Roger Farmer has taken a new look at an issue concerning the Federal Reserve’s program of large-scale asset purchases (referred to in the popular press as “quantitative easing”) that I’ve been discussing on Econbrowser and in my research with University of Chicago Professor Cynthia Wu for some time.

One theory of how LSAP might affect interest rates is that if the Fed takes a large enough volume of long-term securities out of the hands of private investors, the drop in net supply could in principle lower the yields on those securities. In the years since the collapse of Lehman in September 2008, the Fed’s total assets more than quadrupled, and the Fed’s share of the total Treasury debt that was held in the form of longer-term securities increased significantly.

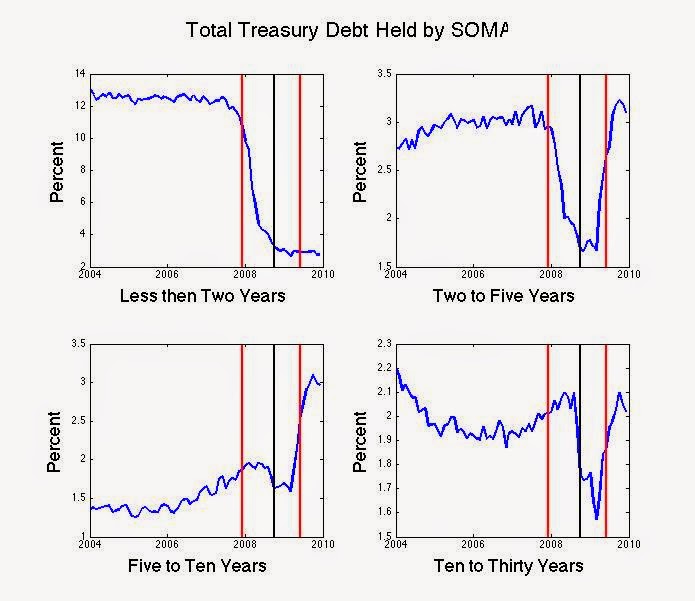

Percent of total Treasury debt held by the Federal Reserve in different maturity categories. Red lines mark beginning and end of the recession, black line marks Sept 2008. Source: Roger Farmer.

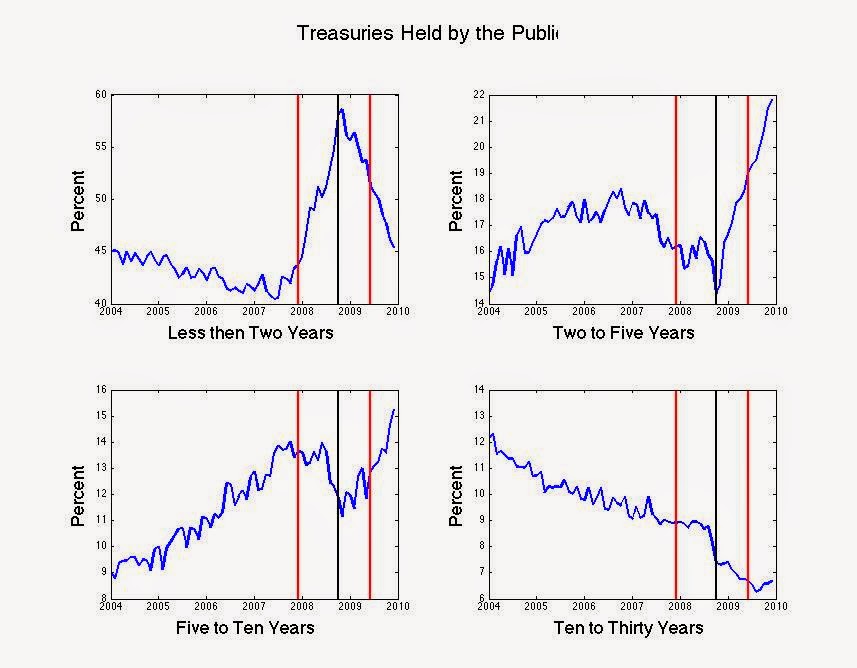

But at the same time that the Fed was buying long-term Treasury debt in order to take these securities out of the hands of private investors, the Treasury was significantly increasing the fraction of debt that it issued that came in the form of longer maturities. The net result was that the fraction of Treasury debt that was of 2-10 year duration and that was held outside of the Federal Reserve actually increased significantly, despite the Fed’s bond-buying efforts. Thus according to one theory of how LSAP might affect the economy, all the Fed’s LSAP accomplished was to incompletely offset a contractionary impulse originating from the Treasury’s separate maturity issuance decisions.

Percent of total Treasury debt held by the public in different maturity categories. Red lines mark beginning and end of the recession, black line marks Sept 2008. Source: Roger Farmer.

