Apologies to Laurence Olivier in “Marathon Man”. Derek Thomson of the Atlantic describes “How the Recession Doomers Got the U.S. Economy so Wrong”. Personally, I don’t think we should take the recession scenario off the table, despite the recent spate of good data. First, term spread models implied a downturn/recession in the 4th quarter of 2023 (using a 50% threshold), and we’re still in the 3rd quarter. Second, these data are going to be revised — and GDP in particular will be heavily revised.

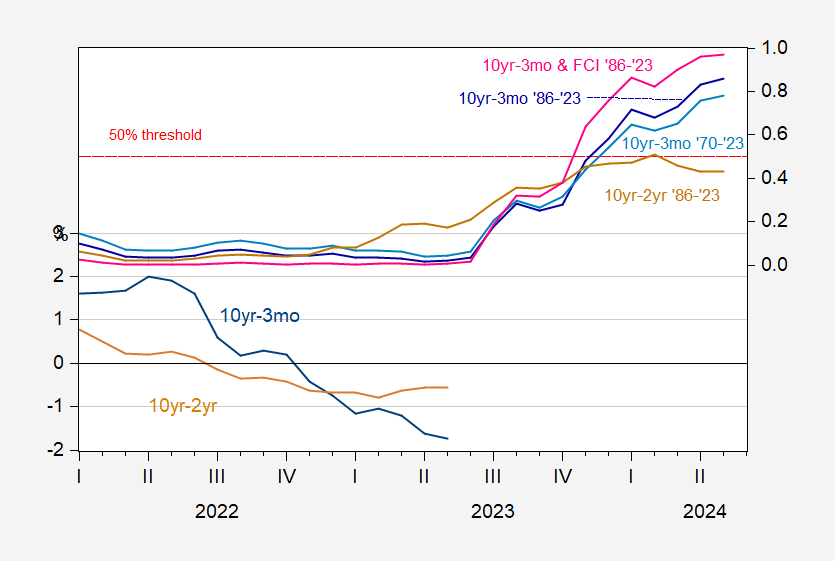

To the first point, I reprise the graph of probabilities derived from term spread models in this June assessment.

Figure 2: 10yr-3mo Treasury spread (blue, left scale), and 10yr-2yr spread (tan, left scale), both in %; and probability of recession from 10yr-3mo over 1986-2023M05 period (dark blue, right scale), augmented by Financial Conditions Index (pink, right scale), 10yr-3mo term spread over1970-2023M05 (light blue, right scale), and 10yr-2yr over 1986-2023M05 period (brown, right scale). NBER defined peak-to-trough recession dates shaded gray. Regressions assume no recession occurred as of May 2023. Source: Treasury via FRED, Chicago Fed via FRED, NBER, and author’s calculations.

So, if historical correlations hold into the 2023-24 period, then a recession is not unlikely, according to these term spread/probit models.

To the second point, I hearken back to my own experiences when as a senior economist in the government, I was told the currently reported data assured no recession by one of my colleagues. That was in April or May 2001, if memory serves. We were already a month into the recession by that time.

