That’s the title of a La Cross Tribune article:

Officials with Republican Gov. Scott Walker’s floundering job-creation agency promised again to do a better job in the wake of another scathing audit and the departure of their second chief officer in just four years.

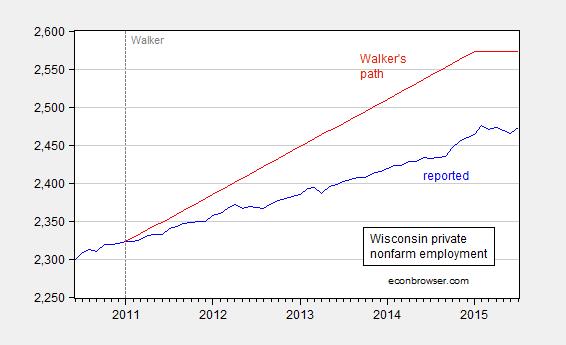

I hope they are right. As it stands, as of July, Wisconsin employment is 99,500 below the target of 250,000 new private sector jobs that Governor Walker last promised in August 2013 would be created by January 2015. This is shown in Figure 1.

Figure 1: Wisconsin private nonfarm payroll employment (blue), and path promised by Walker in August 2013 (red). Source: BLS, Milwaukee Journal Sentinel, author’s calculations.

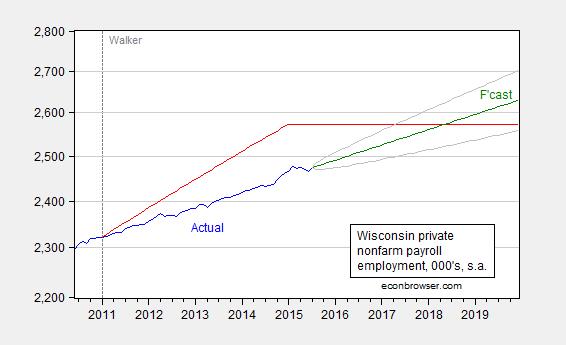

Astute observers will see no net progress toward the goal over the last few months. Using updated data, and an random walk model, I still predict the Governor will achieve his goal before the end of his second term (2018M06), although possibly as early as 2017M05 (using a 90% interval). Of course, it’s possible that occurs later than 2019M01.

Update, 2:30pm Pacific: GeoffT asks for a plot in logs, and I am happy to oblige. I include in this graph a forecast plus 90% interval from a random walk model of employment.

Figure 2: Wisconsin private nonfarm payroll employment (blue), and path promised by Walker in August 2013 (red), forecast from random walk (green), and 90% band (gray). Left scale is logarithmic. Source: BLS, Milwaukee Journal Sentinel, author’s calculations.

August 2013? The latest time I have yet found that Walker reaffirmed his 250,000 jobs promise was at the end of January 2013, so if you have a source from as late as August that year I’d be interested to see it.

Also, given your love of logarithmic plots I’m surprised that the Walker path in your chart isn’t linear in log(jobs) rather than plain jobs. 🙂

GeoffT: See link in legend to Figure 1.

Thank you!

The graph is actually showing the projected path from January 2013.

From Instapundit :

SO THE OBAMA ADMINISTRATION DID ALL THE STUFF THEY ACCUSED BUSH OF DOING. THE ONLY DIFFERENCE IS, BUSH WON THE WAR, AND THEY LOST IT. Exclusive: 50 Spies Say ISIS Intelligence Was Cooked. “The cancer was within the senior level of the intelligence command.”

To be fair, each administration got what it wanted.

Menzie,

I know the primary purpose of your continuing statistical flaying of Mr. Walker is to debunk the supply-side notion that cutting taxes and loosening regulations necessarily leads to superior economic growth. From my perspective, mission accomplished. That said, relative to the rest of the Midwest region, employment and output growth in Wisconsin since 2007 (pre-recession peak) has been mediocre, not moribund. Among the collection of states including IL, IN, IA, KS, MI, MN, MO, NE, and OH (10), Wisconsin ranks 7th in employment growth (non-farm, seasonally-adjusted) and 4th (tied with KS) in real GDP growth. Pedestrian, but not calamitous considering that Illinois, Missouri, and Ohio currently have fewer people employed than they had in 2007, and Michigan has a smaller GDP.

rp,

“From my perspective, mission accomplished.”

unfortunately the mission is not accomplished. you will see the supply siders emerge on this site over and over again, promoting those debunked ideas. mission is far from over until those debunked ideas disappear from the blogosphere and punditsphere. and especially when they disappear from policy.