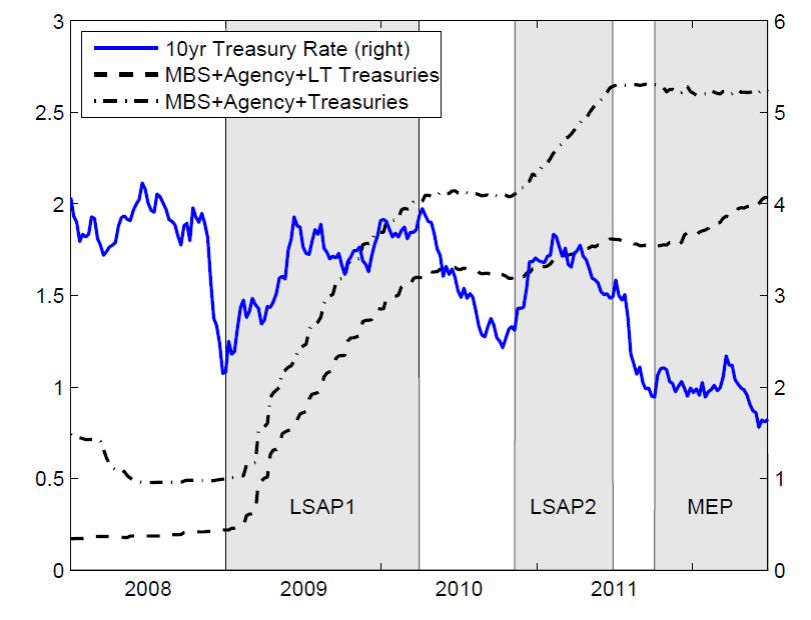

A number of researchers have documented that on the days that changes in LSAP policy were announced there were noticeable changes in long-term interest rates; see for example Christensen and Rudebusch (2012). This evidence suggests that LSAP did indeed matter for yields. Notwithstanding, at the Fed’s Jackson Hole conference two years ago, Columbia Professor Michael Woodford noted that the net move in long-term interest rates over the entire duration of these programs provided little evidence to convince the skeptics. The 10-year yield actually rose between the beginning and end of the Fed’s first bond-buying program (LSAP1). The common interpretation is that some of the declines in the yield prior to the first purchases were actually a response to announcements and anticipation that the program was coming. Even so, any effects during the year of the program were evidently outweighed by other factors influencing bond yields that were changing at the same time. Nor are effects during the actual period when the Fed was engaged in its second bond-buying program (LSAP2) nor its deliberate effort to extend the maturity of its portfolio (MEP) particularly easy to spot in a long-term graph.

Yield on 10-year U.S. Treasury bonds, Jan 1, 2008 to Aug 11, 2012. LSAP1: Jan 5, 2009 through March 31, 2010; LSAP2:

Nov 12, 2010 through June 30, 2011; MEP: October 3, 2011 through last date in figure. Source: Woodford (2012).

The market’s response in the minutes following new announcements about the Fed’s bond-buying program make it hard to deny there is some effect. For example, last year yields rose sharply attributed in part to speculation that the Fed would soon announce a slowdown in the rate of bond purchases, which some observers described as the market’s taper tantrum. Nevertheless, developments in addition to speculation about the Fed’s LSAP plans also contributed to the rise in rates at that time.

The natural reconciliation of this evidence is that it was not the bond purchases themselves that moved the market, but instead it’s what the purchases signaled in terms of future Fed decisions on short-term rates. Federal Reserve Bank of San Francisco researchers Michel Bauer and Glenn Rudebusch have provided some interesting evidence consistent with that interpretation.

My view is that LSAP did have an effect, but that it was primarily through this signaling channel rather than a direct impact on bond markets of the Fed’s purchases of long-term Treasury securities.

Yes, the Fed raised “animal spirits” to facilitate nominal growth, which facilitates real growth.

The Fed deserves a lot of credit (pun intended) learning from the Great Depression (although, the U.S. was on the gold standard) and Japan’s liquidity trap.

Since the easing cycle began in late 2007, the Fed stimulated growth through lower interest rates for households and firms, along with creating a “wealth effect” (in asset markets) to induce demand and reduce saving, in the attempt to generate a self-sustaining cycle of consumption-employment.

The Fed has raised living standards for the masses substantially, ceteris paribus, because smoothing-out business cycles results in a higher level of growth.

Quantitative easing or accommodative monetary policy stimulates demand, e.g. through lower interest rates for consumer borrowing (which reduces monthly payments and raises discretionary income), refinancing mortgages at lower rates, a lower cost of capital for businesses, including for business start-ups and expansions, higher home prices and more home equity, more money in retirement accounts (to reduce saving for retirement – both bond and stock prices rose substantially), etc.

Raising output = income, raises income = consumption + saving.

Lower interest rates and higher bond prices stimulate growth.

Yield Curve:

http://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

The primary objective of QEn+1 was to liquefy the balance sheets of the largest insolvent Too-Big-to-Exist (TBTE) primary dealer banks via the Fed effectively printing fiat digital book entry bank profits, permitting the TBTE banks to fund unprecedented deficits to GDP to prevent nominal GDP from contracting in a Great Depression-like collapse.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=IoY

That process of balance sheet restoration is done, as combined bank cash and securities holdings are now at par with real estate and consumer loans, i.e., those loans that had the highest charge-offs and delinquencies.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Ip1

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Ip2

Yet, despite $3.5 trillion printed by the Fed and $7.3 trillion borrowed and spent by the Federal gov’t, real final sales per capita, real wages, money supply less bank cash assets/reserves at Fed banks, and total employment is only back to the levels of 2007-08.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Hr1

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Ip4

Moreover, as a result of the ~$11 trillion printed and borrowed and spent, since 2009 the aggregate of the growth of the labor force and labor productivity has gone nowhere per capita, a trend that is likely to be the Peak Oil-, debt-, and demographics-induced “new normal” for the “secular stagnation” of the hyper-financialized, deindustrialized debt-deflationary regime at the onset of the post-Oil Age epoch.

