Reasoned analysis and careful decisionmaking is required.

The Chinese Context

The global meltdown in equity markets certainly concentrated minds. But, as I observed before, I think it’s important to keep in mind the overall context in China, laid out by Jim in his post yesterday. Here are a few additional graphs, relating to GDP growth and industrial production.

Figure 1: Q/q Chinese GDP growth. Source: NBS via TradingEconomics.

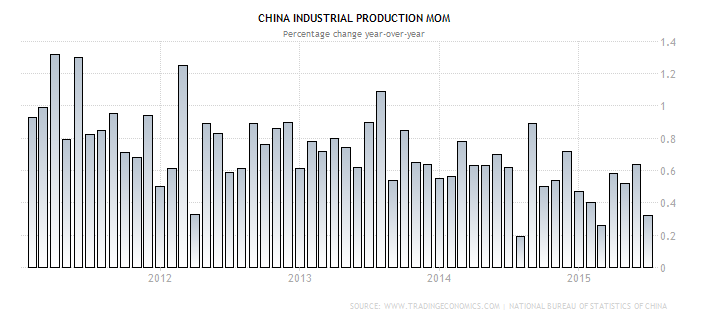

Figure 2: M/m Chinese industrial production growth. Source: NBS via TradingEconomics.

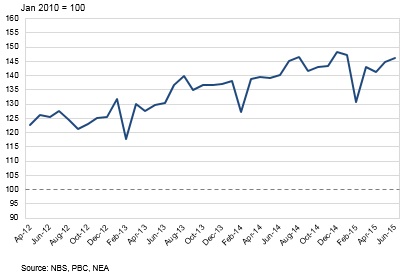

Of course, in China, statistics are difficult to interpret. An alternative indicator, looked to by those particularly wary of official statistics, is the Li Keqiang indicator, an unweighted average of electricity consumption, rail cargo volume, and bank lending (Jim shows the individual components of electricity and railway freight in his post).

Figure 3: Li Keqiang index. Source: World Economics.

No collapse, but surely not vigorous growth. Additional indicators here, here, and OECD.

One key point to remember about forecasting the Chinese economy is that – in my view – the politics matters more than the economics. That is economics is secondary to primacy of the Party. And that primacy depends on perceived legitimacy due to improving economic fortunes. Hence, Chinese policymakers will do what it takes to “satisfice”, i.e. hit a minimum growth level, even if it delays achieving the longer term goals of rebalancing the economy.

In this sense, I think Scott Sumner’s views on the impact of policy is more relevant in China than in the US. Recall, Professor Sumner believes fiscal multipliers are zero because the Fed will adjust its policies to hit a certain target output rate. I’ve never subscribed to this view, but I think it kind of describes the Chinese approach to macro policy: it will adjust policies to make sure it hits minimum level of output viewed as consistent with social stability.

You can see this in the aggressive moves in monetary policy to date:

Figure 4: People’s Bank of China base rate (left scale) and year-on-year CPI inflation rate (right scale). Source: PBoC and NBS via TradingEconomics.

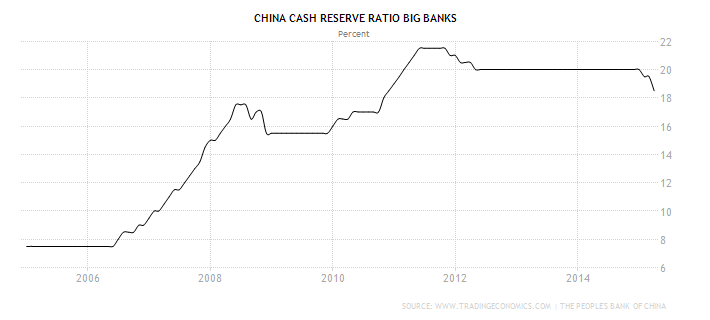

Figure 5: People’s Bank of China cash reserve ratio for large banks. Source: PBoC via TradingEconomics.

Obviously, China has room to loosen monetary policy (as well as exchange rate policy). Inflation is low (and PPI inflation is negative), and the PBoC could further reduce interest rates and the reserve ratio (which it’s indicated it will do).

