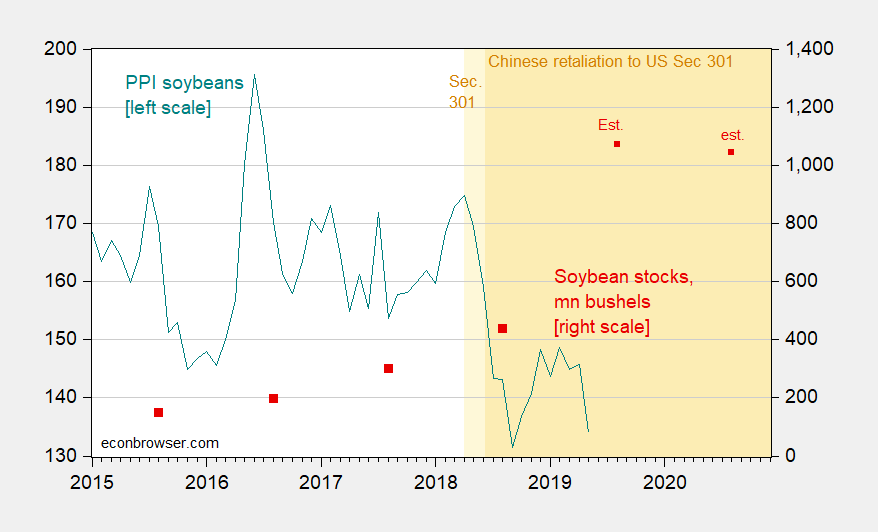

Keep on saying that we’re winning, and maybe it’ll come true. For the rest of us grounded in reality, soybean prices are falling again, and soybean stocks are rising (and estimates of end FYMY2018/2019 stocks have just been revised upward).

Figure 1: PPI for soybeans (teal, left scale), and soybean stocks, end-of-month, in millions of bushels (red squares, right scale). September 2019 and 2020 estimates from June 2019 WASDE. Source: BLS, USDA June 2019 WASDE. [graph corrected for end-month stocks, 10am 6/21]

On July 9, 2018 – nearly a year ago – reader CoRev wrote:

Julian & Menzie, no one has denied the impact of tariffs on FUTURES prices. Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end. We are on record saying the prices will be back approaching last year’s harvest season prices.

Soybean harvest season in North America is late September to end-November; the PPI in July 2018 when CoRev wrote the above comment was 148.3; the PPI for October-November 2017 was 159. As of latest reading (May 2019), the PPI was 134, i.e., a 17.1% price drop (log terms).

So far, CoRev‘s “price blip” has lasted some 12 months…let’s see how much more winning US farmers can take.

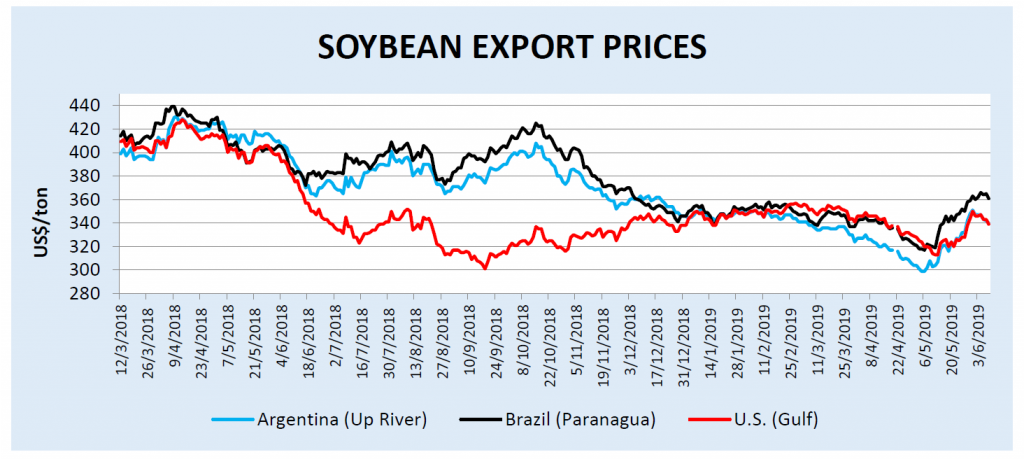

Addendum: On the winning ™ front, the Brazil-US spread has re-opened (in favor of Brazil, of course).

Source:USDA FAS, Oilseeds: World Markets and Trade, June 11, 2019.

How much due to tariffs, sanctions, and how much due to weather? From USDA FAS:

Global soybean exports are forecast lower this month as a 2-million-ton reduction in U.S. exports more than offsets an increase in Argentina. Soybean imports are also lower following a 1-million-ton decline in the China forecast to 85 million. Global soybean ending stocks are lowered 384,000 tons this month as reduced stocks in Argentina and China more than offset an increase in the United States to 29.1 million tons. The U.S. season-average farm price for soybeans is reduced by $0.05 to $8.50 per bushel.

I find nothing wrong with the idea that the best predictor of soybean future price being the future prices. However I am skeptical of such a long trend of price change being due to a single cause, especially over a growing season when farmers have had time to adjust.

Possible other major causes I got from reading are pigs are dying and being culled in unprecedented numbers in Asia, with real fear that the contagion will get out of control. Real estimates are that China’s pork output may fall between 18 and 35%. A lot for world’s largest producer. Another large producer, Vietnam may be down 10%. The disease has had outbreaks in other Asian areas. “This is the largest animal disease outbreak in history,” said Dirk Pfieffer, a veterinary epidemiologist at the City University of Hong Kong. “We’ve never had anything like it.”

https://www.smh.com.au/world/asia/asia-scrambles-to-contain-largest-outbreak-of-pig-disease-in-history-20190621-p51zuv.html

Another cause which may have some impact, is the expectation of government relief for farmers. I find it possible that such expectations may lead to fewer growers switching away from soybeans and thus becoming a cause of the expected stock increase for 2019.

Is it possible to notate these news events were first published? I would be interested if these events or others that may occur can be seen in the charts.

Ed

And in other news, it turns out that “macho”, “strong”, and “powerful” donald trump has no testicles. Who knew??

https://www.nytimes.com/2019/06/20/world/middleeast/iran-us-drone.html

Now we finally know why donald trump paid all those girls to be quiet about his private parts:

https://www.youtube.com/watch?v=vN9YlThJ7I8

“The operation was underway in its early stages when it was called off, a senior administration official said. Planes were in the air and ships were in position, but no missiles had been fired when word came to stand down, the official said.”

WTF? What moron is running this show? You do not start one of these missions just to call it off because the Commander in Chief has no clue what he is doing. Brave soldiers should not have their lives put in mission over a Twitter tirade.