When taxes and regulations are excessive, less is better than more, to promote faster growth.

And, there’ve been unintended consequences, or undesirable effects, the way we’ve been trying to stimulate growth on the demand side.

Since we can’t do the right thing perfectly we need to keep doing the wrong thing.

Got it.

Don’t be so ignorant – there’s a better way.

Get it.

It is ignorant to think the right way, with small unanticipated consequences, is the wrong way. And therefore the wrong way is the right way.

Got it.

peak, perhaps. but i have yet to hear a supply sider consider any tax or regulation as not excessive. it is an ideology in which one will never consider a condition when supply side economics would not work-even in the face of evidence. the past eight years have not been a supply side problem-it has been a demand problem.

How do you know more progressive taxes, particularly on the “middle class,” and more regulations, that affect everyone, haven’t had a negative effect on demand, along with creating disincentives?

Demand in health care is down, because people can’t afford insurance or co-payments. Government has created a huge student debt problem. Energy prices are higher than they should be, etc..

peak, your entire response is a bogeyman of inaccuracies. there truly have not been progressive taxes and more regulations-that is a narrative fiction. you may argue against banking regulations, but look at what happened to the industry with deregulation. we are simply returning to the regulations which worked. notice the bankers want to give up the regulations, but not the insurance from the us treasury and fed. student debt problems are a result of students taking on too much debt-why try to blame the government for private sector misconduct? you know what energy prices should be? really? what about stocks while you are at it. and how did health care costs rise prior to obamacare?

Baffling, I’ve shown you studies and data before. You didn’t show they were inaccurate. You cannot accept you’ve been wrong.

You seem to believe taxes and regulations have no effect on the cost of production and the cost of living. Therefore, you believe, they have no effect on demand, along with creating other undesirable effects.

And, you believe, government had nothing to do with the housing bubble or student debt bubble. It was simply “private sector misconduct” for people making rational choices in the conditions government created.

peak, last time i noticed student loan and home mortgages were taken out by private citizens, not the government. “conditions the government created” is a bogus argument. free markets always operate within conditions the government created. perhaps free markets are not as robust and efficient as you would believe? bubbles appear to result from free markets making rather poor and inefficient decisions.

“You seem to believe taxes and regulations have no effect on the cost of production and the cost of living. ”

no. i simply state they have not had the impact you imply over the past several years.

RP_McMurphy: I agree context is useful. That is why in this post, I constructed a counterfactual based on the historical correlation of Wisconsin employment and US employment up to 2010M12 (formally and error correction model, used to conduct an out-of-sample ex post historical simulation). If you read the post, you will find that Wisconsin employment has been statistically significantly different from predicted for almost the entire Walker period.

While the Walker administration has done some good concerning government spending and over-employment the state still has a serious problem with taxes. Wisconsin ranks 46 out of the 50 states with only New York, New Jersey, Connecticut, and California higher.

No. 46: Wisconsin

State and local tax burden: 11.00%

Effective state tax rate ($50,000 taxable income): 5.68%

Highest tax bracket: $240,190

Rate at highest tax bracket: 7.65%

Per Capita Income: $40,741

The government cannot create sustaining jobs because any job created by the state is actually paid by the state taxing the free market. This means that Wisconsin will not see real job increases until they have serious tax reform. The Walker administration has moved in the direction of reducing taxes but until it begins to move ahead of other high tax states tax reductions will create little incentive to businesses to produce in Wisconsin.

I am hopeful that Menzie is right and Wisconsin will see Walker’s goal reached before the end of his second term but I am skeptical. The power of Progressives in Wisconsin is great and they are very effective in preventing a positive economic environment in the state. Real reform will only come if Governor Walker is followed by another supply theory governor. If the demand theory crony socialists regain political power all reforms are questionable and all bets are off.

Source

“The government cannot create sustaining jobs because any job created by the state is actually paid by the state taxing the free market.”

Ok, so starting from a no-government situation, the government cannot create sustaining jobs, you say? To use the classic case: everyone starts with owning their fair share of road (average: 74 feet in the US), and maintains it. This is a highly unstable situation though: even in the greatest of booms a fraction of people, however small, will fall on hard times and not be able to afford the upkeep on their bit of road, and in any case people will want the road users to pay for that maintenance so tolls are extracted. Singular private ownership of a whole useful stretch of road will be incredibly rare since any owner of any 74 foot stretch only needs to not sell up in order to extract a very disproportionate income from their specific part of an otherwise-useful whole. So the Nash equilibrium with everyone looking out for their own best interests in this free market is for roads to be tolled every few feet and/or decay to the point of uselessness, communications to fall apart and the economy to collapse. Until a government is created, road ownership is socialized, communications restored, economy put back on track, and the government, with taxes on that economy, creates sustaining jobs in road maintenance.