Implications for the World

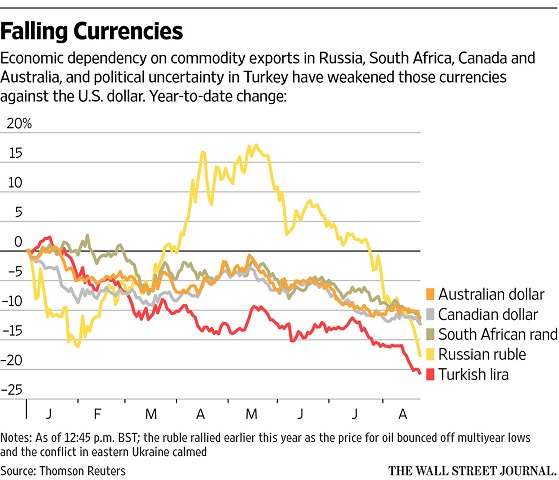

Commodity prices, which have been driven by China’s business cycle, have come down as expectations of growth decline. If my assessment of Chinese policymaker priorities are correct, growth should not slow too much more, putting a floor on commodity prices. I hope that’s correct, because commodity exporting emerging markets have been for years buoyed by Chinese demand. Should my (political) assessment prove wrong, then we should expect a lot more stress on emerging market currencies and foreign exchange reserves (even more than documented in this post).

Figure 6: Falling Currencies. Source: WSJ.

I anticipate further shifts of funds to US safe assets as herd behavior takes hold. [1] (See also Velasco/Project Syndicate.) In this sense, my biggest fears surround the potential runs of August. This is where US policy comes into play.

What Should the US Do?

A couple of years ago, Barry Eichengreen asked “Does the Fed Care about the Rest of the World?” His answer was – sometimes.

…[T]his longer perspective is a reminder that just because the Fed has not attached priority to international aspects of monetary policy in the recent past is no guarantee that it will not do so in the future.

My hope is that this time around, the Fed does put higher weight on the rest of the world. I’ve already recounted the reasons why the Fed should not raise rates on the basis of domestic factors (a persistent output gap). And the dollar appreciation has already depressed aggregate demand, as discussed in this post. There is no need for a rapid tightening of monetary policy.

In addition, I would say US and Chinese policymakers have to tread very careful. Irresponsible calls to cancel state visits, or to impose sanctions because of vague allegations of plots to undermine the US (as in this case) carry the risk of sparking even greater global financial turmoil.

With the world economy running on one and a half engines – the US and (kind of) Europe – further financial stress due to Fed tightening (or bellicose political language) is the last thing we need.

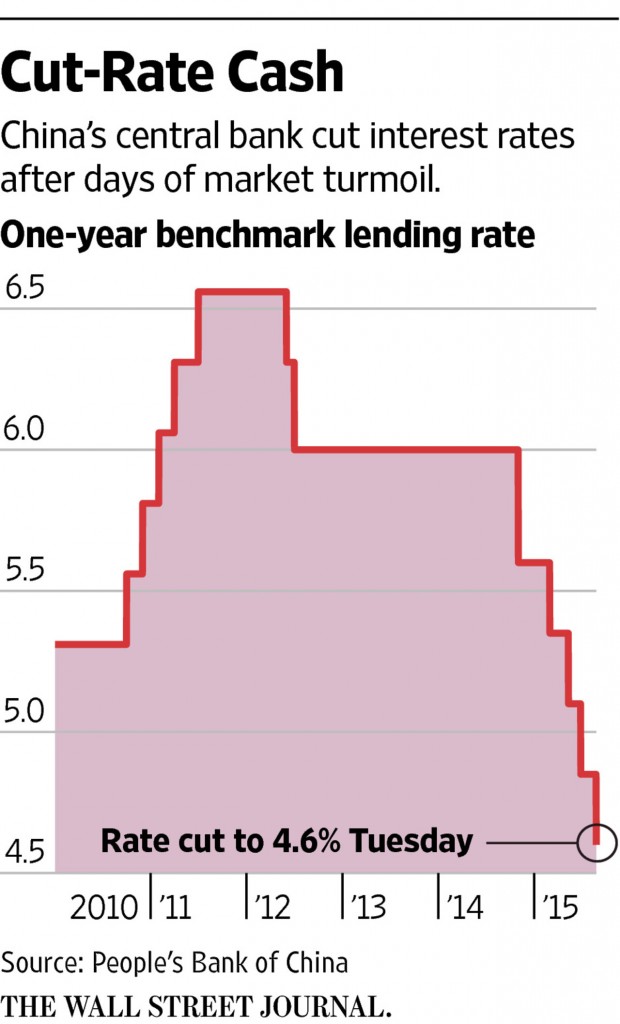

Update, 8/25 9am Pacific: After posting, the PBoC acted, by dropping the one year lending and deposit rates, dropping the reserve ratio, and injecting funds via repos.

Figure 7: PBoC one year lending rates. Source: L. Wei/WSJ. See also Bloomberg, B. Bland/FT.

Interesting stuff, Menzie. Thanks.

Also, you seem to have multiple broken links.

rtd: Thanks, have fixed the broken ones I found.

Looks like they’re fixed.

