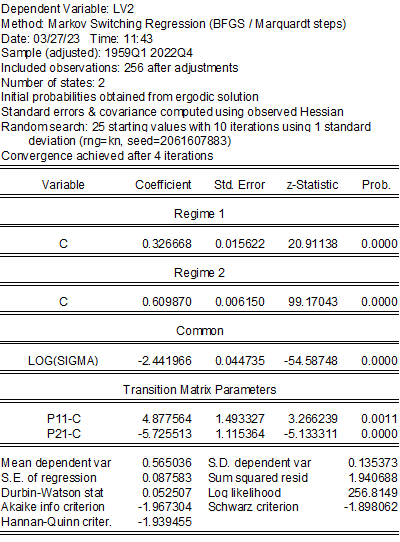

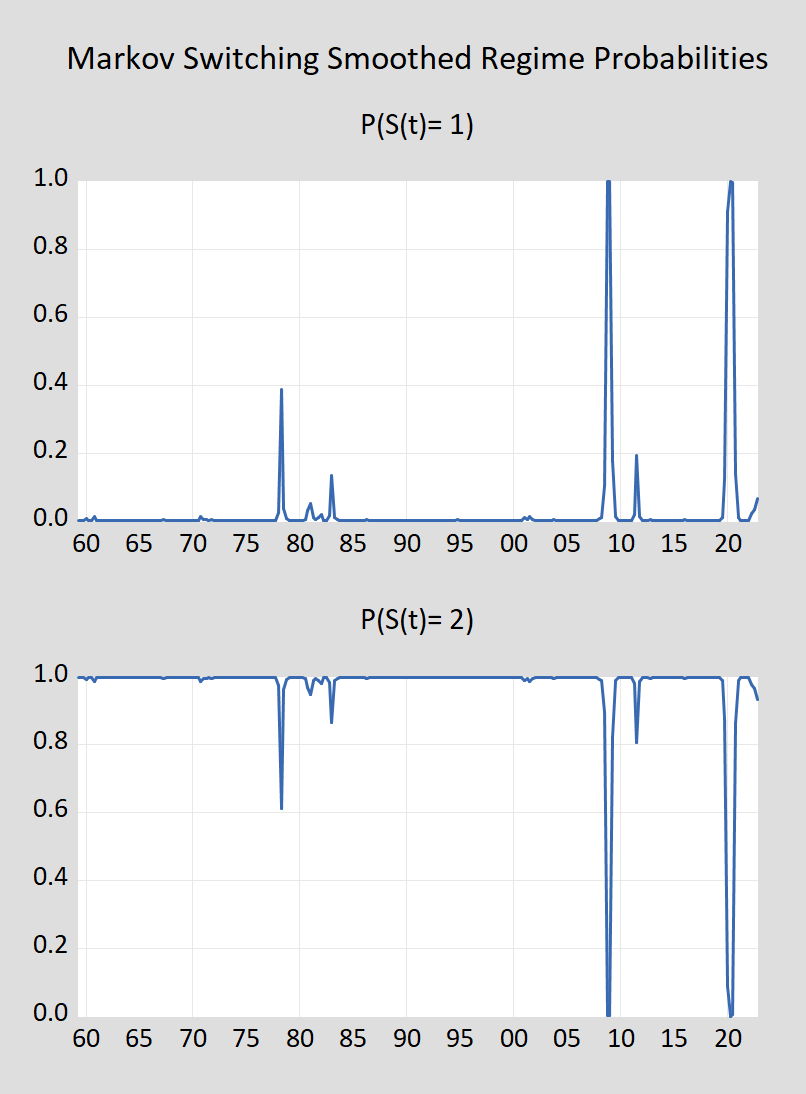

A two regime Markov switching model for the log of M2 velocity, 1959-2022, as suggested by Rick Stryker:

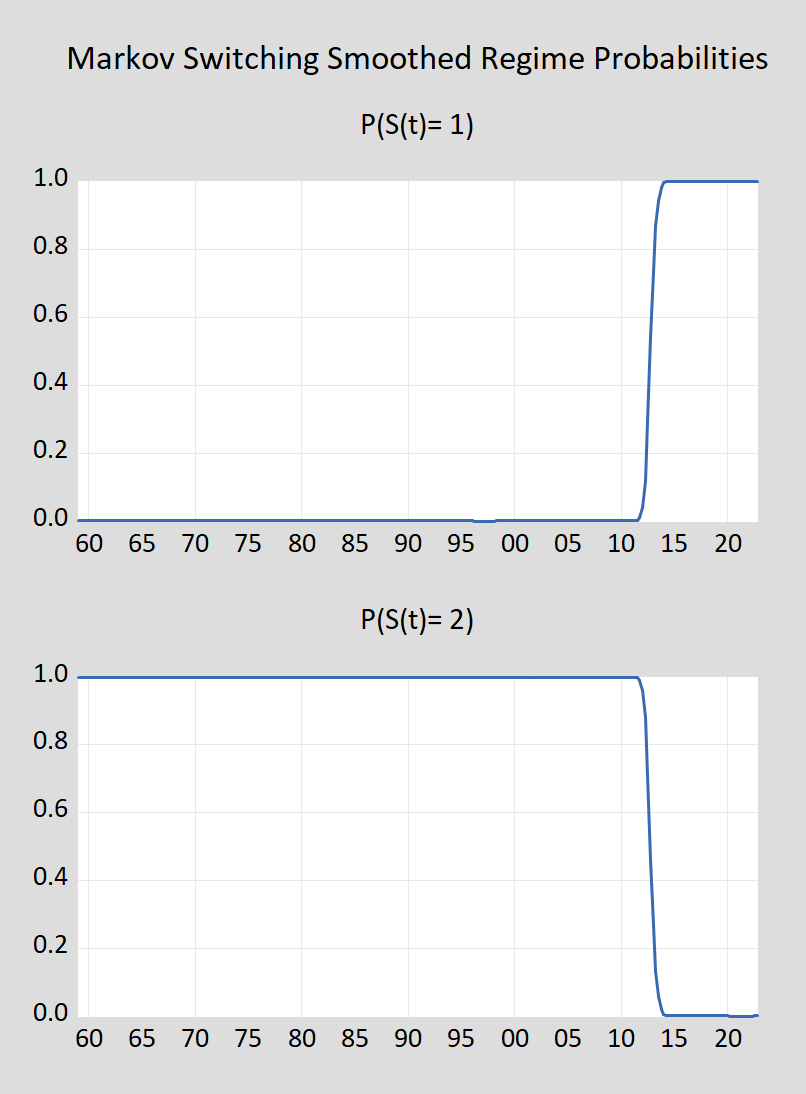

And here are the regime probabilities, smoothed, filtered.

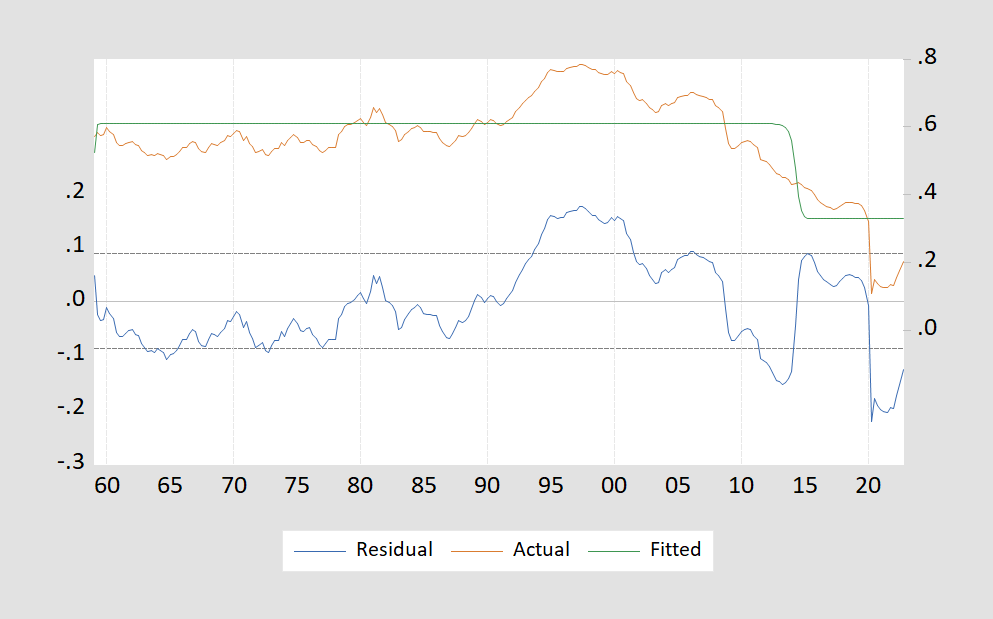

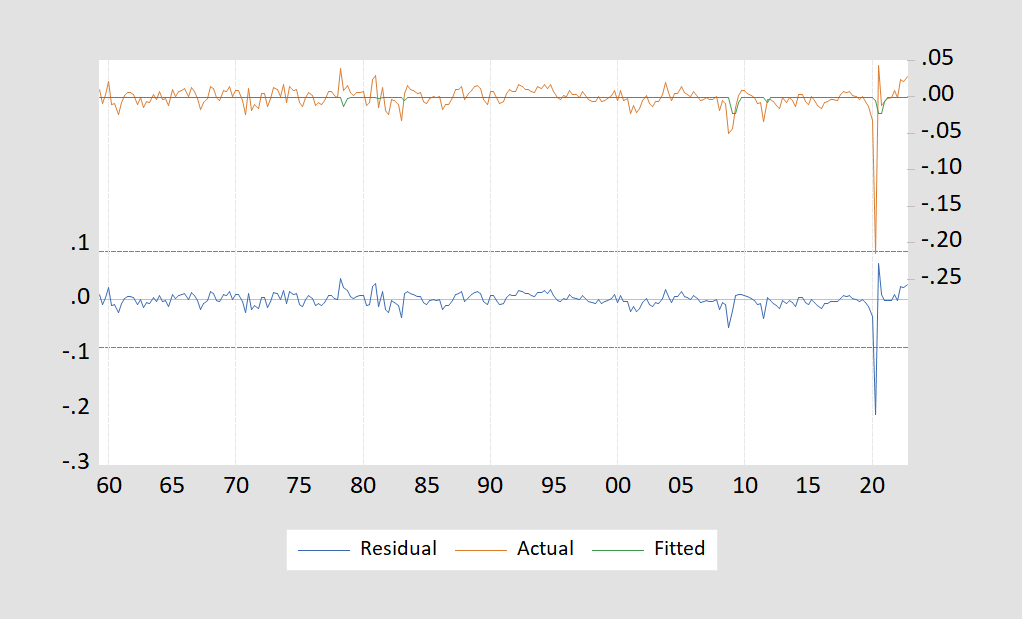

Here’s the fitted values against actual, and the residual.

I won’t claim I’ve done any rigorous robustness tests, or that these results are representative. The data and software are available so one can evaluate how well a two regime Markov switching model does for (log) velocity. For me, it’s not great, probably not particularly useful for policymaking.

Aside from this specification being in logs, I don’t think these results differ substantively from reader AS‘s.

