I was on WPR’s Central Time today, discussing among other things: “Gas and oil prices are starting to come back down. We explore what that means for inflation and fears of a recession.”

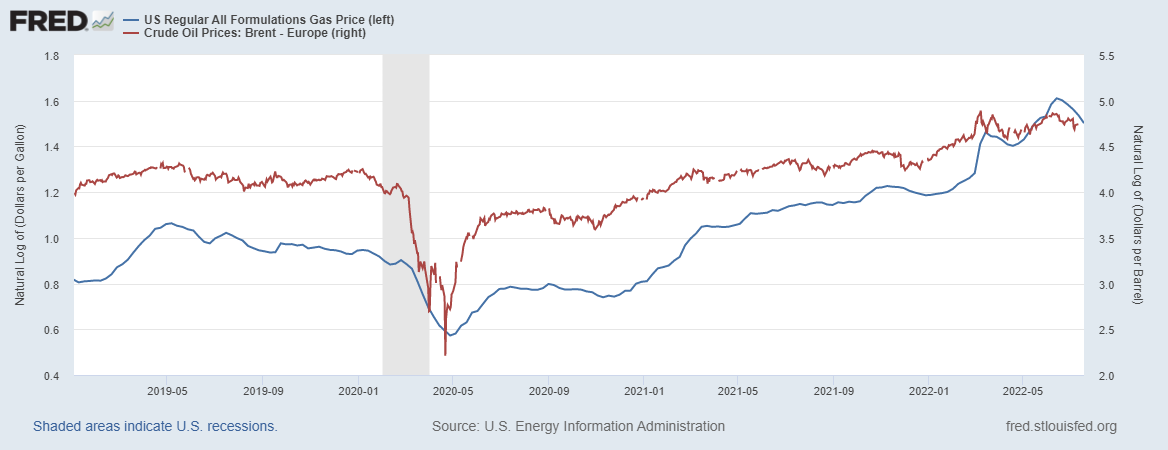

Gasoline prices are continuing their downward move, down to $4.49 for week ending 7/18, down from $5.006 for week ending 6/13.

Source: EIA via FRED.

That’s a 10.3% decline in five weeks. Since gasoline accounts for 3.8% of the weight in the overall CPI bundle, a 10% decline over the month works out to about a 0.4 percentage point reduction in month-on-month inflation. June’s m/m inflation reading was 1.3%.

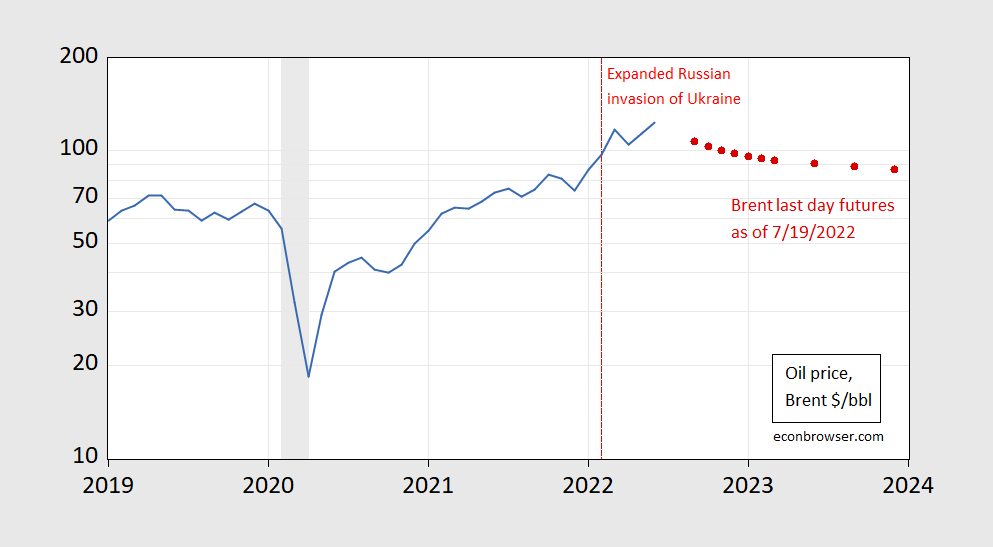

As noted in the past, the bulk of movements in gasoline prices is accounted for by oil prices (the remainder by refinery constraints). Here are futures for Brent as of today:

Figure 1: Price of oil, Brent (blue), and last day futures for Brent as of 7/19 (red square). NBER defined peak-to-trough recession dates shaded gray. Source: EIA, ino.com, NBER.

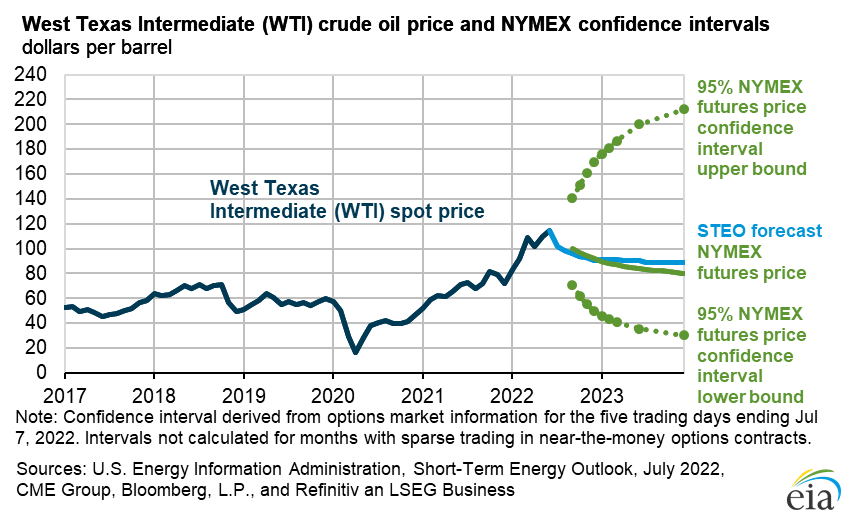

There are of course very wide confidence bands for the forecast based on futures. Using options data, EIA estimated back on 7/7:

Source: DOE EIA Short Term Energy Outlook, accessed 7/19/2022.