@PeakTrader: Real final sales per capita are no higher than in 2007-08, therefore there has been no increase in “the living standards for the masses” peak to peak for the cycle, whereas the so-called “wealth effect” applies only to the top 1-10% who hold 40-85% of US financial wealth.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Ip7

Total stock market cap is in an even larger bubble to wages and final sales than in 2000 and 2007.

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=HFK

Moreover, the annual change rate of the US real median house price again entered historical bubble territory in 2012-13 in excess of real wages per capita (owing primarily to speculative cash buyers bidding prices in the previously bubbly locales), as occurred in the late 1970s, late 1980s, and the 2000s bubble. The real house price fell for 5-7 years thereafter following the previous bubble peaks.

All bubbles burst. The largest bubbles burst spectacularly. The Fed, facilitating the desires of its owners, the TBTE banks, has been instrumental in increasingly financializing the US economy (and now the world), blowing successive financial bubbles that inevitably burst, requiring ever-larger gov’t intervention, increasing public debt to bail out the financial system, and increasing scale of successive financial bubbles thereafter.

Praising the Fed and fractional reserve lending for its successive financial bubble pumping and post-bust rescues over the past 40-45 years on behalf of the TBTE bank benefactors is like lauding a heroin dealer for getting you high, addicted, and for increasing your smack supply every time you come down hard. Eventually you either die prematurely or give up the dosing and turn in the dealer for assisting you in destroying your life and that of others.

At present, the pernicious effects of the parasitic TBTE banks, aided and abetted by the Fed per its charter, are killing the US economy, being permitted by the gov’t they have captured to become unfathomably wealthy and powerful to the point of being untouchable, not unlike bosses of a criminal syndicate.

BC, monetary policy is a crude tool. It doesn’t micromanage the economy or helps only the rich.

You assume it’s ineffective or counterproductive, because you ignore the negative forces, or headwinds, outside of monetary policy.

For example, at the beginning of last year, a massive contraction in fiscal policy began, raising both federal tax revenue and reducing federal spending, substantially.

The Fed wasn’t getting the help it, and the economy, needed. You can’t blame the Fed for doing what needed to be done.

«The primary objective of QEn+1 was to liquefy the balance sheets of the largest insolvent Too-Big-to-Exist (TBTE) primary dealer banks via the Fed effectively printing fiat digital book entry bank profits, permitting the TBTE banks to fund unprecedented deficits to GDP to prevent nominal GDP from contracting in a Great Depression-like collapse.»

You forget (or implicitly include in “liquefy”) another large help that the Fed Board has given to the TBTE banks: they have provided zero-cost unlimited lending only to banks, which has allowed the banks to price lending to their customers to far higher than their cost of funding, widening spreads and bank profits massively.

According to a well observant person Greenspan had started the LIBOrization trend by “massaging” the so called “prime rate”:

http://www.interfluidity.com/posts/1160447599.shtml

«the spread between the Federal funds (and Treasury bill) rate and the prime rate widened from 1 1/2% to 3% in 1991. That was Greenspan’s gift to the banking sector to insure that major banks would not fail.

You may recall at the time that rumors were rife — including some repeated on the floor of the House — that Citibank was about to go under. By doubling the margin between the prime and the funds rate — and essentially increasing the profitability fourfold after taking into consideration the costs of processing loans»

The goal of the Fed Board has been to make sure that the costs of recapitalizing the TBTE banks have been paid by the poorest residents, debtors, not by the relatively rich federal income tax payers, or even worse, voters who are the usually the richest 50% of citizens, or campaign donors who usually are the top 5% by wealth of citizens.

No discussion about how the Fed actions allowed the Federal Government to continue high levels of spending without incurring the debt penalty of “normal” interest rates?

As I’ve said here before, looking to interest rates is a fool’s errand. That’s not going to tell you anything reliable about monetary policy.

By a fortuitous coincidence, Scott Sumner has a post up at Econlog explaining why interest rates aren’t useful as an explanation of the ease (or not) of monetary policy;

http://econlog.econlib.org/archives/2014/08/never_reason_fr_3.html

One theory of how LSAP might affect interest rates

I like the way that’s phrased. “One theory…” I’ve always thought that part of the problem with QE is that there were too many competing theories, which hardly seems consistent with an announced policy of transparency. To be clear, I fully supported any Fed actions that would have either lowered long term rates or raised inflationary expectations, or even both at the same time. But it was never entirely clear to me just how the Fed saw the transmission mechanism by which QE would support aggregate demand.

In terms of Fed operations, I would focus on their MBS purchases. They are large – current Fed balance sheet has $2.4T in Treasuries and $1.7T in MBS (http://www.federalreserve.gov/monetarypolicy/files/quarterly_balance_sheet_developments_report_201408.pdf) It’s not an analytical exercise, but imagine what the housing market would have looked like had the Fed held mortgage rates low. You get two developments from low mortgage rates. First is that buyers dollars go further, helping home prices. Second, you have a massive refinancing boom, cutting everyone’s interest expense significantly (going from 5% to 3% is a 40% reduction in your interest costs.) Some of that reduction in expenses got spent somewhere else. I would say, absent Fed intervention in the mortgage market, home prices would be considerably lower, and the knock on effects would be negative and quite substantial.

Winstongater

This I think is a key sectoral effect. Even a movement of less than 100 bps (ie LT 1%) has a significant impact on household budgets and the housing market.

