I talked about infrastructure investment and taxes on WPR yesterday. Will higher corporate tax rates and closing of loopholes in the taxation of corporations raise prices of goods produced? Given what happened in the wake of the 2017 reduction in corporate tax rates (i.e., lots of stock buybacks, not much higher investment), I think a resulting price increase not likely. On the other hand, the infrastructure spending could have an impact on productivity and hence prices.

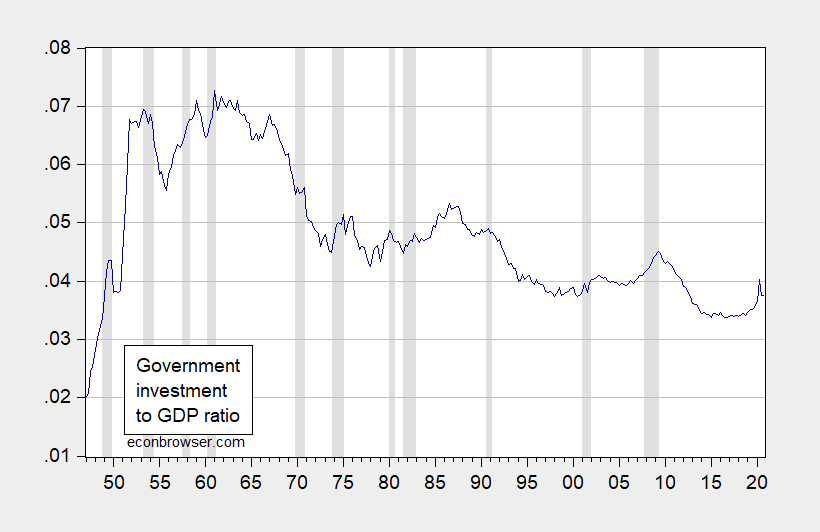

And infrastructure spending has been pretty low…

Figure 1: Government investment as share of GDP (blue). NBER recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

The big question is whether the proposed tax rate increase along with revisions to the measures related to international income taxation will do the trick in terms of raising sufficient revenue.

From Pugliese & Mathews, Wells Fargo (April 1):

President Biden has proposed several changes to corporate taxes to raise revenue for his infrastructure plan. The biggest change from a revenue standpoint would be to raise the corporate income tax rate to 28% from 21% . A general rule of thumb is that a one percentage point increase in the corporate income tax equates to approximately $100 billion of new revenue per year, and most independent estimates are in the ballpark of this rule (Figure 2). Beyond just taking the corporate

rate higher, President Biden has also proposed some other corporate tax policy changes such as introducing a 15% minimum tax on corporations’ “book income”, doubling the rate on global intangible low-taxed income (GILTI) to 21% from 10.5%, assessing the GILTI rate on a country-by-country basis

and eliminating the qualified business asset investment (QBAI) exemption.The AJP also mentions eliminating the tax incentives for foreign derived intangible income (FDII), but it goes on to state that “all of the revenue from repealing the FDII deduction will be used to expand more eective R&D investment incentives,” so we assume that this proposed change does not include any

net new revenue. In addition, the plan also mentions a few other smaller changes, such as more robust tax enforcement and ending “tax preferences for fossil fuels,” but we anticipate that these changes would likely be relatively small from a revenue standpoint.If implemented in full, we project the above tax changes would raise approximately $1.25-$1.50 trillion over the FY 2022-2030 period…

Some improvement in our nation’s year to year collected revenues is better than none.

I read this column in the NYT and thought it was a mood-lifter. It’s related to the Christian holiday. I was hopeful others might find it inspired some happiness within themselves as well:

https://www.nytimes.com/2021/04/03/opinion/christ-resurrection-easter.html?action=click&module=Well&pgtype=Homepage§ion=Contributors

Many health officials have said surface contamination (and accordingly, Easter eggs) is not a likely way of spreading Covid-19. If your children wear a mask, respect social distance and immediately wash their hands at the end of activities, I see no reason for people to break their usual Easter activities, conditional on the prior mentioned precautions.

Will have to listen to the interview later. After all, the McConnell spin is getting really boring. According to Senator Turtle the economy is about to overheat like crazy because the government spent too much helping average Americans and at the same time asking corporations to pay a little more will send an allegedly fragile economy into another recession.

And McTurtle and other GOPs are crying crocodile tears about the deficit, but won’t ask corporations or the rich to give back a DIME of the Tax Scam that has caused us to have such a large structural deficit. As Prof Chinn notes, investment really didn’t change much at all after the Tax Scam became law, and in fact, manufacturing was in recession even before COVID-19 hit.

The GOPs are pathetic frauds, and I think much of the country has stopped buying that “job creator” BS. Frankly, Biden should be raising corporate taxes well above 28%.

On the 3 callers. Not sure what Dave’s point was but loved how this Republican called Trump crazy. I wanted to scream at the 3rd caller (Barry) and his love for corporate welfare but your reply was spot on.

Was the 2nd caller named Karen? She had a very valid point which basically goes to the need to beef up enforcement of transfer pricing. But a couple of nits. You brought up the point of transfer pricing manipulation which was great but it is called profit shifting not revenue shifting. Yea – that army of corporate lawyers and accountants do toss out all sorts of misleading terms but I did want to point that out. The other nit goes to the host who should realize one can shift profits even without doing an inversion. Just ask Apple, Facebook, Google, and a lot of Big Pharma.

One of the cost issues will be steel prices which are soaring:

https://www.thefabricator.com/thefabricator/blog/metalsmaterials/could-steel-prices-soon-hit-1000ton-in-the-new-year

One thing I do not get is why anti-trust is allowing a merger of two major steel producers.

On US corporations not paying income taxes, ITEP has a list of the top 55 companies that paid no Federal taxes in the last year they examined:

https://itep.org/55-profitable-corporations-zero-corporate-tax/

I recognize some of them as being very aggressive with respect to tax evasion. Like Nike – love your running shoes but pay your taxes.

I have to confess that I saw a link to this story on LinkedIn posted by some dork that is pissed that we complain about tax havens. I wanted to comment on his comment and tell this dork what I think about him but such banter is not exactly PC on LinkedIn. But I guess I should investigate if this clown as a Parler account where I would be free to blast his corporate homerism at will.

I had to Google Matt Gaetz and “scorecard” after to listening to an MSNBC interview just now:

https://scorecard.lcv.org/moc/matt-gaetz

OK his scorecard on this particular issue is low which is no surprise. That is not the juicy story. David Jolly who has served with Gaetz in the Florida legislature just let us know about some sexual scorecard Gaetz kept bragging about all the chicks he managed to get in bed. Not on the internet yet but something tells me this part of the story is going to be big news by the time I wake up tomorrow.

