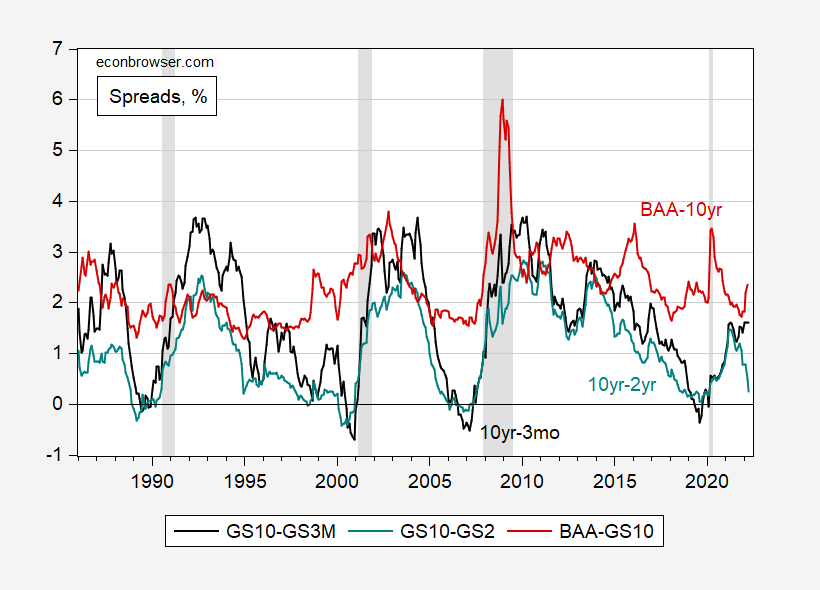

Andrew Sorkin et al. mention “mixed signals” regarding the prospects of recession. I thought it useful to plot some indicators. First, standard term spreads and one credit spread.

Figure 1: 10 year – 3 month Treasury spread (black), 10 year – 2 year spread (teal), and BAA-10 year Treasury spread (red), all in %. Data for March through 3/23. NBER defined recession dates peak-to-trough shaded gray. Source: FRED, NBER, and author’s calculations.

The 10 year – 2 year spread has shrunk considerably, but the 10 year – 3 month has not – and indeed has widened. The 18 month 3 month forward minus 3 month spread (not shown above; see figure from Deutsche Bank at bottom of post) favored by Chair Powell has widened as well, so the case is not strong for an incipient recession

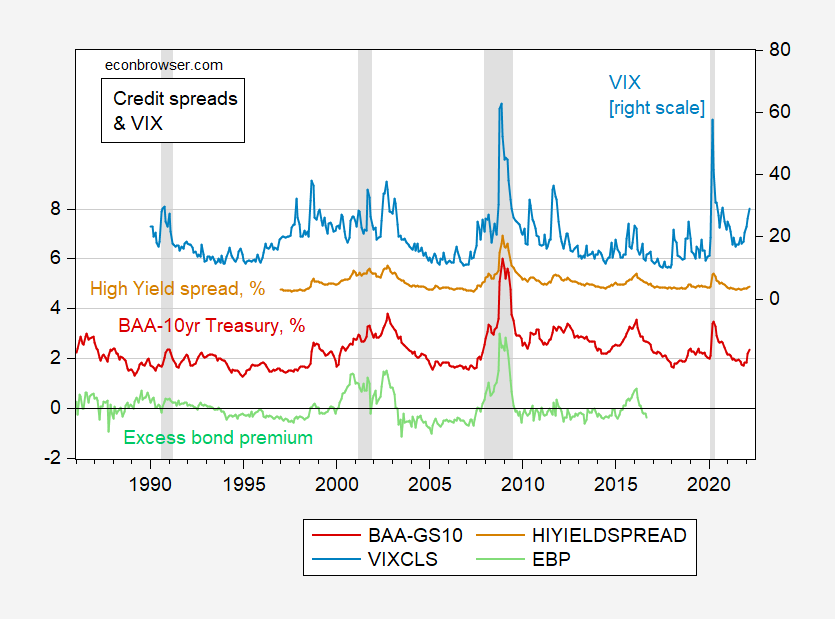

As noted before, older conventional wisdom suggested term spreads as leading indicators, and credit spreads (as in the BAA-Treasury spread shown in Figure 1) as contemporaneous indicators, of recession. Here is an additional credit spread, and the VIX depicted:

Figure 2: BAA-10 year Treasury spread (red, left scale), ICE BofA US High Yield Index Option-Adjusted Spread (brown, left scale), Excess Bond Premium (light green, left scale), all in %; VIX (light blue, right scale). Data for March through 3/23. NBER defined recession dates peak-to-trough shaded gray. Source: FRED, Favara et al. (2016), NBER, and author’s calculations.

The BAA-10 year Treasury spread is not an ideal credit spread since it doesn’t account for differing maturities for the corporate bonds. The high yield spread does. However, neither adjusts for risk aversion, which the Giovanni Favara, Simon Gilchrist, Kurt F. Lewis, and Egon Zakrajšek Excess Bond Premium (EBP) does (see discussion in this post; see [1], [2]). Unfortunately, the latter ends in 2016, so we don’t have insights from this measure for the current situation. Still the fact that the two credit spreads covary with the EBP is suggestive that both credit spreads and term spreads are signalling heightened probability of recession. However, even the 10yr-2yr is indicating only about a 19% probability of a recession in the next year, using a plain vanilla probit over the 1986-2021 sample (for the sake of comparison, in 2006M11, the implied probability of recession in the next year was 29%, in 2000M04, 38%).

