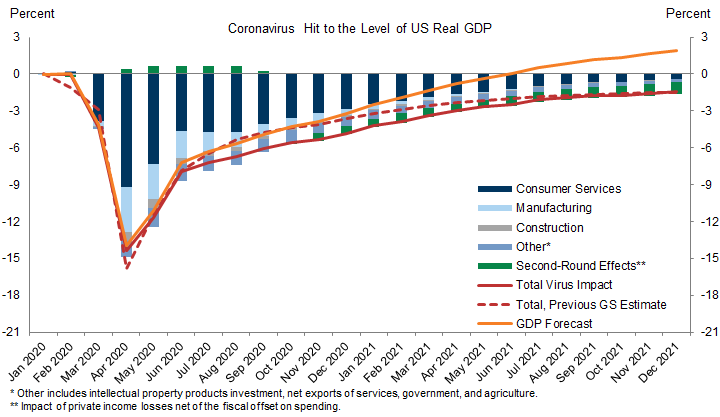

Goldman Sachs observes, over the weekend:

The US has experienced a dramatic resurgence of Covid over the last two weeks, with confirmed daily new cases surpassing 50,000. In response, officials have paused or reversed reopening in states containing more than half the population.

A combination of tighter state restrictions and voluntary social distancing is already having a noticeable impact on economic activity. States with the most severe deterioration in the Covid situation saw declines in consumer and workplace activity at the end of June that will likely continue into July, and activity flattened in other states.

The healthy rebound in consumer services spending seen since mid-April now appears likely to stall in July and August as authorities impose further restrictions to contain virus spread. The ongoing recovery in manufacturing and construction should be largely unaffected, however.

…

Here is the downward revision in the GS forecast:

Source: Hatzius, et al., “The Covid Resurgence and the Economic Outlook,” US Economic Analyst, July 4, 2020.

Notice that the biggest revision is over 2020H2.

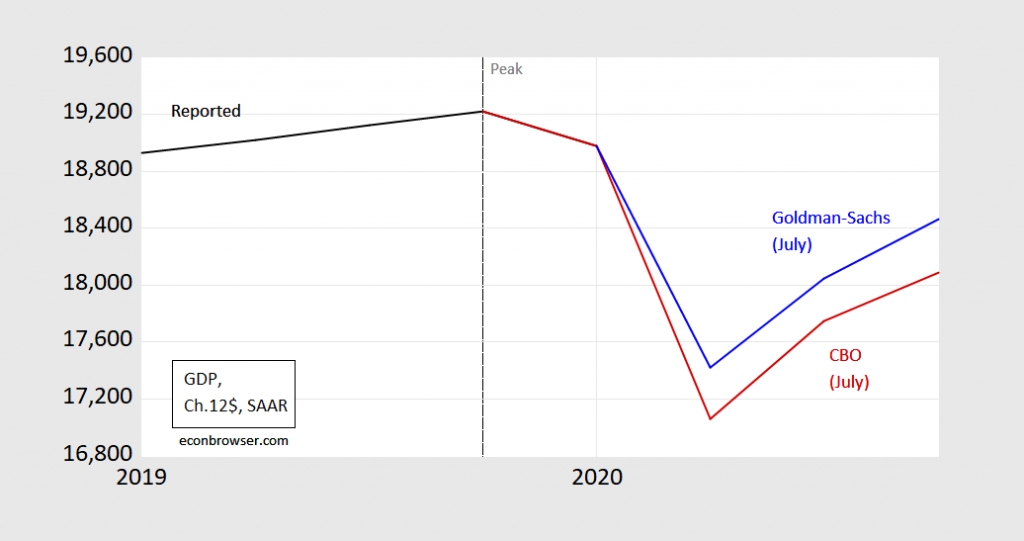

Even then, the GS forecast is less pessimistic than CBO’s (which is close to the IMF’s, not shown):

Figure 1: GDP (black), CBO July projection (red), Goldman-Sachs July 4 forecast. Source: CBO, Goldman Sachs.

