The entire quote is here.

And here I thought it was the Federal Reserve Open Market Committee that controlled short term interest rates. Guess I gotta revise my lecture notes for Economics 435. (and Mishkin, Hubbard, and Cecchetti and Schoenholtz revise their textbooks — the email will go out tomorrow!)

By the way, later on in the same interview, Donald J. Trump states: “…we doubled our debt under Obama, doubled it.” In a standard portfolio balance model, doubling government debt raises interest rates ceteris paribus, but I guess in Trump-world it works in reverse.

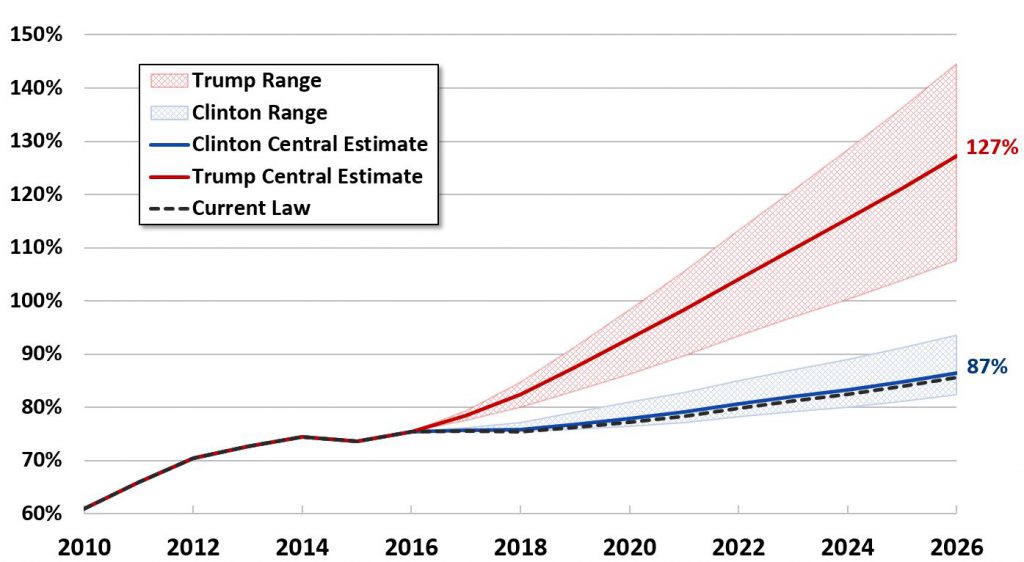

Addition, 8:30pm Pacific: Trump also states: “but I would want to have a policy where we can start to at least gently reduce debt…” As noted in this post, this seems unlikely given Mr. Trump’s tax plan (and this assessment was made before the proposed increment to defense budget.)

Source: CRFB.

Good job at providing the transcript, but why not provide the text and its true context as opposed to a version that you like? However, it doesn’t sound like you’re being an “astute reader” despite recently admonishing others. I guess in Menzie-world it works in reverse. That, or you’re just being your biased & partisan self.

Also, I’d be surprised if Mishkin, Hubbard, and Cecchetti and Schoenholtz assume ceteris to be paribus very often when discussing real-world issues………

rtd: Beyond mere assertion, can you point out how context makes “Obama sets the interest rate” correct?

Do you even have the respective textbooks? If so, you should read them. We economists typically invoke ceteris paribus. That’s why I know the latin — it’s not because I studied it in high school.

rtd: Or are you saying that Janet Yellen is merely a puppet for President Obama, as Donald J. Trump seems to assert? If so, then she surely veered off course last December. In addition, I wonder how it is that Chair Yellen controlled the votes of all the other FOMC members. In your mind, did she threaten them, bribe them, or use mind control. Please provide evidence to support your contention.

