As the Administration mulls over possible trade actions against China, it is important to concede official trade statistics do provide in some sense a misleading picture of US-China bilateral trade — but not misleading in a way such that if corrected bolsters the Administration’s arguments.

Currently, the full value of a widget partly made in Malaysia, Singapore, and Taiwan and finally assembled in China is counted as coming from China. Suppose, instead, we counted the amount of value added in China in the trade statistics. What would the trade deficit look like?

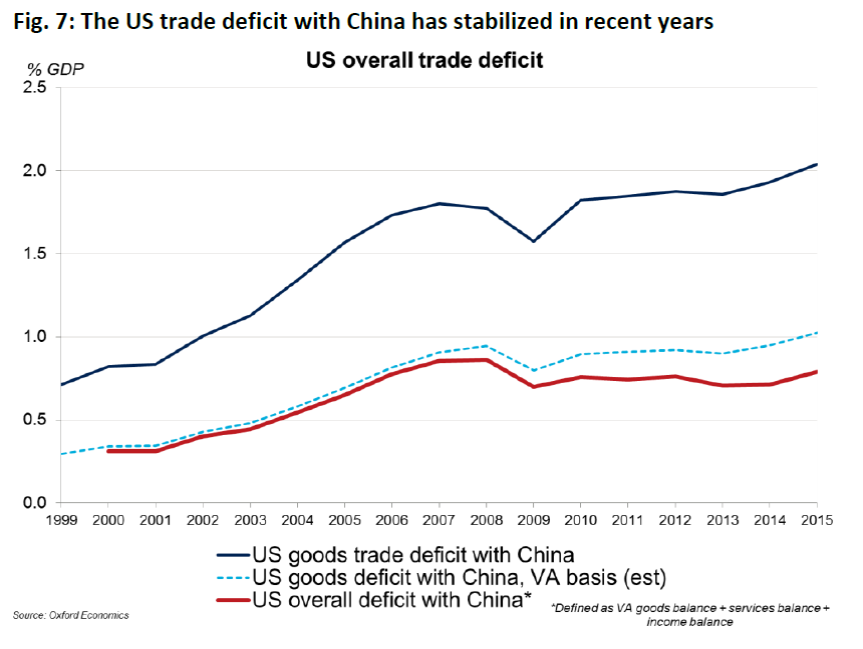

Source: Oxford Economics, “Understanding the US-China Trade Relationship,” January 2017.

As of 2015, the goods trade deficit in value added would be about half the size of the official. Why this disjuncture? From the report:

the bilateral trade number fails to fully explain the impact of trade with China on the US economy. As it plugs into the global industrial supply chain, China is the “Great Assembler.” The OECD estimates that about one-third of the content of Chinese exports is foreign, compared with just 15 percent of US exports. Although China has been trying to increase its domestic consumption and move up the value-added chain, the latest data suggests that even in key growth markets—computer equipment, electronics, and electrical machinery—the foreign content of goods assembled and re-exported from China is still roughly 50 percent.

The quintessential example is the iPhone, as recounted by Xing (2011).

Lest one think this is a finding specific to this Oxford Economics study, be aware that similar results have been found in Johnson and Noguera (2014), discussed in this post, as well as Sposi and Koech (2013).