I feel like I’m missing something on the following: “If my assessment of Chinese policymaker priorities are correct, growth should not slow too much more, putting a floor on commodity prices.” Anything further? Is this assessment that policymakers will further loosen policy given their flexibility as you noted here or further foreign reserve accumulation as noted in prior links?

rtd: The government has many options to ensure a minimal growth rate, including monetary policy, exchange rate policy, and credit policy (given state control over the banking system), and loosening restrictions on local government borrowing and spending. They can use all of these, at the cost of perpetuating distortions that will hinder the ultimately required rebalancing toward domestic private consumption.

If, as you and others have mentioned, “in China, statistics are difficult to interpret”, I can’t imagine how difficult “assessment of Chinese policymaker priorities are.” Example: Even in considering those who are among the most anti-Obama, it would be extremely difficult think someone could (objectively) feel POTUS isn’t in favor of the U.S.’s economic well-being. However, POTUS has continually allowed the BOG to remain empty and acted indifferent in providing zero nominees insight. Granted, House republicans have, on various occasions, been partially responsible for this gross oversight (e.g. Diamond). However, one of the simplest yet most important jobs as it relates to POTUS’s duties regarding the economy is to nominate members for the BOG and this President has failed miserably during one of the worst downturns in recent history. This is a point I bring up all the time. Still, I don’t feel Obama is/was out to ruin the U.S. economy or recovery. However, his actions are (to me) not at all indicative of a president doing the absolute minimum to assist the domestic economy. As it relates to the subject at hand, what makes Chinese policymaker’s priorities easy to understand? Or, maybe, what did I miss from Obama’s priorities during his two terms?

Also, sorry for typos…. such is life typing on a smartphone.

Query: Are you the first one to come up with the slogan “The Runs of August”? Very clever.

Stuart Levine: To my knowledge, nobody else has used it…

This will be old news by October.

The world is rolling over into the second cyclical deflationary recession of the post-2007 Long Wave debt-deflationary regime.

Thus, the Fed is not going to raise rates this year and will more likely resume QEternity sooner than later as the US economy has decelerated to “stall speed”, if not worse since Q4 ’14.

There is incessant talk about the need for China to “rebalance” (as if it will be accomplished by planning rather than the more likely occurrence by default and slower or no growth of real GDP per capita), but the US desperately needs to “rebalance” also away from a hyper-financialized, deindustrialized economy, i.e., the stock market has become “the economy”, at record low labor share and record high debt to wages and GDP.

Trillions more in bank reserves and perpetual reflating of asset bubbles that primarily benefit Wall St., CEOs, the bankster oligarchs, the parasitic financial services and financialized sectors, and the top 0.001-1% ain’t the kinda “rebalancing” the economy and society needs.

That’s a good post.

“I anticipate further shifts of funds to US safe assets as herd behavior takes hold.” Correct, will be.

James Grant hits it spot on. He also gives the original meaning of “trickle down” economics, actually the living dead of modern economics.

Watch the whole video.

“Obviously, China has room to loosen monetary policy (as well as exchange rate policy). Inflation is low (and PPI inflation is negative), and the PBoC could further reduce interest rates and the reserve ratio (which it’s indicated it will do).”

Menzie, you mention loosening monetary policy. Given the existence of an “impossible trinity” (a nation can only do two of either maintaining a peg, allowing for free capital flows, and running an independent monetary policy), how should we be thinking about China’s ability to loosen? Can it run a fully independent monetary policy, say like the U.S., or do weakening capital controls mean that it is losing it ability to ‘loosen’ or ‘tighten’?

JP Koning: Excellent point; this is what I mean by deferring liberalization in order to maintain near term growth. In this case, to retain monetary and exchange rate autonomy, capital controls and financial repression will have to remain in place. It could be that one would want weaker yuan, and looser capital controls would fit in with that objective, but that would be a happenstance, rather than a longer term situation.

Professor Chinn,

Your comments and interpretations are appreciated.

You might want to add this series to your analysis that shows that world trade is contracting.

http://angrybearblog.com/2015/08/world-trade-is-falling.html

I’m skeptical that it’s so simply equated to mollifying masses, but Chinese policy has for a long time been aimed at high real growth rates. And that seems to be a big part of the problem – they’ve built overcapacity in many areas, and misled commodity producers into the same. So prices for both are crushed and the latter must cut their imports.

Tom Warner: I don’t think it’s merely a policy of mollifying the masses — I deliberately avoided use of the term. Some “masses” are more important than other. The rising urban middle class is key. I’m not an expert, but I’ll cite one:

— Arthur Kroeber, Foreign Policy (2015).

menzie, i think the observation on rising urban middle class in china is important. in particular, there was a “mass” of similar constituents several decades ago, during the cultural revolution. some of the brightest city kids were sent to the rural farms to learn how to be good, hard working citizens. enourmous talent wasted on those farms. i would guess the current generation of well to do urbanites do not want a similar repeat, which could occur in a populist movement where the rural masses dictate policy.

