Indications are that a week from tomorrow, we will receive a very strong report on GDP growth (Jim will have his recession probabilities assessment soon after the release). (GS at 4.1%, MacroAdv at 5.0%, NY Fed at 2.8%, FRB Atlanta NowGDP at 4.5%.) At the same time, we are seeing a flattening of the yield curve. I urge observers to not take as “hard data” the advance release of any macro data as firm. Here is a cautionary tale.

In early 2001 (April I think), I was a staffer on the (G.W. Bush) CEA. The macroeconomic data we had in our possession at the time suggested no recession. Yet, subsequently the NBER Business Cycle Dating Committee (BCDC) set the beginning of the recession in March 2001.

The BCDC focused at the time on the monthly GDP series from Macroeconomic Advisers, nonfarm payroll employment, industrial production, real manufacturing and trade sales, and real personal income ex.transfers. All of these were revised from the series we had in April. Instead of showing the evolution of these series, I’ll use as a shorthand GDP revisions.

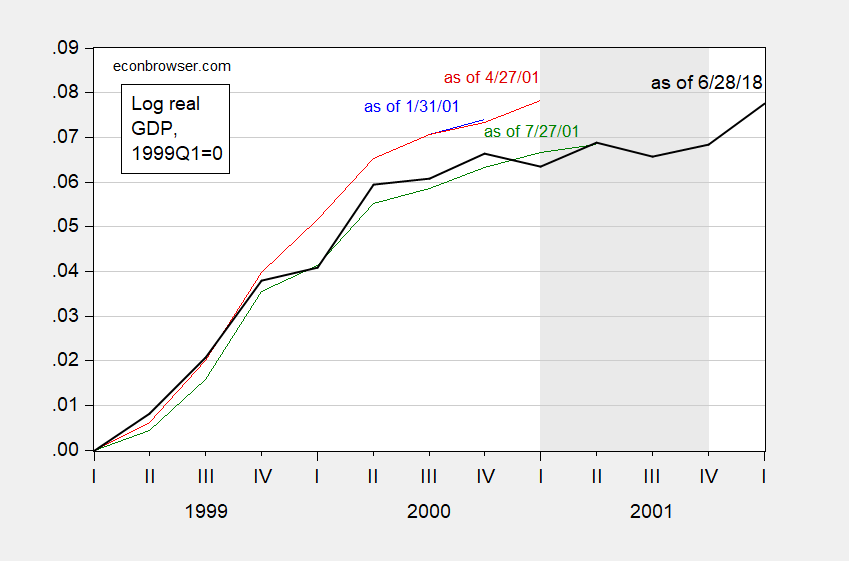

Figure 1: Real GDP normalized to 1999Q1 as of 1/31/2001 (blue), as of 4/27/2001 (red), as of 7/27/2001 (green), as of 6/28/2018 (black). NBER defined recession dates shaded gray. Source: ALFRED, BEA, NBER, and author’s calculations.

Notice that the growth rate does not drop below zero even after the annual benchmark revision reflected in the July release. This is shown in Figure 2 below.

Figure 2: Quarter-on-quarter annualized growth rates of real GDP as of 1/31/2001 (blue), as of 4/27/2001 (red), as of 7/27/2001 (green), as of 6/28/2018 (black). NBER defined recession dates shaded gray. Source: ALFRED, BEA, NBER, and author’s calculations.

For similar cautionary tales regarding the last recession, see here and here (Bonus: Dr. Casey Mulligan figures in both!)

You need initial unemployment claims to begin to rise. They are still falling. A recession usually follows a rise in claims by 8-18 months.

https://fred.stlouisfed.org/series/ICSA

Steven Kopits: I’m not saying I think the data will eventually say the recession started in 2018Q2. I’m saying even if the GDP read is strong in 2018Q2, it might turn out later to turn out weaker (or stronger) than we originally thought. I agree the recession is likely a year or more off, reading off the term spreads.

Warning sign? https://www.marketwatch.com/story/existing-home-sales-slide-for-third-straight-month-in-june-touch-5-month-low-as-housing-sputters-2018-07-23

Menzie, I could be wrong but I think the US of A is the only country to release GDP ‘data’ with so little data .

We all wait until we have enough data as in your second estimate.

It is patently absurd to have some of the ‘data’ which are forecasts by the Department and then you lot annualise it instead of taking the annual rate!

Not Trampis: See this post on the attributes of US forecasts vis a vis other G-7 countries’ forecasts.

UK’s ONS is just now starting to release an official monthly GDP series, so I don’t think the US is out of line in this respect.

It is hard to take Casey Mulligan seriously. Is he a golfer taking a mulligan or is he the 1st mate on Gilligan’s Island?

More like Thurston Howell. He sure as hell isn’t Ginger or Mary Ann (my favorite).

So if the initial GDP report is north of 3%, will the Fed disregard it or take it as a sign to hike rates at the FOMC scheduled for the end of the month? Will the Fed take it seriously or take it with a grain of salt?

Tommy rot. Supporting a nonsense – and as it turns out shallow and egregiously wrong – grasp of the state of the economy in 2001 with coincident indicators. Why shallow? Think Y2K. (Meanwhile, back on the ranch Jim is going to give all you hoi polloi the real scoop with our patented leading indicator a week from tomorrow. So be sure to stay tuned.) What we see here is a classic case of exculpation via revision twisted into mislesson.

Yet the yield curve had already been inverted for over a year! (Remember all the ink spilt here in recent weeks teaching the importance of yield curve inversion as predictor?) As well, by November, unemployment claims had rocket-launched off their 263K pad to an astonishing 345K. And the stock market was crashing.

So Caution about this Cautionary Tale. There, fixed it.

A cautionary tale of an idiot President:

President Donald Trump said the stock market rally since his election victory gives him the opportunity to be more aggressive in his trade war with China and other countries.

“This is the time. You know the expression we’re playing with the bank’s money,” he told CNBC’s Joe Kernen in a “Squawk Box” interview aired Friday.

https://www.cnbc.com/2018/07/20/trump-were-playing-with-the-banks-money-on-markets-gain-since-el.html

“Playing with the bank’s money”? What a moron.

Bill McBride, who predicted correctly the last housing crash, has this to say about recession:

‘https://www.calculatedriskblog.com/2018/07/has-housing-market-activity-peaked.html

Good points about the issues related to sampled/estimated data. There are indicators of “economic concern” (sales related) that should show up before or at the start of an “official recession” while others (employment related) mark the end of that period: https://www.macrotrends.net/1372/auto-and-light-truck-sales-historical-chart

Dear Menzie and Folks,

I’m not going to argue with Jim Hamilton, who is using more data than I am. But I tend to like to look at very broad aggregates. If you look at the BEA numbers, even before the release, you see that Durable Goods spending has cooled off, after rising very substantially in the last two quarters of 2017. Table 1.1.1 has Real Durable Goods spending falling by 2.1% in the first quarter, even in this supposedly strong economy. Fixed investment is doing well, at a 7.6% real increase in the first quarter. But you have to wonder about whether people are trying to get investments in, and contracts locked down, before interest rates start to rise. Real Structures spending isn’t going to increase 16.2% every quarter, even if interest rates don’t rise. Yes, it does fluctuate a lot, but this sort of increase is not something to bank on. Real intellectual property spending won’t increase at a 13.2% rate per quarter, either. Real equipment spending increases have already passed their peak, and it’s all consistent with things starting to change. I can’t give you timing on how it will change just on the spur of the moment, for free, but there are clouds gathering in the sky, whatever the revisions are.

Julian

Don’t forget that this GDP report will be preceded by a major revision of the lasts few years record.