«I would say, absent Fed intervention in the mortgage market, home prices would be considerably lower, and the knock on effects would be negative and quite substantial.»

They would be negative *for relatively wealthy speculators*, and rather positive for most people of modest income and means for whom their house is a cost (rent, for example), not a source of endless tax-free capital gains cashed in easily with home equity extraction debt.

If the Fed Board (and the Bank of England) had not worked hard to redistribute income and wealth from poorer resident to richer residents and corporates, by pushing up real estate and other asset prices by any means necessary, probably the bigger banks would have eventually had to admit that the value of the collateral “guaranteeing” their credits was not sufficient, and would have had to take enormous accounting losses, wiping out their bonus pools (and capitals).

This would have broken what I call the “debt-collateral spiral”, which has been the main economic and monetary policy of the past 20-30 years, where booming credit boosts asset prices, where the increased asset prices can support another round of booming credit, with massive profits for credit salesmen and asset owners (and strippers).

Putting a few trillions of insolvent or otherwise risky assets in the generous hands hands of the Fed Board, which does not need collateral, has allowed a few other turns of the debt-collateral spiral, leading to ever greater (until it all blows up) asset prices and debt.

The usual careeer-oriented well comapensated “experts” have been singing loud that along the lines that “creating a “wealth effect” (in asset markets) to induce demand and reduce saving, in the attempt to generate a self-sustaining cycle of consumption-employment” has “has raised living standards for the masses substantially, ceteris paribus,”, which is a direct restatement of the discredited “trickle down” theory that when asset owners get bigger incomes, and the bigger the assets the bigger the increase, they spend a bit of it in the home country (most in luxury in tax-free fiscal paradises) and this employs a few more servants.

Lower interest rates can increase investment and give the impression that economic health is improving when there are asset values that can be tapped by the inflationists. Money enters the economy through the loan market, but when there is no collateral there can be no loan market. As in the Great Depression the increase in government spending and the debasement of the dollar significantly exchanges bank investment in bonds for bank excess reserves in cash. Whether the banks hold bonds or cash they have the ability to lend IF – and it is a big IF – there are qualified borrowers. The key to economic growth is production and asset values not pieces of paper with pretty drawings. QE has run its course and ZIRP is dragging the economy down. Sadly, the actions of our monetary authorities and congress and its regulatory bing have stagnated the economy and moved us to Japanese territory. Listen to Janet Yelen. If QE and ZIRP were the saviours of the world she should be cheering. Look at the papers presented at Jackson Hole and listen to the discussion. They certainly do not express a rousing success.

Many want to compare our current economic and political environment to the Jimmy Carter administration. Our environment is much closer to the Richard “I am now a Keynesian” Nixon that to Carter.

There are two economies: physical economy where goods and services are produced and exchanged, and money economy. The economy that raises standard of living at the fastest sustainable rate to the benefit of ordinary people is what I term the natural economy. In a natural economy, the money economy properly complements the physical economy. An important condition is that money and credit each grow at their proper pace, with the growth of credit roughly proportionate to the growth of the nominal physical economy.

Quantitative easing has caused the greatest disconnect ever seen between the money and physical economies. Like a huge hot air balloon come untethered. This post is titled: What did QE accomplish? Yet it focuses only on interest rates. Indeed, the price of credit is an important price. But only one of many, and not an answer to the question.

Even more importantly, this question does not address the downside of QE. Every decision humans make is consciously or unconsciously preceded by a look at both costs and benefits. What have been and will be the costs of disconnecting the physical economy from the money economy in a manner never before seen in history?

From the conclusion of Dallas Fed working paper #126 by William White (2012): ‘Moreover, ultra easy monetary policies have a wide variety of undesirable medium term effects ‐ the unintended consequences. They create malinvestments in the real economy, threaten the health of financial institutions and the functioning of financial markets, constrain the “independent“ pursuit of price stability by central banks, encourage governments to refrain from confronting sovereign debt problems in a timely way, and redistribute income and wealth in a highly regressive fashion. While each medium term effect on its own might be questioned, considered all together they support strongly the proposition that aggressive monetary easing in economic downturns is not “a free lunch”’.

White’s conclusion only scratches the surface of the unintended consequences of QE. They have been ongoing, and will surely shape our future in ways not yet foreseen. So I would pose a different and higher level question: What are the consequences of not discussing the unintended consequences of QE?

Good points, JBH. Also, see Hussman’s commentary below:

http://www.hussmanfunds.com/wmc/wmc140825.htm

Another consequence of panicked reserve expansion resulting in increasingly hyper-financialized asset bubbles to wages and GDP, intended or not, is that the larger the asset bubbles to wages and GDP, the larger the net claims on current and future revenues and profits, wages, and gov’t receipts, and the slower real growth per capita will be.

In fact, the hyper-financialized economies of the English-speaking world (and increasingly Germany and Asian city-states) has resulted in annual net financial flows to the financial sector exceeding annual growth of US nominal GDP, which is derivative of the larger condition in which cumulative compounding interest claims to total US credit market debt outstanding to term is now an equivalent of total private value-added economic output in perpetuity.

IOW, whether the Fed officials know it or not, or whether they know and have no choice in the matter, owing to their obligation to the TBTE banks, the successive asset bubbles facilitated since Greenscam have resulted in debilitating net rentier claims to non-financial profits, wages, and gov’t receipts, while encouraging non-productive rentier speculative rent seeking and reinforcing Third World-like wealth and income inequality.