When you say that politics — in the case of China — is more important than economics, it lends weight to a similar notion about political influence over the US economy, its markets, and daily stresses and strains.

Market actions shaped by forces from the political dimension might be informed by electoral politics, such as the tendency for the US economy to enter recession under new republican administrations. So, an oversimplified take on recent market disquiet is that it is discounting a future republican administration. With teh Donald showing national political heft against a backdrop of an uncertain democratic ticket, why shouldn’t the market start to take notice? Ascribing day to day volatility to Trump’s various skirmishes with his political rivals (and the media) may seem ludicrous, it also seems like the one variable that’s new to the equity market’s discounting consciousness. Today’s news has the Donald-Fox donnybrook heating up, revealing that Trump’s rows need re-hoeing and accordingly, valuations experience some restorative relief. When the kissing and making up is consummated…. um… sell.

In a parallel sense, the Chinese market mechanism may be acting in response to political uncertainty by forecasting some form of regime change. Although national elections aren’t yet a “thing” in the world’s second largest economy, an economy which is arguably a sentient entity in and of itself, may become the politically dominant influence. How long will the PBoC remain subservient to the central committee? Politics may indeed be the head of the ouroboros.

Prof Chinn,

Concerning monetary offset and the “zero” fiscal multiplier, have you written a more detailed weblog post in the past? I would be very interested in your thoughts about this issue.

LK Beland: Here are 5 reasons for zero multiplier. A vertical LM yields the same result as a central bank reaction function that fully offsets fiscal policy. See also New Palgrave survey on multipliers.

I’ve lived through a similar situation in Ukraine in 2008 and saw it in russia recently. In 2003-7 it had an unprecedented boom, which can be tied to commodities price, but on the ground I can see it was cheap credit, where people invested in anything at crazy valuations and no account for risk.

Problem when a sudden downshift happens is that you get a lot of bankruptcies, which are never really booked as such – homeowners, companies, government bodies, banks. Once a number of them gets insolvent, then the system seizes up – laws are passed to prevent repossessions of debt, foreign currency debt gets renominated, lenders are “discouraged” from enforcing claims and assets get moved out of companies, leaving creditors with nothing. Corruption becomes endemic (much cheaper to pay a judge to cancel a contract than to honor it)

As China doesn’t really have the system to deal with this and it’s clear there is serious pain out there, it’s this breakdown of systems that will cause economic downturn, new investments will have a hefty risk premium, suspicions left right and centre (kinda like the U.S. Banking sector just after Lehman) and it’s way too early to see it in “real” economy. It’s not a downturn causing a stock market collapse, it’s the other way round and I think people, who haven’t lived in a failed post-communist capitalist economy (Ukraine 2008, Russia 2014) can’t really appreciate how messy and protracted it gets. I’d guess that the market would go down like 70 per cent at least and house prices halve, with serious bankruptcies everywhere

So here’s a question for you.

In a recent article (linked), I argue that China’s devaluation was perhaps best interpreted as correcting an earlier policy mistake. The first graph in the article suggests the Chinese should have devalued by 6.5-8.0% to maintain competitive parity with the Korean won. This would still have represented material appreciation on the Euro and yen, but the Chinese would have regained competitive parity with the Koreans, perhaps their closest competition in the region.

So: Did the Chinese devalue enough?

I think the PBOC tried an incremental approach because they were not sure how it would be received–very poorly as it turned out. But I think a 7% devaluation would not have spooked markets more, and it would have properly aligned the yuan to the won, at a minimum.

Do you agree with this view? Do you think China’s 3% devaluation was sufficient? What happens if it was not?

Would you encourage the Chinese to finish the business now and make one more large devaluation to bring the yuan to competitive balance with the won?

http://www.prienga.com/blog/2015/8/13/oil-and-chinas-devaluation-an-alternative-view

Whether it is the dollar versus the XDR or versus gold (more accurate) the dollar has appreciated significantly so it is absurd to say currencies are falling by comparing them to the dollar as in Menzie’s figure 6 above. To be meaningful much more analysis must be done. This graph is lazy and superficial and misleading.

Ricardo: What’s an “XDR”?

It is a symbol for SDR, Special Drawing Rights. Do you know what they are? (A serious question, not intended to be facetious)

Ricardo: OK, thanks. Pretty obscure ISO code. Don’t think I’ve seen it in 25 years working in international finance.