What’s wrong with that story?

“The power of Progressives in Wisconsin is great and they are very effective in preventing a positive economic environment in the state.”

Democrats in the state legislature have thwarted the Republican agenda all of once since January 2011: the January 2011 Special Session Bill AB11 was forced to have the parts pertaining to the sale of state assets without soliciting competitive bids removed because a 3/5 quorum in the State Senate was denied although a 1/2 one was available. Now I presume by your choice of “progressives” rather than “Democrats” that you wish to count 33-year GOP legislative veteran Dale Schultz as one in order to think of the initial mining legislation as having been prevented. That he helped to shoot down March 6th, 2012 but a verbatim bill went through almost exactly a year later and importantly has led to no mine at all. Democrats technically led the State Senate from July 2012 through January 2013, but the body was not in session for any of that time.

So, pray tell, do you have any examples of Wisconsin progressives actually preventing “positive economic environment” beyond my singular one (if it’s even that), let alone being “very effective” in doing so? It’s a plainly ridiculous thing to claim given that the GOP and its sympathizers have been in control of all three branches of state government for 4 1/2 years now.

JOLTS says its time to raise interest rates. That’s what I think.

http://www.calculatedriskblog.com/2015/09/bls-jobs-openings-increased-to-58.html

I’d add that the Case Shiller Index reinforces this feeling. It looks to me like the Fed is creating another housing bubble.

http://www.calculatedriskblog.com/2015/08/case-shiller-national-house-price-index.html

The Case Shiller National Index is up 74% since January 2000. In a housing bubble you’d expect housing starts to be drifting a long way north of their long-run average, yet we’re still only at 5/6th of the average level of the last 50 years. Also note that the CPI-U is up 41% since then, but while labor productivity is up 31% average weekly wages have only risen 42% from 2001-2014 rather than inflation + productivity. So they’re less affordable than they were 15 years ago, but this is solely due to wages being unresponsive to productivity over this time period.

JOLTS isn’t nearly enough evidence of an inflation risk: just because there are many job openings does not lead to inflation. Wages and salaries are running a bit ahead of productivity, but inflation is nonetheless almost completely dead right now, presumably with the help of collapsing prices of raw materials.

GDP is still 3.1% below its potential, which also throws a lot of doubt that inflationary pressures are looming.

The JOLTS numbers suggest to me that the economy has run out of idle labor. Ordinarily, we might expect increasing job openings and flat hiring to be suggestive of wage pressures. And the Case Shiller Index, you know, it’s up quite a bit. When last we saw this, it was a bubble that took down the global financial system.

I am not saying that we need a big rate increase, but yes, I would shift the car out of neutral at this point., that is, I would raise rates by a quarter percent.

But we don’t need JOLTS to tell us about wage pressures when we have actual earnings data to work with (it’s been plodding along at a pretty consistent 2% growth since the end of the Great Recession). It hints at wage pressures.

Inflation was at 0.17% in July (and note that that includes inflation in the cost of shelter, which is at 3.1% as of June), and the house price index is only 4.0% higher in real terms than in July 2009 when we technically exited the Great Recession. So if we’re in a housing bubble now then the Great Recession clearly did an exceedingly poor job of deflating the last one.

By all means let’s keep an eye on whether wage inflation responds to the JOLTS hint and whether deflationary pressures in the rest of the economy start to back off or not. But until they do there’s simply no corrective action to take. Inflation hasn’t been above 0.2% in any of the first seven months of this year, a stretch that excepting the Great Recession last happened 60 years ago. A major adjustment in the Chinese economy has happened in the last few weeks: has it played out or is there more to come? Iran’s oil exports dropped by over a million barrels/day in response to sanctions: what will the magnitude of the deflationary effect from the impending lifting of them be?

Talk of taming this cryogenically frozen beast is surely precipitous in the extreme.

You may be right. However, I would note four points:

1. I think JOLTS will tend to be forward-looking. It certainly suggests we are at full employment at current labor force participation rates. Actual wage data will be a lagging indicator, and therefore JOLTS may be a preferred forward-looking indicator. I understand Janet Yellen is a big fan of JOLTS.

2. “So if we’re in a housing bubble now then the Great Recession clearly did an exceedingly poor job of deflating the last one.”

