Today, we are pleased to present a guest contribution written by Laurent Ferrara (Professor of International Economics, SKEMA Business School, Paris), and Director, International Institute of Forecasting.

For few months, a recurrent economic issue is the possible U.S. economic recession in 2020 (see discussions on Econbrowser here and here). But there are also some similar questions in the euro area about potentially upcoming recessions, especially in Germany, an open economy that heavily depends on the global business cycle. In this post, I propose to assess the German business cycle based on standard tools often used in the business cycle literature.

Predicting recessions is one of the biggest challenge for economists and even trying to identify recessions in real-time is not an easy job. A first step is to be able to date historical business cycles, defined as the sequence of expansion and recession phases. A rule of thumb is to say that a country is in recession when it experiences two consecutive quarters of negative GDP growth. But in fact identifying a recession is a much more complicated task and needs to refer to the original NBER definition.

A simple tool that proved to work quite well in the literature to date turning points is the Bry and Boschan (1971) algorithm that identifies peaks and trough in macro series by using simple rules, especially imposing minimum durations of phases (2 quarters) and cycles (5 quarters, from peak to peak of trough to trough). Very often an additional filter is applied to the resulting chronology in order to ensure that the recession is severe enough, severity being measured by 0.5 times the loss in output times the duration of the phase.

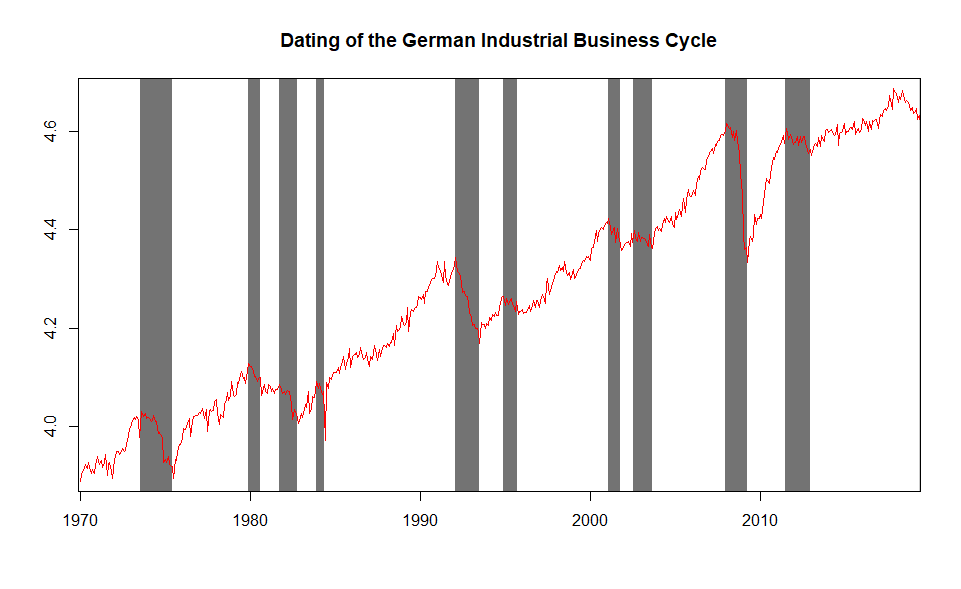

By using this Bry-Boschan algorithm on German GDP from 1970q1 to 2019q2, we get 7 recession periods; the dates from Peak (P) to Trough (T) being: 1974q1-1975q1, 1980q1-1980q4, 1981q3-1982q4, 1992q1-1993q1, 2002q3-2003q1, 2008q1-2009q1, 2012q3-2013q1. Estimated historical recession periods for German GDP are presented in figure below (shaded areas):

Figure 1: Real Gross Domestic Product for Germany, Millions of Chained 2010 Euros, Quarterly, Seasonally Adjusted, 1970q1-2019q2, source : FRED Database and Anas et al. (2007) WP Ca’Foscari University of Venice, Dating from author’s calculations

It is noteworthy that the algorithm does not detect any peak over the recent quarters. Note also that the plain vanilla Bry-Boschan algorithm also provides two additional recessions in 1985-86 and 2004-05. However, the severity of those 2 specific recessions is so low that I decided to discard them from the chronology.

This dating chronology for Germany is well in line with the CEPR chronology for the euro area business cycle. There is a difference in 2002-2003 when the German recession didn’t lead to recession in the euro as a whole, as the recessions in the main euro area countries were not synchronized. Note also that the CEPR estimate a single recession from 1980 to 1982, while we allow for a double dip, as for the U.S.. The ECRI also provides a dating chronology for Germany but they do not account for the 2012-2013 recession. However, it’s questionable that the euro area as a whole was in recession during this period of time, but not Germany that accounts for about a third of euro area GDP.