What about not perpetrating state run, industrial level murder suggests “donald trump has no testicles”?

How much per Iranian killed would it have cost? For what outcome?

The estimate is that the strike would have killed 115 Iranians. And yea – it is a good idea that this strike was called off. My complaint is that Bolton was allowed to start it in the 1st place.

Considering what Lindsey Graham and other “Iran hawks” said in the past few days, Bolton is not that far out in the Iran hawk crowd. What no one seems to discuss before they get their shooting going are unintended consequences, as well as responses from Iran and surrogates.

In terms of marking to reality the run up to Iraq invasion 2003 was a nit compared to the lack of foundation for everything about “rising tensions with Iran”.

Bolton was there then, as well.

Nothing in the Middle East is better from US meddling………

Former diplomat Brett McGurk took to the Twitter with some sage advice on this issue:

https://talkingpointsmemo.com/edblog/iran-drone-strike-brett-mcgurk-donald-trump

I am no sure but is soybean not a substitute for pork? If yes, a decrease in pork production should drive up the price of soybeans (unless they are complementary goods).

Vasja

It is my impression that soybeans provide a substantial part of feed for pigs in Asia. Less need for feed, less need for soybeans, and pressure on price downward. But being no expert on quantities this entails, I asked the question.

Ed

Well you just explained why the price of beans from Brazil fell at one point. But look at the chart – the moment the tariffs were announced, the price of beans from Brazil rose while the price of beans from the US fell a lot. Anything else in your magic wand or kitchen sink explains that?

The next denial and obfuscation missive will no doubt be shortly forthcoming.

I suspect the game might be like my experience of participating in a Pro-Am race years ago – the rush of competing against the best, even if you knew you really never stood a chance – is exhilarating.

“The next denial and obfuscation missive will no doubt be shortly forthcoming.”

Yep – see Ed Hanson’s comment. At least Ed found something that might have shifted the demand curve inwards. The other Usual Suspects talk about all sorts of things that shift the supply curve inwards. This is what one gets when one practices Kitchen Sink economics.

Menzie,

Let me quote you regarding CoRev:

“Since he lacks the courage of his convictions…you should not trouble yourself further with his comments.”

And, hey, the occasionally wise Moses H. has called for an end to the “witch hunt” against CoRev. Yes, he is a witch, but he has been caught and exposed as such, repeatedly revealed to be making up ever newer lies. Let him quietly burn at the stake.

One would think with all the babbling from CoRev – he would get at least one thing right. But not yet it seems.

Barkley,

Corev is a man yes. Thus he cannot be a witch but a warlock

Actually CoRev is a little boy. So when one captures his mother (as in the Wicked Witch of the East) one needs to take CoRev along. No separation of mommy from their children in our world!

CoRev is actually a very strange baby, born from the belly of the MAGA movement. Keep your distance as you look on, as it tries to suck you in through a mind meld into an extreme form of xenophobia:

https://www.youtube.com/watch?v=pbj4Te_guxY

We’re teaching him to count slowly, by walkie-talkie from another room, but once you get up to 5 soybeans it’s time for a nappy.

Another thing to note on this soybeans stuff (and other commodities), and I wish I had the link handy, but I remember reading from a semi-reliable source (I’m pretty much a master of finance and econ blogs— my knowledge on the reliability of farming blogs/websites is pretty weak) that the current year’s price subsidies are largely based on the prior year’s average prices—-so, 2019 is going to hurt much more than 2018, because the 2019 subsidies (farmer welfare) will be based on 2018 average prices. So we can extend this “complicated” logic right?? 2020 price subsidies (farmer welfare) will be based on 2019 prices. Ad on infinitum as long as the current president is pro-tariffs (and/or some other unseen and odd event lowering prices over consecutive years).

Now, I can guarantee you, if this was a Democrat White House—Republicans would watch Democrats fry in their own juices. What will Pelosi do to save Republicans’ bacon?? If she had any brains (she never really has, and now??) she would have all Democrats campaign on “If you want the tariffs eliminated vote Democrat”—and not allow ANY more subsidies (pre-November 2020) than are already written into the law, and run the “Republicans gave you the tariffs” mantra into the ground. What will the borderline senile (I’m trying to be nice here) Pelosi do?? Well just remember how when Hank Paulson semi-jokingly got on his knees to beg for TBTF bank reserves funding, Pelosi basically offered to blow Hank Paulson right on the spot—and that should give you a “rough idea” on if she would follow my legislative prescription as given above.

Off-topic

I love everything about this Editorial— especially the title. I am so tired of people soft-pedaling stuff in the name of “decency” and “politeness”. You know what I think is rude as hell?? Putting shoe polish on cow crap and telling your best friend his suit looks great when his zipper/fly is wide open.

https://www.washingtonpost.com/opinions/2019/06/20/marco-rubios-humiliating-transformation-into-trump-fan-boy-is-complete/?noredirect=on&utm_term=.3b4323a5c08b

Marco has sold out his own race, multiple times. and if there is a hispanic or Spanish language term for “Uncle Tom”, Rubio meets and exceeds it.

Tio Tomas

Barkley and Menzie claim: ““Since he lacks the courage of his convictions…you should not trouble yourself further with his comments.”, and the comment the to which they object: “Julian & Menzie, no one has denied the impact of tariffs on FUTURES prices. Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted >b>this will probably be a price blip We are on record saying the prices will be back approaching last year’s harvest season prices.”

Any reasoning and knowledgeable reader of those comments, AFTER THE MANY, MANY SOYBEAN ARTICLES would take away the opposite opinion. I, CoRev, have not only stood by my prediction, but I have also explained, too many times now, the caveat above: “… the impact of tariffs on FUTURES prices….lasting until US/Chinese negotiations end.”

This obviously is too complex of a concept for the TDS driven haters. Soybean Tariffs is the only cause, even though Menzie, himself, wrote about the African Swine Flu outbreak’s impact on demand/prices. Moreover, I have pointed out the price changes as tariff negotiation announcements were made as the negotiations continued.

My original position was: “Instead of what would be the profits that might have been (removed duplicate phrase) provided the world market wasn’t perturbed by weather. I’m surprised someone from the Upper Midwest doesn’t realize the basics of Ag pricing. Tariffs or other trade barriers/restrictions only are part of what makes up the price. As an economist you are ignoring annual supply and demand. ”

Has ASF, weather, and tariffs perturbed the prices? Yes, Are lower prices caused solely by tariffs? No! Why do the TDS driven continue to try to make that case? Because the “T” Trump is the easiest to blame.

This economic silliness has continued for over a year. Time to give it up. What will be left to influence prices when the trade negotiations ends? Supply and Demand still rule!

