(As distinguished from population at large.) From WPR, referring the Wisconsin Manufacturers and Commerce report:

From winter to summer, the survey shows that the share of employers who think a recession is coming in the next year decreased from 60 percent in January to 54 percent in the newly released survey.

Schulz/WPR continues:

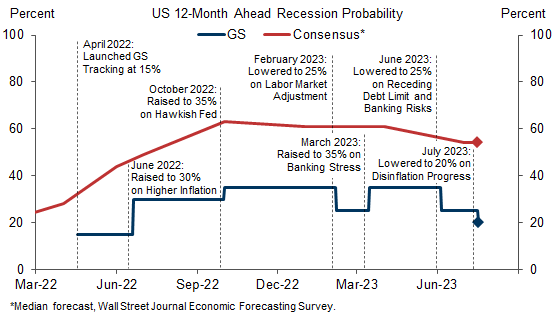

Research from investment banking firm Goldman Sachs says the probability of a U.S. recession in the coming year declined from 35 percent in March to 25 percent last month after the federal government avoided a debt default.

But Menzie Chinn, a professor of public affairs and economics at University of Wisconsin-Madison, said Goldman Sachs’ prediction might be a little rosier than that of most economists. He said economists are anticipating an economic slowdown in the latter half of 2023 or early 2024.

“While people think the chances of a recession are receding, I think the average forecaster still sees a recession coming,” Chinn said. “That being said, I think most of them also think it would be a mild recession.”

Chinn said the economy is still growing, but growth has slowed over the last six months or so. Slowing the economy to cool inflation was the intent behind the Federal Reserve’s interest rate increases.

The disjuncture between Goldman (now down to 20% I believe) and the consensus is shown in this graph.

Source: Jan Hatzius, “Global Views: The Narrative Turns,” Goldman Sachs (July 17, 2023).

The consensus from WSJ differs from that implied by the 10yr-3mo term spread, which as discussed in this post is about 90%.

Note that a recession might feel differently in Wisconsin vs. nationally. Wisconsin is manufacturing intensive relative to the Nation, so is likely more cyclically sensitive than other — more service intensive — states.

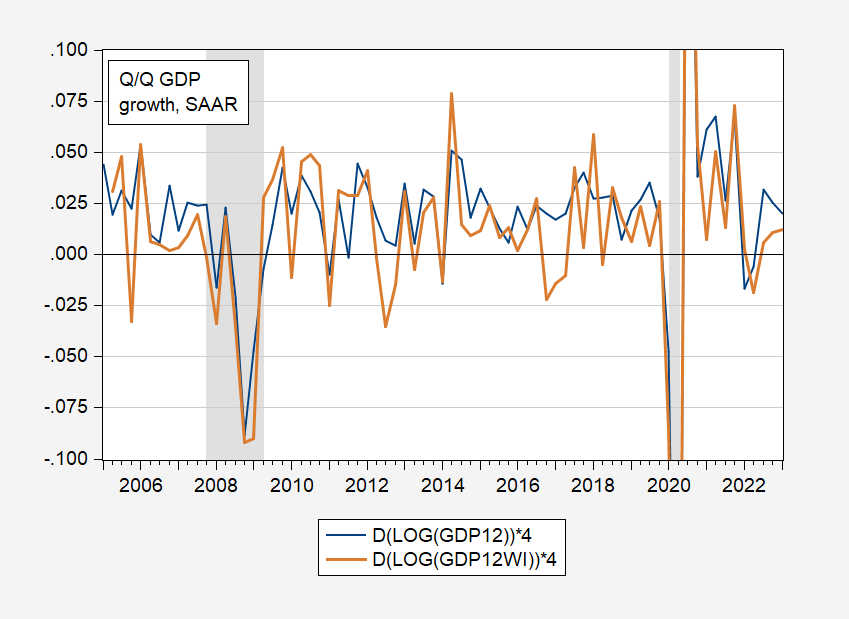

Here’s q/q changes in NFP and GDP, national vs. Wisconsin:

Figure 2: Quarter-on-quarter growth rate of nonfarm payroll employment in US (blue), in Wisconsin (brown), all annualized. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

Figure 3: Quarter-on-quarter growth rate of real GDP in US (blue), in Wisconsin (brown), all annualized. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

After accounting for measurement error (2SLS GDO for national GDP), it looks like each 1 ppt acceleration in US GDP growth is associated with a 1.1 to 1.15 ppt acceleration in WI GDP growth (although the difference is not statistically significant at the 5% level).