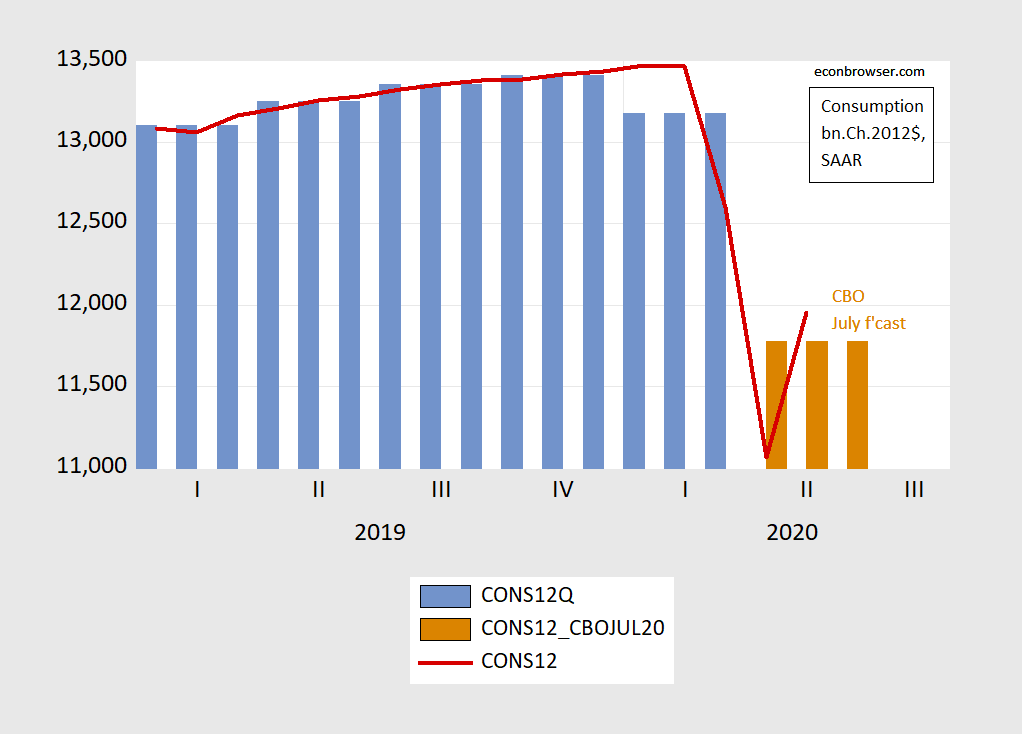

[The two forecasts are not strictly comparable, as CBO relies on current law, while GS incorporates a new stimulus package.] Consumption is key. Here’s the quarterly and monthly GDP data, and the CBO projection for Q2:

Figure 2: Quarterly consumption as reported (blue bar), Monthly consumption as reported (red line), and CBO projection of quarterly consumption (tan), all in billions of Ch.2012$ SAAR. Source: BEA, and CBO (July 2020).

oh here in Germany it looks really good.

And china does even better.

yeah, maybe end of spring 21 is the point of happiness in the US.

everything seems shifted +6 months from east to west.

don’t think covid is the problem, rather the leftwinger badmouthing

with their poison heart to damage our reputation and our country, …

—

Hopefully James posts soon.

Half a million people have died. Millions have lost jobs. Educations interrupted. Families separated. But Covid isn’t “the” problem. People saying mean things is the problem.

And the people saying those mean things? Only lefties, of couse. Lefties like President “Kung Flu”?

Get out.

@ “Johnny”

Isn’t it strange how a large part of the US Deep South went and switched over to Republican when they found out Kennedy and LBJ thought black children deserved access to a quality public education, a living wage, and maybe even a minimal amount of healthcare?? Well, I’m sure it’s nothing, just my mind wandering again.

Here’s an interesting map “Johnny”.

https://www.adl.org/adl-hate-crime-map

It drew my attention, “Johnny”, that if you look at the south USA, including Texas and Oklahoma, none of them are in the darker shade of blue vs the light blue. But two are in orange. I wonder why that is?? Well, I’m sure it’s ” ‘cuz economics” or “all the manufacturing mills are up north” or some such. You’ll figure it out and tell us “Johnny”. Maybe you’re one of those great intellectual types whose ancestors received such and such a rank in the confederate Army, and it emotionally

upsets you when statues of “white saviors” of blacks are taken down, but you find yourself snoring when a black man spends half his life in prison for a small bag of weed under his driver’s seat and he can’t pay the court processing fees?? A lot of those type guys walking around…….. You sound like you could belong to that social echelon. Tell me if you can relate to these guys “Johnny”??

https://theintercept.com/2020/07/05/national-review-william-buckley-racism/

Dumb post. JFK wanted nothing to do with anything you said.

