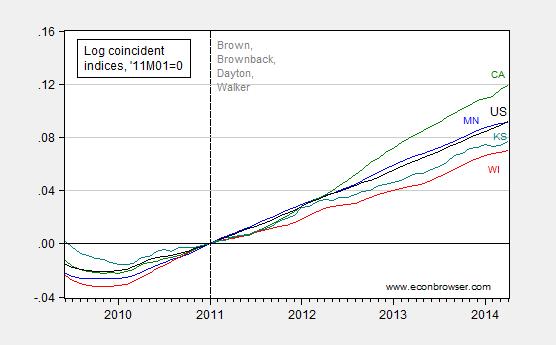

The Philadelphia Fed has just released coincident indicators for state economies. No turnaround for Wisconsin — it continues to lag Minnesota and the Nation.

Figure 1: Log coincident indices for Wisconsin (red), Minnesota (blue), Kansas (teal),California (green), and US (black), all normalized to 2011M01=0. Source: Philadelphia Fed coincident and leading indices for April, and author’s calculations.

See this post for implications from last month’s leading indices, in which WI and KS will virtually tie (for poor performance).

As of 2014M04, the cumulative growth gap since 2011M01 between WI and MN (and the US) is 2.2%. The gap between WI and CA is nearly 5% (all in log terms).

It’s a huge argument for the over-valuing of small effects. The complete data for all the states show no real trends, if you divide up by type of policy approach and so on. Three deep South states are doing the worst but some are doing well and a bunch of Democratic run states are also on the high side with none on the low end.

All this time and energy screaming about policy and the choice of one matters very little compared to the other policy alternatives.

Jonathan, The claim made by Walker WAS for substantively significant improvement. In other words, Walker made a strong prediction about expansionary austerity. Yet, it is clear that Wisconsin did not expand compared to the baseline of the US. He is referring to set of predictions made loudly and repeatedly that have failed. So you cannot say “well, Wisconsin did not fall so far behind”. Austerity is contractionary in a recession, not expansionary and there is no better test of this than at the state level. (As for statistical significance, in an older post, he showed these were statistically significant differences.)

I still think these are the best posts in the econ-blogsophere because they cut through all the bullying and pontification, and simply show in one graph a dispositive test of the main policy debate of the last five years.

Awesome job, Menzie!

There may be some variation of industries between the two states, where some industries have grown faster and some slower.

Also, it seems, Minnesota has a more educated population and higher per capita income (about $6,000 a year more than Wisconsin).

America’s Best (and Worst) Educated States

October 15, 2012

“Nearly one in three Minnesota adults aged 25 or older has a bachelor’s degree or higher, the 10th-highest percentage in the country.

Just 4.7% of adults had started — but not completed — high school, compared to the 8.1% of adults who fell into that category nationally.

Just 8% of Minnesotans 25 or older do not have a high school diploma, compared to the 14.1% nationwide.

However, among states with the most college graduates, Minnesota has fewer adults who go on to the next level of education. Only 10.5% of adults have graduate or professional degrees, the 17th highest nationwide.”

When Wisconsin’s taxes fall below Minnesota’s wake me up.

Kansas lawmakers raised taxes and in 2012 there was a voter tax revolt. The legislature in Kansas was filled with strong fiscal conservatives who have now been moving the state in the right direction. If you can see more than a few months in the future you might make note of this.

One of the most serious failures of modern economics is the failure to learn Hazlitt’s economics in one lesson. It is simple. Consider economic incidents over all economic sectores it touches and consider it over the entire life of the economic event. There is a lot of bad economics out there that is short-term narrow thinking.

Ricardo perhaps you don’t keep up on the fortunes of Kansas. Please explain the following to me in terms of “the right direction”?

1. Kansas stood among 10 states with revenue declines for the first half of fiscal year 2014, according to a new report by the Nelson A. Rockefeller Institute of Government at the State University of New York. Of those states, Kansas saw the second-biggest decline. The drop-off followed income tax cuts that began in January 2013. These are the top 5 states that saw revenue declines in the first half of the current fiscal year, which started July 1: Alaska 31.9 percent; Kansas 7.3 percent; New Hampshire 6.4 percent; Arizona 5.2 percent; Kentucky 2.9 percent.

2. According to the Kansas City Star for May 5 the news turned worse when April tax collections fell $93 million short of estimates. Overall, state revenues are down $480 million for the first three quarters of the current fiscal year. The state’s budget is about $15 billion.

3. On May 5th, Moody’s Investors Service chopped Kansas’s bond rating from Aa1 to Aa2, its third-highest rating.

4. Moody’s also said its analysts were concerned about the budget impacts of more than $100 million in new spending on schools ordered by the state Supreme Court and millions the state will have to spend on pension services. Kansas carries $16.7 billion in unfunded pension liabilities.

5. Simultaneously Moodys cut the bond ratings on the state universities.

OH and it’s time for you to WAKE UP!!!!! Here from the Minnesota Tax Foundation, certainly no liberal think tank: “Tax Freedom Day is the day when Americans finally have earned enough money to pay off their total tax bill for the year. In 2014, Minnesota taxpayers worked until April 29th (5th latest nationally) to pay their total tax bill. The Tax Freedom Days of neighboring states are: Wisconsin, April 22nd (ranked 13th latest nationally)”

Now that you’re up, you’re welcome.

Ricardo There is a lot of bad economics out there that is short-term narrow thinking.

