Compared against Minnesota, Kansas, California, and the Nation

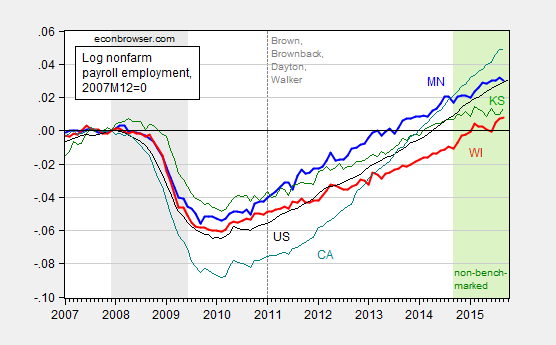

Here’s employment.

Figure 1: Log nonfarm payroll employment for Minnesota (bold blue), Wisconsin (bold red), Kansas (green), California (teal) and US (black), all normalized to 2007M12=0. NBER defined recession dates shaded gray. Green shading denotes data that does not incorporate Quarterly Census of Employment and Wages information post-September 2014. Source: BLS, NBER, author’s calculations.

While Wisconsin has recently experienced some acceleration in measured employment growth, it’s important to note that that has occurred during a period not incorporating recent Quarterly Census of Employment and Wages (QCEW) data; recall, this is the data source that Governor Walker touted as much more reliable (it is) before he ceased citing it as more reliable. My most recent check of the data indicates that if one were to use the QCEW data to update the BLS establishment series, reported employment would be lower (see this post).

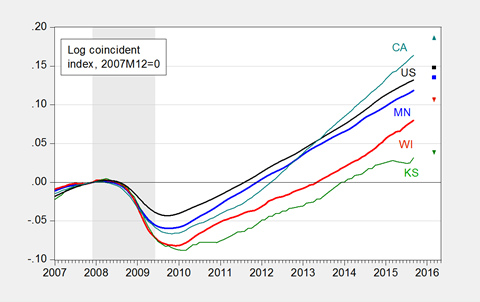

Here’s overall economic activity, as summarized by the Philadelphia Fed’s coincident index.

Figure 2: Log coincident indices for Minnesota (bold blue), Wisconsin (bold red), Kansas (green), California (teal) and US (black), all normalized to 2007M12=0, and forecasted values for 2016M03 using leading indices. NBER defined recession dates shaded gray. Source: Philadelphia Fed (September release), NBER, author’s calculations.

Interestingly, the two bottom performing states are fully controlled (legislature, governorship) by Republicans. The top performing state (California) is fully controlled by Democrats.

An alternative way of assessing Wisconsin performance is to examine where Wisconsin should be, based upon historical (pre-Walker) correlations summarized using an error correction model, and compare it with where it actually is. That depressing story is recounted here.

A final point: In September, Wisconsin employment is over 26,000 below the February 2015 peak. Fortunately, Governor Walker has assured us that Wisconsin is moving in the right direction.

(Latest mass layoff notifications here).

What stands out is how hard CA was hammered and then how well it has performed.

Unemployment rate in CA is 5.9% (41st).

Wisconsin is 4.3% (15th).

Steven Kopits: I think we have had a conversation about “fixed effects” in the past…

California’s unemployment rate minus the national average has averaged 1.06 percentage points over the 1976-2010 period. The fact that it is only 0.9 percentage points above the national average is suggestive that it is doing better than it has over the previous period. In contrast, Wisconsin’s unemployment rate is 0.8 percentage points below the national average, when it typically has averaged (over the same period) 0.9 ppts. The fact that the unemployment gap has been shrinking, i.e., US unemployment rates have dropped faster than Wisconsin’s, over the Walker administrations is suggestive.

What do you think full employment is in Wisconsin?

Hey, why don’t you review my CNBC piece. That actually has a thesis worth discussing.

http://www.cnbc.com/2015/11/13/why-oil-could-rally-big-in-2016-commentary.html

Steven Kopits: Thanks, but I’ll let others talk about it. While oil is important, it’s not the only thing that matters in the world, at least for me.

It makes a specific argument about China and exchange rates.