Infrastructure spending can improve productivity if it is spent improving productivity.

Here are a few items that do not increase productivity:

– onshore wind turbines (reduced reliability at materially increased kWh cost)

– offshore wind turbines (reduced reliability at materially increased kWh cost)

– an expansion of Amtrak (this is a joke, right?)

– high speed rail (not in proportion to cost at at least)

– tunnels under the Hudson River (not in proportion to cost)

– charging stations for EVs

Almost every category mentioned in the infrastructure bills is subject to separate fees and taxes already. We already pay for electricity, including the transmission system. Airport fees are already outrageous. We pay for roads through taxes of various sorts (and is the road infrastructure falling apart where you live?). There is no reason for the government to be involved in EV charging except to the extent of making parking slots available at interstate rest stops. The government didn’t pay for my gas station, why would it pay for a charging station?

In all these cases, if you need more infrastructure, you raise user fees. How hard is that?

“In all these cases, if you need more infrastructure, you raise user fees.”

Some needs to learn the difference between building the infrastructure v. paying for it. Or to quote you – ‘How hard is that?’

A lot of the things on your list of unneeded infrastructure are very much needed. But do not let me interrupt your incessant parade of the dumbest comments ever.

I wonder if our Princeton Know Nothing pretend consultant even knows what the spike was in the graph of government investment/GDP during the 1950’s even was about. Now most people have heard of how Eisenhower got us to build that interstate highway system, which has been a major productivity improvement. And he did not wait for user fees to accumulate before the initial construction occurred.

Now ongoing expenses are 70% financed but “user fees”. But I wonder if our Princeton Village Idiot knows where the lion’s share of user fees come from. Only part of this is tolls. Most comes from fuel taxes. Now if we increased the too low Federal gasoline excise tax, I would applaud that. But it looks like Princeton Stevie whiny pooh is already bitching about paying fuel taxes which are a user fee.

The Eisenhower interstate system did not have tolls, and I don’t believe gasoline taxes were very high then. And of course, the return on investment was terrific.

But which of these Biden investments improves anything? I am not opposed to wind turbines. But if they are so great, why do they need a subsidy?

HIgh speed rail? What a joke for anyone who has commuted into NYC. The potential speed is about 160 mph on the northeast corridor with today’s equipment, which puts DC comfortably within two hours from NYC. How much bigger is the market if the commute were, say, 1:30 minutes? Is there a big class of commuters willing to pay twice the already high price to save thirty minutes? Instead, the problem is that the northeast corridor passes through a large number of communities pressed right up against the track, from New Brunswick north to NYC, all through the Philly area, through a good swath of the Baltimore stretch. The issue is not equipment capability, but rather speed limit restrictions imposed by the community. Infrastructure investment does not help that, certainly not at any payback ratio that makes any sense.

And airport fees. My god, they are already obscene at many airports. And if I unpack those what will I find? Vastly over-paid union labor on the other end and mountains of bad practices. How often was I delayed in New York due to ‘signal problems’? Just how hard is it to maintain signals? Do you think signal problems will go away if you make huge investments in high speed rail? No, because the same clowns will be running the system. Better opex is always better than more capex as a first line of defence.

If you check, you’ll see a bunch of political hacks are running these systems. And why is that? Because the principal customer of NJ Transit is not the commuter, but rather the state of New Jersey which provides them lavish subsidies. And what do those lavish subsidies provide? Lavish wages and over-employment for people with better political connections than professional qualifications. When I say that state-owned enterprises take on the objective functions of their owners, that’s what I mean.

Take as an example the GW Bridge of this phenomenon. Toll: $15. Physical condition: Mediocre at best. Go up the Hudson fifteen miles and there’s the brand new Tappan Zee (now Mario Cuomo) Bridge. Toll: $5. What’s the difference? Lavish subsidies for non-bridge projects.

Should we pay politicians for increasing GDP growth without increasing debt, then we will be able to make these sorts of investments easily and freely. More than 90% of Biden’s infrastructure plan would fall away, and possibly be replaced with more mundane stuff. What high speed rail? Buy up all the properties adjacent to the tracks, which allows you to increase speeds on existing equipment. In Baltimore and Philly in particular, much of the track side housing is semi-abandoned tenements would should have been pulled down years ago anyway.

Were politicians paid for performance, $100 billion would go to buying up properties adjacent to the CT Turnpike to widen I-95 to six or seven lanes each way, an investment which should have happened in the 1970s. If you’ve ever stood in traffic heading in or out of NYC from the north, you can do a phenomenally high ROI on that in your head.

And finally, fuel taxes. I am not opposed to these. But what are they being spent on? Is half of more going to mass transit? Then that’s not a user fee, it’s a regressive redistribution policy. And that’s why they are opposed so often by the public.

“The Eisenhower interstate system did not have tolls, and I don’t believe gasoline taxes were very high then. And of course, the return on investment was terrific.”

You just made my point which undermines what you originally wrote. Pardon me if I skip the rest of your long winded babble.

My bad. I just wasted my time reading all the whining from Princeton Idiot. He likely does not get this but his rant just made the case for using Federal funding to fix the massive infrastructure issues in the Northeast Corridor. I would ask – is this troll really this stupid? But the answer is too obvious – yes.

” I am not opposed to wind turbines. But if they are so great, why do they need a subsidy?”

you are going to need a subsidy anytime you need to change an entrenched interest. look how hard the fossil fuel industry pushes to make it hard to incorporate renewables into the energy infrastructure. and you don’t think that fossil fuels don’t get subsidies? they do not pay for their environmental damage. and the usa spends an enormous amount of money securing the worlds oil supplies and transit around the world. you send that bill to exxon directly, and the company goes under. steven, you should never cry foul about wind energy subsidies again-it is a very disingenuous argument on your part.

fossil fuels served their purpose, but now it is time to move on to a much better alternative-renewables.

I seems to me that wind turbines should have subsidies similar in magnitude to tax breaks and other benefits fossil fuel producers get.

I agree, Willie. And if you do that, you’ll get a bunch of gas-fired plants and no wind or solar.

We can pull out of the Middle East tomorrow if you like, Baffs. We are self-sufficient in energy thanks to shales. And do you think the result will be good?

You cannot pull out of the middle east overnight. But the reason we are still in the middle east was because of our reliance on oil in the first place. I would tax the heck out of oil to help cover the cost of the mess until we do get out. Time for oil to pay for the costs inflicted over the past decades.