Lord – you babble a lot. You never say anything of substance, however. Maybe you should start your own blog. That way we can all just ignore your incessant incoherence.

“Are lower prices caused solely by tariffs? No! Why do the TDS driven continue to try to make that case? Because the “T” Trump is the easiest to blame.”

No one here is trying to imply lower prices are caused solely by tariffs. The point is that tariffs are a/the major cause.

“My original position was: [more blather and lies]”

In fact, your original position was that “FUTURES” prices were not very important as compared to actual prices and that the drop in “FUTURES” prices was but a “blip” that would not end up materially affecting farmers/agriconomy/etc. This position of yours has been shown to be entirely incorrect, as “FUTURES” prices did in fact predict actual spot prices, which actually suffered greatly.

Dave, another who doesn’t understand the meaning of spot and future prices. Spot Price

“The spot price is the current market price at which an asset is bought or sold for immediate payment and delivery. It is differentiated from the forward price or the futures price, which are prices at which an asset can be bought or sold for delivery in the future.”

Is there any relationship of futures and spot prices?

“Futures prices converge to prevailing spot prices on expiry only . futures prices are marked to market each day , so each and every day the contract that the parties entered into is re-priced. The re-pricing happens every day up to settlement when the re-priced price equals the prevailing spot at the time ,…”

Instead of making a fool of yourself, learn and understand. You and pgl are seriously deluded.

I also presume that you believe that the tariffs have not already been priced in requiring repricing each and every day, but that the ASF and weather conditions can be ignored, as apparently Menzie and his cohort of supporters do. Apparently futures PRICES are different than almost every other product price, and they get re-calculated with without consideration of any previous price or new information. ONLY TARIFFS affect prices and nothing else affect supply and demand for ever and ever.

Please read read Steven Kopits’ comment about soybean arbitration.

CoRev: You sum up your knowledge of the field with the phrase “soybean arbitration”…You have *no* idea of what you’re writing about.

Menzie, what a picky comment. So let me correct it to what Steven actually said: “The export price graph suggests the tariff price differential was completely arbitraged away within six months.”.

He also clarified in answering your question: “Steven Kopits: If your point is correct, then (1) why did the gap remain in effect for months and (2) why has the spread re-appeared.” “At a guess, Menzie, I would think it took about six months for the trading houses to run out previous contracts and set up alternative logistics solutions. There is a modest gap to Brazilian prices right now, but not huge. You can see similar gaps of Brazilian to Argentine prices over time. I’d add that there is no difference between Argentine and US prices right now, so one could ask the question why Argentine prices are discounted to Brazilian prices. But these sorts of things happen with local excesses, …”

Even Barkley appeared to agree with Steven: “I think Steven is largely right, and I think Menzie is not in great disagreement. ”

When did the ASF infection get impounded in the prices? What did it do to prices compared to the tariffs impounded price. When did the 2019/20 growing season weather get impounded into the prices? What did it do to prices compared to the tariffs and ASF impounded price? There have been several other events where “new information” has been impounded, but that’s the nature of the market, futures included.

BTW, to which field do you refer, upper Midwest soybean, my gentleman farm’s, or my space vehicle tracking? I’m not a commodities trader, and never claimed to be here.

CoRev: Actually, I don’t think I ever said I agreed w/Kopits, largely or not. In fact, I posted rejoinder:

https://econbrowser.com/archives/2018/04/are-soybean-tariffs-irrelevant

You should remember it, as you commented on the post.

Menzie, I went back and re-read the article. In it you said:\ this: “However, if neither Brazil or Argentina are the largest producer, or the US is low cost producer, then the tariff will lower world prices, and raise prices in China. What do the data say?”

Argentine couldn’t have ever been the largest producer without a catastrophic growing season in Brazil and the US. Today’s data says the world price is lower, 2 major occurrences, ASF and the US weather have exacerbated the already tariff affected prices. The China tariffs did alter the China preferred sources. All that is historical.

As for your: “CoRev: Actually, I don’t think I ever said I agreed w/Kopits, largely or not.” Take that up with Barkley. It wasn’t my claim.

“Please read read Steven Kopits’ comment about soybean arbitration.”

Uh. Okay. Umm. You have no completely and utterly shown yourself to have no idea what you are talking about. Thanks for that.

Also, please note that your entire explanation of the difference between futures and spot prices undermines your position. When you are stuck in a hole, stop digging.

This comment in the WASDE Report seems like wishful thinking: “Although adverse weather has significantly slowed soybean planting progress this year, area and production forecasts are unchanged with several weeks remaining in the planting season. With soybean use unchanged, 2019/20 ending stocks are projected at 1,045 million bushels, down 25 million from the revised 2018/19 projection. ”

For farmers’ sake I do hope it is true.

BTW, did anyone notice this portion: “2019/20 ending stocks are projected at 1,045 million bushels, down 25 million from the revised 2018/19 projection. ”

Versus Menzie’s claim: “and soybean stocks are rising (and estimates of end FY2019 stocks have just been revised upward).” Down is up or is it the conversion to Fiscal year dates from growing season dates. Maybe it is just a confused comment?

Menzie, would your please clarify.

CoRev: Soybean stocks (those are actual, realized) *are* rising. Estimated stocks for end-MY2018/19 *have* been raised. End-MY2019/20 *estimated* stocks are down from *estimated* end-MY2018/19 stocks (you are right they are MY’s, starting on 9/1 rather than 10/1 in FYs; this will be corrected).

Thanks!

CoRev: Graph and text corrected to market years, at 10am Pacific on 6/21.

I don’t follow the farm belt as much as I’m not into commodities investments. I do wonder with the large amount of flooding in the Midwest that has wiped out corn planting in some areas whether there will be a major increase in soybean production as beans can still be planted. This poses a conundrum for the farmer in that his input cost might not be recovered and perhaps he would do better to go for a corn crop loss bailout.

A Goldhammer, this year is definitely a conundrum for those farmers in that area. Around here I’ve noticed the small farmers have again planted soy, where last years crop had been left unharvested. I guess they are hoping the US soy harvest will be much lower than last year.

As for your time still to plant soy, most of the northern farms will be requir4d to plant lower yielding short season beans. Short season or not planting will definitely impact harvest volumes.

It may already be too late for corn in many areas. I’ve also seen claims that even hay has been impacted, which will impact hog and cattle prices later in the year.

A conundrum is an understatement.

“At 252 million bushels, Ohio produced about 17 percent of the nation’s soybeans in 2017.”

Do these Ohio soybean farmers still vote for Trump?

Of course they do! Time for another Trump rally in the heartland. Be sure to wear your MAGA hats.

The export price graph suggests the tariff price differential was completely arbitraged away within six months. This is as would be predicted for a fungible commodity, and consistent with the historical record for, say, oil embargoes.