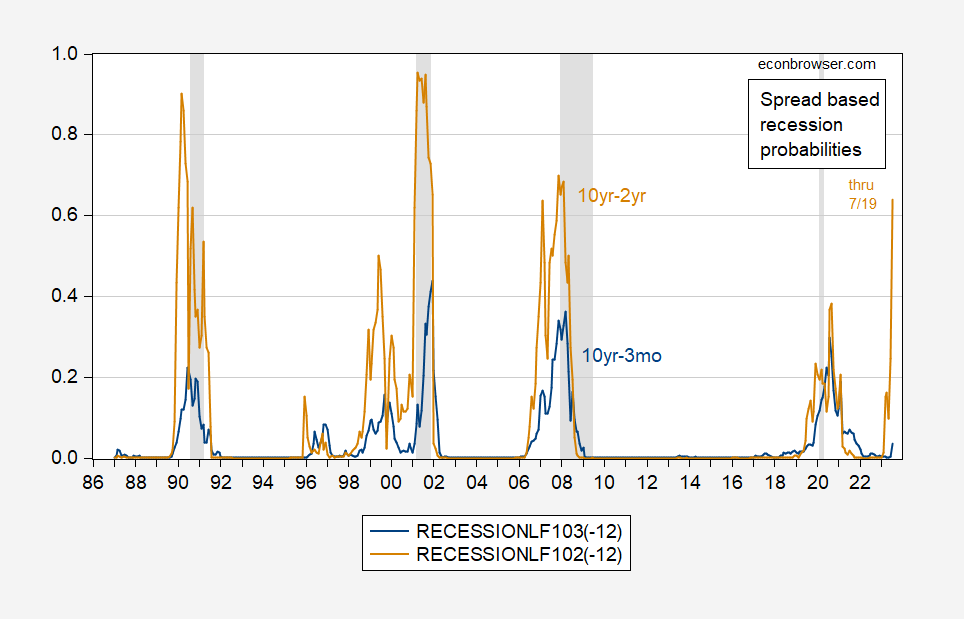

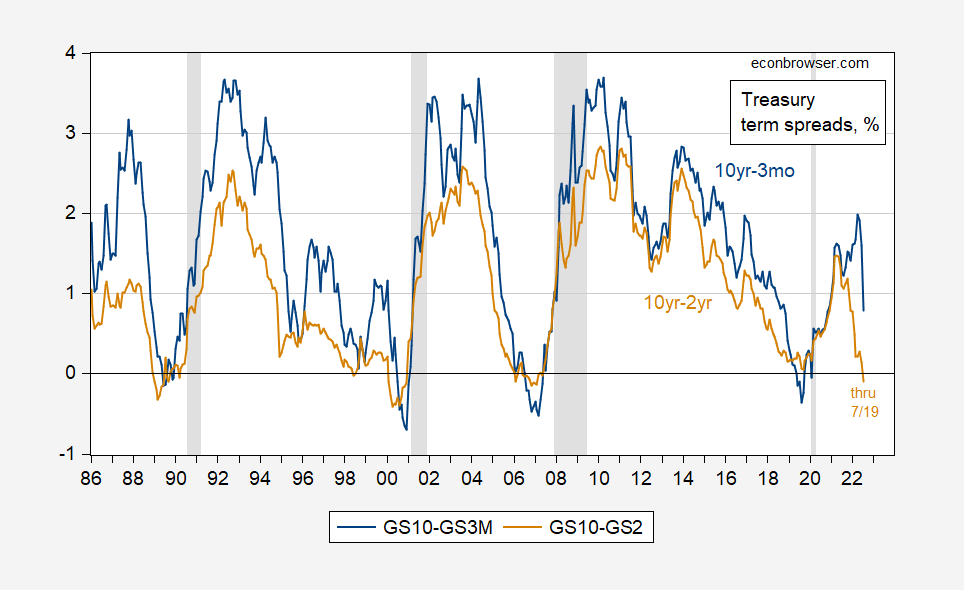

Rob Ferrett, the host, also asked about recession, citing Jared Bernstein’s recent statement that it would be difficult to conclude the US was currently in recession. I agreed, we’re unlikely to have been in a recession in May or June (the latest monthly data we have), but many forecasters are predicting a recession in mid-late 2023. Based on the 10yr-2yr term spread, it also looks likely (despite the precipitous drop, the 10yr-3mo spread is still not flashing recession).

Figure 2: Probability of recession for indicated month, using 10yr-3mo spread (blue), using 10yr-2yr spread (brown). July 2022 observation based on data through 7/19. NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, NBER, author’s calculations.

These probabilities are based on plain-vanilla probit regressions (at 12 month horizon) on term spreads for the 1986-2022 period. These spreads are shown below.

Figure 3: 10yr-3mo Treasury spread (blue), 10yr-2yr spread (brown), both in %. July 2022 observation based on data through 7/19. NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, NBER.

The inversion in the 10yr-2yr spread implies a greater than 60% probability of recession in 2023M07. One caveat is that the 10yr-3mo spread is still positive, suggesting a much lower probability. The 10yr-2yr spread predicted most recessions, but not the 2020 (using a 50% threshold), but also predicted the recession of 1999.

@ Macroduck

As regards last paragraph, ask, and ye shall receive.

Blow me down with a feather, did Chintzy actually give confidence bands a token mention?

What if he drew that same futures curve for monthly sample points during the past year? Would you see that oil futures have been in backwardation even as oil prices increased, because traders buy futures low then sell them as they rise to spot?

I enjoyed the interview a lot. The way Rob keeps things moving, and yet a casual feel at the same time, while staying focused on the topic. I think the dynamic between Rob and Menzie works very well. And I like how Menzie “hears out” the “common man” phoning in, and addresses their concerns, sometimes giving them a better viewpoint or angle without being condescending, and that’s actually a more difficult thing to do than people imagine, but Menzie finds that balance, which is a tightrope to walk, where he’s saying to the callers “Hey, try looking at it from this angle over here” with a kind of, “bedside manner” for lack of a better description on my part without that subtext some expert guests have to callers of “hey dummy, …….” So you know this is one of the reasons I like Menzie, and also, it happens to work really well when talking to people on radio or TV etc. It comes across very well.

On a very weird tangent here, When listening to the caller “Tommy” did anyone else listening here find “Tommy’s” voice oddly familiar, like someone they may have heard on TV or something?? I’m very good at identifying people by their audio voice (without seeing their face), and it’s driving me nuts to figure out who this “Tommy” is, because I think he may be a semi pop-culture figure. If anyone has thoughts on Tommy’s voice and who he might be or reminds you of, please please put it in this thread, because It’s going to drive me crazy until I can piece together who Tommy’s voice is, and/or reminds me of. It may take me 3 days to a couple weeks, but I am going to figure this out, but maybe someone else out there had the voice hitting them as familiar and can help me identify it quicker because this type thing gnaws at me until I figure it out.

July of next year is too late, gosh darn it! The recession has to be NOW!

Here’s the problem. Facts have a liberal bias. Conservatives have to resort to “alternative facts” because actual facts are so prejudiced against conservatives.

If there is a recession before the elections, liberals can be blamed. If not, then the only choice is the “alternative fact” that a recession is whatever conservatives say it is. That may not be good (bad) enough for some voters, and that’s just not fair. My gosh, if the recession comes in Q3 next year, it will bring inflation down before the 2024 elections and by the elections, employment will probably be rising. That would be terrible!