I never asserted Trump’s comment was correct. This is your interpretation of my comment because you don’t like my comment. An astute reader would know I’m just trying to point out you should be genuine in your “quoting” of others. This is one of the problems with dialogue – you’re erroneously assuming my stance is on Trump’s side because the I’m pointing out the flaws in your approach. I’m not standing up for Trump’s comments (or Trump), I’m standing against your comments. Astuteness is reading and not making assumptions is key in garnering respect.

I only have a Mishkin text. The point is that a textbook is not the same as real-life.

I never studied Latin in high school. I know the phrase for the same reason as you.

rtd: Given my experience working with Glenn Hubbard (CEA, 2001), I know he would be careful in distinguishing between what happens, and what happens holding all else constant.

Menzie, I’m saying you’re not being an astute reader & you’re (again) not objectively assessing the topics of your posts. I made zero claims of Trump’s comments. The support of this contention is my comment of which you replied to. I will wearily give you the benefit of doubt in assuming you read my comment (I understand we’re working on the comprehension aspect as we communicate).

I understand that some find it difficult to understand that others don’t always comment about their views on a topic, but rather comment about how others misrepresent or are disingenuous in their reporting the views of others. Truth and transparency is a good thing, Menzie…. and maybe one day you’ll join my crusade.

Holy cow you are a troll.

“Good job at providing the transcript, but why not provide the text and its true context as opposed to a version that you like?”

If there is another version that YOU would like then read the transcript and provide its “true” context yourself.

That would take work, though, and trolls don’t like to work.

Obama’s superpowers are so great that he is also able to control the interest rates in the UK and Germany and Japan.

Also, one who is an astute reader and an honest & objective person would understand the difference between “Obama sets the interest rate” (a quote I can’t seem to locate in the CNBC article – please cite its source) and “the interest rates are kept down by President Obama”. To me, it seems the former is direct whereas the latter could imply coercion (this assessment becomes clear via an astute reading of the article).

rtd: See “I THINK THEY ARE KEEPING THEM DOWN AND THEY WILL KEEP THEM DOWN LONGER AND ANY INCREASE AT ALL WILL BE A VERY, VERY SMALL INCREASE, JOE, BECAUSE, YOU KNOW, THEY WANT TO KEEP THE MARKET UP SO OBAMA GOES OUT AND LET THE NEW GUY, WHOEVER — LET’S CALL IT A NEW GUY, YOU KNOW, BECAUSE I LIKE THE SOUND OF THAT MUCH BETTER, BUT THE NEW PERSON BECOMES PRESIDENT, LET HIM RAISE INTEREST RATES OR HER RAISE INTEREST RATES AND WATCH WHAT HAPPENS TO THE STOCK MARKET WHEN THAT HAPPENS BECAUSE YOU HAVE NO CHOICE. ”

Pay special attention to “the new person becomes president, let him raise interest rates or her raise interest rates…” In my reading of common English grammar, that means the president sets rates. Perhaps your understanding of the English language differs from mine?

Or pay special attention to “they” in your selected quote. As well as the preceding comments (in the same paragraph) you’ve decided to omit. Also, don’t forget the succeeding comments which clearly refer to Yellen acting through POTUS’s influence. What does *your* reading make of all that? One difference is that I understand context clues in the English language and i don’t often read things for the primary purpose of searching for political ammo.

Better yet, why pay special attention to anything this nut job says?

rtd: I see. So your interpretation is Yellen is Obama’s puppet? Or is it FOMC members are collectively Obama’s puppet?

I’m not certain that you do see. I’m wondering if the problem may very well be your “reading of common English grammar”. My interpretation of the article is that Trump believes Yellen (and FOMC) is Obama’s puppet. I’ve made zero personal claims other than stating that my comments aren’t about my agreeing/disagreeing with Trump’s comments but about your sloppy and partisan blogging.

rtd: I thought it was understood, but let me be completely clear: So your interpretation *of what Trump is saying* is Yellen is Obama’s puppet? Or is it FOMC members are collectively Obama’s puppet?

