Wisconsin Department of Health Services indicates additional $760 million Medicaid expenditures for FY15-17. [1] This implies a further worsening of the 2015-17 biennium structural budget balance from -$1.8 billion (discussed here) to something like -$2.56 billion.

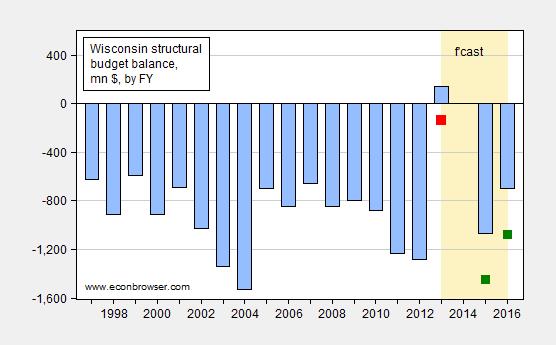

Figure 1: (Negative of) General Fund Amounts Necessary to Balance Budget, by Fiscal Year, in millions of dollars (blue bars); and estimate taking into account shortfall of $281 million for FY2013-14 (red square), and adding $380 million to each of the fiscal years in the 2015-17 biennium (green squares). “Structural” denotes ongoing budget balance, assuming no revenue/outlay change associated with economic growth. Source: Legislative Fiscal Bureau (September 8, 2014), Wisconsin Budget Project, “Wisconsin needs $760 million more for Medicaid,” Channel 3000 and author’s calculations.

In addition to a deteriorating budget situation, employment and output are lagging [National Journal}. BLS will report Wisconsin August employment on Friday, DWD I am guessing will release figures tomorrow. I do not expect anything to change my view that by January 2015, employment will undershoot Governor Walker’s promise of 250,000 net new private sector jobs by about 120,000.

http://www.jsonline.com/news/statepolitics/state-needs-760-million-more-for-health-care-over-next-two-years-b99352545z1-275286471.html

Sounds a bit more complicated than you f&#ked up, Gov. Walker. Were not individuals/families over the poverty level now eligible for subsidized federal insurance under the ACA? It seems like it is all falling back on the states to expand Medicaid and accept a temporary offset by the federal government. It’s a conundrum: lose federal payments if you don’t expand Medicaid; increase future costs if you do. Or is that incorrect?

Menzie,

A Medicaid problem sounds like an Obamacare problem. A $760 milion is a huge increase in expenditures. It is no secret that most of those signing up for Obamacare are being pushed into Medicare. What would this increase be if Wisconsin didn’t have to deal with Obamacare? Also consider that a free market health care system would not increase health service expenditures at all.

ricardo, give up your medicare and go find a free market policy for your age group. at any rate, why should i be subsidizing your health insurance? please fend for yourself.

To be fair, this is a budget request for 2 years to fully fund current level services. I have no idea what the history of such requests has been in the legislature. I would think they’d pay some, cut some services, rearrange some other things within their Medicaid program to try to cut that number down.

But it is important to note this is clearly for current level services, not any new services.

Also consider that a free market health care system would not increase health service expenditures at all.

That has to be the worse blog comment I have ever seen.

don’t confuse his ideology with facts!

Baffling,

How do you know that Ricardo may not have perhaps paid more than his fair share in Medicare taxes. Since all gross income is taxed for Medicare, if he exercised $10 million in stock options, and was no longer employed by the company related to the stock options, his Medicare tax is 2.9% of $10 million or $290,000. Not everyone on Medicare is receiving a subsidy.

AS, i’ll take my chances on the fact the ricardo is not a multimillionaire with $10 million in stock options. besides, there are many strategies available to circumvent these types of taxes-just ask mitt romney about his tax deferred accounts worth millions.

“Not everyone on Medicare is receiving a subsidy.”

this may be true. but on this blog i would imagine the most vocal critics of obamacare are being subsidized for their medicare health insurance.

Think of all the stimulus Wisconsin is providing to its depressed economy.

Spencer,

Please give a reason for your response to my comment “Also consider that a free market health care system would not increase health service expenditures at all.” If the government no longer has a Department of Health Services there would be no increase in expenditures. That is simply a given and cannot be argued.