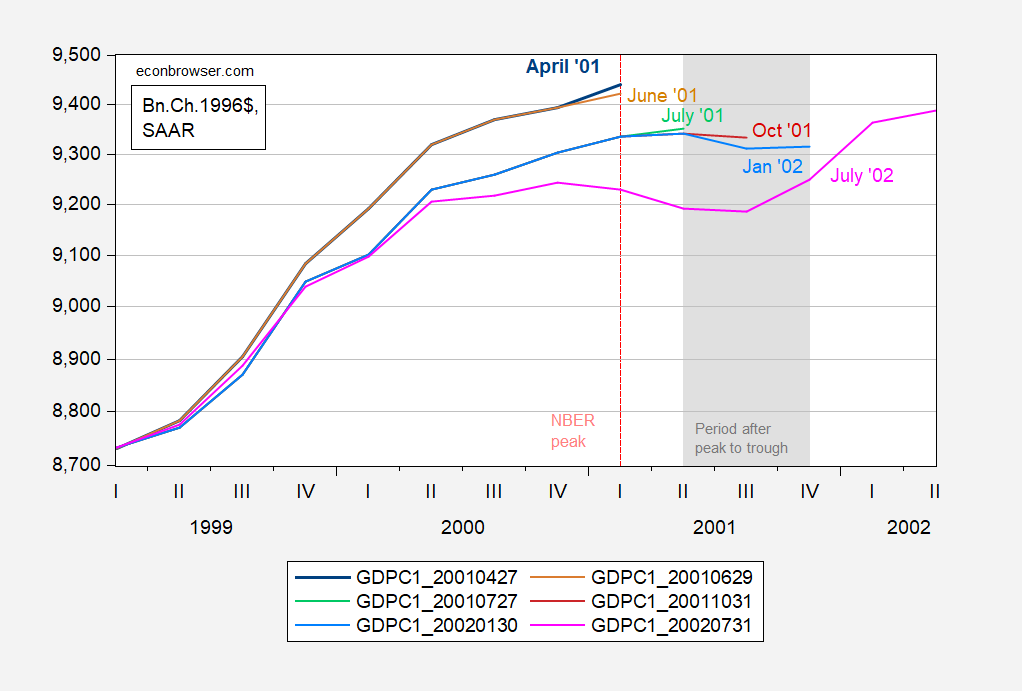

To make this point more concrete, consider the data we had available at the end of April 2001; this is shown in the top blue line in Figure 2 below.

Figure 2: GDP in bn.Ch.1996$ SAAR from April 2001 release (bold blue), from June 2001 (tan), from July 2001 (light green), October 2001 (red), January 2002 (sky blue), July 2002 (pink). NBER defined period after peak to trough recession dates shaded gray. Dashed red line at NBER peak. Source: BEA via ALFRED, and NBER.

Note that as of end-April, the economy looked like it was still expanding. Even after the annual benchmark revision, the gradient was still positive through Q2. It’s only after several more revisions that a downturn becomes apparent.

Now, as I have stressed (to little effect for some people), the NBER BCDC does not rely primarily on GDP for determining peak/trough dates. Rather, they place more focus on monthly indicators, most prominently employment and personal income ex-transfers. The monthly indicators are subject to less drastic revisions, but they still get revised (see this 2006 post regarding the 2001 recession). So, what we see in the monthly indicators today will not be what we see using subsequently released vintages.

The Atlantic article begins with one precocious youngster beating up on a couple of other precocious youngster. Derek Thomson is a successful young journalist who has thrived writing about business despite limited formal training in business. He pokes fun at Bloomberg economists Anna Wong (PhD U. Chicago, Fed, Treasury, CEA, Peterson Institute) and Eliza Winger (MA Warsaw U., Conference Board), and rightly so; they wrote a forecasting model which allowed for recession probabilities of 100%. What!?!?!? That’s ridiculous on its face. Bad economics, but good journamalism I suppose, and they do work for Bloomberg.

Here’s what Thomson makes fun of:

“The latest recession probability models by Bloomberg economists Anna Wong and Eliza Winger forecast a higher recession probability across all timeframes, with the 12-month estimate of a downturn by October 2023 hitting 100%, up from 65% for the comparable period in the previous update.

“The forecast will be unwelcome news for Biden, who has repeatedly said the US will avoid a recession and that any downturn would be “very slight,” as he seeks to reassure Americans the economy is on solid footing under his administration.”

A prospective 100% recession probability is a logical lapse. Nobody who thinks about what that means should publish that number – the model is simply calibrated wrong.There is no such thing as a before-the-fact 100% recession risk.

Thomson – or his editor- is not blameless, either. “On recession watch” or “off recession watch” amounts to a binary choice when we are talking about a continuous probability function. And notice the clumsy attempt to turn a silly forecast into a political issue. It’s as if Bloomberg has hired the troll choir as editorial advisors.

Thomson is in the eyeballs business, not the business of actually informing people. Binary descriptions of continuous functions are great for attracting eyeballs, bad for informing people. Sad, but not Thomson’s fault; he’s a journalist.

The actual tools of economics are less sanguine regarding recession, regardless of what Thomson may write. New Deal Democrat’s leading indicator work still warns of recession. The yield curve in is various forms, as Menzie shows here, still warns of recession. Meanwhile, the labor market steams ahead. Not a good time to be dogmatic, but a really good time to take a balance-of-risks approach to policy and to hiring and investment decisions.