If Steven Kopits meant reversion to the high velocity mean was imminent, well we haven’t seen it it. If he means that there’s a third regime, well, we’re currently into a third, lowest mean – not an intermediate mean – regime, according to a three regime MS model.

Update, 1pm Pacific:

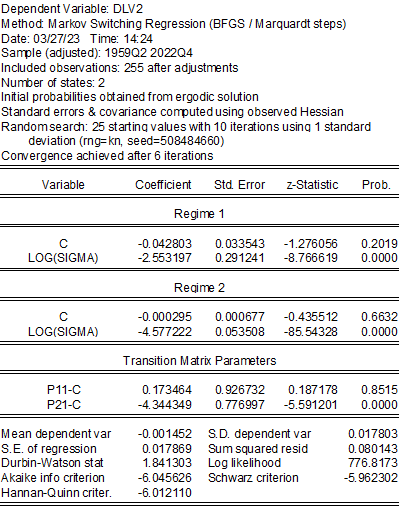

Rick Stryker says this should be estimated in log first differences.

Give these regime probabilities.

A two regime model says the mean of first differences is already currently in a high growth mode. Note a first differences specification though implies no reversion to deterministic trend for that regime…

Now if the claim was that getting really sophisticated could make the velocity crowd better forecaster, these results say no even a sophisticated modern day QTM would be an utter failure. Of course the notion that little Stevie has an ounce of sophistication is about laughable as it gets.

But do note that even the great Ricky Stryker gave up on this idea already. Yea little Ricky let someone else do his dirty work.

Menzie,

If I’m reading the above right, this is not the model I was suggesting. The estimates seem to be done in terms of the log level of M2 velocity, which is a non-stationary variable and means the markov switching model is misspecified. The model should be estimated in terms of rates of growth of M2 velocity.

Rick Stryker: But then even within each regime, velocity is not mean reverting!!!

It’s kind of amazing no one noticed this and sent up alarm bells. It’s updated quarterly?? We had eight quarters of reported numbers, and seemingly no one said “this is unnatural, this is unhealthy for banks, and something is very wrong here”

Who was raising alarm bells about this at the Fed or at investment banks??? Isn’t that kind of wild??

@ Menzie

Got lost in my own blathering and forgot the link:

https://fred.stlouisfed.org/series/QBPBSTASSCHLDMAT

Ahhh – Dr. Chinn did not so it the way you wanted him to. Come on dude – do the real work yourself.

I’m a like you I guess in the fact that I have had enough of Princeton Steve’s blatant LIES. Of course this monetarist moron has written over and over something about M2 increasing by 40%! DAMN – 40% is a lot. But wait FRED tells us that M2 has not grown by nearly this amount in any recent year.

25.75% in 2020 is not 40%.

11.74% in 2021 is not 40%.

M2 actually fell a bit in 2022.

Of course our serial liar never specifies his made up period when M2 supposedly rose by some huge amount. I guess this dishonest troll is looking at the increase over a multiple year period. Hey – why we are at it, why not show M2 today relative to where it was in 1959. After all – if you are going to lie then go big!

I went to graduate school at Vanderbilt so the latest school shooting shook me up as I lived near this school. Credit to the Nashville police for quickly ending this nightmare. Of course the ugly witch from North Georgia went politically sick again:

https://www.msn.com/en-us/news/us/marjorie-taylor-greene-blames-biden-and-other-gun-grabbers-for-nashville-school-shooting/ar-AA198UvX?ocid=msedgdhp&pc=U531&cvid=119662889f5545229d23858811e9ac34&ei=9

In the immediate aftermath of a school shooting in Nashville that left at least seven people dead including three children, Marjorie Taylor Greene blamed Joe Biden, Democrats, and gun control advocates. Greene blamed gun free school zone laws that passed in the 1990s when Biden served in the Senate, in particular, for Monday’s shooting. “Joe Biden’s gun free school zones have endangered children at schools leaving them as innocent targets of sick horrible disturbed people ever since he worked as a Senator to pass this foolish law,” Greene tweeted. “What a fool. What a failure.” Greene blamed gun control advocates, who she described as “gun grabbers.” “Gun grabbers like Joe Biden and Democrats should give up their Secret Service protection and put themselves on the same level as our unprotected innocent precious children at school. “School shootings should NEVER happen and will end immediately when our nation’s children are defended the same way Joe Biden is by good guys with guns!!!”

Hey Marjorie – I get it is difficult being a very ugly and incredibly stupid person. But for God’s sake have some effing respect for the children and just SHUT UP.

Maybe start in the TN house and senate buildings – the only places in the whole state where its illegal to carry a gun (I am not kidding). The person who did this purchased 7 guns in the past few months including the assault riffle used which has such power at close range that it literally cuts a child’s body in half if fired at up close range. Majory is dumb as a rock, but the moronic word salad keeps flowing from her mouth like the blood from a child shot by an assault rifle. As long as the voters in her district are to stupid to look through her self-serving theater, we are stuck with her.

Careful, you already let this guy of middling IQ in on your real name. I can’t help you if a guy as dumb as Rick Stryker puts it together. Hahahaha.

Kevin Drum has a useful post. Now we have seen the blatant lies ala Bruce Hall that the rise in the debt/GDP ratio that occurred under Trump were due to Biden’s big spending. Yea, I get how absurd Brucie can be but let’s hand it to Kevin for noting that spending/GDP has not changed while that Trump tax cuts gets all the credit for high deficits:

https://jabberwocking.com/yes-of-course-big-deficits-are-due-to-tax-cuts/

“If Steven Kopits meant reversion to the high velocity mean was imminent, well we haven’t seen it it. If he means that there’s a third regime, well, we’re currently into a third, lowest mean – not an intermediate mean – regime, according to a three regime MS model.”