“And finally, fuel taxes. I am not opposed to these. But what are they being spent on? Is half of more going to mass transit? ”

federal gas taxes have not increased since 1993, in spite of inflation. and the portion going go mass transit is not even close to half. years ago, there was an 80-20 split which is probably still being enforced.

steven, if you want to know why your highways and bridges are crumbling, start with the fact that the tax per gallon has not changed for nearly 3 decades, in spite of inflation. steven, your arguments are based on false premises. if you want to talk about these items, at least educate yourself a little bit before complaining.

Highways and bridges are not crumbling. And if you used gasoline taxes for roads rather than other projects, we’d have the best road infrastructure in the world.

Gasoline taxes in New Jersey has soared in recent years. And then there’s the punishing cost of tolls, which are really high. But look at the budgets. Why don’t you look at New Jersey’s or Pennsylvania’s budget and see where highway tools and gasoline taxes go.

“ We pay for roads through taxes of various sorts (and is the road infrastructure falling apart where you live?). “

Steven, these were your words. Maybe you can explain what you mean by falling apart, because it sounds an awful lot like crumbling. And if you read the asce report card on our infrastructure, we are not doing well in funding and maintaining, let alone new construction. We have underfunded infrastructure for decades. We have the capability, but lack the fire to fund it.

Steven Kopits I think you’d be on firmer ground if you made the argument that many of the proposals in Biden’s infrastructure plan are inconsistent with his climate change plans.

Well, I can do ROI. I have done power plant development. I have done oil and gas. I have done offshore wind. I know quite a bit about these topics. Show me a renewables project that works without tax credits, subsidies or mandates. Are there any? Can any of these project earn their ROI in the marketplace? And if they don’t, are they going increase productivity? Clearly not.

They only make sense if you put a substantially high price on CO2. But the administration has ruled that out. Why? Is it because all this climate talk is just blah-blah, as it so appears to be. And is it because the US public does not think climate change is worth $0.10 / gallon? That seems to be the case, isn’t it?

So all these are just a giant stream of white elephants, and they bring you to Germany and California: unaffordable, unreliable power. And does that create equality or ‘great manufacturing jobs’? Hell no. It reduces US competitiveness in lower value added manufacturing and construction.

Steven Kopits Well, two can play this game. Show me a carbon based energy source that isn’t based on subsidies.

As to voters not being willing to put their money where their brain is with respect to climate change, you might have a point. But so what? Telling us that voters are myopic nitwits is not exactly front page news.

Show me the subsidies for PXD. See if you can find them on the income statement or balance sheet. Show me the government program. And let’s be clear: US shales are saving US consumers $300 bn / year. How much are renewables saving California consumers?

There are basically two arguments for oil subsidies:

The first is AROs, that states allow companies to get away with underfunding their well retirement obligations. That’s a sum, but states want the jobs and the severance taxes (severance taxes are taxes, not subsidies!), so they sometimes kick these obligations down the line. But how big is that in dollar terms and as a percent of revenue?

The second is the cost of carbon. There is absolutely no agreement on that. And, hey, Pete Buttegieg took them off the table, You know why? Basic the US public would string up the Biden administration. As Madison says to Hamilton in Hamilton:

[MADISON] You don’t have the votes

[HAMILTON] No, we need bold strokes. We need this plan

[WASHINGTON] No, you need to convince more folks

That’s the reality. Right now, the US public is not willing to put their hard-earned cash in the hands climate doomsayers flying their private jets to beachside properties. That’s why we have renewable standards and all kinds of subsidies — it’s all backdoor taxation that Democrats could not get passed straight up.

steven, you are unwilling to acknowledge the subsidies and benefits oil and fossil fuels have obtained over the past few decades. there are bills coming due for those costs. this is clear when you make a statement like “See if you can find them on the income statement or balance sheet.”. subsidies and benefits come in both direct and indirect forms. when you pollute the environment and don’t pay for the cost of cleanup, that is a subsidy. fossil fuels have been subsidized for decades. your industry wants to welch on their obligations.

Just how dumb is consultant “Princeton”Kopits??? The world may never know.

https://www.youtube.com/watch?v=O6rHeD5x2tI

https://www.forbes.com/sites/jamesellsmoor/2019/06/15/united-states-spend-ten-times-more-on-fossil-fuel-subsidies-than-education/?sh=5363c6114473

https://www.rollingstone.com/politics/politics-news/fossil-fuel-subsidies-pentagon-spending-imf-report-833035/

https://www.vox.com/energy-and-environment/2017/10/6/16428458/us-energy-coal-oil-subsidies

https://grist.org/politics/biden-is-eliminating-fossil-fuel-subsidies-but-he-cant-end-them-all/

https://www.theguardian.com/environment/climate-consensus-97-per-cent/2018/jul/30/america-spends-over-20bn-per-year-on-fossil-fuel-subsidies-abolish-them

https://www.eesi.org/papers/view/fact-sheet-fossil-fuel-subsidies-a-closer-look-at-tax-breaks-and-societal-costs

steven, as if on demand, bloomberg writes about the implicit subsidies used by the fossil fuel industries. seems renewable are not the only ones getting benefits these days.

https://www.bloomberg.com/news/articles/2021-04-07/biden-tax-plan-targets-fossil-fuel-subsidies-worth-35-billion

i would like steven to read the vox link provided by moses, and then tell me that fossil fuels are not subsidized. as i said, vested interests are keeping america from achieving the best energy world, to our detriment.

“The government didn’t pay for my gas station, why would it pay for a charging station?”

The government is not charging you for the pollution your gasoline driven car is creating. It should. So they give a slight subsidy for cars that do not pollute and this bothers you? Are stupid are you? Seriously?

Then put on a carbon tax and call it a day. Oh, yes, but Buttegieg just said that’s off the table. Why? Because the public does not give a whit about climate change. And neither do the left’s leaders banging the drum.

If climate change is such a big deal, shouldn’t we outlaw private jets first? You know, the ones used by Kerry and Bloomberg and Gates.

Second, shouldn’t we be pushing all out for nuclear, rather than closing station after station?

And why did Obama buy Robin’s Nest, the Magnum PI house from the 1980s, where three news houses are under construction? That property is no more than 2 feet above sea level. Isn’t he worried about sea level rise?

Best I can tell, leaders on the left completely lack conviction about actually their own thesis. If they want to lead, well then lead. End private jet use. Period. Let’s start there.

Maybe you should learn the meaning of externality. Clearly this is a concept that escapes your rather limited little brain.

Put on a carbon tax. What’s the price you want to put on it? How big does it have to be to get you to ‘carbon zero’ in this century?