The outlook for macroeconomic aggregates from the Evers administration, compared against latest data, discussed in this post.

https://fred.stlouisfed.org/graph/?g=UErl

January 15, 2018

Average Real Hourly Earnings of All Private Employees in Wisconsin and Minnesota, 2017-2023

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=UvCX

January 15, 2020

Average Real Hourly Earnings of All Private Employees in Wisconsin, 2020-2023

(Indexed to 2020)

Just a random thought.

Budgets of states with economies more dependent on manufacturing will be more sensitive to cyclical swings than states less exposed to manufacturing. Income taxes are likewise more sensitive to cyclical fluctuations than consumption taxes. For busgeting purposes, it might be a good idea for manufacturing states to lean more heavily on consumption taxes, and wealth taxes such as real estate taxes, than on income taxes.

Of course, for welfare and economic stabilization purposes, counter-cyclical budgets are best.

“The Piggly Wiggly”. Now there’s a great Midwestern brand that you never here mentioned down south USA way.

Don’t forget kids, if you’re ever “passing through” Marshalltown Iowa, (East of I-35, northeast of Des Moines) God will hold it against you if you don’t grab a bar stool at Taylor’s Maid-Rite.

https://www.maidrite.com/

Don’t forget to get a chocolate or vanilla malt while you’re grabbing a loose meat burger. Get you a little spoon to eat up any loose burger that falls out of the sandwich. You can thank Uncle Moses later. Don’t feel guilty if you want that 2nd malt. I liked vanilla flavored malts when I was as tall as 1/3rd of Menzie’s lecture podium.

*hear mentioned

I swear it’s the summer heat on my brain, I swear it.

US imports from India are down around 22% YOY. When you look at US imports from China being down a lot and also down in other southeast Asian nations (ASEAN), the global, economic picture looks pretty bleak from here. These are stark numbers that happen to be churning out just as the CRE market is coming into default and major stress.

Since you say “just as”, you mean the U.S CRE market (toss in London for good measure), rather than China’s, I suppose? ‘Cause yikes!

But then, the latest defaults are just a matter of timing. You knew it was coming.

As a Wisconsinite and frequent listener to WPR during my road trips around the state – I think WPR does an above average reporting of news. They actually interview subject-matter experts rather than the normal NPR model of interviewing another journalist. Although I take any citation from WMC with a grain of salt. For non-Wisconsinites – the WMC ( https://en.wikipedia.org/wiki/Wisconsin_Manufacturers_%26_Commerce) along with the Tavern League of Wisconsin (https://en.wikipedia.org/wiki/Tavern_League_of_Wisconsin) pretty much runs the WIGOP agenda. Thanks Menzie for injecting some nuance into the discussion.

(BTW- IMHO – looking at various slowdowns that the Fed has started with their interest rate hikes and dingbat GOP attempts to cut needed infrastructure spending https://www.washingtonpost.com/business/2023/07/18/republican-spending-bills-infrastructure-cuts/ – the pundits may be talking about deflation rather than inflation. That is, as this post illustrates, interest rate hikes take 6 to 12 months before they start to have an impact.) (Another BTW – the GOP attempts to cut climate change mitigation spending – while people across the Southwest are warned that it is too hot to even go outside, insurance companies fleeing Florida, etc. – when does the GOP get a realistic climate change policy?)

“They actually interview subject-matter experts rather than the normal NPR model of interviewing another journalist.”

You said it brother. And they do it over and over and over and over.

Or how about the one where someone on the in-house news staff is going through a personal issue, and suddenly they think that all of us should be overtaken with grief and waylaid because “one of their own” is going through something. My Dad, who was a huge consumer of news (newspaper and local TV news) would really get worked up on that. He mockingly labeled it as “the news as the news” or “the news thinking it’s news”. It’s really worse than even Hollywood navel-gazing, because we expect Hollywood to be navel-gazing. News (journalism, is that a curse word now??) is supposed to be outward looking and searching/digging for crucial info, not interviewing “Suzie” at the desk next to them in the studio. I am so glad you stated this, because it’s very bad journalistic practice and NPR and other media do it ALL the time. Robin Roberts of “GMA” has made a damned near entire career out of self-pity. One of these days (if she hasn’t already) I am certain Robin will do an “in-depth” report on the contents of her refrigerator, to tell us which items “I like” or “I think that’s great packaging”, or “I really enjoyed that food item” and which items she regrets. Just so we all know what’s crucial in life while people are dying in Ukraine. We all need to know what “Robin likes” and what “Robin dislikes”.