Actually Stevie’s latest had two inflation forecasts: (1) inflation will be 9% under his naive mean reversion model; or (2) we will have 3% deflation as GDP/M2 is expected to decline even further.

Maybe we need a Markov switching model to keep up with Stevie’s incoherent babbling.

This started with Stryker claiming he has had to correct Menzie in the past, and has done so again here. Except Stryker is the only one crediting Stryker with schooling Menzie. “I showed him, by golly!” Really?

Menzie shows his work. You claim to have done work. Where is it?

This is the usual “fake science” trick of casting doubt where there is no reason for doubt. Nothing honest about it.

“You claim to have done work.”

Actually little Ricky has admitted a couple of times he is incapable of doing the hard work.

Ok, that’s fine–I was taking no position on the outcome.

I’m merely suggesting you might want to update the results with the estimates in return space, since the above results are misspecified.

Rick Stryker: Done! Take a look at end of post. I really don’t think this is what Steven Kopits had in mind…

Taking no position except to claim our host is wrong and insane little Stevie is right. You should check out where your underpants have landed as they are down around your ankles.

Setting aside banking troubles for a moment, Western Europe’s political situation is looking iffy. The big countries, especially.

Strikes can do small economic damage or big economic damage, depending on breadth and duration. Same with protests. Governments facing domestic troubles can beco.e unwilling, or unable, to deal with international issues, and banking is international. So I guess I’m not setting aside banking. If EU failure to expand its bank rescue fund is an important factor in bank sector wobbles, political weakness at home right now is a worry.

Msybe,but what your going to find is, banking is less international than a decade ago and even less since the pandemic. The world is economically splitting into 3 regimes……again. The Biden Trudy plan to stop Nickel exports is pretty telling. Time to stop selling West Virginia coal to China??

Menzie,

I have to agree that M2 velocity is not consistent with long swings. Just to check another specification, I estimated a version in R that has one autoregressive lag of quarterly growth rates and whose AR and constant coefficients regime switch. Looking at the plot of regime probabilities and the estimates, we just don’t see it. Code and results below in case anyone wants to try this.

library(quantmod)

library(MSwM)

m2v <- getSymbols.FRED('M2V',source='FRED',auto.assign = FALSE)

m2v_ret <- na.omit(diff(100*log(m2v)))

m2v_ret_df <- fortify.zoo(m2v_ret)

T <- nrow(m2v_ret_df)

y <-m2v_ret_df$M2V[2:T]

y1 <-m2v_ret_df$M2V[1:(T-1)]

df <- data.frame(y=y,y1=y1)

reg <- lm(y~y1,df)

summary(reg)

k <- 2

mv <- 3

jdh |t|)

(Intercept)(S) -0.0094 0.0581 -0.1618 0.8715

y1(S) 0.4454 0.0671 6.6379 3.182e-11 ***

—

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.8502124

Multiple R-squared: 0.2302

Standardized Residuals:

Min Q1 Med Q3

-2.0510416882 -0.5592374259 -0.0006946694 0.5323782092

Max

2.2846050169

Regime 2

———

Estimate Std. Error t value Pr(>|t|)

(Intercept)(S) -1.9273 1.5799 -1.2199 0.2225

y1(S) -0.0983 0.2550 -0.3855 0.6999

Residual standard error: 5.624223

Multiple R-squared: 0.009061

Standardized Residuals:

Min Q1 Med Q3 Max

-19.91518718 0.07292388 0.11300021 0.17280272 5.69516531

Transition probabilities:

Regime 1 Regime 2

Regime 1 0.9720018 0.3996196

Regime 2 0.0279982 0.6003804

I have to agree that M2 velocity is not consistent with long swings.

So you wasted our time with your feeble defense of Princeton Steve’s BS? Good to know.

Code and results got messed up in cut and paste:

library(quantmod)

library(MSwM)

m2v <- getSymbols.FRED('M2V',source='FRED',auto.assign = FALSE)

m2v_ret <- na.omit(diff(100*log(m2v)))

m2v_ret_df <- fortify.zoo(m2v_ret)

T <- nrow(m2v_ret_df)

y <-m2v_ret_df$M2V[2:T]

y1 <-m2v_ret_df$M2V[1:(T-1)]

df <- data.frame(y=y,y1=y1)

reg <- lm(y~y1,df)

summary(reg)

k <- 2

mv <- 3

jdh |t|)

(Intercept)(S) -0.0094 0.0620 -0.1516 0.8795

y1(S) 0.4454 0.0672 6.6280 3.403e-11 ***

—

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.8502124

Multiple R-squared: 0.2302

Standardized Residuals:

Min Q1 Med Q3

-2.0510416884 -0.5592374276 -0.0006946693 0.5323782092

Max

2.2846050173

Regime 2

———

Estimate Std. Error t value Pr(>|t|)

(Intercept)(S) -1.9273 1.5803 -1.2196 0.2226

y1(S) -0.0983 0.2551 -0.3853 0.7000

Residual standard error: 5.624223

Multiple R-squared: 0.009061

Standardized Residuals:

Min Q1 Med Q3 Max

-19.91518718 0.07292388 0.11300021 0.17280272 5.69516531

Transition probabilities:

Regime 1 Regime 2

Regime 1 0.9720018 0.3996196

Regime 2 0.0279982 0.6003804

Macroduck,

I was only saying that you can’t do a non-stationarity test to claim that there can’t be long swings in the data that look like mean reversion. The data could be regime-switching. But I explicitly said I took no position on the question of whether there are in fact long swings in M2 velocity.