So there has to be a recession now, for the good of the only part of the nation that matters. And to heck with those darned liberal facts!

Yeah, you will begin to hear a different narrative if the timing of the recession is not politically convenient. That is why we have folks on this blog emphatic that the recession is now. Early 2023 will be a wasted recession, in their view. And a strong recovery during 2024 will be a disaster. They need a recession today.

MD, pull your tongue out of your cheek. Are your serious? “My gosh, if the recession comes in Q3 next year, it will bring inflation down before the 2024 elections and by the elections, employment will probably be rising. That would be terrible! ” Trading runaway inflation for a recession before the 2024 elections is good for Democrats?

“July of next year is too late, gosh darn it! The recession has to be NOW! ” No one wants a recession, but we conservatives aren’t afraid of one, DUE TO THE POLITICAL CONSEQUENCES. We are in fact fed up of the ECONOMIC consequences of your party’s horrible policies, and that will show up in the 2022 elections.

It will not be just conservative shouting stop implementing your horrible Don Quixote-like policies. They cost too much!

There you have it folks, the closest thing to honesty you’ll get from CoVid. He posts comment after comment about talking down the economy, leaning over the rail with his $2 betting ticket in his fist screaming “Come on , Recession!.” He denies wanting a recession like he denies climate change, but the truth is in “we conservatives aren’t afraid of one, DUE TO THE POLITICAL CONSEQUENCES.”

CoVid would be perfectly happy for a few million people to lose their jobs, just like he’d be happy for a few million to be prevented from voting, because it would mean more power for his guys.

@ CoRev

Don Quixote?? And here all this time I thought you were a Rasputin fan.

Though he insists he never said he was a spokesman for “citizens of the world…(aren’t we all citizens of the world?)” CoRev did write “We warned you for years that your policy goals were inflationary. Now we, citizens of the world, have to live with your poor policy judgment.”

We?

In true George III fashion, not I, but we.

So, who else could be responsible the UK’s economic distress but me? And Joe Biden.

Please. Don’t get me started on Slovenia. CoRev is still apologizing to Melania (her GQ pictures on his bedroom wall) how the blame for her country’s 11%+ inflation rate reflects on my poor policy choices. And those of Joe Biden.

Nonecon, more gibberish? Just what was the point here: ” “citizens of the world…(aren’t we all citizens of the world?)” CoRev did write “We warned you for years that your policy goals were inflationary. Now we, citizens of the world, have to live with your poor policy judgment.” If you think I’m a/the spokesman for the world your crazier than Barking Bierka.

Who’s “we”? Who else are you speaking for? You didn’t mean “we, citizens of the world” like you specifically said?

Econned, how desperate are you to make a point? From your comment I take you believe you are neither a citizen nor part of the world citizenry. Well OK. A it’s a little strange to think so.

If you think I’m a/the spokesman for the world your crazier than Barking Bierka.

CoRev: simple question that even a simpleton should be able to answer: “who’s we”?

The egotist and his close relation, the narcissist, deem themselves empowered to speak for others. Since you’ve chosen to refer to yourself in the plural, you must be assuming a role in which you speak—or somehow believe you speak—for others.

Who? 330 million Americans? Everyone in Europe and Asia? Your dog?

How desperate are you that you continually fail to respond?

(BTW, I’m not Econned)

8.1% CPI inflation in Canada. Did you hear the collective groan out of British Columbia and Alberta this morning??~~”Thanks President Biden!!!” [ imagines in my mind’s eye, CoRev, Bruce Hall, and sammy looking to see what part of the New England states Canada is in ]

Related to “Tom”. It could be a movie character. But the person it’s reminding me of is a dark figure. Possibly the type of person you might strongly dislike. Especially the part after he mentions Great Britain. from then on, the voice becomes more distinctive. A little bit Canadian, but slightly evil aura. I’m not trying to be funny, this is actually bugging me who this might be.

You know the saying “It’s right on the tip of my tongue”?? This guy his identity or the character his voice strongly strongly reminds me of, is like right within the reaches of my mind, but it’s like it’s on the top of a shelf, and my mental fingers are like 1/4 inch away from grabbing the face or name of who it is. Aaaahh!!! I am going to still be thinking about this at 3am or something. A salesman of bad products?? Like a Mike Lindell type?? Man it’s making me go batty think who this is.

I figured it out. I figured it out. You guys will think I have lost my mind (and you’re probably correct to a degree). Who does Tom’s voice super super super remind me of?? The nutjob Jordan Peterson. Wow, I thought I was going to be up half of the damned night trying to think who “Tom’s” voice reminded me of. It’s very similar to that freakazoid druggy Jordan Peterson’s voice. If you don’t know who that is, do yourself a huge favor and don’t look him up. Wow, “Tom”, Jordan Peterson’s long lost brother.

Well, I am pleased to see these forecasts of Brent and WTI falling. But the hard fact is they have risen steadily over the last week or so, including today, now up on the order of $7-9 per barrel over their recent lows. That rise needs to stop and like tomorrow or the next day, or all the talk of gasoline prices continuing to decline is not going to come true, much as I hope that it does.

I have to say, offhand, that Biden did not get much for that awful fist bump he delivered in Jiddah over the weekend.

The visit to MbS was a really bad idea on any number of fronts. Biden has terrible judgment. His popularity continues to unwind, now net approval of -17.9, a new low for the president and second only to Truman at this point in his administration.

If he had not gone to Saudi Arabia – you would be criticizing for not trying to get more oil production. Face it – you are as two faced as it gets.

I believe I am on the record as saying it was a bad idea ex-ante. Indeed, I think I am on the record calling for harsher measures against MbS following Khashoggi’s murder.

However, you are correct that I have criticized the president for not going to Texas to call for more production.

You have this thing about “on the record”. Who talks like this beyond someone whose arrogance is over 100 times his intelligence.

BTW of you think Texas can replace the lost Russian oil then you are the dumbest consultant ever. Put me “on the record” for noting that.

Atlanta Fed Q2: -1.6%

Jeff Frankel has a new post that you really need to read. Of course we know you will not.

Re: Fist Bump

Re: FDR:

“Our Son of a Bitch”

Although Somoza was recognized as a ruthless dictator, the United States continued to support his regime as a non-communist stronghold in Nicaragua. President Franklin D. Roosevelt (FDR) supposedly remarked in 1939 that “Somoza may be a son of a bitch, but he’s our son of a bitch.”

Reminds that presidents have to deal with the son of a bitches they have than the ones they would like to have.

https://www.nytimes.com/2017/05/22/world/middleeast/trump-glowing-orb-saudi.html

Well, maybe it has more to run. Crude dropped slightly today, finally.

Also, where I am in Harrisonburg, where there was a one day price increase, there was a noticeable 10 cents price decrease in retail gasoline prices.

