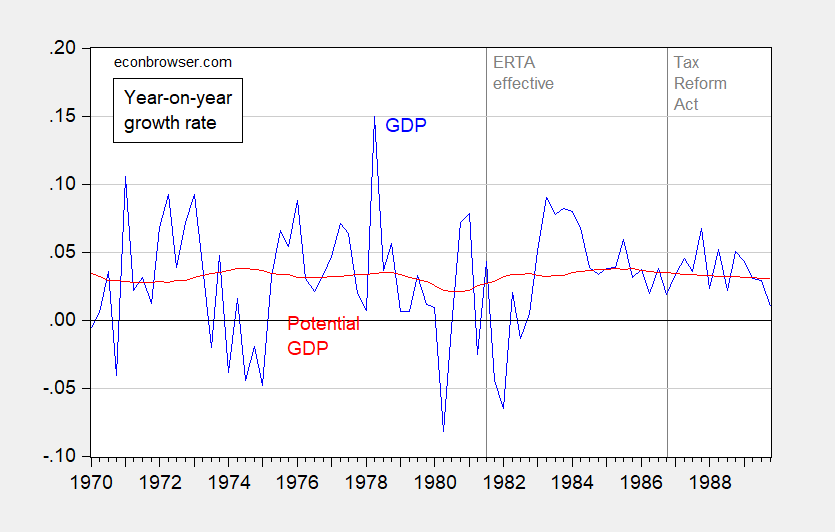

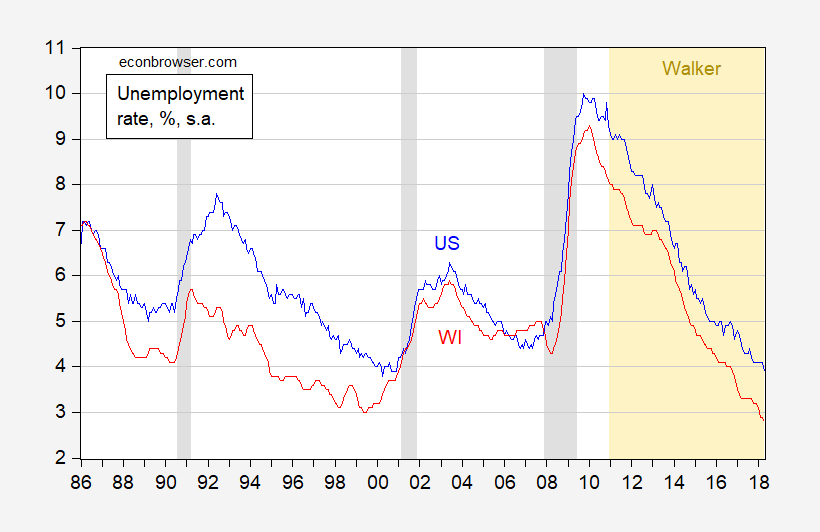

Wisconsin’s unemployment rate has dropped to 2.8 percentage points in April. The national rate is 3.9 percentage points. Proof of Walkernomics success? Well, since on average Wisconsin’s unemployment rate is typically 0.9 percentage points below, the answer is “no”. Consider the Wisconsin and US unemployment rates.

Figure 1: Unemployment rate for United States (blue), for Wisconsin (red). NBER defined recession dates shaded gray; Walker administrations shaded orange. Source: BLS, DWD, NBER.