“Because the public does not give a whit about climate change. ”

actually the public does care. i was surprised when a friend of mine, from a very republican family, came out in such support of efforts to mitigate climate change. but she lives on the coast in florida, and sees the reality.

one big issue for the public is the decades old PR attack against anything to do with climate change. this intentional effort to create controversy and misinformation has slowed down the efforts by creating confusion, to the detriment of our nation and its security. and steven, i would imagine you were a part of the misinformation campaign, unknowingly and unwittingly. your continued push for oil at the expense of electric and renewables indicates you are still part of that misinformation campaign. stop being a pawn.

Then carbon tax it is. Knock yourself out.

“Then carbon tax it is. Knock yourself out.”

its a pollution fee. or do you think it is ok for an entire industry to make itself economically viable by not paying for their pollution costs? steven, you sound like somebody that is ok paying their water use bill, but refusing to pay for the sewer bill because you would rather just dump the water on the street. why should you pay for the water to be cleaned when you can simply release it back into the environment for free?

steven, i would expect somebody in bed with the oil industry would put up a fuss against renewables. but you have been wrong about renewables for several years now, and your comments indicate you still have not learned your lesson. first, you comments on wind turbines are simply false. and second, your comment about “The government didn’t pay for my gas station, why would it pay for a charging station?” is very misleading. the gasoline infrastructure was built along with the interstate system and other paved roads across america. without the explicit construction and improvement of the roads, there was no business model for the success of the gas station. gasoline automobiles were significantly subsidized by the us government. and that is fine, because the result was a net benefit for the nation AT THAT TIME. the same thing can be argued for EV and the support structure TODAY. a future transportation system based upon electricity rather than gasoline is a much better future. the government should be doing everything they can to move us to that point. gas is NOT the future.

“We pay for roads through taxes of various sorts (and is the road infrastructure falling apart where you live?).”

you are implying that those taxes and fees are sufficient, and the government has squandered those funds. that is NOT correct. the transportation system has been chronically underfunded for decades. you are simply seeing the result. and the longer you wait to fix it, the more expensive it becomes. steven, your attitude is a contribution to our transportation neglect, not a solution.

“In all these cases, if you need more infrastructure, you raise user fees. How hard is that?”

steven, spoken like a true proponent of a vested interest which would be hurt by meaningful change and improvement. rather than improve, you want us to stay at the inefficient level to your benefit. in texas, user fees are quite common with the construction of toll roads. they are fast and uncongested. and only the wealthy can afford to use them. that does not benefit our society as a whole. but general tax funds were used to built those roads.

I am not opposed to renewables. I am opposed to wasting money. If California’s power rates were 90% of the national average, rather than 90% above the average of states without renewable portfolio standards, then I would be full of praise. But that’s not the case. Power is punishingly expensive in California — and it’s neither reliable nor safe, as a series of fires have shown.

You write, Baffs: ““We pay for roads through taxes of various sorts (and is the road infrastructure falling apart where you live?).”

you are implying that those taxes and fees are sufficient, and the government has squandered those funds. that is NOT correct.”

That is absolutely correct in much of the country. But, hey, let’s start with your premise. Let’s split out everything but road infrastructure construction from gasoline taxes and let’s see where we are. I know the toll on the GWB would fall to $5 and minimum wage workers could cross the bridge again to work on the other side. You ok with that?

“ Let’s split out everything but road infrastructure construction from gasoline taxes and let’s see where we are”

Steven, please do exactly that. At the federal level, it will be over 60%, at least. But remember, part of the reason you fund and build transit is so that you can reduce demand on highways. Its not an either or scenario.

If you are charging me a user fee, then charge me a user fee and use if for the purposes intended. But don’t come complaining about a lack of money for road maintenance when you’re using road maintenance money for other purposes. Buses are not roads. People using subways should pay for the subways. Not that complicated. (The problem in the NYC subway, of course, is rampant wage inflation and over-staffing due to unions.)

You know, it many poor countries, buses are run as profit centers. They could be in the US, too.

“Buses are not roads. People using subways should pay for the subways. Not that complicated.”

you need to start looking at this as a transportation system. if you look at it as individual components, then you get each segment to compete against each other. that does not benefit the system. and it gives you the results we have today. you cannot solve our transportation issues but keeping them in a silo.

“and is the road infrastructure falling apart where you live?”

a lot of the road and bridge damage that occurs on our highway system is due to overweight trucks. enforcement of truck loads goes a long way towards keeping your road infrastructure from falling apart. this is really not an issue of the DOT doing a poor job of building and maintaining. it is an issue of the public abusing their own resources.

“an expansion of Amtrak (this is a joke, right?)

tunnels under the Hudson River (not in proportion to cost)”

this reads more like an argument to reduce the influence of new york city than anything else. personally, i think it is a mistake to minimize the growth of the nation’s most important city. but i certainly understand the envy and jealousy of those living in new jersey. but for the nation as a whole, new york city is more important than the entire city of jersey. just saying.

Well said. Now the incessant battle between NYC v. NJ hits home. I would nationalize the whole damn thing but then Stevie pooh might go off how I am some how a commie!

If Buttegieg finds a way to deliver the Hudson tunnel for $4 billion rather than $20 billion, then consider me a supporter. Btw, I am not against the tunnel per se. Personally, I would bring the 7 subway line out to Secaucus, which would have a lot more incremental value and vastly reduce the load on the Hudson River train tunnel.

In any event, a rail river crossing is actually necessary infrastructure. But at $20 bn, you can’t make the numbers work.

Just to size this a bit more: New Jersey’s total state budget is about $40 bn, on a tunnel cost of $20 bn. The cost of the tunnel is more than NJ collects annually in income taxes.

My understanding is that at least tunnel under Hudson easily has a B/C ratio well over 1 reasonably measured. This is a major bottleneck for all of East Coast transportation, not just metro New York.

Yes – a true cost benefit analysis. Careful there before Princeton Idiot calls you a commie too!

The Suez Canal incident highlights the significance of these crucial transportation bottlenecks, although tunnels under the Hudson are not as crucial as the Suez Canal.

The Suez Canal should have been widened fifty years ago. Who owns it? Oh, yes, the Egyptians, those paragons of governance and public goods investment.

But it could have been worse, It could have been owned by the State of Connecticut.

Btw, by my math, the breakeven on the expanding on the canal is on the order of $50 bn, that is, it makes economic sense if you can bring in the expansion project under $50 bn, assuming no incremental through traffic associated with a widening (just a reduction in delay times).

Do the math, Barkley, and report back. All the necessary info is public source.

To preview the matter, it would involve doubling the price of a monthly NJ Rail pass from around $400 to around $800. Add another $1,000 for parking and another $1000 for the NY subway and you’re talking $12,000 / year post-tax to commute to NYC, maybe $16,000 pre-tax for most commuters. So essentially you wall off NYC for anyone making less than, say, $150,000. And of course it’s expensive to drive. So if you’re a regular guy wanting to be, say, a waiter in NYC, you’re basically screwed.

