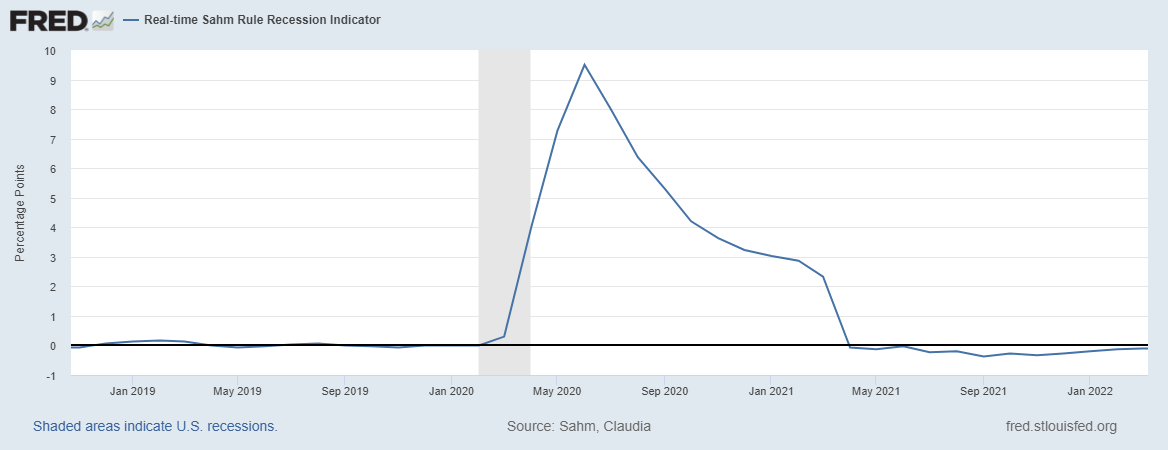

With today’s employment situation release, we have the real-time Sahm rule indicator through June:

Source: FRED, accessed 7/8/2022.

This indicator does not suggest that we were in recession as of mid-June (when the survey was taken), contra suggestions (e.g.). For other high frequency based indicators through June, see this post.

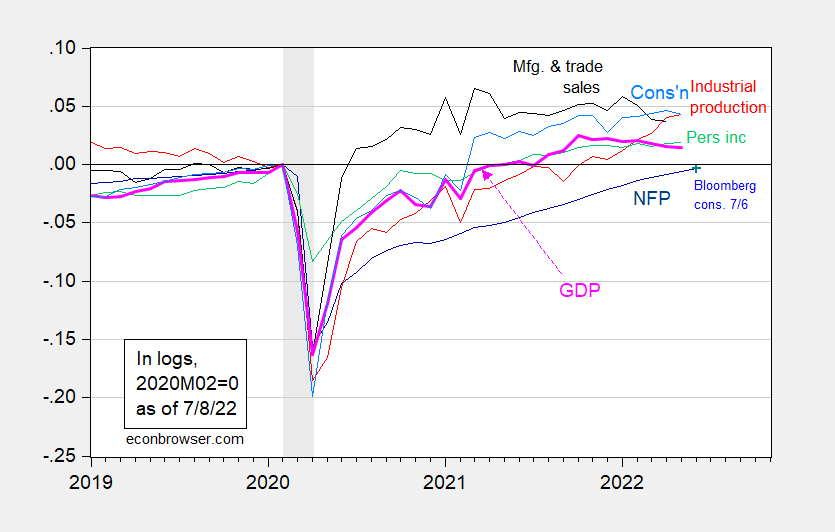

Here are some of the key indicators followed by the NBER’s BCDC:

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus for NFP as of 7/6 (blue +), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates, peak-to-trough, shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (7/1/2022 release), NBER, and author’s calculations.

Update, 7/10/2022, 4:30pm Pacific:

Jason Furman discusses whether revisions in labor market data could push us into negative employment growth, and hence arguably into recession. He’s skeptical this could be true for June, less skeptical for the future.