Crude down a whole lot more today, with WTI back below #100 per barrel. So, looks more like those gasoline prices may continue to decline some more.

Latest odd thing with crude prices is gap opening between Brent noww at about $103 per barrel and WTI now down to about $04 per barrel. No idea what is going on with that, but crude in general still declining here at end of this week.

Prices are going down. Wait until the builds get going. Down 20+ barrels. They are forgetting Russia sleepy oil back into the west is a key part of this.

From my friend Amrita Sen of Energy Aspects, speaking on CNBC. She is a very good analyst.

Sen views this [oil price] pullback as a temporary blip caused by a lack of traders and a knee-jerk reaction to predictions of a looming recession. Longer-term, she thinks the extremely limited supply will drive prices higher again.

“The market is incredibly tight. What we are seeing on the price, on the screen, is just pure sentiment and low liquidity. That doesn’t actually tell us what the true price of crude oil is,” she said.

Sen pointed out that summer traditionally sees a lot of traders take vacations, leading to the low liquidity in the market. “Right now, there’s more machines trading this than humans,” she contended.

As a result, the Energy Aspects founder predicted that the “temporary softness” could continue for “another four weeks or so” as traders continue their summer holidays. From there, Sen predicted that crude will begin to push higher.

so we are now blaming lower oil prices on the bots?

Oh, so it’s trader vacations that dictate market prices for oil?? Wow. So all the traders go on holidays when they can purchase oil at discount prices?? I bet they’re going to feel dumb when they gat back to the office. /sarc

I do not recall Amrita Sen appearing on Fox and Friends. Maybe she is not as desperate as you to make a fool out of herself. Smart on her part.

Steven,

I must say this is the first time I have ever heard such an argument before, and I am not aware of price declines in the past in summer times because traders were om vacation. This looks pretty questionable.

The fundamental issue is the fundamentals and how they will look in a few months, supply and demand, and that remains unclear. I think this “traders on vacation” comment is just a joke.

Think about what Ms. Sen is saying about the future. While she notes that chatter about a RECESSION (which she probably heard during some unwelcome advances from Princeton Steve) might have temporarily lowered oil prices. But she seems to be saying that strong demand will increase oil prices down the road. Makes sense.

But WAIT – Stevie says we will get both the recession as in now and higher oil prices. It seems he is contradicting himself as he does not get what his “friend” is saying. But come on – when a woman gets away from a dude at every possible turn, maybe it is hard for the dude to get what she has said.

Temporary blip? Talk to CoRev. He’s very familiar with blips.

Seems like a tendency to take credit for the downward moves and not for the upwards ones. (The whole “core” subset metric, versus total.) Almost as if the analysis of the economics is not objective, but biased by political leanings.

Also, gasoline (and oil) are affected by geopolitics, but this is not new. Just different that it is a Russian War, not a ME one doing it. And as always, easier for the cartel to maintain discipline when there are geopolitical shorts.

Biden administration owns it’s decision to have a (relatively) anti-oil policy. Oil is heavily affected by 1-2 MM bopd. And the US could be supplying that. But there’s significant political uncertainty about the long term prospects, based on Biden administration actions and comments (leasing freeze, permitting freeze, Keystone kyboshing, Pete’s remarks, JulieG’s remarks, Biden in the debate remarks, etc.) Sure…they’ve backed off of the above (except Keystone). But oil is a commodity business with heavy capex dependency. If the political risk exists, it makes the project hurdle higher for long term projects (access roads, gathering pipelines, seismic shoots, etc.) It’s pretty easy to look at drilling rigs versus price and see activity is low.

Anonymous,

Gag, your comments are just so incredibly stupid. No wonder you do not even make the effort to come up with an actual fake name.

Oh, so just who is worse: GOPsters blaming Biden for rising gasoline prices and not crediting him for them falling or Biden for doing the opposite?

As for Keystone, you do happen to know that it already exists, don’t you, A.? The extra length would slightly shorten an already existing route. It is a total nothing burger. On that I shall say that those who have opposed it have also made way too much of it. It is/was neither as good as its advocates claimed or as bad as its critics claimed, basically a big nothing burger.

KXL is a larger diameter and a second (mostly) parallel pipe. It would add transport volume.

But, A., The Albertans have had and will continue to have alternative ways to get all that extra oil out. We are talking about a fairly small decline in costs of doing so. Sorry, still a nothingburger, despite all the whooping that commentators on Fox News have liked to make about it.

No it cannot. It’s dirty and has high refining. It’s naturally expensive. Oil is set by elitists in financial companies and sweet oil cartels like Russia.

This is going to make Putin’s pet poodles very unhappy:

https://www.msn.com/en-us/news/world/putin-faces-second-war-front-as-chechens-threaten-new-offensive-in-russia/ar-AAZMV4i?ocid=msedgdhp&pc=U531&cvid=950be5e76d4c4ad485ddb965748ad80e

Putin faces second war front as Chechens threaten new offensive in Russia

Russian President Vladimir Putin could be facing another war front, this time on his own turf, as one Chechen battalion prepares a second offensive against Moscow, a spokesman for the volunteer fighting force in Ukraine said. Following Russia’s invasion of Ukraine in February, volunteer Chechen forces joined the fight in support of Kyiv – fueling the flames to a long-held animus towards not only Russia, but Putin.

if we can overcome the auto shortages, especially with the EV and chip shortage, that will continue to make a dent in the gasoline demand. we have an older car that needs replacement. once prices and availability drop, we will definitely look at an EV option. there are probably many with a similar mind set.

https://www.businessinsider.com/trump-allies-biden-selling-oil-china-but-did-same-2017-2022-7

Trump and his allies have been blasting the Biden administration for selling oil to China.

However, reports show that Trump did the same thing in 2017 while he was president.

Records show the Trump administration sold 550,000 barrels of crude oil to PetroChina that year.

While former President Donald Trump and his allies have been blasting the Biden administration for selling oil to China, reports show that Trump did the same thing in 2017 while in the White House. In Trump’s first year as president, the Department of Energy sold 550,000 barrels from the US Strategic Petroleum Reserve — or SPR — to PetroChina, a state-owned energy giant and China’s largest oil producer, Axios’ Sophia Cai first reported. Reuters and S&P Global reports show that the 2017 deal was made for $28.8 million, priced at $52.30 per barrel.

Huh – what was the price for this deal?

On July 11, the Biden administration announced that it had sold 950,000 barrels to Unipec, a subsidiary of Chinese state-owned oil and gas enterprise Sinopec. It was part of a broader strategy that uses US reserves to counter a global crude oil shortage stemming from the Ukraine war’s economic fallout, the Department of Energy said.