Given that I commuted to NYC for five years, I know the routine. I would have been willing to pay max another 10% to have a little more stable service. (Keep in mind that tunnels are not the principal source of delay. Signal problems and equipment (train) failures were the most typical issues.)

So like I said, the math doesn’t work. But good ahead, do your own analysis. The numbers are all readily available.

Steven,

We never made people using the interstste pay for it. So I see no reason to make commuters pay for a tunnel. The benefits of this go way beyond NJ or commuters. This affects the entire northeast corridor, not just NJ/NYC relations.

The traffic in the tunnel consists principally of NJ Transit commuter trains, probably about 80% of the total, and 20% Amtrak trains, almost all of which is going towards Washington. The amount of through-traffic at Penn Station is small, probably less than 10%, and maybe in the lowish single digits. The tunnel effectively serves New Jersey, but you can double Amtrak rates to NY too if you like. Amtrak — that public utility — is barely competitive with driving to DC as it is.

If you are interested in regional through traffic, then you’re principally concerned with I-95, where hundreds of thousands of people wait in traffic every day. Yes, absolutely, that should be the top priority, and I could even justify $100 bn to get it done. Is that in the Biden plan? I’ll bet you a good bit it’s not.

Clearly you’ve never driven on the New Jersey Turnpike or crossed a bridge or tunnel into New York.

Steven,

I lived in Princeton for a period of time, and I have driven in and out of NYC many times over many decades as well as riden trains, both from DC and from Princeton and back many times. Really, Steven, by now you should know better than to come on like Moses Herzog with me in some failed effort to denigrate my personal knowledge, really.

There is more to this than the numbers you cite, and you should know it. It is that this would take pressure off alternatives that are part of the larger transportation system in the much larger region.

BTW, Steven, I happen to be fine with a carbon tax and nuclear power, with Janet Yellen long favoring a carbon tax, with many thinking she would push it from her new position, given Treasury role in taxation and Biden admin commitment to being green.

But, quite aside from screaming opposition from all GOPs to any tax increase, Biden has himself stuck on his promise not to raise taxes on those making less than $400,000 per year. This may have been an unwise promise, and of course an increase in the corporate tax rate will be at least partly borne by those making less than that cutoff indirectly. But I fear the Biden promise outweighs even the wise advice or position of Yellen and others.

Subsidizing renewables will be a tax on the poor. Who do you think pays the high power prices in California? Everyone using electricity, including the poor.

“Subsidizing renewables will be a tax on the poor. Who do you think pays the high power prices in California? Everyone using electricity, including the poor.”

now you are simply fear mongering

With all that contradictory babble from Princeton Steve – let me just note he claimed he can do ROI? Seriously? His comments on the Federal debt to GDP ratio are dumber than a rock as he insistence that we are in some sort of housing bubble. Steve clearly has no clue what a present value analysis looks like but he claims he can do ROI. Please!

So, an interesting tidbit from the CBO;

The CBO sees federal debt held by the public essentially flat at 102% of GDP between 2022 and 2028 while the cumulative deficit during that period is 27.8% of GDP. This is a great financial innovation.

56977 Data Underlying Figures

https://www.cbo.gov/publication/56977

Great financial innovation or the folks at CBO understanding things you will never get? Stocks v. flows perhaps. You certainly flunked that basic concept. Or is your forecast of nominal GDP in 2028 = nominal GDP in 2020? After all – you write really stupid garbage for a self style consultant. Who pays you for consulting? The Three Stooges?

BTW CBO is clear in its forecast of nominal GDP over the next decade suggesting it will increase by 4.2% per year. 2% expected inflation and 2.2% real GDP growth. Sounds reasonable to me.

Now for a little arithmetic for the dumbest consultant ever. This means nominal GDP will be 150% of current GDP. So if these nominal deficits increase debt by 50%, then the debt/GDP will be the same. Of course Princeton Steve insists it will explode because he is using the math he exploits to bilk his clients.

Folks should go and read Appendix B. I doubt Princeton Stevie pooh has. If he has read it, it is beyond dishonest for him to note CBO is protecting a primary surplus = 3.5% of GDP. That’s right surplus.

Yes CBO is projecting nominal interest expenses to rise over the decade. While some economists (including our host) has questioned this assumption, note even if it is true nominal interest expenses exceed real interest expenses. A fundamental which naturally escapes our Princeton Know Nothing “consultant”.

Primary surplus is irrelevant unless its greater than interest expense. What matters in terms of debt is not the primary surplus but the total deficit, including interest.

The CBO sees the US economy growing at 2% per year — thank God no recession in the 2020s despite every sign of a financial crash on the, say, two year horizon. And even with a strong economy, deficits run in excess of 4% of GDP per year. So nowadays that passes as good macro policy. No need to balance the budget over the cycle. Keynes is dead, it appears.

“Primary surplus is irrelevant unless its greater than interest expense.”

So you think Sargent and Wallace, Milton Friedman, Robert Barro, James Tobin, and Ensy Domar are all idiots? Sorry but they get basic finance as in things like present value analysis. Then again – you have repeatedly proved that even the freshman course in Finance is over your head.

I think Milton, Barro and the rest would agree that you have to finance the whole deficit, not just the primary balance. That’s why the 60% debt-to-gdp rule was used by the IMF for a long, long time. Of course, the US is now over 100% of public debt to GDP, so we’re in the range the IMF twenty-years ago associated with banana republics.

Steven Kopits in the range the IMF twenty-years ago associated with banana republics.

Speaking of banana republics, I believe it was the World Bank that pointed to a gini coefficient banana republic threshold of 0.40. To date no democratic government has survived if the gini coefficient persists above 0.40. The US is currently at 0.414…tied with Argentina and just a little worse than Haiti at 0.411. So if you’re worried about a banana republic, sorry but that ship has already sailed.

Steven Kopits

April 6, 2021 at 8:03 am

I think Milton, Barro and the rest would agree that you have to finance the whole deficit, not just the primary balance. ”

What an unresponsive and stupid reply. Steve – you clearly have no clue but you keep babbling any way. I think I should go talk to the trees in my backyard rather wasting time with someone who claims he knows ROI but is incapable of doing the most basis present value analysis.

“Primary surplus is irrelevant unless its greater than interest expense. What matters in terms of debt is not the primary surplus but the total deficit, including interest.”