One concern with using job growth to “nowcast” a current or imminent recession is that these estimates will be revised (revisions to the unemployment rate, which is solely survey-based, only reflect updated seasonal factors and are typically minor). Specifically, to estimate job growth, the Bureau of Labor Statistics (BLS) supplements the information reported by employers with a model-based estimate of the number of new businesses that were created and destroyed. Since BLS’s model does not know when the economy is at a turning point, it will tend to overestimate jobs when the economy is turning down and underestimate jobs when it is turning up. That means that subsequent revisions, which incorporate administrative data like tax reports, will tend to be negative. For example, it was originally estimated that the economy lost 159,000 jobs in September 2008, but the most recent estimate is that the economy actually lost 460,000 jobs that month.

In the five recessions prior to the pandemic recession, the average revision to total job growth in the six months leading up to the recession was -0.2 percentage points, or the equivalent of about 50,000 jobs per month now. As shown in figure 6, even if the recent jobs numbers are eventually revised down, they are still very likely to be much higher than is typical before a recession.

“This indicator does not suggest that we were in recession as of mid-June (when the survey was taken), contra suggestions”

That comment from Stevie was a flurry of his usual confusion which seemed to conflate Biden’s popularity numbers with the prospects of a recession. But it was also wrapped by CoRev’s incredible disinformation on oil prices and Biden’s alleged policies.

I guess a new reader here might think this is some sort of Trumpian partisan venue to the right of even Faux News as opposed to the comment box of an economics blog.

BTW – Stevie had his own version of the Sahm rule which proved he had no clue what her rule was even about. But hey – that is par for the course with Stevie.

“Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months.”

I have always worried that the unemployment rate was not as reliable as the employment to population (EP) ratio given that it is also moved by the labor force participation (LFP) rate. The latest BLS release had unemployment not changing even though EP fell as LFP also fell.

So has anyone considered a variant of her rule that relied on the EP ratio rather than the unemployment rate?

Just consider how utterly absurd this is:

“Steven Kopits

June 25, 2022 at 1:06 pm

VMT says US entered recession in the Jan-Apr time frame.

Michigan Consumer Sentiment posted a new all time low for June, 50.0. That also suggests we’re in recession.

I would not read too much into falling crude prices at present. Crude will tend to track other capital markets in the short term. But if we’re in a recession, yes, at some point crude should fall.

My analysis suggests that the US could see both inflation and and recession at the same time.”

Steve has mined just about every time series in the book and has dismissed all of the series that suggest the economy is still growing. He comes up with two – just two – series neither of which are seen by actual economists as telling us very much.

It is crystal clear that Steve WANTS a recession no matter what. That way he gets invited back on Fox and Friends as their “chief economist”.

I’m sorry but this level of trolling cannot be taken seriously even by the right wingers at the National Review.

https://news.cgtn.com/news/2022-07-08/Non-fossil-sources-to-dominate-China-s-energy-mix-within-3-years–1buQS5SOixa/index.html

July 8, 2022

Non-fossil sources to dominate China’s installed power capacity by 2025: report

Non-fossil fuel energy sources will make up more than half of China’s total installed power capacity by 2025, according to a report released by the China Electricity Council (CEC) on Wednesday.

By 2025, China’s installed power capacity will reach 3 billion kilowatts, and non-fossil fuel energy sources such as wind, nuclear, solar and hydro-power will account for 51 percent of China’s total power generation capacity, according to the report.

By the end of 2021, China’s full-caliber non-fossil energy power installed capacity stood at 1.11845 billion kilowatts, accounting for 47 percent of the national total capacity, 13.5 percentage points higher than the previous year.

Coal-fired power plants up to the ultra-low emission standards have a total capacity of around 1.03 billion kilowatts, accounting for 93 percent of China’s total coal-fired power generation capacity.

The scale of China’s electricity trade continues to expand. In 2021, a total of 3.7787 trillion kilowatt-hours of electricity were traded in the national market, accounting for 45.5 percent of the total electricity consumption of the whole society.

“A unified electricity market system has gradually taken shape. From January to May this year, the entire volume of electricity traded at the market reached 2.0229 trillion kilowatt hours, accounting for 60.4 percent of the total, higher than that of last year. The role of market allocation will expand further,” said Hao Yingjie, secretary general of the CEC.