For nostalgia’s sake, here’s my September 2019 prediction of recession for August 2020, using a plain-vanilla probit.

Addendum: 18 month forward 3 month minus spot 3 month spread (dark blue, left scale), 10yr-2yr Treasury spread (light blue, right scale).

Source: Luzzetti, et al. “Which curve signal to trust: The party in the front or business in the back?” Deutsche Bank, 25 March 2022.

The BAA-10 year Treasury spread is not an ideal credit spread since it doesn’t account for differing maturities for the corporate bonds.

I always read how FRED described the BAA rate as being a long-term as in 20 years rate. So using a 10-year rate may understate the spread.

I do know that there are all sorts of data vendors (Bloomberg, S&P Capital, Refinitiv, Barclays) who provide carefully constructed credit spreads for all sorts of credit ratings but the information from these sources is not exactly free,

https://www.msn.com/en-us/news/politics/ginni-thomas-texts-spark-ethical-storm-about-husband-s-supreme-court-role/ar-AAVuJEa?ocid=msedgntp&cvid=d7c99624c0104f8eabfa5e8f936ec90f

Ginni Thomas tried to subvert the Constitution by overturning the 2020 election. Her husband is worse as he used his place on the Supreme Court to vote against releasing key evidence to the 1/6 committee. A story with the reactions of some of our Constitutional scholars. Clarence Thomas needs to be removed from the Supreme Court.

I have been criticizing the treasonous activism of Ginni Thomas as well as how her husband abused his position on the court to vote against releasing WH materials. Leave it to the rag publication Washington Times to call that a “backdoor racist squeeze”:

https://www.washingtonexaminer.com/opinion/washington-secrets/criticism-of-ginni-thomas-seen-as-backdoor-racist-squeeze-on-justice-thomas

I might be tempted to tell the low life who wrote this eff you but I will simply remind this clown about how Thomas defended his sexual abuse of Anita Hill. After all calling out a sexual predator who just happens to be a black Federalist is a “high class lynching”.

Women’s rights do not matter. Our Constitution does matter. Just do not criticize the right wing’s Uncle Tom.

It’s worth remembering that we now know Clarence Thomas perjured himself in his SCOTUS nomination testimony. In that testimony he flatly denied ever having seen any of the porno movies mentioned by Anita Hill. Long after he was confirmed some energetic investigative reporters scoured local video rental outlets (yes kids…back in the days before streaming you would rent video tapes!!!) and discovered that he had indeed rented those same movies. So we know that he lied under oath at least once.

A lot of reports are saying that Ketanji Jackson has no Republican support. But all of these reports are blatantly false. Republican Joe Manchin of West Virginia is on board with Jackson. So Democrats did flip one Republican to approve Ketanji Jackson.

When Biden nominates a white male to replace Thomas, you’ll be mad.

I’m pretty neutral on the race actually. I like Neal Katyal quite a bit though. Everything I have seen of him (admittedly mostly surface traits) indicates he is a man of high ethics and morality. He would be the first Asian person on the U.S. Supreme Court.

To be very honest, of the ones Biden was looking at, Leondra Kruger would have been my first choice.

https://forward.com/fast-forward/481566/leondra-kruger-jewish-stephen-breyer-possible-supreme-court-nominee/

I will say Ketanji Jackson has impressed me much more to the positive side with her Senate hearing than I anticipated. She was and is a great choice, and I regret my prior cynical view towards her.

As i said before, she is eminently qualified. In every definition of the word. She impressed me more every day.

Makes you wonder how even a partisan hack could have approved the turd named kavanaugh. Not even comparable. One is a role model for young women, the other is a predator of young women.

@ Baffling

My memory isn’t quite as sharp as it once was, but I think in a prior thread you were the one taking issue with my comments on Judge Jackson, and one of her staff’s tampering with Wiki pages. Honestly at that time, I thought it had a very bad smell to it, and that maybe she had put that person up to tampering with the Wiki page. Now, seeing her testimony, I find it much harder to believe she is the type person that would do that (though we can’t know 100%). So, the long and the short of it is, I think Judge Jackson was a good choice by Biden, i.e. you were right, I was wrong.

moses, i don’t think i took a strong position on the wiki situation. i doubted her involvement, but i had not followed the story much.

that said, after hearing her speak during the hearings, and learning more of her backstory, i am even more impressed with the woman. i can’t think of a better selection for supreme court justice, based on the evidence to date. well chosen. and while she was very mild mannered during the hearing, i will lay money she will hold the feet of those old white (and black) justices to the fire once on the bench. she seems to have a very ethical sense of right and wrong, not an ideological one.

democrats chose kentanji jackson. republicans chose kavanaugh. that speaks volumes. there exists no world where kavanaugh is even remotely qualified to be a supreme court justice.

Well Merrick Garland would be a good choice

The word you were looking for is “if”.

Since you have a tenuous grasp on the present, you should probably not pretend to know the future.

https://news.cgtn.com/news/2022-03-25/Chinese-mainland-records-1-366-new-confirmed-COVID-19-cases-18GnSKwyKl2/index.html

March 25, 2022

Chinese mainland reports 1,366 new COVID-19 cases

The Chinese mainland recorded 1,366 new confirmed COVID-19 cases on Thursday, with 1,301 linked to local transmissions and 65 from overseas, according to data from the National Health Commission on Friday.