If I am reading the graph correctly, US export prices — which are subject to a 25% Chinese tariff — are now about 6% below those of Brazil and indistinguishable from those of Argentina, whose soybean exports are not subject to Chinese tariffs.

Indeed, on the graph in the post entitled US Exports of Oilseeds and Grains to China v RoW (link below), it looks like losses to China are pretty much offset one-for-one with gains to the rest of the world. https://www.cfr.org/blog/tale-two-tariffs-chinas-so-far-ineffective-tariffs-us-manufacturing-exports

This would seem to suggest that what I posited a few months back has largely come to pass. Fungible soybean exports have ended up just shifting the patterns of trade, without shifting the total volumes that much. That is, European and Argentina soybeans are going to China, and US soybeans are going to Argentina and other countries, with limited effect on US sales and prices overall.

Overall, the tariffs appear ineffective, which for a fungible commodity, they ought to be.

Steven Kopits: If your point is correct, then (1) why did the gap remain in effect for months and (2) why has the spread re-appeared.

By the way, the gap is a nontrivial 6%…

I have an idea how to balance the budget. Take everything Princeton Stevie pays for and add a 6% surcharge. Since he thinks this is trivial, I’m sure he will not mind! Oh wait – 6% of his income isn’t BILLIONS. But hey – it is a still a good idea!

At a guess, Menzie, I would think it took about six months for the trading houses to run out previous contracts and set up alternative logistics solutions. There is a modest gap to Brazilian prices right now, but not huge. You can see similar gaps of Brazilian to Argentine prices over time. I’d add that there is no difference between Argentine and US prices right now, so one could ask the question why Argentine prices are discounted to Brazilian prices. But these sorts of things happen with local excesses, etc. In oil, for example, WTI is $10 cheaper than Brent, a difference of about 15% or so.

You know, trading houses are very clever about finding ways to arbitrage prices. A Panamax bulker can carry about 50,000 tons of soybeans with a value in the $15-20 million range. How much do you think you’d have to bribe a Chinese customs official or product tester to certify a load of soybeans as originating in Argentina? $5,000? $10,000? Almost certainly not more than that.

So a 25% value differential is, call it, $5 million per Panamax load. That’s plenty to grease palms. So US beans are still going to China via Argentina, or via a piece of paper that says they come from Argentina. It’s tough to police source of origin for fungible commodities, particularly when tariffs create a large excess profit, easily deployed to circumvent the system.

It confirms my faith in economics, and human nature.

LIKE!

Stevan Kopits makes an excellent point. Given the fact that soybeans are a fungible product, and Chinese corruption is rampant, it is possible that the tariffs have no meaningful effect on the price of US soybeans (as CoRev has proffered) Unfortunately for Trump it proves that tariffs are also not effective for fungible products. For non fungible products ie. Apple, we’ll see.

I think Steven is largely right, and I think Menzie is not in great disagreement. After all, somewhere in these recent threads he has agreed that the gap is probably in the range of $6, not large, but also not completely non-trivial.

What should be kept in mind here is that Menzie certainly never claimed that arbitrage would be permanently shut down. Over time that gap would clearly close.

However, what is more important is that CoRev (and Peak Trader, who seems to have disappeared) a year ago were claiming that Trump’s claim that it is easy to “win” trade wars was true, and that the disagreement with China would be resolved soon with little economic damage. This has not remotely happened, and there has been large damage to US farmers well beyond the soybean farmers, despite Trump’s aid to some of these people. CoRev and PT were simply wrong.

As a minor note, while indeed NASA made sure that “clocks are synchronized” at takeoff, there was a time before when my late old man made NASA aware of the problem; they did not track the clocks on the ground and going up, although they have always tracked the actual vehicles. But it took those vehicles landing not where was forecast that led my late old man to realize that those clocks were operating on different time systems, and it was due to his initiative that this lacuna was fixed.

CoRev, you have made claims of having been a serious professional in the US space program all the way to you supposedly receiving a “medallion” for your supposed input to the US space program. I challenge you. As near as I can see you have piled lie on lie. Put up or shut up. Give us credible evidence on any of these claims or else admit you are playing a game as you did on your ed background when you proudly claimed a degree (level not specified) in womens’ studies.

Otherwise, the evidence is overwhelming that you are just a lying troll, and Menzie’s point to me earlier that one should simply not respond to you is true.

Barkley says: ” … Trump’s claim that it is easy to “win” trade wars was true, …This has not remotely happened, and there has been large damage to US farmers well beyond the soybean farmers, despite Trump’s aid to some of these people. CoRev and PT were simply wrong.” I have already admitted I was wrong on this. I don’t speak for Peak.

I do not agree that farmers has been large damage to farmers due to the subsidies and insurance being paid. What economists like you is missing is that farmers are less fearful of income loss due to price changes, tariffs, subsidies and insurance, than total loss of income due to weather. Even after a year and now the 2019/20 growing season weather conditions, for some unfathomable reason y’all persist in this misconception.

You, however, won’t let your exaggerations of your father’s story alone/go. I see your new and latest version of the story has now dropped any claim of saving the Mercury, Gemini and Apollo missions. That’s both an improvement and more truthful. I won’t try to re-calibrate your understanding of space and missile tracking, but can assume that your father’s finding and the corrections occurred very early ion the missile program.

For some reason you are fascinated by another’s awards. I won’t discuss the psychological importance of that, but it is an interesting point. Incidentally, that’s only one of my awards, I was also a recipient of the Federal 100 award, given numerous challenge coins, plaques, etc. do I need to show them also? I don’t think they would total 200+ published papers, but then I lived and worked outside the “publish or perish” world. My BIL has several patents, do you want to see or challenge them also?

Your failure to refute my questions regarding your exaggerations of your father’s story and your contribution to climate science is clear, and your need to resort to angry personal attacks also point to the truth of my contentions.

I am clearly living in your head. “…one should simply not respond to you is true.” but, yet there you are again. Let it go! We’ve both made our points.

CoRev,

I get annoyed when people falsely accuse me of lying, which you have done repeatedly, although now you are scaling it back down to a claim that I am merely “exaggerating,” also false, if not quite as bad as accusing me of outright lying, which you seem to do over and over and over.

You are still playing games. You now claim not just to have received a “medallion,” but now we have an expanded list: “the Federal 100 award…numerous [how many exactly?] challenge coins, plaques, etc.” What the heck is in that “etc.” oh, the now missing “medallion” that supposedly went to the moon and back? Yeah, you need to show them as you have no credibility on this at all, none.