I bet the price now was about twice the price Trump got. So the Art of the Deal dude made a poorer deal than Biden did.

https://www.yahoo.com/now/oklahoma-texas-reach-115-degrees-160600828.html

Twenty-eight states issued excessive heat warnings Wednesday amid a nationwide heatwave. Almost two-thirds of the U.S. experiencing above 90-degree highs. In particular, Texas and Oklahoma reached temperatures of 115 degrees this week, according to The Washington Post. The extreme temperatures are concentrated in the south-central states and stretch into California in the West and New Hampshire in the east, according to an announcement from the National Weather Service’s Weather Prediction Center. The head advisories and warnings currently affect nearly 110 million Americans, the NWS reported Wednesday. The Weather Channel also announced that as many as 211 million Americans will be in these above-90 temperature zones on Wednesday, continuing through the end of the week. The heat advisory comes after the National Oceanic and Atmospheric Administration reported in June that this summer’s heat is “remarkable.” This June was the 15th warmest June the U.S. has seen in 128 years.

Climate change? Oh no says the dog outside chasing its tail barking WEATHER.

I asked its owner what is up with his insane dog and the only reply I got was “his name is CoRev”.

Weather? Climate? It all depends on which side of the slow moving/stalled high pressure system you’re on.

https://149366104.v2.pressablecdn.com/wp-content/uploads/2022/07/image-7-720×540.png

Aren’t you dizzy from chasing your own tail all day?

Trying to anticipate CPI for July, I calculate CPI All at 0.347 rounded to 0.3 to 0.4% for July. The Y/Y rate could still be at about 8.9%. and the month annualized at about 4.3+%.

M/M the unweighted food forecast shows 0.82, energy at (3.1) and CPI excluding food and energy at 0.649. The weighted food forecast shows 0.11, energy shows (0.269) and CPI excluding food and energy shows 0.506.

CPI all was calculated, using the May weight for food at 13.423, energy at 8.665 and all items excluding food and energy at 77.912.

Bloomberg as of 7/20/22 seems a bit confusing. I get the same Core CPI M/M at 0.6%, but not the same CPI All M/M. Bloomberg shows 1.1% for the CPI All M/M which seems high given the most likely negative CPI Energy M/M contribution which could be (3.1) % unweighted and weighted at (.3) %. If we assume Bloomberg’s Core CPI M/M of 0.6% and this represents about 78% of CPI All, then food and energy must be together about 0.6% (1.1% – 0.5 weighted%) for the month of July.

Enlightenment welcome.

Not enlightenment, but an annualized pace below the y/y pace indicates a slowing. Happier for the Fed and the rest of us, though not yet happy.

Energy and durables were the main drivers of the fastest period of inflation. Durable have cooled some and energy be cooling. Non-durables and services are still heating up

Consumer prices for gerbil goods, up 8.4% y/y, less than half the pace in February:

https://fred.stlouisfed.org/graph/?g=RYXb

Non-gerbil goods, up 16.2% y/y and rising:

https://fred.stlouisfed.org/graph/?g=RYXj

Services less energy, up 5.5% y/y:

https://fred.stlouisfed.org/graph/?g=RYXs

Energy, up 41.5% y/y and rising till recently, which doesn’t show on the chart:

https://fred.stlouisfed.org/graph/?g=RYXA

@ AS

July CPI comes out August 10?? I was trying to find some bank notes or something to toss out there for you to gnaw on in your mind or might provide assistance. I don’t have much to add at the moment but may find something later and put it near here in the thread. I certainly don’t see anything objectionable or out of line with your numbers at first glance.

Bank notes? I’ll take some bank notes!

@ AS

I don’t think this will help much in your efforts in finding a “dead on” correct target number for July CPI. But I still thought you might find it interesting. Often “we” “the general public” are often told that the reason companies increase prices on products and services, is because “profit margins are being squeezed”. That is, that private businesses, both large and small “have no choice” but to raise prices, because If they don’t raise prices their profits will be destroyed, and they will go out of business. And that “only by raising prices” or “passing their increased costs along to the consumer” can these businesses remain “an ongoing concern” (in accountants’ talk). AS, read the following link, and ask yourself, is inflation rising because of “input costs” or “intermediate goods” being placed into final goods?? Or is it related to something else entirely?? And after you ask yourself that question (in my view an important question), you might ask yourself yet another question. “Do these numbers in this Fed Reserve link, and how these numbers have increased over time, reflect the profit margins context one would expect during or just before a supposed recession??”

https://fredblog.stlouisfed.org/2022/07/corporate-profits-are-increasing-rapidly-despite-increases-in-production-costs/

Moses,

Your questions seem to be above my pay grade. But thanks for the effort.

https://apnews.com/article/fires-london-england-19da2bdf578a292a37e0396917ce7ed5

LONDON (AP) — Britain’s record-breaking heatwave has spurred calls for the government to speed up efforts to adapt to a changing climate, especially after wildfires created the busiest day for London firefighters since bombs rained down on the city during World War II….Britain needs to prepare for similar heatwaves in the future because manmade carbon emissions have already changed the climate, said Professor Stephen Belcher, chief scientist at the Met Office, the U.K.’s national weather service. Only aggressive emissions reductions will reduce the frequency of such events, he said.

This will set off CoRev again! Yes CoRev is actually denying that this was record heat. After all some place in the middle of Saudi Arabia had hotter temps at some point. And what does Professor Stephen Becher know anyway?

https://www.metoffice.gov.uk/research/people/stephen-belcher

The bio of Professor Stephen Belcher. Just in case CoRev tries to pull out some blog post from one of his favorite nutcases.

Well, it’s official now. Tomorrow late afternoon, Ron DeSantis will be the new autocratic leader of Italy. Sieg Heil Il Duce!!!!!

https://twitter.com/CNBCJou/status/1549829273799761920?cxt=HHwWgICx9evgjIIrAAAA

This is an excellent idea:

https://www.republicworld.com/world-news/russia-ukraine-crisis/us-senate-committee-advances-resolution-to-designate-russia-a-state-sponsor-of-terrorism-articleshow.html

US Senate Committee Advances Resolution To Designate Russia A ‘state Sponsor Of Terrorism’

US Senate’s Foreign Relations Committee advanced a measure that would direct the Secretary of State Blinken to designate Russia as a state sponsor of terrorism.

US Senate’s Foreign Relations Committee, on Friday, adopted a measure that would direct the Secretary of State Antony Blinken to designate the Russian Federation as a State Sponsor of Terrorism. The bill was initiated last month by Republican senator Jim Risch amidst the Kremlin’s “unprovoked and illegal war” on Ukraine. As per the US law, the proposal would require approval of both the houses of the American parliament, before making it to the Oval Office for final signatures. If passed, it would put Russia into the same category as Iran, Syria, Cuba and North Korea. It would directly allow Washington to slap all kinds of trade embargoes on Moscow, whose economy has already been hit hard by Western sanctions. Earlier in the day, Senator Jim Risch, the top Republican on the committee, told an audience that Russia’s actions make it a “bully” and a state sponsor of terrorism because it invaded a country that was smaller in size, population and military capability. Earlier in May, US Senators Lindsey Graham and Richard Blumenthal introduced a Senate resolution affirming that the US Senate views the actions of the government of the Russian Federation, at the direction of President Vladimir Putin, as sponsoring acts of terrorism. “Putin is a thug, and a bully, and he will continue being an increasing threat to Europe and the world unless he is stopped,” Graham said advocating for his proposal and added, “If there is anybody who embodies terrorism, and totalitarianism and tyranny, it’s Putin.” Notably, the resolution came at the request of Ukraine’s Volodymyr Zelenskyy-led administration.