A total of 3,622 new asymptomatic cases were also recorded on Thursday, and 27,046 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 140,651, with the death toll remaining at 4,638.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-03-25/Chinese-mainland-records-1-366-new-confirmed-COVID-19-cases-18GnSKwyKl2/img/c3d3fc5993ba40f2aa2d4a25fdd3490c/c3d3fc5993ba40f2aa2d4a25fdd3490c.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-03-25/Chinese-mainland-records-1-366-new-confirmed-COVID-19-cases-18GnSKwyKl2/img/6259e84f5794416a86cc29f300b4576a/6259e84f5794416a86cc29f300b4576a.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-03-25/Chinese-mainland-records-1-366-new-confirmed-COVID-19-cases-18GnSKwyKl2/img/d33c28361d6640e8bdefa66830172de2/d33c28361d6640e8bdefa66830172de2.jpeg

https://www.worldometers.info/coronavirus/

March 24, 2022

Coronavirus

United States

Cases ( 81,565,957)

Deaths ( 1,002,259)

Deaths per million ( 2,998)

China

Cases ( 139,285)

Deaths ( 4,638)

Deaths per million ( 3)

Yes China is in deep trouble with Covid-19. This is the highest daily numbers they have ever had. If they try to handle Omicron 2 with lock-downs it will have very bad effects on the economy. If they don’t they will have a raging pandemic. In either case there will be problems for any supply chain that depend on China – and a lot of companies will have to decide whether they really want to be dependent on China for their supplies in the future.

Apparently, China agrees with you. There are reports of lockdowns more limited than in the past in recognition of current economic stresses.

Yes and the problem is that you cannot stop the pandemic with limited lockdowns. Omicron 2 is extremely infectious. Rolling sector specific “lock-downs” are no match for Omicron 2. It will continue to break through those. The testing everybody approach is also somewhat flawed. You can test negative in the first few days after you get infected. They better get everybody vaccinated and boosted.

Why ignore funding costs like repo rate?

Aren’t your rates just trades used after you get your funding in repo or whatever, right? Are you ignoring primary causes?

Why did this sentence from today’s https://statmodeling.stat.columbia.edu/ remind me of this blog?

《CBO, BLS, BEA report estimates of the federal budget, unemployment rates and counts, GDP, without acknowledging uncertainty or acknowledging only some forms (e.g., sampling error) and burying the information about those away from the top level estimates. 》

Nobody ignores the cost of funding. Well, that is to say, nobody but you until just now.

It’s comical how often you run into some concept that the rest of us take into account without making a daily fuss about it, and run around claiming you’ve discovered a yawning gap in other people’s knowledge.

Where is cost of funding, Macroquack, in the above? Would you say, perchance, it was ignored?

Repeating your mistake doesn’t correct the mistake.

https://www.nytimes.com/2011/06/14/opinion/14Reynolds.html

June 13, 2011

Rescuing the Real Uncle Tom

By David S. Reynolds

THE novelist Harriet Beecher Stowe, born 200 years ago today, was an unlikely fomenter of wars. Diminutive and dreamy-eyed, she was a harried housewife with six children, who suffered from various obscure illnesses worsened by her persistent hypochondria.

And yet, driven by a passionate hatred of slavery, she found time to write “Uncle Tom’s Cabin,” which became the most influential novel in American history and a catalyst for radical change both at home and abroad.

Today, of course, the book has a decidedly different reputation, thanks to the popular image of its titular character, Uncle Tom — whose name has become a byword for a spineless sellout, a black man who betrays his race.

And we tend to think of the novel itself as an old-fashioned, rather lachrymose affair that features the deaths of an obsequious enslaved black man and his blond, angelic child-friend, Little Eva.

But this view is egregiously inaccurate: the original Uncle Tom was physically strong and morally courageous, an inspiration for blacks and other oppressed people worldwide. In other words, Uncle Tom was anything but an “Uncle Tom.”

Indeed, that’s why in the mid-19th century Southerners savagely attacked “Uncle Tom’s Cabin” as a dangerously subversive book, while Northern reformers — especially blacks — often praised it. The ex-slave Frederick Douglass affirmed that no one had done more for the progress of African-Americans than Stowe.

The book was enormously popular in the North during the 1850s and helped solidify support behind the antislavery movement. As the black intellectual W. E. B. Du Bois later wrote, “Thus to a frail overburdened Yankee woman with a steadfast moral purpose we Americans, both black and white, owe our gratitude for the freedom and the union that exist today in these United States.” …

David S. Reynolds is a professor of American studies and English at the Graduate Center of the City University of New York.

https://www.nytimes.com/2011/06/14/opinion/14Reynolds.html

At the heart of the book’s progressive appeal was the character of Uncle Tom himself: a muscular, dignified man in his 40s who is notable precisely because he does not betray his race; one reason he passes up a chance to escape from his plantation is that he doesn’t want to put his fellow slaves in danger. And he is finally killed because he refuses to tell his master where two runaway slaves are hiding….

So, what do you think an Uyghur person being held in a Xinjiang interment camp run by Han enslavers would do in this same situation?? Would the Han enslavers just torture the Uyghur person or go ahead and murder him you think??

And if uighers behaved in this manner in western china, they would end up in a prison camp. However, based on her post, i suppose ltr would embrace any uighers who stood up against a society and government that was hell bent on suppressing their cause?