How about being specific, especially about those that supposedly involved the space program, as you have been setting yourself up as somehow more knowledgeable about it than either me or my late old man. It is a matter of public record (unlike his advice for the Space Vehicle Committee) that he published a widely respected book in 1946, “The Mathematics of Space Flight” along with other related works, with that one still in print and readily available. I could say much more, but will not bother. But he has a well-recognized publlc record. You, however, CoRev, remain anonymous, showering us with what look to me and most people here as just fabrications as part of a Trumpish ego game you are playing, although occasionally you tire of it as when Menzie pressed you on your academic degrees and you said “to heck with it” and said your degree was in womens’ studies. Only your fantasy challenge coins and plaques and etc. matter, not the stuff that comes out of the “publish or perish” world of which you have none.

As for living in peoples’ heads, pretty obviously I have gotten inside yours. I have probably done more than anybody here to highlight what a lying fake you are. Your list of supposed stuff you supposedly received for who knows what looks even more fraudulent than your silly “medallion” lie.

Barkley, the only one who has exaggerated her is you: “ex·ag·ger·ate

[iɡˈzajəˌrāt]

VERB

represent (something) as being larger, better, or worse than it really is….”

I’d be happy to replay your story line changes. As for calling you a liar, show us all where I did that.

What does bug you is being called out and the veracity of your your being challenged. I didn’t change the story, You did. You seem unsure that there is another world outside academia out there with different metrics and awards.

CoRev,

No, you just said what I was saying was “BS” and “at best an exaggeration. You are simply wrong on both counts.

So, give us real evidence on any of your accomplishments or awards or whatever. I note that id you actually did any work on the US space program, especially the moon part, that would have been in the 1960s or earlier. We know you were joking, but I note that womens’ studies degrees did not exist then, lol lol lol. But maybe you did your medallion and coin challenge winnng work after getting out of high school before going back to get your womens’ studies degree.

LOL LOL LOL.

OMG, Barkley is questioning my Woemen and Gendeer Studies degrees. Well, maybe he is correct, or maybe not. Lol, lol, lol! Degrees can be awarded even later in life. But is this true: “We know you were joking, but I note that womens’ studies degrees did not exist then, lol lol lol.” ?

You are absolutely correct that the Apollo program occurred in the 60s, and for me to have worked on it, it would have been then. Great analysis! As is your reminder that I called BS on your father’s contribution to saving the landings accuracy of the Mercury, Gemini, and Apollo story.

Another great analysis, because once challenged your story versions changed.

1st by dropping the Mercury and Gemini reference (IIRC YOU SAID they were suborbital after I pointed that out in a challenge),

2nd you then dropped the Apollo reference, after admitting they were all tracked (IIRC YOU SAID they were tracked after I pointed out they were in almost constant bidirectional communications and being tracked in another challenge).

3rd you then dropped all reference to the manned space program and admitted your father’s contribution may have occurred prior to their inception. Again after my challenge. To this I agrees that it is most probable to have occurred in this time frame, but that it’s impact was less than you described on any ensuing flights.

Why do I add the caveat? Because, in the space program each flight or even the flight simulations, finding this level of fundamental errors was the norm, and the very reason for their occurrences. You seem to forget that 5-6 decades ago, these efforts were way over the bleeding edge of our capabilities. Compare then to today when we are trying to commercialize them.

Instead of claiming: “No, you just said what I was saying was “BS” and “at best an exaggeration. You are simply wrong on both counts.” Frequently changing you story after challenges is an admittance of your story’s errors. Removing the key parts is an indication of them being exaggerated. Calling the challenger a liar is another sign kind of psychological issues.

Why the concern over my successes and awards in life? You did admit the possibility: “But maybe you did your medallion and coin challenge winnng work after getting out of high school before going back to get your womens’ studies degree.” It’s possibly true, but you forgot after being in the service. All of which I have admitted. (BTW, I now have to be careful when quoting you because your penchant for profanity get’s me in trouble.)

CoRev,

You just keep repeating your lies over and over. I am not going to repeat it again, but my account of this matter has been consistent all along. It has not changed, although I have mentioned different details and aspects of it in different posts. You just rush in and note that “Oh, in this one account you mentioned the Mercury program and in this account you did not.” Sorry, but you spouting BS again

I would let this go, although you simply have to keep coming back with more lies and misrepresentations, but this is how you have been arguing all along with evetrybody. You started with nonsense arguments about Trump’s tariffs and soybean prices, arguing that the weather was much more important than tariffs, which would disappear soon anyway, and berated large numbers of people here for supposedly not knowing about weather and agriculture, because, wow, you are a gentleman farmer in contact with other farmers, not to mention very knowledgeable about climate, not to mention how nobody here knows the difference between climate and weather (after all, we need to wait 10,000 years to account for the ice age cycle before we can say it is climate change, right?). When I suggested that maybe I know more about climatology than you do, that turned into a farce where you had to end up ridiculing “publish or perish” activities that show I know something about climate that you do not. I then made a true point about my late father’s role in the US space program, which you could have easily just ignored, but, no, you had to leap in declaring me to be handing out BS about this true matter, even though I have provided some evidence that my late father was one of the world’s leading rocket scientists, but, no, you have won all sorts of awards for who knows what and with no believable training, while continuing to hold to an insulting and incorrect tale.

No, CoRev, you have been lying from beginning to end, as your whole soybean and tariff story has been shown to be garbage you are backing off a bit, admitting that, hey, you always agreed that tariffs could have some effect, and, no, you did not exaggerate the role of weather so why is everybody giving you a hard time, and on and on. It never stops. You just keep making up one lie after another, even as your earlier ones are revealed to be what they are. In this, you very much resemble Trump, with his post-inaugural verified lies closing on 11,000. However, I don’t think you will be able to match that.

Barkley, claims: “It (his story) has not changed, although I have mentioned different details and aspects of it in different posts. ” Except that his detail and aspect changes were more than minor, and his time line has shifted perhaps by a decade or more. He still says he’s been consistent with his story, while the only constant point was his father told him he discovered a difference in the clocks. While almost all surrounding details and aspects have changed. lol, lol, lol

I won’t respond to the rest of his comment. It’s probably as inconsistent as his story.

CoRev: We can verify lots of things about Barkley because we know his name, and his father’s name. You come in anonymously, and so we cannot verify a single thing you say about yourself. So excuse me if I give zero credence to anything you write.

Menzie, you give zero credence to what I write? It isn’t about my story changing, nor anything I wrote, but what Barkley has written and then changed! He hit an area of my experience and expertise with an unsubstantiated and exaggerated story. After being challenged Barkley changed the story several times.