Now we could argue whether free market health care would be less expensive that government run health care. It would be like arguing FEDEX and UPS vs the post office, but we could argue it. The fact that any government service costs more than the free market alternative is pretty much a given. After all who pays for all the crony socialists.

There is a correlation between health care costs and market involvement. The more a health system involves markets, the more expensive it is. Nations that have extensive govt involvement have lower costs.

Steve

Ricardo Have you ever read Kenneth Arrow’s famous paper on why free markets in healthcare don’t work? Oh wait…it’s kind of “mathy” so I wouldn’t expect you to read it. Your tastes run more towards econ taught at the sophomore level.

2slugs,

Obviously, you haven’t read it or you wouldn’t say its “mathy.” Arrow explains in plain English all his reasons why the health care market differs from the competitive model. He only employs mathematics in the appendix to prove a couple of statements about optimal insurance he made. You don’t need to know anything about mathematics to read and understand the main arguments of Arrow’s paper.

Baffling,

Are you also a tax expert in addition to a fortune teller? It is very difficult to shield most income from income taxes. What specific tax maneuvers are you ascribing to Romney? I would be interested in knowing what you know, having taught income tax.

as,

romney had an ira worth $20-$100 million as reported during his election attempt. how do you think you get an ira worth 10’s of millions of dollars?

http://www.bloomberg.com/news/2014-09-16/romney-sized-iras-scrutinized-as-government-studies-taxes.html

you think we employ all those tax lawyers so that folks ensure they have paid their taxes in maximum?

Ricardo: “A Medicaid problem sounds like an Obamacare problem. A $760 milion is a huge increase in expenditures. It is no secret that most of those signing up for Obamacare are being pushed into Medicare.”

Ricardo, Scott Walker refused to participate in the Obamacare expansion of Medicaid. Therefore there are exactly zero people from Obamacare being enrolled in Medicaid in Wisconsin. Walker’s Medicaid problems are entirely his own.

Bruce Hall: “It’s a conundrum: lose federal payments if you don’t expand Medicaid; increase future costs if you do. Or is that incorrect?”

No, that is incorrect. Haven’t you been paying attention? There was a very well publicized Supreme Court decision on this authored by Justice Roberts. The Supreme Court ruled that the Federal Government could not cut off Medicaid payments if states refuse to expand Medicaid. In addition, states are free to turn down extra Obamacare federal money if they don’t expand Medicaid.

Baffling,

One way you get a $10 million IRA is to have had a defined benefit pension fund. Terminate the pension fund and roll the pension money into an IRA. Remember the same tax laws that apply to Romney and other Republicans and Independents also apply to Democrats. For example, when Bill Gates formed his foundation, he enjoyed significant tax benefits. Warren Buffet is participating in a tax inversion investment. He supposedly will personally pay more income tax immediately, but perhaps will benefit even more upon an increased value of his investment due to decreased corporate income taxes resulting from the tax inversion. Both Gates and Buffett are worth significantly more than Romney.

Regardless of tax lawyers, folks with high incomes (Republicans, Independents & Democrats) pay a significant amount of income tax and as I say, please let me know what the methods are for avoiding income taxes. Avoiding is legal, evasion is not.

as, i am not arguing for anybody doing anything illegal. i simply suggest ways to avoid certain types of taxes-or a least minimize them. if i have the ability to move an asset into a tax exempt account at an undervalued price, then in the future i can fully value it with profits untaxed (think roth ira vehicles). i buy a bunch of swampland that i know will be developed in 10 years time, and move the cheap assets into my ira holding. when they mature i do not pay taxes on the enormous profit. there are plenty of ways to minimize my tax burdens-legally. i didn’t accuse romney of illegal activity. an executive with a large tax advantaged retirement account has simply found a way to minimize taxes. but you digress from the original concern, which was ricardo has paid a large sum of taxes and hence is not receiving a medicare subsidy. i don’t think so.

AS As I recall, Romney’s trick was to radically undervalue the IRA when it was created. And then investments were pumped into the fake IRA.

2slugs,

No, that is just the self-serving speculation of Romney’s political enemies that you recall. Romney did not release any details about the IRA other than the amount.

