Bowl. The Federal Crop Insurance Corporation (FCIC) was created in 1938 to carry out the program. Initially, the program was started as an experiment, and crop insurance activities were mostly limited to major crops in the main producing areas. Crop insurance remained an experiment until passage of the Federal Crop Insurance Act of 1980….

https://news.cgtn.com/news/2019-10-29/-China-issues-guidelines-on-developing-agricultural-insurance-LbIg3dsl9K/index.html

October 29, 2019

China issues guidelines on developing agricultural insurance

Chinese authorities issued guidelines on promoting the high-quality development of agricultural insurance on Monday. According to the guidelines jointly issued by the Ministry of Finance, the Ministry of Agriculture and Rural Affairs, the China Banking and Insurance Regulatory Commission, and the National Forestry and Grassland Administration, insurance will cover at least 70 percent of the three major staple crops of rice, wheat, and corn by 2022.

https://news.cgtn.com/news/2020-01-20/Pig-farmers-in-C-China-s-Henan-get-257-mln-in-insurance-payouts-NoW6bTRGMg/index.html

January 20, 2020

Pig farmers in Chinese agricultural province get $257 mln in insurance payouts

Farmers in central China’s Henan Province have been compensated 1.76 billion yuan (about 257 million U.S. dollars) for their losses in raising pigs in 2019, a local insurance watchdog said.

The value accounted for more than 60 percent of total agricultural insurance payouts last year, according to figures released by the provincial banking and insurance regulatory bureau.

The compensations were paid to offset the losses of farmers, help them resume pig farming and stabilize the pork market, said the bureau….

Why not present us with a portfolio of futures, and report actual results?

Are you ignoring contango and backwardation hedging, and their effects on price?

Are futures contracts being bought and sold many times before actual delivery? Do those intermediate trades themselves provide profits that can serve as hedges for quite a lot of middlemen options traders?

《If futures were systematically wrong about spot prices at some future time, hedgers would learn not to use them.》

If you see a contango pattern and sell back months to buy them back low, are you making money despite the inaccurate prediction of spot?

Is your model maybe leaving out options trades, thus ignoring 90% of the transactions involved in futures trades?

《Insurance against total loss must have a negative expected value if private insurers are to remain in business.》

Why can’t insurers invest premiums in financial products that return more than needed to pay out claims?

what are the risks of those financial products? what if they lose money need to pay out those claims?