This is incorrect. The Great Recession did deflate the housing bubble. It has since been re-inflated. Did you not look at the graph I referenced? It’s visible to the naked eye.

3. Impact of China is unknown, but conceivably negative and a reason to hold interest rates lower. There is a report out this morning that Xi wants to continue the dollar peg. That would crucify the Chinese economy. (You know, Menzie, if Xi were an American politician, he’d be a Republican.)

4. Oil prices are really depressed now. We could go to the shut-in price, in the $20-30 range, but that’s a, say, $15 / impact compared to the $60 / barrel already incurred. At this point, the oil industry is bleeding out. So if you expect oil prices to stay low forever, well, they won’t. By the way, US production fell by some 83,000 bpd just last week, if I believe the EIA.

Didn’t realize there was a comment nesting limit, so it would appear that I have to reply to my own comment to reply to you, Steven.

1. Agreed, but we were talking about the time to pull the trigger on interest rates, not about when full employment is reached. JOLTS suggests keeping an eye out for an increase in the rate of wage increases, which will then be an inflationary pressure if not coupled with rising productivity, and if there are no countervailing deflationary pressures at the time then we may finally see a rise in inflation, at which point it may make sense to raise interest rates.

2. Of course I saw the chart, and it takes no account of inflation. I pointed out that the index as of the end of the Great Recession has grown a mere 4.0% in real terms to get to the current value. Here’s the calculation: the Great Recession’s official last quarter was 2009Q2. In July 2009 the S&P Case-Shiller National Index was 150.79, rising to 173.84 in June 2015, the last available data. The CPI-U was 215.351 in July 2009 and 238.638 in June 2015. So in June 2015 dollars the S&P Case Shiller Index was 150.79 x 238.638 / 215.351 = 167.10 upon exiting the Great Recession vs 173.84 in June 2015, a rise of (173.84 / 167.10) – 1 = 4.0% in real terms. That is what the data behind the chart you linked to says, and what I mean by the Great Recession doing a bad job of deflating the housing bubble, if it only deflated it to 4% below what you consider to be bubble prices. The naked eye is a really poor tool to use on a chart that you’d normally expect to have an exponential curve.

A big contributor is San Francisco Bay Area prices, which are beyond their 2006 peaks in current dollars, but they have the same fundamental problem as Oslo: lots of wealth and a lack of buildable land. Historically, buildable land has been generated by filling in the Bay, but that’s obviously not going to happen in a timescale less than years.

(While researching this, the S&P version isn’t inflation-adjusted but the original index is. Robert Shiller keeps it updated at his site).

3. Ouch.

4. I certainly don’t expect oil prices to stay low forever. It seems rather more likely than not that Iranian sanctions will be lifted shortly, potentially bringing another million barrels/day onto the international market. Sure, other oil producers are going to respond to that, but in the short term at least it’s a significant deflationary pressure that’s highly likely to appear. Also note that the week-to-week changes of the EIA weekly US crude production series has a standard deviation of 102,000bbl/day, so a weekly drop of 83,000bbl/day is not significant.

Finally, as I pointed out, inflation is at historic lows right now. There is a large amount of leeway to get things wrong on pulling the interest rate trigger too late, but no room at all to get it wrong in pulling it too early.

Geoff –

For housing, we’d probably want to use the last ‘clean’ number as a base. I’d probably use 2000, in part because McBride also uses 2000, and adage No. 2 states, “Be careful about challenging McBride.”

Since 2000, the CPI-U nationally ran 2.2% pa, cumulatively 38% over the 15 years. National housing prices are up by about 70%, and the price of housing has thus risen by 23% in real terms by this measure.

For San Francisco, housing is up about 90%, the CPI-U SF is up 45%, and housing has increased by 31% in real terms.

So, yes, I do think there is a mini bubble in housing. But I agree, we are once again beginning to see a shortage, with housing starts still well below normal. So we’re going to need a lot more construction workers, just as JOLTS has told us we’ve just about run out of them–at least at current prices.

As for oil, here’s the quote I sent to US News yesterday:

“The reporting systems at the IEA, as well as the EIA, tend to operate with a lag and will ordinarily miss turning points in real time. This has to do, in part, with lags in data provision from emerging economies, not to mention Texas. Institutional conservatism also plays a role.

“In the first half of the year, we expected the demand growth to be under-estimated, and it has been, by as much as 1 mbpd. In the second half of the year, we assumed supply declines would be under-estimated, with downward revisions over time. Therefore, the IEA’s downward revision comes as no surprise, and further material downward revisions should be expected until at least December, and perhaps through 1Q 2016.