Menzie (and AS) followed up by estimating a regime-switching model that showed no evidence of any long swings. I confirmed Menzie’s result by estimating a more general regime-switching specification, the results of which I posted in another comment (for AS in case he wants to get into R) The evidence does not point to any long swings in M2 velocity.

Menzie provided some econometric evidence against Steven’s claim. I disagreed with that evidence. Menzie followed up by estimating a model that met my objection. I confirmed his result. That’s great–the facts are the facts. That’s how these discussions really should be.

Rick Stryker – total waste of time. Per usual.

so was Steven wrong?

One would think that a person who claims to be good at statistics would, over a period of months/years have something contributive to say, rather than “Stop picking on ‘Ironman’, stop picking on Kopits”?? Just one thing to provide additional insight??

“I told Rick Jr that in my experience when Menzie tries to own a commenter with some econometrics he only ends up owning himself. I reminded Rick Jr about the time that Menzie attempted to falsely claim that Ironman ran a spurious regression. I had to take Menzie to time series school on that one.”

You insulted Menzie. Now you’re pretending this was all very calm and wven-handed. Your the same arrogant jerk you’ve always been. Bad example for Jr, bot as an arrogant jerk, and for lying about it when called out.

A Menzie Chinn ego model…

H0: Menzie Chinn is an ego maniac

P-value (punching down value): 0.000001

We do not reject the null that Menzie Chinn is an ego maniac. Repeatedly punching down is a well-established approach in attempting to boost one’s ego.

Is there some model that explains why you even exist? Please factor in that you had a total waste of space.

@ Econned

Projection is an interesting psychological tactic. Feeling better now??

So, Menzie runs an economics and policy blog, aimed at informing readers, with a special responsibility to his student readers. Other people wander in and make claims which are either wrong (the velocity of M2 is mean reverting) or open to discussion (not relevant here). Menzie corrects there error, showing his work. That’s punching down? You must have had an extremely hard time in school.

Macroduck,

Yes, Menzie is punching down when he uses a public forum to (repeatedly) call out commenters who he knows doesn’t understand many of the topics. He’s the only Econ blogger who spends time (of course it would be a waste of time to a respectable economist but not to one merely seeking an ego boost) penning new posts to call-out fringe (and often anonymous) comments. And that’s a large reason why this cesspool of a comment section is full of sewage. The lines between Menzie’s ego-driven posts on one hand and “informing readers” or fulfilling some fantasy “special responsibility to his student readers” on the other hand is blurred beyond any recognition.

BORING! Find some other place to air out your little emotional problems.

If his commenters don’t understand, but pretend that they do, then it’s a public service to correct thir errors, lest the errors spread. A public forum is a fine place for a public service. And by the way, you’re playing a little lose with “public forum”. This is Menzie’s blog.

So really, this is just you being your old ad hominy grits self.

Macroduck,

It’s ego-driven because of the constant publishing of new threads as opposed to merely correcting in the thread comment sections. Sure, there are occasional instances where the discussion may warrant a thought-provoking discussion via a new post – but that’s rarely what Menzie is interested in. There’s zero (meaningful) need to create sh*t-posts attacking nonsense from nobodies in a comment section. Menzie knows he holds the ‘power’ when penning a post as it relates to how the ‘issue’ is framed, responses, etc. He’s known for omitting key parts of arguments – but then he claims this isn’t his main job and he has other responsibilities when called out. You want to talk ‘public service’? This ain’t the place. Also, errors aren’t spreading, in any meaningful sense, from this trash pile of a comment section – you’re far too full of yourself if you think otherwise.

So really, it’s just you doing yet another poor job of defending Menzie.

econned, professional jealousy continues to drive your rage and grievance agenda. you are the classic snowflake. if you were smarter, you would be the same as rick.

@ Macroduck

Steve Waldman has what he calls a “drafts” blog up now. He’s been writing somewhat about the banks lately. Worth a perusal Sir.

https://drafts.interfluidity.com

Excellent.

As to Waldman’s latest post, I agree in part. He wants undiversified investment management. That’s the right choice for institutional money and for professional money. They have the capacity to diversify on their own. For amateur money, one-stop diversification is still the best option.

The same argument, for specialist management of narrow assets, is also true for firms in the real economy. We don’t need Amazon or GE diversifying away risk by expanding into several industries. That’s what financial portfolios are for. Weneed real-economy management to be the best it can be at its specialty.

Anyhow, thanks for the tip.

Nice breakdown on European banks from FT and Jefferies (mostly encouraging that things are stable at the moment).

https://www.ft.com/content/2f9388ef-50ef-4cec-9866-c270b881b7e9

Great visual breakdown on individual European banks’ ability to cover deposits.

its professional jealousy. econned once aspired to be an academic. but he failed. he blames “liberals” on the failure, rather than his own shortcomings. which are many. he cannot understand why others take prof. chinn seriously, and think of econned as a joke. so the goal is to try and take down prof chinn, rather than fix his own shortcomings.

baffling,

Hahaha.

You’re uninformed as literally not a single sentence you wrote on March 29, 2023 at 7:01 am is correct. Every sentence is incorrect. All of them. 100%.

Feel free to prove otherwise econned.

Baffling,

The onus is on baffling to support the claims made by baffling.

the professional jealousy is obvious, and on display every time you make a comment. the evidence is presented almost daily by you, econned. your comments are fueled by jealousy and grievances against prof. chinn.

baffling,

I have never attempted, nor desired, to be a part of academia.