The long leading indicators – the data that best tells us what the economy will be like in 12 months or so – are still absolutely awful. In addition to the yield curve, credit conditions, corporate profits, real money supply, and real sales per capita are all even more negative than they were last year. Housing data and interest rates are off their worst level, but not by much. For that reason alone we are at heightened risk of recession in the near future.

By the end of last autumn, almost all of the short leading indicators were also very negative. Hence I felt confident one was likely to start in the first half of this year. But now they are much more mixed.

As you point out, revisions could still show a recession did start earlier this year. Let me remind people that unless it gets revised way later this month, the QCEW for Q4 last year indicates that payrolls were much weaker than the monthly reports suggested. Some of the other “positive” metrics are nevertheless at slow growth rates equivalent to what they were early in past recessions.

I’ve been undertaking a top to bottom review of what may have been “different this time.” I’m not done, but as of now my best guess is that I underestimated the hurricane force tailwind of the unspooling of the pandemic related supply chain bottlenecks. A nearly 10% YoY decline in commodity prices can work wonders for producers, and similarly a less than 1% increase in CPI ex fictitious shelter works wonders for workers who are still getting big wage increases. Which means that “real” measures like real personal consumption and real average hourly wages have been rising consistently. It’s very hard to generate a downturn during that dynamic.

So here is the current issue: The NY Fed says that the supply bottlenecks in the aggregate are gone as of a few months ago. YoY gas price comparisons are getting much less positive. If the hurricane force tailwind dissipates, but the effect of Fed rate hikes will not be fully felt for another 12 months, what happens? I’m still working on that.

Here is one very good reason not to be dogmatic – or binary – in discussion the economic outlook:

https://fred.stlouisfed.org/graph/?g=17zOk

Uncertainty over the current (one-month horizon) and near-term economic outlook is high. One-handed economists let clients feel they know the future, but two-handed economists provide a clearer understanding.

Thanks for your periodic injections of realism into the tornado of economic punditry.

https://www.bls.gov/news.release/empsit.nr0.htm

THE EMPLOYMENT SITUATION — JULY 2023

Total nonfarm payroll employment rose by 187,000 in July, and the unemployment rate changed little at 3.5 percent

Household survey suggested employment grew by 268 thousand increasing the employment to population ratio from 60.3% to 60.4%.

Kevin Drum adds something else which is good news for workers:

https://jabberwocking.com/chart-of-the-day-net-new-jobs-through-july/

weekly blue-collar earnings increased 3.0% after adjusting for inflation. This is the third month in a row that they’ve gone up … This is bad news for the Fed, which is obsessed with labor costs, but good news for workers.

I’m already on record, I don’t see a recession for this calendar year.

Could there be something out of left field like grain stockpiles in Ukraine?? Yes. But with the supply chain behaving better, greedflation rate slowing down, wages doing better than normal, unions having more leverage than normal and people like Janet Yellen at the helm of the rudder it seems like a better situation than we have had in awhile. Would I rather have an Alan Blinder type running the Fed than Georgetown Jerome?? Yes, but this isn’t a fantasy land where everyone suitable for a job gets that job.

Here’s an interesting stat I read in WSJ. Our good man Macroduck might even find this interesting. Moody’s Analytics says only 11% of household debt outstanding carries rates that fluctuated with benchmark interest rates. And that metric has stuck nearby that 11% for over 10 years.

i.e. Households have been much smarter about the types of debt they use since the year 2008, choosing fixed rate mortgages, over adjustable rate mortgages. Which probably royally sticks in the craw of Jamie Dimon and GS types who are predatory towards their investment clients and customers.

My apologies in advance for weighing in on legal issues but Jonathan Turley’s First Amendment defense of Trump turns on this Supreme Court decision:

https://www.oyez.org/cases/1968/492

The Court used a two-pronged test to evaluate speech acts: (1) speech can be prohibited if it is “directed at inciting or producing imminent lawless action” and (2) it is “likely to incite or produce such action.”

I think Jack Smith’s indictment has passed both tests. Of course I’m not a law professor at Georgetown but I would suggest Georgetown should fire Professor Taylor.

https://www.msn.com/en-us/news/politics/elena-kagan-at-odds-with-samuel-alito-over-supreme-court-ethics-reform/ar-AA1eMQXp

Elena Kagan At Odds With Samuel Alito Over Supreme Court Ethics Reform

Kagan makes sense. Alito is a dinosaur who needs to retire.