Now I have nominated a lot of comments as the stupidest thing ever written but I have to admit Princeton Idiot just won the gold medal. First of all this moron is not distinguishing between nominal v. real interest expense. But he also has zero knowledge of the history of public debts as noted in a 1979 JPE piece by Robert Barro. Simply put nominal interest expense did exceed the primary surplus for much of the 1970’s but the debt/GDP continued to fall. Something called growth in nominal GDP. Something called present value analysis if one is projecting things for the longer term. Yea I know – concepts that Princeton Idiot will never understand.

Maybe Menzie and others will think this crosses “the lines of good taste”. I found myself applauding it and raising my fist up into the air in agreement. It reminds me of how Southerners in “old dixie” would run around telling people that Blacks were “dirty”, but didn’t mind eating the food their black servants had prepared or minded at all when Blacks stood in as caretakers for their own children. Suddenly, in those convenient moments, Blacks were no longer “dirty”.

https://www.youtube.com/watch?v=9H0ViPMutHc

mate,

you make valid arguments but how about no name calling!

Israel was getting a lot of praise for their vaccination efforts but they hit a major snag. It appears Pfizer is halting shipments as the government has not been paying up:

https://www.jpost.com/breaking-news/banana-republic-pfizer-outraged-israel-failed-to-pay-for-covid-vaccines-664140

I just got this boo hoo email:

Cobb County, home of Braves, claims loss of MLB All-Star Game will cost it $100M. MLB’s call to move the All-Star Game out of Atlanta was always going to cost the local economy some money, but Cobb County officials’ initial estimate is staggering.

Actually the Braves are Atlanta’s team as in Fulton County Stadium where Aaron played and then Turner Field. When they moved out to the former home of the KKK, I thought that was a big insult to the great history of the Braves. So this boo hoo is all about a few racists losing money. If it don’t affect the actual city of Atlanta, all I have to say is go Hawks and go Falcons. Screw Cobb County.

An increase in productivity, all else equal, is likely to lead to a rise in interest rates.

There is likely to be an offsetting effect from demographics, with continued aging of the U.S. population (https://www.census.gov/library/publications/2020/demo/p25-1144.html) and population globally (https://ourworldindata.org/age-structure).

The relative importance of the two factors is not easy to pin down, but assuming productivity increases on trend, it will represent a substantial change in the inputs to interest rate determination.

Mom will be so pleased.

Menzie, you might be able to pick up on the fact I’ve been reading too much of the Russian propaganda blog again, but I was curious if we could get you to post your thoughts on Pasquariello”s (of Goldman Sachs) writings on the trajectory of the 30-year treasury rate. He is I guess specifically referring to this graph:

https://cms.zerohedge.com/s3/files/inline-images/30Y%20TSY%20yield%204.4.jpg?itok=_6zuxsgM

Whatever one thinks of interest rates and inflation moves between now and December, I think one has to admit, it’s a fascinating little graph. I was thinking instead of making a direct query to you on this topic, I might have a higher probability of getting you to dedicate a post on it by saying something completely asinine about long-term rates, but then thought I prefer this boring method of inquiry.

JAMA publication on causes of death last year:

https://jamanetwork.com/journals/jama/fullarticle/2778234

COVID19 played a major role while deaths from the flu fell sharply. Given a recent post here that caused a stir – it should be noted deaths attributed to suicide fell.

The chances the Senate will approve an infrastructure bill just went up:

https://jabberwocking.com/democrats-suddenly-get-a-big-break/

The McConnell veto can be eliminated and no one is listening to the BS from Princeton Stevie pooh!

“There are several regulatory barriers to the deployment of EV charging infrastructure including permitting of charging infrastructure, the lack of a technical standard for charging infrastructure, policy uncertainty regarding sale of electricity, regulation regarding EV-related investment by utilities, etc. Cities which face these regulatory barriers should address them as early as possible by building political consensus and then mandating the relevant government agency to address each issue whether it be modifying building codes, streamlining permitting, deciding a standard in consultation with OEMs, etc. As mentioned in Chapter 4, city governments hold a comparative advantage in zoning and building codes and permitting, and they should use those levers to good effect. Cities should use their regulatory influence smartly to remove / mitigate barriers to create a conducive environment for private investors. This report also shows that perse a direct subsidy to private infrastructure providers is not required because charging networks offer a viable business opportunity – the notable exemption being cities with large proportions of on-street residential parking where residents might be undersupplied with charging infrastructure as the economics under those conditions are less appealing.”

https://www.innovations.harvard.edu/sites/default/files/1108934.pdf

There are a lot of regulatory barriers to doing a lot of things in this proposal by Biden. It has been noted by many that back in the 30s major infrastructure like the Lincoln tunnel and other items were rapidly built at low costs, but that now we build things slowly at very high costs. That these costs are really way out of line and unreasonable can be seen by comparing our costs for such things with those in Europe, a place that also has lots of regulations, not to mention a lot more unions demanding high wages that get paid. But somehow their infrastructure construction costs are about half ours on average.

Biden should make a push to get these lowered, but I also understand that this is sort of like our high medical care costs, not easily reduced as not due to one or even two obvious things that one could easily undo at the federal level by a presidential executive order. There are man layers and aspects at multiple levels of government that have accrued to build up all this mess.

My comment pertaining to this AEI discussion if there is still a great stagnation.

https://twitter.com/AEIecon/status/1379800424845299713

It is painfully obvious in the AEI talk that we desperately need balance sheet data on the US economy, notably, the stock of not only physical infrastructure, but also education and health.

The panel was talking about GDP gross, not net. If you are spending on infrastructure and only replacing roads with potholes, you’re not increasing GDP — or at least net welfare — at all. By contrast, if you’re building a new road in, say, a new development, then you are in fact creating something new and better.

Similarly, if you are spending to educate people who would not have been educated before, then you’re expanding the capability of society. If you’re spending that amount just to maintain a level of education in the population, then that’s not improving welfare, only holding it steady.

Finally, if you spend money fixing the broken arm of an eleven year old, then that will pay dividends for their working life. If you fix the arm of a 90 year old, then that is pure GDP loss to the economy. It’s not increasing productivity capacity at all; it’s preventing welfare from falling.

In a mature economy with slow GDP, population and productivity growth, it is absolutely essential to distinguish nets from grosses in a way that was not necessary in, say, 1970.

For this reason, the whole AEI discussion was stilted. You guys don’t have the numbers.

Steven Kopits: Net is more important than gross; but “net” for capital of all stocks is hard to measure, even if only physical. What was the depreciation rate of human capital for those who learned COBOL?

Gosh, I learned COBOL. No wonder both Steven and Moses think I am just completely depreciated human capital, :-)!

