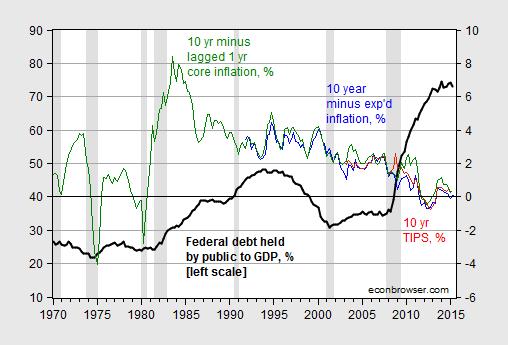

As I updated my slides for teaching an economics course on the financial system at UW-Madison, I recreated this graph, which depicts the rise in Federal debt as a share of GDP, and the trajectory of real interest rates, as proxied by several measures.

Figure 1: Federal debt held by the public as a share of GDP, in % (bold black, left scale), and 10 year constant maturity TIPS in % (red, right scale), 10 year constant maturity Treasurys minus 10 year median expected inflation in % (blue, right scale), and 10 year constant maturity Treasurys minus 1 year lagged core inflation in % (green, right scale). NBER defined recession dates shaded gray. Source: Treasury, Fed, BLS via FRED, Philadelphia Fed Survey of Professional Forecasters, NBER, and author’s calculations.

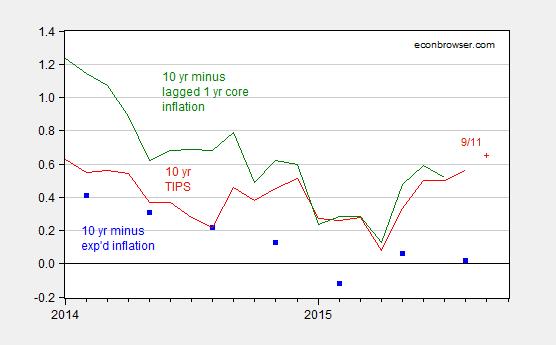

Here’s a detail of interest rates, at the monthly frequency.

Figure 2: 10 year constant maturity TIPS in % (red), 10 year constant maturity Treasurys minus 10 year median expected inflation in % (blue squares), and 10 year constant maturity Treasurys minus 1 year lagged core inflation in % (green). Source: Treasury, Fed, BLS via FRED, Philadelphia Fed Survey of Professional Forecasters and author’s calculations.

Interestingly, real rates have not risen noticeably even as the shadow Fed funds rate (as measured by Xia and Wu) has risen by about 1.35 ppts since January of this year.

With apologies to Simon and Garfunkel, I ask, Where have you gone, Mister Paul Ryan?.

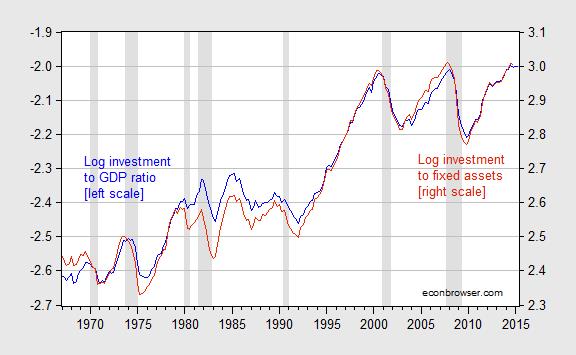

Update: Reader Jeff asks why I don’t provide a plot of private investment. The answer is (a) I’ve done it before, and (b) it doesn’t change the conclusions. But for the skeptical, here’s the relevant graph:

Figure 2: Log nonresidential fixed investment-GDP ratio (blue, left scale), and log nonresidential fixed investment-private fixed nonresidential assets ratio (red, right scale), all in Ch.09$ or Ch.09 index. NBER defined recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Why do you chose to look at interest rates rather than some measure of private investment?

Jeff: See update. It doesn’t change anything.

Professor Chinn,

Why aren’t investors being paid after inflation to loan funds to the government? Is the lack of payment due to a high degree of safety preference? If so, why is the safety preference seemingly so different from the 1980s? Is there also an issue of expected versus unexpected inflation? Most perplexing to this layman.

Is there a better time to raise the minimum wage than when the labor market is strengthening with disinflation?

However, I wouldn’t place the entire burden on businesses, particularly small businesses.

So, we should also remove and reduce some of the $2 trillion a year in federal regulations and cut middle class taxes.

We can help the working poor, bring more people into the workforce, facilitate business start-ups and expansions, and turn entitlement spending into tax revenue.

Peak,

Is there ever time to raise the minimum wage?

Ricardo, how about when there’s exploitation.

Peak,

So essentially every day? Your kidding, right? What is the minimum wage in Venezuela, I forget?

Professor Chinn,

I notice that the link works for the IS LM selection on your course materials for your economics 435 class, but following links do not work. Is this intentional?

AS: Yes, it’s intentional; I post the notes as they come close to the lecture date, so I can update if necessary.

How is it even possible for government spending to “crowd out” private investment when the Fed is adding trillions of dollars to its balance sheet?

“Crowding out” is only relevant in a gold standard monetary system or when the central bank refuses to accomodate government spending with fiat money. Hasn’t this been obvious since we abandoned the gold standard decades ago? Ben Bernanke utterly destroyed the “crowding out” thesis as well as Friedman’s inflation thesis – two birds with one QE stone. (BTW, I am writing this from the U. of Chicago campus and I have not been struck by lightening yet!)

The total effect depends upon how much growth you get in the crowding-in period and how much growth you lose in the crowding-out period.

Higher interest rates on a larger national debt crowds-out growth.