My understanding is that 99 Senators like this idea but one is holding it up. Anyone know if this one Putin fan in the Senate is also the junior Senator from Kentucky?

Jeffrey Frankel wrote a revealing and timely essay in October 2021. The gist of the essay was that a continuation of significant economic growth would lead to high energy prices, and energy prices had already been rising in 2021. Concern over rising energy prices had already led to an emphasis on increasing energy supply in China and relatedly to increasing food production. The Chinese emphasis continues. Frankel’s writing however seemed of minimal influence in the United States or Europe.

The importance of Frankel’s writing to me, was the implicit suggestion that increasing energy and food prices should be subject to price “policy.” Price policy was just what Isabella Weber would write about early this year, supported by James Galbraith. Paul Krugman however severely criticized Weber and that criticism evidently made price policy impossible to consider by the Federal Reserve or Treasury, leaving traditional monetary policy as the only real means of lessening inflation. Along with Galbraith, I find this outcome unfortunate.

https://news.cgtn.com/news/2021-10-26/High-oil-prices-can-help-the-environment-14G7DOwZEdy/index.html

October 26, 2021

High oil prices can help the environment

By Jeffrey Frankel

Prices of fossil fuels increased sharply in October. European prices for natural gas hit a record peak. Prices for thermal coal in China have also reached all-time highs. The price of U.S. crude oil is above $80 a barrel, its highest level in seven years, prompting U.S. President Joe Biden’s administration in August to call on OPEC and other major oil-exporting countries to increase production….

https://news.cgtn.com/news/2022-01-22/The-case-for-strategic-price-policies-171AF24WDgk/index.html

January 22, 2022

The case for strategic price policies

By James K. Galbraith

With a single commentary * in The Guardian (and an unintended assist ** from New York Times columnist Paul Krugman), economist Isabella Weber of the University of Massachusetts injected clear thinking into a debate that had been suppressed for 40 years. Specifically, she has advanced the idea that rising prices call for a price policy. Imagine that….

* https://www.theguardian.com/business/commentisfree/2021/dec/29/inflation-price-controls-time-we-use-it

** https://twitter.com/paulkrugman/status/1477247341212184577

https://www.nytimes.com/2022/07/20/business/mexico-energy-usmca.html

July 20, 2022

The Biden administration will challenge Mexico’s state control of its energy industry.

The move stems from concerns that Mexico is violating the United States-Mexico-Canada Agreement, which seeks to level the playing field for industries across the continent.

By Ana Swanson

The Biden administration plans to request consultations with the Mexican government over energy policies that the United States believes have hurt American companies, an action that could result in punitive tariffs on Mexico if attempts to resolve the dispute fail, the administration said on Wednesday.

President Andrés Manuel López Obrador has worked to strengthen the dominance of Mexico’s two main state-owned energy companies — the Federal Electricity Commission, or CFE, and the oil and gas company Pemex — in an effort to make the country more self-sufficient.

But American energy companies say those steps have made it increasingly difficult for them to do business in Mexico, which they say gives its own giants favorable treatment, including on pricing, emissions standards and contract terms….

https://fred.stlouisfed.org/graph/?g=Gb0g

January 30, 2018

Consumer Prices for China, United States, India, Japan and Germany, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=Ftkb

January 30, 2018

Consumer Prices for China, India, Brazil, Mexico and South Africa, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=lv0w

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 2007-2022

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=RYSD

January 15, 2018

Real Broad Effective Exchange Rate for China, India, Brazil, Mexico and South Africa, 2007-2022

(Indexed to 2007)

Not that high hydrocarbon prices are all bad. It has recently rained on Greenland’s highest peak, something unseen till now in all of human history. Rain means melting.

https://www.counterpunch.org/2022/07/19/greenland-threatens/

I’m probably gonna have a drink this Friday, try to keep it light and sunny will yeh?? I have enough problems avoiding “the dark side” about the 4th tallboy can. (joking)

“it rained at the Summit Station at 10,530 feet above sea level where it has never rained throughout all recorded history. It’s not supposed to rain at the top of an ice sheet nearly two miles above sea level. But, it did.

Why?

Climate System Scientist Paul Beckwith knows why, as he explains in a 41-min video released July 14, 2022 entitled: Greenland Ice Sheet Vulnerable to Bone-Crushing Melt from Stronger More Frequent Atmospheric Rivers.

He starts by explaining how the first rainfall in recorded history at the summit happened one year ago. An atmospheric river caused it. Accordingly, he explains: “These atmospheric rivers are occurring more frequently.”

Here’s how Beckwith sees it: “The idea that the ice on Greenland will last decades and decades, even centuries. I think you could throw those ideas out the window as you get more and more atmospheric rivers, you’ll get more and more abrupt changes in the melt rate.”

Before we call this climate change, let’s sit back and watch CoRev chasing his own tail as he barks WEATHER!

Off topic, but interst in the abortion issue has been expressed in comments-

The hypocrisy of opposing abortion rights on the basis of “respect for life” while supporting the death penalty but not social spending has long been noted. An explanation for opposition to abortion rights based in Darwinian self-interest ignores what people say and considers what they do:

https://phys.org/news/2022-07-anti-abortion-beliefs-sexual-strategies.html

It comes down to controlling other people’s sexual behavior out of pure reproductive self-interest.

I think I quoted the old joke here before to commenter “noneconomist”. Catholics “care” a lot about life in the womb, but after you pop out you’re on your own. Here’s another variation on the theme:

A rabbi, a priest and a minister are discussing when life begins.

The priest says: “In our religion, life begins at conception.”

The minister says: “We disagree. We believe that life begins when the fetus is viable outside of the mother’s womb.”

The rabbi responds: “You both are wrong. In our religion, life begins when all of the children are married off.”

Amen, brother.

Moses,

I think the hypocrisy problem tends to be much worse for the Protestant fundamentalist types on this. They are more likely to oppose abortion while opposing both social safety nets and supporting the death penalty. While some of the more conservative Catholics go along with that, the official hierarchy actually does support social safety nets for children and also opposes the death penalty, thus being more consistent in their “pro-life” position.

It’s all very debatable. I was raised Methodist, so, maybe it colors my thoughts.

