From EJ Antoni (Heritage), article entitled “Coming recession may already have arrived” in the Boston Herald (8/21):

“…an increasing number of indicators say the recession has arrived in the broader economy.”

Here are key indicators followed by the NBER Business Cycle Dating Committee:

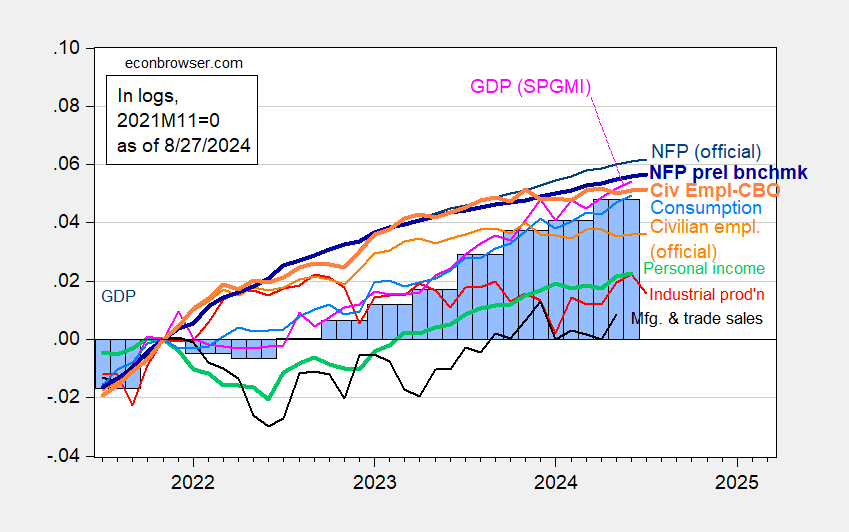

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), NFP implied preliminary benchmark revision (bold blue), civilian employment (orange), implied civilian employment using CBO estimates of immigration (bold orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (8/1/2024 release), and author’s calculations.

For preliminary benchmark revision, see here; for alternative civilian employment using CBO estimates of immigration, see here. Note I used 2024 CBO estimates in these estimates as well; in the previous iteration, I used CBO estimates only up through 2023M06.

Of these indicators, I’d only count civilian employment from the household survey and perhaps industrial production as signaling a possible recession.

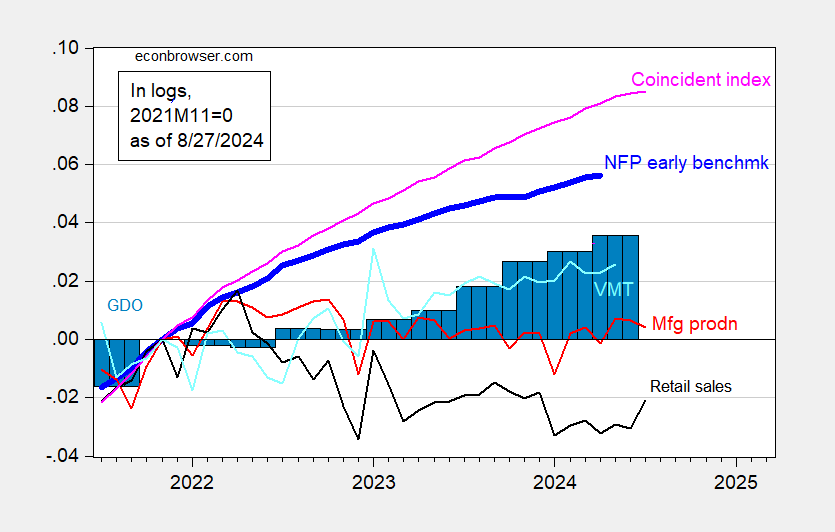

Here are some alternative indicators. Note that the vertical scale is the same for Figure 2 as for Figure 1, for the sake of comparability.