My pointing out Menzie’s flaws are only related to Menzie’s flaws. This is evident by the fact that I don’t need to make similar comments on the dozen of other Econ blogs I frequent.

econned, the professional jealousy is STILL there. on just about EVERY POST. you are unable to hide it. it is your grievance mentality that gives it away, snowflake.

you knew enough not to attempt an academic career, because you would not achieve it. you lowered the bar to reach your goals. that is ok for some folks who need the support.

baffling,

Let’s review:

1) “professional jealousy” – I effectively retired before age 45 and absolutely loved my profession. Now I occasionally continue to do the work I love to assist friends and colleagues. What jealousy? I worked for myself ~50% of my short career and the other half for phenomenal teams and firms.

2) “EVERY POST” – i criticize Menzie for legit reasons. You may not necessarily agree with my criticisms but there’s zero basis that the criticisms aren’t firmly grounded on the topics at hand

3) “grievance mentality“ what grievance mentality? Haha. Please show an actual example.

4) “snowflake” – I occasionally enjoy snow but do prefer the tropics. Don’t know why you think snowflakes are relevant

5) “knew enough not to attempt an academic career” – yes, like I knew I would have the opportunity to achieve more happiness, career satisfaction, leisure time, and money

6) “because you would not achieve it” – I doubt that’s true but it’s certainly possible. I worked with academics throughout my career and they have also asked me (and I’ve occasionally obliged) to teach adjunct positions in graduate programs. As such, I have a decent grasp of what the path towards and the life of an academic entails.

7) “you lowered the bar to reach your goals” – you would literally laugh if you only had the slightest clue how ridiculous this claim is

8) “that is ok for some folks who need the support” – agreed

its called professional jealousy, snowflake. describes you quite accurately, econned.

He’s also the guy who has no problem joyfully wading into “a cesspool of a comment section..full of sewage” delighted to add his own fecal matter to the mix.

Of course, Econned is confident his contributions are odorless, if not downright pleasant . That’s his way of fulfilling his own special fantasy.

Noneconomist,

Yes!!!

Microsoft now has a Chat option, so I asked Chat for fun, if M2 velocity was stationary. I realize we have rejected this proposition but thought it would be interesting to see what has been claimed in the past.

Up popped an article from the Federal Reserve Bank of Richmond from 1989 saying M2 velocity was stationary as of 1989. See page 15. Interesting for historical perspective, if not prescriptive as of today.

https://www.richmondfed.org/-/media/richmondfedorg/publications/research/economic_review/1989/pdf/er750502.pdf

A classic that many of us read. But not Princeton Steve naturally.

pg13,

Yes, economic analysis happened.

I know you consider that a waste of time since you are here to rant.

Statistical manipulations without some economic foundation is not economic analysis. But how would a troll like you know the difference?

I guess Jim Jordan thinks effective gun control is a Communist plot:

https://www.msn.com/en-us/news/politics/jim-jordan-accuses-democrats-of-politicizing-nashville-shooting-and-delays-atf-markup/ar-AA199nhf?ocid=msedgntp&cvid=a76d40eb0fdc4ce99581d5cc1dabd01d&ei=14

Jim Jordan is delaying the Judiciary Committee’s markup of a part of Joe Biden’s budget that seeks to implement more gun control by massively increasing funding for the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF). The chairman of the House Judiciary panel is accusing Democrats of using the latest tragedy shooting at a Nashville, Tennessee elementary school on Monday to ‘politicize’ Second Amendment rights.

Seriously? Can we have this turd returned to coaching wrestling at Ohio State? Just make sure this pervert is not left alone with any of the student athletes.

https://fred.stlouisfed.org/graph/?g=BkzA

February 25, 2015

Velocity of M2 money stock, * 1960-2014

* http://krugman.blogs.nytimes.com/2015/02/25/monetarism-in-winter/

The velocity of M2 — the ratio of nominal Gross Domestic Product to a broadly defined version of the money supply — has turned out to be hugely variable.

Paul Krugman

https://krugman.blogs.nytimes.com/2015/02/25/monetarism-in-winter/

February 25, 2015

Monetarism in Winter

By Paul Krugman

Brad DeLong is writing about “cognitive closure” on the right, and focuses on the case of Allan Meltzer, * the long-time monetarist standard-bearer and co-founder of the Shadow Open Market Committee. ** Meltzer has been predicting inflation, just around the corner, for six years; the experience apparently has had no impact on his conviction that he understands the economy better than the Federal Reserve. And he considers it rude and unprofessional when some of us point out how wrong he has been for how long.

But there’s one thing that struck me in particular about the last entry *** in Brad’s bill of particulars, where Meltzer says this:

“The Fed’s third major error is its baffling inattention to the growth of monetary and credit aggregates. Central banks supply the raw material on which financial markets build the credit and money magnitudes. The reason given for neglecting these aggregates is usually a claim they are unstable. That is true only, if at all, of quarterly values. It is not true of medium- and longer-term values, as many researchers have shown.”

I’m not sure what Meltzer is saying here, exactly. Surely the claim is not so much that the aggregates are unstable as that the relationship between those aggregates and variables of interest — like inflation — is unstable. Now, where might the Fed have gotten that idea? Maybe from this:

https://static01.nyt.com/images/2015/02/25/opinion/022515krugman3/022515krugman3-blog480.png

The velocity of M2 — the ratio of nominal Gross Domestic Product to a broadly defined version of the money supply — has turned out to be hugely variable. Once upon a time Milton Friedman called for slow, steady growth in M2 as the key to a stable economy; surely you can’t think that makes sense given developments since the mid-1980s.

But here we have Meltzer insisting that the Fed is making a terrible mistake by not worrying about monetary aggregates, and complaining bitterly about those who question whether, given his track record, he has any authority to lecture the Fed. It’s really very sad.