Baffling,

I am glad you seem to know so much about risk taking, investing and income taxes and fortune telling knowing Ricardo’s economic situation. I find most of your comments the same no matter what the topic. The original topic was Wisconsin, you are the one who diverted the topic, Again the tax laws you criticize apply to all citizens, not just one political group. Since you seem to have the strategy, are you taking advantage of the scenarios you list? You make it sound easy. Be careful buying the swampland with debt financing, this causes problems with your IRA. Also be careful about moving your swampland into an IRA, there are limits on what you can do on your way to becoming wealthy.

as, i’m not criticizing the tax laws. you seem to want to pick a fight. i simply noted the extremely high tax deferred retirement account held by romney as a real example of how one could have large income without paying high medicare taxes-as opposed to the hypothetical you posted about ricardo’s $10 million stock options. and i would not have a problem if he did have those stock options-good for him. but my guess is he does not. and neither do i. and probably you as well. so why are we at all concerned about the possible tax subsidy, or lack thereof, of a hypothetical situation none of us will ever encounter?

Yes, Baffling continues to make confident, precise statements about the personal details of people that he’s never met and can’t know anything about.

I’m not sure why he continues to comment on an economics blog when he seems to know nothing about economics. In fact, he’s never shown any expertise about anything that I’ve seen. He does a lot of name-calling though.

rick stryker, it was as who made the precise detail of ricardo sitting on $10 million in stock options, not me. I simply made the observation that it was highly unlikely the detailed description provided by as was correct. your complaint is with as, not myself.

as for know nothing commentary, your ideologically backed descriptions of how obamacare would collapse should make you questions your contributions to any economics blog.

Bruce Hall It’s a conundrum: lose federal payments if you don’t expand Medicaid; increase future costs if you do. Or is that incorrect?

No, that is incorrect. Over 10 years the federal government will pick up about 93% of the cost. The states will be responsible for the remaining 7%. However, in exchange for that 7% contribution the states are also being relieved of most of the responsibility for covering the currently uninsured. So on balance the net effect is to lower state expenses.

A lot of recent discussions about Obamacare, unemployment insurance, inequality, etc. aren’t really about the issues themselves for way too many folks on the conservative spectrum. Something else is just lurking beneath the surface. These issues just serve as a sounding board for the resentments of white conservatives against “those people” that they feel are undeserving. For example, that’s really the only explanation for the crazy demand that welfare recipients get drug tested. Economically it makes no sense whatsoever. But it’s all about kicking people when they’re down. Obama had it mostly right six years ago when he talked about how resentful white conservatives just cling to “gays, guns and God” issues. I would update that to say that they cling to “gays, guns, God and government giveaway” issues. It’s a deep rooted pathology with far too many of today’s conservatives. Unfortunately, the only cure is another “g” word…the graveyard.

Baffling,

I am not picking a fight, I am just saying that you seem to comment on subjects you know little about such as income tax laws. Regarding Roth IRAs you need to check the regulations. Generally it is not possible to put funds into a Roth that experienced tax benefits without repaying the tax benefits. Also there are limits on how much one can put into Roth IRAs and there are income limits that disqualify a taxpayer from enjoying the benefits of Roth IRAs. I assume that Romney’s IRA is a traditional IRA which means that he will pay ordinary income tax rates when he begins his mandatory withdrawals generally upon reaching age 70. If Romney’s income tax rates are higher in retirement than while working the taxes paid upon withdrawal will result in a higher tax bill than the original tax benefit. Also you do not know the financial situation of readers of this blog. Your assumptions may be wildly wrong. Regarding Medicare subsidies, even if someone grosses $50,000 to $100,000 and has done so for many years, the Medicare tax for the employee and matching employer is $1,950 to $3,900 per year. If one ascribes an interest factor to the premiums paid (future value of an annuity) which may be paid for 40 years prior to Medicare enrollment, the premiums may very well mean that the taxpayer may not be receiving a subsidy.

as,

i know you want to grandstand about your expertise with income tax law, so have at it. i was not trying to give a lecture on the details of tax laws-you were. you asked for an example of how romney could get around paying those taxes. i demonstrated how it can be done. again you are trying to pick a fight against arguments i never made. i simply stated how you could undervalue assets and place them into tax advantaged accounts, where the profits are no longer taxed the way they were in a regular account. this is what romney did. there is nothing incorrect about that description. but by all means keep giving lectures on income tax strategies if that floats your boat-i am always interested in ways to save a buck or two.