If so, then I need to send emails to Mishkin, Hubbard, Cecchetti and Schoenholtz telling them to modify their textbooks so that FOMC is nominally independent, but acts at the direction of the President. Please reply ASAP so I can tell them the news!

My interpretation is the FOMC and the current chair considering both are a part of the Federal Reserve System.

More importantly, why on earth would you tell them “the news”? You see, as opposed to other economists (cough, Menzie Chinn, cough) these guys are rational enough and well-aware not to pay much attention to the opinion of central banking in the US coming from a politician such as Trump while being interviewed.

While you’re at it, tell Mishkin’s to bold the section explicit about the dangers of associating policy stance on short-term interest rates.

” these guys are rational enough and well-aware not to pay much attention to the opinion of central banking in the US coming from a politician such as Trump while being interviewed.”-rtd

except that politician is running for president, and his commentary with respect to the fed provides insight into how he views the fed if he were president. sure, you should avoid listening to the commentary coming from some right wing conservative talk radio nut job-his opinion really does not matter. but to suggest one should avoid the commentary of the republican party’s presidential nominee is rather foolish.

baffling – but, but, but, the textbooks say otherwise.

As debt is a major impediment to real growth, Mr. Trump is to be commended for raising this important issue and expressing his intention to move debt in the right direction.

Debt is an Impediment to Growth? Really?

• When we abandoned gold-backed money in 1933, our debt increased 1095% by 1946 which ended the Great Depression and enabled us to win World War 2.

• We had our highest debt-to-GDP ratio after WW2, then increased the debt 82% and federal spending 725% over the next quarter century from 1948, producing our greatest prosperity: a 168% increase in real GDP.

• By 2015, federal spending was 454% higher and the national debt was 20 times greater than when Pres. Reagan took office in 1981. The result: Real GDP gained 153% and private sector jobs increased 60%.

I think he means the lack of debt is an impediment to growth

What is so interesting is that your belief system is such you could not imagine I meant what I said so in your mind you inverted it. In fact, I meant exactly what I said. This opens up a fertile line of inquiry. Allow me to cut straight to a hypothesis. The minds with the strongest belief systems are the hardest to change. And now a corollary. In general, a Ph.D. with a reputation built over a lifetime of scholarship will be more reluctant to change when new information comes along than an ordinary layman. (This is how the scientific paradigms Thomas Kuhn talked about get stuck.) Moreover, it would be incorrect terminology to say false beliefs. The beliefs are not false. They are very real residents of the mind. The far better terminology is erroneous beliefs. An erroneous is a belief that does not comport with reality. It is life-changing when this light bulb finally comes on and one begins the painful process of examining long-held beliefs for their truth content.

Let me reframe this for you, Paul. It is prima facie evident that there is such a thing as optimal debt. If you need help on this, get back to me. Optimal is someplace between zero and infinity. The optimal level is not a universal constant of course as economics is not physics, but varies over time (and by country) by some small amount. We can effectively ignore the time variation because it is so small. What the optimal level of debt (ratioed to GDP) is, then, is an empirical question. As an exercise, construct a parsimonious reduced form model with real GDP growth as the dependent variable and overall debt-to-GDP one of the handful of independent variables. Annual data is a good place to start. See what you come up with. You might also read the extensive body of work by Reinhart Rogoff and the articles by others validating it.

@JBH

Reinhart Rogoff? Seriously?

The Debt Has Not Doubled under Pres. Obama

It has increased 81%. Under Pres. Reagan, however, the debt tripled as Reagan ran record deficits every year. https://fred.stlouisfed.org/series/GFDEBTN

“Gently” reducing the debt is a prescription for a recession. Over the past 60 years, whenever we have started paying off the federal debt, the result has always been a recession shortly thereafter because demand and money are both being drained from the economy and therefore profit margins of companies must fall if consumption does not increase to replace the lost government spending. The U.S. economy has never been harmed by increasing the federal debt, but it has been harmed by paying it off many times. During the 1920s, we had a budget surplus every year and 4 separate recessions during that decade with the last one causing the worst depression in a century.