Looks like we have moved into late stage business cycle……incredibly fast. A recession in 2022 is about impossible without a real outside shock(sorry, the probable ending Russia;Ukraine stuff ain’t it). With lagging bls data(slowly catching on to new business creation which artificially lowered both lfpr and epr) likely catching up, things will probably look very “peakish” and “tight” by the end of year. Now we will see how long it stays.

It appears in the current context, that those who like to trade fixed income, or sell their bonds before they reach maturity, could be in trouble. Who is going to purchase the increased supply of treasuries?? Nobody knows the answer to that right now~~not in a complete context~~and volatility of rates will probably be high.

Would I be showing my age by using the archaic phrase “hemming and hawing”?? Because I foresee a lot of hemming and hawing from our fixed income “experts” on the TV in the not very distant future. Or maybe they do that already??~~but now “in spades”.

I really hate to diverge from pal’s rant (which would be called racist if Thomas were a liberal judge), but perhaps some insight regarding the subject matter of this post is appropriate.

https://finance.yahoo.com/news/recession-unavoidable-without-russian-oil-143157154.html

(Bloomberg) — The global economy likely won’t be able to avoid a recession without a resumption of Russian energy exports this year, according to a study by Federal Reserve Bank of Dallas economists.

“If the bulk of Russian energy exports is off the market for the remainder of 2022, a global economic downturn seems unavoidable,” economists Lutz Kilian and Michael Plante wrote in an article posted by the Dallas Fed Tuesday. “This slowdown could be more protracted than that in 1991.”

The authors drew a parallel to the 1991 global recession, set off by Iraq’s invasion of Kuwait in the year prior that caused an oil-supply shock. Back then, Saudi Arabia partly reduced the impact by pledging to ramp up production, helping ensure what the researchers called “only a brief U.S. recession,” which lasted less than a year.

The refusal of financial institutions to support Russian energy exports has been the main development putting those shipments at risk, the Dallas Fed economists wrote. “This outcome was largely unanticipated, as U.S. and European Union sanctions originally deliberately excluded Russian energy exports.”

Barter Schemes

Replacing that supply may be challenging, given that Saudi Arabia and the United Arab Emirates have signaled they won’t provide relief, the researchers said. They also highlighted that U.S. shale producers are “constrained by supply-chain bottlenecks, labor shortages and the insistence of public investors on capital discipline.”

“There are indications that some oil-importing countries are exploring alternative-payment schemes that avoid the use of trade credit, bypass current financial sanctions or rely on alternative currencies,” which could help ease the hit caused by financing difficulties, Kilian and Plante wrote.

Without a supply response, the drop-off of Russian exports will cause an inflationary hit that compresses spending, according to the authors.

“Unless the Russian petroleum supply shortfall can be contained, it appears necessary for the price of oil to increase substantially and to remain elevated for a long period to eliminate the excess demand for oil,” they wrote. “This demand destruction is likely to be assisted by the recessionary effect of higher natural gas prices and other commodity prices, especially in Europe.”

The IMF, meantime, still sees the global economy expanding this year. International Monetary Fund Managing Director Kristalina Georgieva said Tuesday that while there was the “possible risk of recessions” in some economies, others with fast rebounds from the pandemic are in a stronger position to cope with the reverberations from the Ukraine war.

So that’s a big “maybe”.

I bet your little pal would get the terms conflict of interest applies across the policy spectrum even if you are too stupid to care

the Dallas Fed is pulling it’s punches compared to this guy:

‘Wakey, wakey. We are not going back to normal business in a few months’: A top hedge-fund manager says crude oil prices could hit $250 this year – Energy industry experts are warning oil prices could double from current levels to $250 per barrel this year amid an ongoing international boycott of Russian energy supplies. There simply aren’t sufficient supply alternatives available outside of Russia, according to Pierre Andurand, who runs Andurand Capital Management and is known as one of the top hedge fund managers in the energy sector. “Wakey, wakey. We are not going back to normal business in a few months,” Andurand said on Wednesday at the FT’s Commodities Global Summit in Lausanne, Switzerland. “I think we’re losing the Russian supply on the European side forever.”

Picked up gas yesterday at $3.63. And as some might suspect on here, it was not with a Costco or Sam’s card. Old school cash payment.

Well except Russia is selling more to China, while Europe follows the Pols back to the middle east……which due to China buying more from Russian oil, means more supply. Yes, the Hedge fund elitist is tight. Except cut off the 2 bud.

it’s not that simple; Russian oil is not fungible…it’s a heavy sour grade for which there are only a few suitable substitutes, and the best of those from other sanctioned countries; likewise, i’d doubt there are many refineries in China that can process it….i tried to explain some of the problem when US sanctions on Russian oil were still being considered; here once again is Platts periodic table of more than 100 different oil grades (interactive)…

https://www.spglobal.com/commodity-insights/plattscontent/_assets/_files/downloads/crude_grades_periodic_table/crude_grades_periodic_table.html

to replace the type of oil your refinery was built for, you have to find a similar grade, or blend a number of other grades to get an oil your refinery can use….for an example, here’s Yves Smith on how the embargo of Russian oil is exacerbating the global diesel fuel shortage:

Russia Sanctions Collateral Damage: Diesel Shortage Risk Worsening, EV Batteries by Yves Smith – Forgive me for what amounts to news snippets,but the Russian sanctions induced energy squeeze looks to be bearing down on Europe and the US even faster that most sources anticipated. First are diesel shortages, which we had warned about virtually from the get go. Russian gas is heavier than either fracked gas or Saudi light sweet crude. Heavier means more long chain hydrocarbons which are more energy dense. Lighter grades can be used to make diesel…but that’s at the expense of the gas which you presumably also wanted to have.We had pointed out that diesel shortages are so imminent that the IEA is recommending aggressive energy conservation measures now, like more work at home, more ride-sharing, cutting air travel, so as to reduce the severity of the crunch they expect to kick in over the next four months.The news on the diesel front is only getting worse. From the first of two germane stories on OilPrice, an overview called Europe Faces Systemic Diesel Supply Crunch: Europe risks being exposed to a “systemic” deficit of diesel supply that could worsen and even lead to rationing of fuel, the top executives of the world’s largest independent oil traders said on Tuesday….“This is a global problem but for Europe it’s very hard because Europe is so short” of diesel, Gunvor CEO Torbjorn Tornqvist said at the Financial Times Commodities Global Summit as carried by Bloomberg.Europe’s diesel shortage is worsening as Russian oil refiners have started to cut back on refinery throughput, Tornqvist added.Diesel stocks globally were already low even before the Russian invasion of Ukraine, but the shortage has now been exacerbated by the lower global diesel supply from Russia.In the highly volatile global energy markets since Russia’s war in Ukraine began, even the biggest traders are exposed to rising margin calls. The possibility of a derivatives shock blowing back to the physical market is a new angle, but after the LME canceled a full day of nickel trades so as not to blow up the exchange or too many big fish, do not underestimate the extreme measures that will be taken to keep perceived-to-be-too-critical-to-fail institutions and players alive.

much more at the lead link, and her earlier posts on diesel…

rjs,

the germans, et al are not, as of thursday pm, implementing a self embargo, for all the reasons of no alternative sources presuming the persian gulf exporters not interested in dismaying their growing asia customers.

it may be the gulf are not into supporting the rage against russia.

Who are the Trump Republicans supporting Putin in this evil invasion and why are they doing so:

https://www.msn.com/en-us/news/us/republicans-are-backing-ukraine-in-the-war-so-why-is-there-support-for-russia-on-america-s-far-right/ar-AAVweuL?ocid=msedgdhp&pc=U531&cvid=1904ae0d54664dadb6b7371c108d9a91

Reason Number One: Commies like YOU are for Ukraine.

You nothing more than a worthless little pest.

Oooooo, Shawshank scores BIG…in his own wee brain.

Ad hominy grits? Really?

By the way, your little tantrum amounts to an admission that principle, that right and wrong, don’t determine your position. Whatever position your imaginary commies take, you’ll take the opposite. Like a little puppet.

There you go, again.

The elephant in the middle of the room: blowback from sanctions. Finally someone actually did have the audacity to mention it:

“The price of these sanctions is not just imposed upon Russia, it’s imposed upon an awful lot of countries as well, including European countries and our country as well.” Putin puppet??? No, it was Joe Biden who said that.

https://news.antiwar.com/2022/03/24/biden-warns-of-real-food-shortages-says-russia-sanctions-will-hurt-everybody/

Funny how few esteemed academics and infotainment pundits noticed…but some felt the urge to bloviate about the impact on Russia whose economy they barely understand.

JohnH: Earlier, I quoted James Hamilton regarding repercussions of the sanctions. You did not respond. Are you indicating that James Hamilton is one of the non-esteemed academics. I am curious.

Hamilton’s analysis focused mostly on energy. When it comes to supply disruptions, oil is the tip of the iceberg.

As I have commented several times, wheat, fertilizer, uranium, palladium, lithium, nickel and probably many other commodities have experienced significant disruptions and price rises. As we saw with last year’s surge in inflation stemming from supply chain issues (coupled with monopolistic price gouging,) shortages of relatively minor inputs can have a big impact. The same is undoubtedly true of disruption of Russian exports, which hold large shares of some major commodities markets

Though it is true that many of these items have not been officially sanctioned, cutoff from SWIFT and voluntary cessations of orders, have achieved the same effect as official sanctions.

If people can determine the effect of these measures on the Russian economy, why is there so little information about their effect on the US economy? As far as I can see, Yves Smith at Naked Capitalism is the only on looking at the scope of the potential problem.

Well Russia’s main exports related to energy so what did you expect Dr. Hamilton to write about – Snickers Bars? BTW it took me 2 seconds to find 1.36 million discussions of these sanctions and fertilizer. Something called Google. Obviously you never learned to us that either. Look – your research skills are really awful because you are too busy writing your usual intellectual garbage.

This is a rehash of the garbage you wrote under the prior post (JohnH March 25, 2022 at 1:35 pm)

Macroduck called you out quite appropriately but yea Dr. Chinn referring you to Dr. Hamilton’s post on this very subject was classic. I guess you do not read these posts before you pontificate.

So I offered you the opportunity to state your policy preference when you previously lied about the consequences of sanctions. Here, again, are the available choice:

– Allow Russia to kill, starve, orphan and displace tens of thousands of Ukrainians (and Georgians and Moldovans…) unopposed

– Engage in direct military confrontation wih Russia, which has a nuclear arsenal sufficient to wipe out human life on earth many time over

– Impose economic sanctions on Russia

There are no other choices. But of course, you won’t pick one, because your game is to pretend there is some obvious alternative that everyone but you is ignoring.