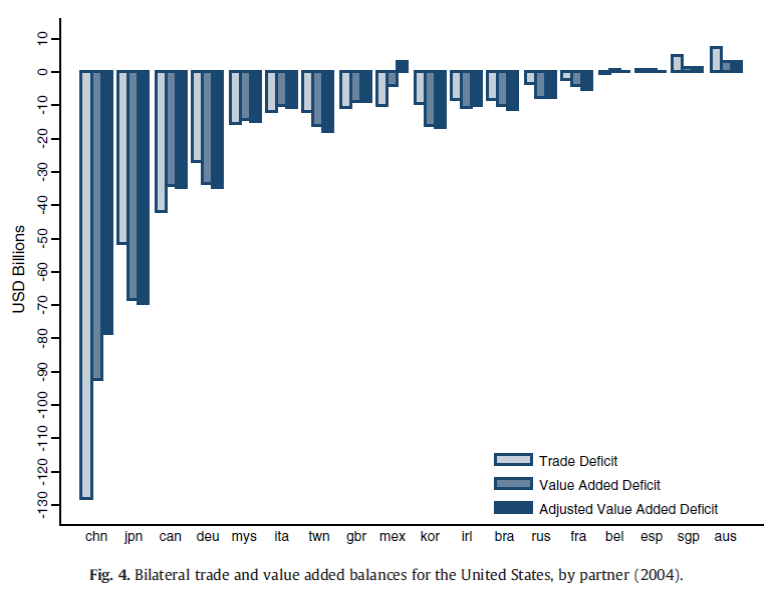

Here is a picture of what US bilateral trade balances look like after adjustment (2004 data):

Source: Johnson and Noguera (2014).

So, if people want to have a better insight into what bilateral trade balances look like, they should not be looking to imposing nonsensical asymmetric treatment of imports and exports. Of course, getting “better” numbers is a lot harder and time consuming than just manipulating the data to justify some predetermined policy measure.

More on trade in value added, see Johnson (2014), on value chains and macroeconomics, Chinn (2014).

Yes, China’s exports are overstated. And, China has an unfair competitive advantage, e.g. from disparities in labor, safety, and environmental standards.

To level the playing field, either China needs to raise those standards or the U.S. has to lower them. Obviously, even a firm like Apple cares more about big profit margins than the welfare of workers and the environment.

The hidden downside of Santa’s little helpers

The Irish Times

December 21, 2002

“An investigation into the price of a Mattel Barbie doll, half of which is made in China, found that of the $10 retail price, $8 goes to transportation, marketing, retailing, wholesale and profit for Mattel.

Of the remaining $2, $1 is shared by the management and transportation in Hong Kong, and 65 cents is shared by the raw materials from Taiwan, Japan, the US and Saudi Arabia. The remaining 35 cents is earned by producers in China for providing factory sites, labour and electricity.

China now makes 70 per cent of the world’s toys, and its exports have doubled in just eight years. In addition, it exported nearly a billion dollars’ worth of Christmas-related goods, half of it to the United States.

Toy factories hire the least-skilled workers…Sixty per cent are young women between 17 and 23 years old who live cramped in company dormitories, 15 to a room, earning just 30 cents an hour and often inhaling spray paints, glue fumes and toxic dust.”

peak, that is about the third time you have posted that ariticle, which is 15 years old. are you sure those numbers are still representative of the situation?

“To level the playing field, either China needs to raise those standards or the U.S. has to lower them. Obviously, even a firm like Apple cares more about big profit margins than the welfare of workers and the environment.”

why should the us be drawn down to the lowest common denominator? and apple should care more about the welfare of workers and the environment. it is an extreme ideology to say profit trumps everything, when we live in a society. we are not wild animals. in fact, social aspects of corporate governance is continuing to grow, and pushing back against the extreme ideology of profits that you and others on the conservative side promote. a corporation is responsible to the society in which it exists.

Baffling, I know you like regulations that waste people’s time and make people poorer, except lawyers. And, you don’t seem to mind Chinese living and working like “wild animals.” You don’t believe the Chinese masses are being exploited and there’s massive environmental devastation in China?

And, profits is not an extreme ideology. Profit maximization creates efficiencies. Even if the minimum wage is $15 an hour, firms should still pursue profit maximization. Producing more with less frees-up limited resources for an economy to expand. You should be against waste, not profits.

peak, i like regulations that make a country safer. and you are making statements about my view of china that are completely wrong-as usual. just because i ask a question does not define my position. i do believe that china should have regulations for its environment and workers. they are showing the example of what happens when those regulations are not strong-just like we had in the us half a century ago. i also believe the same thing about the us today. as for profits, that cannot be the only variable you maximize. you do not want to acknowledge those other variables. it is the excuse to maximize profits ,and give a pass to pollution and social inequalities, that is the extreme ideology. you are dealing with a multivariable function, not just a single variable of profit.