I wonder if it is fair to include California with the other states? California is almost a nation unto itself. I did a quick eyeballing of the California GDP vs a group of states of the midwest. The GDP of 9 states including Kansas, Wisconsin, Minnisota had a total GDP of approx 1.9T vs California’s 2.4T. I think it hard to tease out the effects of which party controls the statehouse economic activity from a lot of other effects . I wonder how much the California activity is driven by the SF Bay Area/Silicon Valley complex? I don’t think the other states have anything to compare to that complex. Maybe Texas?

dilbert dogbert: I agree that it’s not an ideal comparison. However, many commenters have in the past written that the onerous regulatory burdens imposed in California would drive the state to penury. Having lived in the state for a total of seventeen years and a continuous visitor with relations there, I am still waiting for the regulatory-induced economic apocalypse to occur (I think it will occur about the same time as the long promised Fed-induced hyperinflation materializes…). On the other hand, we see the rather immediate effects of sub-optimal fiscal policy in Kansas.

California has a huge base of affluent and high-skilled people throughout the state.

That huge base attracts even more affluent and high-skilled people from the rest of the country and the world.

While, steep increases in the cost of living drive-out much of the “middle-class.”

The growth comes from richer people moving in and poorer people moving out, although the large rich population provides lots of money to the large poor population.

And you can document this supposed phenomenon how?

See all the info on immigration, in and out migration, state policies, including social programs, regulations, and taxes, wealth and income inequality, etc..

You may want to compare the data to other states, e.g. Asian populations, education, millionaires, etc..

peak, it could simply be silly economic policies promoted in the lagging states. california policy does not seem to be detrimental to its growth. or perhaps that successful population is attracted to california type policies, and not wisconsin and kansas policies?

Baffling, Wisconsin and Kansas cannot afford California’s policies.

And, California could improve its “middle class” living standards.

PeakTrader: Do you mean WI and KS can’t afford raising taxes, instead of slashing taxes on high income groups, while slashing spending on education, a process which has worked so well to spur growth in WI and KS? Perhaps you should refer to Figures 1 and 2 in the post, to see if you can reconcile reality with your preconceived notions.

Menzie Chinn, in California, most of the tax revenue comes from a smaller percentage of the population.

And, the larger proportion of wealthy can still thrive with the excessive regulations.

Those policies in Wisconsin and Kansas would be a much bigger burden on the “middle class.”

peak, it appears wisconsin and kansas cannot afford their current conservative economic policies. your statement regarding their inability to afford california policies is unsubstantiated by the data-your opinion. and yes, california could improve its middle class. you could make the statement “could improve” about anything, really. but that is a distraction from the data at hand. the data says california is doing better than wisconsin and kansas, who are both below the us on average. don’t let ideology get in the way of reality. for example, when you crush a states education budget, would you expect to attract and keep talented technology people in the state? kansas economic policy. wisconsin not far behind.

Baffling, if Wisconsin and Kansas had a large pool of rich, and ultra rich, people, to tap into, a lot more can be done on education.

Without a large pool of rich people, the burden will fall on the “middle class” to fund government programs.

I doubt Wisconsin and Kansas can survive California taxes and regulations without a steep fall in living standards.

And, given the volatile swings in California tax revenue, because a small portion of the population pays a large portion of the taxes, I’d expect a more volatile economy too.

peak

“I doubt Wisconsin and Kansas can survive California taxes and regulations without a steep fall in living standards.”

again, this is speculation. what is known, especially in kansas, is a conservative economic agenda certainly dropped the standard of living in the state. perhaps it is time to reevaluate your taxes and regulation paradigm. perhaps the conservative economic dogma on taxes and regulation has little basis in reality. i am not arguing simply raising taxes and increasing regulation is the way to go. i am arguing the standard mantra of lower taxes and less regulation does not always lead to a positive economic outcome. perhaps it is time to reconsider your views on the matter.

I settled for studying IRS data. It doesn’t show what you claim because it’s aggregated.

So if you’d care to link me to data that proves your assertion, please do. Otherwise I will continue to believe that you’re talking anecdotes and not facts.

You can find the data I cited. For example, the top 1% in California pay over 50% of the state income taxes (the top rate was raised recently), the Asian population is 15% of the population of California, Chinese are snapping-up houses, paying premiums and cash, 43 states have less income inequality than California, there are more billionaires in California than any other state (and, I suspect, more upper and upper middle class, given its wealth and mix of jobs). Krugman’s Nobel Prize paper shows people are attracted to large metro areas and California has three large metro areas, with many skilled jobs, etc..