And speaking of ignoring things, every speculation regarding the possibility of recession since Russia invaded Ukraine is a recognition of the economic costs of sanctions. Menzie’s posted? The one you’re commenting on? The economic cost of sanctions. The Dallas Fed piece everybody’s talking about? The cost of sanctions. Two pieces from Professor Hamilton? Cost of sanctions.

Johnny, you’re a joke.

Johnny did offer a reply which addressed nothing you asked or had any substance. He is like the fellow who just loves to hear himself talk,

As economics supposedly teaches us, policy decisions should be informed by careful analysis of costs and benefits. Yet no one has a clue about costs to Americans arising from Biden’s sanctions. Maybe if we were told about the real costs, which is the case in all wars, people would not be so gung-ho to get involved in this one. Most all wars are made to look good prospectively. Retrospectively, when the costs become evident, most wars look awful.

As for “ Allow Russia to kill, starve, orphan and displace tens of thousands,” are you aware of what is happening in Afghanistan? Are you aware of dear Madeleine Albright’s trivializing the deaths of half a million Iraqi children due to economic sanctions? The US is hardly a benevolent hegemon.

IMO the blowback from sanctions on Russia will be much more significant than anyone will acknowledge. But isn’t such economic analysis exactly exactly what economists are trained to do professionally?

‘As economics supposedly teaches us, policy decisions should be informed by careful analysis of costs and benefits.’

This from a troll who never learned economics.

‘Yet no one has a clue about costs to Americans arising from Biden’s sanctions.’

Macroduck gave you a list of the economists who have talked about this. Of course Johnny Boy cannot be bothered to read these discussions.

Dude – you are embarrassing your own mother.

“Macroduck gave you a list of the economists…“

I checked the last weeks comments.nada.

I’d be very surprised if Macroduck supplied anything. Heck he can’t even provide links. And a few links to good analyses would easily refute my point. Amazing that no one seems to know or care how it will affect the US economy!

In any case I’d love to see an analysis of the blowback related to sanctions and related actions. Just focusing on oil doesn’t cut. Cuts to a lot of other Russian exports will only compound the problem.

We were on the highway to economic Hell long before the sanctions, which will add to the hurt.

“Most all wars are made to look good prospectively.”

Since you are clearly Putin’s spokesperson, please educate us how he thought Putin’s war would be good. Until you recognize that this is Putin’s war, none of your babble has any credibility.

I and many others are under no illusions about the cost of the economic sanctions. I am also not under any illusions about the threat to democracy and world peace that putin represents. John, you are foolish if you dont think people have thought about the consequences of both a war and sanctions. Unlike you, john, I understand the ramifications of letting putin steamroll and reclaim eastern europe. Unlike you, i will resist that outcome. It is bad.

JohnH,

Sigh probably should not waste more time on you, who seems to read nothing that is written here.

You claim that “most all wars are made to look good prospectively” (in terms of economic impact apparently). This may be true, but I have yet to see a single person commenting on this, either an economist ort a politician in the US, who has somehow claimed that aside maybe for some military production this was is going to be good economically for the US. President Biden openly said that imposing economic sanctions would hurt the US economy, most dramatically through higher oil prices, which have already happened, as have increased prices for various food and other items. I also did not see any Republicans disagreeing with him, although some of them have jumped up and down blaming him for higher gasoline prices even as they claim he is not doing enough to help the Ukrainians, normal political hypocrisy.

As it is, there are all kinds of discussions by economists going on about these costs, with this thread on whether or not the US might go into recession being an example. Clearly inflation is being exacerbated and everybody agrees that at a minimum growth will slow, with the debate being whether or not it will actually go negative with the US going into recession.

A major reason we do not have a definite answer as to just how bad the impact will be on the economy, with absolutely everybody agreeing it will have a negative impact on the economy, even as somehow you are not seeing any of this, is that none of us know how long the war will go on, which makes a huge difference. A very important matter coming up is whether or not farmers in Ukraine will be able to plant crops or not this spring, with that having a major impact on the food sector going forward one way or the other. But we do not know now, and there is no way to know now. However, obviously the longer the war lasts and the sanctions, the greater the chance we have outright recession, with all the people making definite statements now one way or the other basically being full of it. They do not know.

BTW, you keep saying that there is nobody here who knows anything about the Russian economy. That is inaccurate, although I am not going to fill you in on who might. I shall, however, repeat the claim I made on an earlier thread, which you seem not to believe: there will be more damage to the Russian economy from the sanctions than to any of the economies elsewhere, although the sanctions will indeed bring costs to the whole world. And both for the Russians as well as everybody else, the sooner the war ends the less will be the economic costs for everybody everywhere.

the proxie war ends when biden/boris stop giving kiev weapons, to make more russians mad at usa.

“Anonymous

March 27, 2022 at 4:43 pm

the proxie war ends when biden/boris stop giving kiev weapons, to make more russians mad at usa.”

Anonymous spews these lies routinely. He is clearly part of Putin’s disinformation campaign. Sorry troll but that the world has decided to help Ukrainians is a good thing. And you sir are disgusting.

the proxy war (not proxie, learn english if you want to troll in the language) ends when putin withdraws his forces from an illegal and immoral war on peaceful people. otherwise the russian people will be bankrupted.