Baffling, I’m glad you concluded China has an unfair trade advantage (in part) from the huge disparity in regulation. So, we need to reduce regulations and China needs to add regulations. Getting rid of most of Obamacare and Dodd-Frank would be a good start, although there are too many regulations in many other U.S. industries.

You still need to acknowledge businesses are in business to make money, i.e. profits. Of course, government has a role, but it can do too much and too soon.

“So, we need to reduce regulations and China needs to add regulations. ”

peak, actually, that is a false choice. we are not obligated to reduce regulations. just because somebody else wants to poison their air and water, does not mean we should drop to the lowest common denominator. the wealthy in china are fleeing to the us and elsewhere, especially their families, because of the pollution problems. why recreate those problems here, after we solved them years ago?

and regarding dodd-frank and obamacare, if you look at the economic performance since the financial crisis, there has been no obvious change in growth as those regulations began to be implemented. if they were the disaster you and other republicans claim, you would see abrupt changes when they were implemented. the data does not show such a situation. while i would agree, we can improve on some of the rules, your blanket assessment of these programs is not supported by the data.

I’ve shown we’ve had a multi-trillion dollar output gap, which still hasn’t closed. Fewer regulations doesn’t mean water and air will be poisoned. You liberal/socialists make me laugh.

the output gap has been closing steadily since the financial crisis

https://fred.stlouisfed.org/graph/?g=4za

i don’t think the output gap ever closed under st reagan either. try again peak.

“Fewer regulations doesn’t mean water and air will be poisoned.”

i guess you are right. we never had a period with few regulations and clean water/air. what was i thinking. we implemented the clean air and water acts after we cleaned up the environment. i would laugh at you, but knowing people with your thought process actually exists is worrisome.

China’s GDP is overstated, since exports have been overstated. Also, environmental damage is estimated to cost over 3.5% of its GDP per year (which includes desertification, although China has little arable land). Moreover, health problems and quality of life costs aren’t taken into account.

What the Chinese do best is corruption, crony capitalism, misallocate resources, cause negative externalities, prevent creativity, create inefficiency, and export much of its GDP. Moreover, it steals a lot of intellectual property (a communist government doesn’t care much about property rights anyway).

https://mobile.nytimes.com/2013/03/30/world/asia/cost-of-environmental-degradation-in-china-is-growing.html

peak, one direct question. has there ever been a country that significantly raised the standard of living of more people than that of china over the past thirty years? they raised that standard of living, at the expense of some of those items you listed for sure. but they raised that standard of living.

in the us, we are faced with similar decisions. do we continue to roll back environmental protections, financial protections, social protections, in the name of growing the economy? is it ok for us to roll back those protections, but not china?

The U.S. raised living standards faster than China during the Industrial Revolution, and surpassed Great Britain and Imperial Germany, the two industrial giants of the time.

How much protection do you need? It’s very costly to always protect everyone.

Also, in the past 30 years, the U.S. added more value than China. One example is adding 10% to $5,000 of income is less than adding 2% to $50,000 of income, although there are other examples that show the U.S. had greater improvements in living standards.

Measuring trade on a value-added basis has no impact on a country’s GDP. It simply reallocates bilateral balances among a country’s trading partners. Aggregate net exports remain the same.

While China’s trade surplus with the U.S. is much smaller on a value-added basis, its trade surplus with all other trading partners is larger by the same amount, in the aggregate.

It’s my understanding that some members of the new administration are not big fans of value-added trade measures because they show smaller U.S. deficits with certain countries.

Yes, imports subtract from exports.

Measuring trade on a value-added basis has no impact on a country’s GDP. It simply reallocates bilateral balances among a country’s trading partners. Aggregate net exports remains the same.

While China’s trade surplus with the U.S. is much smaller on a value-added basis, its aggregate surplus with all of its other trading partners is larger by the same amount.

It’s my understanding that members of the current administration are not fans of value-added trade measures because they reduce the U.S. trade deficit with certain countries.