The result is non-financial US corporate debt (increasingly to buy back shares) to wages and GDP and equity market cap to wages and GDP at the levels of 1929-30, yet the central bankers and Wall St. claim there is no evidence of financial bubbles. If the Fed officials have no obligation nor ability to recognize dangerous financial bubbles and the gross misallocation that accompanies them, then we can only expect that the Fed will permit the bubble to expand until one or more precipitating factors causes the bubble to burst with predictable consequences, including massive deleveraging and many trillions of dollars more printed to bail the TBTE banks while Main St. gets the consolation price of no growth of real final sales per capita and a falling living standard indefinitely hereafter.

Ok, it’s a heterodox view, but I’d say a pretty good model of the trend behavior of interest rates indicates that QE’s primary effect was to lower short term interest rates with, to leading order, no effect on long term rates (some graphs at the link — while I generally don’t agree with Cochrane, I did agree with him on the limited impact on short term interest rates):

http://informationtransfereconomics.blogspot.com/2014/08/in-which-i-agree-with-john-cochrane.html

Not seen any comment on the foreign exchange rate channel, but it is surely important.

Had US interest rates been higher, to attract more foreign buyers of US government debt, then the dollar would have been higher.

That means less imports and less import substitution.

The devaluation of the dollar must have been a significant factor in holding US industrial output up. Also in higher inflation, which in an environment of sticky nominal wages (Krugman has pointed out how wage settlements cluster on zero increase in the last 5 years) means you get higher (real) output (because your real interest rate, if not your nominal one, is more negative).

To say there are two economies, a physical economy and a money economy is absurd. You can eat little pieces of paper but they are not very nourshing, and you can build houses out of little pieces of paper but they are not very sturdy.

There is one economy and that is the economy of goods and services. Money is a tool that is used to facilitate the production and acquisition of goods and services to ease the discomfort of individuals. It is a dangerous delusion to believe that the tools used in the process are the end item. When we loose sight of the fact that money only has value when it can be exchanged for goods and services, we lose our foundation of a sound mnetary policy and embrace a delusion.. Do not be seduced by the love of money. It is the root of all kinds of evil.

Ricardo: One ounce of gold in 1913 = $18.92. Annual rate of gold production since 1913 not far below the economy’s rate of growth. Gold does not change its physical properties over time. Ounce of gold today about $1300. This 70-fold disconnect of money from gold proxies the secular disconnect of the physical economy from the money economy that went exponential after 1971. I use gold only as a proxy to make the larger point. Credit and debt are part of the money economy. The varying amount of credit and debt relative to a homogeneous unit of physical economy over time, both cyclical and secular, induces large untoward cycles in the physical economy. It goes without saying these unnecessary cycles are damaging. And the debt, once grown past optimal, presses down on growth potential a la Reinhart Rogoff. All this damage has its causal roots in the disconnect. Being educated in a fallacious paradigm makes this that much harder to see.

«One ounce of gold in 1913 = $18.92. Annual rate of gold production since 1913 not far below the economy’s rate of growth.»

Really? Really? So the *worldwide* stock of gold has grown as fast as *worldwide* GDP over the past 100 years?

Because as it is rather obvious the market for gold is worldwide, and demand for trade gold comes mostly from India, for historical reasons, and that goes all into long term storage. So comparing gold production worldwide to USA GDP seems rathtotal golder dumb to me.

Besides according the monetarist propaganda the velocity matters too, so you should take into account both worldwide stocks of and its velocity to compare to GDP. Velocity of gold is a difficult notion though because only a small part of it is traded, most is stored long term, so probably th velocity is very low.

Also, in not so recent times a lot of the price of gold is that not of physical gold, but of gold “certificates” and they seem to have multiplied vigorously :-).

«Gold does not change its physical properties over time. Ounce of gold today about $1300. This 70-fold disconnect of money from gold proxies»

That’s 4.3% compound over 100 years. Does not seem like a catastrophic rate of gold price inflation, consider a couple really huge wars in between and other “black swan” episodes.

«the secular disconnect of the physical economy from the money economy that went exponential after 1971.»

That “1971” seems to be a random obsession with goldbugs… Oh please. The really big turning point happened in 1994-1995, with every debt level and asset price curve in anglo-american culture countries steepening their slope rather glaringly. What caused the start of nation-scale debt fueled asset stripping in 1994-1995? Japanese ZIRP? Removal of capital ratios for “AAA” loans? The general climate of the Contract on America by Gingrich? But a lot of it is due to Rubin and Summers.

If there was a big turning point in the seventies it might have been the decline in USA oil production and the great oil price shock. Do people still remember long periods of gasoline rationing?

Here’s an interesting story about how the legalization of marijuana in the US is undermining the drug cartels in Mexico.

It illustrates how tricky monitoring the cost/benefit of policy changes can be. The major benefit of pot legalization may actually occur in Mexico, not the US.

Paradoxically, the legalization of pot may also prove President Obama’s most important and lasting legislative achievement. It is not because he led it, but rather, because he acquiesced in it, and it is the sort of thing that people may remember as characteristic of him (as a laidback guy), even if he didn’t do it. It may also represent the greatest benefit to the most people any of his policies.

https://news.vice.com/article/legal-pot-in-the-us-is-crippling-mexican-cartels

Steven Kopits, so, you’re a drug pusher. If I was in a foreign government intent on destroying the U.S., legalizing marijuana would be part of the strategy. There’s already massive propaganda on the internet about pot to brainwash more Americans into legalization.