If I was 30 years younger and not married for 44 years [Three of the best weeks of my life!], I’d propose matrimony to Stephanie Pomboy.

She’s the brains behind Macromavens. She thinks a recession is in the cards. She and Barron’s reported that nearly all the recessions in the past 30 years were preceded by oil price and interest rate shocks. I would add unduly large increases in volumes of leveraged assets purchases.

I don’t know. I wonder whether you call it a rate shock raising real, inflation-adjusted rates from negative 5% or 6% to negative 2% or 3%?

Plus, America’s banks have $17 or $19 trillion in deposits and some say $2 trillion in money market funds which could be spent or invested.

Plus plus, this week equities markets bounced from recent lows.

https://www.msn.com/en-us/news/world/thousands-of-russians-in-prague-protest-against-war-in-ukraine/ar-AAVwNFl?ocid=msedgdhphdr

Prague hosts a protest against Putin the killer that had thousands of Russians wanting this invasion to end.

https://oilprice.com/Energy/Crude-Oil/Big-Oil-Is-No-Longer-Unbankable.html

《It’s an open secret within energy circles that the eventual death of oil and thermal coal won’t come from environmentalists or even directly from renewable energy, but rather when big banks decide to stop financing it, rendering it ‘unbankable’. […] But the lure of those juicy oil and gas dollars amid an energy boom has been proving hard for Wall Street banks to resist 》

Doesn’t the above reaffirm the view that supply chains are just payment chains in reverse?

I.e., if the Fed really wants to fight inflation, why can’t it fund oil supply firms instead of mucking around with interest rates?

There you go again, the same tired trick of hiding behind a question in making a (mistaken) assertion.

So, I’m gonna help you understand stuff. In claiming (in the form of a question, as always) that payments are “just” supply chains in reverse, you have elevated an accounting identity to the level of behavior.

Go look up the difference between accounting identities and behavior, figure out why you see the world in a fundamentally silly way, and get back to us.

rsm,

the banks are recognizing you don’t make money on economies freezing in the dark, and that preferential underwriting of premature tech in wind and solar projects is not long term good for society.

You may have heard about financial sanctions against Russia but did you know there is a Goldman Sachs loophole?

https://www.msn.com/en-us/news/other/this-big-wall-street-bank-knows-how-to-bypass-russian-sanctions/ar-AAVnwlW?ocid=msedgdhp&pc=U531&cvid=83abf73d49874cf88bc0ea4e7495b422

If this story has this correct – this is so wrong. But I am rather shocked that JohnH could not interrupt his usual drivel to note this as this has been one of those sand boxes he perches on where he may have a point.

I thought this was interesting and thought Menzie and Professor Hamilton’s readers might enjoy it as well:

https://markets.jpmorgan.com/research/open/latest/publication/9002054

《The data in this report is based on transactions sourced from select Chase consumer credit and debit cards and is not representative of Chase’s overall credit and debit cardholder population. All cards included in the data were used for at least one transaction in each of 18 consecutive months, resulting in a panel of more than 30 million US cardholders. The data may differ from total US consumer spending for many reasons, including differences between cash and card spending patterns, geographic and demographic differences between the panel of Chase customers and the overall US population, and other factors.》

So, noise, amirite? Plus-or-minus 100%? Is this just Indicative of a target demographic, and let the rest eat cake?

Why is it so hard for Macrodoofus to admit that the dismal science has been elevating accounting identities to behavior in a fundamentally silly way long before I came along?

Why does Macrocuck criticize a mote in his brother’s eye, while ignoring the log in his own?

And if Mackcrodumb#^ck thought about behavior for even a minute with his half brain cell, wouldn’t he realize that suppliers behave like they want to get paid first? Hence, isn’t it pretty obvious that behavior and “finance precedes production” are perfectly compatible and supported by lots of evidence such as the oilprice article linked?

Is the Socratic Method too hard for our little Marcodump?

Macroduck. Have some respect for someone who actually makes sense.

“elevating accounting identities to behavior in a fundamentally silly way”

I am aware of such fallacies but you have never provided us with a single example as you have written word salad that you do not understand. Troll on clueless wonder.

Ooo, lookie! A tantrum from rsm! Where’s the popcorn?

md,

I think rsm is trying to get an Oscar for coming up with variations of your name used here, :-).

The trolls think they are being SO cute. Serial liar loves to call me Lucy and he claims you are the reason for this. Me? I think Brucie is a thing for some young boy named Lucy but I do not know and really do not care.

Can Lucy trollsplain away “savings = investment”, MV = PT, or a million other fundamentally silly accounting identities fervently adhered to by economists?

Is it so hard to realize that oil producers want money upfront, and banks decide at their whim (based on noise and momentum) whether to fund them?

Identities are just that – identities. Getting such things right is sort of fundamental. But you made a claim that economists dress up entire theories which are not more than identities. Of course that is far from true. So either you are an incredibly STUPID person or you are just writing one lie after another. Either way – you are a worthless little troll who should just disappear.

Why does Macrosmurf leave out positive incentives to deal with war like as Mosler suggests offering Russia US statehood, or as M^3T (Modern Mother#^@%ing Monetary Theory) proposes: Universal Generous Inflation-Protected Dollar-denominated Basic Income?