The report predicts that the total electricity consumption of the whole society throughout 2022 will grow by five to six percent….

Only 392,000 jobs in June. Da××ed recession!

I told AS I thought it would be higher than his 303k. I still “got it”. I never gave a number though. If you trust me, after the fact, if someone had held a gun to my head I probably would have given a number like 325k or something. I thought AS was in the ballpark but slightly low.

Gotta to love this headline:

https://www.msn.com/en-us/money/markets/jobs-data-make-a-mockery-of-recession-fears-economists-react-to-junes-employment-report/ar-AAZn1Jn

“Jobs data ‘make a mockery’ of recession fears: Economists react to June’s employment report”

OK – I will stop making fun of Princeton Steve and let this economist speak:

Andrew Hunter, Senior US Economist, Capital Economics:

“The strong 372,000 gain in non-farm payrolls in June appears to make a mockery of claims the economy is heading into, let alone already in, a recession. That may be enough to solidify the case for another 75bp rate hike at the Fed’s meeting later this month, although signs that wage growth is cooling and the recent plunge in commodity prices both suggest the inflation outlook could improve more quickly than officials had feared.”

Andrew? You are also mocking Princeton Steve?!

Even bigger indicator than the jobs gain is the drop in U-6 unemployment from 7.1% to 6.7%, with a big drop in Pepe working part-time for economic reasons. That’s the complete opposite of what you’d be seeing if we were heading toward recession.

The Federalist Five on the Supreme Court has declared war on the rights of women and it seems some states have a technological weapon in tracking apps:

https://www.msn.com/en-us/news/politics/u-s-women-should-be-wary-of-period-tracking-apps-white-house-says/ar-AAZn1g1?ocid=msedgdhp&pc=U531&cvid=7fe149594b2c4e09a3d7799e006104e2

U.S. women should be wary of period-tracking apps, White House says

Women in the United States should be wary of apps that track their menstrual periods after the rollback of federal abortion rights, a White House official said Friday.

“I think people should be really careful about that,” Jen Klein, the director of the White House’s Gender Policy Council told reporters Friday, when asked whether the administration recommended that women delete such apps. The Department of Health and Human Services has published “practical instructions on how to delete certain apps that are on your phone” she added.

The radical right is indeed this creepy.

Moses,

Worried about German industry? Oh, and France, too.

https://balkangreenenergynews.com/european-energy-prices-soar-as-winter-gas-supply-pessimism-mounts/

I’m very concerned about it. Not ready to push the panic button yet, but some of the numbers are worrying including the twitter/Bloomberg link I put up in a prior thread. I’m kinda hoping there’s some behind closed doors things going on here with politicians we haven’t heard about yet. But with India, China, and others behaving as they are, that may be the old “wish in one hand and cr*p in the other and see which one fills up first” on my part. I’m sure some of these bank reports will update.

I may have already put this link up, but again the quotes from people who would know are bothersome:

https://www.reuters.com/markets/europe/germany-risks-recession-russian-gas-crisis-deepens-2022-06-21/

Perhaps even more worrisome, is we’re seeing no sense of urgency from American leaders about this, and as far as I am aware of, no punishment of India and other bad actors as of yet. If anyone knows of ways the American Congress has made punitive punishments on India and others’ purchases of Russian oil, I’d love to hear them. I miss and fall asleep on some important stuff sometimes so maybe someone has heard something I didn’t. The truth is Germany hasn’t taken as much action as they should have, and now it’s become “too little too late”. How can Germany blame India for their own short-sighted policy of treating Russia like a trade ally?? The answer is, on purely moral grounds, they can’t.

https://www.nytimes.com/2022/07/08/opinion/inflation-oil-biden-monopoly.html

July 8, 2022

Wonking Out: Rockets, feathers and prices at the pump

By Paul Krugman

One of the sad paradoxes of politics is that few economic indicators matter more for public opinion — for voters’ evaluation of the government in power — than energy prices, especially the price of gasoline. This isn’t just a U.S. phenomenon: Inflation driven by soaring energy prices has undermined the popularity of leaders across the Western world.