Barkley Rosser: Interestingly, your human capital depreciated from when you learned it until… 1999 in anticipation of the Y2K problem…at which time it suddenly became “un-depreciated”. My guess is that COBOL is still running in a lot of systems so maybe it’s still “un-depreciated”.

I think it’s COBOL II that’s still running on lots of systems.

https://ibmmainframes.com/references/a4.html

Most of the folks in my old office loved Fortran…or for the real old timers FORTRAN. Typically “wrapper” programs were in COBOL that called Fortran modules to do the actual math.

2slug,

When I learned Fortran it was Fortran II. Yes, I am an old timer, watching these programs go up and down. As it is, Fortran gets used by quite a few high-powered people these days, way more than COBOL which is just still lurking about there in a lot of systems. People are writing research programs in it. Of course it is miles beyond Fortran II. I have not kept up with these things lately, so do not know latest number.

Fortran is still the best language for number crunching. Too bad it is not taught much in most schools today.

When I was in grad school, the IMF data tapes used some COBOL programming written way back in 1969. I never learned the damn program (I was a Fortran type) but I figured out with a little help how to do the needed annual changes to keep us reading the tapes.

I sure hope the IMF has updated that old fashion reporting system.

pgl: First time I accessed IMF International Financial Statistics, it was off of a tape (I think 1987 or so). By the time I was a newly minted assistant professor (1991), it was off of CD-ROMs. By the time I arrived at UW (2003), it was off of a website.

1969, pgl? Ah yes, that was when I was in my COBOL prime. I wrote a program that handed out large sums of money for the UW-Madison School of Education around the state for various programs. I know that it was still floating around in the UW system for quite a long time after that. Oh, the power, long gone…

@ Barkley Rosser

“completed depreciated human capital” would be a little harsh. More like “overly self-appreciated human capital”. The latter description fits you exact. You’d me more useful if you quit brushing your hair over your shoulder looking in the mirror, so to speak. Or even just thought a little more before trying too hard to impress the room.

If you actually know COBOL well, and aren’t blowharding again, then I applaud that.

Moses,

I knew COBOL well once upon a time. But that was decades ago. Would not claim to know it at all well now, indeed a case of depreciated human capital.

It’s not that hard to measure, Menzie. I could give you ballpark on education stocks and flows — on a historical cost basis — in an afternoon.

Ditto for health. You know health spending. You know demographics, You know health spending by demographic cohorts. Again, I could put together a basic picture in an afternoon.

Same for infrastructure. Find the road infrastructure spend, allocate by new roads and existing roads. Not particularly hard to do.

It’s a matter of digging out the data and crunching some numbers. You could do it, too.

Steven Kopits: So, then, write it up, and submit it to a peer reviewed journal. Then share with us all the referee reports.

You’re the one teaching econ, not me. If you’re saying that a clear understanding of nets and grosses isn’t important to understanding the economy, well, fine. I disagree, and if I were a macro-economist, I would have done in twenty-five years ago.

Steven Kopits: Obviously the difference between gross and net capital stock is important. The question is operationalization.

One could get a big spreadsheet and arbitrarily put in a bunch of depreciation rates on cumulated investment, and get “a number”. The question is whether those depreciation rates are estimated in a plausible fashion, and estimated precisely.

Let take another example: health.

Human well-being is not typically measured by economists to the best of my knowledge, but it becomes important when the fastest growing segment of your population is the 65+ group.

But make a simple assumption: 1) All human well-being is equal, thus, a healthy 92 year old has the same well-being as a healthy 32 year old; and 2) health spending only restores well-being. So healthcare spending, by definition, only prevents well-being from falling. It does not increase it. Now, this is a bit of an over-simplification, but not much. You go to the doctor typically when there’s something wrong with you that needs treatment; or you go to preserve your current state of health with preventative medicine. So we can talk about healthcare spend in aggregate as preventing a decline in well-being. It does not add to it ordinarily.

Thus, while healthcare spend shows up as activity in GDP, if you put in on a national balance sheet including human health, it would literally be equal to depreciation. That’s your capital maintenance budget on health.

But it’s worse than this, because the health of a 92 year old is not the same as that of a 32 year old. So with an aging population, your maintenance budget is not adequate to maintain the well-being level of the national balance sheet. Put another way, healthcare spending would not find its way to ‘retained earnings’, the underlying growth of the economy. If you had a national balance sheet, you’d see that net GDP growth today is substantially less than nominal GDP growth. And that would materially change your view of macro policy, and in particular, fiscal policy.

Let me close with a thought about the professional context of economics. Twenty years ago, economics was principally about growth, about insuring the efficient use of funds to maximize welfare, with the assumption that this meant steady and sustainable economic growth. It does not seem to be about that anymore, and it seems to me that economists are at sea as to what their role in society is now. In many ways, economics seems to have become more about advocacy, rather than analysis and efficiency.

Some of the virtues I associate with economists like Jim Hamilton are falling by the wayside. Part of this involves doing yeoman’s work, building the infrastructure of the economics profession. And that involves, for example, collecting data and advancing national and international accounts. A lot of this is not glamorous work, but it underpins our understanding of society.

One necessary task is the building of national balance sheet accounts to provide insight into net and gross balances in a rapidly aging and slow growing economy. I would add another would be to expand IRS data collection to include demographic data on taxpayers. The IRS should have on file where and when I went to school, my areas of concentration, and my profession and employer, among others. For most people, all of this is available on Linked in anyway. But in statistical aggregates, we should be able to see the income and employment of, say, Harvard econ majors forty years after graduation in an easy-to-search database.

And I think tax returns would be a good time to ask people about their intentions: “Do you intend to move this year? Do you intend to change jobs? Do you intend to have more children? Do you intend to get married? Do you intend to obtain more education? Do you intend to retire this year? In the next three years? In the next five years?” If you paired this with tax return data, it would provide incredibly detailed information about trends in the economy. This is again economics infrastructure. Economists should be championing it.

So, I think economists are in something of a rut. They are at once trapped in the thinking associated with a younger economy (eg, inflation) and willing to abandon well-accepted norms largely unthinkingly. One example of this is the 60% debt-to-GDP rule. It’s gone out the window. Or has it? Or do we have a new rule? Or take deficit spending: Is it now okay to run large deficits through the entire business cycle? Is money borrowed by the government now effectively free? Why? How long does this last? Is it a good thing?

So, I see the profession as kind of lost. It doesn’t have to be, but I think there is a need to return to roots, on the one hand, and accept that we are growing old, and that this calls for a different understanding of macro economic processes.

A ballpark estimate may be easy to do. But is it reliable? I can see why no Wall Street firm would ever hire you are as people making imprecise guesses get played by this ground. Then again – most Wall Street people get basic finance. You do not.