Figure 2: Nonfarm Payroll early benchmark (NFP) (bold blue), manufacturing production (red), retail ales in 2019M12$ (black), vehicle miles traveled (light blue), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed, Federal Reserve, Census, via FRED, BEA 2024Q2 advance release and estimated (by author) enterprise surplus, and author’s calculations.

Among these indicators, retail sales and manufacturing production might be signaling a recession, although the former has picked up on the latest available month. The coincident index rose at an annualized 1.8% over the last three months reported.

The usual caveat applies — all these series will be revised, particularly the GDP series, which is why the NBER BCDC does not place primary reliance upon this series (see how the 2001 recession only briefly fit the two consecutive quarter rule-of-thumb, here).

The one indicator in favor of the recession call is the Sahm rule. The caveat here is that the indicator is pulled up because of a major labor force increase, rather than employment decrease, as shown in this post. A year ago, I noted that the standard term spread models indicated a high likelihood of recession by mid-year 2024, so I’m loath to declare the outlook safe now, despite the fact that weekly indicators (e.g., WEI, for data thru 8/17) still indicate growth at 2.32%. Nonetheless, not quite ready to be put in the recession camp, yet.

“The Herald” ain’t “The Globe”, not close. It’s another Murdoch creature, in a bottom-feeding symbiotic embrace with Heritage.

“I’d only count civilian employment from the household survey and perhaps industrial production as signaling a possible recession.”

I understand that Steve Koptis is screaming VMT, VMT, VMT!

His piece is nothing more than a rant that shows he hates deficit spending. Catch the closing paragraph:

The bill is coming due for years’ worth of profligate spending, and the price is steep. As businesses report declining demand and plummeting orders, and as hiring slows, it becomes increasingly clear that the party is over. The recession may have already begun.

What businesses are reporting less demand and plummeting orders? He did not say. Hiring has slowed? Excuse me but employment is still rising [er at least the payroll survey as well as ADP reporting.

This clown pretends to be an economist? Maybe it is time he acts like one.

Antoni has mistaken level for change. It may be true that demand growth is slowing, but demand is rising. Here are some of the major categories for the past 6 quarters:

https://fred.stlouisfed.org/graph/?g=1tdB7

Demand is not declining.

What an elementary mistake to make when one has all that education.

Orders plummeting? Only if you look at June and ignore July:

https://fred.stlouisfed.org/graph/?g=1tdCQ

https://tradingeconomics.com/united-states/ism-non-manufacturing-new-orders

Antoni has a PhD? Wrong about the data. Mistaking level for change. Funny way to use a PhD.

Manufacturers’ New Orders: Durable Goods shows a fair amount of variability month to month but one thing is clear. It is much higher on average since Biden took office as compared to Trump’s prepandemic years. Even an incompetent moron could see this but not this fake Ph.D.

Antoni is not concerned with being correct. all he wants to do is throw doubt into the economy prior to the election. that is his only goal here, to try and damage Harris in any way possible. because if he were concerned about deficits, as he claims, then he would castigate trump for the humongous increase in debt during that administration. be sadly he does not do so. just another political hit job, done poorly. probably took a class from rick stryker, based on the poor level of intellect in his arguments.

Antoni is on par with Luskin, Kudlow, Moore, and Laffer, I used to use the term the Three Stooges but now it seems we have Five Stooges.

Off topic – underestimating climate change by a lot:

Y’all may have noticed reports over the last few years that climate change is happening faster than had been predicted. This suggests these models may need to be adjusted. New research into climate history agrees; we have apparently been underestimating the heating effect of atmospheric CO2:

https://research-information.bris.ac.uk/en/publications/continuous-sterane-and-phytane-%CE%B4sup13supc-record-reveals-a-substa

Rock cores representing the past 15 million years, taken from an especially low-oxygen environment which helps to preserve evidence of atmospheric CO2, show evidence of a substantially bigger temperature response to CO2 than we previously thought.

Rather than conventional models’ moderate outcomes, this new evidence is more in line with UN Climate Panel extreme high estimates. A doubling of atmospheric CO2 could induce an average global temperature increase of between seven and 14 degrees, double conventional estimates.