“US production alone could decline another 500 kbpd this year. The EIA, for example, reports US production dropped 83 kbpd just in the last week, and Lower 48 production–heavily influenced by shale production–fell by 208 kbpd in a single week. Our expectations call for US production to fall by 1 mbpd to year-end from the early July peak. Of this, 469 kbpd has been realized already, if EIA data is to be believed.

“Thus, the IEA’s forecasts for falling production should be treated credibly, and indeed, falls will likely prove greater than the IEA currently expects.”

I think Steve has a point, but if I can add my own $.02, the cost of job postings is lower than in the past. Also, a vast number still look like ’09 to ’13 style squirrel and unicorn hunting. When a majority start including words like “no experience necessary”, “will train”, “transportation assistance available”, then I will believe full employment has been reached.

Also, weak homebuilding has created major housing shortages in areas with high productivity and job availability. It’s extremely difficult for a person of modest means to move where his or her job skills are truly in demand. For example, I read a Thoma-linked piece (NYT I think) where a fast food manager with years of management and military leadership experience was making some $9/hr in Atlanta. In the Twin Cities many fast food companies are openly advertising $45k a year + signing bonuses for management trainees with similar experience. Moving for a salary tripling is a no brainer, but making that move right now is exceedingly difficult. Many Twin Cities landlords are demanding that folks from out of state have 10-year clean criminal records, and 3x the annual rent in liquid assets. Pretty unbelievable for rental units relative to the previous 20 years. I believe these patterns are repeated across the country.

So I’m skeptical that the swift rise in job openings will result in faster job or wage growth, mainly due to structural factors that are limiting worker mobility. Of course I’ve been surprised many times in the past.

The big run up in job openings has occurred in the last year. I don’t think posting a job has become materially easier in the last twelve months.

Lack of mobility may actually limit the supply of labor, and thereby raise it’s cost, that is, a lack of mobility may actually support wages, rather than depressing them.

Does high employment necessarily lead to high inflation? Maybe not. It could instead increase the share of labor’s take v that of capital. Indeed, I would expect to see some of that now.

steven, what do you accomplish by raising rates today?

now if you are wrong and you raise rates, what happens?

now if you wait to raise rates and you are wrong, what happens? and if you wait to raise rates and are right, what happens?

due to the asymmetry in results, why would you be interested in raising rates anytime prior to being late?

on another topic, an interesting running article from calculated risk has been

http://www.calculatedriskblog.com/2015/09/public-and-private-sector-payroll-jobs.html

From the newspaper article; ‘Walker created the WEDC in 2011 to replace the state Department of Commerce.’

Wouldn’t a professional economist want to compare the performance of the new agency to the one it replaced?

Of course, if Menzie wants to admit that government agencies are naturally deficient at private sector job creation….

The verbiage in the Tribune article after your quote (see below) leads to additional questions regarding Republican state administrations and free market principles. Why is the Wisconsin state government awarding loans and grants to businesses? Aren’t loans the purview of banks and investors? Aren’t grants another form of welfare? Why hasn’t a conservative governor running on free market principles shut down this gross interference with the free market? Where are the vocal proponents of free market economics calling for an end to this affront to the free market? Why haven’t other Republican presidential candidates jumped on this inherent contradiction between free market principles and state funded loans and grants?

I’m not naive and know the answers to my own questions. Being from Texas, we have already seen the supposed free market loving Republicans turn a blind eye while Rick Perry doled out state funds from his slush fund that was approved by a Republican controlled legislature. It was no coincidence that 50% of the companies receiving state loans and grants donated to Perry’s campaign coffers.

From the article:

State audits in 2013 and 2014 revealed the agency routinely failed to adhere to its own rules or state law when awarding cash to businesses and lacked documentation justifying spending on expenses and grants.

A third audit this May found that the WEDC’s problems continued in fiscal year 2014, noting contracts with grant and loan recipients haven’t complied with state law and the agency hasn’t demanded proof that recipients are creating or retaining jobs. Later that month word broke that Walker aides had pressed for a $500,000 loan to a failing construction company owned by Walker donor William Minahan.

In June, the WEDC released documents showing that the agency gave out more than $124 million to companies without a proper review. Some of that money included the Minahan loan.

Patrick R. Sullivan: I think you will be hard pressed to find anyone who will argue that WEDC has thus far outperformed the now disappeared Department of Commerce. If you do, please send me a link. I think there are aspirational expositions on how WEDC will eventually do better.

But now that we talk of data, I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

The Walker Admin is a perfect example of government being the problem and not the solution.