Why do I call this a sad paradox? Because while policy can have a big effect on overall inflation, it doesn’t have much effect on energy prices. The rates for oil, in particular, are set on world markets; even the U.S. president (let alone the leaders of smaller nations) has very little influence on that global price.

Still, given the political salience of prices at the pump, leaders have an incentive to do what they can to bring them down a bit or at least be seen making the effort. So a few days ago, President Biden tweeted an appeal to “the companies running gas stations” to “bring down the price at the pump to reflect the cost you’re paying for the product.” Indeed, wholesale gasoline prices have fallen about 80 cents a gallon since early June, while the decline in retail prices has been less sharp.

The reaction to his remark was, however, savage. Most notably, Jeff Bezos in a tweet assailed Biden for “a deep misunderstanding of market dynamics.”

Hmmm. Did Bezos check out what we know about the market dynamics of gasoline prices (or order an underling to do it)? Because if he had, he would have learned that there are some peculiar things about those dynamics — things that suggest at least some justification for Biden’s appeal. Serious research offers a lot more support for the idea that market power has played a role in recent inflation than you’d imagine from the ridicule heaped on that notion, including from Democratic-leaning economists.

Monopoly power isn’t the principal cause of inflation, which has been driven by an overheated economy plus external shocks like Russia’s invasion of Ukraine. But there’s a reasonable case that monopoly power is a cause of inflation — and blanket attacks on the mere possibility reflect, well, a deep misunderstanding of market dynamics.

So, about those gas prices. As economists at the St. Louis Fed recently pointed out, there’s a longstanding phenomenon in the fuel market known as asymmetric pass-through or, more colorfully, rockets and feathers. When oil prices shoot up, prices at the pump shoot up right along with them (the rocket). And when oil prices plunge, prices at the pump eventually fall, but much more gradually (the feather).

Why this asymmetry? There have been a number of economic papers trying to understand it, pretty much all of which stress the market power of companies that face limited competition (something Bezos surely knows a lot about.) …

https://www.nber.org/papers/w4138

August, 1992

Do Gasoline Prices Respond Asymmetrically to Crude Oil Price Changes?

By Severin Borenstein & A. Colin Cameron

Our empirical investigation confirms the common belief that retail gasoline prices react more quickly to increases in crude oil prices than to decreases. Nearly all of the response to a crude oil price increase shows up in the pump price within 4 weeks, while decreases are passed along gradually over 8 weeks. The asymmetry could indicate market power of some producers or distributors, or it could result from inventory adjustment costs. By analyzing price transmission at different points in the distribution chain we investigate these theories. We find that some asymmetry occurs at the level of the competitive spot market for gasoline, perhaps reflecting inventory costs. Wholesale gasoline prices, however, exhibit no asymmetry in responding to crude oil price changes, indicating that refiners who set wholesale prices are not the source of the asymmetry. The most significant asymmetry appears in the response of retail prices to wholesale price changes. We argue that this probably reflects short run market power among retail gasoline sellers.

In China, gasoline and diesel prices are set and reset in response to significant 10-day average changes in the price of crude oil. This avoids “rockets and feathers” market pricing. Fuel price increases in agricultural settings may as well be strictly limited during planting and harvesting times, while supply at controlled prices is guaranteed through those times. The effect of Chinese policy, is to lower gasoline and diesel prices over time.

I bet Justice kavanaugh is searching the Constitution for the provision that grants arrogant beer drinkers the right to enjoy a steak dinner:

https://www.msn.com/en-us/news/politics/brett-kavanaugh-is-the-latest-target-of-protests-at-d-c-restaurants/ar-AAZno9x?ocid=msedgdhp&pc=U531&cvid=8cf52a9dddf140da8d84731277a162c4

After the Supreme Court overturned Roe v. Wade, eliminating the fundamental right to abortion, comedian Samantha Bee floated a plan for targeting the conservatives on the court who made up the majority opinion: “We have to raise hell — in our cities, in Washington, in every restaurant Justice Alito eats at for the rest of his life,” she implored viewers of her late-night show, “Full Frontal with Samantha Bee.” “Because if Republicans have made our lives hell, it’s time to return the favor.” It seems some abortion rights activists are taking a page out of that playbook — although the first justice to have his dinner publicly disrupted wasn’t Samuel A. Alito Jr., but Justice Brett M. Kavanaugh, who left Morton’s the Steakhouse in Washington on Thursday night through a back entrance to avoid the crowd gathered out front.