And, if I was a pot smoker, breaking the law, I’d feel guilty about giving money to drug cartels, which marijuana is a small part of their criminal activities. Why make that part of their business legal and easier to promote?

It should be noted, the “War on Drugs” was a response to drug use reaching epidemic proportions in the ’60s and ’70s. It not only stopped the steep rise in drug use, it reversed it and contained it.

Spending $20 billion a year to prevent and reduce $300 billion a year in social costs, which include lost productivity, traffic & work injuries & fatalities, health problems & drug treatment, mental illness, unemployment, crime, domestic violence, child abuse, and other social services, means we’re not spending enough on the “War on Drugs.”

Drug Legalization: Why It Wouldn’t Work in the United States

By Edmund Hartnett, Deputy Chief and Executive Officer, Narcotics Division, New York City Police Department, New York

March 2005

“Former New York City Mayor Ed Koch described drug legalization as “the equivalent of extinguishing a fire with napalm.”

Joseph Califano, the author and a member of President Johnson’s cabinet, stated: “Drugs like marijuana and cocaine are not dangerous because they are illegal; they are illegal because they are dangerous.”

William J. Bennett, former director of the Office of National Drug Control Policy…”legalized alcohol, which is responsible for some 100,000 deaths a year, is hardly the model for drug policy.””

Alcohol on one hand and marijuana on the other is a powerful combination. Why compound a problem?

Examining the Impact of Marijuana Legalization on Marijuana Consumption

Insights from the Economics Literature

“From this review it is clear that total consumption will rise in response to legalization due to increases in the number of new users, increases in the number of regular and heavy users, and probable increases in the duration in which marijuana is consumed for average users.”

American College of Pediatricians, June 2010

Marijuana Use: Legalization Not a Good Idea

“The negative physical and mental effects of marijuana use are well documented. It’s associated with lower educational accomplishment, lower work productivity, increased risks of motor vehicle accidents, and heart and lung disease. All forms of cannabis are mind-altering drugs due to delta-9-tetrahydrocannabinol (THC), the main active chemical in marijuana. THC affects nerve cells in the region of the brain where memories are formed. This makes it difficult for the user to recall recent events. Chronic exposure to THC may hasten the age related loss of nerve cells. Marijuana impairs a person’s judgment, coordination, balance, ability to pay attention and reaction time. Cannabis use in adolescence is a predictor of depression in later life. Cannabis induces psychotic symptoms and cognitive impairment in some individuals. Numerous mechanisms have been postulated for the link between cannabis use and attention deficits, psychotic symptoms, and neural desynchronization. Studies indicate that it impairs driving performance in the same way alcohol does, with users displaying the same lack of coordination on standard sobriety tests. Marijuana is second only to alcohol as a factor contributing to traffic accidents involving loss of life. Students who regularly use marijuana have lower grade and test scores and are less likely to achieve personal goals. Marijuana smokers often jeopardize their future by engaging in risky practices or committing criminal acts.”

AMERICAN ACADEMY OF PEDIATRICS

Marijuana: A Continuing Concern for Pediatricians

“The abuse of marijuana by adolescents is a major health problem with social, academic, developmental, and legal ramifications. Marijuana is an addictive, mind-altering drug capable of inducing dependency. There is little doubt that marijuana intoxication contributes substantially to accidental deaths and injuries among adolescents, especially those associated with motor vehicle crashes, and is frequently involved in incidents related to driving while intoxicated. Adolescents who use marijuana are 104 times as likely to use cocaine compared with peers who never smoked marijuana.”

NPR: Mixed Results For Portugal’s Great Drug Experiment

January 20, 2011

“When Portugal decriminalized all illegal drugs in 2000, officials hoped to reduce addiction rates and drug-related violence. Today, more users are in rehab, but drug use is on the rise, and reporter Keith O’Brien says the policy has made the problem worse….”

When you legalize something, you get more of it.

Michael Woodford is at columbia (not Princeton), and was at columbia tow years ago as well.

Oops. Fixed now, thanks.

It’s a very complex topic but here’s a quick outline:

– There have been three kinds of US QE, each acting differently: purchases of agencies, purchases of Treasurys, and purchases of specifically long-dated Treasurys.

– All three increase M0 and M2, that is, they increase both the supply of reserves and the supply of commercial bank deposits.

– The increase in M0 is not very important because M0 was already in great abundance before QE was launched.

– The increase in M2 is very important as it means there must be found additional willing holders of cash. That’s what drives asset price increases; asset prices must rise till enough people/companies prefer to hold the additional cash supply.

– QE purchases of agencies are effectively loans by the Fed to individual mortgage borrowers through long chains of intermediaries. They drive down the spread of mortgage borrowing over base rates and encourage mortgage borrowing and refinancing. They can have a quasi-fiscal effect, boosting spending on real estate by increasing borrowing or on general consumption by reducing borrowers’ financing costs and freeing up disposable household income. They also provide an exit to others who hold on claims on mortgages; foreign banks especially have taken advantage.

– QE purchases of Treasurys are loans by the Fed to the US government. They alternative means of financing federal deficits, which replaces the sales of Treasurys to the public. QE doesn’t remove total Treasury supply because the scale of Fed Treasury purchases is never as big as the scale of the federal deficit. QE only reduces the growth rate of Treasury supply.