Oh……

Please give JFK a message for me?? “Don’t tase me Bro”. THANKS. Also tell him watch out for that Judith Exner chick, word is she may have gonorrhea. Remember, bros before……

This is cool, I’ve always thought of Menzie as a man of multifarious talents, but I didn’t know we could interact with dead people here. Is this part of the whole zombie craze thing??

jtj,

Governors in places like Texas and Arizona are closing down bars and other activities because “leftwingers badmouthing”? Are you kidding? If it was leftwingers, one would expect it to be in more lefwing states that one would see the new closures that are now slowing the economy, but about the only such state where that is happening is California, with most of the bad events happening in the more conservative southern part of the state. Sorry, jtj, you have not got a leg to stand on with this fantasy.

And as for China and most of Europe, they have with a few exceptions managed to get the virus really under control, certainly far more than we have in the US, so most of them look to have more solid recoveries that do not get blindsided by a major new upsurge of the virus, although that could still come later if the world as a whole has a full blown second wave. But for now they have come close to beating the first wave, while the US and a few other losers like Brazil and Russia and Sweden are still struggling to get the first one under control.

I tend to agree that it looks like we are going to see a slowdown, although I note one thing offsetting a bit for awhile is that even though we see widely publicized shutdowns in Texas and some other hard hit states, in some other states reopening is still going on. Thus in Virginia where I am, the third phase of reopening just started on July 1, and DC and MD are complaining to Gov. Northan that he has included Northern VA in it, except for bars, while DC and Maryland remain in second phase still. So there will be some offsetting upward push as long as those reopenings contimue. But they will probably be all done by end of July, or pretty much so, although by then we may see yet more new shutdowns in freshly hard hit states.

Johnny know problem. Left winger badmouth with poisonous heart.Try to destroy reputation and country. Johnny not speak with forked tongue. Johnny just tongue tied.

He know great white father in Washington love his children and want all to live together. Great Spirit love great white father. Want his face on mountain too.

Construction is a following indicator. It is a long freight train that takes time to slow. Then once it stops, it takes time to start again. I recently counted about 24 cranes on a trip to downtown Seattle. There were 30 cranes a couple months ago. A few others that I was aware of in the other direction are down. When a crane comes down and the project is done, another project is now less likely to take its place. There may not be a dead stop like 2008. Money and insurance have not fled yet. While that could happen as it generally does when construction collapses, this downturn will be demand related. Working at home reduces demand, and people out of work do not buy or rent.

I sure hope it is shallow, but is going to hit enough to be obvious fairly soon.

Willie,

Construction employment has been one of those sectors that has bounced hard up in a V-fashion in the last two months, not lagging at all. However, I have speculated without data earlier on this blog that this might be a matter of the restarting of ongoing projects that got temporarily stopped due to the coronavirus. I think on the matter of new projects starting your point about being a lagging indicator is more accurate.

I know you worry about her a lot. And I was starting to worry as well, for the entire family. I did some research on your behalf Junior, and it looks like for at least one more month she’s going to be good on her next shipment of $12 per pint ice cream. You can sleep through the night again Junior.

https://www.bloomberg.com/news/articles/2020-07-06/firm-linked-to-pelosi-s-husband-got-virus-loan-u-s-data-show?srnd=premium

This also explains the “record breaking” 8% increase in consumption for May you discussed Junior, great investigative work on your part.

Moses Herzog: I don’t understand why you keep on mentioning “8%” growth, as if it weren’t a record. M/M real consumption growth in May was 8% (not annualized), and it is a record for the 2002- period. Nominal consumption growth was also a record in May, for the entire period since 1959.

Thanks, Menzie. I have been a bit mystified by why Moses seems to diss BEA numbers. It is the Bureau of Economic Analysis of the Dept of Commerce. It certainly has more official standing than SAAR, which somehow he seems to favor (I do not know what they say consumption growth was in May, but I bet it is not too different from the BEA numbers).

Needless to say we are seeing further degeneration here on Moses’s part, more linking to topics irrelevant to the thread and not amounting to much, mot to mention verging on territory where he has previously really seriously come across as wildly inappropriate, not to mention screamingly wrong. I thought avoiding this was the one thing he learned on his vacation, but maybe not.

BTW, I am not making any near term forecasts right now. I made a lot of noise recently because it seemed that I was out of line with widely respected forecasters who looked to me to be getting things wrong, not catching on that growth was happening more rapidly than they seemed to realize. But now with it looking to probably slow, I am more in line with their latest, although also thinking a lot is very much up in the air right now, but without me having any strong sense of where it is all going.

Sorry, Moses, this means you will not be getting any more numbers to post here repeatedly with perfervid denunciations of me. But, heck, I am not enough of a Real Man to make specific forecasts for you to dump all over. After all, I wear a mask in public, and we know from our nation’s leader that this means that I am not a Real Man, so I am certifiably and officially not one, almost as if ihad been reported by the BEA itself.