He was heard screaming “I like Beer”!

wow those employment and unemployment just prove the USA is in recession. Why don’t you blokes get it. ( sarc)

pgl: “The Federalist Five on the Supreme Court …”

Why only five? Roberts was also in concurrence on Dobbs. And Roberts was also a member of the Federalist Society, confirmed by records, although he tries to deny it by saying, ha ha, “I don’t remember”. What a lying weasel.

OK – I should say the extremely Federalist Five plus their good buddy the Chief Justice.

Keeping up with FWIW:

For June, at a 372k change, nonfarm employment was above the Econoday consensus range which was 190k to 350k. Any ideas of what the person did to forecast a change of 350k?

The consensus forecast for Econoday was 270k, 268k at Bloomberg and 250k at Briefing.com. I managed to show a forecasted 303k change which met the goal of being within the Econoday consensus range. The seventeen-category forecast method seems to work so far. Although given the mean absolute error of individual forecasts, it is difficult to get closer than the 71k under forecast shown for June. Using the same model for July as used for May and June, I am showing a forecast change of 251K for July 2022. Hopefully there will be no catastrophes over the next month which would drastically change the employment picture.

Remember that nfp’s new business creation issues and like are going to create large upward revisions to 2021.

@ AS

Have you got job openings/ job offerings in your seventeen categories?? I think it would be very easy to add and would vastly improve your forecast if not already there. The toughest part would be figuring out your weighting of job openings amongst your 17 or 18 factors on that. Maybe your forecast books will have some suggestions.

I think at least one high frequency number would also be well-advised. Especially when tweaking your final number at the last minute.

@ AS

Some of the content here you have to pay for, some is free. But you might play around on this site a little and just wander and see if it adds any insight.

https://www.estimize.com/economic_indicators/united-states-us-change-in-nonfarm-payrolls

Yeah, pretty clear the economy went through a microrecession due to omicron/russian war. Credit spreads lurched and credit crunched. But that is over. Inflation flattened in June and real consumer spending accelerated aided by price cuts due to the inventory glut. Can see a furniture spending boom, a lot of furniture on sidewalks.

Next comes the big oil gap down. Probably down to 80$ by August.

GB,

But but but, consumer sentiment is at an all time low! What is the matter with all those consumers, such low sentiment but somehow they keep on buying?

Actually, for all my implied mockery, this is a genuine mystery. What the heck is going on with this? I do not know.

“Microrecession” is what is wrong. People seem intent on talking down the economy, mostly for political gain. Inly a political hack with an agenda would throw around the term microrecession. It is meant to be demeaning and dispiriting. And it is utterly wring description, just a political hack trying to keep recession talk on the table, despite what the data shows.

@ Baffling

I think the term you mentioned is something you might hear on FOX news, or from our friend Kopits, who would use it to muddy the waters for his illiterate fans on FOX and OAN.

Republicans are much better at this type thing than Democrats. Which is why it was, as I stated before, a masterstroke to get Liz Cheney on a lead spot with the Jan 6th hearings. Some Democrat will try to inject transgender rights while questioning Steve Bannon, instead of thinking about who is viewing the hearings, what is the target point for the hearings, and how to change misperceptions. If Pelosi was on the Jan 6th committee, she’d start off with “Back in my home district, SanFran Sicko, it’s estimated that 0.000000000006% of abortions are future transgender children…..Mr Bannon, how did you think building a wall north of Mexico would fix that??” We need sane/cogent people who know how to present things in a tactile way like Liz Cheney is very capable of doing, not women who just had lunch at the Funny Farm Ice Cream Salon.