Moses,

Well, most Methodists are mainstream Protestants, not holding the extreme views of the fundamentalists, quite aside from differences with Catholics.

there is a cost to keep a preterm baby in a nicu for months to keep them alive. the cost is hundreds of thousands of dollars. if a woman were forced to keep a baby she would otherwise abort, then the government should compensate her for this cost. otherwise, the government is imposing a reproductive tax on the woman.

“Other women’s sexual openness can destroy these women’s lives and livelihoods by breaking up the relationships they depend on. So sexually restricted women benefit from impeding other people’s sexual freedoms. Likewise, sexually restricted men tend to invest a lot in their children, so they benefit from prohibiting people’s sexual freedoms to preclude the high fitness costs of being cuckolded.”

In honor of the late Ivana Trump who gave Donald 3 children only to see him run off with tart Marla Maples – someone should have cut the Donald off. Of course he became the father of five kids – none of which he gave a damn about. Then again Marla cheated on Donald as much as he cheated on her.

https://news.cgtn.com/news/2022-07-20/Chinese-mainland-records-150-new-confirmed-COVID-19-cases-1bOxMGb0U4U/index.html

July 20, 2022

Chinese mainland records 150 new confirmed COVID-19 cases

The Chinese mainland recorded 150 confirmed COVID-19 cases on Tuesday, with 108 attributed to local transmissions and 42 from overseas, data from the National Health Commission showed on Wednesday.

A total of 862 asymptomatic cases were also recorded on Tuesday, and 4,611 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 227,980, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-07-20/Chinese-mainland-records-150-new-confirmed-COVID-19-cases-1bOxMGb0U4U/img/5d75f89b382a49339b8a99b893070700/5d75f89b382a49339b8a99b893070700.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-07-20/Chinese-mainland-records-150-new-confirmed-COVID-19-cases-1bOxMGb0U4U/img/e07ced70edef45ad9e2d37d058f9c603/e07ced70edef45ad9e2d37d058f9c603.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-07-20/Chinese-mainland-records-150-new-confirmed-COVID-19-cases-1bOxMGb0U4U/img/9a8255ecfca147c59f873a3610fb1456/9a8255ecfca147c59f873a3610fb1456.jpeg

https://www.worldometers.info/coronavirus/

July 19, 2022

Coronavirus

United States

Cases ( 91,529,862)

Deaths ( 1,049,683)

Deaths per million ( 3,158)

China

Cases ( 227,830)

Deaths ( 5,226)

Deaths per million ( 4)

I think it is a moral you Yanks will have a recession. My guess is and it is a guess that the Fed will overeach and put up rates too quickly and too far. I suspect most central banks will as they have all been very poor thus far.

When watching the yield curve it is the short end that is important. If the yield curve inverts because short rates are rising that leads to a recession. Not so much if it is because 10 year bond yields fall.

A. I would not overlook the strong dollar as a factor in Crude and gasoline prices. WTI would be at $119, if the dollar was at July 2021 strength.

B. The 10% decline is from a point in June, compared to current. The current average for July is down -6.0% from July’s average. It might make -8.0% by end of month.

C. The old adage of the U.S. sneezing and the rest of the world catching a cold… may be out of date. I think Europe is trying hard to catch a cold… all by itself.

We tend to forget that the US economy is not monolithic. Some states are doing well; some are just so-so.

https://fredblog.stlouisfed.org/2022/07/mapping-growth-in-new-businesses-state-by-state/

It would be interesting to find the common denominator for better growth.

Bruce Hall: Or, you can look at macro data: https://sites.google.com/view/weeklystateindexes/dashboard

Uh, this is helpful?

Week ending Alabama Alaska Arizona Arkansas California

1987-04-04 0.208690728 -1.891722887 0.243133694 -0.389487081 0.95779

1987-04-11 0.374188635 -1.865149642 0.267444702 -0.135057079 1.107654449

1987-04-18 0.515848084 -1.94519762 0.292458087 -0.111396274 1.189032275

1987-04-25 0.659721719 -2.022489295 0.366163132 -0.054768359 1.332117082

1987-05-02 0.788712486 -2.066566825 0.374800697 0.066718173 1.404460555

1987-05-09 0.883821221 -2.050703358 0.378704362 0.04127068 1.448468612

1987-05-16 0.958562921 -2.117460696 0.389319511 0.086980319 1.481009337

1987-05-23 0.951691623 -2.097004443 0.371571234 0.143950639 1.529545086

1987-05-30 1.044795781 -2.157379397 0.346862579 0.072129172 1.53190335

1987-06-06 1.065064535 -2.152792026 0.361108989 0.108967075 1.50816709

1987-06-13 1.114987463 -2.01906412 0.384451049 0.239206952 1.517271495

1987-06-20 1.12625621 -1.934151503 0.391723217 0.245504952 1.494913925

1987-06-27 1.061640975 -1.723028539 0.374675636 0.288552572 1.429882688

1987-07-04 1.192720439 -1.667722192 0.369202585 0.278237052 1.400013389

1987-07-11 1.148103808 -1.673509252 0.351420497 0.302563142 1.383621226

1987-07-18 1.361503099 -1.597778154 0.35666489 0.510470748 1.393866438

1987-07-25 1.403440472 -1.597086256 0.350161361 0.496426313 1.371149769

1987-08-01 1.470204414 -1.602266679 0.35212552 0.428452341 1.385258862

1987-08-08 1.566771243 -1.608859844 0.359992921 0.446611188 1.398302968

1987-08-15 1.684980435 -1.633719532 0.359582426 0.549340228 1.401116229

1987-08-22 1.770918103 -1.648191627 0.378029151 0.565785355 1.444280806

1987-08-29 1.814593596 -1.743485865 0.326668407 0.648226925 1.451287925

1987-09-05 1.966284079 -1.759862098 0.339838336 0.757553695 1.480229392

etc. etc. etc.

Not so much.

How about something other than a metric? What are the policies, taxes, etc. that states with larger recent growth have in common that are different from those of slower growing states?

Bruce Hall: Well, here’s a first stab.

https://econbrowser.com/archives/2020/05/the-intellectual-bankruptcy-of-arthur-laffer-stephen-moore-and-jonathan-williams-illustrated

You can download on your own business formation data (might be useful to have business deaths data too), and run regressions of the form I estimated.

I await with bated breath your tables of regression results.

Bruce Hall was their research assistant.

Uh, this is helpful?