If you want to discuss how sidereal time is used in space vehicles we can. Or if you want to discuss the problems associated with finding a moving point in space where all three coordinates, X, Y and Z are changing from a point on a rotating planet we can. Or how to find that moving point in space where all three coordinates, X, Y and Z are changing from a MOVING point on a rotating planet we can. Or we can discuss the transforming those data to hand off to another moving or stable point on that rotating planet. At least as to how it was done with the technology available during the period of the manned orbital flights in Gemini and Apollo program.

BTW, have you yet changed/edited Barkley’s profanity? You edited it in my comment QUOTING him, and then chastised me for its use. You may not understand, because it is inherent, but it shows prejudice.

Why all the interest in my accomplishments? Did you not realize outside academia, and similar publish or perish fields, that success is measured differently? Asserting falseness of my life’s successes and their awards, smacks a little bit of envy or ignorance that a life outside academia or economics can be both successful and rewarded. You and Barkley can question my knowledge and credential if you wish, but at least know something outside your own areas of expertise, otherwise your judgements are more than suspect.

CoRev: I’ve seen your level of “statistical analysis” (which I posted). That is all I need to know about how much credence to give your analysis, and your purported history. Provide your real name and documentation and we can proceed from there.

Barkley and Menzie, due to your curiosity over my degrees and the Apollo medallion, I got them out of where I had them stored, the back of a drawer. As an indication of what I found important, my undergrad degree was still in the tube in which I received it. My other degrees were still in their original packaging when awarded. My medallion was in another drawer, the only reason I can think of separate locations, was that I last showed it to my grandson.

However, on my wall are a couple of framed awards. The Fed 100 and an Apollo 11 award are there. I have lost a couple of lesser space program awards, but still have a couple more displayed in different places. Do you understand the military term “luv me wall”? I’m sure this concept/term is not limited to just the military. I’ve seen to many examples.

One day when there is less animosity I might show them, name withheld of course. If I did it today, you’d just focus on the name being withheld while ignoring the fact that they are in my possession. They could have been my father’s after all. Some days comments just amaze.

BTW, my wife’s wall is larger than mine from her many tokens of appreciation for her charitable and deployed military support work. Care to question or scoff at that?

CoRev,

Still no word on where those degrees are from or what they are. I note that Fed 100 awards have only been around for 30 years, so whatever you got it for, if you did (your credibility is really in the toilet here, buster), it was probably not for anything to do with the moon shot, although you are claiming now to have an “Apollo 11” award as well as the infamous medallion. But you have also claimed to have much more, coin challenges and plaques and “etc.” all in plurals. Do none of these hang on your wall? Heck, if you have as much as you have claimed you do, I would think that you would have more than your estimable wife, not to scoff at her at all.

Anyway, I am outtahere for now. You did not help yourself much with this. We are now supposed to believe you because you claim to have a grandson? LOL.

Barkley, you’ve shown even again you are as bad or even worse than pgl at reading and understanding comments.

You: “I note that Fed 100 awards have only been around for 30 years, so whatever you got it for, if you did (your credibility is really in the toilet here, buster),t was probably not for anything to do with the moon shot, although you are claiming now to have an “Apollo 11” award as well as the infamous medallion. ”

Me: “However, on my wall are a couple of framed awards. The Fed 100 and an Apollo 11 award are there. I have lost a couple of lesser space program awards, but still have a couple more displayed in different places.”

Notice no mention of why and for what the Fed 100 award was given. It certainly wasn’t for any space program contributions. I had long left that phase of my life. Even more amazing is to think multiple awards were not given. I do have multiple Apollo 11 awards, and several other Apollo mission awards.

Someone might think that Apollo 11 was a big thing in US history, unless of course, your father found a minor problem with timing and exaggerated it into saving the Mercury, Gemini and Apollo program mission vehicle landings. 🙂

Sometimes comments do amaze.

Menzie claims: “CoRev: I’ve seen your level o “statistical analysis” (which I posted). That is all I need to know about how much credence to give your analysis, and your purported history. Provide your real name and documentation and we can proceed from there. ”

But, Menzie never did understand what I had done:

“CoRev:

I was going to post a graph of your series, but honestly I can’t tell what you’ve got in the file, and what it means.

You have de-meaned (i.e., subtracting averages pertaining to different periods) the nonfarm payroll series, but this doesn’t tell me anything about whether a given trend is appropriate or not. In each case, the series is negative until it turns positive….what am I to make of that.

Can you illuminate? If not, I’ll just post the spreadsheet and let people figure out what you’re trying to do… ”

IIRC, only 2slugs knew.

There never was any statistical analysis done by Moi. I did an anomaly analysis, which is used in most climate temperature change calculations. Telling about Menzie’s comments is that he failed to recognize that process. Why telling? Because of Menzie’s and others apparent blind acceptance of those very same catastrophic claims of Global Warming, Climate Change, Climate Weirding, etc. (Whatever the current term may be.) How can you blindly accept claims without at least knowing something about the data and the process?

How can these claims be blindly accepted without knowing the fundamental math processes from which they are developed? No wonder he questions the credence of my analysis skills: “That is all I need to know about how much credence to give your analysis, and your purported history.” Being befuddled about the approach could be the answer.

Not everything is about economics and statistical analysis. Other fields use different methods, even the space program or perhaps the agriculture industry. Yet, on what grounds can he question my credibility in farming, my space program experience and climate? 😉

CoRev: The anomaly analysis you conducted was essentially looking at observations detected by a filter; applying a filter is a type of statistical analysis. I don’t think there is any statistician who would disagree with that conclusion. Applying the type of filter you did is okay for trend stationary series. I am almost positive it is not for an obviously nonstationary series of the sort analyzed.

Menzie, “The anomaly analysis you conducted was essentially looking at observations detected by a filter; applying a filter is a type of statistical analysis. I don’t think there is any statistician who would disagree with that conclusion. Applying the type of filter you did is okay for trend stationary series….”

Then, I am quite shocked that you failed to recognize this statistical method.

BTW, it is not uncommon to consider a temperature time series as a trend stationary series. https://link.springer.com/article/10.1007%2Fs10584-008-9524-8

I guess not being a statistician shows again. How does this effect your original comment and failure to understand? Is/was the data trend stationary for the period covered? I’ll let you, the statistician, do the tests.

CoRev: Mebbe. But for the past twenty-odd years (if not more) is has been completely uncommon to model nonfarm payroll employment as a trend stationary series. I’ll do an entire post on this soon.

Lol, Menzie, not you’re complaining that an alternative method confirmed your results? Your familiarity with one method not trumps mine with an alternative method. OK, as you say its your blog. and your way. Got it.

You still have not answered my query re: your expertise in evaluating temperature data, which makes you blindly accept the extremists’ views/projections? You are obviously unfamiliar with how average temperatures are calculated.

CoRev: You … applied … a … filter … not… adapted … to … nonstationary… series… to … a …series (Nonfarm payroll employment) …that … virtually … everybody … agrees … is … nonstationary.