“f you’re saying that a clear understanding of nets and grosses isn’t important to understanding the economy, well, fine.”

Menzie never said that. This kind of babble is beyond insulting. But since it all you got – whatever.

“One could get a big spreadsheet and arbitrarily put in a bunch of depreciation rates on cumulated investment, and get “a number”. The question is whether those depreciation rates are estimated in a plausible fashion, and estimated precisely.”

Funny. I wonder if Princeton Steve has ever read a 10-K for a publicly traded company. Operating profits are reported both before depreciation and after depreciation in the income statement. Of course the details for depreciation are often relegated to the cash flow statement. The balance sheet tends to report fixed assets both in gross and net levels.

Now anyone who knows anything about accounting (which has to exclude Princeton Steve who also flunked Finance 101) these are accounting estimates which are notoriously divorced from reliable estimates of economic depreciation.

But Princeton Steve claims estimating depreciation is an easy. Yes he is THAT stupid.

Well, first, I’m glad you’re expressing interest in the issue. You’re not going to be able to do meaningful macro policy without it. Btw, if you have not already, I encourage you to watch the AEI talk and you’ll see just how they are struggling with some of these issues.

I think you can start the process with some first order approximations. Let’s take, say, roads.

I’m sure if you look up, for example, Wisconsin DOT, you’ll be able to find the length of the networks in miles or lane miles. And you’ll be able to see new construction and capital maintenance. And you’ll be able to allocate the budget by maintenance capex and new capex, which will provide insight into trends over time in aggregate spend, as a share of total road spend, and in nominal and real cost per lane for new and resurfaced roads.

We can then assume that maintenance capex prevents GDP from falling; and new capex raises GDP or something along that line. That will give you a feel for gross versus net and why more infrastructure spending may not lead to a bigger economy. If we’re speaking of fixing America’s ‘crumbling infrastructure’ (wherever that is), then we’re really talking maintenance capex. It won’t grow the size of the economy, only prevent it from shrinking.

For all I know, someone has already done this analysis, but I could probably cook up a first order approximation over a weekend.

Steven Kopits: Do the analysis, I will circulate it on Econbrowser for “peer review”. Let’s see how your analysis stands up to critical assessment from people who have spent their careers trying to estimate the capital stock.

And who are they? Why not introduce us to the literature. Or maybe you don’t think net vs gross matters?

Steven Kopits: Well, since I wrote these posts which you missed, I suspect I *do* think the distinction is important:

https://econbrowser.com/archives/2019/11/gross-vs-net-investment-pre-and-post-tcja

https://econbrowser.com/archives/2018/04/net-vs-gross-investment

https://econbrowser.com/archives/2015/04/what-remains-of-the-high-policy-uncertainty-lagging-investment-thesis

https://econbrowser.com/archives/2012/12/investment_why

https://econbrowser.com/archives/2007/05/is_the_investme

Experts on capital depreciation: Hulten; Wykoff; Fullerton; Bronwyn Hall; Diewert;

Depreciation is not hard to measure??? Have you ever read the Warren Buffett 2002 WSJ oped “Stock Options and Common Sense”. Funny but brilliant – so I guess this is not something you would read.

But he uses the difficulty of estimating depreciation to make a key point. We do it even if it is hard. Now if you think you know more finance than Warren Buffett, I have a local bridge to sell you.

I guess Princeton Steven and all his lecturing of us stupid macroeconomists on the topic of depreciation totally missed the proper scoring of the long-run effects of that 2017 tax cut. Yes gross investment was predicted to rise but most reasonable economists noted that the increase in net investment was less than the increase in capital held by foreigners.

So yea we get the concept of net investment. Macroeconomists were writing on this before Menzie and I were even born. But according to Princeton Steve – we macroeconomist are too stupid to get what we have been writing about for almost 70 years. I do not know what to say – is Stevie really that stupid or is he just a jerk with an overinflated ego?

“The CEOs wanting to keep it that way put forth several arguments. One was that options are hard to value. That is nonsense: I’ve bought and sold options for 40 years and know their pricing to be highly sophisticated. It’s far more problematic to calculate the useful life of machinery, a difficulty that makes the annual depreciation charge merely a guess. No one, however, argues that this imprecision does away with a company’s need to record depreciation expense. Likewise, pension expense in corporate America is calculated under wildly varying assumptions, and CPAs regularly allow whatever assumption management picks.”

A key paragraph from a WSJ 2002 oped by the always brilliant Warren Buffett, which I asked Princeton Pompous if he had read since this know nothing claimed estimating depreciation is easy. Buffet notes it is not but we do it anyway. Of course Princeton Pompous likely thinks he knows more than Warren Buffett.

Steven Kopits

April 9, 2021 at 8:30 am

Let me close with a thought about the professional context of economics. Twenty years ago, economics was principally about growth, about insuring the efficient use of funds to maximize welfare, with the assumption that this meant steady and sustainable economic growth.

It is comments like these which should tell everyone to just skip these long winded rants from Princeton Pompous. And yea this was followed by a very long winded worthless rant.

Now it is true that Robert Barro wants everyone to focus exclusively on long-term growth and not business cycles. But ever since the Great Recession no one listens to such nonsense. And efficiency with no concern about income distribution? This is the kind of intellectual garbage that only gets aired on Fox and Friends.

In the middle of that long winded stupid pointless and yet pompous rant Princeton Steve wrote this bizarre nonsense:

“One example of this is the 60% debt-to-GDP rule. It’s gone out the window.”

Gee whose “rule” is that? He did not say. What is so magic about keeping government debt at 60% of GDP. He does not know. Now most economists who get this issue would note as long as the present value of expected future primary surpluses > current debt, the debt/GDP ratio will decline over the long-run. But wait Princeton Pompous declared that the primary surplus is irrelevant. Of course his statements on this prove over and over again that basic financial economists is something he never learned and refuses to learn.

So we get nonsense about his imaginary little “rule”.

pgl,

A major reason for the emphasis on the 60% “rule” is that this is the ratio the EU has long imposed as a condition for prospective members. They could not have a debt/GDP ratio higher than that to join. But that was cooked up a long time ago when interest rates were higher and was always basically arbitary.

As it is, when I studied growth theory a half century ago the importance of net investment was always very clear and central. It was also taught that it is difficult in reality to estimate it, and there are competing systems of accounting for it. Yes, Steven Kopits is quite out of it on this issue and making himself look almost as foolish as Moses Herzog with his lecturing on this.

Heck, I even know some of those experts on depreciation Menzie cited personally, one of them extremely well, but I had better not say who or Moses might pop up to accuse me of “blowharding” again, and maybe citing Quora numerous times inaccurately.