Medicare Tax

Meant to say $1,450 to $2,900 Medicare premiums for the $50,000 and $100,000 gross earned income amounts respectively.

Baffling,

Your strategies are nonsense and can’t be done. Stick to what you know. The IRS may have a bit to say about “undervaluing” assets and trying to use some sort of tax exempt strategy to subvert the tax system. The IRS has the ability to reconstruct transactions to account for the intent of the transaction rather than the structure of the transaction. If the IRS determines that the intent is to subvert the tax system it will impose taxes on the transaction regardless of the structure attempted. The IRS can also remove the tax exempt status of tax exempt organizations that try to “hide” income improperly in tax exempt entities. In addition, the IRS is ramping-up its efforts to review “unrelated business income” connected with tax exempt entities.

as

your complaint is with mitt romney and the irs, not me.

Baffling

No, my complaint is with your nonsense strategy of putting undervalued swampland into a Roth IRA, which cannot be done. The IRA must purchase the land directly from on outside party with cash that is in the IRA. In addition a self-directed IRA must have a plan sponsor that agrees with the purchase. Any self-dealing with the IRA by the IRA “owner” is not allowed. In order to establish a Roth IRA, the taxpayer must have earned income and if married filing jointly, must have modified adjusted gross income less than $188,000 as of tax year 2013. If one qualifies to establish a Roth IRA, as of 2013 the maximum cash deposit was $5,500 per year or $6,500 per year for those who are 50+. Roth IRAs thus are not designed for the rich folks, but for those in “normal” income ranges. See IRS Publication 590 or IRC Section 4975 for further information. My argument is with you, not Romney or the IRS on this issue.

It is legitimate for a defined benefit pension plan to be terminated and the funds to be transferred to a traditional IRA. When the funds are withdrawn from the traditional IRA, all withdrawals are taxed at ordinary income rates.

as,

again if you want to grandstand about your income tax experience, have at it. but you still need to pick your fight with romney, not me. he is the one who accomplished the task at hand. ask him the details. i just pointed out that it happened. you seem to be in denial of that.

Baffling,

Where does it say that Romney holds a Roth IRA with swampland or any other type of asset? As I have tried to explain, it is possible to transfer pension assets into a traditional IRA, the distribution of which will be taxed at ordinary income tax rates. What is your obsession with Romney and his IRA? He will pay his fair share of income taxes when he withdraws the cash. If he had held stock in a regular stock account that pays no dividends just appreciates (which is not a certain bet), he would be able to defer paying income taxes until he sells the stock and then pay a maximum long-term capital gains federal income tax rate of 15% rather than ordinary federal income tax rates approaching 40%.

I am not certain why you or the government is concerned (jealous) about how much someone has in a traditional IRA, the government will get its taxes, no one is going to escape paying taxes from a traditional IRA. Romney would not qualify for a Roth IRA, so when he reaches 70, funds will start flowing into the US Treasury from his required annual minimum withdrawals.

I don’t see what fight anyone has with Romney, he had to follow the tax laws as you or anyone else may do. You have pointed-out nothing except your ignorance. I have no idea about what the denial is that you are claiming. I understand that Romney has a reported IRA that has significant assets. Again where does any story say it is a Roth IRA?

You suggested a silly, nonsense transaction that needed to be addressed.

AS,

You will never get through to Baffling on anything. Romney clearly did not have a Roth IRA and attempting to put undervalued assets into an IRA is not even feasible, as you have pointed out. But I’d be interested in your opinion on this since you seem to have been professionally involved with taxes.

When I first read about Romney’s IRA, I found it quite puzzling, but not for the same reason as Romney’s detractors. Rather than lowering his taxes, Romney’s IRA looks like he’s maximizing his taxes.

Of course you are right that it’s possible to roll over a defined pension plan into an IRA. I’m considering doing that myself currently. Defined pension plans don’t have maximum contributions but they do have maximum benefits I thought. So I can’t see how a rolling a defined benefit plan could explain the size of the IRA.