@ Menzie

Because the question is “from WHERE??”. And it’s not a very intelligent view to not recognize that fact. If I have a record increase in a crop harvest measured year-to-year, measured immediately after a record drought, WTF do you think that means Menzie?? I would LOVE to hear your answer on that.

Moses Herzog: The cumulative decline over two months preceding (in logs) was 20.4%, so the 7.9% increase in May was not inconsequential.

@ Menzie

That’s a very fair statement on your part. I expressed myself poorly, and I will even “come clean” and say I did not know that it was in fact a record.

Here is how I would rephrase my words: YES, it is technically a record, but if we label it a record, there should be an asterisk beside that record, with a small footnote explaining the situation for the two months prior. I’m certainly not going to clash swords with you on this Menzie, as I know you will have me sliced and diced like a cucumber. And as I know you to be a man who takes no thrill in argument, but wants the chronicling and gauging to be accurate, I would have no animosity if you did slice and dice me.

More to the point, Moses, not only was that increase by a record amount, not many were expecting anything like that. Certainly you were not predicting it. You had been pushing the “L” pattern “recovery pattern, which meant that there would be near zero increase. You were quite firm and also highlyi sarcastic about it when pushing it in comparison to other possible patterns. But in the end, you were wildly wrong, although you do not admit it and continue to make ridiculously sneery remarks about the actual figures. as if that will let you off the hook.

Just man up and admit that you were wrong, Moses. This effort to avoid it or pretend it is not the case is becoming more and more absurd.

@ Barkley Junior

I suggest you go back to things you’re masterly at. Such as wearing leather pants at an age no one else would, and going on tangents during class time that have nothing to do with the materials you’re supposed to be teaching, and giving Ds and Fs on material you never discussed in class because you were going on tangents and screaming, like the 10 year old class clown sorely desperate for the attention he wasn’t getting at home. Because it is very obvious, you can’t forecast SAAR GDP numbers very well. Which everyone here knows, is what you were discussing here:

Barkley Junior said on June 27th 2020: ” ‘Possibility’ it might be as high as -20% for second quarter? It now looks like consumption is highly likely to be positive for the second quarter kills any chance of overall GDP growth for the second quarter being -20% or lower. Heck, I would be very surprised if it is lower than-10%. ”

https://econbrowser.com/archives/2020/06/gdp-nowcasts-june-26th#comment-237778

The current V in construction is a bizarre phenomenon related to the hard shut down for COVID reasons. The projects were interrupted but didn’t stop. They started back up where they left off. I would discount both the drop in construction and its recovery. What’s far more important is the trend that follows the apparent V. It’s not up. It’s tapering now as it would in a normal, insurance and lending based construction downturn.

I spent most of my working career in construction or related fields, and the rhythms are painfully familiar. This latest V is completely unfamiliar. It does make sense if you think about it in terms of an interruption of current projects that then resume to completion. Construction was beginning to taper a little before the interruption, so I was expecting a slowdown. For now, I don’t know what kind of slowdown we will have, but I’m not optimistic about the industry right now.

Willie,

I agree. I do not know if you saw me making exactly this point several times here. But I understand if you have not bothered to read anything I post because I have gotten dragged off into answering the various screeds Moses sends at me.

I usually do read most of what you write, but that point might have got past.

In texas existing construction has continued, and been an economic support. I have not seen much breaking ground on new construction projects.

In our area (Bethesda, MD) there was hardly any lull in construction since things were shut down in early March. Lots of high rise construction going on in the downtown area. Permitting continues and we have a 17 unit housing development on a vacant parcel of land in our neighborhood getting ready to break ground. Of course things will vary by region.

There are leading indicators for construction spending. The AIA billings index is one:

https://www.aia.org/press-releases/6306192-architecture-billings-downward-trajectory-

That index bounced in May after a monumental decline, but remained well below 50, indicating continued contraction in architectural work that leads construction.

This is a tricky one – it may mislead. because the lead is long enough that design work can be caught up – not completely, but enough that construction need not follow the path of design work at all precisely. In this case, the drop probably represents clients cutting costs in the face of massive uncertainty rather than deciding they won’t want new construction in 18 months.

It also depends a little on which sector the architectural billings are in. With the exception of the federal government, I expect a sharp decline in public works construction. The collapse of tax revenues and the expense of unemployment insurance will put the kibosh on state and local projects. Private construction is a little harder to read, but for what I would hope are fairly obvious reasons I expect a sharp decline in office construction over the next few years. Industrial facilities are a hard one for me to read. Residential, light industrial, and light commercial construction may continue if the finance and insurance markets do not fall apart like they sometimes do.