Paul Mathis I’m not following your comment. The Fed’s actions affect the way government spending is financed, but I don’t see how those actions affect what happens in the real economy. When the government increases spending, we would normally expect that this would not only increase demand for loanable funds, but also increase demand for real resources; i.e., the capital and labor that is redirected towards the production of goods and services demanded by the government. And here is deliberately chose the word “redirected” as an alternative to “crowd out.” But when you’re in a liquidity trap and aggregate demand is exceptionally weak relative to potential GDP, then real resources are “directed” rather than “redirected.” See the difference? If they were previously idle, then real productive resources get directed; but if those resources were previously employed, then they are redirected. I’m not an economist sitting in Hyde Park, so I’m not particularly worried about lightening striking me if I say something heretical, but my understanding of “crowding out” is really about what happens on the real goods and services curve.

Paul Mathis: If prices were fully flexible, then crowding out would be complete. If you are saying it’s not particularly relevant in these times with reasonable people running monetary policy, I’d agree. And yet, it is strange so many (usually noneconomists) believe in complete or near-complete crowding out.

Dr. Chinn,

Many prices are obviously sticky – e.g., lawyers’ fees – and the Fed maintains a “sticky prices” index to track them as I’m sure you know. So prices are never fully flexible and therefore the crowding out condition is never met (Keynesians vindicated again!) When the Fed accomodates fiscal expansion with trillions of dollars of QE, crowding out of private investment does not happen as reflected in falling interest rates. Business investment in the current recovery has been weak due to anemic demand, just as Keynes theorized; not due to crowding out.

@ 2slugbaits

Your analysis would be correct only if the economy were operating at full employment. Otherwise, there will always be idle resources to be “directed” by increase government spending. As for loanable funds, interest rates have decreased over the past 7 years so there has been no crowding out there either. Bernanke has proven that crowding out is simply the result of wrong monetary policy per Milton Friedman.

Paul Mathis Okay, I think I understand you now….and I agree that we should not expect crowding out as long as there is significant slack in the economy.

@ PeakTrader

While our national debt has increased 18 fold since Ronald Reagan’s inauguration, interest rates on government debt have fallen from double digits to zero in real terms. The evidence seems to contradict your theory that crowding out actually occurs in the real world.

Paul Mathis, there’s more crowding-out than you think.

Paying interest on the national debt crowds-out other government spending, unless government borrows more or raises taxes.

If borrowing and spending or taxes doesn’t generate enough economic growth, like the past six years, interest payments on the national debt will eventually rise and crowd-out more growth.

It’s not realistic to assume interest rates will continue to fall, below zero, to offset more and more debt.

“Paying interest on the national debt crowds-out other government spending, unless government borrows more or raises taxes.”

peak, the crowding out argument is typically directed at crowding out of private investment, not government spending. but in reference to the government, if the us debt had been much lower than currently exists, your argument seems to imply we could have spent even more on stimulus without crowding out. i don’t think the recent stimulus was limited by crowding out concerns. the debt has risen quite a bit in the past few years. do you really believe the increase in debt has been what has crowded out economic growth?

Baffling, GDP includes private investment and government. The point I was making is when over $5 trillion is borrowed, in six years, for little GDP growth, there’s a cost.

The cost will be a larger share of the federal budget going into interest payments (assuming interest rates can’t go much lower and begin to rise) or higher taxes. The result would be slower GDP growth.

I’ve explained before why growth has been so slow over this “recovery.” When one foot is on the accelerator and the other foot is on the brake, you either ease off the brake or floor the accelerator. It’s a lot cheaper to ease off the brake.

peak, it seems to me you are confusing the present with the future. you argue slower growth in the future. but the future is not today. i do not see any evidence that the growth in debt has caused the slower economy today. no crowding out has occurred. but you seem to argue todays slower economy is a result of crowding out that will occur in the future. i know this is not what you are trying to say, but this seems to be implied in your argument.

interestingly, you argue that $5 trillion borrowed has resulted “for little GDP growth”. compared to what? what kind of growth would you have expected in the absence of the stimulus program? we were headed for a depression. lack of stimulus mostly likely would have had you not questioning how little growth occurred, but how much contraction had occurred.

Baffling, I’m not saying what you’re saying. I’m saying what I’m saying.

The federal government, on a massive scale, borrowed and spent, while the Fed bought bonds, also on a massive scale, to crowd-in growth. Yet, the result was very weak growth.

The addition of more anti-growth policies to stimulative policies is one explanation why growth was so weak.

Now, there’s much more government debt with a huge Fed balance sheet, in this on-going depression, which will crowd-out and constrain future growth. It certainly won’t help.

peak

“The federal government, on a massive scale, borrowed and spent, while the Fed bought bonds, also on a massive scale, to crowd-in growth. Yet, the result was very weak growth.”

i simply do not see evidence that this process resulted in the crowding effect in real time. again, you are making an argument for future behavior (which i am not sure is correct, but save that for another post). but you are saying the fed’s and government’s action resulted in very weak growth today. i do not believe that is correct. you are implying growth would have been larger if the government had stepped back and took no action. i do not believe any credible economist believes the economy would have been better off if that had occurred. i think your memory is fading regarding the severity of the financial crisis and its impact on economic behavior. it was not a run of the mill recession-it was a fiscal event of enormous magnitude. and we have made a decent recovery in spite of its impact.

Because GDP is essentially a measure of government spending and the national debt is simply the financing of federal spending it seems that the only real difference between the two is timing, the spending comes and then borrowing (the debt) to pay the “credit card.” I don’t see much information to be gained but as Sudoku I am sure it is entertaining for those little virgin brains.