So, have a nice flight, drive, burger. No worries.

“If you go back to the Trump presidency, we had 12,000 factories that were built during Donald Trump’s presidency.” – JD Vance on the August 25, 2024 Meet the Press. Does this sound plausible? Check it out!

https://www.msn.com/en-us/news/politics/vance-repeats-a-bogus-trump-claim-on-factories-debunked-years-ago/ar-AA1pBogV?ocid=msedgdhp&pc=U531&cvid=ef896956c044404990ae80533b909d0c&ei=7

https://fred.stlouisfed.org/series/OUTMS

Manufacturing Sector: Real Sectoral Output for All Workers

Someone ask Vance how did production fall under Trump (even pre-pandemic) if 12 thousand new factories were built? Oh wait – his AppHarvest facilities were not all that productive. Got it!

Poor JD Vance. First this fake Marine tries to defend how Trump dishonored Arlington National Cemetary with his gross exploitation of a ceremony for the 13 soldiers who died in Afghanistan about 3 years ago. And then the moron claimed this incident happened on Abbey Road. Yea — blame the Beatles!

https://x.com/Acyn/status/1828875332289806380?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1828875332289806380%7Ctwgr%5E44e2b6a89707aa363e8862f9c674ea654fc78203%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.rawstory.com%2Ftrump-arlington-national-cemetery-2669092687%2F

I just saw a clip of Antoni trying his little best to defend the merger of Albertson’s and Kroger. The poor boy must not be able to read a damn 10K filing as he claimed Costco was much larger than these two firms. Well – Costco did have $230 billion in sales in 2023. Funny thing, the combined revenue of the two firms trying to merge was also $230 billion in 2023.

Antoni also claimed that these two firms would have only a 13% market share. Did he pull this out of his lying rear end? Try 25% for Costco and 25% for Kroger-Albertson’s. Now I get Antoni’s Ph.D. gave this clown zero experience with Industrial Organization (the economics behind anti-trust law) but two firms having a combined market share of 50% sound like a concentrated market to me.

Oh Antoni was being interviewed on Faux News where stupidity and lying are both a must.

During Antitrust Trial, Exec Admits Kroger Jacked Up Milk and Egg Prices Above Inflation

“The thing is, execs all over the economy were saying this stuff on their earning calls back in 2021,” said one progressive economist. “This was not a secret.”

https://www.commondreams.org/news/kroger-egg-prices

Now Jack Smith’s trials against Trump are getting a lot of well deserved press, this trial should prove interesting!

Antoni is on the Twitter. Trust me – his tweets are dumber than the garbage you might see on Truth Social.

His latest “evidence” that we are in a recession? The demand for sausage is rising. Huh – I never knew sausage was a Giffen good.

Zerohedge agrees with Antoni that the rise in the consumption of dinner sausage = RECESSION because they assert that this is a Giffen good. No real evidence presented of course. But wait, we have a real analysis here:

https://www.agmanager.info/sites/default/files/pdf/TonsorLusk_PriceSensitivityReport_03-05-21.pdf

Consumer Sensitivity to Pork Prices: A Comparison of 51 U.S. Retail Markets and 6 Pork Products

Dr. Glynn T. Tonsor, Kansas State University (agri.food.analytics@gmail.com) & Dr. Jayson L. Lusk, Purdue University (jayson.lusk@gmail.com)

March 5, 2023

Tonsor and Lusk would not agree with Antoni and Zerohedge it seems.

https://www.bea.gov/news/2024/gross-domestic-product-second-estimate-corporate-profits-preliminary-estimate-second

Gross Domestic Product (Second Estimate), Corporate Profits (Preliminary Estimate), Second Quarter 2024

Real gross domestic product (GDP) increased at an annual rate of 3.0 percent in the second quarter of 2024 (table 1), according to the “second” estimate released by the U.S. Bureau of Economic Analysis. In the first quarter, real GDP increased 1.4 percent.

Now who was saying we are in a recession?