You can also look at how people live in the San Francisco/San Jose, Los Angeles/Orange County, San Diego/Oceanside areas and compare those with other metro areas.

The Bank of England, in its Nov. inflation report, presented a decomposition of oil prices along the lines of Jim’s ICE (interest rate, copper, exchange rate model).

https://econbrowser.com/archives/2015/09/common-factors-in-commodity-and-asset-markets

Here’s my take on this matter, at CNBC this morning (not my title):

http://www.cnbc.com/2015/11/13/why-oil-could-rally-big-in-2016-commentary.html

Interesting choice of states. Probably the most conservative state in the U.S. (economically that is, socially we are quite liberal, which makes us fairly libertarian) is Colorado. We have had a law in place called TABOR (the Taxpayer Bill of Rights) since 1994 that makes it illegal for the legislative branch to increase taxes without voter approval, and Colorado is doing extremely well economically while allowing citizens to keep their money (tax rate for citizens and corporations is 4.6%).

Menzie, do you really believe that today’s economic performance is based off of who is governor now and not the culmination of hundreds of years of policies that accrue over time?

California has (almost) the same law: Prop 13

All tax increases must be either approved by either 2/3 in both houses of the legislature or by a 2/3 majority in a referendum for a local (special) tax increase

I’m not sure that has really turned California into the darling of the conservatives. Like Colorado, California is quite liberal socially.

Shorter YogiTrader: “Nobody wants to live in California because it’s too crowded.”

CA has the highest poverty rate in the country. How does income inequality in CA compare to the other states under consideration here?

http://www.huffingtonpost.com/2013/11/07/california-highest-rate-of-poverty_n_4233292.html

Menzie,

Perhaps Peak Trader was referring to something like this: http://www.latimes.com/business/la-fi-california-migration-20150101-story.html

or this: http://politicaloutcast.com/2015/04/high-tax-states-are-losing-middle-class-residents/

or this: http://www.washingtonpost.com/sf/business/2014/12/12/why-americas-middle-class-is-lost/

or this: http://www.sacbee.com/opinion/california-forum/article17238611.html

Sometimes the “big picture” doesn’t really help one understand the dynamics of the situation.

Others have differing opinions about Wisconsin’s performance: http://www.forbes.com/places/wi/

or this from a Minnesota point of view: http://www.startribune.com/minnesota-and-wisconsin-how-did-two-peas-in-a-pod-grow-apart/295426901/

“Right now, of course, lots of people are making such comparisons — mostly looking for political ammunition by suggesting that Wisconsin Gov. Scott Walker, a Republican, and Minnesota Gov. Mark Dayton, a Democrat, are largely responsible for the economic conditions of their states, even though each has only been in office since 2011.

The story goes back farther than that.” But that’s just an intro.

Bruce Hall: The question is then why did Wisconsin veer off from the path implied by historical correlations, starting in 2011M01 (see this post)? I agree that where we are depends on the past; but that’s what the econometrics is supposed to take care of.

Menzie,

I’d refer you the the article written by the former Wisconsinite and now a Minnesotan … as a start. Individual states have never moved in lock-step with each other or the nation. There are policy aspects and there are structural aspects. I’ll provide the link again:

http://www.startribune.com/minnesota-and-wisconsin-how-did-two-peas-in-a-pod-grow-apart/295426901/

Bruce Hall: I’ve seen this already. Many of these effects mentioned are long in effect, long in gestation. The question is why over the business cycle frequency (i.e., over the last five years) Wisconsin employment and/or economic activity in general has veered off. By including US employment which arguably has a unit root, then I include a trend.

Perhaps, and I’ll admit I’m speculating, the long term effects in Wisconsin were significantly exacerbated by convergence of an acceleration of jobs being exported, tightening of banking as a result of the “great recession”, and a politically toxic environment (generated by both parties) which is hardly inviting to either individuals or businesses.

I’m not a fan of correlation as causation. Nothing is ever as simple as it first seems (although other will argue Occam’s razor). In this case, I’m inclined to see Wisconsin’s present problems as a manifestation of the long term issues more than short term politics. If I recall an earlier comment to an earlier post, you indicated that Wisconsin’s lag in employment? was not statistically significant. Given the long term issues, what are the “quick fix” solutions? That’s rhetorical.