There’s also a lot of non-thinking out there…especially in Kansas. Just how long-term do you have to look out before you can declare something a failed policy? Telling us that Gov Walker’s policies and Gov Brownback’s policies will lead to better growth 10 years down the line is both useless and untestable. You haven’t even advanced a coherent theory that would tell us why tax cuts for the rich would help long term growth. This is what I meant by mumbo-jumbo economics. Look at the graph. Both Wisconsin and Kansas are doing worse than the country at large, not better. This trend has continued unabated for over three years. What kind of empirical evidence would convince you that tax cuts for the rich and rentier classes are not the cure for every economic problem? As I’ve said before, there’s not a lot that governors and state legislatures can do to overcome larger macroeconomic forces. Dealing with the business cycle is primarily a job for the federal government. But there are lots of things that governors and state legislatures can do to make things worse than they otherwise have to be. Walker and Brownback seem to be going out of their way to find the dumbest, most hurtful policies imaginable.

Ricardo: Wisconsin’s personal tax rate (4.40-7.65%) is already below Minnesota’s (5.35-

7.759.85%). So feel free to wake up.Professor Chinn, Minnesotastan highest rate is now 10% for

the highest bracket.

http://www.revenue.state.mn.us/individuals/individ_income/Pages/Minnesota_Income_Tax_Rates_and_Brackets.aspx

Hans: I stand corrected; I have edited accordingly my comment. But this means that Ricsardo really needs to wake up!

You are most welcome, Professor Chinn.

In the link below, that shows a map of state tax revenue growth, Minnesota and Wisconsin are mentioned:

• Minnesota’s tax revenue first surpassed its 2008 peak in 2011 and was 20.6 percent higher by the end of 2013. After raising taxes on high-income earners that year, the state trimmed taxes during the 2014 legislative session in response to a predicted surplus.

• Of the five states where tax revenue dipped the least after the recession—Arkansas (-4.0 percent), Iowa (-6.5), Wisconsin (-6.7), South Dakota (-7.4), and Kentucky (-7.4)—only Kentucky’s tax collections had not fully rebounded by the end of 2013, after adjusting for inflation.

http://www.pewstates.org/research/analysis/state-tax-revenue-grows-but-a-full-recovery-eludes-26-states-85899545362

Is it possible Wisconsin actually had a milder recession and therefore a slower recovery?

For example, Minnesota had a more severe downturn in home prices and a stronger recovery than Wisconsin:

http://research.stlouisfed.org/fred2/series/MNSTHPI

http://research.stlouisfed.org/fred2/series/WISTHPI

Short of estimate because some bureaucrat failed to properly forecast the effect of a one time fiscal cliff in fiscal 2013. Darn that trend line. But oh, because the professional forecasters were way off resulting revenues well below estimate it’s outrageous that a politician’s predictions were off. (Who is advising the politician)?

Most hurtful? Illinois was around $607 million short of estimate after April. Oops. Illinois only wishes it had a bond rating like Kansas’s rating (Illinois having the worst in the nation). Oh, that’s right. We’re supposed to be comparing Wisconsin to California (but not Texas because Texas makes California look bad). Wouldn’t it be nice if Wisconsin had wine country, a federally funded phantom high speed rail system, and proposition 30 taxes on silicon valley stock options to carry the day?

Sorry Wisconsin and Kansas, no oil, no condensate, no natural gas liquids, no Facebook or Apple. Fix the structural imbalance but certainly don’t borrow ideas from the Democrat party in Illinois.

The job of the federal government? Uh huh. Setting aside the federal reserve, what does our federal government do anymore? Care not at the VA? Bounce astronauts from a trampoline to the international space station?

You know nothing, too.

I doubt that Brownback’s economic policies can ever fail – being directed by God to shower favors on the rich and connected as they are.

Thanks guys for pointing out the massive increase the Democrats have placed on Minnesota. I didn’t realize they had increased the confiscation so much.

Actually I meant debt per capita, but it was actually a fortuitous mistake. I am awake now with these huge Minnesota tax increase. The Walker budget is actually intended to reduce the spending burden on Wisconsin residents. Thanks to the previous Democrat government in Wisconsin the debt burden is almost twice that of Minnesota.

Debt per capita

Minnesota $1,236

Wisconsin $2,144

But that would not explain the change since Walker took over in a way that supports expansionary austerity. We are looking at change since Walker took over compared to other states. The only way it explains what happens is if Walker’s debt reduction plans (austerity, basically) have failed. As I said, it is as near of a dispositive of test as we can get. Simply put, austerity in a recession is contractionary. Look at the damn graph!

Could the superior performance of Minnesotastan over it’s

neighbor be a function of education?

Governor Walker, has no college degree unlike our brilliant

Mark Macy Dayton who has a graduate degree from Yale!

Yale, should be very proud of this graduate and what he has

accomplished spending his entire work life in the performance

of public service.

Just the other day, President Yellen, in Yankee Stadium, assured

graduating students – that their schoooling was a great investment.

One student had a sign saying – monetize us, so we don’t go bust.

Professor Chinn, I wish you would do a comparison between

the Badger state and Illinois, their direct southern neighbor.

http://www.forbes.com/sites/travisbrown/2014/05/23/a-legislative-blunder-in-illinois-that-may-cost-each-worker-1100year/

Hans: IL outperforms WI by 2.3 ppts…

Time to really wake up Ricardo.

http://m.lacrossetribune.com/vernonbroadcaster/news/opinion/local-op-ed-walker-balances-the-budget-by-borrowing-billion/article_b87178a2-9c71-11e2-9537-001a4bcf887a.html?mobile_touch=true