I’m aware that there are some very large IRAs out there. But they tend to be Roth IRAs, not ordinary IRAs like Romney has. In those Roth situations, you often find that an entrepreneur may have taken the founding stock, which is worth very little at the time, paid tax on it, then put it into the Roth (as long as his income is low enough at the time). On the very rare chance that the start up works, the stock can appreciate in the Roth IRA and there will be no tax penalty when it’s withdrawn, thus reducing capital gains taxes. But that’s not what happened in Romney’s case.

Some people have speculated that Romney put some of the funds necessary to participate in his partnership interest into the IRA and that the IRA grew very rapidly from the returns on private equity. But that doesn’t make any sense either. By leaving them out of the IRA, the returns would be taxed at the lower long term capital gains rate (carried interest). However, by putting them into the IRA, Romney must take minimum withdrawals starting at age 70.5 and those minimum withdrawals will attract the the very highest marginal tax bracket. And, as you know, that minimum withdrawal amount rises every year. If that IRA is transferred to his heirs upon his death, they still have to pay the taxes. So, if this is what happened, it would maximize his taxes it would seem.

Do I have this analysis right? What’s your opinion on what’s actually going on?

Stryker writes:

“Romney clearly did not have a Roth IRA and attempting to put undervalued assets into an IRA is not even feasible, as you have pointed out.”

LOL. It is extremely easy to transfer undervalued assets into an IRA, to children, to wherever you desire if they are the right kind of assets.

And Bain Capital’s business involved massive amounts of the right kind of assets. The value of a business that is not publicly traded is very easy to lowball. The IRS can’t prosecute you for being “on the low side”, they have to show that your valuation is unreasonable to the point of being a violation. And, if you have a minority share of the equity, such that you effectively have no voice in how the business is run, the IRS allows a further devaluation of your share. Parents who have a business routinely take advantage of this when transferring shares in the business to children. The tax professional who told me about this said at the time that a 30% devaluation was generally accepted without question by the IRS. Non-traded equity shares in a highly-leveraged business can be valued at extremely low levels, because the book value can be a tiny fraction of company assets and the risk is high. Also, in such a leveraged situation, very modest changes in the accounting assumptions made could result in very large percentage changes in the book value.

AS might argue that such assets would not be “undervalued”, because the valuation placed on them were acceptable to the IRS. Fine, I won’t argue about how you define a term. I’ll just note that certain illiquid assets have a very wide range of valuations that would pass IRS scrutiny, and that, while running Bain Capital, Romney would have had the ability to structure deals so that some equity shares could pass IRS evaluation at the low end of that wide range. I will also note that Bain often did set up a special class of equity shares that were given a very low valuation and that were made available for purchase by Bain employees (and by the SEP-IRAs of those Bain employees) when Bain purchased a company.

Rick,

I have seen situations in which a consultant received stock options as part of a consulting fee. For example, one consultant received stock options at $0.75 per share and eventually exercised the options at $14.00. The consultant along with an actuarial company formed a defined benefit plan with the maximum amount allowed by law to defer taxes on the exercise of the options. When the consultant retired, the consultant terminated this one-beneficiary pension to save administration fees and rolled the amount into a traditional IRA which must begin withdrawals by age 70.5 as you mention. If the consultant had terminated the plan, paid the tax and then invested in something like an S&P 500 index fund, the consultant would be subject to capital gains tax rather than ordinary income tax on IRA withdrawals. It seems that the consultant may come-out a bit better by using the IRA than by terminating the IRA, paying the tax and investing in an index fund (assuming the same return for both situations). You can run the math better than I can, the beginning and ending tax rates are critical to the analysis.

To help with your tax and investment planning you may want to look at a book written by Myron S. Scholes and Mark A. Wolfson et. al. “Taxes and Business Strategy: A Planning Approach, 3ed. Prentice Hall (2005). There may be a newer edition. In the past Prentice Hall has included a chapter (18) from the book in its “Federal Taxation, Individuals” text (2007), written by Pope, Anderson and Kramer. The essence of the chapter is the comparison of four investment models, two of the models are an Exempt model (such as tax exempt bonds) and a Pension model (such as a traditional IRA). The conclusion is that the main reason to invest in a traditional IRA compared to using tax exempt bonds (during normal times) is if a taxpayer’s tax rates are higher when the deduction is taken compared to when the traditional IRA withdrawals are made. If a taxpayer’s withdrawal tax rates are higher than his/her contribution rates, it is preferable to use the exempt model, assuming the same earnings. I think you will enjoy the math presented in the text or chapter.