Ultimately, I see a decline in overall construction, but there may be sectors that do reasonably well. People still need places to live.

Poison heart? Oh you mean like all those white people calling the cops on black people for doing nothing.

Damage our reputation? Oh you mean like how Trump has alienated all our european allies and salivates over authoritarian regimes like Putin, Erdo, and Kim-J. He fires Comey for the “Russia-thing” and the very next day invites the 2 heads of the Russian embassy to the white house and refuses to allow anyone to attend except Russian media.

Badmouthing? Oh you mean like all the misplaced pejorative adjectives about “leftists” and “anti-fa” that are projections of what white nationalist groups like those stormed the Lansing, Michigan state capital with guns blazing actually do.

So you mean like those black-clothed non-leftist, non-antifa white nationalist group operatives who seemed to be the ones who smashed windows and started fires like in Oakland, Atlanta, and Minneapolis — most of whom infiltrated the protests. Or those white boogaloo boys from Arizona and Santa Cruz who shoot cops .. because their hearts have been poisoned and they want to instigate a civil war so they can install some modern version of the Southern Aristocracy.

I agree, COVID did not create this culture war that is being instigated by corrupt politicians who are distracting the gullible lower classes while the oligarchical gradually destroys the constitutional republic and the middle class.

[edited for profanity – MDC]

Ennio Morricone died. Age 91. A GIANT in musical composition:

https://www.npr.org/2020/07/06/516840947/ennio-morricone-the-sound-of-the-american-west-dies-at-91

My personal favorite was “Once Upon a Time In the West”. “Hateful Eight” had some good ones, and also if I’m not mistaken he even did some parts for John Carpenter’s “The Thing”. Many others…..

Turn it up so you can pick out the little parts. Like many great pieces of music it builds up emotion like a pyramid:

https://www.youtube.com/watch?v=PTwWp6VMNGs

This is what it’s all about. Respect for those who have set the standards, in a quiet way:

https://twitter.com/newbeverly/status/1280228177944539136/photo/1

Menzie mentioned IMF, June 24th.

[ Sigh……..] “Be still, my forlorn and abandoned heart. Servants, my ticker is frail, slowing, and beating arrhythmically. Fetch my defibrillator. Hark, it is Gita!!!!!” [ Faints]

https://www.imf.org/en/News/Articles/2020/06/25/tr062420-transcript-of-the-press-conference-on-the-release-of-the-world-economic-outlook-update

I shall simply remind all of the more specific numbers in that late April Nature report on carbon emissions. They are not perfectly correlated with GDP, but are generally somewhat so. Anyway, from Jan. 1 to the low point around April 7, global emissions of CO2 declined by 17%. That seems to be more than the decline in global GDP the IMF is reporting for first quarter. Carbon emissions have supposedly been rising slowly since the low point, although I have been unable to get updated numbers. However, a sufficiently slow growth of emissions would leave the overal second quarter average well below the first quarter one , which would be not inconsistent with IMF report of a sharper decline of global GDP in second quarter relative to first quarter, even though most of the second quarter might well have been experiencing positive, but slow, GDP growth.

Well, I guess we will be finding out what the official Q2 numbers are fairly soon.

No, Willie, we shall not. It will be well more than more than a month from now that we get even a preliminary number from the BEA. And no, SAAR is not a superior source of data on such matters.

You may be bored, but please pay attention to what is real data and when we get it and when we do not.

2020Q2 GDP advance release will be on 7/30.

7/30 is pretty soon as far as I’m concerned. I think far more glacially than most here, perhaps. And, I’ll be curious to see how Q1 and Q2 data get revised over time. I follow this stuff out of curiosity these days, now that I’m not dependent on the construction industry to keep eating regularly and living inside. I’m not actually bored by any of this. The ebb and flow is fascinating, as are the different ways to forecast what’s coming beyond my rudimentary tea leaf reading and comparisons to what happened in the past. Furthermore, my filter isn’t as well tuned as it would be with economics training, and I’m happy to acknowledge that fact. Reading this blog and testing what I’m seeing and thinking against what others with more information and analytic tools is a way to hone the filter over time.

Willie: GDP is released on a set schedule, and revised multiple times. This article by Jason Furman is a good primer on macro releases and variables.

Thank you. I just learned something else. There’s a reason I read this blog and all the comments.