It is a universal in economics that any prime cause will have two effects. In general, each effect will cut in the opposite direction on the down-line variable. At a more basic level if need be, clusters of effects can be grouped together by sign. Classic example: income and substitution effect. Classic example: near-term effect of a liquidity injection by the Fed transmitted through instantaneously higher short-term rates to longer-term rates, versus longer-term effect on long-term rates transmitted through inflation which after enough time has transpired will be of the opposite sign. The Keynesian multiplier is another example in that the immediate impulse effect will be of one sign, while the cumulative long run effect can be and usually is of opposite sign. Similarly for those who consume a cup of sugar a day; for a long time the contemporaneous glow is real, but eventually the piper will be paid. So precisely it is with debt. Only by taking cognizance of the dynamic time element in economics do you ever arrive at the right answer.

@JBH

The Dynamic Time Element

After more than 80 years, our debt is now 865 times greater than in 1933 at the bottom of the Great Depression. Obviously, the debt has been tremendously beneficial to our ascendance as the world’s only super-power with the largest economy in world history and the reserve currency of the world’s economy. Interest on that debt is 1.2% of GDP, the same as it was 60 years ago. We could easily afford it back then and we can easily afford it today. https://fred.stlouisfed.org/series/FYOIGDA188S

Good post.

If you look at the Federal deficit as a share of GDP, since WW II every Republican administration left office with a larger deficit than they inherited and every Democratic administration left office with a smaller deficit than they inherited.

Under Obama the deficit has fallen from about 10% of GDP to some 2% of GDP, except for Clinton that is the best record of any modern president. Of course that is probably part of the reason why growth has been so weak.

@ Spencer

Probably?

Pres. Obama reduced the deficit by 75% (as a % of GDP) from FY 2009 through FY 2015 during the worst recession since WW2—something that was never done during any previous recession—and that is the cause for our slowest recovery in the post-WW2 era. Even Pres. Hoover increased the deficit during the Great Depression from FY1931 through FY1933.

According to the NBER the receswsio0n ended in June 2009.

You know what he means. “During the recovery following the worst recession …”

“Anyone who believes that exponential growth can go on forever in a finite world is either a madman or an economist.” Debt is growing geometrically if not exponentially. Global debt-to-GDP is record high. Overall debt ratios of the US, Japan, Europe, and China are far beyond optimal level. Each region has its own peculiarities. The common element is too much debt. China’s growth is slowing, yet China dare not cut credit growth or it risks a hard landing. The Japanese economy is in a multi-decade depression. The US is approaching the end of the weakest economy recovery in history. Europe’s banks are insolvent, propped up only by domestic central banks and the bond buying and credit creation of the ECB. The ECB has had to resort to buying near junk rated corporates. Greece is bona fide bankrupt. Negative interest rates have migrated financial and banking systems into the region of negative returns. Across the globe, market pricing is now more distorted than ever in history because of negative rates. The Dow is third most overbought in history. A gigantic bubble. Bubbles like this abound in asset markets around the world. Only the oil bubble has thus far burst. A tiny quarter-point hike in the funds rate crashed global markets last December. Global central banks had to do a coordinated stick save to stave off global recession. This foreshadows what is coming.

As the brilliant second recipient of the John Bates Clark medal sandwiched between Samuelson and Friedman so eloquently said, only a madman or an economist …

“The Dow is third most overbought in history. A gigantic bubble.”

Lots of folks on Wall Street disagree. In fact, the Dow will likely hit new record highs over the next several years just as it has been doing for the past several years. Another recession is nowhere in sight.

http://www.advisorperspectives.com/dshort/updates/2016/09/09/ecri-weekly-leading-index-wli-yoy-another-interim-high