You may want to find a suitable CPA or tax attorney in your geographic area to explore strategies, perhaps after reading the book or chapter mentioned above.

AS,

The value of some out-of-the money options could certainly fit within the limits of a defined benefit pension plan and those could well grow to the reported numbers in the IRA, so that certainly makes sense.

On the motivation to roll into an IRA, just as a back of the envelope, if we define

A = current amount in the pension plan

T(N) = tax rate now

T(L) = tax rate later

r = growth rate of the amount

CG = capital gains tax later

So, there are two options:

1) Terminate the pension, pay the income tax, then put in an investment that grows at rate r until “later” and then pay the capital gains tax on that later. The final value of that will be A(1-T(N))(1+r)((1-CG)

2) Roll over into an IRA, put in the same investment that grows at rate r, than pay the income tax later. The final value of that will be A(1+r)(1-T(L))

So, you are better off rolling over into the IRA when

(1-T(L)) > (1-T(N))(1-CG)

For A very large, you will be in the highest tax bracket either way, so at the very least T(L) = T(N), and given the tax rates prevailing when this decision to roll into the IRA was made, it’s very reasonable to suppose that T(L) > T(N). So, you’d be better off rolling into the IRA as long as the capital gains tax rate CG > 0. This makes perfect sense as well and I think clarifies what likely happened. Thanks very much.

Thanks very much for the book recommendation too. It appears that there is a 4th edition now. I will pick it up.

rick and as,

so you both demonstrated how you can put undervalued assets into an ira or similar instrument to capitalize on its outsized growth. my point exactly!

as,

you simply wanted to pick a fight so you jumped on the roth ira as the tool. that was simply given as an example of a tax preferred instrument-and you knew that-but you wanted to argue for the sake of arguing. you avoided the bigger issue of the ability to grow those undervalued investment opportunities in a tax preferred vehicle so that you could cry over and over again about the roth ira. romney grew an outsized ira in this manner and you need to come to terms with that. you simply employ a bait and switch tactic. just like you saying ricardo is a multimillionaire, and then trying to criticize me for characterizing his wealth when i challenge your statement. not very noble.

Baffles,

The stock options in AS’s example are not “undervalued.” They have to valued at fair market value, which depends on the current price of the stock, the strike price of the option, the implied volatility of the stock, the maturity of the option, the current risk free rate, and the expected dividend stream. You can’t just put “undervalued” stock options in .

Baffling,

I don’t think you are capable of learning. The investments were put into the pension plan at the then fair market value. The risk is that the options may expire worthless. There was no assurance that the stock would rise in the example I gave. The company could have gone bankrupt or just done nothing. The company almost declared bankruptcy. The consultant took a big risk that the consultant’s work would save the company. Assets must be valued at fair market value when dealing with pensions or IRAs. If you own an IRA, you will receive a statement of FMV by the plan sponsor each year that is also sent to the IRS. Any manipulation of FMV would be severely addressed by the IRS.

Your ignorance knows no lower limit.

rick and as,

you are right. romney grew his ira to somewhere between $20 and $100 million dollars by funding his ira by around $5000 in cash per year, and then investing wisely in an s&p index fund. what was i thinking. you can easily grow that to $20 million dollars in a few years. maybe as was right to begin with, and we are all millionaires on this blog by now. at least you two keep me laughing!

Baffling,

How many times do we need to explain that most likely Romney had securities in his pension fund, perhaps stock options or partnership interests that were placed in his pension, or some other tax deferred account when the market value was low. The pension fund could have been in the $20 million + range due to the increase in value of the pension investments. He then terminated the tax exempt fund and then rolled the securities (subject to the IRA plan sponsor’s review) or cash into a traditional IRA at market value. Pension funds and other tax exempt funds are not subject to the same contribution limitations as IRAs.

as, this is the “most likely” scenario because you have proof it happened this way, or because this scenario makes you most comfortable?