– QE purchases specifically of long-dated Treasurys can flatten the curve by reducing supply of that segment of the market, if the purchases exceed Treasury’s issuance. Or, as you suggest, they can simply be counteracted by Treasury altering its issuance mix to include more long-dated bonds. In any case there’s a limit to how much flattening can be achieved by reducing supply, as expectations of the future rate path still apply.

– You’re right that QE announcements’ main impact on long bond rates comes through changing expectations of the future rate path. But QE’s biggest effects are through the increase in M2 and resulting rise in asset prices, and through the affects of agency purchases on mortgage borrowing and refinancing.

«QE purchases of agencies are effectively loans by the Fed to individual mortgage borrowers through long chains of intermediaries. They drive down the spread of mortgage borrowing over base rates and encourage mortgage borrowing and refinancing. They can have a quasi-fiscal effect, boosting spending on real estate by increasing borrowing or on general consumption by reducing borrowers’ financing costs and freeing up disposable household income.»

This is such a wonderfully euphemistic, “aligned” description.

Expressed a bit more bluntly, the Fed Board has purchased at very high prices quite a lot of largely insolvent property debt, giving in effect gigantic tax-free capital gains to the holders of that debt and benefiting in a lesser measure real estate owners themselves, as the Fed Board is not in the habit of triggering repossessions, and thus keeping a lot of sales pressure off the market.

The sums involved are much, much bigger than any previous government investment in supporting jobs and wages, because obviously the productivity of real estate and derivative rentiers and speculators is so much higher than that of mere workers.

«They also provide an exit to others who hold on claims on mortgages; foreign banks especially have taken advantage.»

Why would anybody want to get rid of existing dollar denominated long-term fixed rate assets in a period of very low short-term floating rates, and with the dollar being pretty strong too? The only plausible reason is that they are worth pennies on the dollar and the Fed Board is keen to pay full price instead and stash the collector’s items thus acquired in obscure “special investment vehicles” like Enron.

Steven,

I am currently reading the two book series THE AGE OF REAGAN. One thing that is described is how Reagan won his run for Governor in California and it is something the Democrats under the rule of David Axelrod have used powerfully. Reagan understood that the independents and Democrats were in struggling. If he could hold his base of Republican voters in a block and then pick up just a reasonable percentage of others he could win easily.

In the words of our Defense Secretary the world is currently on fire. There are major events any one of which could cause serious damage to the US, but the Democrats strategy in the 2014 mid-terms is to ignore the serious issues. With the help of their minions in the press the issues are initiatives to legalize pot (an issue to motivate young voters and get them out to the polls), Ferguson (an issue to enflame racial unrest and motivate the black voters to turn out at the polls), immigration (create a crisis than then demigogue the issue to motivate Hispanics to get out and vote Democrat). All of this while the Republicans are as rapidly as possible alienating much of their base: Chamber of Commerce and establishment Republican attacks against the “Tea Party,” both the House and Senate Republican reelection committees pouring money into races to prop up losing progressive Republicans, and Republicans bickering at one another in both the House and Senate. The Democrats are pandering to their base and will probably turn it out. The Republicans are surpressing their base and will probably see a weaker turnout than they expect from the polls. It is amazing how the Democrats will throw the whole country under the bus to motivate their base to win elections while the Republicans simply repeat the truism that they are the stupid party. It is amazing that today Democrats can win elections but are horrible at governing while Republicans are better at governing but horrible at winning elections.

If the goal of QE is to lower interest rates, why are rates in Europe at record lows and the ECB has not used QE?

Anything that increases excess reserves will lower short rates, including CB lending to banks, as the ECSB mostly uses.

QE is a name for policies used to increase excess reserve volumes, which are usually done after short rates are already near zero, and are aimed at chasing savings into riskier assets, not at lowering rates.

QE3 and Twist had the goal of lowering the spread of long rates over short rates, which is another matter. I think Jim is putting too much emphasis on that secondary goal, when the primary goal was to chase savers into risk, which has clearly been very effective, albeit not necessarily for the long-term good.

Stephen wrote: If the goal of QE is to lower interest rates, why are rates in Europe at record lows and the ECB has not used QE?

You are joking, right? Draghi is quoted as saying the will do anything he can to stimulate spending, then he instituted negative interest rates.

That is my point. Draghi has achieved lower rates without resorting to QE. As far as chasing savers into riskier assets, I assume the German saver must feel the pressure with the 10-year German bond yielding less than 1%. If Draghi decides to implement QE in Europe, will the goal be to drive down the 10 year German bond yield to 0.1% ?

«Draghi has achieved lower rates without resorting to QE.»

I vaguely remember that the ECB, which should not buy directly EU government bonds, has been buying large amounts of bonds issued by “government sponsored” EU banks, which have used the loan capital thus raised from the ECB at very low rates to largely buy their governmment’s bonds at higher long term rates, as mandated or “suggested” by the “prudential” regulators of those “government sponsored” banks.

«when the primary goal was to chase savers into risk, which has clearly been very effective, albeit not necessarily for the long-term good.»

Depends on what one means by risk. I doubt very much that much capital has been chased into productive risk, into investing into businesses. Where are the business opportunies? If investment into productive capital, such a 20th century unfashionable idea, has happened long-term good may have happened.

But I think that lot of savings have been chased into the “risk” of ever ballooning asset valuations, which are obviously all but government guaranteed in the USA.