Week ending Alabama Alaska Arizona Arkansas California

1987-04-04 0.208690728 -1.891722887 0.243133694 -0.389487081 0.95779

1987-04-11 0.374188635 -1.865149642 0.267444702 -0.135057079 1.107654449

1987-04-18 0.515848084 -1.94519762 0.292458087 -0.111396274 1.189032275

1987-04-25 0.659721719 -2.022489295 0.366163132 -0.054768359 1.332117082

1987-05-02 0.788712486 -2.066566825 0.374800697 0.066718173 1.404460555

1987-05-09 0.883821221 -2.050703358 0.378704362 0.04127068 1.448468612

1987-05-16 0.958562921 -2.117460696 0.389319511 0.086980319 1.481009337

1987-05-23 0.951691623 -2.097004443 0.371571234 0.143950639 1.529545086

1987-05-30 1.044795781 -2.157379397 0.346862579 0.072129172 1.53190335

1987-06-06 1.065064535 -2.152792026 0.361108989 0.108967075 1.50816709

1987-06-13 1.114987463 -2.01906412 0.384451049 0.239206952 1.517271495

1987-06-20 1.12625621 -1.934151503 0.391723217 0.245504952 1.494913925

1987-06-27 1.061640975 -1.723028539 0.374675636 0.288552572 1.429882688

1987-07-04 1.192720439 -1.667722192 0.369202585 0.278237052 1.400013389

1987-07-11 1.148103808 -1.673509252 0.351420497 0.302563142 1.383621226

1987-07-18 1.361503099 -1.597778154 0.35666489 0.510470748 1.393866438

1987-07-25 1.403440472 -1.597086256 0.350161361 0.496426313 1.371149769

1987-08-01 1.470204414 -1.602266679 0.35212552 0.428452341 1.385258862

1987-08-08 1.566771243 -1.608859844 0.359992921 0.446611188 1.398302968

1987-08-15 1.684980435 -1.633719532 0.359582426 0.549340228 1.401116229

1987-08-22 1.770918103 -1.648191627 0.378029151 0.565785355 1.444280806

1987-08-29 1.814593596 -1.743485865 0.326668407 0.648226925 1.451287925

1987-09-05 1.966284079 -1.759862098 0.339838336 0.757553695 1.480229392

etc. etc. etc.

Not so much. That’s like comparing 50 people for their weights and showing their weight history rather than the factors that changed their weights. Did some consume more food? Did some exercise more? Did some gain fat while others gained muscle?

How about something other than a metric? What are the policies, taxes, etc. that states with larger recent growth have in common that are different from those of slower growing states? What can we learn from the disparities? Were their distinct changes at various points in time that changed the growth trajectories?

Bruce Hall: Since you are repeating yourself, I’ll repeat myself…

Well, here’s a first stab.

https://econbrowser.com/archives/2020/05/the-intellectual-bankruptcy-of-arthur-laffer-stephen-moore-and-jonathan-williams-illustrated

You can download on your own business formation data (might be useful to have business deaths data too), and run regressions of the form I estimated.

I await with bated breath your tables of regression results.

Someone buy Bruce Hall a basic statistics text as he will need all the help he can get.

So, you throw another data mash out and say, “See?”

No, that’s simply avoiding answering a straightforward question. Disappointed….

Again, in the most recent period, what has caused the wide disparity in business development among the states? Are there common factors in policies and taxes (and education and infrastructure etc.)? Or is this merely because of random events affecting states differently? Michigan, aside from outlier Alaska, had the lowest state growth of new business applications and had one of worst economic performances in 2020. Delaware is a special case so that can be disregarded. What do Michigan, California, Illinois, Nebraska, and Colorado have in common (if anything) for lower new business applications? What do Nevada, Wyoming, South Dakota, New Mexico, Mississippi, Alabama, and South Carolina have in common for a high rate (if anything)?

You don’t feel the question is worthwhile? Okay. It would just seem that the why is more important than the what.

Oh, and sorry for the double post. Sometimes when I click on “post button” the comment disappears and no “awaiting moderation” shows up. Not trying to annoy you with that. Maybe it’s a Mac or Safari issue or some sort of automatic page refresh.

@ Bruce Hall

Any theories on why Michigan’s economic growth is so low comparatively to other states??

https://www.bridgemi.com/michigan-government/michigan-now-officially-red-state

“You know, when you look at the state level, it’s very much a red state, and I think it’s balanced by those purple voters who are willing to vote for Obama for president and then a Republican for county executive, and sheriff and prosecutor,” said Darnoi.

But the 2016 election made some analysts rethink how they characterize Michigan. That’s because, in a break from recent history, Michigan went “red” in the presidential election, narrowly voting for Donald Trump.

Robert Yoon is a reporter and analyst for Inside Elections. He said it’s possible Trump’s Michigan win was a blip. But it could also signal a shift in the state’s political character.

“There are few things to wonder about, whether 2016 was the start of a long-term realignment from blue to red,” Yoon said.

https://www.michiganradio.org/politics-government/2018-10-23/red-state-blue-state-analysts-weigh-in-on-michigans-political-identity

“Political observers roundly expect that funds for road repair, if it gets done, will only happen in the upcoming lame-duck session, due to the unwillingness of some in the 2015 Legislature to vote for new taxes, for anything. Beyond that, speculation is wide open on how aggressive House and Senate Republican leaders will be on taxes, education and social issues important to their conservative base in the months and years ahead.”

Remember when Chris Christie was governor of New Jersey. His legacy was to turn NJ’s road into a disaster as he was too cheap to raise the state gasoline tax. And one of the best public education systems took a nose dive. But hey – the rich avoided pay taxes!

Michigan is fairly mixed in its voting as witnesses by a Democratic Party governor and a legislature dominated by Republicans. But that doesn’t explain why other states with relatively low new business applications do not have that mix. If the disparities were predominantly regional, I might think that there might be some political issues related to the regions, but the map is fairly dispersed. So, “where’s the meat”? I suspect regression analyses will tell us nothing from the “usual suspects”… or databases.

For example, could it be tourism and gasoline issues? Possibly for states like California and Florida where the cost of travel and accomodations have diverged and perhaps COVID restrictions have suppressed California more than Florida.

Why the great differences between Colorado and Nebraska versus Wyoming and South Dakota? That’s not as superficially apparent. And speaking of Michigan, why so much lower rate than Indiana or Wisconsin?

Perhaps there are no reasons other than randomness.

“Perhaps there are no reasons other than randomness.”

The smartest thing you have said in this thread.

Fascinating you think a state that has its legislature packed with Republicans is “purple”.

https://www.bridgemi.com/michigan-government/michigan-lawmakers-repeal-whitmer-powers-months-after-court-overturned-them

https://www.politico.com/news/2021/09/15/wisconsin-power-robin-vos-tony-evers-511582

I’m curious Bruce, how you would compare Whitmer’s and Tony Evers’ “executive powers” to the Orange Abomination’s executive powers??

https://www.nbcnews.com/politics/white-house/angry-over-how-social-media-platforms-are-treating-him-trump-n1216401

Bruce, are you supporting donald trump killing off military veterans’ right to vote after they became paraplegic defending YOUR right to vote, etc??