* http://www.bradford-delong.com/2015/02/five-years-ago-meltzer-on-inflation-econtalk-library-of-economics-and-liberty.html

** http://en.wikipedia.org/wiki/Shadow_Open_Market_Committee

*** http://www.economics21.org/commentary/allan-meltzer-fed-reserve-financial-crisis-2015-02-05

“Meltzer has been predicting inflation, just around the corner, for six years; the experience apparently has had no impact on his conviction that he understands the economy better than the Federal Reserve.”

If Krugman thought Allan Metzler was bad back then – he would have had a field day with Princeton Stevie who actually thinks his discredited Monetarist BS makes Stevie so much smarter than people who actually gets macroeconomics. Yea – Stevie knows less than sad little Allan.

DeLong on Allan Metzler:

I paraphrase:

Inflation is coming! (February 2009)

Inflation is coming! (May 2009)

Inflation is coming! Inflation will start with either a sustained increase in bank lending or a large increase in Fed purchases of government debt or both. (January 2010)

Inflation is coming! Those who believe inflation will remain low need to think more clearly. There are plenty of good textbooks that explain. (August 2013)

Inflation is coming! QE is Federal Reserve financing of budget deficits. Using central banks to finance government deficits sooner or later produces inflation, always and everywhere. (February 2014)

Inflation is here! Food prices will rise as much as 3.5% this year, the biggest annual increase in three years. Inflation is in our future. Food prices are leading off, as they did in the mid-1960s before the “stagflation” of the 1970s. Other prices will follow. (May 2014)

Paul Krugman is mean. The New York Times should not print him. But, really, inflation is coming! If Krugman were more astute he would recognize the $2.5 trillion of idle reserves means his claiming victory can be likened to announcing the game’s result with one half still left to play… (September 2014)

Inflation–or recession, or both–are coming! Eliminating excess reserves without causing inflation, recession or both is a major problem. The Fed’s major error is its baffling inattention to the growth of monetary and credit aggregates… (February 2015)

Sound familiar?

Sounds like John “Grumpy Economist” Cuckrant. He predicted inflation 50 times and finally got it right. And when Cuckrant FINALLY got it right it was during a GVC clusterf*ck created by a respiratory disease pandemic and war in East Europe. Congrats to John Cuckrant for getting 1-in-50 inflation calls correct and the ONE he got correct created by factors he had no clue would occur. You’re a soothsayer Cuckrant, take a bow.

@ ltr

Did you have any thoughts on Putin’s murder of many Chinese miners??? This is Xi giving Putin the guanxi, 关系,

https://www.thedailybeast.com/witnesses-accuse-russias-wagner-group-of-killing-9-chinese-miners-in-central-african-republic

Putin buys a few trinkets from China and then Putin gets to murder multiple Chinese?? That’s some grade A guanxi right there. Go team.

https://fred.stlouisfed.org/graph/?g=E1g5

January 15, 2018

Velocity of M2 Money Stock, 1960-2022

https://fred.stlouisfed.org/graph/?g=11TPC

January 15, 2018

Velocity of M2 Money Stock, 1960-2022

(Indexed to 1960)

Dear corporation are you using your monopoly power and our capitalist system to profit on a health crisis ?????

https://www.cnn.com/2023/03/29/business/egg-profits-cal-maine/index.html

Cricket …………. Crickets …………………. Crickets

……. but we are no worse than all the other predatory capitalists

A while back, I linked to a paper which attempted to explain sharp rises in profits in times of scarcity as defensive measures on the part of producers. Of course, when one specifies a model with a give set of assumptions, there is opportunity to confirm those assumptions.

I’m too lazy to dig up the link, but what I didn’t see in that paper was an attempt to account for consumer hoarding. Suppliers track demand, and can know when hoarding is occurring. With eggs, that was obviously the case. There has not been time to replace laying hens since the latest bird flu kill-off, but egg price locally have fallen from $6.80 per dozen to $2.50. Hoarding follows a pattern. Plenty of eggs now, even though there are fewer laying hens. Profiteering certainly looks like a more parsimonious explanation for a 700% rise in profits than does defensive pricing by suppliers.

Coorporations and their little toadies at the Fed are concentrating on the wage-price inflation cycle. Turns out the price-price inflation cycle is responsible for twice as much inflation.

https://www.cnn.com/2023/03/29/investing/premarket-stocks-trading/index.html

Yes predatory capitalists will jack up prices as far as we allow them – and then use the “look over there!” strategy to make sure nobody pay attention to what they are doing. Like a right winger after a school shooting, blame anything else, and pay no attention to the gun that killed those children.

The article to which you link cites Lael Brainard. She championed this idea of prive/price inflation. She’s no longer at the Fed. White House grabbed her. Not sure that’s Pareto optimal.

Did you have any thoughts on…

[ This writer is a prejudiced bully and needs to forever leave me alone. ]

https://econbrowser.com/archives/2023/03/china-signals-stability-with-surprise-move-to-keep-pboc-governor#comment-295379

March 12, 2023

BTW, where is “ltr”?? Is he drawing the water for Li Keqiang’s bath and prepping his hands for Li’s first post-retirement full-body rubdown?? I mean, I know “ltr” loves China, but this is taking it too far.

— Moses Herzog

[ This writer is a prejudiced bully and needs to forever leave me alone. ]

I wish you would leave us alone with the clutter you post.