The crucial advantage of chasing money into boosting asset valuations (note I say “valuations” and not “prices”) is that higher valuations translate into higher collateral “mark-to-market” values, improving the look of the balance sheets of deeply insolvent holders of those financial assets (most first-world pension funds and other financial institutions), thus pushing onwards the debt-collateral spiral that has enriched so much debt salesmen (Wall Street) and their accomplices (short-term asset holders).

James Hamilton Stated:

How does this square with the the following statement on page 6 of Domestic Open Market Operations published by the New York Fed?

The NY Fed report was for 2013 OMOs. Sorry about the confusion.

JBH,

I want to return to your comment about two economies. Is there a transportation economy?

The economy is the act of man attempting to reduce discomfort. There is production where goods and services are created for this purpose and there are factors of production that enhance the production of these goods and services. If you confuse the two you distort economic thinking. Money only has meaning and value as a factor of production and must never be considered an end in itself. When money becomes an end in itself you get a distortion of resources toward money production and away from goods and services production.

Consider our economy today. In the past companies spend few resources on monetary issues. At most it was only a part of the responsibilities of an accountant or finance employee. Today no major company, especially if it is involved in international trade, ignores changes in the value of the monetary unit and its foreign exchange rate. A significant amount of labor resources are expended attempting to guess what the monetary authorities are going to do next and what the impact is going to be based on the actions they have already taken. Our current focus on money as an end item is wasting a huge amount of resources, and I have not even touched on the resources wasted on educating economic soothsayers or defending against fraud and dislocation caused by the need to hedge and resist confiscation. Seeing money as an end item leads to all kinds of superstitions.and inefficiencies.

Ricardo: I do not confuse the production of goods and services with land, labor, capital, and the know-how used to produce them. These concepts are all part and parcel of the physical economy. Nor at any place did I say money is an end in itself. Whatever you say about money as an end, true or not, deflects away from the insight I was trying to impart that the money economy and real economy have become disconnected. Your third paragraph makes my point.

I shall rephrase that paragraph of yours. In the past there was reasonably sound money. Over millennia, gold eventually came to be the form that that money took. Today the monetary unit is no longer gold. The monetary unit is now pure fiat. Today considerable resources must be devoted to keeping track of and trying to project the vagaries of the fiat monetary unit. Waste results.

If the elements of the money economy – unit of account, credit, debt – ran parallel with the physical economy as rails of a train track, the problems that concern you that relate to economics would not arise. You can perhaps better see this if you go back to barter. Barter ran on a perfectly parallel track right along with the production that was traded. Conceptually barter served the function of money, though the concept of barter is rarely looked at in this way. I’m simply decomposing “water” here to get at the deeper thing. The O of one side of the exchange and the O of the other side bonded tightly with the act itself, call that act H. I’m not claiming H, which is an act, is a medium of exchange. But certainly congealed within that act is trust. That same trust is just as an inherent a characteristic of money – which is a medium of exchange – as it is a characteristic of the act of exchange itself. Continuing with the story, money then came into being. Had money run on a similar parallel track, remaining tightly bound to the requisites of exchange, macro problems would have been minimal. Eventually credit entered the picture. Similarly as with money, if credit were tightly bound to the requisites of its economic purpose again problems would have been minimal.

Of course that was not to be. The element of trust necessary to sound money has been greatly eroded in going to fiat. Even more so with credit. This is especially so on the time dimension. That is, the transport of a medium of exchange from one time to the next before it can be used again. A unit of moneyness today cannot be relied on to maintain its purchasing power over time. Trust has been broken. The money economy has become disconnected from the real physical economy, be it goods and services, factors of production, or congealed wealth in the form of non-money assets.

Business cycles and far worse result from this disconnect. It is at the heart of the economic problem. I believe since you see money as a factor of production, you cannot get your mind beyond or around a corner to imagine this disconnect. I’ve thought hard on this trying to understand if money is a factor of production. I do not think so without stretching the concept. Some combination of the four factors I mention above is all it takes to produce any known good or service. Nor can any good or service be produced without one or more of these four. More generally, of course exchange also comes into play. But a long line of brilliant economists have isolated exchange as something quite separate from the process of production. On the other hand, can a Particle Accelerator be produced without any exchange taking place? I don’t think so. If exchange is necessary to this, then maybe exchange too is a factor of production! Which then opens the door for money being so as well. But where on the income statement and balance sheet is “exchange” debited or credited? And if we are to parse the concept of money so finely as to admit it as a factor of production, we must also recognize its many other characteristics which are in a different universe. That universe is what I am calling the money economy. The thing that has gotten so disconnected.

Today the monetary unit is no longer gold. The monetary unit is now pure fiat…Business cycles and far worse result from this disconnect.

The US business cycles under the gold standard were far worse than they’ve been since then, right?

Reading Sloan’s history of GM was instructive – GM was almost destroyed by a recession in the 1910’s that would have been called a Great Recession these days, but that recession is completely forgotten – it was rather smaller than many others.

Seeing money as an end item leads to all kinds of superstitions and inefficiencies.

That makes sense to me, but it doesn’t seem to fit well with a conservative business orientation.

Isn’t “money as an end” the very definition of the profit motive?

JBH,

Barter is direct exchange. Money is third party exchange.

When money comes into being credit comes into being. The very existence of money is credit. Credit is the provision of goods and services under the assumption that there will be a recovery of the value of the goods and services in the future. This can be a promise, or a contract. Money relies on both the promise and the contract.

So money is a tool. If the usefulness of a tool is reduced, production is destroyed and wealth is destroyed.