Bruce Hall: (1) The difference in employment growth was not statistically significant at the 10% significance level for the past year. (2) The correlation between the US and Wisconsin level employment is not proof of correlation. But if I were to ascribe the majority of causality, would you argue that the reverse is true? I.e., are you arguing that Wisconsin “causes” US employment? Or are you arguing that there was a statistically significant common shock so that the variable mysteriously co-trended until 2011M01 and then magically did not co-trend in the same way thereafter, but there is absolutely no inference to be made?

bruce, the overriding theme in that article is that education-in all forms-is extremely important. you cannot blame walker for the past few decades, but you can blame him for the states recent anti stance towards education. that has not helped the state in recent years, and will continue to haunt the state going forward. he continues to promote anti education policies to the detriment of the state.

But Baffling, Wisconsin’s education system wasn’t really delivering the goods for the money (as compared to Minnesota’s), so perhaps not continuing to do what was being done is not so insane.

“Wisconsin and Minnesota both have good schools, but Minnesota has the edge over its neighbor. Fewer Minnesotans drop out of school before completing the 12th grade (7.6 percent vs. 9.1 percent) and more go on to college (66.1 percent vs. 58.9 percent). The differences become more pronounced when we compare those with four-year college degrees and graduate and professional degrees: Roughly one-third of Minnesotans have a sheepskin, compared with 27.8 percent of the Badger State.

Given that full-time workers with college degrees earn twice as much as those with high school diplomas, the education gap between Wisconsin and Minnesota is an important piece of the puzzle.” Prof. Roger Feldman — University of Minnesota

There have been some very significant changes in Michigan regarding school funding and unions (right to work law) which have not resulted in the disastrous outcomes predicted. Part of hope and change does include change… even though most people affected by change prefer to keep things they way they have always been.

bruce, you imply the lower high school and college degree rates are a result of inferior education system in K-12 and undergraduate institutions in wisconsin, when compared to minnesota. i highly doubt the lower rates are a result of an educational system not “really delivering the goods for the money”. cutting funding on those institutions, while a great talking point for many with an anti-education agenda, is most likely not going to improve the performance in wisconsin relative to minnesota.

Bruce hall, thank you for providing info that peak trader didn’t; I’d like to see the source, since I just spent some time looking at IRS data without seeing the details the times references.

Dear Dr. Chinn,

Please add the recent closing of the Oscar Mayer plant in Madison and the loss of an estimated 1,000 jobs.

One person has suggested that displaced workers can find job training at the UW-Madison’s Division of Continuing Studies. http://host.madison.com/wsj/news/opinion/column/guest/jeffrey-s-russell-uw-madison-can-help-displaced-oscar-mayer/article_afef5799-0bbb-57ce-bbcb-25e9b4bb8831.html

Illustrates that maintaining and funding a robust educational and continuing ed systems helps people.

Thank you for continuing to document the situation in WI.

Hasn’t private employment in Wisconsin been falling as share of total US private employment fairly steadily since the early 1990s?

Neil: Yes, which is why I have been referring readers to the error correction model of Wisconsin employment, based upon US employment. Since the cointegrating vector is (-1 0.70), this takes into account the declining Wisconsin share. For details, see the error correction model estimates in this post; the post includes a graph with the 90% forecast interval. Once one estimates the model, one finds that Wisconsin employment performance since 2011M01 has been subpar, with statistical significance.

What would California and Minnesota’s economies look like if they fully funded their pensions like Wisconsin?

Anonymous aka Asian with 4.0 and a perfect SAT rejected by Harvard aka Anonymous aka Future President Donald Trump aka Scott Walker, American Patriot and Freedom Fighter aka BUT THE MODELS SHOW US!! aka (xo poa) aka YOLO! aka JS aka Joe: I dunno; you asked this on 10/23 and 9/1 — you sound like a broken record. Since you work at a bank, it seems to me you would have the resources to answer this question yourself.

anonymous, chris christie continues to hurt his states economy, and he chose not to pay his pension obligations. you imply underfunding a pension would give benefit to the economy. new jersey performance does not agree with that sentiment.