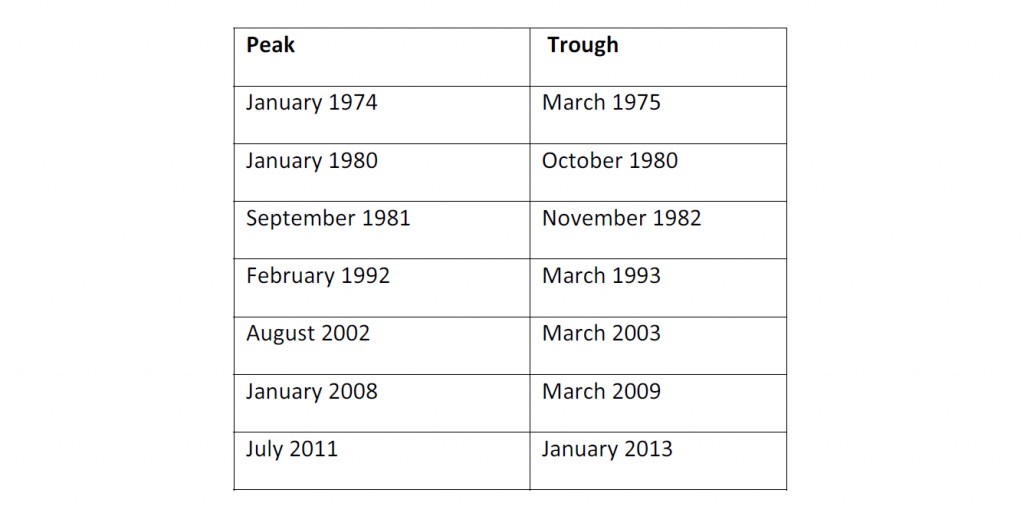

Based on the Bry-Boschan algorithm applied to GDP, we only get a quarterly dating of business cycles, while monthly chronologies are sometimes useful. To go from quarterly to monthly frequency, an idea that we put forward in this paper, is to also consider monthly industrial production. This series is much more volatile and cyclical than GDP. Applying the same Bry-Boschan algorithm leads a globally similar picture as regards the timing of cycles (see figure below) but obviously there are more industrial recessions than global recessions. Indeed, there are three industrial recessions that didn’t end up in global recessions: in 1984, in 1995 and another one in 2001. Thus that’s interesting to keep in mind that an industrial recession does not necessary lead a global recession.

Figure 2: Production of Total Industry in Germany, Index 2015=100, Monthly, Seasonally Adjusted, source : FRED Database, Dating from author’s calculations

At the end of the sample, the algorithm clearly identifies a peak in November 2017, but the trough is not yet identified, suggesting thus that an industrial recession started in December 2017 and is still on-going. This story is consistent with the slowdown in the global economy since 2018, fueled by the trade war between U.S. and China and a negative growth in world trade volume in 2019h1 (-0.3% in q1 and -0.7% in q2 2019).

Thus we can mix the quarterly GDP chronology and the monthly Industrial Production chronology in order to put forward a single monthly chronology. An easy rule is to choose as peak/trough the month of the quarter the closest to the industrial peak/trough. The estimated final monthly chronology of German business cycles is summarized in the following table:

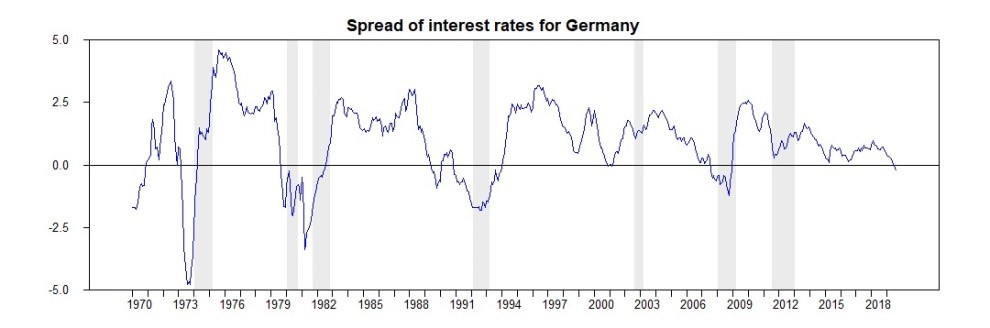

Dating business cycles is not only a pure historical exercise; that’s also useful for predicting recession when using binary response models, as the Probit model. Below we use the spread between long term and short term interest rates for Germany as predictor of recession. We clearly see in the figure below that this spread tends to decline before each German recession.