Menzie, and you still have not answered my query re: your expertise in evaluating temperature data, which makes you blindly accept the extremists’ views/projections? You are obviously unfamiliar with how average temperatures are calculated.

As for your concern over my test, I used the tools in my non-statistician tool chest. Why on temperature calculations do you blindly believe the alarmists. There’s no excuse for no curiosity.

CoRev: I think I have cited several times work by James H. Stock. You should google him. Then come back and tell me if I am using “extremists” views. If you think James Stock’s statistical methodology is “extreme”, then I think you should be similarly characterizing my co-blogger James Hamilton’s approach, summarized as say, in Time Series Analysis, as extreme. I await your response with bated breath.

Geez, when will you learn a little modern time series analysis before pontificating?

To make clear my view:

I am no fan of trade wars. Now, economic theory says that tariffs on fungible commodities and implemented on only a select — or in this case, one — country, should lead to a re-arrangement of trade patterns and practices by intermediaries, such that the tariff should be largely negated.

But this is also true of manufactures, potentially. I would imagine there are now manufactured exports from Vietnam that looks strikingly similar to — indeed, virtually identical to — exports from China, with the entire difference that the label now says “Made in Vietnam”, rather than “Made in China”.

There is plenty of cynicism, corruption, and tariff evasion to go around. The Chinese are an entrepreneurial people. They will figure a work-around, both on imports and exports, as will the Argentines, Brazilians, Vietnamese and Americans involved.

Steven Kopits: If your argument is valid, the gap between US and Brazilian spreads should not have persisted for six-plus months; nor should the current spread exist.

Not necessarily. You’re moving a lot of soybeans. It make take time to get the physical logistics right. Not to mention the corruption.

But at this point the differential appears to have disappeared. Why is there exactly the same spread between Brazilian and Argentine prices as there is to US prices? Argentine and US prices are identical. How could that be, if US prices are subject to a 25% tariff, and Argentine prices are not?

Steven Kopits: You’re behind the curve. The differential has re-appeared…it’s now about 6%. See https://twitter.com/menzie_chinn/status/1141931747896152064

Menzie, the spread may be because the Brazilian soy harvest has ended, and freshly harvested Brazilian beans are now available. How did the Argentinian harvest go? Earlier predictions were for a slightly reduced Brazilian harvest.

CoRev: If there is storage, and beans are highly substitutable, then your explanation doesn’t make sense to me.

Menzie, didn’t you note (if IIRC) 2slugs comment about the degradation in quality of stored soybeans? Also I believe you and others noted that carrying costs added to the break even price brokers can charge.

As a non-economist some of these things are obvious why a differential may exist between older, stored US soy versus new non-tariffed Brazilian soy. There’s a whole list of other costs, some associated with Steven’s contention, currency valuations, shipping, etc. that adds to broker’s costs to explain a price differential.

Your failure to perceive these, and you willfully ignoring them doesn’t make sense to me.

CoRev: There should be a cost of carry gap, in theory. In practice, there isn’t — *for soybeans*. How many times do I have to write this, and have published in peer reviewed papers, for you to get this?

Your own graph shows US prices as identical to Argentine prices. Are Argentine exports subject to a 25% tariff by China?

In general, if the trading patterns have circumvented tariffs — as we expect they would in this case — then it’s unlikely the tariffs will re-assert themselves unless there is a change in regime, for example, if Chinese authorities cracked down on ‘fake’ Argentine exports which are in fact US product.

Steven Kopits: As we say in the business, absence of deviations is not proof of no impediments (in both purchasing power parity calculations and interest rate parity calculations). My guess is that the PRC is exerting implicit or explicit influence to prevent purchases of US soybeans. See this https://www.reuters.com/article/us-brazil-grains/brazil-rides-wave-of-soybean-sales-to-china-as-u-s-trade-war-rages-idUSKCN1SN1Z7

You know, the relationship of the authorities to black markets is often ambivalent. Successful tariffs increase domestic prices and hurt domestic consumers. Is it in leadership’s interest to do this? Or is leadership’s interest merely to demonstrate that they are ‘tough’ with foreigners without actually churning the soil too much? If you look at the track record with illegal immigrants in the US, it is actually the latter, not the former.

Menzie, you asked a question, and now you question the possible answers?

Your positions: “If your argument is valid, the gap between US and Brazilian spreads should not have persisted for six-plus months; nor should the current spread exist.”

and

“If there is storage, and beans are highly substitutable, then your explanation doesn’t make sense to me….

There should be a cost of carry gap, in theory. In practice, there isn’t — *for soybeans*. …”

Yet the PRICE spread disappeared for months early this year. https://pbs.twimg.com/media/D9j0L1-WkAA1JY2.png (your own referenced chart) The beginning spread can be explained by the tariffs, the convergence may be explained by your theory. The ending divergence is due to???? I gave my answer. What’s yours?

Since I’m not a trained economist I need to research some things: https://www.investopedia.com/terms/c/carryingcharge.asp

”

Carrying Charge

Reviewed by James Chen

Updated Mar 27, 2018

What is a Carrying Charge

A carrying charge is the cost associated with storing a physical commodity or holding a financial instrument over a defined period of time. Carrying charges include insurance, storage costs, interest charges on borrowed funds and other similar costs. As carrying charges can erode the overall return on an investment, due diligence should be given to them in considering the suitability of the investment and also while evaluating investment alternatives. This term is sometimes referred to as cost of carry.

Carrying charges are generally incorporated into the price of a commodity futures or forward contract. Under normal market conditions, therefore, the price of a commodity for delivery in the future should equal its spot price plus the carrying charge. If this equation does not hold, due to abnormal market conditions or some other development, a potential arbitrage opportunity may exist.

Carry Charge Arbitrage Example

Assume that the spot price for a commodity is $50 per unit, and the one-month carrying charge associated with it is $2, while the one-month futures price is $55. An arbitrageur could pocket a risk-free profit of $3 per unit in this case by buying the commodity at the spot price and storing it for a month, while simultaneously selling it for delivery in a month at the one-month futures price. This process is known as cash-and-carry-arbitrage. It is a market neutral strategy combining the purchase of a long position in an asset, such as a stock or commodity, with the sale (short) of a position in a futures contract on the underlying asset.”

I think this definition/explanation supports both Steven’s and my explanations.

Perhaps in reality your theory, “In practice, there isn’t — *for soybeans*. …” does not hold true for all situations.

CoRev: I’m just asserting carrying cost explanation does not seem to hold for soybeans. I have a peer-reviewed published paper on the subject, with about 250 google scholar citations. What do you have?

Menzie, what do I have? Data.