@ ltr

See, many people here think you’re very predictable. But they don’t know the ltr that I know. The one who applauds Putin killing large numbers of Chinese. I bet no one on this blog but me saw that one coming from you ltr. You give priority to foreigners who murder Chinese nationals than China keeping its self respect. I think that’s very independent thinking on your part. You, a man who has nothing to say about Putin murdering Chinese, being a propagandist?? Balderdash!!! Pure bunkum and balderdash!!! You know Putin means well when he spills Chinese blood on the ground. You are a fair-minded man about Chinese blood being spilled for Russian economic gain. We respect that about you ltr

Where do these people get off saying you only care about Chinese interests?!?!?! I think yawning in complete boredom to a mass killing of Chinese miners shows you are a VERY INDEPENDENT THINKER ltr

Kinda hoped we were done with Xi’s troll. She’s back. Apparently, re-education is complete.

Watch ltr get quiet now, kinda like when I ask Kopits why he doesn’t want employers to be punished for hiring illegal immigrants. That’s usually good to make Kopits disappear for at least 5 posts. I’ll keep steady jabbing this murdering of Chinese nationals, and ltr will go silent. Both of them are easier to read than trump at a McDonald’s.

When Judge Michael Luttig speaks, real conservatives listen:

http://globcapadv.com/publications.htm

One of the nation’s most prominent conservative judges warned that the Republican Party presented a grave peril to democracy. Former federal appeals court judge Michael Luttig, who famously told Mike Pence the vice president did not have the authority to alter election results, made clear in a new interview with The Bulwark that the ongoing threat from Donald Trump and his GOP allies had only grown more ominous since Jan. 6, 2021. “With the former president’s and his Republican Party’s determined denial of Jan. 6, their refusal to acknowledge that the former president lost the 2020 presidential election fair and square, and their promise that the 2024 election will not be ‘stolen’ from them again as they maintain it was in 2020,” Luttig said, “America’s Democracy and the Rule of Law are in constitutional peril — still — and there is no end to the threat in sight.” The conservative legal icon memorably testified during the House select committee investigation that Congress must update the Electoral Count Act of 1887 or risk another attempt to subvert the will of voters, and he said this week that the failure to do so was undermining the rule of law. “We are a house divided and our poisonous politics is fast eating away at the fabric of our society,” Luttig told The Bulwark. “The Republican Party has made its decision that the war against America’s Democracy and the Rule of Law it instigated on Jan. 6 will go on, prosecuted to its catastrophic end.”

https://econbrowser.com/archives/2023/03/china-signals-stability-with-surprise-move-to-keep-pboc-governor#comment-295379

March 12, 2023

BTW, where is “ltr”?? Is he drawing the water for Li Keqiang’s bath and prepping his hands for Li’s first post-retirement full-body rubdown?? I mean, I know “ltr” loves China, but this is taking it too far.

— Moses Herzog

https://econbrowser.com/archives/2023/03/the-stryker-velocity-model#comment-296234

March 29, 2023

Did you have any thoughts on…

— Moses Herzog

[ I am afraid of this bullying writer. ]

@ ltr

When someone can look at you, and in immediate fashion see the rot in your soul, it can be very frightening.

Matthew 5:30

New King James Version

“And if your right hand causes you to sin, cut it off and cast it from you; for it is more profitable for you that one of your members perish, than for your whole body to be cast into hell.”

Looks like a single $540 million sale of Deutsche Bank credit default swaps was the cause of the Friday sell-off in DB and other European banks’ shares:

https://markets.businessinsider.com/news/stocks/deutsche-bank-credit-default-swaps-banking-crisis-stock-market-decline-2023-3

So instead of market participants responding to news, market activity was the news. We’ve been here before.

Off topic but tangential, housing prices and CPI –

Including yesterday’s data, FHFA home purchase price index and owners equivalent rent:

https://fred.stlouisfed.org/graph/?g=11WEk

If something like a 4-quarter lag is at work, looks like we should see a significant slowing in CPI services inflation starting in May or June. Lags aren’t iron laws, but something like that.

MD,

Does the NY Fed survey contradict the hope for lower equivalent rant?

“Short-Term Home Price Expectations Drop Sharply; Rental Price Growth Expectations Remain Elevated”

https://www.newyorkfed.org/newsevents/news/research/2023/20230328

Only if those expectations prove correct.

According to Apartment List:

“Year-over-year rent growth is continuing to decelerate, and now stands at 2.6 percent, its lowest level since April 2021,”…“Year-over-year growth is now pacing slightly below the average rate from 2018 to 2019 (2.8 percent), and is likely to decline even further in the months ahead.”

https://www.globest.com/2023/03/29/apartment-rents-do-an-accordion-fold-in-march/?slreturn=20230229205358

There is a good bit of recent rental industry commentary anticipating continued cooling in rent growth. One of the metrics used in the industry is the gap between rents on new leases and rents on renewed leases. Owners like that gap to be small, ideally zero. In 2022, the gap narrowed sharply. So far this year, less so. That’s one reason the above quote says “is likely to decline even further in the months ahead.”

There is a ton of freely available information on commercial real estate which helps to give us a handle on the sector.

Globest os OK:

https://www.globest.com/sectors/

Realpage, too:

https://www.realpage.com/analytics/topics/apartment-data/retention/

Bill the Diver is a national treasury:

https://calculatedrisk.substack.com/p/year-over-year-rent-growth-continues-ff5

Oops,

meant to say “rent”.

I bow to McBride.

Wow, Bill going over to substack. Is Menzie the next to take the substack plunge?? What happened to “Medium”??~~are they still in the game? And why do these people enjoy so much making me feel old?? What’s next??~~are they all going to go on the quantum computer web?? To hell with progress I say. Where’s Gabby Hayes when you need him??

I like medium, but you need a good filter. a lot of posers on the site. for for a select number of topics that I enjoy, there are some really good writers there. have not looked at economics and finance on the site, however.