I bet Macroduck has no clue what this babble means. We know for sure you haven’t a clue. Run away worthless troll.

https://english.news.cn/20220319/4942ab24cdc14fe698584d0b7336d0a0/c.html

March 19, 2022

Better education gives wings to children in Xinjiang’s remote areas

URUMQI — One day ahead of the spring semester, 11-year-old Ayizmal Mirzjan and her friends left their home village deep in the mountains of the Pamir Plateau for school.

It was the first time that the students boarded a standard yellow school bus, the same as the ones they saw in movies. After a six-hour journey, the bus took the little passengers to their boarding school at the county seat.

Easy as it seems today, the 250-km trip used to take several days on a horse, camel or motorcycle.

Upon the departure, Ayizmal Mirzjan’s cousin Zyatm Mayir took a selfie by the school bus and posted the picture on social media. “If only I could be as young as Ayizmal Mirzjan and go to school by such a comfortable school bus,” she wrote on her WeChat account.

SCHOOL ON HORSEBACK

Ayizmal Mirzjan’s village Reskam, which means “land with ores” in the Tajik language, is a border village located in the southwesternmost part of the Taxkorgan Tajik Autonomous County, northwest China’s Xinjiang Uygur Autonomous Region.

At an altitude of over 3,000 meters, with several major rivers and mountains stretching through, the village used to see its residents’ settlements scattered in a dozen of relatively inhabitable valleys.

The complex landscape had restrained the accessibility to education for the children of Reskam for generations, including elder members of Ayizmal Mirzjan’s family.

Jamlhan Yantonghan is a retired teacher in Reskam. Having worked in the village for over 30 years, Jamlhan Yantonghan called himself a mobile “primary school on horseback.”

There was a time when he had to travel on a horse all across the vast pasture, visited the scattered households from door to door, found as many students as he could, and gathered them for class. Their classroom could be in a yurt, on a grassland, or even by a cliff.

It was not until the 1980s that the village established a proper school with classrooms and dormitories, Jamlhan Yantonghan recalled.

The school ignited a passion for education among Reskam’s students. However, it soon occurred to the villagers that access to quality and modern education still seemed out of reach in such a remote village.

In 2008, Taxkorgan adopted a school policy whereby all the students enjoy free education for up to 15 years from kindergarten to high school, and students from fourth to sixth grade can attend the boarding school in the county seat.

PAVING A WAY TO SCHOOL

However, the road to school has always been challenging for Reskam’s students.

Over 20 years ago, Ayizmal Mirzjan’s father attended the school in Reskam, which only gave lessons up to sixth grade. Like most of his peers, he did not continue with his education afterward.

Even five years ago, as Chen Jingquan, an officer at a police station along the route to the county seat recalled, once when a snow disaster struck, the students had to get out of the car and trekked 18 km across the snow-capped mountain peak, and then got in another car waiting for them at the other side.

Having escorted thousands of students over the past eight years, Chen knows all too well the difficulties: students had to navigate a perilous journey — two 5,000-meter-high mountain peaks, a single-lane way built on the cliff right along the roaring Yarkand River, and snowfields — before making their way to school.

Thanks to a construction project with an investment of 1 billion yuan (about 157.7 million U.S. dollars) in 2019, the road to and from the county seat has been renovated, while a tunnel that bypasses the two mountain peaks is scheduled to open to traffic by the end of this year.

Now, with 14 school buses put into operation this year, students in Taxkorgan can enjoy safe and comfortable journeys free of charge, which their past generations could hardly imagine.

OUT OF THE MOUNTAINS, AND BEYOND

In the past eight years, the county has invested more than 200 million yuan to improve school conditions. The enrollment rate of primary and secondary schools in Taxkorgan has increased from 75 percent in 2006 to 100 percent at present, and the university admission rate surged from 48 percent to 100 percent in 2021….

Another article linked to the ccp propaganda web site.

Ltr, i am still waiting for your apology about the racist slander you charged me with. Unprovoked. And mean spirited.

Chris Wallace lets us know what he really thinks about Faux News:

https://www.nytimes.com/2022/03/27/business/media/chris-wallace-cnn-fox-news.html

Welcome back to real journalism Chris!

President Biden along with both Democratic and Republican Senators want to quickly pass a bill imposing trade sanctions. Sounds like something we should do quickly – right? Well guess who has decided to delay this worrying his little libertarian brain that the sanctions might be too broad:

https://www.msn.com/en-us/news/politics/rand-paul-throws-fresh-wrench-in-senates-push-for-quick-russia-trade-sanctions/ar-AAVsuUp?ocid=uxbndlbing

Yea the junior Senator from Kentucky has put his weird agenda ahead of the Ukrainian people. Of course the senior Senator from the same states keeps wapping that Biden is not doing enough. Hey Mitch – stop your grand standing and go tell Rand Paui to stick it where the sun does not shine.

if you are buying and sending weapons…..

and not talking peace….

you are pushing neloib empire….

nothing about the ‘ukraine people’!

And if you invade a peaceful country and slaughter its civilians, you are a war criminal. And people who support such actions will be held accountable for their brutality.

@pgl

March 28, 2022 at 2:41 am

your line of “reasoning” plays only among the colonizing, imperial clatch.

to the rest …… ukraine is a pawn in a war of bloc domination.

be disgusted if you will.

my pity is for yemen!

“@pgl

March 28, 2022 at 2:41 am”

The latest comment I made was on March 27. Gee Anonymous – your lying for Putin has become rather transparent. If you want to come after me bucko – refer to something I actually wrote.