BTW, about the time of your Reuters article pgl and I got into a discussion over Brazil price differentials. In it I mentioned evaluation of currencies. He, of course, poo pooed it. I bring it up again because it was your Reuters article from which I think I organically had that idea.

“Soybean trading in Brazil has gained momentum in recent days, driven by a wave of Chinese demand, boosting prices and premiums paid at ports amid a weakening of the Brazilian currency, according to analysts. ”

I had considered listing it in my list of carry costs, but then ignored it. So let’s add weakening of the Brazilian currency to that list of factors affecting the price differentials.

Aren’t you ever leery of absolute statements? ” In practice, there isn’t — *for soybeans*. ”

and

“CoRev: I’m just asserting carrying cost explanation does not seem to hold for soybeans. ”

Are there no exceptions? BTW, I think we have gotten wrapped around the axle re: carrying costs, when the original question had to do with explaining US and Brazil price differences or the Brazil premium.

I do agree with you that the Chinese leadership is probably “exerting implicit or explicit influence to prevent purchases of US soybeans. ” for negotiation leverage.

“However, what is more important is that CoRev (and Peak Trader, who seems to have disappeared) a year ago were claiming that Trump’s claim that it is easy to “win” trade wars was true, and that the disagreement with China would be resolved soon with little economic damage. This has not remotely happened, and there has been large damage to US farmers well beyond the soybean farmers, despite Trump’s aid to some of these people. CoRev and PT were simply wrong.”

LIKE

If you want to talk about problems, let’s talk Iran and Strait of Hormuz.

According to the EIA, 20.7 mbpd — 21% of the world’s oil supply — transits the Strait of Hormuz every day.

https://www.eia.gov/todayinenergy/detail.php?id=39932

The closure of the strait would lead oil prices to jump to $200 / barrel and a very, very steep and severe global recession within 30 days.

With the latest round of sanctions from the US and the visible willingness of Iran to start a war, we now have to consider seriously the prospect of a hot conflict in the Persian Gulf. For the US to ‘win’ this conflict, not only does it have to prevail militarily, it has to do so within a week to ten days and convince vessel insurers to continue to provide coverage for tankers in the Gulf. Otherwise, the Gulf will close with or without actual attacks on oil tankers.

For the Iranians, this is the math: Right now they are facing win (US) – lose (Iran). They can’t flip that to lose (US) – win (iran). But they are more than capable of flipping it to lose (US) – lose (Iran). (And we haven’t even spoken of what happens if the Iranians start targeting the Saudi oil fields.)

That’s a very long coast in the Gulf — about 600 miles running along Iranian territory. Can the US completely extinguish the threat in a week? I don’t think so.

Tightening sanctions looks like a very bad mistake at this point. I expect the Iranians to come out firing, and the Trump administration to find itself trapped into a military conflict with the now real prospect of an oil shock and a severe global recession.

Here’s my related CNBC article from 2017

https://www.cnbc.com/2017/11/10/saudi-iran-war-would-create-domino-effect-of-global-disaster-commentary.html

Steven, do you have an estimate of how much of the oil loss could be made up from US sources, especially at $200/barrel? Could there be oil birdies whispering into you know whose ear?

Steven,

So, what do you think of the Saudi claims that they can get most of their oil out via pipelines going to the Red Sea?

US oil production is completely inelastic at the 30 day mark. At six months, you can move the production needle, but it takes about 11 weeks to deploy additional rigs in response to an oil price change, and another 3-4 months to complete wells and bring them online. Now, US production growth remains strong, around 1.5 mbpd / year, but that’s already baked into prices. Changing that trajectory materially requires at least six months, and even then, we’re talking about increasing the pace at maybe 500 kbpd / year at the one year mark. So US production growth, indeed, production growth from anywhere else in the world, cannot move the needle by more than a few hundred thousand barrels per day in the short term. Production growth, therefore, is not available to offset a Persian Gulf outage of any magnitude.

There’s some, but not a lot, of excess inventory globally, maybe 100 m barrels. At a loss of 20 mbpd, that would last a week. It wouldn’t prevent an immediate and severe price spike.

There is also about net 3 mbpd of extra capacity on pipelines running west out of Saudi Arabia which could replace lost Gulf capacity.

To bring down the global economy, a loss of 2-3 mbpd should be sufficient, that is, you don’t need to close the Gulf, just reduce throughput by 10-20%.

Iran could achieve this with nothing more than peppering the strait with a couple of hundred mines. Don’t actually have to blow up anything. It would take the US a week or more to clear the ordinance, which the Iranians can always replace from somewhere along their 600 miles of Gulf coast. Given that Iran has already demonstrated a willingness to challenge the US directly, I think the simple read is that we should expect some sort of military action from Tehran, either mining the Gulf or, say, putting a missile through a tanker.

Trump is way overplaying his hand. If lose/lose has a higher value to the Iranians than win (US)/lose (Iran), then it becomes rational to take down the whole edifice to force the US back to the negotiating table. Trump could easily end in a headlock here — just as he did with the shutdown — because he will be directly blamed for an oil shock if it comes to it. He has a lot of leverage to a point, and none thereafter.

Now, the effects of this are quite interesting and more than a little scary. The US, for example, is all but a net oil exporter and Trump has a point in asking why the US is paying to protect other countries’ sea lanes. In the event of an oil shock, the US coastal states implode — the ones like NJ, NY, CT which have structural fiscal problems — and Texas makes money like it’s going out of style, the sort of wretched excess we saw from Saudi Arabia in the 1970s.

Europe is crushed, and most importantly, so is East Asia. Much of their oil comes from the Persian Gulf and they are all major importers. So China hits a major recession. The Chinese will have an urgent need to secure their own oil in the Gulf and right now have a couple of aircraft carriers with some capability to project power. If nothing else, China will take away the lesson that they need a ten carrier navy like the US and that they have to prioritize power projection into the Middle East — actually, much the same lesson the US took away in the 1970s. And that sets up a more direct confrontation with the US, let’s say ten years down the line.

The White House has plenty of belligerence, very little finesse or sophistication, and virtually no serious policy analysis that I can discern. These are dangerous times.

Steven, thanks. I have some reading and thinking to do.

Steven,

Largely in agreement. There is a question of how long it would take the Saudis to shift to sending their oil through the pipelines. If they can do it quickly, the disruption and price surge might be quite short. If that is the case then the more drastic outcomes described later in your post would not come to pass, or not very much so. In my latest post on this on Econospeak I have basically argued that probably such a surge would not last too long between the Saudi pipelines and the US military cracking hard on whatever Iran would be doing in the Strait.

Last I checked, US still a net importer of oil, although that is indeed closing on a balance, with US net exporter of selected petroleum products.