Figure 3: Difference between Long-Term Government Bond Yields and Short-Term Government Bond Yields for Germany, 1970m1-2019m9, source : OECD MEI through FRED Database, Dating from author’s calculations

An estimation of a Probit model based on this business cycle chronology indicates a recession risk of about 25% in 12 months. This high recession risk is consistent with some latest high frequency data, such as new orders in the manufacturing sector.

In conclusion, with the data that we have at hand as today, it seems a bit early to acknowledge a recession in Germany. Officially calling for a recession generally takes some time (the announcement delay of the CEPR for a peak is about 1 year) and more data than GDP and industrial production should also be considered, such as employment data or sales. Also, at some occasions, a recession in the industry didn’t end up into a global recessions. However, the economic outlook in Germany appears to be quite pessimistic and the recession risk is quite high.

This post written by Laurent Ferrara.

Like many an interesting topic, it does not lend itself to easy answers does it?? Hence, like a sports event with many variables (such as 22 players on the field at any one time) it attracts many wannabe prognosticators and professional gamblers. That concludes my Captain Obvious lecture for today. Me and Cliff Clavin will be serving punch and cookies in the main lobby.

Seriously, great post. It won’t be terribly surprising if the German and American recession end up correlating pretty closely time-wise will it?? That’s a relatively safe bet.

Historically, there is always a lag between US and European business cycles. Maybe the globalisation has reduced this lag, but no evidence so far

Thanks for the thoughts. Great post.

Germany had a recession from mid-2011 to early 2013. While the U.S. did not, U.S. average annual growth was less than 2% during this period of stupid state/local fiscal austerity.

2011-13 is a pure euro area recession related to the sovereign-banking nexus, fueled by fiscal austerity in the EA.

This is probably a stupid question, but how is it that there wasn’t a recession in the immediate wake of German re-unification in 1990?

One guess might be the exchange rate that the West gave to the East for savings that had been built up over time – might have acted like a helicopter drop of money.

Maybe because the East German Mark was accepted at equal to the West German Mark. The west spent a bit to help the East adapt. A bit of Keynesianism????

Seems like a very intelligent question to me. I would assume there is just some economic “lag” there, like what we’ve seen with donald trump’s tariffs, and the ’92 year is when the assumed affects finally were observable:

http://www.levyinstitute.org/pubs/hili67a.pdf

That’s a dart toss on my part.

Well, there was that started a bit over a year after the unifiication.

Very good question! German GDP doesn’t show a peak but there is one clear peak in 1990 in the industrial business cycle, then a plateau, then another peak. We cannot also exclude data issues during this very specific period.

Looking at those graphs, it is not hard to be impressed, and to wonder if there is any plausible way to extrapolate over the next 50 years.

It is quick difficult to imagine what per capita income would be for Germans in 2050, save staggering huge.

Then, one of the oddities of economic projections is that we rarely consider that there might be limits to nearly exponential growth.

And, if there aren’t, why do worry about the future over the long haul?

One guess might be the exchange rate that the West gave to the East for savings that had been built up over time – might have acted like a helicopter drop of money.

One guess might be the exchange rate that the West gave to the East for savings that had been built up over time – might have acted like a helicopter drop of money.

Oh!!!! I am an entire month late to see her latest post. The shame…….. the shame…….. Can I ever show my face in public again??

https://blogs.imf.org/2019/08/21/taming-the-currency-hype/

Sonnet 129: Th’expense of spirit in a waste of shame

BY WILLIAM SHAKESPEARE

Th’ expense of spirit in a waste of shame

Is lust in action; and till action, lust

Is perjured, murd’rous, bloody, full of blame,

Savage, extreme, rude, cruel, not to trust,

Enjoyed no sooner but despisèd straight,

Past reason hunted; and, no sooner had

Past reason hated as a swallowed bait

On purpose laid to make the taker mad;

Mad in pursuit and in possession so,

Had, having, and in quest to have, extreme;

A bliss in proof and proved, a very woe;

Before, a joy proposed; behind, a dream.

All this the world well knows; yet none knows well

To shun the heaven that leads men to this hell.

I guess if you don’t talk about black people like it’s still 1965, and you show that at age 78 you have a mind as sharp as a Japanese made Katana, you can get young people very enthusiastic about you:

https://i.redd.it/7ofvjahpz2n31.jpg

That’s Emily Ratajkowski for those limited in pop culture knowledge.

Emily Ratajkowski is 78? She aged well.

The rumor is it’s all due to Nivea brand almond oil. But don’t quote me on that, ok??

Some assumably intelligent people discussing the oil supply “disruption”:

https://www.youtube.com/watch?v=K4TZ4tSf99w