Will this Supreme Court repeal Heart of Atlanta Motel (1964)?

https://www.msn.com/en-us/news/us/return-to-the-whites-only-luncheonettes-of-the-1960s-south-us-supreme-court-strikes-blow-against-lgbtq-rights/ss-AA1eNaKR?ocid=msedgdhp&pc=U531&cvid=be84157e2e8b40ac9779edd710a87efe&ei=7#image=1

“Return to the ‘whites-only’ luncheonettes of the 1960s South” – US Supreme Court strikes blow against LGBTQ+ rights

The Supreme Court ruled in favor of an evangelical Christian web designer from Colorado who refused to work on invites for same-sex marriage, giving a significant blow to the rights of LGBTQ couples.

Either we pack the Court or we just accept that the 14th Amendment means nothing.

John Lauro is the kind of clown Trump hires as his lawyers:

https://www.tag24.com/politics/politicians/donald-trump/donald-trump-attorney-makes-stunning-admission-after-arraignment-and-it-may-mean-big-trouble-2914070

Trump attorney John Lauro, who stood next to the former president on Thursday as he was arraigned on charges to overturn the 2020 election results, joined Fox News host Laura Ingram for an interview that night to discuss how Trump did absolutely nothing wrong. “What President Trump said is, ‘Let’s go with option D,'” Lauro explained. “Let’s just halt, let’s just pause the voting, and allow the state legislatures to take one last look and make a determination as to whether or not the elections were handled fairly.” “That’s constitutional law,” he added. “That’s not an issue of criminal activity.” Lauro went on to repeat his argument later that night in an interview with Newsmax, adding that Trump “desperately” wanted to “get to the truth.” While the attorney seems convinced that he is arguing a sound defense, some critics argue that Lauro just admitted to what the case is accusing the president of doing.

Even John Eastman has admitted Option D was a crime. Maybe Trump is going for an incompetence council argument.

They are all there for the exposure so they can make more money.

The only time an attorney should be on national TV is if the issue is political (such as during an impeachment). Otherwise both client and attorney should just clam up and save it all for the jury. You don’t want to tell the prosecutor what you arguments are going to be – so they can plan and counter you from day 1.

Yes the incompetence is astounding. However, as I understand it, the the argument has to be based on things that were not done to defend – that could otherwise have gotten the defendant free.

More evidence that the Republican Party is a Trump cult:

https://www.ipsos.com/en-us/reutersipsos-survey-despite-indictments-trump-leads-primary-field-desantis-loses-support

Under half of Republicans (45%) say they would not support Trump if he were convicted of a felony by a jury, while over one in three (35%) say they would support him, and 20% don’t know what they would do.

Though, more Republicans would support Trump (35%) than an unnamed candidate (19%) if he were convicted of a felony by a jury.

Similarly, half of Republicans (52%) say they would not support Trump if he was currently serving time in prison, while 28% say they would support him, and 20% are not sure what they would do. Half as many (13%) would support an unnamed candidate in prison.

Even if a jury convicts Trump of trying to overturn our Democracy, a large number of them would still want this criminal to be President.

@ pgl

Now comes the moment of truth. You weren’t at Union Square today beating up people for a PS-5 were you??

Fortunately I was in Brooklyn. That broke my heart as Union Square is one of my favorite spots in Manhattan.

“The madness of crowds” or “The madness of youth” or the “Madness of….. ” ?? Ohp!!!! can’t say that last one anymore, even though our own eyes saw who 90% of them were. Naaaahh!!!! I am sure, if say, Donny Osmond had offered free PS-5s it would have attracted the same crowd.

Did I hear this correctly? Trump has made Mark Levin his attorney? Oh well this Fox and Friends rant may be why:

https://www.msn.com/en-us/news/politics/mark-levin-goes-off-on-bill-barr-weasel-mike-pence-this-indictment-is-crap/ar-AA1eLQME

Ah Marathon man. great movie even better was Olivier’s retort to Hoffman on acting.

Poms are simply better at acting than Yanks

As an American, I would agree, generally speaking. I would say if you did a complete top-down approach British actors tend to be better trained. But if you honestly made a top 30 list of the greatest actors of all time, excluding the classically trained Paul Hogan of course, and Margot Robbie as “Barbie” (America can’t be held to “too high” of a standard after all) , can you honestly say there would be more Brits than Americans?? I’d love to see your version of that list.